Latest Posts

Stocks Cut in Half & Gold Doubles in 2016-Bo Polny

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Market cycle analyst Bo Polny says stocks are going to take a beating, and gold is going to shine in 2016. Polny contends, “What we’ve seen happen so far in gold is just a warm up. We are not even close to see movements in gold, this is just the start. . . . What’s coming is a transfer of wealth. When you are looking at a transfer of wealth, it means a huge financial shift in the landscape. . . . You are going to have the stock market crash this year of a minimum of 50% . . . and gold will double. A $5,000 stock investment, after it is cut in half, will only buy you one ounce of gold that will be $2,500, and that will happen this year.”

Elites Know Economy in Deep Trouble, ISIS Will Attack US, Election Update

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

(WNW 226 2.12.16)

The economy is in deep trouble and elites know it. I think it’s so dire that it’s safe to say the trouble coming is going to be unlike anything we have seen. It will be Biblical in nature. The headlines this week were touting plunging markets and spiking gold prices. You know people are nervous when Drudge Report has a main headline that talks about gold demand. Anybody with two neurons touching knows the economy is in trouble, and the Fed is totally out of options.

Gold Will Smell Blood of Negative Rates-Peter Schiff

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Money manager Peter Schiff says forget about the Fed raising interest rates. The next move is down. Schiff explains, “I think there is a pretty good chance we’re going to get 0% interest rates before the end of the year, and I think we’re going to get QE4. We will see if the Fed is going to go negative, but they are going to do it eventually.”

DOW 6,000 Extreme Sell-Off Coming-Gregory Mannarino

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Trader/analyst Gregory Mannarino called the top of the DOW in May 2015. The market was well over 18,000 then and currently more than 2,000 points lower. Mannarino now says the Dow is going to “6,000–or lower.” Mannarino warns, “People need to be ready for a major, extreme sell-off in equities which are inflated in a bubble.”

Mannarino also says that the current stock market is, “the biggest bubble of them all that was inflated by a runaway central bank, and I believe it is bursting now. . . . There is nothing to push this back up.”

Hillary’s Iowa Loss, Economy Keeps Sinking, Obama Mosque Visit

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big loser in the Iowa Primary is Hillary Clinton. Yes, she came in first by a tiny margin, but even that is in question. Iowa’s biggest newspaper is calling for a recount because of the .2% margin of victory. The head of the Democratic Party in Iowa, also, reportedly, is a huge supporter of Clinton, and her Iowa license plate reads HRC 2016. Dr. Andrea “Andy” McGuire, the state’s Democratic Party Chairman, says there will be no recount. The biggest problem for Hillary is the ongoing FBI investigation over big national security issues caused by her private server. One of the big Republican winners in Iowa was Donald Trump. Why do I say this when he came in second? Trump spent far less time and money in Iowa than Rubio and Cruz. Iowa was basically a three-way tie.

World Going into Nasty Depression-Hugo Salinas Price

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Billionaire retail magnate Hugo Salinas Price says the world debt has peaked and has no place to go but down. Salinas Price explains, “It is a global phenomenon, yes. The world has too much debt, and now it’s trying to get out of debt. That’s what’s going on. . . . The debt peaked in August of 2014. I’ve been watching this for 20 years, and I have never seen anything like it. It was always growing, and now something has changed. A big change of this sort is an enormous event. I think it portends a new trend, and that trend will be to get out of debt. Deleverage and pay down debt. That is, of course, a contraction. Contraction means depression. The world is going into a depression. It’s going to get very nasty. The end result is nations, governments are going to have to revalue gold because that is the only thing they will have left. They will have to resort to that to keep trade coming in. No country is completely independent economically. We all need things others produce. . . . In order to have that world trade going, we are going to have to go back to gold. That’s my vision anyway.”

Investors Heading for Slaughter One More Time-David Stockman

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

By Greg Hunter’s USAWatchdog.com (Early Sunday Release)

Former Reagan White House Budget Director David Stockman says retail investors are going to take, yet, another very big hit. Stockman explains, “The retail investor waded in again. The sheep lined up and, unfortunately, are heading for the slaughter one more time. I think it is very hard to see how this Baby Boom generation, with 10,000 of them retiring a day, can afford one more devastating crash in their stock holdings. That is, unfortunately, what we are heading for. That’s why I say it’s dangerous. When the bubble breaks, it will spill and flow throughout the Main Street economy.”

All Trump All the Time, Bad Economy Sold as Good, Lucifer is In Style-NOT

By Greg Hunter’s USAWatchdog.com (WNW 224 1.29.16)

By Greg Hunter’s USAWatchdog.com (WNW 224 1.29.16)

Trump talks, he makes news. Trump doesn’t talk, he makes news. Trump tweets, he makes news. Trump offends, he makes news. Trump makes sense, he makes news. You may think what is going on with Donald Trump is all about Trump, it is really about the changing landscape of media and the old mainstream media (MSM) losing its relevance. Look at what just happened with Trump and this debate fiasco with FOX. FOX thinks it’s still running the media show, and Trump is showing them they are not. When you hear about Trump tweeting, switch out the word ‘tweet’ with ‘broadcast’ and there you have it. Trump, via the new media such as Facebook and Twitter, doesn’t need a network of TV stations or a cable outlet. The mainstream media is so freaked out they cover each and every tweet of Trump’s so as to not miss out and retain some relevance. No front-runner would have ever turned down a TV appearance until now. Why did he turn it down–he doesn’t need it. The MSM needs him. Times are changing, and the MSM is losing its grip in media and thus its relevance. Of that there is no doubt.

Monetary Meth Coming Soon-Gerald Celente

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Top trends forecaster Gerald Celente says the global economy is tanking, but don’t expect central banks to go down without a fight. Celente explains, “So, what happens? The markets are going down, and you hear from people like Ray Dalio (hedge fund manager) from Bridgewater Associates saying that the Federal Reserve needs to consider quantitative easing again and more stimulus. All of a sudden, the markets go up because, what happens, Mario Draghi, former head of the Goldman Sachs gang in Europe. . . . . Now, of course, he’s the head of the European Central Bank (ECB). Davos, Dalio, Draghi, three D’s man. Draghi gave these money junkies over there some monetary meth. All of a sudden, Draghi comes out and promises more stimulus on the horizon, folks. Whether it’s the Fed, ECB, China or the Bank of Japan talking about it again—more stimulus. All they are doing is keeping this money junkie, this Ponzi that is addicted to cheap money, alive. At some point, as we saw, it’s crashing and they keep coming up and give it more life.”

Next Crash Worse than 1929 & 2008 Combined-Michael Pento

By Greg Hunter’s USAWatchdog.com (Early Sunday release)

By Greg Hunter’s USAWatchdog.com (Early Sunday release)

Money manager Michael Pento says the next crash will be one for the record books. Pento contends, “If you look at any of the economic data coming out, it screams recession. It will be one of the worst recessions since 2008 and 1929—combined.” This is a description of a global depression. Pento contends, “Unfortunately, I think that’s exactly where we are headed. It’s not my opinion. It’s not a Cassandra. It’s not my view. It’s the entire view of all global markets. China is 45% down. There’s a bear market in Europe. There’s a bear market in Japan. There is a bear market in most of the United States.”

Elites Know Global Economy Tanking, Hill in Much Deeper Email Trouble, Bizarre US Middle East Policy

By Greg Hunter’s USAWatchdog.com (WNW 223 1.22.16)

By Greg Hunter’s USAWatchdog.com (WNW 223 1.22.16)

It appears the declining economy is so obvious that even the elite are admitting the global economy is tanking. At the World Economic Forum in Davos, Switzerland, where the richest people in business and government gather annually, the mood couldn’t be gloomier. Even the headline at USA Today reported this week “CEO’s Pessimism Over Global Economy Rises.” Actually, if you read their story, they soft-pedaled how bad it really is. Only 27% of 1,400 CEOs surveyed think economic growth will improve in 2016. (more…)

New Recession is Here Now-John Williams

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Economist John Williams says a recession isn’t on the way–it’s already here. Williams explains, “There are a number of factors here that are showing recession. Number one is industrial production. You can’t ignore industrial production; it is usually used with retail sales in timing formal recessions. It turned down last December, and it generally has not looked up since. You’ve had three out of four quarters in the last year contracting. The numbers that came out for the fourth quarter showed year to year contractions that you never see outside of recessions. This is typical of a formal recession. You are also seeing recession if you look at the housing numbers. They have turned down quarter to quarter for the fourth quarter . . . with housing starts. If you look at the stock market and the S&P 500, the revenues that are being reported for companies . . . revenues for the S&P 500 are falling off quarter to quarter. You never see that outside of a recession. That is a broad measure of economic activity. . . .The Atlanta Fed . . . their GDP number for the fourth quarter has just dropped to .6%. . . . I think it will be negative in the second reporting. With all these factors coming together, I think you will have an early call on a new recession or at least it will be viewed as a new recession in the early part of this new year.”

Financial Crisis Worse Because It’s Global-Nomi Prins

Greg Hunter’s USAWatchdog.com (Early Sunday release)

Greg Hunter’s USAWatchdog.com (Early Sunday release)

Best-selling author and journalist Nomi Prins says the next financial crisis will be much worse than 2008. Prins contends, “If you look at the beginning of 2016 . . . it’s indicative of the rest of the year. We are seeing declines everywhere, and they are significant declines. The stock market won’t be a correction, but indicative of more downward spiraling to come.”

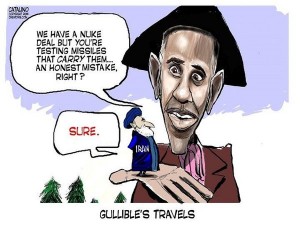

Obama’s State of Delusion, FBI Widens Hillary Email Probe, Iran Detains US Sailors

By Greg Hunter’s USAWatchdog.com (WNW 222 1.15.16)

By Greg Hunter’s USAWatchdog.com (WNW 222 1.15.16)

President Obama’s State of the Union should be renamed to the State of Delusion after he said, “Anyone claiming that America’s economy is in decline is peddling fiction.” This is so off base and delusional I simply do not know where to start. There are so many metrics that prove the President wrong. The Labor Participation Rate stands at around 94 million, a record. The Baltic Dry Index has plunged to record lows, and the stock market is off to the worst start—ever. There is one headline after another that confirm the problems with the stock market are real. So is the fear the economy is sinking, and there is nothing the Fed can do about it.

Full Default of Global Debt Coming-Andrew Hoffman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Financial writer Andrew Hoffman says the Fed has a lousy track record for predicting the economy. Hoffman explains, “It’s not just the Fed, but all central bankers have been wrong on pretty much everything they have said. In the case of the Fed, in particular, which is by far the most important central bank in the world because what they . . . do destroys everyone else, it’s been three years, and they have been talking about economic recovery, and then they decide to raise rates just as the economy gets the absolute worst in our lifetimes. We are getting closer to the Yellen reversal when she is forced by markets to admit they have been wrong.”