What Is Really Behind QE2?

The article you are about to read is from Ellen Brown. She writes a good post here, but I disagree with one of her main points. She says Quantitative Easing (QE) will not cause inflation because of “$15 trillion in write-downs in collateral and credit.” To refute this, I quote Nobel Prize winner Milton Friedman who said, “Inflation is always and everywhere a monetary phenomenon.” If a country could simply buy its own debt with zero downside, I say we should have been doing this all along. The rest of Brown’s article is very good and puts a clear focus on this round of QE. She correctly points out it is being used to mainly finance the U.S. government over the next 8 months. I do not have to totally agree with everything a Guest Writer has to say to put them on the site. I want you all to have perspectives from people other than my own. I think it stimulates critical thinking and gives you a better insight to the enormous financial problems we all face. Please give this a read, and feel free to post a comment. –Greg Hunter–

——————————————————————-

By Ellen Brown Guest Writer for USAWatchdog.com

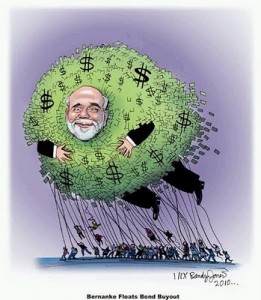

The deficit hawks are circling, hovering over QE2, calling it just another inflationary bank bailout. But unlike QE1, QE2 is not about saving the banks. It’s about funding the federal deficit without increasing the interest tab, something that may be necessary in this gridlocked political climate just to keep the government functioning.

On November 15, the Wall Street Journal published an open letter to Fed Chairman Ben Bernanke from 23 noted economists, professors and fund managers, urging him to abandon his new “quantitative easing” policy called QE2. The letter said:

We believe the Federal Reserve’s large-scale asset purchase plan (so-called “quantitative easing”) should be reconsidered and discontinued. . . . The planned asset purchases risk currency debasement and inflation, and we do not think they will achieve the Fed’s objective of promoting employment.

The Pragmatic Capitalist (Cullen Roche) remarked:

Many of the people on this list have been warning about bond vigilantes while also comparing the USA to Greece for several years now. Of course, they’ve been terribly wrong and it is entirely due to the fact that they do not understand how the US monetary system works. . . . What’s unfortunate is that these are many of our best minds. These are the people driving the economic bus.

The deficit hawks say QE is massively inflationary; that it is responsible for soaring commodity prices here and abroad; that QE2 won’t work any better than an earlier scheme called QE1, which was less about stimulating the economy than about saving the banks; and that QE has caused the devaluation of the dollar, which is hurting foreign currencies and driving up prices abroad.

None of these contentions is true, as will be shown. They arise from a failure either to understand modern monetary mechanics (see links at The Pragmatic Capitalist and here) or to understand QE2, which is a different animal from QE1. QE2 is not about saving the banks, or devaluing the dollar, or saving the housing market. It is about saving the government from having to raise taxes or cut programs, and saving Americans from the austerity measures crippling the Irish and the Greeks; and for that, it may well be the most effective tool currently available. QE2 promotes employment by keeping the government in business. The government can then work on adding jobs.

The Looming Threat of a Crippling Debt Service

The federal debt has increased by more than 50% since 2006, due to a collapsed economy and the highly controversial decision to bail out the banks. By the end of 2009, the debt was up to $12.3 trillion; but the interest paid on it ($383 billion) was actually less than in 2006 ($406 billion), because interest rates had been pushed to extremely low levels. Interest now eats up nearly half the government’s income tax receipts, which are estimated at $899 billion for FY 2010. Of this, $414 billion will go to interest on the federal debt. If interest rates were to rise just a couple of percentage points, servicing the federal debt would consume over 100% of current income tax receipts, and taxes might have to be doubled.

As for the surging commodity and currency prices abroad, they are not the result of QE. They are largely the result of the U.S. dollar carry trade, which is the result of pressure to keep interest rates artificially low. Banks that can borrow at the very low fed funds rate (now 0.2%) can turn around and speculate abroad, reaping much higher returns.

Interest rates cannot be raised again to reasonable levels until the cost of servicing the federal debt is reduced; and today that can be done most expeditiously through QE2 — “monetizing” the debt through the Federal Reserve, essentially interest-free. Alone among the government’s creditors, the Fed rebates the interest to the government after deducting its costs. In 2008, the Fed reported that it rebated 85% of its profits to the government. The interest rate on the 10-year government bonds the Fed is planning to buy is now 2.66%. Fifteen percent of 2.66% is the equivalent of a 0.4% interest rate, the best deal in town on long-term bonds.

A Reluctant Fed Steps Up to the Plate

The Fed was strong-armed into rebating its profits to the government in the 1960s, when Wright Patman, Chairman of the House Banking and Currency Committee, pushed to have the Fed nationalized. According to Congressman Jerry Voorhis in The Strange Case of Richard Milhous Nixon (1973):

As a direct result of logical and relentless agitation by members of Congress, led by Congressman Wright Patman as well as by other competent monetary experts, the Federal Reserve began to pay to the U.S. Treasury a considerable part of its earnings from interest on government securities. This was done without public notice and few people, even today, know that it is being done. It was done, quite obviously, as acknowledgment that the Federal Reserve Banks were acting on the one hand as a national bank of issue, creating the nation’s money, but on the other hand charging the nation interest on its own credit – which no true national bank of issue could conceivably, or with any show of justice, dare to do.

Voorhis went on, “But this is only part of the story. And the less discouraging part, at that. For where the commercial banks are concerned, there is no such repayment of the people’s money.” Commercial banks do not rebate the interest, said Voorhis, although they also “‘buy’ the bonds with newly created demand deposit entries on their books – nothing more.”

After the 1960s, the policy was to fund government bonds through commercial banks (which could collect interest) rather than through the central bank (which could not). This was true not just in the U.S. but in other countries, after a quadrupling of oil prices combined with abandonment of the gold standard produced “stagflation” that was erroneously blamed on governments “printing money.”

Consistent with that longstanding policy, Chairman Bernanke initially resisted funding the federal deficit. In January 2010, he admonished Congress:

“We’re not going to monetize the debt. It is very, very important for Congress and administration to come to some kind of program, some kind of plan that will credibly show how the United States government is going to bring itself back to a sustainable position.”

His concern, according to The Washington Times, was that “the impasse in Congress over tough spending cuts and tax increases needed to bring down deficits will eventually force the Fed to accommodate deficits by printing money and buying Treasury bonds.”

That impasse crystallized on November 3, 2010, when Republicans swept the House. There would be no raising of taxes on the rich, and the gridlock in Congress meant there would be no budget cuts either. Compounding the problem was that over the last six months, China has stopped buying U.S. debt, reducing inflows by about $50 billion per month.

QE2 Is Not QE1

In QE1, the Fed bought $1.2 trillion in toxic mortgage-backed securities off the books of the banks. QE1 mirrored TARP, the government’s Troubled Asset Relief Program, except that TARP was funded by the government with $700 billion in taxpayer money. QE1 was funded by the Federal Reserve with computer keystrokes, simply by crediting the banks’ reserve accounts at the Fed.

Pundits were predicting that QE2 would be more of the same, but it turned out to be something quite different. Immediately after the election, Bernanke announced that the Fed would be using its power to purchase assets to buy federal securities on the secondary market — from banks, bond investors and hedge funds. (In the EU, the European Central Bank began a similar policy when it bought Greek bonds on the secondary market.) The bond dealers would then be likely to use the money to buy more Treasuries, increasing overall Treasury sales.

The bankers who applauded QE1 were generally critical of QE2, probably because they would get nothing out of it. They would have to give up their interest-bearing bonds for additional cash reserves, something they already have more of than they can use. Unlike QE1, QE2 was designed, not to help the banks, but to relieve the pressure on the federal budget.

Bernanke said the Fed would buy $600 billion in long-term government bonds at the rate of $75 billion per month, filling the hole left by China. An estimated $275 billion would also be rolled over into Treasuries from the mortgage-backed securities the Fed bought during QE1, which are now reaching maturity. More QE was possible, he said, if unemployment stayed high and inflation stayed low (measured by the core Consumer Price Index).

Addison Wiggin noted in his November 4 Five Minute Forecast that this essentially meant the Fed planned to monetize the whole deficit for the next eight months. He quoted Agora Financial’s Bill Bonner:

“If this were Greece or Ireland, the government would be forced to cut back. With quantitative easing ready, there is no need to face the music.”

That was meant as a criticism, but you could also see it as a very good deal. Why pay interest to foreign central banks when you can get the money nearly interest-free from your own central bank? In eight months, the Fed will own more Treasuries than China and Japan combined, making it the largest holder of government securities outside the government itself.

The Overrated Hazard of Inflation

The objection of the deficit hawks, of course, is that this will be massively inflationary, diluting the value of the dollar; but a close look at the data indicates that these fears are unfounded.

Adding money to the money supply is obviously not hazardous when the money supply is shrinking, and it is shrinking now. Financial commentator Charles Hugh Smith estimates that the economy faces $15 trillion in writedowns in collateral and credit, based on projections from the latest Fed Flow of Funds. The Fed’s $2 trillion in new credit/liquidity is therefore insufficient to trigger either inflation or another speculative bubble.

In any case, Chairman Bernanke maintains that QE involves no printing of new money. It is just an asset swap on the balance sheets of the bondholders. The bondholders are no richer than before and have no more money to spend than before.

Professor Warren Mosler explains that the bondholders hold the bonds in accounts at the Fed. He says, “U.S. Treasury securities are accounted much like savings accounts at a normal commercial bank.” They pay interest and are considered part of the federal debt. When the debt is “paid” by repurchasing the bonds, all that happens is that the sums are moved from the bondholder’s savings account into its checking account at the Fed, where the entries are no longer considered part of the national debt. The chief difference is that one account bears interest and the other doesn’t.

What About the Inflation in Commodities?

Despite surging commodity prices, the overall inflation rate remains very low, because housing has to be factored in. The housing market is recovering in some areas, but housing prices overall have dropped 28% from their peak. Main Street hasn’t been flooded with money; the money has just shifted around. Businesses are still having trouble getting reasonable loans, and so are prospective homeowners.

As for the obvious price inflation in commodities — notably gold, silver, oil and food — what is driving these prices up cannot be an inflated U.S. money supply, since the money supply is actually shrinking. Rather, it is a combination of factors including (a) heavy competition for these scarce goods from developing countries, whose economies are growing much faster than ours; (b) the flight of “hot money” from the real estate market, which has nowhere else to go; (c) in the case of soaring food prices, disastrous weather patterns; and (d) speculation, which is fanning the flames.

Feeding it all are the extremely low interest rates maintained by the Fed, allowing banks and their investor clients to borrow very cheaply and invest where they can get a much better return than on risky domestic loans. This carry trade will continue until something is done about the interest tab on the federal debt.

The ideal alternative would be for a transparent and accountable government to issue the money it needs outright, a function the Constitution reserves to Congress; but an interest-free loan from the Federal Reserve rolled over indefinitely is the next best thing.

A Bold Precedent

QE2 is not a “helicopter drop” of money on the banks or on Main Street. It is the Fed funding the government virtually interest-free, allowing the government to do what it needs to do without driving up the interest bill on the federal debt – an interest bill that need not have existed in the first place. As Thomas Edison said, “If our nation can issue a dollar bond, it can issue a dollar bill. The element that makes the bond good, makes the bill good, also.”

The Fed failed to revive the economy with QE1, but it could redeem itself with QE2, a bold precedent that might inspire other countries to break the chains of debt peonage in the same way. QE2 is the functional equivalent of what many countries did very successfully before the 1970s, when they funded their governments with interest-free loans from their own central banks.

Countries everywhere are now suffering from debt deflation. They could all use a good dose of their own interest-free national credit, beginning with Ireland and Greece.

Ellen Brown is an attorney and the author of eleven books. In Web of Debt: The Shocking Truth About Our Money System, she shows how the Federal Reserve and “the money trust” have usurped the power to create money from the people themselves, and how we the people can get it back. Her websites are webofdebt.com, ellenbrown.com, and public-banking.com.

“If a country could simply buy its own debt with zero downside, I say we should have been doing this all along.”

Wake up, Greg. How else would the international banksters make a buck if they didn’t hoodwink us into borrowing our own money.

Thomas Edison: “If the Nation can issue a dollar bond it can issue a dollar bill. The element that makes the bond good makes the bill good also. The difference between the bond and the bill is that the bond lets the money broker collect twice the amount of the bond and an additional 20%. Whereas the currency, the honest sort provided by the Constitution pays nobody but those who contribute in some useful way. It is absurd to say our Country can issue bonds and cannot issue currency. Both are promises to pay, but one fattens the usurer and the other helps the People.”

Thank you AuntieX for the cold slap in the face to wake me from my fantasy world. Thank you for the comment.

Greg

Thank you, Greg, for the response. Gives one hope!

That is an amazing quote by Edison, AuntieX, thanks.

“If a country could simply buy its own debt with zero downside, I say we should have been doing this all along.”

Boy, I wish I had been the one to put it that way. Talk about summing it up and slamming it home.

During your brief moment in fantasy world, did you happen to see Krugman flying around on a broomstick or visit Bernanke behind the curtain? Auntie Em, Auntie Em….

Greg Hunter’s USAWatchdog.com…I check in daily!!!

Ellen Brown is one of the smartest people I know, both in this article and on her public banking site – where I have been a member for nearly 2 years. I have quoted her often in my own articles on Op Ed News, though I don’t have nearly the following she does. She is sometimes criticized for being a populist writer, as if the pointy-head intellectuals have guided the economy so well by comparison.

Brown is right – $15 trillion in eventual write-downs cannot be offset by 2 or more trillion in new money used to buy bonds from the reluctant bank sellers. It’s not that Friedman was wrong, exactly, it’s just that he never lived long enough to see the gargantuan & unprecedented debt overhang and unsupported credit bubble caused by this latest land-based bubble (ultimately that’s what it was, as it is for every major financial bubble going back nearly a thousand years in Western Civilization, and occurring apx. every 18 years too).

Money, as Brown has been pointing out recently, in what may turn to be her signature contribution to the filed of economics, is not a “thing” that one can run out of, not in a fiat-money economy anyway. This is hard for people to understand who still think money is commodity based, or somehow gold-backed, but money is backed by electrons used to create it on computers now, plus all the goods and services that are continuously repriced on the open markets every day, nothing more.

Money ought to be just a medium of exchange, but in the hands of semi-private central banks it is much more.

Prediction: Bernanke will soon stop paying interest on all that bank reserve money, now enhanced by bond purchases, sitting at the Federal Reserve, and may even start CHARGING interest, in order to force the banks to start loaning again, now that their reserves are more than adequate. Infrequently cited, the Fed is on record as saying that keeping reserves is an antiquated requirement and at one point he considered lowering reserve requirements to zero, apparently believing that the Fed is the provider of funds of last resort. Well, we are at the last resort now.

2 questions arise:

1. Can the Fed force the banks to lend?

2. Will the treasury, pumped full of new money channeled to it by the Fed for “goods and services rendered” use the money to pay down the debt, on economically helpful projects, like infrastructure, or just sit on it?

Also, of course, the Elephant in the room is the Republican Party, which as Krugman reminds us, will likely paralyze the government this April, when the debt ceiling needs to be raised, yet again.

#1 Lend on what? The banks are well aware that real estate, both residential and commercial, are still significantly overpriced, meaning even at 80% LTV they are in a high risk position as soon as the loan is written. The consumer is still in a weak financial position and still too far in debt for consumables. The employment situation is not stable and will not improve in the foreseeable future.

#2 The Treasury is looking at payments on a Federal debt that will be astronomical as soon as interest rates begin to reflect reality. The choice is either to let interest rates rise or to continue to hold them down artificially which will ultimately be inflationary.

The government and banking cartel have backed themselves into a catch 22 situation where any course they take has negative repercussions. They are indulging in a game of postponing the inevitable while a few are using the opportunity to enrich themselves.

The public has been robbed and their wealth transferred to the wealthy. The wealthy are trying desperately to hide that fact, knowing the civil unrest that will result when the truth is common knowledge. For now the games continue, the government builds “family relocation centers” and the wealthy purchase out of country retreats. The TSA tries in vain to condition people to accept martial law, and the unemployed stare into a future without jobs or government safety nets. Food and basic commodities are becoming increasingly inflationary. Meanwhile the media continues to sell the propaganda that things are getting better and the future is bright. I believe Orwell called it “Newspeak”.

Read the sixth paragraph from the beginning – and I can’t tell if those are her thoughts or those of one Cullen Roche. This woman is either an utter fool or a liar. Is she married to Krugman?

Gary North seems to really enjoy taring this woman apart from what I have been reading. The real battle here is about fiat currency I think. I am a lowly carpenter but I read way too much and I will be the first to say I am no economist at all. That said, would we be better of having a private central bank with fiat fed money run by criminals or a public central bank with fiat greenbacks run by criminals? I say neither myself. The value of the greenback didn’t fare to well after the civil war or we would still be using it. Politicians spend fake money as fast as they can get their hands on it regardless of where they get it from. In a perfect world a public central bank would be far better than paying interest to a privetly owned central bank for obvious reasons. If your going to have worthless money then why pay interest on it, that is a no brainer. However where in a government as corrupted as ours are we going to find anyone to run this bank honestly without tilting the tables a little here and there for his friends. Whether I want to get ripped off by politicians or bankers is not the answer I was looking for. As I said I am not an economist but it seems to me that central banking with fiat currency is the biggest problem in and of itself. Creating more government jobs without any more productive people in the private sector to pay for them seems incredibly stupid to me. Right now the beast is starving itself to death by destroying private sector jobs at an unprecedented rate and this woman says it is good to print up another trillion so we do not have to double taxes? I am laughing myself off my chair right now. You can quadruple taxes and it would do nothing but destroy what little is left of the productive members of this already over taxed over regulated over burdened sector of our economy. If I paid the government 150% of what I earned productively they would just find new ways to waste it unproductively. The situation is, shall we say, unsustainible with out cutting spending. You can not spend more than you have or earn or even speculate to earn in the future whether your a government or not. Until DC is starved to death we will continue to suffer. Giving these fools a few more trillion to piss away is not the anwser but I am just a small business owner not one of the highly educated and brightest minds that DC has to offer, so what do I know about money? I do know I don’t have any right now lol. Reduce the size of government and bring back real money or competing currencies and remove all this BS regulation and cut DC down to its appropriate size and scope. Get the politicians out of the way of the free market, let the banks fail, if they like derivitives so much then let them keep them, and let real estate find its own value. I would love to buy a house for $35k. The state is and will always be totally incompetent.

To complicated for my feeble mind to absord. But I do have a couple of comments.

1. Doesn’t seem like the economy will begin to move from a very slow growth to faster growth until people begin to spend. With the recent economy, many individuals found they were living on the brink of collapse themselves (if they did not go under with losing a job), so they have begun to pay down debt and save for a rainy day. Neither of these prime the economy and get it moving. But individuals may be in a stonger position to withstand any future downturns. They will also avoid the pitfalls like variable rate mortgages and other instruments to get them into houses they can not afford or use as their bank accounts to finance toys, again causing a slower growth.

2. When the economy begins to grow, historically interest rates have risen since the feds begin raising rates to hold down inflation and control the economy from getting overheated. When that happens, interest rates on the debt goes up and even with increasing revenues due a better economy, wouldn’t the deficit stays high.

rabbit hole, give me some of that stuff man. BLACK FRIDAY GOOD DAY FOR CHINA. peace

Greg, Brown leaves out 2 key facts about the Fed & wall St Bankers in her articles. 1. The Fed & Wall St Bankers CEO’s are hard line Progressives. 2. What the effects of QE2 will have across the Geo-political world & how the MSM will report it!

Keynesian economics has been embedded into generations of Iva league students,that now holds power in government,unions,corporations & Wall St banking. Now the day has come to pay the piper & all the Progressives know to do is tax,spend & tax some more. The Fed has nothing left but QE to infinity. The progressive socialist Marxist ways have failed, & the progressive politicians know there’s no solution & will embrace QE2,3 & on. All progressives politicians know, any austerity programs would end their political careers. National interest be damn, they choose to save their own political asses. It’s a sick bunch of weasels that have moved their wealth off shore & left tax payers holding the bag.

We have a new group of physical responsible politicians that want to cut the debt & spending across the board,but I’m afraid their falling into a progressive political trap! Americans are hurting like never before, therefore now depend on govmint hand outs. Many that never dreamed they would have to use food stamps are growing by the day. Obama & the progressives are trying to pass more bills that gives gov more control before the new bunch takes power. Damn what a “trap” the progressive have set! The new “Republican controlled congress” shall be front & center on CNN,CBS,CNBC “portrayed” as their only ideals are cutting social security, unemployment checks extensions, Medicare/medicaid. Of course Obama will veto any bill that hurts his voting base. We will have to wait & see how the MSM covers inflation numbers as the Fed’s QE2 is deployed. QE2 has already started a currency war that stops prosperity, innovation & our manufacturing base will continue to shrink as inflation, higher taxes puts pressure on consumer spending & jobs creation.

Ellen Brown as a writer means nothing to me, but I would hope that the people that make a good living off of their endeavorers, writing, radio, TV will all stand up for the America like our Founders did. If not, we are all on a path to no where, that you can bank on! LOL! M.Smith

M Smith,

Thank you for your analysis and comment.

Greg

“Interest rates cannot be raised again to reasonable levels until the cost of servicing the federal debt is reduced; and today that can be done most expeditiously through QE2 — “monetizing” the debt through the Federal Reserve, essentially interest-free.”

Greg,

I hope the absurdity of the above excerpt is not lost on your readers. The author is saying that interest rates cannot be raised until we reduce the deficit. Pray tell how we do that while we are deficit spending? And at some point, the interest rates will go up regardless of what the Fed does as no one will buy our bonds at these artificially low rates. She states that if rates go up even a few % that we will be paying 100% or more of our entire tax revenues just to service the debt.

I don’t believe she understands she made the point of the coming collapse of the system due to higher interest rates.

“In QE1, the Fed bought $1.2 trillion in toxic mortgage-backed securities off the books of the banks. QE1 mirrored TARP, the government’s Troubled Asset Relief Program, except that TARP was funded by the government with $700 billion in taxpayer money. QE1 was funded by the Federal Reserve with computer keystrokes, simply by crediting the banks’ reserve accounts at the Fed.”

So let me get this straight; the tax payer is not on the hook for Fed Reserve debt? Those computer keystrokes are backed by the full faith and credit of the American tax payer…Daaahhhhh!

Thank you George and Kevin,

You both said different things but came to the same conclusion. I love it!!!!!!

Greg

“If there were no debts in our money system, there wouldn’t be any money.”

The above quote is of a former Fed official, and the quote comes from one of Ellen Browns articles.

So the truth is unveiled. Our ‘money’… the Dollar, is nothing but someone’s debt. Not only that … it gets conjured up by banks, ahhh not exactly the most reputable of entities these days.

Having our money based on debt is not very comforting at a time when debt default is rampant. And that’s the problem…. that we still use such a system (it being forced on us these last 100 years since the third iteration of a US Central Bank came into being).

Isn’t it time that we move to a more sustainable monetary system, especially considering we’re in an age of ‘peak oil’ and that will likely act as a throttle on physical expansion as a means of pursuing the the holy grail of ‘growth’.

For awhile now, I’ve followed the FOFOA site and digested his words.

There’s some real sense to the concept of ‘FreeGold’. Basically as far as I can tell, it means a split monetary system. Each country retains a fiat system for everyday transactions and yet uses Gold to settle International transactions (FOFOA/FreeGold fans … jump in here to correct me if I’m mistaken). Gold also serves as a means to store ones surplus in a venue free from the inflation manipulation of governments and central banks.

The fact that Gold is used as a means for international settlement and that each countries fiat currency floats against it results in a self regulating system that limits the issuance of fiat (or at least ensures consequences if excessive printing occurs).

The Greenback system of money creation as explained in this article has on the surface some attraction… but it would never work without items such as a balanced budget amendment. Congress lacks the discipline to stay within a budget on its own. Even beyond that, having government mandate that its printed bits of paper constitutes ‘money’ goes directly against the thoughts and mandates of our founding fathers. The writers of the US Constitution made themselves quite clear that Gold and Silver were to be used as the basis of money. In looking at our present day predicament, it is obvious there was real wisdom in their judgment.

Art,

The Founding Fathers had seen the fiat rip-off before and you are corect they had wisdom. Thank you.

Greg

Greg,

I concur with your disagreement.

This topic would be much more manageable if we would define our terms. We should start with inflation. Inflation is an increase in the money supply. Money is the entity that is inflated. Higher prices DO NOT cause inflation. Without increasing the money supply, prices for goods and services are governed solely by supply and demand of the goods and services considered. Higher prices for ALL goods and services only occurs when money suffers lowered purchase power caused by inflating the money supply. So the law of supply and demand operates consistently with money – increase the supply of money and its value as an exchange medium goes down – every time!

When the money supply is increased for a specific desired outcome such as: “QE2 promotes employment by keeping the government in business[,] [t]he government can then work on adding jobs[,]” that increase still eventually lowers the purchase power of money. In fact the velocity of the inevitable devaluation will be greater in QE2 than it was in QE1. In QE1 banks did not circulate the inflated supply to new borrowers, but “loaned” much of it back to the FED.

As for the government adding jobs, that appears to consist of hiring more bureaucrats who produce no tangible goods and provide questionable service (such as more regulating and interfering with services supplied by the private sector). So we end up with more people being paid for jobs created by an artificial demand, who spend the inflated money supply into the economy. These expenditures will likely be used for goods made outside the country – since we have outsourced a major portion of our nation’s manufacturing infrastructure.

But even if the goods purchased were made in the U.S., such as food and real estate, the demand for them is still artificial – not market driven. Since we have jobs created for which there was no market demand (paid with inflated money) the end result is the same. That is we have more dollars chasing fewer goods.

This outsourcing brings up an issue which the FED does not address. That is: how do you revive an economy that has outsourced its means of production to foreign nations?

Franktruth,

You last question is right on target!!

Greg

What happens in Europe ultimately comes to America. Just heard that the biggest buyer of Treasury notes is no longer China or Japan, but America!! So, I guess we are doing it now.

With Russia & China stepping away from the dollar it’s going to be a horrible 2011 with high inflation & even civil unrest as seen in Italy yesterday.

With that said, I recommend a new thriller that shows Americans finally taking a stand against corporate/bank tyranny. It’s about all of us & possibly history calling us to our true destiny. It’s that good!

http://www.booksbyoliver.com

This outsourcing has been dramatic to our economy & D.C. (District of Corruption) continues to support the mass exit of jobs. Great article!

Fallen Tree

Thank you for the comment and link.

Greg

Ellen Brown, like Lyndon LaRouche, does a remarkeable job at diagnosing the cancer but her treatment (as LaRouche) is found wanting. “Brownians” recommendation for a kinder gentler state banking is nothing more akin to the same. Alas her nonsensical comment about gov creating jobs should stop the reader from divulging further. Sorry Ms Brown. Anything worth reading has been written already.

Greg, I appreciate your caveat at the beginning of the article, but Ms. Brown is way off base on some of her concluisions and I worry that her crazy ideas may gain traction with some of your readers.

“Adding money to the money supply is obviously not hazardous (obvious to who) when the money supply is shrinking, and it is shrinking now. (WHAT??) Financial commentator Charles Hugh Smith estimates that the economy faces $15 trillion in writedowns in collateral and credit, based on projections from the latest Fed Flow of Funds. The Fed’s $2 trillion in new credit/liquidity is therefore insufficient to trigger either inflation or another speculative bubble.”

What does asset write down have to do with money supply? She later goes on to argue that “the flight of “hot money” from the real estate market” is one of the causes of higher commodity prices. Huh? She just said that the Fed needs to juice the economy with an additional $13 TRILLION just to keep pace with the write downs in real estate. Sorry, you can’t have it both ways. The increase in commodities represent REAL inflation (increase in fiat money supply) and it is only going to get worse as “bad money” (US dollars and Euros) chases “good money” (i.e. commodities) out of the system. Get ready for $500/oz silver and $5,000/oz gold (or more), especially if the Ms. Brown and the rest of the Keynesians continue to get their way. Sad

FamilyForce6,

Don’t worry, I have some of the smartest readers on the net. It is hard to get anything by these folks. Thank you for your comment and adding to this post!!

Greg

While it might be true that $2 trillion injection of money and credit should not cause inflation following a $15 trillion write down in assets, what Ms brown overlooks is that $15 trillion was itself the result of a bubble caused by the inflation of credit. So, one might say that the write down, indeed all of the write downs of inflated assets (and there are more to be revealed and more to come) merely offset the inflation-induced bubble. The $2 trillion Increase in credit/liquidity is something new and needs to be evaluated against a benchmark that recognizes both the asset bubble and the offsetting consequences of it’s popping.

One of the most difficult concepts to grasp is something that is “higher (or lower) than it otherwise would have been.” If the Fed had not injected the liquidity, for example, prices would have been ” lower than they otherwise would have been.” That, of course, is what the Fed intended, and more — it wa

Continuing — it wanted asset prices to go up. But that will take a lot more injections and the Fed cannot assure that the liquidity will go into the dead real estate. And it won’t.

Re “lower than they otherwise would have been,” see Inflation, Deflation and Chaos — http://thematrixnot.blogspot.com/2008/11/inflation-deflation-and-chaos.html.