Housing Sales and Inflation Surge

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big news in the economy last week was new home sales jumped 27% in March. It was the best monthly increase percentage wise since John F. Kennedy was in office. What the mainstream media did not tell you was new housing starts jumped up from a very low level– like the lowest level in history! This chart from shadowstats.com illustrates the point:

This is one of the many reasons why shadowstats.com founder, John Williams, says the economy is “bottom bouncing.” That is exactly what the chart shows. In early 2006, housing starts were more than 2 million–now they are just over a half million. Housing starts are down around 75% from the peak. Does this look like a big turnaround to you? Please do not get fooled into thinking we are on the brink of a real recovery. Williams says, “The U.S. economy remains in an economic depression, which is about to intensify anew. . .”

On the inflation front, the Producer Price Index was also out last week. The increase was dramatic. According to the latest shadowstats.com report, “Year-to-year, March’s annual PPI inflation rose to 6.0%, up from the 4.4% annual inflation reported for February.” I talked to Williams, and he told me this jump in PPI was, “close to 1970’s price increases.” The 70’s gave America some of the biggest inflation of the last century.

All the bailouts and money printing that has been going on the last couple of years will be inflationary. Already, “real inflation” is running at 9.5% according to shadowstats.com. We are going to see a repeat of the 70’s, but this time around, inflation in the U.S. will be on steroids. Eventually, we will see hyperinflation. So, a good place to store some of your wealth will be gold and silver. Williams says, “The prices of precious metals, particularly gold and silver, also tend to lead broad consumer inflation, reflecting inflationary expectations in addition to acting as safe-havens against political and financial market uncertainties.”

If you are going to be a buyer in this market, physical gold or silver coins should be your core investment. You can expect big price volatility, but long term, both of these metals will go up substantially. Which is better to invest in? Famed investor Jim Sinclair likes gold. After all, central banks vault gold for themselves. But Mike Maloney of goldsilver.com likes silver better. Maloney is forecasting silver prices will jump much higher in the coming years (on a percentage basis) than the yellow metal. In a recent Bloomberg interview, Maloney said, “For the first time in human history, silver is more rare than gold.” You can waqtch the complete Bloomberg interview with Mr. Maloney below:

Please do not get fooled into thinking we are on the brink of a real recovery. Williams says, “The U.S. economy remains in an economic depression, which is about to intensify anew. . .”

Greg – Didn’t you hear? “The chance for a double dip recession is COMPLETELY over.” per ABC News Radio broadcast this morning on WZTK in Greensboro. There seems to be a huge chasm between what I hear you saying and what most legacy news outlets are putting out there. How long before the crap really hits the fan? When do we really have to pay the piper? Can we just float along the bottom indefinitely? Time will tell.

Stephen,

It is not just me who is right on this issue. . . it is also all the people I quote. The “crap” is slowly hitting the fan as we speak. Thank you for your support.

Greg

Hello Greg,

When three critical sectors show signs of health, for a sustained period of time and without “monetized capitol” to spur sales, I will believe that our “bottom-bouncing” MIGHT be ending.

markm

Mark,

I agree!!

Greg

I beleive it Greg! What is the worst that can happen if one prepares for inflation and it never materializes? Get stuck holding gold and silver coins? Not such a bad thing in my opinion. Very good material Greg.

Mark,

Gold and Silver in the hand can never fall like Lehman, AIG or Bear. It will never go to zero or anywhere near. Keep holding those cards and you will be protected fro what is surely coming.

Greg

Greg – I know that you aren’t the only one beating this drum. Your writings and the wealth of additional sources have confirmed what I have felt at a gut level for some time now. It is just amazing that so much has been written and yet so few are aware of it. Keep up the great work!!! BTW – what is your recommended method for acquiring gold and sliver? THANKS!!

Stephen,

AU and AG coins are the best for so many reasons. DO NOT buy exchanged traded funds. If you must buy paper, buy good stocks in the mining industry but please do your homework. Thank YOU for the comment and kind words.

Greg

Greg,

Why the DO NOT buy ETF? I have 5% of my IRA in GLD (SPDR Gold) and it has increased quite well the past couple of months. Just want to know the “why”. I also have Palladium and Platinum ETFs but only 1% each of my IRA.

I just started accumulating gold and palladiumm maple leaf coins too.

Thank you.

Derek

Derek,

First of all, you need to read the prospectus. Does the ETF actually have gold? Read the prospectus and you will be shocked. Will you get paid if the brokerage goes under? The ETF on gold is one tenth ounce of gold per share and pays no dividend. Why not just hold the gold without anyone between you and your insurance? Thank you for reading USAWatchdog.com.

Greg

Greg,

Greetings from the Gulf South!

I thought that your article was spot-on. Keep it up!

What about items to barter like toiletries, liquor, and the like? Do you think that such items would be more desirable or less desirable than gold or silver?

Look forward to hearing from you. In the meantime, all the best!

Kent

Kent,

Your core store of wealth is AU and AG coins. That said, all you mentioned is good provided you have a place to store them.

Thanks for the comment.

Greg

Mainstream media has a ‘job’ to do, which is to pacify and dumb down the masses. Far-fetched? I don’t think so. This role media plays, is it for the benefit of society as a whole to prevent it panicking and the markets being devastated, or is it part of the economic problem itself? because if media had honestly spelt out the real situation years ago maybe there would have been enough awareness to avoid the situation we are now in.

Peter,

You make some good points. I spelled out what was happening in 2007 and 2008 and I got let go from CNN. You can check out what I said back in March of 2008 on the “Bio” section of this site. I said, ” the Banks were in trouble!” People looked at me like I had two heads. Thank you for your insight and comment.

Greg

Hi Greg, I agree with you completely about gold and silver,I’ve been steadily accumulating both since 2003 and have no complaints! Stocks, on the other hand, have been a comlete disaster. I’m thinking that we have seen nothing yet re: inflation, and even though we all talk about it and think we are prepared, we probably aren’t. We American couch potatos are not prepared for hyperinflation either physically, mentally or spiritually and it will be devastating when it occurs. But occur it probbly will, and I can’t help but wonder what kind of world awaits on the other side of the sh**storm.

Pokerface,

Things will get bad but how bad? When in doubt go stoudt. Thank you for the kind words and comment.

Greg

Hi Greg,

Nice article. I certainly follow John Williams and also like Gerald Celente (who is forecasting real doom)!

That said, I heard from a reliable source that each completed foreclosure counts as a SALE! The reason for is is simple. Ownership changes hands so the Title changes names…Also, it is said that Fannie & Freddie’s ‘trash mortgage’ forclosures have not yet been reported by our honorable Government. This of course, to make the housing stats look better.

Have you heard either of this comments?

Thanks!

Elihu,

Yes, that is the way I understand it as well. My sources also say this is correct. A foreclosure sale is counted as a sale. Fannie and Freddie debt and liability of approx $6.3 trillion is not reflected on the U.S. budget. The $1.3 trillion printed out of thin air was spent buying Fannie and Freddie sour debt. The U.S. is in very big trouble financially right now and there is no easy fix. I predict the government will print money until it runs out of trees!!! Thank you for your comment and support.

Greg

I think the bad 70s was the cost of the Vietnam war. We payed that war of with inflation.

Bob,

We are going to pay for war this time around with inflation. Lets not forget the most important form of war payment–the lives and limbs of good american service men and women. Thank you for commenting.

Greg

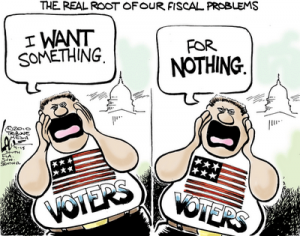

Greg,

That cartoon, The Real Root Of Our Fiscal Problems, is very odd to me. The way I see it, ALL wealth production comes from the labor of the voters/working class. When they open their eyes and see that the lazy and greedy upper class are stealing more and more of the wealth the voters/workers are producing, then the voters/workers want a greater share of their wealth returned. Something for nothing? Hardly! The wage disparity between the classes proves who is getting something for nothing, and it’s not the voters/workers.

Why would you put such a cartoon in your great blog? I don’t believe you are a socialism basher, as the creeping fascism is far more dangerous. Perhaps, in my ignorance, I have misunderstood something. If so please set me right.

DonF

Don,

I think all the big bankers are incompetent fools that should have been fired. Tha banks they run, should have been taken into receivership and only depositors should have been protected. So sorry I picked a cartoon that was not to your liking. Please continue to support USAWatchdog.com. Thank you for weighing in on this issue.

Greg

Another great post by the DOG. YES this is something that people need to be reminded of. There are some great prices out there on the things that most homes use. Paper towels, baggies, toliet paper etc. Something to think about is to gain a little stock.

I am not an expert but I pay attention. History dictates that we need inflation than another recession before we ever start to gain steam and truely start to grow. According to this articles which makes 100% sense and obviously comes from rational thought.

So strap it up it could be long winter

Patriot,

Thank you for your comment!

Greg

Greg

I am a socialism basher, Socialism removes the insentive to acheve and produse thir by killing econimoic grouth. I thought the cartoon was spot on. Americans need to wake up. It’s time to tighten your belt

Robert,

I think you are in the majority of the people who read this site. Thank you for your thoughts.

Greg