Don’t Let The Facts Get In The Way Of A Recovery

By Greg Hunter’s USAWatchdog.com

For awhile, the term “green shoots” was the buzz word for the economic rebound. Remember that? The “green shoots” have now turned into a “recovery” almost every time the economy is mentioned. It seems we are constantly bombarded with stories of how the economy is turning around when the facts say otherwise.

I do want to be positive, but some of the spin I am hearing would make “Baghdad Bob”(Mohammed Saeed al Sahaf) proud. You remember the former Iraqi Information Minister who made wildly false statements about the 2003 Gulf War. One of “Bob’s” last zingers was, “This invasion will end in failure.”

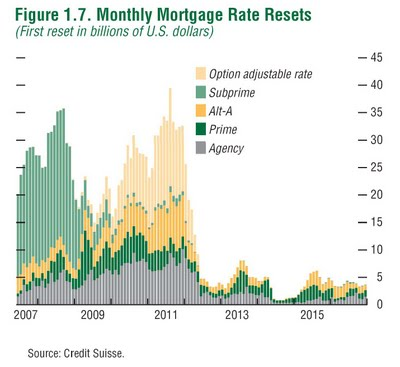

There has been some good news, such as a story that came out earlier this week in the Los Angeles Times. The headline read: “Home prices in California show strong, unexpected gains in January.” The Times story went on to say, “L.A. leads the S & P/Case-Shiller index of 20 cities with a 1.8% increase from December. The index rises 0.3% overall, its eighth monthly increase in a row.” This is great news, but buried in the story is this fact, “A breakdown of the index showed mixed results, with 12 cities posting increases and the rest decreases. When left unadjusted for seasonal variations, the 20-city index fell 0.4%.” Yes, the index “fell 0.4%,” if you leave out the “adjustments.” (Click her for the complete L.A. Times story.) Do you see a recovery in the mortgage reset chart on the below?

Is this the best the real estate market can do, even with government tax credit programs that pay buyers between $6,500 and $8,000 to buy a house? According to one report, foreclosures are making up more than 40% of sales in some areas. Also, the government is almost totally supporting the mortgage market by financing at least 90% of the loans. Is this what a “recovery” looks like?

Then there is news this week about failed mortgage giants Fannie Mae and Freddie Mac who both just hit new all-time records for foreclosures. Taxpayers are on the hook for more than $6 trillion as the unlimited bailout continues. Don’t expect an improvement on the foreclosure front anytime soon. White House economic advisor Diana Farrel said late last week, government efforts to stop foreclosures will not prevent as many as 12 million defaults over the next three years! How is there going to be a meaningful recovery with that going on, and why isn’t the mainstream media reporting on this huge Fannie and Freddie taxpayer rip-off? (Click here to read more about Fannie Mae.)

Speaking of stories getting ignored, nearly every week there is a fresh batch of insolvent banks that are taken over by the FDIC. So far this year, 40 banks have gone under. Elizabeth Warren, head of the Tarp Oversight Committee, projects 2,800 community and regional banks could fail in the next 3 years because of sour loans. That is nearly 40% of the 8,000 banks in America. How is this “recovery” going to take hold?

There are so many other real impediments to the “recovery” story it is almost comical. There are ballooning government deficits, hundreds of trillions of dollars in unregulated derivatives (like the ones wrecking the Greek economy) and dozens of U.S. states in dire financial trouble—to name a few! These problems, and many more, make talking up a recovery look like “Baghdad Bob” is writing the wire copy.

All this is the backdrop for which Congress passed health care reform. It is the biggest entitlement program since Medicare. Economist John Williams says the government’s health care takeover will “depress the economy” and make the “deficit and inflation” much worse. Not to end on a gloomy note, I leave you with this quote from an unknown author:

“Let me get this straight. We’re going to be gifted with a health care plan written by a committee whose chairman says he doesn’t understand it, passed by a Congress that hasn’t read it but exempts themselves from it, to be signed by a president who also hasn’t read it and who smokes, with funding administered by a treasury chief who didn’t pay his taxes, to be overseen by a surgeon general who is obese, and financed by a country that’s broke. What the hell could possibly go wrong?” –origin unknown

Time to hoard CASH. Actually it’s been time for quite a while, but really mean it now. No lavish spending, and SAVE. Savings can take many forms:

1. Savings account

2. Gold and silver coins

3. Food – when inflation strikes those extra food stuffs purchased today will help stretch your dollars until the paycheck adjusts upward

4. Other things you buy daily/weekly/monthly – oil for oil changes, buy winter gear now while it’s on clearance, etc., etc.

Live like your parents/grandparents of the Great Depression. Start a garden! We did that last year and so enjoyed the fresh vegetables and teaching the kids how to maintain it we are tripling the size of it this year.

Greg – there is a typo. “…projects 28,000 community and regional banks could fail in the next 3 years because of sour loans. That is nearly 40% of the 8,000 banks in America…” I’m no economy whiz but 28,000 isn’t 40% of 8,000 using the old math 😉

Will,

Good points and thank you for catching my typo. I meant to say 2,800 banks NOT 28,000. That’s what I get for posting after midnight.

Thank you for your comment.

Greg

Forgot one. Have cash at home. Here’s an interesting experience if you have the means. Go to the bank and ask for $10,000 cash from your savings account. I did that a few years back and had to wait while they made sure they had enough money!

Your deposits are guaranteed safe by the FDIC but it’s NOT guaranteed that you can get cash for those numbers on the statement!

English philosopher Edmund Burke said, ‘The only thing necessary for the triumph [of evil] is for good men to do nothing.’ Well, are you doing anything? Let’s work to protect our families and work against Democrats and Republicans that don’t understand what a balanced budget looks like or the US Constitution.

Good stuff again George.

Greg

The time for playing King Canute is over, George. Sometimes, the dragon wins. Notice how Burke doesn’t give us any advice about what to do once evil has triumphed, which it now has, at least temporarily.

Luckily, though, we can take a page or two from The Atlas Shrugged Playbook and stand back, step out of the way, and stop trying to “fix” something that is hopelessly, irreparably broken. This is admittedly difficult for anyone with confidence in their ability to “fix” things, be they mechanical or systemic, but the urge to “fix” must be overcome so the collapse can be not only allowed to proceed, but hastened.

Hello Greg,

I am listening to 560 KSFO right now. Brian Sussman took a break for top-of-the-hour news from ABC. Guess what? Baghdad Bob was reporting. The reporter stated that our economy was in recovery with 130,000 jobs being created. Another reporter qualified the report with a few notes about temporary census workers.

I just checked BLS table A15 for March. Unemployment remains 9.7% (U3) and U6 went up to 16.9%. There is a little movement in construction and industrial employment, but marginal job growth was reported, overall.

http://www.bls.gov/news.release/empsit.t15.htm

You did a great job on Sussman’s show yesterday!

Thanks,

makrm

Mark,

Thanks man!!!

Greg

The irony is that “Baghdad Bob” may well turn out to be right when he says “the invasion will end in failure.”

Peter,

Very good point. I thought the same thing myself. Thank you for the comment.

Greg

Cash is worth exactly the paper it is printed on.

Time to hoard gold.

Nikko,

And AU has a much longer winning track record than the buck!! Thank you.

Greg

Our government specializes in lie’s, we the sheeple are in the process of beening sheared by a blind man with a dull hatchet…….it’s gonna get brutal folks so savor the time in eye of the hurricane…..pray without ceasing and prepare as best you can RIGHT NOW!!!!! don’t procrastinate….times running out.

Kenny,

I am afraid the people who read this site are in the minority. You have done the right thing. Thank you for your passion.

Greg

Greg, never mind recovery, the libs don’t let facts get in the way of…..well……anything! Facts don’t get in the way of entitlements, healthcare, global warming, cap and trade, tax increases, TARP, calling the right racists and violent, the Prsidents past and present associations with radicals……. nothing. It is such a propoganda campaign that I find myself amazed at just how many of my fellow citizens are stupid enough to believe whatever they hear on the MSM. Welcome to Obama’s USSA, hope and change baby. If you vote in November for any incumbent then you deserve what you get! I challenge anyone to finda contradiction to this rule in all of world history, what a government subsidizes it gets more of, and what it taxes it gets less of. We have been subsidizing poverty since 1964 and the problem of poverty has brought down the middle class, dramatically reducing the number of taxpayers to support the welfare class. When are the tards going to learn that you can’t multiply wealth by dividing it! Thanks for the good work Greg, rock on!

Tom,

Everybody should be hopping mad about what has been going on!! I agree with you totally! However, there is plenty of blame to go around to both parties for the mess we find ourselves in. We will all sink or rise together. Thank you for your insightful comment.

Greg

This is nothing else but freakonomics.

Mike,

It may be worse. Thank you for your thought.

Greg

I’ve been hunting pretty much everywhere for this specific information… I’m grateful anyone seriously has the answer to a really very simple query. You have virtually no idea the amount of internet websites I’ve also been to throughout the past hr. Thx for the knowledge

Milo,

Thank you. Please come back and bring your friends.

Greg

I have been looking into applying in the oil industry. I’ve read that the pay is excellent with a lot of vacation time. This article says I can get a great position even though I don’t have a degree. Oil Rig Jobs No Experience. All I want to know is, is it possible?

Have a great day!

Eleonore,

Just be careful and by no means do not pay a fee to get the job. Make sure you are actually applying to an oil company.

Good luck. Tell us how it turns out.

Greg