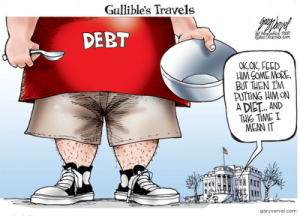

The Worst 4 Letter Word of All–Debt

You can write volumes on what is actually wrong with the economy. We have record foreclosures, the FDIC closing banks every weekend, high unemployment, enormous deficits, food banks running out of money, sour mortgage-backed securities and the list goes on and on. You could tie almost every financial problem together with one little ugly four letter word—DEBT. Even our money is debt because, for the most part, it is loaned into existence.

You can write volumes on what is actually wrong with the economy. We have record foreclosures, the FDIC closing banks every weekend, high unemployment, enormous deficits, food banks running out of money, sour mortgage-backed securities and the list goes on and on. You could tie almost every financial problem together with one little ugly four letter word—DEBT. Even our money is debt because, for the most part, it is loaned into existence.

The guest writer you are about to read has written one of the best posts on debt I’ve read in a long time. He goes by the pen name Giordano Bruno. You history buffs out there know that Bruno was an Italian philosopher and astronomer from the mid to late 1500’s. Bruno was burned at the stake because he believed in the infinity of the universe. He was a big thinker just like our guest writer, Brandon Smith (aka Giordano Bruno). Smith’s web site says he, “. . . is the head writer and co-founder of Neithercorp.us which specializes in alternative macroeconomic analysis as well as studies in mainstream media disinformation.” Anyone who reads this site knows I think the mainstream media is not giving it to you straight, especially when it comes to the economy. This is why it’s easy for me to put Brandon Smith (aka Giordano Bruno) on this site for you to read. You can find out more about Mr. Smith at the end of this long, but well researched, and interesting post. Enjoy!—Greg Hunter–

——————————————————

The Great Global Debt Prison

By Giordano Bruno, Guest Writer for USAWatchdog.com

Tense and terrible times inevitably summon an odd coupling of two very different and difficult human conditions; honesty, and brutality. Certain painful truths are revealed, and often, a palpable fury erupts. Being that times today are particularly tense, and on the verge of being spectacularly terrible, perhaps we should embrace both conditions in a constructive manner, and become brutally honest with ourselves. This begins by admitting to that which most ails us. It begins by admitting how far we have fallen…

Our economy, our culture, our entire world, is built upon debt. No one ever asked us if that’s how we wanted it, it is simply how the system was designed when we came into it. Many of us have lived our entire lives under the assumption that debt is a necessary function of daily commerce and a valuable driver of successful society. Most households in America operate at a steep loss, trapped in constantly building cycles of liability and interest. There are even widely held schools of economic thought that are centered completely on the production and utilization of nothing but debt. Only recently have many people begun to ask themselves what the tangible benefits are (if any) in being dependent on debt based finance.

After careful examination, it becomes evident that debt does not fuel economy, it suffocates it. It does not nurture growth, it stunts and poisons it. Extreme debt is not a fundamental organ in a body of commerce; it is an aberration, a spreading cancer which disrupts the circulation of healthy trade. Debt is, in large part, unnecessary.

Of course, debt can be very useful if you are the controller or determining overseer of a system, especially if you wish to centralize and maintain power over that system. The tactical wielding of debt has been used by elites for centuries as a means to imprison the masses, or to create an atmosphere of endless dependency. Let’s take a look at what debt really is, and how it is being used against the average American today…

Understanding Debt

The Charles Dickens classic ‘Little Dorrit’ is commonly misinterpreted as a “love story”, however, the primary character in the book is not Little Dorrit, or the kindly Arthur Clennam, but the debt system of Britain itself, and its effects on every social class from the street beggar to the elitist socialite. Dickens despised the idea of debt and debtors prisons, being that his father was thrown into one for a good portion of his life, forcing young Charles to work just to support his parents. Dickens understood well the evil intent behind the debt system, and railed against it often in his writings.

One figure in ‘Little Dorrit’ which fascinated me was the character of Mr. Merdle, a national banking superstar who dominates the investment world with the help of British treasury officials and various political deviants. Merdle is referred to by merchant circles as “the man of the age”, a financial marvel who seems to make fortunes in every endeavor he touches. Little does anyone realize that Merdle is a fraud, a Ponzi scheme artist who takes money from unwary speculators and sinks it into increasingly more tenuous investments. In order to continue hiding the fact that all his financial ventures are ending in ruin, he lures more and more depositors to pay off previous debts. The problem is that Merdle is creating debt to chase debt. Eventually, his insolvency, and that of all those who trusted him, will catch up and overtake the lie he has carefully projected. All economic instability is invariably revealed, no matter how expertly it is hidden.

Mr. Merdle, in my mind, is an almost perfect literary representation of today’s private Federal Reserve and the global banking syndicates of JP Morgan, Goldman Sachs, Citigroup, etc. The Federal Reserve, with the help of politicians on both sides of the aisle, created a series of illusory incentives (through interest rate cuts) which allowed banks to begin lending almost unlimited fiat at rock bottom prices. America was awash in credit, to the point that it was nearly impossible for the average person to avoid the temptation of borrowing. What we didn’t understand then, but are beginning to grasp now, is that credit derived from fiat is not “capital”, it is NOT wealth. Credit is the creation of an obligation, to be paid at a later date, if it is paid at all, and because there are no rules to tie the debt to any legitimate collateral (at least for banks), there is nothing to back the obligation if it falters. Therefore, fiat induced credit is not the creation of wealth (as Keynesians seem to believe), but the destruction of wealth!

Because of its lack of tangibility, debt can be packaged and repackaged into whatever form banks like. Derivatives are a perfect example of the phantom nature of debt; securities which have no real value whatsoever yet are rated and traded as if they are a solid commodity. This brand of commerce is, at its very root, a kind of fiscal time bomb. Just as in the literary world of ‘Little Dorrit’, the Ponzi scheme in our very literal world had to reach a tipping point, and in 2008, it did.

One glaring difference between our troubles and those of Dickens’ fiction is that Merdle actually feels guilt over what he has done (or he at least fears the justice that will be dealt him), causing him to commit suicide towards the end of the novel. In the real world, the Merdles of our era appear fully content to watch this country crumble due to their intrigues, and rarely suffer any consequences for what they pursue. In fact, the modern banking elite are more liable to revel in the searing shockwave of a credit detonation, rather than feel any “remorse”. The point is, Dickens saw clearly over 150 years ago what many Americans today still do not; debt is an abstract idea, an absurd game which confuses and ensnares innocent people. Debt based systems con the citizenry into trading away their tangible wealth and labor for the promise of future settlements that will never come. Debt serves only to weaken the masses, and empower creditors.

The Consequences Of Debt

How has debt based economics served us so far?

The credit card debt of the average American household ranges from $8000 to $15,000. Total household debt including mortgage and home equity loans has hit an average of 136% of annual household income:

http://www.creditcards.com/credit-card-news/credit-card-industry-facts-personal-debt-statistics-1276.php

http://blogs.forbes.com/moneybuilder/2010/06/24/one-big-difference-between-chinese-and-american-households-debt/

Approximately 80% of mortgage loans issued to subprime borrowers over the past decade were Adjustable Rate Mortgages (ARM), meaning 80% of mortgages in the U.S. have reset or are ready to reset at much higher interest rates. There were approximately 1.4 million bankruptcy filings in 2009, and 1.5 million in 2010. One in every 45 homes in America received a foreclosure filing in 2010:

http://www.marketwatch.com/story/top-10-cities-where-foreclosure-rates-are-highest-2011-01-27

http://www.uscourts.gov/Statistics/BankruptcyStatistics.aspx

Keep in mind that in 2005, new government regulations were implemented making filing for bankruptcy much more difficult. In 2006, filings collapsed. Now, despite stringent obstacles, filings are up again over 100%.

The “official” national debt now stands at over $14 trillion, which is around 100% of U.S. GDP (with entitlement programs like social security included, this number is probably closer to 400% of GDP) . The 100% mark is often cited as the breaking point for most countries struggling to sustain liabilities. Greece’s national debt stood at 108% – 113% of GDP when it collapsed into austerity. From 2004, to 2010 (a span of only six years) our national debt has doubled. To put this in perspective, it took the U.S. over 200 years to reach its first trillion dollars of debt. Now, we are looking at the accumulation of at least a trillion every year. This is unsustainable.

The much talked about debt ceiling has been raised six times in the past three years. This frequency is unprecedented. International ratings agencies are now openly suggesting an end to America’s AAA credit rating:

A credit rating downgrade would be devastating to what little foreign interest is left in the U.S. Treasury bond investment.

On the local front, cities and states are on the verge of folding due to the evaporation of municipal bond markets. Cities depend greatly on two sources of revenue in order to continue operations; property taxes, and municipal investment. Property taxes, obviously, are disappearing as property values continue to spiral downwards. This leaves only municipals, which have also unfortunately fallen off the map:

Wall Street analyst, Meredith Witney, recently stated in an interview with 60 Minutes that she believed 50 to 100 American cities would default in the midst of a municipal crisis in 2011. She was promptly lambasted by the rest of the MSM for her prediction. In my opinion, she was rather minimalist in her estimates, especially if the Federal Reserve does not commit to another round of quantitative easing (QE3) for the states (Bernanke denies this policy would be enacted by the Fed, though, which means there is a good chance it will be).

To summarize, the U.S. is swimming in debt. Absolutely nothing has been changed for the better in terms of wealth destruction and liabilities since the credit crisis began, and the situation only looks more precarious with each passing quarter.

Where Is The Debt Roller Coaster Taking Us?

What is the most likely outcome of the conditions described above? The vital factor will be the continued Federal Reserve policy of fiat bailouts as a “counterbalance” to the evolving debt crisis.

As is clearly explored in the Dickens novel we discussed earlier, staving off the effects of debt by creating more debt is a temporary solution that only leads to greater calamity down the road. Anyone who believes that fiat inflation actually “cancels out” debt instability is going to find themselves sorely disappointed. At bottom, government created stimulus is not a solution to corporate engineered debt burdens, but a reallocation of debt away from banks and into the laps of the American taxpayer. The Federal Reserve and our own Treasury have not paid off anything. They merely shifted the responsibility of payment away from the banks that created the problem, and handed that responsibility to us. On top of this, they have also set the dollar up for a crushing blow of devaluation. Here is where the prison bars enclose…

If our historic debt is not being diminished, but only moved around while it expands, then this means that eventually our credit worthiness will come into question. In fact, it already has. Foreign investment in long term Treasuries has dwindled. Our own central bank is now the largest holder of U.S. debt, surpassing even China (Note: this news has so far been ignored by almost all mainstream outlets):

http://www.ft.com/cms/s/120372fc-2e48-…

So, the question of debt default turns from theoretical to quite imperative. If the Federal Reserve continues buying our debt with fiat, it means that the effects of the debt will only be delayed, the dollar will be dropped as the world reserve currency, and hyperinflation is a certainty. If they do not continue buying, then our government defaults, the country’s financial infrastructure ceases to exist, the dollar loses its world reserve status, and hyperinflation is a certainty. The banking elites haven’t just erected a prison, they’ve tossed us in Alcatraz!

The battle over yet another increase of the debt ceiling has obscured the fact that the debt has already done all the damage it needs to do. Freezing the ceiling in place becomes a battle of principle, and an important one, but it would in no way stop the dysfunction and chaos to come. At best, it might shorten the duration of the disaster by a few years. The important thing to remember is that government intervention will only incur greater loss. There is no easy way out, no magic shortcut, no last minute brilliant idea that will wrap up this mess. Years of hard work, determination, honesty, and sacrifice are ahead of us.

Inflation will be the buzzword of 2011. Endless debt facilitates endless Keynesian liquidity. Expect to see commodities double once again this year.

Household debt will probably level off through 2011, as more Americans abandon their credit habits and make more concerted efforts to save. In 2009, Visa lost 11% of its credit use, while MasterCard lost 22%. Over 8 million consumers have stopped using credit cards altogether since the end of 2009:

http://abcnews.go.com/Business/holiday-shopping-americans-cut-back-credit-card/story?id=12367547

Bank lending is still tight as creditors raise the requirements necessary to receive FHA (Federal Housing Administration) mortgages:

http://www.bloomberg.com/news/2010-11-17/home-ownership-gets-harder-for-americans-as-lenders-restrict-fha-mortgages.html

Will credit use and debt based consumption ever return to levels similar to 2006? Not a chance. One might predict then that savings will rise dramatically as credit use falls, but this too is unlikely. Why? Because over the next year Americans will be spending far more on essential goods due to inflation than they ever have before. Whatever savings they would have accrued will be eaten up by the relentless spike in commodity prices. The term used for the combination of chronic debt, low job growth, and burgeoning inflation, is “stagflation”. I honestly can’t think of a worse situation than being subject to exploding costs in light of a dilapidated standard of living. As Dickens points out plainly in ‘Little Dorrit’, how can a man be expected to settle his obligations when he is imprisoned for them?

Breaking The Cycle In The Midst Of Global Strife

Why after thirty years under the despotic rule of the Hosni Mubarak regime did the Egyptian people suddenly decide to revolt? Why now? The MSM will field a number of political tales, but the key to most popular uprisings, especially in the Middle East, has been the lack of necessities. The last time Egypt saw an uprising of this magnitude was during the Bread Riots of 1977, when the IMF terminated state subsidies of basic foodstuffs. Is it any wonder that turmoil has developed so quickly in the region as grain prices double? This is the devastating power of debt, and the so called “solutions” which merely perpetuate debt.

Tunisia, Egypt, and Yemen, are only the beginning. The sting of inflation will be unbearable as austerity measures take hold in Europe, and the potential for riots in Greece, Spain, Portugal, and Italy looms large. The most volatile environment on the planet to date, however, is the United States, which, as we have shown in previous articles, is being dismantled deliberately and viciously in preparation for IMF regulation and centralization. Today, the IMF is stalking Egypt, ready to pounce as the nation goes mad. Tomorrow, it will be us. I will be very surprised if we are not hearing about IMF intervention in the U.S. economy and the dollar by the end of this year, offering more debt, and more unaccountable governance.

The secret to breaking the circle of debt is to adopt a policy of decentralization, and self sufficiency. To take back control of our local commerce and to establish micro-economies with self contained methods of trade. Debt must be removed from the equation altogether, and systems protected by flexibility and redundancy must be applied. Savings and meaningful production would have to take the place of endless spending and outsourcing. The claustrophobic nurse-maid philosophies of globalism would have to be cast aside and replaced with goals of independence and self reliance. By cutting our dependency on the corrupt establishment, we sever its ability to feed off of us. By building a better system, we make the faulty one obsolete. Whether or not we throw off the trappings of the debt machine is entirely up to us.

Two very important steps are required; the realization that debt is not the only way, and, the realization that debt is the worst way. Prosperity is not achieved at the expense of the future. The society that finally takes this fact to heart will accomplish incredible things indeed…

————————————————

You can contact Giordano Bruno at: [email protected] For a bio of Brandon Smith, aka Giordano Bruno, (please click here.) To visit Neithercorp.us click here.

Nice rant. And I mean that. But Bruno never uses the word “money” in his essay.

In this type of discourse you can’t honestly talk about debt unless you talk about money… and how debt and money creation contribute to the non-stop destruction of wealth.

I do give credit for his warnings of inflation (it’s already here, after all) but I’m a bit reluctant to accept that “hyperinflation is a certainty.”

Stagflation is more likely, IMO.

“…debt is not the only way, and, the realization that debt is the worst way.”

Geez, maybe I should never have bought a house…which is paid off in August this year. Couldn’t have done that without 30 years of debt.

…ikb

In response to “I know better”, hopefully, you have savings as well, because if you are not retired yet, and lose your job, you will NOT be allowed access to any of your home equity. You could be two or three payments short of paying off your house, and eventually lose everything if you lose your job.

Well, I think the word “fiat” (which I did use) applies much more aptly than “money” to our current economy. “Money” is not the problem, the overprinting of unbacked money (fiat) by an unaccountable corporate body like the Federal Reserve is the problem.

Also, stagflation often includes symptoms of hyperinflation. I’m not sure where you are drawing your distinction.

It’s great that you are about to pay off your house, however, you seem to be forgetting about the millions of Americans who took out ARM loans and then lost their jobs due to the derivatives schemes of global banks. In countries across the world, people SAVE to buy a house, they don’t borrow themselves into debt slavery. There are many better ways of getting the things that we want, including your home….

Giordano, touche on several points. I don’t disagree with you, though I may have nitpicked a bit.

I am highly aware of ARM loans (and the derivative debacle.) My wife and I took a 12.5% three-year ARM at the 1981 peak of interest rates when people were lucky to find a 19% mortgage. Our loan was held by the S&L all these years so it never got securitized/derivatized. It bottomed at 7.5% and we didn’t refinance.

We SAVED to buy a house. (My wife is so averse to debt that she actually wanted to save money and pay cash for a house.) We save to this day and are essentially debt free. In many ways we are lucky. In many ways we were actively investing while avoiding consumer credit and debt. Saving and investing helped us acquire a home and pay a mortgage.

If there are “better ways of getting the things that we want, including your home” I’m interested. Then again, I don’t want for much. But I do love to hear about better ways of doing things.

Until the economic and real estate blowup happened, I’ve found no better way (than a mortgage) to get the thing we NEED — shelter — without pouring rent money down a hole.

On stagflation… we’ve been there before. Wasn’t that about 1981, too? It didn’t lead to hyperinflation. This time I think it’s more likely and, apparently you do, too.

To Alesandro Machi (in an earlier post),

Thanks for your concern. I’m aok. I’ve been a part-time computer-based home worker for over 10 years. My wife dodged all bullets for about 40 years. She’s always been the steady income stream. I’m the investor. In 2001 I bought about 54 oz. of gold and over 500 oz. of silver. I saw the megatrend thanks to Jim Sinclair. (Ask Greg Hunter about Jim Sinclair.)

We never accessed home equity and never will. We treat credit cards as charge cards. All are paid off in full monthly. It’s apparent most people haven’t had the same discipline.

My life laid bare, yet still anonymous,

….ikb

I felt this article was pretty good, but it skimmed over one important point about our debtor based economy. Up until 2007, increasing levels of consumer debt was rationalized as part of a growing economy because home values and 501K’s overall wealth were keeping pace.

Homes once worth 150,000 had gone up to 300,000, 400,000, even 500,000 dollars.

In warmer markets, homes originally purchased for 120,000 150,000 in the late 70’s, peaked at 800,000 dollars in 2007. It is likely that consumer debt was taken on in proportion to the home equity and/or 501K savings that consumers had accrued, which means consumers were actually BEING RESPONSIBLE with their debt.

Once those home values and 501K’s reduced anywhere from 35% to 70% from their peak value in 2007, and the stock market then crashed in the fall of 2008, consumer credit card debt levels remained the same. Suddenly, consumer credit card debt in relationship to overall wealth spiked by an amount that I would guess to be anywhere from 200% to 500%!!!!

Wealth reversal exploded at the beginning of 2008. Credit card companies have offered balance liquidation programs at lower interest rates, however, the problem with these balance liquidation programs is that is some people need to be able to respend a SMALLER PORTION of what they are paying down every month to get by.

This monthly respend component for credit card balance liquidation programs have been COMPLETELY overlooked by everybody, and is why we must conclude that indeed, keeping everybody in debt, and continuing to favor the rich billionaires and their investments, is what wall street, and Barack Obama, are most pre-occupied with these days.

I have offered a four point economic program that requires no bailout and basically addresses the points made in this article.

http://wallstreetchange.blogspot.com/2010/11/2010-after-election-4-point-economic.html

Not only would this 4 point economic plan have an instantaneous positive affect on the economy, this program would offer mid term and long term relief as well.

There has been a very decrease in overall consumer credit card debt in the past year, and even that has sparked some renewed enthusiasm for the economy. Imagine if Barack Obama actually supported legislation that made it REASONABLE for consumers to pay down their debt loads, rather than just write it off, like the banks do all the time.

Great piece as usual Greg. I really wish there were a “printable page” option available on your pages- so I can share them with others in paper form, like a high school economics class.

Eppoh,

I’ll have to look into that. You can always cut and past the article into word and print it from there. Just an idea. Thank you for your comment.

Greg

I worry a lot for my children and grandchildren. Our current govt – nay most of our federal govt do not have the balls to resist the IMF.

It will be a dark day but I can see it coming.

I have no debt – have not for years. But it has always pained me to do without while others recklessly mortgaged their future for expensive consumer goods.

Getting out of this mess will have to start with the common folk – unfortunately the majority of the common folk have no common sense.

Witness the current administration.

We need to make our voices heard.

Thank you Mike. You are in a good position for what is coming.

Greg

The cycle of gold standard to fiat currency war spending, back to gold standard to fiat war spending. This is a long cycle used to keep the working population in the debt cycle. Now the war spending is coming to a end, so the folks who profit off this mass war spending want to keep profit safe with higher interest and dry up the money on the street. My little brain thinks this is part of the problem. We might of got away with it again but the housing bubble, that was done to keep the shoppers happy doing war spending is the straw that broke the camels back. I know it’s not that simple but knowing this simple cycle, kept me out of debt and when to buy and sale. PEACE

Bob,

Sounds like you might be on to something. Thank for the comment and support.

Greg

On the subject of debt, but a little off topic.. Mortgage applications seem to be an indicator used by some to gauge the real estate market. When they go up, the cheer leaders at CNBC point to it as a sign of an improving economy. HOWEVER, I hear more and more about “reverse mortgages”. These little devils put more Americans deeper in to debt, who may own their homes outright.

I would like to know what percentage of the new mortgage applications are made up from reverses. Think anyone tracks this?

That reverse mortgage is like another death tax that takes equity away from an estate, and puts it in the hand of bankers, who already own too much real estate,

Hoppe,

Good question. Thanks.

Greg

Greg, good article. Wife and I went to COSTCO today. Regular gas for the trip was $3.35 per gallon and prices had gone up considerably at the store. Toilet paper is now almost $20 for the bulk package. Not long ago is was $9something. We do now have inflation, I notice the TV personalities still are behind the low CPI numbers but like Rush says, he hasn’t been to a grocery store in over 10 years. I doubt that any of the others are much different. And what the heck if gas was $10 a gallon, that still wouldn’t be over $500 a week, probably less than a couple of dinners in New York.

Thank you Hang Time for reporting from the front lines of real life!!

Greg

great article. I’ve noticed something recently about money. On paper, I appear to have a debt far less than some of my other friends, but I also seem to have been locked into this prison of “the american dream.” When I bought my house in 2007, it seemed that the sky was the limit. Nevermind that I was let go from my job later that year about 5 months into my mortgage. Somehow, the good Lord saw fit to keep me afloat until I found another job by sheer numbers of applications to every place I knew was within driving distance of my house.

I felt something was coming, so I decided to diversify in May of 2008 and I lost very little. However, I’m now faced with the internal turmoil of knowing a lot more about this little financial game and knowing that on paper, I could qualify for another home in an area I want to be in, and hope that we somehow magically correct the course of this coming economic blunder.

I feel bad betting on the renter market staying strong until the house of cards falls, but I don’t want to be here anymore. My family and friends are far more important to me than perpetuating this myth that we are living in a country with infinite resources and economic growth! Everyone keeps feeding the beast and saying “it’s okay to have $8,000 in credit card debt, we’ll just adjust your payments and make it affordable for you!” but it needs to stop. You bought stuff you couldn’t afford, you can’t buy any more until you have paid for what you have.

But I can’t help but think that houses and property should be treated exactly the opposite. Instead of it being “well you bought a home you couldn’t afford, you can’t buy a house more in your price range because of market instability,” it should be “sorry you bought a home you can’t afford, let’s get you into a place you won’t be drowning in debt, stress, and unhappiness. Oh, and we’re getting our cut, but we’re not gonna screw you to the wall with fees and predatory lending shenanigans.”

This is NOT the way Americans should be. Global business ethics should be based on the Nash Equilibrium and this clearly has not been happening for a good long time. There’s no “Golden Rule” in economics because it’s all about the consumption. BUY MORE! SPEND LESS! No equilibrium is ever reached. I can only hope and pray for my children and grandchildren, that we start to look forward instead of backward.

Stop this nonsense of “well, I didn’t have this, or that, when I was younger, but by God, little Timmy will…” We are basically saying “Timmy can’t do it all by himself, I have no confidence in my child to make good decisions, so I’ll just make them for him.” This echoes throughout future events and ultimately puts us in this situation all over again.

Sorry I went off on a rant, but when I read articles about how bad debt is, I realize that when it was used constructively, it was a powerful tool that made this country awesome. But it has become a destructive force more powerful than all of the other armies in the world attacking us at once.

Greg thanks for putting this one. Kudos to Brno

Thank you DroidX-G.

Greg

Hey Greg,

Great post! Keep up the good work. You’ve inspired me to write my own articles now. Here’s my latest: http://www.daily-ops.com/689/checkmate

I plan to write as good as you some day.

all the best!

Jonas

No doubt Greg, there is no free lunch! Managing my small business is very trying on a cash basis. I have only a few monthly expenses but I have to have enough money to “churn” in-order to make money. Insurance runs me about $4500 yearly for auto, truck, gen. liab and E&O ins. just to begin to operate …..

Mitch Bupp,

I have alot of respect and compassion for anyone running a small business these days. I am a small business owner too. Thank you for the comment.

Greg

Here’s another famous Dickens character – Mr. Micawber – who worked for the dishonest Uriah Heep. His hopeful words are below (excerpt from Wikipedia):

“He is famous for frequently asserting his faith that ‘something will turn up.’ His name has become synonymous with someone who lives in hopeful expectation. This has formed the basis for the Micawber Principle, based upon his observation:

‘Annual income twenty pounds, annual expenditure nineteen pounds nineteen and six, result happiness. Annual income twenty pounds, annual expenditure twenty pounds ought and six, result misery.'”

Even as the officials were hauling him off to debtor’s prison, he was eternally optimistic; unfortunately, it was too late for Mr. Micawber.

Do we see any similarities in today’s political officials as they seemingly want us to believe that “something will turn up” as our country gets hauled into debtor’s prison?

Thanks, Greg. Great article.

Hi Girodano, you sure are someone with an interesting life story. Too bad the Church never saw it that way and you had to end up burnt alive at the stake, eh? So sad. Phooey, I say! Anyway, since you are now writing from the great beyond about economic matters such as DEBT, I wanted to ask you what you thought about this guy called MartinArmstrong.org? I mean, like you, He writes about DEBT, but unlike you, he is alive and well and wasting away in an American jail! (LOL Are’nt a lot of people these days?) You Giordano, of course, know how it feels like to face trumped up charges especially by an organization as dense as the medieval church but can you imagine the hypocrisy of being jailed by the worlds top jailer, the US government AND, TO TOP IT OFF, to have no means to blow their rumps off as it were? Anyway, sorry for letting the Muslim side of me peak out, I just want to let you know Giordo dear, that if you ever get confused about debt and unclear about the future *smirk*, just read Martin. And also, learn a little more about the city of Mainz. 🙁

Call it what ever you like. Our ‘medium-of-exchange’ is not printed. All money is created on private bank ledgers as numbers that they then lend to borrowers. The numbers do not exist until someone borrows them. They are destroyed when repaid. We use numbers for money representing debts to the borrower. Federal Reserve Notes or those things that everyone sees being printed and thinks are the money are not available for direct delivery to the public. To get into circulation they must be purchased with checkbook money which cannot exist until the lending process takes place. Example: A bank creates 100 as a loan to a borrower. They give the borrower a deposit slip. The borrower now has 100 in his checking account. He writes a 10 check for ‘cash’. The bank gives him some variation of 10 in Federal Reserve Notes and or coins. The borrower still has 100 but he has 90 in checkbook money (numbers) and 10 in FRNs or coins which are an eveidence of the loaned numbers. That’s why the printed paper says, ‘Federal reserve Bank Note.’ A bank note is always an evidence of debt. We use evidence of debt for money. Nothing else. The low switch overtime from wealth to deabt has put us into economic servitude which has nearly destroyed America and its people. Let’s get Free again. Spend it don’t lend it into circulation debt and interest free!! Follow the principles of the 1792 Coinage Act. Monetize the people’s production as a wealth to them and trade the new money into circulation for other production.

I have recently just started with Primerica, and I am in Michigan, must be licensed and all I can say is that it seems I am being told more about what I can’t do than what I can do. I have to be regulated even down to Facebook. Frankly, I am sick of it. I am a person who thinks outside the box and I want results not restrictions. Can you help me?

Pattie Suski,

What help do you need?

Greg