Latest Posts

Four Biggest Banks in America have Huge Leverage

By Greg hunter’s USAWatchdog.com

By Greg hunter’s USAWatchdog.com

I keep hammering away at the fact the Fed doled out $16 trillion in the wake of the credit crisis of 2008. This is an enormous sum that is greater than the all goods and services produced in the U.S. in a single year. Domestic banks and companies got the money, right along with foreign banks and companies. In effect, the Federal Reserve bailed out the world financial system. (more…)

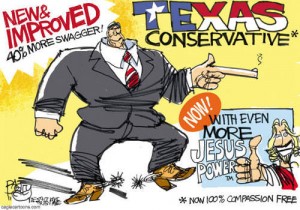

Can Rick Perry Take the Heat?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It is hard being a front runner, and just weeks after entering the race for President, Governor Rick Perry now knows it. During the Republican Presidential debate on Monday night, Perry was hammered for signing an order in Texas four years ago requiring pre-teenage girls to be vaccinated against the human papillomavirus. HPV is a sexually spread virus that can cause cervical cancer. (more…)

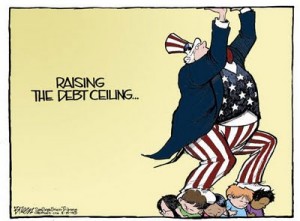

The Weekly News Wrap-Up 7/8/11

By Greg Hunter’s USAWatchdog.com (Updated and revised)

By Greg Hunter’s USAWatchdog.com (Updated and revised)

It is amazing that so few people know or want to know about the debt ceiling negotiations going on in Washington D.C. this weekend. It has been reported the raise is in the neighborhood of $2.4 trillion. That’s 2,400 billion bucks, and please remember a billion is 1,000 million. On the other hand, the public is being bombarded with every tiny detail about the Casey Anthony case by the mainstream media. (more…)

We Need Honest Money

Last year, I wrote a piece called “We Don’t Have Honest Money.” It’s about how the Fed is debasing our currency. I wrote, “It is said, when empires fall, one of the first signs of decline is a debasement of the currency. Long before the Roman Empire fell, its leaders debased the currency. The debasement was small at first, but over time, precious metals were watered down and coin sizes shrank. For example, silver coins ended up having so little silver in them they became unpopular and shunned. A debased Roman currency brought, what else, inflation. Sound familiar?” (more…)

Last year, I wrote a piece called “We Don’t Have Honest Money.” It’s about how the Fed is debasing our currency. I wrote, “It is said, when empires fall, one of the first signs of decline is a debasement of the currency. Long before the Roman Empire fell, its leaders debased the currency. The debasement was small at first, but over time, precious metals were watered down and coin sizes shrank. For example, silver coins ended up having so little silver in them they became unpopular and shunned. A debased Roman currency brought, what else, inflation. Sound familiar?” (more…)