Weekly News Wrap-Up 3.30.12

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

A budget has been passed in the House of Representatives by the Republicans that cut $5.3 trillion over the next 10 years. Can it pass the Senate where the Democrats are in control? Probably not, and that means we are back to the fight of spending reductions by Republicans and tax increases by the Democrats. It’s election year politics at its finest. The budget proposed by President Obama was unanimously defeated in the House. The Supreme Court heard the case of Obama Care this week. It will not be decided until summer, but conservative judges picked apart the individual mandate where Americans who do not purchase healthcare insurance are taxed or fined for not doing it. The Wall Street Journal is reporting the Federal Reserve bought a whopping 61% of our nation’s debt last year.

Former big buyers of Treasuries, China and Japan, are shunning U.S. debt. Maybe that’s why Ben Bernanke is trashing gold and questions about a gold standard. The Fed Chief said, this week, there are “problems with a gold standard.” You mean there are no problems with printing lots of cash to buy debt and live beyond our means? Think $4 a gallon gasoline national average, and many experts say they expect an average $5 a gallon this year. Housing prices fell again according to the latest Case-Shiller report. The MSM spun this story and said it was not that bad. But the report said it was that bad–the worst report in the current housing slump. Home prices are the same as they were nearly 10 years ago. What recovery? Finally, renowned economist Martin Armstrong says the next financial calamity happens in 2015. Because of the severe and ongoing problems in Europe and Japan, many are predicting an earlier demise of the global economy. Nothing is fixed in Europe. The U.S. economy isn’t so hot either, but it is the thinnest fat person in the room. Greg Hunter of USAWatchdog.com gives his analysis on these stories and more on the Weekly News Wrap-Up.

Greg,

Of course Bernanke is against the gold standard – does anyone know if the U.S. Gold Reserves still have the gold? The last real audit of the U.S. Gold Reserves took place in 1954.

If Bernanke continues to print money, he will put the counterfeiters out-of-business because it will soon cost more to print counterfeit money than the real “junk” dollars.

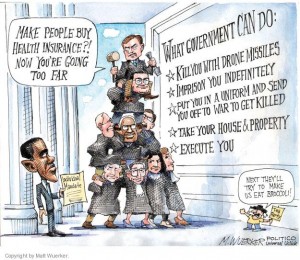

It is amazing to see that the U.S. Supreme Court judges are so concerned about our rights to buy health insurance. But where are they when the Patriot Act, the NDAA and the NDRP took our constitutional rights away?

Finally I don’t trust everything I see in the news. Things are not what they seem to be – especially in politics. During this economic hard time, the members of Congress are getting richer – nearly half of Congress are millionaires. The fights between Obama and GOP look more and more like a “Good Cop, Bad Cop” show playing in Washington. Whatever they decide to do or not do, they are still the winners (and making money) while we are the losers and suffering from their actions.

God Bless America! We need miracles.

Ambrose

http://www.youtube.com/watch?v=REqrkeonbWc&feature=player_embedded#!

Greg,

The proverbial rabbit hole gets deeper by the day. The NYC Department of Education wants 50 ‘Forbidden’ words banned from standardized tests. Welome to Idiocracy!

http://newyork.cbslocal.com/2012/03/26/war-on-words-nyc-dept-of-education-wants-50-forbidden-words-removed-from-standardized-tests/

By the way, I’d like to steal your “the thinnest fat person in the room” line. That’s some literary genius! Have an enjoyable weekend and be safe, happy and healthy.

Thank you Baja Bryan for the comment and link.

Greg

Does not matter which way the Supreme Court rules. There will always be spin to place the blame as to what party put what Supreme Court Justice on the bench. Never ends you know.

I do not see any slowdown at the gas pumps. Neither do I see cars doing the speed limit. I think these drivers just get one less Starbuck’s coffee to compensate for the rise in the gas price. Party On Dudes!

Hey! Anyone heard anything on what is going on with Israel or the in the Middle East? Now that we are fixated on the shooting of a Black man by a Latino who was a neighborhood watch, is the story of the hour that packs the news punch of the day.

Our buddy, Ben Bernacke, just keeps on printing like the Energizer Bunny. Have not seen him smile lately, with the balance act of interest rates, housing, the national debt and a few other annoyances.

SWIFT must be giving him a big headache.

We have all heard of the record gun and ammunition sales this past year. Did you hear that the government purchased a few million rounds of 40 caliber handgun? I do go to gun shows and they are packed and they are buying items at high prices. I buy and sell military web gear and my sales are up.

I want to point out that there is something going on behind the scenes. That people either do not care or want to admit to what is happening. The people and the government are “Gearing Up for Something”.

Take it with a grain of salt, if you like.

Greg,

Video looked as good as the content!

and we need miracles and leadership

Thank you Jill. A very good friend of mine inspired me to improve the quality.

Greg

You know Greg,there seems to a lot more smoke every where you look compared to the late 90’s! On one of the blog I read daily, one poster complains about what is going on in the EU zone, how Greece has become a different place for the worse as many of the other Nations who use the euro as their national currency. He continues to say we Americans do not know what pain is to watch nations lose their sovereignties to keep the euro zone alive. Well I counter him with a quote from a close friends wife who is from Spain, they just retured from a visit to spend time with her parents. The pics she brought back & sent via email were of great pain to look at! The large fields of wind mills setting idel, the huge plant that produced them shuttered & the land packed full of New Motors to power the ones never installed or shipped to other nations. From the words of her parents, the Green Movement, Cap & Trade was no more than a scam upon the people of Spain who fell head over heels for this job killing policies forced upon all of Europe & now we can prove to the world it was no more than a scam! Now they are doing the same in the USA & the results have shown to be very bad, just look at the billions gone in the wind!

Like I said, there’s smoke every where & getting thicker as each day passes, most who read your work can see the smoke also, if we can see it then our leaders can yet they do nothing but make excuses or lay blame for the sourse where the smoke comes. Now instead of doing the right things they keep putting fuel on the fire to all is gone except the foundation which to rebuild on. For all of us who have seen the smoke & moved all of our savings to a place that is fire proof, rebuilding will be come to us sooner than those who chose to follow these leaders who live a lie!

Enjoy the week end Greg, it will be nice in my neck of the woods & we plan on making the best of it! Thanks again for standing tall for the truth!

Thanks M Smith for the comment and support.

Greg

greg,

really? rising housing prices is a sign of a recovering economy?

have you too been into the kool-aid?

does noone realize what got into this mess in the first place?

how do you make housing prices rise without heading to yet another bubble?

a home should not, nor should never have been a financial investment commodity. since a home has only intrinsic value and is not a means of production or fiscal growth, the only way one can increase in value is through inflation. when you buy real estate on spec, you are investing in inflation. for you to gain, someone has to lose.

why is this so hard?

G. Johnson,

I totally agree. If we had a true recovery, demand for housing would be rising and prices would not need the help of suppressed interest rates. Even with 4% 30-year rates, prices are falling. My point is there is no recovery. No kool-aid for me.

Greg

greg,

i am not sure we agree. you still seem to think that it would be ok for housing prices to rise as long as “natural market forces” are the impetus. and you still seem to say, “prices are falling so there is no recovery.”

my point that true economic recovery means that things are affordable to all without undue sacrifice. effort yes, suffering no.

or, did i misunderstand your response?

g. johnson,

Yes, it is OK for house prices to rise on legitimate demand, not demand cause by suppressing interest rates by the Fed. And yes, am saying “prices are falling so there is no recovery.” Please keep in mind that prices are falling despite near record low 30-year mortgage interest rates. I am a capitalist. I believe in free markets, transparency and no government bailouts unless it is of profound national interest. Sometimes people will have to “suffer” through their mistakes. I and other taxpayers should not have to put up with the destruction of the credit rating of the U.S. and the debasement of the dollar to protect reckless bankers and homeowners from “undue sacrifice.” House prices will rise someday but from much lower levels then they are now. What the government and The Fed are doing is printing money and making things much worse for the common man. Why do you think the national average for a gallon of gasoline is $4 despite a global glut of oil?

Greg

greg,

this is why you need a forum on your sight so that certain subjects can be debated at length.

you last question is a good place to start my retort. why do i think gas is four bucks a gallon despite a global glut?

two reasons mainly. the first, of course is that the dollar is going to hell in a handbasket. the second is that the prices are artificially set for profit taking and, sadly, to help in the asset stripping of the middle class. contrived, contrived, contrived…….by “capitalists”

sorry, that may have seemed like a low blow. i too believe in free markets (the way our forefathers explained them) i am a huge fan of transparency and i do not condone government bailouts period. national interest is the excuse that is always used. too big to fail means that it will hurt the country if it fails even though we should all know by now that it hurts the country way more to not let it fail.

but i do not consider myself a “capitalist” as that term has come to mean far too many different things in the past half century or so. i am pretty sure that the founders were not thinking corporate fascism when they used the term “free enterprise”. i think they just meant that business should be free of government meddling and overregulation. fraud is fraud. we don’t need ten thousand laws to say that fraud is bad, we only need one….but we do have to enforce it. i believe in free enterprise, but i don’t consider myself a capitalist because, simply, i believe there are things more important than money.

when i was a mere stripling back in the mid 50’s interest rates hovered at between 3-4% and the prime at 2-3%. high risk investment loans were going at around 6-8% and at around 9% usury and loan sharking laws kicked in and were heartily enforced. if you could come up with a 5% down payment for a home, you mortgage was typically right around 20% of you take home pay. a decent 3 bedroom in a good working class neighborhood went for around 8-10,000 bucks in western washington state.

the economy boomed! 2 chickens in every pot.

housing prices are not falling despite 4% interest rates. interest rates have very little, if anything, to do with it.

housing prices are falling because noone can afford them. noone can afford them because they rose to staggering heights way beyond the ability of flagging income increases to keep up.

the fuel behind the rising price of real estate has been speculation, the debt based dollar, and well, not much else.

suffering from mistakes is one thing. and hopefully such suffering can be mitigated by learning from those mistakes.

suffering because a bank arbitrarily called in your farm loan, because oil companies conspired to artifically inflate gasoline prices (which in turn jacked up the price of everything else except your labor) or investors drove the price of a new home up beyond affordability is another thing entirely.

i will sum up with my reply to roderick below.

g. Johnson,

You say, “the fuel behind the rising price of real estate has been speculation, the debt based dollar, and well, not much else” What about “liar loans” cheap money, securitization of mortgage debt and 0% down-payments? You say, “housing prices are not falling despite 4% interest rates. interest rates have very little, if anything, to do with it.” Interest rates have everything to do with real estate. What do you think would happen if 30-year mortgage rates were just 7%? Prices would crash even faster!! Good men can disagree my friend. Thank you for your spirited comments and for supporting this site.

Greg

greg,

really? some slimeball scam artist suckers a nine dollar and hour soda jerk into buying a two hundred thousand dollar house with no down payment and a whole lot of “enhanced” financing and that drives up the price of the house? sorry, methinks it was already up too high and going higher anyway. all them fancy scams was just to get someone into something noone else would (could) buy and turn the paper into derivative junk.

interest rates would have more of an effect if the price of a home was in the realm of sanity in the first place.

so, here is a twenty dollar apple, gonna pay cash? or put that on your credit card? (no fair looking into the future, i am talking about right now)

of course the answer is neither, you are going to pass up that deal. ( right? i mean, if you are considering it, i do have apples 😉 ) and you are going to pass it up because it is just plain not a realistic price. not because you can get a nice low interest rate.

ok, jack up interest to 7%, might speed up the crash as you say, but not by all that much at this point. this is a bubble bursting because it got way to full of air.

G. Johnson,

Prices will come down. I would have never suppressed interest rates to begin with and I would not have bailed out the banks. We would have had deflation and dollars would be king. I think we might be saying the same thing in different ways. Peace.

Greg

ok, you seem to be looking at things more from the perspective of the investor and i know that i am looking more through the eyes of a consumer. in that vein, you will never convince me that rising prices and higher interest rates are in any way good for an economy.

but you are damn sure fun to disagree with :-).

keep it up greg, we’re out here pullin for ya.

g. johnson,

I do not require my friends to agree with me on every point. It looks like you don’t either. Thank you for all your comments. They are always welcomed no matter what your point of view.

Greg

According to Lendsey Williams, the Dollar is done by the end of the year (2012). What do you think about his prediction?

James T,

I do not know if Williams is correct but one thing is for sure, the dollar is being intentionally devalued. Even Forbes.com recently said the government wanted to devalue it by “30%”. The U.S. Dollar is also under attack from the BRICS as they are openly and actively looking for an alternative to the U.S. dollar. That can also be documented from multiple sources. Will it be gone by the end of the year as Williams says? I don’t know, but it is a safe bet to think it will lose buying power.

Greg

What I think Greg is really saying about falling housing prices is since 2001 real estate pretty much was the economy. Everyone and I think I am spot on about this benefited big time from real estate prices going up.

Bush was happy the Federal Reserve goosed the economy thru real estate. It made Americans giddy. Took everyones attention off the lies of the Irag war and peoples rights being stomped on. Torture being against the Geneva convention was not given attention because we were so busy pulling money out of the ATM machines and shopping to care about the evil we presented to those we called our enemies. As long as they don’t torture Americans. Well that turned around and bit us in the ass now didn’t it? What with the recently signed (on New Years eve) NDAA.

To say real estate was the economy brings us to the reason we are seeing such hardship today, what with over 15% of Americans now on food stamps.

Hell I saw houses double in my area in one years time. Everyone was in on it, builders, house flippers, remodelers, construction people, landscapers, painters. The money people made was spent for new cars, vacations, second properties, new clothes, kids put in college etc.

Then bam the economy flat lined. The housing market took a downturn and has not started to come back up yet. Now what do we have since the economy was housing?. Nothing thats what.

Oh yeah I forgot we still have defense contractors making billions building weapons to use whenever our evil leaders can bring forth enough propaganda to engage in destroying life and property in any land they can put forth that some boogyman exists.

Basically we have money printing and the war machine. America is lost in darkness.

roderick,

you are correct but wrong.

everyone benefited big time from rising real estate prices…..except those paying the mortgages and rents on anything purchased after say, 1989. yeah, of course a lot of folks who purchased a home or invested in real estate prior to that did real good on capital gains from the increases. but, again, someone else had to pay too much to make it happen for them.

The game changer!

BRICS make it official, March 29th, 2012

http://www.youtube.com/watch?v=o0zFREv8-as&feature=player_embedded