Two Stories that Should Scare the Heck Out of You

I was sitting here trying to find a way to wrap up the week and then, like a bolt of lightning, an idea hit me. Gold expert Jim Sinclair sent me this story: “Federal Budget Deficit Hits $1 Trillion For 1st 9 Months Of FY’10.” The story said, “The shortfall, reflecting $2.6 trillion in outlays for the first three quarters and $1.6 trillion in receipts, narrowed slightly compared with the same point in fiscal 2009.” So where did the “shortfall” come from? Try the more that 8 million who lost their jobs. The story went on to say, “. . . individual income and payroll tax receipts were down 4% over the nine-month period, suggesting that wages and salaries have not improved to the extent that corporate profits have.” Corporate profits have “improved” because they laid-off all those workers!! (Click here for the entire Dow Jones Newswires story)

Sinclair says, “Nothing has changed. Nothing has been rescued. The can that is being kicked daily down the path is going to turn around and bite the kickers.

Gold is the only insurance.” When things get bad enough, there will be more stimulus cash put into the economy and more bank bailouts. Sinclair is like legendary football quarterback Joe Montana–never bet against either of them.

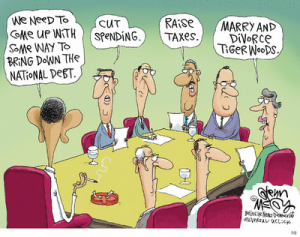

The second story that should scare the heck out of you is one where the headline reads, “IMF presses US to cut debt.” The story goes on to say, “The International Monetary Fund on Thursday urged the United States to rein in its ballooning budget deficit without putting the “modest” economic recovery at risk. Amid jitters that high levels of unemployment may force a double dip recession, the IMF warned the slow U.S. recovery would continue and that debt problems loomed.” (Click here for the complete story from Yahoo News.)

Talk about a squeeze. The U.S. has lost millions of jobs; it has falling tax revenues and a ballooning deficit. Now is the time the International Monetary Fund picks to tell the U.S. to cut its debt? Not a chance going into the 2010 mid-term elections! People like Paul Krugman and Nancy Pelosi are pushing for more spending (money printing). I am betting they will get their wishes granted.

These two stories do not bode well for the so-called “recovery,” the value of the U.S. dollar and keeping interest rates held down to ridiculously low levels. These two stories scare the heck out of me. Not just because of what they say, but also because they’re making their way into the mainstream media. That means, before long, everybody will catch on America is in deep financial trouble. We do not have a “dip” coming our way but a swan dive off of Niagara Falls into a dry river bed.

Greg

You are right on all counts. I am confused about the recent decline in gold prices. As I search the internet for some explanation I find silence except for gloating of those that think gold is not a good buy but rather a goodbye. I have asked the NIA for an opinion three times and have not received an answer. This makes me wonder if a number of websites are merely shills for gold miners; in particular paper gold sellers.

I think our situation is bound to get worse, how can it get better?

By the way, I’m 65 and have traded gold since 1973. I have followed Jim Sinclair since about 2000 and never miss a word he posts.

What he says is so. We are about to experience the greatest economic catastrophe the world has ever seen so far in history.

Put your faith in Sinclair and no one else and stop trying to figure out this market. If you don’t know what has happened by now, follow Jim’s directions and do it quickly as we don’t have very long before the collapse moves into high gear and gold explodes above $2000. (Sinclair is ALWAYS conservative so as not to be thought to be a kook!) GOLD IS YOUR SURVIVAL!

You should have all your survival supplies in house NOW and know how to do everything it takes to survive on your own. This means providing your own food by gardening, hunting, etc and how to defend yourself and your family. There are lots of survival sites on the internet with excellent information.

GET MOVING NOW! You don’t have any time to waste in getting your house in order for what’s coming. Supplies will soon become hard to find at any price, hence the need for gold to keep your assets from disappearing as paper money becomes worthless.

Thank you Goldtrader.

Greg

Great articles as usual Greg!

I noticed that JSMineset links to you,although I hope that Jim is right about gold going to $1650. by the end of Feb 2011,I have my doubts.

Look at it this way,for the last 10 years,gold has risen on average about $8.oo per ounce per month,but for Jim’s prediction to come true it would have to rise by $63.00 per ounce each month from here on out!

Good luck.

Dave,

Sinclair did not make the $1650 call last month; he made it when gold was in the $300’s. Anyway you cut it; calling gold at $1650 in the early 2000’s is a damn good call. It was one of the single best buys of the last 10 years. Are you expecting things to be nice and stable while we calmly dive into the tank? Bet against Sinclair at your own peril! Good luck to you my friend.

Greg

thanks Greg for all your hard work and research

Guru fah~Que

Thank you E.S.Fair!!

greg

Revenues are falling short of expectations. Perfect excuse for letting the Bush tax cuts expire at the end of the year. “We can’t afford to extend them.” You can just hear them saying it.

And again, nothing will change, nothing will have been rescued. And that can will keep getting heavier & heavier until….

Thank you Mike and JB inFL!

Greg

Great article. It’s about time the mainstream media stop feeding us the Elite Banker spoonfed garbage, eliminate the smoke and mirrors, and start telling us the truth. We need to allow the correction to happen. That will never happen as long as congress and the senate and this President continue to spend more money than we have and continue printing money out of thin air to fix a problem that was caused by excessive debt and easy credit in the first place!!!

Greg,

Add this to the scare the heck out of you news. How long can they hide the truth? Bush’s administration was not always transparent BUT Obama’s is more opaque than Bush. Why is the main stream media not calling them on this?

Are Overdue Reports Concealing ObamaCare Impact On Medicare?

http://www.investors.com/NewsAndAnalysis/Article/539411/201007061804/Are-Overdue-Reports-Concealing-ObamaCare-Impact-On-Medicare-.aspx

And I quote, “The Congressional Budget Office reported last week in its Long Term Budget Outlook that Social Security was already running a deficit this year. According to last year’s Social Security Trustees Report, that was not supposed to happen until 2015, with the trust fund to run out completely by 2037.

With the disastrous Obama economy, the great Social Security surplus that started in the Reagan administration is gone completely.”

George,

Good additional info man!

Greg

GOLD GOLD GOLD. It won’t matter if you don’t have a army. And why is the dollar still hanging in there it’s because the USA is still top dog when it comes to killing people and taking what we want.If a country loose a war, your money becomes worthless over night. When you get right down to it there is no wealth unless you can take advantage of others.A man on the street with gold in his pocket is going to have his head kick in just for fun. What this country needs more then a note of your worth is law. At this time in are lives, we are living in a lawless land. We had 3000 people murder on 911 and lie to about that. Wall street,banks and DC is full of lawless people. Gold won’t make much differences in a lawless land.

Bob,

You might consider taking a trip to your local gun store. Thank you for your comment.

Greg

Every election is a sort of advance auction sale of stolen goods.

H. L. Mencken

Democracy is the theory that the common people know what they want, and deserve to get it good and hard.

H. L. Mencken

Each party steals so many articles of faith from the other, and the candidates spend so much time making each other’s speeches, that by the time election day is past there is nothing much to do save turn the sitting rascals out and let a new gang in.

H. L. Mencken

The Bank for International Settlements added 382 tons of gold to it’s vaults from the central banks. Initially when this information was made public the Wall Street Journal said ti was the central banks then revised later that it was the commercial banks. According to Julian Phillips at Goldseek.com:

“The Wall Street Journal informs us that the B.I.S. did these swaps with commercial banks. We know of no commercial bank that has 382 tonnes of gold on their books. It is likely then that should these commercial banks have been in the deal, they would have been acting for a central bank [or several over time] who wished to remain anonymous.”

Then Rocky Vega of DailyReckoning.com concludes from this that gold is returning to the banking world as a financial instrument.

To tap into a conspiracy theory it would make sense for central banks to have a role in suppressing gold prices if it were to return to the world stage as actual money. Buying it up on the ‘relative’ cheap now anticipating a collapse of fiat currencies in the future puts them squarely in the driver’s seat.

Nobody forget the “golden rule”. He who has the gold, makes the rules.

Stephen

Stephen,

Good as always. Thank you.

Greg

Greg,

I’ve heard rumblings on the ‘Talk Radio’ circuit concerning “Lame Duck Session” maneuvers if the Dems lose big in November. Several topics brought up were; Cap in Trade, VAT, and some kind of “Transaction Tax” on bank & purchase actions.

I may not be totally clear in my understanding of these (my source is mainly from the Neal Boortz show).

If you’re familiar with these I’d love to hear your opinions on what may be coming.

If I’ve wasted space on your blog then I apologize.

God Bless

James,

I think Democrats are smart enough to know they are going to have real problems in the November Mid-terms. I think it is only natural they will push what is important to them while they have a majority. Thank you for your support.

Greg

Thanks Greg great read……I wonder how much paper rolled off the printing presses in the time it took to read this

Thank You Dino and Mark!!

Greg

Great article Greg! I strongly urge your readers to get Jim Sinclair’s newest book, A Pocketbook of Gold and read it. Jim refers to his book as A Survival Manual for the Monetary Mahem. This book lays out the facts as to why this country is in the financial condition it is today. And guess what? We are NOT on any road to recovery! Do NOT bet against Mr. Sinclair.

We ain’t seen nothing yet. The real collapse is coming. And I look forward to seeing the despair of all the clueless people. As you cannot prepare effectively for the actual economic collapse of the so-called “free” (feminized) U.S….

Let’s kick the IMF down the road also. If you want to see what following their advice leads to, look at Latvia. We could also add Greece to that discussion, because the IMF advice formed the basis of the EuroZone’s non-bailout of Greece. Can someone actually demonstrtae an historical example of a severe austerity program eventually resulting in prosperity without being overridden by either a war or a default???