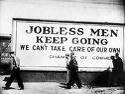

The Lean Years

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

This week, a North Carolina newspaper headline read “Beauty Queens Feeling Squeeze of Economy.” It was a story about how pageant contestants are cutting costs by wearing dresses more than once. Some contestants are also selling old dresses and renting others to girls going to their proms. It is just one of the many small signs of how the economy is changing.

A giant flashing red light signaling trouble ahead is the news this week the Federal Deposit Insurance Corporation is now $20 billion in the hole. Let that sink in for a minute. The fund that is supposed to insure banks has a negative net worth! According to FDIC Chairman Sheila Bair, the number of banking failures will “likely rise” in the future. What the FDIC calls “problem” banks grew to 702 at the end of 2009– up from 552 at the end of September. That’s more than a 25% increase in just 3 short months. How are we going to pay for the continuing bank failures? (Click here for more on the FDIC story)

And, what about the unfunded obligations in America? A segment on FOX Business, this past Monday, was supposed to be about the $1 trillion shortfall in public pensions. It unexpectedly turned into a much bigger discussion with pension expert Jose Pinera. He dropped a bomb when he said, “You have a much bigger problem . . . You have a $100 trillion problem.” He quoted the U.S. government’s own numbers for unfunded entitlements such as Medicare and Social Security. Pinera pushed through entitlement reform in Chile 30 years ago, and now everyone there has a private account. It is a system that works. Pinera, a Harvard educated scholar, said America’s unfunded liabilities are “700% of GDP,” and it is simply a “gigantic liability.” Pinera also said, “It is like you are passengers on the Titanic” and are heading for the “iceberg of an aging population.” (Click here for the complete Pinera interview) How is America going to pay for health insurance and retirement for everybody in the country?

Syndicated columnist Thomas Friedman wrote this week, “We’ve gone from the age of government handouts to citizen givebacks, from the age of companions fly free to the age of paying for each bag.” It was a commentary on lean years ahead and how we have already eaten through the “fat years.”

I wrote about what was happening in America a year ago in a post called “Hard Right Turn.” This is not about some far right wing ideology– but a radical change of direction for the country. I wrote, “When is the economy going to get better?. . . It’s not going to get better; it is going to get different. Meaning, the economy will not return to what we have grown to consider “normal.” There is going to be a new “normal.” This is not a recession, a dip or a temporary very bad economic condition. We are witnessing a “hard right turn” in a new direction on a global scale. Many of the jobs lost in this downturn will be gone forever. A couple of changing industries I can think of are financial services and the automotive sector. The good news is that people are going to be forced to live within their means. Almost everybody rich and poor will consume less and save more. There is going to be a new age of frugality and that, as Martha Stewart says, “Is a good thing.” Thrift is the new black and this mindset is going to be in vogue for a generation or more!” (Click here to read Hard Right Turn in its entirety)

How are we to handle the lean years? The best way I think people can get ready for what’s ahead is to get out of debt. What’s coming is going to be a freak show of defaults and bailouts. The bailout part has already set in motion a money printing party the world has never seen before — and that will lead to inflation. Inflation always hurts the folks who are not rich. I guarantee your income will not keep up with the inflation that is coming. So, you must have complete control of every dollar you spend, and that means get out of debt as soon as you can.

Hey Greg,

You wrote, “I guarantee your income will not keep up with the inflation that is coming.”

To what extent, if any, might the USA avoid domestic hyperinflation by exporting it?

All the Best,

Thrash

Brad,

According to economist John Williams and others we will not avoid huge inflation. Also we are already exporting inflation–just ask anyone who buys oil in dollars, which is just about the entire world.

Greg

I continue to read and contemplate the advice to get out of debt in preparation of massive inflation, and I’m wondering if this is truly good advice. For the record I have no debt, but does it make sense to pay off $10,000 today when you could instead invest your money in hard assets and look to pay off your debt (If you’re able to) much later when the $10,000 debt is worth less relatively speaking? Wouldn’t it be better to assume debt and purchase hard assets just before a major inflationary period? If everything from clothing and household goods to gold and food is going to double in price over the next few years, why not borrow and buy as much as you can now (To the extent that you would buy them in the near term anyway)?

Jonah,

Borrowing money to invest in anything is a very risky proposition. When you buy gold or anything else, you should do it with your own cash. Thank you for your comment.

Greg

Greg, I agree you shouldn’t borrow to invest, but you avoided the real question that with more dollars floating around won’t debt be “easier” to pay in the future than now. It seems to me rapid inflation is bad for lenders and good for borrowers (an oversimplification, but you get my point).

Sean,

As long as you are sure you will have an income and that income will not be reduced, debt is fine. Who knows how bad this crisis will get? I think it will be far worse for much longer than people can imagine. Having no debt gives you a power that debt cannot.

Greg

Austerity for the masses is not going to help until big brother takes it up in earnest. As far as the assault on SS: Here is one area that the US will face its waterloo. Here is a fact. A blue ribbon committee decided in the early eighties that we would over-pay in advance our payroll taxes just to offset any boomer induced shortage of benefits. Now that the day is here and as we have known for quite some time that extra money we contributed along with the entire Trust Fund has been spent in the general fund. Changing the game on reckoning day will be looked upon as the swan song of financial credibility.

Gee,

Good point, thank you for the input!

Greg

In preparation for the lean years, I’ve been buying large quantities of nonperishable items that we use in everyday life. Laundry detergent, dishwashing liquid, soap, shaving cream, razor blades, deodorant, toothbrushes, toothpaste………

I’m fortunate to have the room to store these items. The only downside I can think of is deflation, where prices are lower in the future. Maybe it’ll rain beer too.

Mike,

You are smart and funny!!!

Greg

I repeat: time to STAND BACK and LET IT ALL COLLAPSE, as quickly as possible. Then, the rebuilding can begin.

Man,

I think you will get your wish…I just do not know when.

Greg

If everyone would STOP trying to play King Canute, it could be over in a matter of weeks.

Man,

I like your style.

Greg

Great stuff Greg – keep it up!

Might I recommend http://www.businessinsider.com/there-is-nothing-that-japan-can-do-to-escape-its-economic-demise-2010-2#japan-is-way-worse-than-everyone-else-5

The graphs closely relate to how the US is handling our economy. Zombie banks/economy is an unsustainable path.

Joe,

Thank you for the info and comment.

Greg

So assumming rampant inflation were to strike us as severely as as some say, what recommendations would you give (to a novice) someone on how to purchase gold as some inflation protection; e.g gold stocks, gold coins, gold bars??? Thanks Anthony

Anthony,

Read this post called “Where Should I Invest My Money?” Here is the link: https://usawatchdog.com/where-should-i-invest-my-money/ Please read ALL the links. If you are going to buy gold your core holding should always be gold bullion coins NOT an ETF. Do not bet the farm in this position. Au is should only be part of a truly diversified portfolio. Good luck.

Greg

Hey Gang,

The economy just hit me. My bride sent me out to the grocery store. She said, raw spinach, tomatoes, creamer, milk and bananas.

They had baby spinach pre-wrapped with croutons and a bacon salad dressing for $3.39 a bag that would give 2 side salad sized servings. Tomatoes on the vine, how ’bout $3.49 a pound.

For the first time in our 25 consecutive years of marriage we just went through the mailers to look for better prices on food.

Thankfully, another market is having a sale tomorrow. Roma tomatoes 4#’s for a buck and raw spinach $.78 per lb.

All the Best,

Thrash

Brad,

This is the inflation we have all been talkinbg about. You document it nicely. Thanks for the info!

Greg