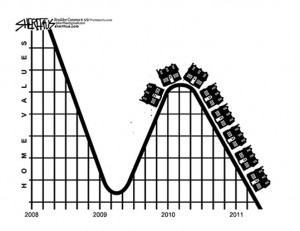

Mortgage Settlement Not Only Thing Plunging Prices

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

New data just released revealed delinquency rates for mortgage holders is up in the last quarter of 2011. Now, the national mortgage delinquency rate is 6.01%, up from 5.88% in the third quarter of 2011 according to TransUnion. This downward trend in real estate prices will not be slowed by this bad news. Also, keep in mind, because of the $26 billion foreclosure fraud deal just agreed to (that lets the biggest banks off the hook for forgery and perjury), the banks are only going to be empowered to spike the pace of foreclosures in 2012. This is all negative for prices in a market where nearly half of all homes in America (11 million) are worth less than the mortgage. More mortgage delinquencies plus more foreclosures will equal more bank owned inventory, and when you have a lot of something, the price goes down. It is a law of economics not even the Federal Reserve can defeat.

We have not seen the end of the trend of negative equity in real estate. I would not be surprised to see more than 60% of residential real estate become underwater in the next year or so. When the Fed stops suppressing mortgage interest rates (as it has been doing for the last few years, currently at or below 4% for a 30-year loan), what will happen to prices? You have to ask yourself, how many more people will just throw in the towel and stop making mortgage payments for a losing investment? My bet is the banks won’t even have to go through the grueling foreclosure process where they have to commit forgery and perjury. The big banks will just be getting a lot more “jingle mail” in the form of house keys from defaulting borrowers.

It seems no matter how bad the news is, it is spun to be positive for the so-called “recovery.” The Washington Post reported today, “We were hoping for better, because delinquencies remain very high,” said Tim Martin, group vice president of U.S. Housing in TransUnion’s financial services business unit. Prior to the housing bust, the mortgage delinquency rate typically hovered around 2 percent.” Here comes the positive spin to awful news. The Post story goes on to say, “He added that while the increase was not good news, the year-over-year decline is encouraging, and points to a continued, if slow, recovery in the housing market.” (Click here to read the complete Wa Po story.) (Click here and here for other versions of the same story.) You have to be kidding me!! Mr. Martin is certainly kidding himself that there is any kind of recovery in housing.

The mainstream media (MSM) just cannot let go of the “recovery” theme. Yes, some markets have had declines in mortgage delinquency rates, but they are in markets that have already taken bigger than average price declines in real estate because of the ongoing crisis. In those markets, the delinquency rates are still very high compared to the national average. This is a real estate collapse in slow motion that has been slowed down by ultra cheap rates and the Fed buying trillions of dollars in toxic mortgage debt. My only question is when will we see it all speed up to real time?

Greg,

The answer to your question in regards to speeding up to real time is when the MSM gets taken down from controlling the fabricated news and broadcasting the REAL news.

That day is coming sooner than you realize, once the article written by David Wilcock titled “FINANCIAL TYRANNY: Closing the Doors–Cease and Desist” becomes a reality when the already in motion process gathers up the crooks running this country.

http://www.divinecosmos.com/start-here/davids-blog/1026-financial-tyranny-final?start=2

Enjoy the link

Greg:

As a Realtor, I love real estate and love selling houses. But I had to have a conversation with yet another homeowner yesterday who was simply too upside-down and underwater to sell. Jobless, he blamed himself that he couldn’t get a job and if he had, well, he’d have been okay. But I had to point out that he still has no control over a market that continues to put downward pressure on pricing, and shows no sign of abatement (Case-Shiller) anytime soon. I told him, “You’ve done all you can do. It’s a business decision at this point.” A sobering conversation to have on Valentine’s Day of all days, but I fear it won’t be the last one I’ll have with a homeowner who is trying to make sense of this market we are in.

Nicole,

Thank you for sharing the real deal on this site. More and more folks are going to walk from these underwater mortgages and the banks and pension funds and 401-k plans will take the hit, and a big one at that.

Greg, your question, “My only question is when will we see it all speed up to real time?”, when it reaches critical mass or for the layman the “tipping point”. Understand that in pure physics it would have already reached critical mass or tipped over, but in economics there is a strong psychological variable in play which is holding it up, mainly by the results of the misinformation onslaught of the MSM

propounding a recovery behind every tree. As more Americans wake up to the Pravda style MSM and their jobs continue to go south while gas and necessities move north critical mass is building to flash point. Its simply a matter of time, but probably not in a American election year unless a black swan appears like war with Iran which got out of control. But within the next presidential election cycle I predict is the answer to your timeline question.

Thank you Art for the comment and prediction.

Greg

Yeah, the usurper-in-chief is the “sewer stream media’s” (heard that one from a caller to Alex Jones a few minutes ago) boy, they can’t admit what a failure he’s been. They are going full-tilt to have him re-elected, even though all we’ve gotten is higher unemployment, higher prices, skyrocketing gasoline and oil prices, never-ending war and never-ending depression.

The republicats won’t do anything different either, both parties believe in fiat money, deficits, sending our jobs overseas and allowing trade imbalances and refuse to demand equal trade. The republicats simply posturing, they are just like the demogogs at heart, no real change either way the next election turns out. Two heads on one beast, both political parties are wealthy and have screwed the middle class for the last 40 years.

Excellent analysis, as always, Mr. Hunter. Further evidence that there has been no bounce in real estate like some in the industry would have us believe. Because this entire real estate ‘boom’ was essentially driven by debt and easy money, it is my view that this slide will continue until home prices stabilize at their historical mean price of around $120,000 (inflation adjusted, of course). There will, As you suggest, be serious implications when mortgage rates start to rise… In the 1980’s crisis they hit 18%…. Can you imagine what effect that will have on real estate today? Yikes!

When the Japanese bubble burst in the early 90’s they experienced a collapse in prices of roughly 75% from top to bottom… We are not immune to similar consequences in the U.S.

Thanks,

Mac

Mac slavo,

I think you are correct overall. My only caveat–I think prices will plunge through the mean for a few years. But, Yes your analysis is spot on my friend!!!

Greg

out 30 percent of retirement generating retirement funds with bank stock collapses and zero interest rate policy forcing spendings even after cutting all expenses to the bone to get and stay there, old by most employable standards, and ill healthed …..seee no way to break even with what turns out to be a trusting fools investment with government and thinking that it might return to normal times at normal times………………odd thinking if you can not trust them be rid of them and that the opposite of law and order and government may not be anarchy but freedom………and that while heading to forced into dependancy…..that would make one fear for ones life in the dealings with “good” peoples………..grandparent an immigrant with reasonings…………

Thanks Greg for reminding us that it is really all about supply and demand. Forgetting for a moment the FHA mortgages at 5% down (which is just perpetuating the Ponzi), there are, in reality, a limited number of us in these uncertain times that have all the requirements for a conventional mortgage: stable employment, a 20% DP, and a 700 FICO.

Given that the shadow inventory, at present, may be as high as 10 million homes, any recovery meme is highly delusional, despite the pumping of the Administration and the NAHB and NAR stooges.

Thank you Andy B.

Greg

I had a conversation with my neighbor this past weekend. He asked me if I had gone back to buying RE yet. He asked me why not, it is all over the news about how much traction the recovery is taking on. Then I told him that I had recently read an article about up to 10 million more forclosures in the pipeline that could take up to ten years to recover from. He asked me what I was talking about and that it has already been a couple of years since the crash. I told him that prices actually started nosing over in late 2005 and that it was going to take a while longer to hit the bottom and that we can expect to bounce along the bottom for an extended period of time. I don’t think he believed me.

I was also watching MSNBC this morning for the first time in ages. It is amazing how pro Obama that station is. There was some female host on and she was going on and on about the recovery, about how Social Security is in fine shape and is working just fine the way it is. Then she yammered on about how great the drop in unemployment is for the nation. Nevermind the FACT that there are more people deciding to simply not look for a job than are finding jobs.

This really is making me ill, the way that the whole nation is being led like pigs to a slaughter house.

I look for the persident to place a freez on forclousers. Heres why.

Is all about eggs. When gass goes up .50 cents more, eggs will to.

The chiose will be do i eat,or pay the mortgage? We know what wins.

Oboma wants to be the savior relected so he will put a freez on. the chain of events dictate a bail out for home debters.

Jay,

Interesting, didn’t think of that angle. You may be right.

Greg

New very important update. The government announced that instead of past dues being reported on a 30 day delinquency cycle, they have determined that a 60 day cycle better defines the past dues. It seems more people fall in and out of the shorter cycle. Haaahaahaahhaahhaahhaha. Financial Repression at its best. I am so surprised that people still have not waken up. I guess it is going to take a massive Crash.

Thank you for the info Craig.

Greg

Greg,

For the politicians, the bankers and the MSM, the real estate market is booming. For the homeowners who are underwater, the real estate market is pooping.

Ambrose

it was bad enuf when i first realized that the national debt was deliberate–ie, to make debt serfs out of all citizens by creating the federal reserve and making it necesary to borrow any money into existence–and then, forcing us to borrow, far beyond tax receipts, thru their legislation devised for wars, social progams etc

but now its gotten worse for me.

I believe now that the income tax was created, at the same time as the Fed, so that there would be a way to collect all the trillions in interest that the debt policy would require–ie “we can put the working stiffs into this massive national debt, but how the hell are they going to pay it ‘back’ to us?–certainly not thru the old tariffs and fees method–no, the only source big enough is the money they earn from their labor–so let us pay congress to pass an income tax law”.

the sweat of your brow that you have been sending in at tax time is ‘10%’ for real governmental needs and almost all the rest has been so you could pay the interest on loans that you were forced to borrow thru your government–of money that was created mostly out of thin air.

add to this horror the hidden tax thru inflation–inflation caused by the forced borrowing.

this is no different than the the loan sharking racket the we saw the mafia run in the film ‘On the Waterfront’.

remeber what henry ford said: “its a good thing that the american public dosen’t understand it’s banking and financial system, for if they ever did i believe there would be a revolution by the next morning”

shelly weiner

Greg: how long do you think it will take for a Treasury auction to take place and there will be no buyers for US debt and we will become like Greece?

Jerry Frey,

I do not know for sure but it is already happening. That what QE 1 and 2 were about in part. I do not know the timing but when is does happen the Fed will be the buyer of last resort.

Greg

AndyB hit the nail on the head with this comment:

“there are, in reality, a limited number of us in these uncertain times that have all the requirements for a conventional mortgage: stable employment, a 20% DP, and a 700 FICO”.

I don’t think Obama or the banks realize this because this deal makes absolutely no sense.

If you are either unemployed or under-employed, you simply won’t be able to pay your mortgage and you’ll have no choice, but to walk away.

3 months after gas remains at 3.75/gal if 1st half of year or 3 months after if remains $4.00 gallon second half of year.

My opinion is that the finance globalists are very close to reaching dominance over all of the worlds economic regions – at least to the extent that they can soon (within the next 3 – 5 years) begin unimpeded regional central banking activities between groups of nations that will facilitiate alignment of regional central banks along internationally harmonized standards.

Once that happens, the maintenance of the dollar as a hegemonic tool will no longer be a requirement to drive the current economic model that funds the globalization effort – primarily the USD under the Federal Reserve system. But until then, support for the model needs to continue which means that there still needs to be political support from the US voters to maintain our current economic system.

We’re near a precipice hear. Others have labeled it a rubicon moment, where we’re crossing from one economic paradigm of sovereign economies to a new interdependent model of a globally harmonized economy. The challenge for globalist who run the US economy is keeping the American voters onboard until that rubicon has been crossed, since the USD remains the hegemonic and funding vehicle that makes the corporate globalization effort possible.

How do the globalists keep us on board while also sinking our economy to more easily harmonize us into an interdependent system? They need to float out the dollar and all fallout from associated bubbles and economic failures (local, state, and federal levels) as long as possible so that they can maintain control of policy until all of the pieces are in place and formal economic integration actions are implemented that enable a move away from the USD.

That’s when you’ll see volumes of Americans out in the streets in protest as they lose voter control over sovereign economic policy and our financail future as a nation. Most won’t understand exactly how we arrived here but they’ll understand that as Americans, they’re losing their national currency, their economy has been undermined, and now they’re losing Constitution-based voter choice over national policy. In my opinion, that’s the moment when we’ll see full implementation and use of NDAA and other abusive legislation.

So the housing values will continue to decline but they won’t fall through the floor. Values will be controlled and manipulated to the extent possible until the rubicon moment is achieved. At that point, from a globalist perspective it won’t matter if the US economy falls into a death spiral that makes Zimbabwe and Argentian look like a small blip on the trending chart. The globalist concentration of economic control will be complete and they can start over from scratch in every corner of the globe in a new paradigm that suits whatever design and goals that they desire.

Hi Greg,

Just a note to bring your attention to something I was not aware of on the most recent 25 billion dollar deal for the banks in which AGs of 49 out of 50 states signed on. Chris Whalen of Tangent Capital makes a very interesting point with respect to the deal struck and that this being an election year many AGs are looking to become governors. But the important point he makes is that while the banks seem to be getting a deal on the surface, their is looming serious litigation over upaid tax revenue. The interview is on Keiser report with Max Keiser. All the very best Greg.

Mark,

Thank you for the comment and info man!!

Greg

What about the realtors for instance in Flushing, Whitestone,Bayside, Queens New York area who are in another world and refuse to bring down the overly priced homes in these neighborhoods. Promising homeowners that they will still get top dollar for their homes because of “the neighborhood”. It’s the neighborhood they say. Your paying for the neighborhood. These realtors have no clue in what is going on in this country. Some of these homes are original owners in horrid condition going for $550000.00 and up. Those selling in these neighborhoods need to make a quick deal and move on……otherwise you will be selling your homes for 200-300,000.00 by sometime 2013. Retired realtor.

JimNYC,

Thank you for the NY real estate analysis!!!

Greg

got the tax assessed value notice for the next year on the house im in now and it has fallen to 50 percent what it was in year 2002, meanwhile, im out looking at totally unmaintained distressed propertys not selling at an eigth their last sale prices that are taxed at a tenth the cost of where im at, and im thinking that buying a distressed one and mismaintained for years provided they do not force me to replace septics, electrics, fences, water lines still could preserve principle that is making zero interests even sitting empty till i unload the present problems costing ten times higher associative and tax, a depression property.?. while firing all associative helps…laying low with less demandings upon me……till turn arounds or i make myself comfortable…….

Catherine Austin Fitts said the banks are in a hurry to help these people save 60 buck a month on the refi because they then get to create a new note..Those are what they don’t have now and can not legally foreclose with out them

Mark,

She is correct!! Love her and thank you for the comment!

Greg

What was it that Mr. Greenspan said years ago? Oh I remember,,,”Americans should use their homes like a piggybank!” Then of course he admitted that for the life of him he couldn’t understand the derivatives used during the packaging of these mortgages as securities! Are you kidding me?

Very nice posting along with solid information, many thanks for investing time to talk about it with people! I will return often for up-dates you might post. Many thanks.