Is the Greek Debt Problem Really Solved?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Yesterday, a short but ominous press release was issued at the Commodities Futures Trading Commission. It said, “At the request of CME Clearing Europe Limited (CMECEL), pursuant to Section 7 of the Commodity Exchange Act, the Commodity Futures Trading Commission issued an Order on March 13, 2012, vacating the registration of CMECEL as a derivatives clearing organization.” (Click here for the CFTC press release.) In plain English, the Chicago Mercantile Exchange (CME) no longer wants to be the clearing house for European derivatives. The derivatives market in Europe must have been very lucrative for the company. After all, just the credit default swap (CDS) market is reportedly worth $50 trillion globally. (A CDS is a form of insurance. If there is a default, the debt is paid by the entity that sold the insurance contract.) I ask myself, why would the CME willingly stop being the clearing house for this profitable and large market?

Just last week, it was reported there was a new Greek debt deal where 95% of the bondholders voluntarily agreed to take nearly a 75% loss on Greek debt. CNBC reported, “Greece successfully closed its bond swap offer to private creditors on Thursday, opening the way to securing the funding it needs to avert a messy default on its debt, according to several senior officials. . . . The biggest sovereign debt restructuring in history will see bond holders accept losses of some 74 percent on the value of their investments in a deal that will cut more than 100 billion euros from Greece’s crippling public debt.” Buried in the CNBC story was this little tidbit that said, “That would potentially trigger payouts on the credit default swaps (CDS) that some investors held on the bonds, an event which would have unknown consequences for the market.” (Click here for the complete CNBC story.)

Is the CME exiting the European CDS market just when the proverbial CDS contracts are about to hit the fan? This comes just after the CME’s 50 year old CEO, Craig Donohue, announced his retirement earlier in the week. I am sure that is just a coincidence. I know the mainstream media has been telling folks everything is just fine with the Greek debt crisis, but that’s not what a Member of the European Parliament said in an interview yesterday. Nigel Farage said on King World News, “We sort of pretend that it didn’t happen and it wasn’t really a proper credit event, yet we know that various CDS’s are being triggered. We also know that yesterday 110 private bondholders, who had held their bonds through German banks, are now taking legal action. Just to top it all, the thing that almost made me laugh was that yesterday the German Finance Minister said, ‘We must be preparing now, any day, for a third bailout.’ So this idea that the leaders of Europe give that everything is fine, everything is not fine.” The outspoken Farage went on to say. “You can argue that the ECB, by printing money, has staved off the crisis for a few weeks. But the fundamentals haven’t changed one bit, the euro is in deep, deep crisis. . . . They are determined to prop up and keep together this completely failed experiment. But they know as soon as they give in on Greece, the circus will move on to Portugal, Spain and possibly Italy.” (Click here to read and hear the complete Farage interview on King World News.)

You might think the situation in Greece has stabilized, that everything is getting back to normal and, now, the Greeks can finally meet their debt payments. If you did, you would be in the same delusional state Wall Street is in after a 200 point run-up yesterday. A Testosteronepit.com post about Greece from last Friday said, “Unemployment is veering toward disaster. The overall rate of 21% in December, announced Thursday, was horrid enough, but youth unemployment rose to a shocking 51.1%, double the rate before the crisis. A record 1,033,507 people were unemployed, up 41% over prior year. Only 3,899,319 people had jobs—a mere 36.1% of a total population of 10.8 million!” The story’s conclusion said, “We still don’t have a solution for Greece, so there will be a harder default to come,” predicted Charles Wyplosz, director of the Geneva-based International Center for Money and Banking Studies.” (Click here for the complete post.)

To me, there are at least two big questions that need to be answered: 1) When will the final Greek default take place? 2) How much exposure do big foreign and domestic banks have to the CDS contracts sold on sour Greek debt? I don’t have the answers, but I am sure we will get them in the weeks and months ahead.

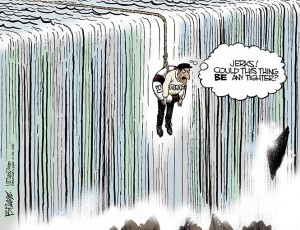

CME has loaded the barn with financial explosives, poured financial gas on the structural timbers and lit the time delay fuse. No wonder they want to get out of the barn.

Greg: Regarding the potential quadrillion of derivatives out there, it is assumed by keepers of the status quo (i.e. government and banker economists) that in any financial catastrophe, the net effect would be zero, so “nothing to see here, move on”. I think that this notion has just been disproved in the Greek fiasco, or am I missing something?

Andy,

What you are talking about is something they call bilateral netting. We saw how well that worked with MF Global, Bear, Lehman and AIG. You aren’t missing a thing. Thanks man for weighing in.

Greg

From what I under, bilateral netting allows the bankruptcy party to pay profitable swaps & forces payment of nonprofitable swaps in the event of bankruptcy. Does it really matter during default or bankruptcy? All of the payment is not going to be paid – HINT: THE NAME – Default.

Did the ISDA conclude that a 75% haircut was not a default?

NM,

I am not sure what they are going to do but ISDA did say there was a credit event. My question is for whom?

Greg

It is for that 5% of owners of Greek dept that did not voluntarily accept the 75% cut. The other 95% signed away their rights…

You are correct sir and then there is Spain, Portugal and Italy. I am sure those countries and others will want the same deal as Greece. That is the real problem. Thank you Marcel.

Greg

They use more proper language. I think the term would be “restructuring of debt”. No need to hit that panic button there are only enough life boats to save a few.

Thanks for your informative articles. I suspect (based on previous actions) that there will be a package of lies and a new “funding” program initiated to cover the situation. Observations by a rational person now, although both tragic and entertaining, follow the Marx Brothers logic “who are you gonna believe, me or your lyin’ eyes?”.

Thank you Eric,

Greg

Greg,

Just to keep it simple, if someone “forced” me to take a 74% loss on a portion of my investments, I would be “mad as hell”. Fight-back? You better believe it. Still lose in the end? I probably would, but someone else is going to lose with me.

Write-offs are a bitter pill to swallow, but the indigestion is always worse.

At some point, if not already, the vultures(the Soros’ and Mr. Potters of the world) will move-in, and buy cheap, while the rest of us beg for mercy, and run for cover.

This ain’t going-away anytime soon! Europe(and the rest of us as well} are in deep doo-doo.

You got that right David. Rich people are stating to lose money now. There will be consequences to the EU debt crisis and they will not be pretty.

Greg

The BIS publishes the total OTC derivatives for CDS, interest rate swaps ect and so on. Do they collect information that points to a defentive number of the notional value of CDS on a spefic country? Like if i wanted to find out the notional value of CDS on greek debt how would i go about doing that. I also understand that of course this number can be farbricated but i see so many numbers from 3 billion to 100 billion. Whats the story where can i find an officaial number the ISDA or BIS publish? ANy one have a clue?

The BIS keeps track of the Notional value of Derivatives CDS, Interest rate swaps ect. Where can i find the notional value of CDS on a specific debt such as Greece debt? Does the ISDA and BIS have this data available for individual countries and companies? I know its invalid any way i would just like to see what the the value the BIS/ISDA report it is. Any one have a clue how i would find this number?

Jflan,

There is no public market for this junk, and that means no transparency, no regulation, no guarantees, and no price discovery. This is a monster mess and I think no one knows for sure until the dominos start falling. Anyone else? Thank you for your participation in this site.

Greg

Jflan,

There is no public market for this junk, and that means no transparency, no regulation, no guarantees, and no price discovery. This is a monster mess and I think no one knows for sure until the dominos start falling. Anyone else? Thank you for your participation in this site.

Greg

Thats amazing. As i understand it OTC derivatives a prelimary email is sent for a CDS contract then all the standard mumbo jumbo from ISDA is put in these contracts. Im just surprised. Lets say AIG sells insurance protection (CDS) to hedge fund A. How can AIG not have a record some where of how much they are liable for if the reference entiy goes bankrupt. Even if they issue it through an SPV they should still keep track of it. I guess my question is AIG issues a whole bunch of CDS. They have to be aware of how much they have i mean they are collecting a premium from the protection buyers. How can the BIS published a number on the notional value of CDS. I would like to see CDS for every reference entiy and have them all add up to the total CDS market. Everyone saying the data doesnt exsist i just find that absurd. No one knows how a greek defualt will impact the economy and how is going to have the most pain from it.

I wonder how many Grecians own iPads?

Greg, thank you for your elegant explanation of the current Greek complicated financial crises. We all know that Greece cannot recover under the condition imposed on her by the MMF and EU bankers. Greek economy is currently in a deep recession having too high unemployment rate and there are no any signs on the horizon that her economic situation will improve in the near and/or distant future. I am not an economist, but if I were in position to be an advisor to the current Greek government, the example of recent Argentine and/or Iceland should be followed very closely.

Thank you Miro for your comment and support.

Greg

No the Greek debt problem has not been solved but just deferred with another bailout and an effective default on private bond holders. It’s perhaps politically expedient for EU leaders to deal with the problem this way but it’s not a medium or long term solution.

The Greek Government will likely not be able to meet future debt liabilities so additional bailouts will likely be required in future or there will inevitably be a further default in some form.

As we now know the ISDA CD Determinations Committee declared a credit event in relation to Greek debt on 9 Mar so the CDS trigger has been officially pulled.

The full text of the statement:

http://www.isda.org/dc/docs/EMEA_Determinations_Committee_Statement_09032012.pdf

The ISDA issued a statement in the past in respect of the obligations of the counter parties(the sellers) for CDS payments in the case of a credit event trigger for Greek sovereign bonds. This is it.

“Would a Credit Event on Greece lead to massive payments by protection

sellers?

No. According to the Depository Trust & Clearing Corporation’s CDS data warehouse, the total net exposure of market participants who have sold CDS credit protection on Greek sovereign debt is approximately $3.7bn as of 10-21- 2011. This figure is calculated by summing the net exposures of the protection sellers, and so it is impossible for any one firm selling protection to have more than $3.7bn in exposure and, of course, given that there are many net sellers, any one seller’s exposure is likely to be far less. Also, firms’ net exposures are partially offset by the recovery value of underlying obligations. For example, if the CDS auction showed the recovery value of debt to be (hypothetically) 50%, the maximum aggregate amount payable would, in Greece’s case, be 50% of $3.7bn: $1.85bn. Furthermore,

statistics indicate that, on average, 70 per cent of derivatives exposure is collateralised and the level of CDS collateralization is likely to be even higher as over 90% of CDS transactions (by numbers of trades) are collateralised. Thus, in this example, of the $1.85bn payable, about $1.5bn has effectively already been paid.

The data regarding CDS exposures on Greek sovereign debt, and for the top 1,000 reference entities, are public. They are available here: http://www.dtcc.com/products/derivserv/data_table_i.php?tbid=5 (Greece is listed under “Hellenic Republic”).

Regulators have access to additional data, including individual firm CDS exposures.

©2012″

http://www2.isda.org/greek-sovereign-cds

Make of this what you will.

Unfortunately Greece is a failed western socialist welfare state whose economy was heavily dependent on unsustainable domestic and foreign public sector borrowings. Western style socialism / welfare state work just fine until you run out of money and that’s Greece today. The inept politicians don’t get it and, from the statements published, some in Greece are still living in La La land when it comes to facing the economic realities of disastrous economic management, an unaffordable welfare state and a multi – national currency over which they have no control.

There are presumably going to be some pretty stressed out counter parties on the CDSs when they have to hand over the cash to the qualifying bond holders. So we will all watch developments from here with great interest.

Is it not Greece who is in trouble for borrowing too much and the banks for lending too much, not the EURO itself that is in trouble?

The Euro is a transactional currency that has cut it’s ties to a nation state, and it marks-to-market it’s gold every week. It (the ECB) also just paid out a big wedge of (gold) profit for 2011 to the CB’s around Europe so it must be doing ok!

Don’t get me wrong, Greece and other nations that have, and are, borrowing too much are definitely a problem, but I think too much is being blamed on this transactional currency and not enough is being blamed on the profilgate spending/lending that has taken place over last years.

IMO the Euro will outlive the dollar like it was designed to do.

Gold will save it in the end as explained much better than I could here:

http://fofoa.blogspot.com/2011/07/euro-gold.html

Thanks Greg, I really enjoy your posts!

Fred

Thank you Fred for weighing in my friend.

Greg

When you stiff old investors for 100 billion euros and then turn around and borrow 130 billion euros from new investors, do the new investors really believe they won’t get stiffed also? If so, the new investors must be real suckers. Where can I meet these guys, I could use a loan too.

There is a increase of rope sales, I guess the wall street bankers will take the easy way out from the dirty deeds they committed & are scared to face the justice they deserve, only time will tell if the insiders will start talking to save their own hide! All of these bought & paid for judges who have let these people walk free will find themselves in the lime light, what will do if they are exposed for their own actions? Again time will tell & soon I hope!

Have a great day folks while the big boys shake in their shoes as they expose each other to save their butts. What a buying spree many are on right now, loading up on physical at the local coin shops & web sites who are so busy selling with no one selling their PM’s, get it why you still can!

If I bought Greek debt at a discount, and I bought a CDS in case of default so as to insure my asset, I should collect on my CDS should a credit event transpire. What I seem to be hearing is that the ISDA is saying because a large group of Greek debt holders agreed to voluntarily take a haircut, there was no credit event and CDS’ will not be honored. Now why in the world would anyone ever buy a CDS again if those who issue them can unilaterally declare them worthless and tell you basically ‘this is not a credit event regardless of wether your credit instrument pays off in full or doesn’t’? Am I missing something here?

Greg,

Less and less people pay attention to the Greek debt crisis. Even the MSM have less coverage of the Greek problem. Many of us are probably getting tired of the so many back and forth negotiations between the Greeks and the EU.

Meanwhile in America, the MSM are chanting about the good news of the economy. The jobless claims are at 4-year lows. The unemployment rate is gradually declining. The Dows rises above 13,000 points. Car sales are booming. Real Estates market shows signs of turn-around. Businesses and consumers are more willing to spend… The Happy Days are back again! Or is it?

What happened to the rising national debt? The MSM rarely talk about it anymore. The U.S. Debt Crisis is not much better than the EU’s.

Just beware of the volatile stock market and don’t be surprised to say, “Holy Cow!” when you see the next downfall of the Bull Market. When it sounds too good to be true, it probably is.

Ambrose

“1) When will the final Greek default take place?”

Define “final”. Greece has been insolvent in one form or another pretty much since it has become independent. It has already defaulted on one set of debt. But that’s not all the debt it has. All those bailouts weren’t gifts to Greece – they were loans. One day they will have to be repaid. It is hardly unlikely that when this day comes, Greece will be able to repay them. This means that more defaults and more bailouts are forthcoming.

“2) How much exposure do big foreign and domestic banks have to the CDS contracts sold on sour Greek debt?”

Only about 3.5 billion euros remain. Peanuts, really, compared to what was a couple of years ago. And colateral has already been posted for most of them, so the payout of these CDS won’t cause any significant disruption (exceot that several financial institutions will see a one-time drop in profits). Why do you think the crisis was dragged over two years, when anybody with even a room-temperature IQ could see that a default was unavoidable from the beginning? For the banks to be saved, of course!

In general, things are always much more complicated than the media reports and people think. Some remarks:

1) Greece is irrelevant. Its economy can go down the drain and nobody would care. The whole bouhaha is in order to avoid a contagion of the rest of the EU and to save the Western banks. If this is achieved, Greece will be left to the dogs.

2) The minimum salary in Greece is about 680 euros per month – and that’s after it has been reduced, as part of the agreement with the troika. For comparison, my salary in Bulgaria is about 210 euros per month. And it’s not a minimum salary, either – I’m a doctor at the Bulgarian Academy of Sciences. The Greeks themselves are known to have said “with all those restrictions you are imposing on us, we will become as poor as the Bulgarians”. 😀 And the crisis hasn’t hit seriously Bulgaria yet, so I tend to smile when reading about the “horrible economic crisis in Greece”. The Greeks have been living way beyond their means for way too much time; it’s time for them to adjust to the reality.

3) Greece didn’t get 95% of the bondholders to agree to the deal. That’s how many they needed, in order not to default. But they got less than 84%. That’s why they had to invoke the Common Action Clauses, which forced the ISDA to declare a credit event.

4) There are 3 kinds of credit events: outright default (as in “tough luck, you aren’t getting your money back”, see Argentina), cannot pay (as in “no coupons for you bondholders just now”) and debt restructuring (as in “take a hirecut and a promise to pay less and for a longer time than promised originally”). This was a credit event of the third kind.

5) After the “saving” deal Greece is still left with debt-to-GDP ratio of above 120%. No country in history has ever recovered from such a ratio by paying off its debts in real terms. The only alternatives are still the same as before the default – default on the debt or stealth default via inflation. Greece cannot print money, so it cannot inflate. Either the ECB has to inflate for them, or more defaults are in the pipeline.

6) The ECB didn’t “stave off the crisis for a few weeks”. It staved it off for about 3 years, since all the banks that needed recapitalization loaned as much freshly printed money as they needed. The interesting times will resume when the time comes to pay back all these LTROs.

7) A similar crisis in Spane and especially Italy is a long way off. Portugal is probably next and let’s not forget Ireland and Belgium. On the plus side, the markets now know that the ECB is willing to print with abandon, so there is less uncertainty and these future crises should be easier to handle. The problems of Spain and Italy is their sheer size – but, as I said, it’s not their turn just yet.

8) In the end, it is all going down the drain, of course. Europe, the USA, China… The whole contemporary financial system will implode. I hope not to be alive when it happens (I’m 55; average male lifespan in my country is 66) but I’m afraid that it’s a futile hope…

Greg,

Even the shameless ISDA clowns finally admitted to a “credit event” in Greece- what a howl. So let me guess what lays ahead for Portugal. The ECB rolls in their Barbershop and puts out the spinning pole with the much needed mesmerizing lines on it and all the private bond suckers- er- holders coming running in for their free haircut- HAH ! This past “credit event” will change the very meaning of “my word is my bond”.

Martin you are on target when you say, “This past “credit event” will change the very meaning of “my word is my bond”.” Thank you.

Greg

There’s one more question to ask, Greg. How does Greece borrow money going forward? I mean, who in their right mind would purchase a Greek Bond of any kind, knowing what just transpired??

Richard,

Bing, bing bing!! You have asked the most important question of the day. Thank you for putting your thoughts here on USAWatchdog.com.

Greg

This is not an accurate portrayal of the CME at all. It is in fact a case of mistaken identity…. you have the wrong man!!

The CME hasn’t managed to successfully clear CDS because the banks who control this market have resisted the transparency the CME clearing solution would bring to the CDS market.

So there was really no business for CME in CDS yet to give up.

Far from CME setting the bonfire, they were not even invited to the party. The people hosting this frat party are the usual suspects….

Thank you squawkinghead for weighing in. I think the CME bowing out now definitely signals trouble.

Greg

Surely you are not suggesting that CME is as pure as virgin snow. As a longtime participant in the market it is impossible to have survived/prospered as long as they did only to result in an innocent victim status. Where there is smoke there is fire and it is very smoky indeed. This of course does not mean that other participants have not also been playing with matches.