Inflation Everywhere but MSM Says NOT

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

It seems every chance the mainstream media (MSM) gets, it tells us things really aren’t that bad. For example, the headline from the Associated Press (AP) said, “Consumer prices on the rise, but inflation outlook is benign.” Who approves the headlines at the AP? Prices are rising, but there is no inflation? Aren’t rising prices the main ingredient of inflation? The story goes on to say, “Consumer prices rose modestly in January on higher costs for food, gas, rent and clothing. But economists downplayed the increase, saying inflation will likely ease in the coming months as prices for raw materials level off.” (Click here for the complete AP story.)

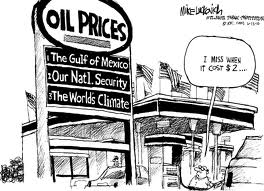

I wonder where the people who write for the MSM shop for groceries and buy their gasoline. Maybe they have a time machine and magically go back where prices are a lot lower for everything. But for those for us eating and heating our homes today, things are not getting cheaper and inflation is a problem! Look at this from a different AP story where the headline says it all, “Gasoline prices are highest ever for this time of year.” The story goes on to say, “Gasoline prices have never been higher this time of the year. At $3.53 a gallon, prices are already up 25 cents since Jan. 1. And experts say they could reach a record $4.25 a gallon by late April. ‘You’re going to see a lot more staycations this year,” says Michael Lynch, president of Strategic Energy & Economic Research. “When the price gets anywhere near $4, you really see people react.” (Click here to read the complete AP story.)

Do the writers at the AP read their own stories? Do these reporters not talk to each other or read the rundown (a list of stories every reporter is working on.) Do the editors for the AP not want some sort of continuity? I don’t have the answers to any of these questions, but those are the ones I am asking to myself. In another story from CNBC a little more than a week ago, the headline read, “Get Ready for $5 Gas This Year: Ex-Shell CEO.” (Click here for the complete CNBC story.) Do you think this is signaling the “inflation outlook is benign”? Oh, Iran just cut off oil exports to French and British firms. A report from Reuters said, “Iran has stopped selling crude to British and French companies, the oil ministry said on Sunday, in a retaliatory measure against fresh EU sanctions on the Islamic state’s lifeblood, oil.” (Click here for more on the Reuter’s story.) This is around 700,000 barrels a day cut off to the EU from Iran. Do you think this will make gasoline cheaper in the coming weeks and months? This is financial war, but what if there is a shooting war? You think gasoline prices will be heading south or go up to that $5 a gallon mark?

“Inflation outlook is benign.” I don’t think so, and neither does economist John Williams from Shadowstats.com. The Federal Reserve concentrates on what it calls “core” inflation. That’s just about everything except energy and food. I don’t know who lives without energy and food at their “core,” but this is what the Fed focuses on as its main predictor of inflation. In his latest report, Williams said, “On an annual basis, “core” CPI-U inflation moved higher for the 15th straight month, up to 2.28% in January, from 2.23% in December. When Fed Chairman Bernanke used his jawboning in a successful effort to debase the U.S. dollar in the global markets, in advance of announcing QE2 in November 2010, annual “core” inflation was at 0.61%.” (Click here for the Shadowstats.com home page.) So-called “core” inflation has more than tripled since late 2010 and “Inflation outlook is benign”?

By the way, if inflation was computed the way it was in 1980 by the Bureau of Labor Statistics, it would be 10.5% annually according to Shadowstats.com. It is said a picture is worth a thousand words; in this case it’s a chart from John Williams. As I finish this post, ask yourself, where do you think inflation is headed?

http://www.foxnews.com/politics/2012/02/19/report-millions-jobless-file-for-disability-when-unemployment-benefits-run-out/

Apparently the MSM is also trying to spin unemployment again – Stating that more and more Americans who are running out of unemployment benefits are filing for disability benefits. The good news, according to the MSM, are that these people are removed from the unemployment statistic driving down unemployment!

Greg,

Did you really expect anything different from the mass media? Heck you worked there so you should know that their policy is to not let the truth get in the way of an agenda.

We have the nanny state because the government knows that to keep us fat, happy and lazy is to keep us from revolting. Has nothing to do with “doing the right thing” by taking care of those who can’t take care of themselves. Dependency is their weapon, much like a drug dealer who hooks their “customers” with a free hit.

We aren’t uncomfortable enough yet for change to occur.

Stephen

Stephen,

I really like this line in your comment, “We aren’t uncomfortable enough yet for change to occur.” Spot on man!

Greg

Greg, inflation is up for the working class. The political class only sees it from a political perspective, having much to much wealth to worry about a few dollars a week. The MSM, who now is the political class and elite’s mouthpiece (pravda),their income is rising quickly as well. That leaves only the working class to feel the results of inflation in real terms. If the MSM and the administration plays it right Iran can be used as the reason for high gas prices, but its a short term play as inflation is simply the result of economic fiat money printing which will not stop. Both parties voted to add to the deficit last week, there will be no stopping inflation with policies like that. Talk is cheap, the republicats talk fiscal conservative but vote the other way every time; all posturing for the home folks who are too busy working to read the vote. $4.00 gas is already here on the western front and rising. My gas bill is up $25.00 a week since this time last year, at least one cheap dinner out for one. Inflation is here to stay. What you didn’t outline in your well written article is that you are seeing the commencement of hyperinflation. What your readers need to know is that hyperinflation doesn’t start in a vacuum, meaning, it starts with modest inflation then escalates and the only brake the government has is interest rate hikes to control it. However, when hiking interest rates is not an option inflation continues to to to a point of panic; then comes the tiger out of the cage (hyperinflation). As the old song said “hold on I’m coming”.

I’m sure “journalists” who get their paycheck from conglomerate media are told “You write what I tell you to write. You’re NOT paid to think. WE do that for you.” Of course, that’s never said nor written. It’s just strongly implied so that they self-censure their work. Some “journalists” probably think they’re protecting us from someone yelling “fire” in a crowded theater.

Edward Ulysses Cate

I think it sounds you you worked for the MSM at one time. You got it.

Greg

It’s like going over a cliff in slow motion. Sometimes I wish it would just go into free fall and hit bottom so we can begin the healing process.

Amen

Dont you know that the price of gas and food rising is a figment of our collective imaginations, and is not really happining,we the people are suffering a collective delirium.and should all be sent to the nearest government sponsored mental instutition for a complete mental checkup.

“It seems every chance the mainstream media (MSM) gets, it tells us things really aren’t that bad.”

That’s because their man Barry Obama is in the WH. I have no doubt if it was a republican, they would be peddling against him.

I used to be a democrat, until I reliased they promise more domestic spending, and pretend that we aren’t broke so we are borrowing to pay for that spending. If W was still there, I have absolutely no doubt, they would be going after all this all the time, and I did not support Bush, but Obama makes Bush look fiscally responsible.

I dont’ watch any MSM anymore, all lies, all lefties, all BS.

Thank you to sites like this, ZeroHedge, etc, where truth is not just a fad, lay out facts and whatever conclusions it leads to.

Yep, all lies. But if you think it’s all from the left, you’re lying to yourself. There is no right, there is no left. Get that through your head and you’ll be much better off. There are powers that be, and they laugh when you say this shit.

Bingo! Your 100% right. 99% of this country has got to stop believing in the false left/right paradigm. There is left, there is no right. There is only ONE party and they represent the elite. The top 1% The elite being: wall Street/Private evil FED, military industrial complex, Bog Oil and any other multinational corporation. There rest of us don’t count.

Gas has never been Higher? Don’t you have it backward-paper money has never been cheaper?

A silver quarter bought a gallon of gas in 1954. Today a quarter buys 7 and one half paper dollars.

Gas is cheaper today than in 1954 if measured in silver or real money!

jack alderson,

Good point! Thank you for making it here.

Greg

Jack, we can’t be saying things like this. It just gives the Mourge another reason to hammer Silver.

With the PBoC, ECB, BoJ and the Federal Reserve all racing to print themselves a new lease on life, the competition for resources will only intensify as freshly printed ‘money’ chases the same goods.

To paraphrase Mr T, ‘ I pity the fool who trusts the CPI’.

Jay and NC,

Good stuff from you both! Thanks.

Greg

Greg.

Pat,pat on your back. Another good artical.

In my garage pee brain i have a prediction. The fed will print, and flood the market with counterfit cash money. Then declare a bank holiday to fix the problem with new money..A devalued money.

The money problems will be blamed on counterfit bills.

For a pee brain you sure are smart, A. B.

Jay, Greg, “Don’t cry for my Argentina” that is exactly what the Fed will do in conjunction with the other central banks. Canada has already started to convert their currency to new bills, vinyl, to stop counter fitting, now people with cash in the mattress have to exchange them.

As the BOC governor is a ex managing director of Goldman Sachs, now we have a cut back on pensions, however the BOC through the IMF is bailing out European Banks, plus the BOC is a required bidder at US treasury auctions for more debt to suppress the Canadian Currency.

Should I buy a Igloo in the Arctic, or cocoanuts from Hawaii.

No currency is safe, I feel like going to North Dakota to buy a cow, and them mix them up with a Canadian Cow, then practice Cow Theory.

Were hooped and we cant stop it. As Ron Paul said yesterday, Corporate Fascism is here. “A wise man remonstrates with the government three times”and then heads for the hills.

Get your money out of the banking system while you still can,

Frustrated Canuck, “The Canadian Dollar Is not a Safe Haven”

I think we have have six months at the most to get to tangible assets and that includes ass wipe.

Other indicators, take a look at this article http://articles.marketwatch.com/2012-02-17/industries/31070171_1_general-mills-yoplait-nature-valley at the whopping increases that these companies have implemented and are still saying that they are going to have to lower outlooks.

It’s worse than the 99% think.

WKC,

Thanks for the comment and content for everyone to read.

Greg

Many (including yours truly) have been flummoxed by the obvious disconnect between what the media propaganda machine reports and observable reality. There is an explanation, but it’s implications are terrifying. Consider this quote:

“The aide said that guys like me were ”in what we call the reality-based community,” which he defined as people who ”believe that solutions emerge from your judicious study of discernible reality.” I nodded and murmured something about enlightenment principles and empiricism. He cut me off. ”That’s not the way the world really works anymore,” he continued. ”We’re an empire now, and when we act, we create our own reality. And while you’re studying that reality — judiciously, as you will — we’ll act again, creating other new realities, which you can study too, and that’s how things will sort out. We’re history’s actors . . . and you, all of you, will be left to just study what we do.” ”

The quote, later attributed to Karl Rove, came from New York Times reporter Ron Suskind. It is increasingly apparent that establishment officials are, literally, clinically insane. They really do believe they are immune from the very real forces that drive economics and human behavior. We are watching them create their own reality.

This system is doomed.

Bernanke is too stupid to realize that the money he is pumping into the economy is going to drive up the futures markets dragging our gutted economy wit it ….

The gambling is continuing at full speed and soon the USS Amerika will hit an iceberg of debt. Debt just like the iceberg that sunk the Titanic was mostly unseen and underwater our real debt load is under the water. This is a great anaology for todays economic conditions. And the banksters are hidding more of it and the seas are treacherous……

Mitch Bupp,

I think Mr. Bernanke knows exactly what he is doing. We are all just guessing the timing of the end game, but we are going to hit that “iceberg of debt” sooner than later. You got that spot on man!!!

Greg

“Aren’t rising prices the main ingredient of inflation?”

No.

They are however, the main after-effect and the metric by which most people (rightly so) judge the real world in cost-of-living terms.

This is a Monetary event. Actually, the ‘main event’ isn’t even on stage yet, if you can believe that. Our politically-based economic overseers have their collective fingers crossed hoping that domestic economic growth will offset the $Borrowing. Notice I said ‘offset’. No one knows better than the Bernank and other Fed governors, that our $Debts are unpayable – EVER, but…

Pain management. Ever heard of that term? Not pain ‘cure’, pain Management.

_That_ is what our political-economic leaders are striving for.

Greg, the MSM only has one thing on its agenda. Reelect the President. If you look at 2006, the MSM was all over President Bush for rising gas prices. Today, what do you hear about that? Little in my way of thinking.

And other inflation. They keep changing the calculation to fit their needs. What would it be using the calculation when President Reagan developed his misery index?

But we have to admit no one in Washington is doing much to fix the problem. If they were, they all would be talking about the deficit and nothing other than fixing that problem.

I suspect that an inflation measure that was designed to gauge the real pressure on buying power for most of the ‘regular’ people would be even more telling.

Food, Gas & Heat, Electricity, Clothing, Phone, Internet Service, Insurance, Medical and Dental costs, Water. Garbage Pickup…. and maybe a basket of stuff you are obliged to pick up from a department store … vacuum cleaner bags, toys, whatever.

The prices at the local grocery are absurd; They more than double the price of sale items and then have “buy on get one free”. Meanwhile, the package sizes keep getting smaller.

I completely agree with you. Last time gas prices went up so many items in the grocery store went up by a large chunk of money because of transportation costs being passed on to the consumer. Then the gas price came down but the food prices stayed the same. Oh yes, and the packages got smaller. With oil prices going through the roof food and everything else is getting much more expensive, AGAIN. We are putting away as much food as possible. This year we are spending our entire tax refund on long term food storage. If your looking for food that has a long shelf life (25 years) at reasonable prices check http://www.ShelfRelianceSanAntonio.com. We’re getting the giant package for 4 people for a year. This is NOT some MREs or prepackaged meals. This is real food that tastes great!

The way things are going there might not be a need for food that will last 25 years…. May have to eat it sooner than that….

It seems that MSM is constantly and blatantly out of step with news in general. Their lack of objectivity, condemnations and opposition to fact is ruining a vital industry. If you are not connected to a online service and can read news input from around the world you lose perspective and judgement is clouded you representation of actuallity is askew. I do not want my info sources trying to bribe me, or make me believe they are my guiding light, what I want is facts and good reporting to give me a picture that represents as much of the truth as possible.

Greg, you can go to http://www.coinflation.com/ and see what the silver content of pre 1964 U.S. coins are worth in dollar terms, not long ago a 1964 dime would equal to a gallon of gas, now it would 1.5 1964 dimes to buy a gallon of gas. Gold & Silver are way under priced to keep up with inflation. There is forms of pricing PM’s, the paper markets & then the physical markets & there is a point coming where the paper price will move higher with equities.

Why is Warren Buffet bashing gold? Here a good piece I read this morning at http://fofoa.blogspot.com/2012/02/yo-warren-b-you-are-so-og.html. I have learned alot from this blog. I hope it adds to todays topic, it really helped me understand what ‘savings/savers’ do in these time compared to investors like Buffet who would have lost lots of money if not for the bailouts he benefited from at the tax payers/savers expense!

I read this article and many others like it and frankly I am frightened, very frightened. America is not the nation that I was born into almost 70 years ago. I see lies from our political leaders from our bankers, from our military, from our police departments and from our courts. And I am dazed, what’s happened to the land I love, to the nation I served in the marines to defend? our nation is seeminglly built on lies and deception. sometimes I feel like acamedes who searched the world with a lantern looking for one honest man. The media is as false as everyone else, I see the dishonesty going on regarding votes for Ron Paul and wonder, WHO COUNTS THE VOTES.

Richard – When one evaluates the researched facts & factors in the observations, yes, the media is ALL LIARS. Yes, we that are paying attention are all un-nerved over what is happening. I am also VERY frightened. Have nightmares as well. The pace of insanity is accelerating each day.

In my 60’s myself my man. I feel the train wreck coming. Just trying to get the timing of the collision. Prep as much as you can as I know you are. It is all we can do.

Yes, what a grand country we once were. A virulent virus of liberalism has rotted us from within. No FACs, CAP, armour, hell, no Hueys to the rescue. No Freedom Birds. I don’t know if I have enough life left to endure what is about to happen. But I ain’t quitting or giving up no matter what. I am taking that fear and channeling it.

Take some comfort in the training and experience we ex-GI’s have had. We can help others get through the crap-storm. They are going to need it. Most of my neighborhood is sheeple. Some are so sorry assed slow that if they fell off my barn roof, I could drink a six-pack & mow the front pasture before they hit the ground !

Cheers ! , things could be worse….because they will get worse.

Greg,

nice report, well done

bob

Thank you Bob D!

Greg

hey, lets have a big ol’ war. that’ll fix everything…..including our wagon.

Greg,

Well, it is not the first time the MSM bless the released fake inflation rates. And I am sure it won’t be the last. For many countries, including the U.S., this is an era of “No News is Bad News” (when the real news is blocked or censored), “Good News is Fake News” (when the news is manipulated or distorted) and “Bad News is Rare News” (when bad news is rarely reported by the MSM).

Last week there were two interesting news that very few media covered. One of them is that “Geithner Should Be Ordered to Testify in JPMorgan Suit, Lehman Says” (http://www.bloomberg.com/news/2012-02-17/geithner-should-be-ordered-to-testify-in-jpmorgan-suit-lehman-says.html) I was hoping to see the “Foxes” fighting in court, but that might not be possible.

Another interesting news is the “Record $6 Trillion of Fake U.S. Bonds Seized in Mafia Probe” (http://www.businessweek.com/news/2012-02-19/record-6-trillion-of-fake-u-s-bonds-seized-in-mafia-probe.html) The $6 Trillion is less than half of the $13.5 trillion in mortgage and foreclosure fraud or 40% of the current U.S. National Debt ($15.4 trillion). It looks like U.S. Department of the Treaury is not the only one busy printing U.S. money and bonds.

Ambrose

Hey Greg

I went a couple weeks ago to buy some more silver and the store keeper said he didn’t have any and he was spending $40 an ounce for it if I wanted him to get me some. Today I lucked up and bought 14 ounces in a pawn shop. Things like this need to be our wake-up call. I’m sorry the majority still looks to the phony news sources when they should be looking at the world around them. If we could get them to look through our eyes for only a moment then they would see the warning signs every where. The Pawn shop is buying silver coins for $10 for every dollars worth of pre-1965 coins,ie.10 dimes or 4 quarters or 2 fifty cents pieces. Little signs going unnoticed are why bridges collapse under heavy traffic.

I went to the public/goverment school system and inspite of that even I can reason that we live in a world of lies. I really hop I can become more prepared in the near future. Thanks Greg……

Inflation! Oh, please, how many times have I heard this. Now excuse me while I go buy my $20 loaf of bread……gotta find about $4 in pennies for enough gas to get to the store first.

Great read, on the mark again.

When gasoline hits five dollars a gallon its going to get rough.

sensetti

I have to wonder how much longer the public will fall for the MSM lies? Everyone shops, eats and buys gas do they think we are stupid? I think the gig is about up, the natives are getting restless.

Could someone please explain the difference between a “business cycle” and a pyramid scam reaching a peak needing another reset?

” This ain’t no Disco, this ain’t no Party.

This ain’t no fooling around”.

By. TALKING HEADS.

It is nothing more than destruction by design. Most will not realise till it is at their door step. Many will not care. They will continue their lifestyle till they can not afford it. What Five Dollar gas really means is that we have squandered the opportunity of being Energy Independent. We have failed at nuclear, solar and wind power. When was the last hydro electric plant built? The opposition of “Not In My Backyard” is bolstered by “Envionmental Barricades” which inhibits growth and provides security of our nation. We have allowed others to now control our destiny and invite the specter of War for finite material resources. Because of the time from conception to actual functional powerplants, combined with increase costs, I doubt we will ever become “Energy Independent”.

Saudi Arabia has cut its oil production and Iran stopped its oil to the EU. The move to pay for oil in gold or local currency, instead of the Dollar. Our Federal Reserve Bank ready to implement QE3 whether overtly or covert are indications of what is in the future. More inflation.

Our addictions to the latest electronic gadgets, at whatever costs, over rides the need to address our energy deficiency. Our children will owe for their fine education but can’t find a job to support themselves. Our elderly on fixed incomes will need more support from their family. New families will work two to three jobs to make ends meet. The majority will move in together and combine incomes. Is the combined family a step away from the Tent Cities? Out of site,out of mind. What will the next U.S. Census indicate?

Too many variables to handle, but five dollar gas is hard to cover up.

Regarding Iran, here is some perspective that the trutworthy US Mainstream Media has been omitting:

http://www.tehrantimes.com/economy-and-business/95570-kish-oil-bourse-transactions-hit-14-billion

“Kish Oil Bourse transactions hit $1.4 billion

18 February 2012 16:49

In Print: Sunday 19 February 2012

Over $1.4 billion worth of oil products have been transacted at Iran’s Kish Oil Bourse since the beginning of the current calendar year (March 21, 2011), ILNA news agency reported.

The transacted products amounted to 3.1 million tons in weight, the report added.

The Iranian oil bourse was officially inaugurated on July 14, 2011 on the Kish International Commodity Exchange, as a tool to strengthen Iran’s position in the international markets. Iran possesses the world’s second largest gas reserves and third largest oil reserves.

The Iranian oil bourse is intended as an oil exchange for petroleum, petrochemicals and gas in various currencies other than the U.S. dollar, primarily the euro and Iranian rial and a basket of other major (non-U.S.) currencies.”

Here’s a little more background for readers who have been left in the dark by our media regarding the Kish Bourse:

http://oilprice.com/Energy/Crude-Oil/Iran-Opens-Oil-Bourse-Harbinger-Of-Trouble-For-New-York-And-London.html

“The Kish Exchange dates back to February 2008, when instead of Tehran, Kish was chosen because it had designated as a free trade zone. The Exchange was set up to trade contracts in euros, Iranian rials and a basket of other currencies other than dollars. The previous year, Iran had requested that its petroleum customers pay in non-dollar currencies. But the Exchange initially traded contracts only for oil-derived products, such as those used as feedstocks for plastics and pharmaceuticals. Now the institution has taken the next step.”

Greg, guys like you who are not afraid to stand up and speak the truth are true Patriots.

Bernanke clearly wants a weaker dollar which is very inflationary. He’s getting it by running the electronic printing press. Inflation is an invisable tax because it transfers purchasing power from savings accounts of the people to the Govt. They create electronic money, buy T-Bills (monitize the debt) and the increase in money supply weakens the dollar and contributes to higher prices. If gold was as common as grains of sand it would be worthless……… same principal on huge amounts of new dollar creation. Its simple supply and demand economics. Fed creates lots of new dollars, the rest of the World sees it and decides they want to use other currencies for world trade (Fed increases supply, World decreases demand by selling dollars)dollar falls, prices measured in dollars goes up.

Huge #s of products are derivatives of Oil………..plastics, cloth fibers, paint, fertilizers and pesticides in farm products. So when you exclude oil, its easy to say inflation is not a threat. Inflation allows them to pick the pockets of main street without the negative PR of a direct tax increase. They have three ways of raising money, borrowing, taxing or printing new dollars which is inflation. The form that is the most politically palatable is printing cause people who dont know what is going on are less likely to blame the Govt for the transfer of wealth away from them to the Govt

Keep up the good work Greg.

Hi Greg

Off subject but why the hell do we keep replaying this tragic scene across the middle east.http://news.yahoo.com/quran-burning-u-sparks-afghan-protests-132458731–abc-news.html

peace

Greg. Big news ..Big news the market is magically back. yahoo artical below.

http://finance.yahoo.com/news/dow-breaks-13-000-first-164838965.html

Greg,

You’re looking at this all wrong. Do like I do: turn the chart 90-degrees clockwise. Now, as you can clearly see, there is absolutely no—WHOA! Look at that deflation! Now THAT is cause for alarm!

The Greek bailout money will be indirectly funded by the IMF and the US contributions. This Greek Central Bank and national banks will lose nothing. This does not just nationalize Greece’s debt but globalizes it. This will cause inflation in the midst of global contraction. Most places will have to endure a lower standard of living as the negative effect of inflation outpaces any raises and increase in investments.

The Black Jesus says there is no inflation! Stop saying there is you racists! lol

(being sarcastic)

JJ The Fed

yeah, the coverage is laughable. i read an article this article

http://www.crainsnewyork.com/article/20120219/SMALLBIZ/302199995

in crain’s ny business this morning. it’s about how the rising prices of commodities is effecting the bakery business. i found it interesting that they blamed the across the board rise of commodity prices on poor harvests, etc. i’m sure that’s a factor but the main reason is, of course, the fed’s manipulation of the money supply.

“Aren’t rising prices the main ingredient of inflation?” Well, no. Actually, they are the end product of inflation.

Inflation is an increase in the money supply…that isn’t accompanied by a comparable increase in goods and services. It means that there are more dollars than before, but the same amount of goods and services, therefore, prices of those goods and services rise due to competition between parties now holding more dollars.

It means the money unit loses value. The goods haven’t gained value, the money you have buys less of them.

The Fed Reserve has dumped 10’s, perhaps 100’s, of Trillion$ into the world economy over the last few years. When the world at large catches on to this fraud, prices will literally go through the roof. Think Weimar, think Zimbabwe, squared.

We are so screwed.

DayOwl,

I could have worded that better. Yes, money supply increases are the what causes inflation. Rising prices are a sign of inflation. Thank you.

Greg

MSM are not just putting out propaganda about the lack of inflation, they are also hypocritical about it. Example: More than 100% (!!) inflation in subscriptions to digital edition of the Economist. Last year, on August 22, I had subscribed to the digital only edition of The Economist for $51.00 for one year. Today, they offered me to renew “at an attractive rate” They now want more than twice as much ( $120 introductory rate, $12 for first 3 months, then $12/month). That jolt comes from one of the more persistent deniers of significant inflation. Worse, the proceeds from a digital subscription they sell are “pure gravy” because it costs them nothing to enable access for another subscriber.

Glad to be speaking with intelligent people here. You are all on target

with regard to the Bernanke cancer and all the other malignancies that

come with it. Including a “controled MSN. Unfortunately, we are all saying the same thing and agreeing with one another. That’s simply not

enough. We are all here seeking solace and support for being right

when we should indeed start trying to ACTUALLY DO SOMETHING ABOUT OUR

ULTIMATE CONCERN OBJECTIVELY. Again, we all know we’re intelligent.

We all know what’s going on. We all know what a Bernanke Cancer is.

the Question, here and now, is what are WE going to DO about it?

Would anyone here like to open up that very critical dialogue?