Real Estate at a Bottom…NOT!

By Greg Hunter’s USAWatchdog.com

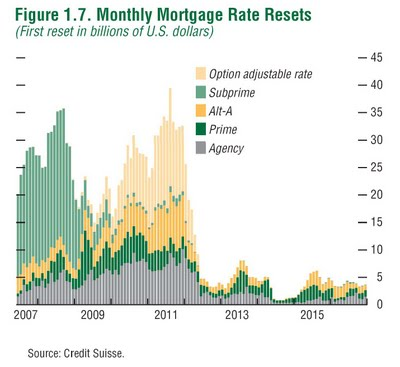

I keep hearing the constant drone of real estate being “at a bottom” or “finding a bottom.” I started to really notice this chatter by the talking heads of financial television in the middle of June when I heard Jim Cramer declare that “real estate has bottomed!” Yes, we just got some good news on the home front about exsisting home saIes jumping more than 7 percent in July. It is the 4th consecutive increase in sales. However, factor in 31 percent of all sales are foreclosures and short sales and that yearly median house prices have dropped 15 percent and there is not that much to celebrate. Also, the numbers are being artificially pushed up because of an 8 thousand dollar first time home buyers credit that will expire in November. I wish as much as the next person that the worst is behind us and better days are ahead, but that does not square with the facts. They say a picture is worth a thousand words and the one below from Credit Suisse says plenty about where we are in the real estate downturn.

It could not be any clearer that there is a tsunami of mortgages that are going to reset to higher payments between now and mid 2112! There will no doubt be families that will be able to pay increased monthly payments, but there will undoubtedly be many who will not. This will not help the foreclosure problem or support prices!!

I bet you the Fed and the Treasury are very familiar with this chart. Officials must be scared to death that resets and possibility of rising rates would kill any long term recovery. The Fed is spending (or printing) 300 billion dollars to buy their own notes to create demand and that is what is holding rates down! This is called Quantitative Easing or QE, but what will happen when the program expires this fall? What will happen to housing prices if the 30 year fixed mortgage, which is now around 5.5 percent, rises to say just 7 percent? Prices would definitely go down.

Some other recent news about real estate points to anything but a bottom. A little more than 13 percent of residential mortgage holders nationwide were at least one payment overdue or in foreclosure last quarter, according to the Mortgage Bankers Association.

A Deutsche Bank report claims that 25 million homeowners will probably owe more than their mortgage is worth by 2011. That will be nearly half of all homeowners in the U.S. The bank estimates 26 percent of homes are currently underwater.

Also, there is the recent news from Realty Trac where foreclosures are up 32 percent nationwide from July of last year. In fact, home foreclosures failed at a record pace despite the ongoing state and federal programs to help people to stay in their homes. Finally, commercial real estate is another 2 to 3 trillion dollar meltdown and that is not going to end well either.

This does not mean there are not bargains out there in the market, but let’s not confuse a plateau on a downward trend as a bottom. Please keep the picture above on your “favorites” and every time you hear “the real estate crisis has bottomed” take a long look at it. When I gaze at the Credit Suisse chart, I do not see a bottom until at least 2012. I hope I am dead wrong!

When do you recommend I buy a house? How long should we wait?

John,

That depends on many factors. If you don’t need to then wait and save your capital. We are nowhere near a bottom.

Greg

John,

Thank you for the comment. Take a long look at the Credit Suisse chart above. It looks like the bottom is 2012. Just be careful buying because I feel there is no hurry especially if it is a home you plan to live in.

Greg

Good job, keep up the posting.

Amador,

Thank you!

greg

How about the depressed prices in Phoenix. I’ve already started buying homes there as rental properties. The houses are 1/3 or even less than the 2006 highs. It would cost more to build a house than what the prices are going for.

I’ve already noticed the same sq footage house in same neighborhood going up by 10K. I think we’re scrambling at the bottom. The way I see it, when the market is ready to turn around, you may not find the house you want, especially when you have to deal with short sales, it can run you to 6 months to complete the transaction.

http://financedealers.tk gfhgf