Spinning the Economy to a Recovery

By Greg Hunter’s USAWatchdog.com

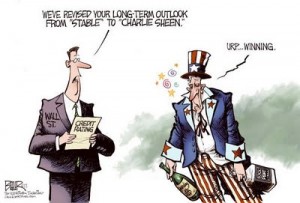

Remember back in early-2009, when the mainstream media (MSM) started with the ridiculous “green shoots” talking point? Even though the data were dismal and there were no signs of the economy recovering, the “green shoots” term was used by just about everyone in the MSM. I think not long after economist Nouriel Roubini said that the much talked about “green shoots” was really “yellow weeds,” the talking point changed to “recovery.” (Click here to read the complete “Yellow Weeds” article from professor Roubini.) Ever since, the MSM has described the so-called “economic recovery” in terms such as “fragile,” “jobless” and “tenuous,” to name a few. The data have repeatedly shown the “recovery” isn’t any of these terms because THERE IS NO RECOVERY. Oh sure, the stock market has gone up, but so have the number of people on food stamps, which is at a new record of 44 million. There is also no recovery for the 33 million people who are unemployed. Forget the government B.S. of 9%, the true unemployment rate has been stuck north of 22% for months according to Shadowstats.com.

The latest numbers have shown there is bad news across the board for housing, autos, manufacturing, employment and consumer confidence. Well, here we go again with the spin by the MSM. Even though many are now admitting there is a double-dip in the economy, the talking points used to describe this new downturn are things like “temporary,” “transitory” and a good old fashion “soft patch.” Here’s how the Associated Press reported the story after a nearly 300 point drop in the Dow this week. It said, “We’re definitely in a soft patch,” says Steve Blitz, senior economist for ITG Investment Research. No one knows whether the slowdown is a temporary setback or the start of a prolonged period of anemic growth. Many analysts hold out hope that the economy will rebound in the second half of 2011.” (Click here for the complete AP story.) “Soft patch, temporary,” see what I mean? Since when is holding out “hope” an investment strategy? Me and the people I have been quoting on this site have been clearly telling readers there would be another plunge in the economy. We were right and the MSM was wrong—again.

Money manager Hank Smith of Haverford Trust said yesterday on FOX Business, “It looks like we are having a soft patch for a quarter or two as we are in the expansion phase.” Mr. Smith blamed this “soft patch” on higher energy prices, the Japan earthquake and extreme weather. Mr. Smith went on to say, “All these are transient or cyclical factors. So while it is having an impact near term we do expect growth in the second half.” “Transient, cyclical” all words that scream the message–don’t worry, it will be ok, just keep spending all your money!

The only way we see “growth in the second half” of the year is if the Fed starts printing gobs of money in what will be called QE3 (quantitative easing). Mike Riddell, a fund manager at M&G Investments in London, was quoted on CNBC this week. The story said, “Pointing to the dramatic turnaround in the Citigroup “Economic Surprise Index” for the United States, Riddell said the tumble in a matter of months to negative from positive is almost as bad as the situation before the collapse of Lehman Brothers in 2008. . . . ‘You’ve also got to wonder at what point the markets for risky assets start noticing, too. QE3 anybody?’ asks Riddell.” (Click here for the complete CNBC story.)

What you are seeing in the economy is not “soft patch, transient, temporary,” and it is veritable NOT a “recovery.” What we have now will one day be called the Greatest Depression in history! Things will forever be changed in America, and it will take a generation to dig out from under the avalanche of debt bankers created. That is the cold hard truth the MSM will never tell you.

Greg

Excellent summary as usual.

MSM really does believe that the majority of people are basically stupid and will uncritically accept on face value whatever they are fed by the media and political leaders. Unfortunately an element still are that stupid.

A phony economy based principally on:

– consumption;

– excessive borrowings;

– imports;

– excessive foreign sourced financing due to a lack of domestic

savings; and

– more recently, the majority of Government debt being financed from

FED money printing

is not sustainable but that is the USA. So is it any wonder we are where we are? The US is now the “Greece” of the Americas. The US’ response to out of control debt is not to curtail excessive Government spending and introduce essential austerity measures but instead to continue spending like a drunken sailor and create yet more debt on the national Visa card.

When you have to increase your federal debt ceiling to avoid beginning to default on your payment obligations to Bond and Note holders, do you think you have a problem?

Well if you read the MSM line you would never think so.

Wealth is generated from savings, investment, production and exports (as in the successful Asian economies) not from consumption and excessive borrowings – both Government and private.

You are dead right Greg about another round of QE in one form or another. According to PIMCO most of the publically issued $9 trillion plus (much higher now) of Treasury notes and bonds are now in the hands of foreign sovereigns and the Fed (60%) while private market investors such as bond funds, insurance companies and banks are in the (40%) minority. However,much more importantly, nearly 70% of the annualized issuance since the beginning of QE II has been purchased by the Fed, with the minority balance being absorbed by the Chinese, Japanese and other reserve surplus sovereigns.

So who then is going to buy US Federal debt instruments (rolled over and new debt)after QE II ends – with their pathetic repressed yields – to maintain the out of control and ever increasing US Government spending?

Primarily the FED I would think with virtually endless new money printing and thus further currency dilution. In other words more QE, more inflation/currency dilution and further undermining of the value of the USD.

What of the “successes” of QE II?

– The phony consumption based economy remains in the doldrums but no surprises there.

– Across the board inflation – bad for economic growth.

– Spikes in commodity and energy prices, much of it attributable to QE – meaning an increase in input costs and a detriment to economic growth

– a rush of cheaply borrowed cash flowing to stable off shore growth economies seeking higher yields and insulation from a depreciating USD.

Looking across at the European disasters – Iceland, Greece, Portugal, Ireland and Spain (and perhaps Italy and others to follow), there is not a lot to be optimistic about in many Western economies.

Next time you see a favourable GDP figure remember it is adjusted for “inflation”. Given that official inflation figures are understated, due to the methodology used, then GDP growth (adjusted) always appears more favourable than it actually is. In times of more substantial increases in inflation this is something to watch out for.

All the best to you.

Thank you Sean S for adding to this post with your analysis and comment.

Greg

Hey Greg, bang on once again. You would think that all this recent negative economic data would convince these MSM clowns that there is, has and never was any sustainable recover to speak of, but no. They’ll continue to see the glass as half-full despite having housing in the US decline 33% and almost a 1/3 of homeowners in negative equity and as you mentioned, true unemployment numbers in the low 20’s. Not to mention the trillions printed by the Fed since ’09 with only 3-4 weak months of miniscule growth.

Greg, I’m clapping, wow, you said it “greatest depression”, and the MSM knows its becoming a real possibility with some of the “soft landing” media people beginning to chang to “hard fall” as we speak. Simply put: AMERICA IS BROKE! Our esteemed polititics don’t get it either. They run around saying they believe in America, it can be fixed while none of them have any solutions except more of the same.

Since the late 60’s I seen the value change here, where good is now bad and vice versa, tolerance for everything at all cost, tax & regulate everything, open the borders while jobs are exported, allow daughters to get birth control pills without parents consent, etc., etc., etc. – there is no way out of this problem anymore and I suggest this is more central than just economic debt; the too big to fail, the banksters & the debt crisis is just the staw that broke the camels back. Too bad for us, as this was a great country with high values just a short 40 years or so back or so.

For the Americans who live in the pockets of “old America” I’m sure its coming to your town soon. You ought to see the homeless populations of young people all over California, three & four empty homes on a street, whole retail small malls empty, youth gangs all over the place, barred up windows in residential areas, long lines outside medical clinics for shots, etc., people hitchhiking on every third or so on-ramps. Frankly, the western front is not “all quiet”, its in a controlled type state of oncoming panic. Yea, the banks are open, groceries are in the stores, gas at the stations, but something is looming and we all know it. Thanks Greg for stating it, a Great Depression is coming and it can be seen easily out here for those with eyes to see.

Thank you Art and Sling, and I am not going to wig out–I hope.

Greg

Greg.

Lots of HEAVY type. Not going to wig out are you? ;0) I feel the same way. I wonder why people do not wake up. We are spinning out of control like a top. In my efforts to understand these problems, I find that no action will be taken to solve them, till the impact of our actions or inactions, simply become to unbearable to stand.

Either it comes from the government in legislative process or the faultering economics lay waste to the country. Dissolvement of the Constitution or the devaluation of our money as byproduct acts of desparation, would set in motion other factors.

The attack upon the First, Second , Fourth and Fifth Amendments by the Judicial Branch are sure indications of what is to come.

We are divided into three sections. People, Government and Corporate/ Wall Street.

People do not care or not enough of them at the moment. I could go on and on about this subject. All I have to say is, If your going to be STUPID, you gotta be TOUGH!.

Government is what we made it and is running away with itself. More intrusive and there has been talk of internment camps. Can’t happen here? A good size football stadium did well in El Salvador.

Wall Street, to big to fail, smiles as our government latches on to our retirement funds to pay the debt, as they play in the sun with major bonuses. I am sure they laugh at us.

The lender of last resort is not the Federal Reserve, it is the American People. Maybe one day they will close the banks and we end up like Argentina. I do not think the price of gas, goods or even the statisical indicators means anything as we continue to go along with it. We have been droned into recovery this, Blah, Blah ,Blah. Stock Market that, Blah, Blah, Blah.

I await the day when the American People get “B” slapped. You know the type you can hear across the room. The one that shocks the receiver into reality. Quick and painful.

Hey Greg,

This and your last article were very good. You are not in a “soft patch” when it comes to reporting on economic reality.

Obama could only fudge the U3 unemployment down to 9.1%. I wonder what the real number is?

markm

MarkM,

According to economist John Williams of Shadowstats.com, the true Unemployment rate is north of 22%. He gets that number by computing unemployment the way the Bureau of Labor Statistics did it prior to 1994. Williams thinks the UE rate will top out around 35%!! Thank you for your support and kind words my friend.\

Greg

Hey Greg,

Thanks for the Shadowstats.com update. My statemenet wasn’t very clear. I was thinking: I wonder how Obama fudged the conclusion which resulted from an already fudged formula for U3?

Is that better?

markm

MarkM,

Yes it is, and thank you for the update.

Greg

Greg has mentioned the following for the real statistics: Shadowstats.com. The price is worth it. I enjoyed reading your post Art. You cover it all in just a few words. I feel the real crash will come on the second week of this November. It seems the American people have to really get hammered in order to get out of their “what’s in it for me” and “If it feels good, do it” mentalities. Having been in poverty after the ’29 crash I know how much it hurts. Back then we manufactured most all of our goods…now our manufacturing is mostly gone. Because of this, our recovery will be long and terrible. No one seems to watch our balance of trade, but it is so important. It’s right under our morality and our religious beliefs. I thank my Heavenly Father for putting men like Greg on this earth. This is my home page. Oldguy

Great article… you nailed it!! The newspaper said today “Weak sales and job reports hurts stocks”, same spin… not a mention on how it hurts main street!!

Thank you Laura, Hoppe Brian for the comments.

Greg

Whew, it’s a good thing we have the corp owned media to talk us out of economic disaster.

To parody Wm. Randolof Hearst ‘Get me the charts and I’ll give you a recovery’.

Hey Hoppe,

Its not the corporations, it is the neo-Marxists who populate the media. Remember, neo-Marxists believe in a false religion, which is similar to the faith system of people who blame corporations for all evils.

markm

Just goes to show that you cannot control an oxcart without first getting control of the ox.

The “government” seeking to steer or control the economy, ie wealth redistribution, wage and price fixing, supply of money..etc, must first gain meaningful control of the people that drive the economy, ie word meaning, symbol usage, standard/norm setting, prompting or dampening of emotional states…etc.

I think of things like refined sugar, concentrated caffine and television as being the new chain, whip, karat and stick, if you know what I mean.

A relatively small number of complete malcontents have hijacked the lives of a relatively large number of complacent, placated fools…….isn’t this the sad, worn out story of human history?

Greg —

Have you read the book, Conversations With God? All volumes of it (all 3) are great. In the second, “God” discusses a 1 world economy, 1 world government run with people that are enlightened as concerned for the greater good as they are for themselves . . . thus leading to a world where ABUNDANCE exists for everybody. (Maybe not in terms of everybody having material wealth, but in terms of everybody having all they need for survival without worry and fear.)

Ah, to dream of such a day when the world as a whole is so enlightened. Think it can happen before we pass on to the non-physical realm? 🙂

Thank you for continuing to share your truth! (And check out the book series if you haven’t already!)

All the best,

CIGA Christopher

Thank you for the comment and reading tip Christopher.

Greg

You’re reading sci-fi books about an imaginary utopian society. While idealistic societies make for great reading, in realty, they don’t work. Communism, of course, is the perfect example of an idealogy that was based on equality and fairness for all. Epic failure. Individualism has a nasty way of raising its head and ruining the collective…thank goodness. Certainly, read your books, but read “Atlas Shrugged,” as well.

Christopher

Is not that what the Soviet Union had?

No, the Soviet Union had socialism, less opressive, less powerfull, less utopistic and less destructive form. Even that was more than enough.

Hi Greg,

Perhaps it will take more than one generation (16 years) to dig free of the debt. We checked these numbers not too long ago and here’s an update:

U.S. Debt this am from http://www.usdebtclock.org/

14.408 trillion = 456,560 years

A million seconds is 12 days

A billion seconds is 31 years

A trillion seconds is 31,688 years

Incomprehensible; looks like a default situation to me.

🙂 Diane

Thank you Diane, Gary and Jeff for adding information and analysis to this post!

Greg

That’s a cunning answer to a challenging question.

Hi Greg,

A revelation occurred to me following President Obama’s speech which threw Israel under the bus. That revelation had to do with the mostly muted response by American Jews. It became evident to me that being a Liberal overshadowed any contradicting evidence to the wisdom of that philosophy. Carried further , it explains the bulk of -Teachers- Blacks-Journalists– etc. – add your own Liberal Democrat mono-block voter.

My wife and I struggled as early as grade school with “progressive” teachers that felt it was their duty as a teacher to indoctrinate their charges with left wing thinking. Until there is some inkling of balance in our Schools of Higher learning the propagation of Liberal philosophy and propaganda will continue no matter how the facts of it’s fundamental failure become more and more self evident.

I used to think that our founding Father’s worries about a “Free Press” were based in a suppression of free speech but I now think that they might have foreseen a one party press that ” spins” the truth for ANY Liberal that needs support.

Martin,

Thank you for your comment and support, but I would just like to point out that I see very little difference in the big picture between liberals and conservatives, Democrats and Republicans. They just take turns ripping us all off.

Not a criticism just an addition to your fine comment.

Greg

how is it that the government can publish the horrible jobs and housing numbers that they did last week and nobody seems to have noticed? you have to give them credit for one thing: they now have the whole society numb to the slow motion meltdown of our economy. i guess that’s healthier than the anger and panic that i feel.

i know i shouldn’t take martin’s bait but i can’t resist: the reason that the response to obama’s position on israel was muted is because he didn’t throw them under the bus. the 1967 borders with swaps had consistently been the u.s. position until bush 2 and is what was agreed to in oslo. the “with swaps” got lost in netanyahu’s temper tantrum. the ’67 borders are the starting position from which both parties need to negotiate the final borders.

i think these comments would be better served, if we all stick to the economic issues that greg has so clearly outlined here and leave the israel comments as a follow up to greg’s israel article.

Josh,

I love this line, “they now have the whole society numb to the slow motion meltdown of our economy. i guess that’s healthier than the anger and panic that i feel.” Thank you for weighing in.

Greg

Hi Greg, All this “Will we or won’t we get QE3” questioning are looking in the wrong place, the Fed. This time QE3 will come from Congress with the raising of the Debt Limit over 2 Trillion Dollars which will come from the same place as QE1 and QE2…The Fed.

I think what has so many people confused is the stock market action over the past couple of years. We are institutionalized to think that the economy is improving when the markets are going up. They understand this very well in Washington and make the decisions accordingly. If there are no jobs, what is exactly recovering?

Vik,

Good point here. The Federal Reserve was doing QE 1&2 in part to support the stock market, according to Bernanke and others at the Fed. Charles Biderman from the Wall Street research firm Trim Tabs confirmed this last year on CNBC. Thank you for bring this up.

Greg

Greg,

Unfortunately true conservatives like Ron Paul have a prayer of gaining the Oval Office. I agree that without term limits most of our Representatives will pander to the masses and never take a stand for the Country.

Where you are truly wrong with lumping conservatives and liberals together is in education as I wrote about. My son came home from 8th grade class and told me that the teacher ( a Kerry volunteer with posters in the classroom) said if George Bush won re-election the class was going to get mountains of homework. I battled with almost every teacher my children had and was stunned by the liberal bias of every one of them.

Martin,

We can only hope Paul Power catches on.

Greg

if..? wealth is created by and is savings, the US government is destroying savings…perhaps ex patri is the only answer…? to preserve any wealth..

I simply assume the economy can’t improve until the MSM finally admit its tanked and they don’t have the answers.

This could go of for quite a while 🙁

“A generation to dig out” of the mess sounds about right.

People are going to need to learn how to live with less, much less. Not because it’s the right or smart thing to do. There will be no other choice. If jobs ever return to America in large numbers they will be at very low wages. People will happily take them. The real question is will Uncle Sam ever be forced to live within HIS means? Let’s hope so.

Greg,

Great article! Herr Goebbels, Reich Minister of Propaganda, would be proud of our MSM. It is sad that after years of thinly veiled lies by the MSM; most of the sheepople still believe their propaganda.

Our government is like a heroin addict. Does anyone really take a junkie serious when the junkie says, “Just one more hit of heroin and I’ll go through withdrawals”? If we don’t take the drug junkie’s word when they say something you know is a lie, why would we take the word of the “Spending” junkies in Congress?

Thank you George and yes the wild spending will stop because it will have to.

Greg

Greg,

I recently found your site via Steve Quayle. The moneychangers are in charge of this country. It is so obvious, and so sad. It is painfully obvious to the common man that the economy is not doing well. Unfortunately, many are so, so clueless.

I am glad you have the WTC 7 link on your main page. I woke up when I learned about WTC 7, and that was only in 2008.

Since I was able to open my mind to WTC 7 and 9/11, I was able to learn about the Federal Reserve and the evil Illuminati financial scams and have been able to put my money into silver metals.

I thank God for the day I learned about WTC 7, or I would not have had the knowledge to put my money into silver to survive the economic collapse.

God Bless you and other Patriots and good men, such as Steve Quayle and Alex Jones.

Thank you hbeachrealist!!

Greg

Hbeachrealist,

Interesting article and video your are referring to. You have to admit Greg provides thought provoking articles through his site.

Just a few questions? What reason do the Building 7 people give for this grand conspiracy? To kill a few people? I have to admit our government is mad but if they wanted to kill even a few hundred people quickly in the building, they would have done it the old fashion way; muggings, hit and runs, rarely searched for toxins that present the look of natural causes or a train wreck at most. Explosives in these amounts would have been very hard to hide before, during and after installion.

And how many engineers are on the side saying it was fire? Of the 1400, how many are experts in fire damage or demolition? Are all the 1,400 structural engineers? And how many actually looked at the schematics and blueprints? 1,400? Not unless they are unemployed.

Just my two cents. I do know the government is evil. I just don’t believe they would destroy three buildings in the WTC complex, or even one just to kill a few people; Too much capital destruction just to cover up murder. And if not murder, what purpose is this supposed to have?

I just suggest you do your research on 9/11. Watch “Loose Change: The Final Cut” on you tube. It is obvious that the three towers were controlled demolitions.

WTC 7 had CIA, FBI, and SEC paperwork and info there.

It is believed that Enron files were there and that the whole 9/11 plot was done in the bunker in WTC 7.

There is no recovery. Spin is rampant.

Since a few posts on this thread addressed jobs, I offer this…

A 55-ish friend suggested that raising the Social Security retirement age is counterproductive. He thinks the SS retirement age should be lowered.

Why? Because many old fogies (cough) like us could make room for young blood who are in dire need of jobs. More young workers, even at lower pay, means more people are paying into social security.

Sounds like a win-win to me. This idea might even break the “I’ve gotta work forever in these dire times” attitude amongst seniors who hear politician’s calls to raise the retirement age.

However, SS incentives to remove the quasi-elderly from the workforce could give hope to younger people aspiring for livable-wage jobs. Also, proving that the oldster’s SS benefits are truly secure would be a bonus.

Lowering the retirement age doesn’t need to be permanent. Open the window for a couple years, maybe. Corporations do this all the time. They call it a (retirement) buyout.

…ikb

greg,

good stuff, but maybe too little too late.

everyone needs to reed this.

http://www.federalobserver.com/archive.php?aid=7849

this is not “market forces” at work. this is an orchestrated, 100% contrived event. a culmination of virtually hundreds of years of effort by what is truly the dark side.

the reich never died. what happened in germany in the 30’s is about to happen to the western world 100 fold.

can’t happen here? do you think pre-nazi germans were running around in the 20’s thinking “it can happen here”? do you really think that a struggling artist and part time paper hanger just decided to take over the world all by himself? same people who pulled those strings are pulling these strings. and they are smelling victory.

The US economy has been nothing more than a “confidence market” for years now. The real valuations for a companies assets died in the dot-com bubble and they have never been revived. Just as the banking sector has dumped all of those bad loans onto the taxpayer through Frannie and Freddie. Todays corporate world looks more like an Enron-Madoff-FED corporate ponzi scheme and the only place left to get money to keep the ponzi going is the US taxpayer. The sad truth is that Congesss will once again bail them out and raise the debt ceiling so the FED can continue devaluing our currency.

Only when the credit card is cut off will Congress make real systemic reforms in tax collection by eliminating corporate tax loophole and end rewarding companies with tax deductions for goods produced outside the USA.

Ron Paul for President

The Last Nail, ,by Congressman Ron Paul

Congressman Ron Paul delivered a five-minute speech on the floor of the House of Representatives May 25, a short speech that may sound to the uninformed like one wild statement after another. In his speech, Dr. Paul (he’s an obstetrician) made a number of charges that the executive branch of government has established a virtual dictatorship with the willing assistance of Congress and many Americans who fear for their “security.” But Congressman Paul is complaining about the erosion of constitutional protections that have already happened. Following is his speech verbatim, along with links documenting his allegations. All words are by Congressman Paul; hyperlinks were added by The New American’s Thomas R. Eddlem.

http://www.thenewamerican.com/usnews/politics/7672-the-last-nail-by-ron-paul-with-documented-hyperlinks

Sean Said:

“nearly 70% of the annualized issuance since the beginning of QE II has been purchased by the Fed”…..

Can someone please explain the above to me? The fed creates money out of thin air, which it then uses to buy it’s own debt???

Why do they do this?

Nm,

Because the Fed is actually suppressing interest rates when it buys 70% of the U.S. debt. This creates false demand and it is the reason why mortgage rates have been frozen at around 5%.

Greg

Because there are not enough other buyers dumb enough to buy our debt at the ridiculously low rates we offer (with the high risk of a nation in debt so high it can never be repaid).

As a truck driver i watched that sucking sound to the south(ross perot)as for many years i witnessed whole factorys and jobs leave.Now i see so many empty commercial buildings,even places ive eaten at for years go belly up.Also the trucking industry gets so many new drivers who find out how tough it is to drive for a liveing and how little truckers make.The newest thing is the stepped up inspections and fines,seems like broke states look at truckers as a big revenue source.printing money and borrowing is whats keeping us afloat,it cant last,better tryin be ready.

What would happen if the Fed didn’t buy it’s own debt?

NM,

Much higher interest rates.

Greg