Get Out Of Debt, Stay Out of Debt!

By Greg Hunter’s USAWatchdog.com

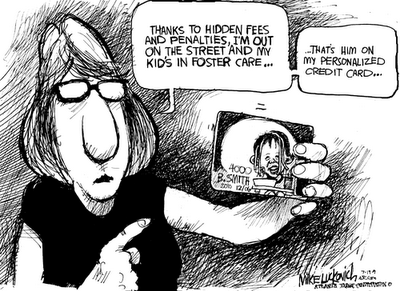

This cartoon would be even funnier if were not partially true. These days the average American owes $8,000 dollars on his credit cards. I was asked by a friend of mine, “How should I hedge my investments in this environment?” What he really should ask is, ” How do I prepare for an economic storm?” I am not a money manager, so I cannot tell you how to make tons of money. I can tell you how to rig for trouble.

First of all, the best hedge you can have is low or no debt. Once you have a car payment, credit card payment or mortgage payment, you cannot cut back on it. In tough times, you either continue to pay or default. So, cut your debt first and foremost. If you have a car payment, pay it off. When you own your car and your state DMV sends you the title, it will amaze you how well that paid for car will run. Car leasing is one of the worst things you can do financially unless you work in sales and you can write it off. Do not lease. Find a good used car and pay it off as fast as you can. It will be cheaper and more cost effective.

Credit cards are death on plastic. You should only use a credit card if you can pay it off every month. If you are carrying a balance, interest is eating your financial house like termites 24/7. If you want some motivation to help you accelerate paying off your credit card debt, then take a good long look at what you pay in interest every month. Let’s say the interest portion of your payment is $300 dollars a month. Start thinking in terms of 300 bucks a month in gas, groceries, shoes, tires, whatever, but start thinking in terms of what you could be buying instead of paying interest to the credit card company. This will be painful to ponder but you need to do it for motivation to pay off those credit cards.

Save some money! Keep at least 6 months of emergency money! Then and only then are you ready to hedge your investments. You should bank at more than one institution and check its financial health at a place like The Street.com or Bankrate.com. I do not get paid to promote these companies; these are just the ones I use. You should also have two well capitalized brokerages. I like Scottrade and Edward Jones. Again, I do not get paid to promote these companies. These two places have some of the highest capital ratios in the business. That is important because the insurance that you get on your brokerage account is not really worth that much. It is not easy to collect and you are not guaranteed to get all of your money back. Also, look at the Bernie Madoff and Alan Stanford fraud cases. People who were wiped out had all their money in ONE PLACE and that is stupid!!

You should also own some physical gold such as U.S. minted coins. Most experts recommend between 5 – 15%. You should keep it in a safety deposit box at a bank you check out and trust. I guarantee you every rich person has a physical gold position. And finally, let me repeat myself…GET OUT OF DEBT and STAY OUT OF DEBT. If that means staycations and wearing shoes longer than you would like – suck it up and do it!