The Low Inflation Lie

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

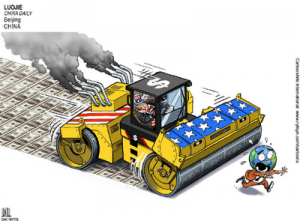

If you believe government inflation rate numbers, inflation is 1.2%, according to the Consumer Price Index (CPI.) That’s how much prices rose last year. Last week, Fed Chairman Ben Bernanke testified in front of the Republican controlled House of Representatives and inflation was a hot topic. Even though the government says inflation is low, some lawmakers are not buying it. The new leaders of key financial committees are not fans of the Federal Reserve or its money printing policies called quantitative easing (QE.) The Fed continues to do this to suppress interest rates, bail out banks and fund the government. CNNMoney.com reports, “Paul Ryan, a Republican from Wisconsin who heads the committee, has been a vocal opponent of the Fed’s recent stimulus policy, which pumps $600 billion into the economy through purchases of long-term Treasuries. He said he fears the policy, known as quantitative easing, will cause inflation to accelerate rapidly, forming asset bubbles and crushing the dollar. “There is nothing more insidious that a country can do to its citizens than debase its currency,” Ryan said. . . . But Bernanke countered that quantitative easing would not permanently increase the money supply, since the Fed plans to reverse the policy once the economy recovers.” (Click here for the complete CNN story.)

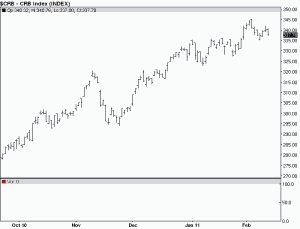

Another obvious indication of inflation is this chart (below) from the Commodity Research Bureau (CRB). Since October 2010, shortly before the start of the latest round of money printing (QE2), commodity prices are up around 20%. This index tracks things like corn, whe at, soybeans, cattle, oil, gold and silver, to name a few.

at, soybeans, cattle, oil, gold and silver, to name a few.

The idea the Fed can print money out of thin air and there not be an inflationary downside is preposterous. We will have inflation, but looks like it will be reported as growth. I wrote about this last month in a post called “Inflation is Here.” Back then I said, “If not accounted for properly, inflation can appear to be growth when, in fact, it is nothing more than price increases. For example, the latest spending numbers from the Christmas holiday season were reported as a record $462 billion. A recent AP story said, “Just because Americans spent more this holiday season doesn’t mean they bought more. A button-down shirt you bought your father in 2010 probably cost more than it would have three years ago. The government figures on which the National Retail Federation based its holiday total do not take into account rising prices.” (Click here to read the complete AP story.)

Jim Willie from Goldenjackass.com says expect more and more of the coming inflation to be reported as growth. Mr. Willie wrote in his most recent post, “The main point is that price inflation will rise sharply, called economic growth, a process already begun. The USGovt and Wall Street handlers will ignore it, under-state it, and herald the return of growth as success of policy. The reality will be less growth, in a deeper decline into recession.” (Click here to read the complete Goldenjackass.com post.)

In the Congressional hearing last week, Bernanke maintains that inflation is low and points to Treasury inflation-protected securities (TIPS) as proof there is not a problem. Currently, they are paying less than 2%, in line with inflation, right?—wrong. TIPS are calculated using most of the same information that is used in calculating CPI. The accounting gimmicks used by the government today make inflation look better than it actually is. If inflation was calculated the way Bureau of Labor Statistics (BLS) did it in 1980, inflation for 2010 would be 8.9% (according to Shadowstats.com.)

In a recent Shadowstats.com report, economist John Williams said, “On the inflation front, however, where there is an overhang of $7 trillion or so outside the United States — being held at the whim of dollar investors — that has to be considered in the U.S. monetary picture. Higher prices already are being seen in a number of dollar-denominated commodities, ranging from oil to food. The higher prices are anticipating and fueling the early stages of Mr. Bernanke’s desired debasement of the dollar.”

In the closing paragraph of Mr. Krugman’s Op-Ed piece last week, he said, “Wednesday’s hearings aren’t likely to have any immediate effect on monetary policy. But they offer a revealing — and appalling — look at the mind-set of one of our two major political parties.” I am not a proponent of either party. I want what’s best for the country. What I find “appalling” is a Federal Reserve secretly picking winners and losers. The Fed issued $12.3 trillion in loans and giveaways to bail out everyone from Toyota to foreign banks. $9 trillion of those transactions were “off balance sheet”that only saw the light of day because of a special provision slipped into the Dodd-Frank financial reform bill. To say we can print money to rebuild our morbid economy with zero downside is foolish. We are all living the low inflation lie.

Clear and consise Greg. Just more distortion that only government, the Fed and its policies spin. The eruptions in the ME are more about the bottom line of putting food on the table and a roof over ones head than autocracies in power which will only spread throughout Europe with austerity measures in full swing. Whether one wants to believe the Fed has exported inflation around the globe, or other Central Banks have also inflated their currencies and thereby imported their own brand of inflation, it’s the people who suffer in the end through the insidious greed of speculators and currency inflation.

Thank you Glenn and Steve A.

Greg

Greg: My wife and I receive COLA’s twice yearly based on the CPI yet we haven’t seen one in over 2 years. Now how can that be?

Let’s see. Although Lundberg says there is a glut of gasoline on the market, gas is up $.39 per gallon in the last year. I fear OPEC has raised their prices due to the cheap dollars produced in QE. It’s something to ponder.

Due to ObamaCare the medical insurance companies are acting like it’s the ’49 gold rush. Our premium jumped significantly. I read of a Calfornia couple that has had their Blue Cross/Blue Shield premiums raised 3 times in 2010. (Sorry I can’t find the reference).

Groceries are rising weekly. You say commodity prices are up 20% and I don’t doubt that. Taking corn, wheat and soy beans I summize most of our diet consist of these. From bread, meat, dairy products, pasta, cereals etc. So how can there not be inflation in food.

Property taxes going up to cover for the foreclosures. Our state is considering raising sales taxes, local college raising student costs to cover for shrinking tax base. Sounds like inflation to me.

No raise for Social Security recipients due to no inflation in 2010. Really…..

You’re right Steve….our Medicare Supplemental premium was raised three times in 18 months. Most Americans don’t know the “coreCPI” does not include “volatile” things like food and fuel (also known as basic necessities) which are skyrocketing. The references to “inflation” are really not the textbook definition, but are PRICE INFLATION based on the CPI, and the CPI has been manipulated for years by substitution. The major purpose of this manipulation has been to make the government look good and to contain COLA adjustments to Social Security based on the CPI.

Oh, and Paul Krugman is a liberal shill.

Its simply criminal for the retired and working folks that the government continues to pretend, by their creative inflation numbers, that there isn’t any inflation to speak of. Some day, mark my word, the american people will take a lesson from the brave people of Egypt and take it to the streets. At that point, watch the MSM, when they figure they make a mistake of taking the losing side to ask for forgiveness of the people – at that point, I say “let them eat cake”. The simply fact and truth of the matter is: The MSM is the 4th arm of govenment and is now completed aligned with the government. The MSM has become the enemy of the people and some day will have to atone for their sins. I, for one, may not live to see it, but my children will and what a great day on earth when the MSM has been ruled irrelevant.

Uncle Ben has a new shill in Paul Krugman who I think is on the goverment payroll! How this guy won a Pulitizer I will never know because he must never come out of his Manhattan office to the real world. Krugman may take the subway to work and even there the fare has increased by 10% with another increase on the way!

Bernanke before congress saying we don’t have inflation then the goverment reporting 1.5% when we all know if is closer to 7%. I think a figure of 15% by year end is coming fast!

I think housing is 40% of the inflation index and we all know where that is………….so the numbers are tilted low. The index is flawed to favor the Fed. The interest the goverment must pay to service the debt remains low………..thus helping them “balance” the budget…………or as we all know COOK THE BOOKS!

I think Krugman will soon be doing a joint book with Uncle Ben………..why else?

Thank you for weighing in Jeff.

Greg

People have to live, they shop, they spend, the people are not living the lie of inflation, they know better. The government knows better too but they pretend it isn’t so by selling that old accounting crap method on us, you know the one, where gas and food don’t count in the equasion – well it isn’t working any longer.

The governement’s inflation & unemployment numbers, as well as many of their other statistics are irrelevant now. They became irrelevant because once the truth is known on any subject the prior falsehood (belief) becomes irrelvant. Take for a silly example that no one claims that the earth is flat any longer simply because the reality became known.

Greg, when gas hits $4 this summer the government’s claims of low inflation will remain the same, making their numbers more absurd and therefore irrelevant to more of the masses.

“There can be no solution if one does not admit there is a problem” (Art Barnes 2011)

Thank you Art for the comment and quote.

Greg

Hey Greg,

Inflation is apparent with food and fuel. Even the unemployed and under employed need fuel and food.

Bernanke is going to be too late at reducing the money supply when the economy does kick in.

What is M3? Is Bernanke publishing that metric?

markm

MarkM,

The Fed stopped publishing the M3 in March of 2006. Thank you for the comment.

Greg

Would this be a good time to buy TIPS and if so what maturities?

Joe R,

If you buy TIPS you will never get the full buying power of your money back. TIPS understate inflation just like CPI.

Greg

Profound sounding words about the exceedngly obvious without any suggested solutions! Maybe we can wear those shirts a little longer and have shoes resoled and shined rather than get new ones. The best kind of car is one that runs and is paid for. How about a garden or a clothes line for fresh air drying? Maybe an extra log on the economic fire will ensure that everyone survives a cold winter. It might encourage some older workers to begin their retirement and create job/career openings for a younger generation that has been challenged to out-innovate, out-educate and out-build the rest of the world.

I have not bought into the government Inflation Rate numbers for many years (1991). I believe the rate is actually a little over 10% and we will see a continued climb for the foreseeable future. I do also agree that the government does spin inflationary pressures into what they now deem as “economic growth”.

I feel that with the depth of deception from our “leaders”, there are certain markers that we can watch for. The most obvious “marker” will be a bank “holiday” declared by the treasury. This will be when the dollar actually collapses under the weight of this unsustainable government.

Washington has done the U.S. no favors by cranking up the printing presses, they have only accelerated the selling of the American people down the river. Nothing has been “saved”, only delayed. This will bring the collapse that much more sudden & severe. But, I do believe that what did and has made this country great, will in the end make it great again. A Rugged Individualist is not someone to fear.

I also do not understand how Mr. Krugman compares the devaluation of a currency relative to another basket of devaluating currencies. Has to be on some Keynesian’s payroll.

I think that one of the reasons people may not be feeling the effects of inflation is that they have stopped paying their credit card bills and in some cases mortgages (if they are under water).

When you stop doing this, you’ll have extra money to spend on food, gas and clothing and this is what’s happening. I think people have just given up when it comes to trying to repay their debts. Why struggle to pay back a bank that is getting bailed out by the government with your money?

This switch in mindset about credit and debt is not being talked about enough and it amazes me.

I no longer care about my credit report because I have no intention of borrowing money any time soon and I just won’t apply for jobs that require me to have good credit.

I bought my car and paid cash for it by going through a wholesale auction. I buy clothes on sale & retailers have been forced to slash their prices because of shoppers like me. If it’s not on sale, I won’t buy it. No more using credit cards.

My inability and unwillingness to rely on credit has forced me to think outside the box in terms of finding bargains and in terms of learning how to live within my means. This is the new American reality.

No inflation!?! You’ve got to be kidding. Just ask someone who was born in the 50’s and can remember when gas was 19 cents a gallon, milk was 69 cents a gallon and hamburger was 59 cents a pound. Back then I spent $40-60 for a week’s worth of groceries when I got married in 1970 with no children to feed. Now I spend several hundred a week for the same two people and that’s not for a lot of luxuries, just regular food and necessities.

Thank you Kerry and Diane for the inflation reports from the real world.

Greg

Hi Greg,

Here’s a comparison for today’s $3.73 trillion 2012 budget proposal by Obama. He declares it’s supposed to reduce deficits and keep inflation “in check”, I suppose (omg).

Now, this is in seconds, guys:

A million seconds is 12 days.

A billion seconds is 31 years.

A trillion seconds is 31,688 years.

$3.73 trillion budget = 118,196.24 years

Oh dear,

🙂 Diane

I think for every family that has abandon their financial obligations like house payments and credit cards, there many more families who continue to make their payments and try to live within their means. Inflation in food, fuel, utilities and clothing will wipe out those who are trying to do the right thing. Most have been listening to the MSM and are totally unprepared for what is to come.

Yes Jan, totally unprepared. Thank you.

Greg

Prices have certainly gone up, but now those fresh veggies and fruits may be even more expensive, if not impossible to find! With major food dealer Sysco and it’s suppliers claiming Act of God, due to the recent hard freezes in Mexico, they’ve given notice that imported produce will be exponentially more expensive, mediocre at best, and likely impossible to find, in short order. And we all know what will happen once new gardens begin to produce – prices won’t go down! The next month or two may be very interesting at the grocery store…we will get a full taste (no pun intended!) of what full-on shortages and exhorbitant prices will be like.

The government will lie as long as it seems a majority of the people are believing what is being handed out! When the masses begin to get angry and make noise, there will be a convenient scapegoat to blame. The govt really does think we’re all idiots. But as other govts are finding, as in Egypt and other places, HUNGRY masses are dangerous – and the masses here will have weapons. The Egyptians had rocks and homemade gasoline bombs. It could get really ugly really fast!

I read a passing reference somewhere yesterday that Iceland had arrested some of it’s banksters – haven’t found any other info. Have you heard anything? If that idea catches on, there might be a lot of nervous corporate types…. just sayin…

Thanks Greg! I read you every day. Keep up the good work!

Thank you GrannyB!! You keep reading and I’ll keep on writing.

Greg

Jan;

What is doing the right thing?

Your congressman took your money and gave it away to rich bankers on wall street. They complain about corrupt dictators like Mubarak, but the US congress acted like a corrupt dictator when they took the people’s money and gave it away.

Those bailouts were pure, unadulterated theft and they created a moral dilemma that the banks will soon have to contend with.

I Own a restaurant and in one year shrimp price increased $1

From $3.10 per pound to $4.10 per pound…

We were hit just a little bit for speculation for the gulf coast

But only about 20% is us produced..

Also other seafood imported …..

Multiply that per 20000 pounds annually…

Thats $20000 more paid annually for the same stuff…. OMG

Thank you Alejandro for the inflation news from the real world!!

Greg

Greg – here’s just how much of a well, fibber, Ben Bernanke is:

This chart speaks volumes. I’m beginning to think John Williams from Shadow Govt. Statistics is right. He says that hyperinflation in the United States is INEVITABLE.

http://www.chrismartenson.com/blog/how-long-can-party-in-stocks-last/52040

note: scroll down the page to see the chart/bar graph under the headline which says “On a tear.” This chart is shocking. Note at the top of the chart it says 1 year performance,as of Feb 01, 2011. 1.2% inflation???!!! Must be some good weed, Ben!

FranTheMan,

I am beginning to think Ben Bernanke knows he is lying. How could he not? Thank you for the link.

Greg

Greg – another excellent piece! Hilarious, but very serious at the same time.

The second paragraph: “The conclusion I have drawn from all this data is that the captain of our economy, Ben Bernanke, is either an economic imbecile or a financial terrorist. Through evil intent, or sheer stupidity, the outcome remains unchanged. The bottom-line: He has hijacked our economy flight and changed our destination. Bernanke is about to crash Flight 666 and all 308 million of us sitting helplessly in the passenger cabin into Zimbabwe’s airport known as Hell’s Hyperinflation Field.”

http://www.zerohedge.com/article/guest-post-economy-flight-666-our-one-way-ticket-zimbabwe

A short but very good read!

Yes, Mr. Krugman is correct. The dollar is about where it was three years ago, but using this reference point distorts reality. The U.S. dollar has lost more than 30% of its buying power if you look back to the early 2000’s.

But the Fed didn’t begin quantitative easing in the early 2000s, it started in 2009.

Juanita,

Inflation is inflation. I pointed out that Mr. Krugman only used the USDX for the last 3 years because I think he was trying to make things look better than reality. I also showed a CRB chart from October of 2010 that showed a 20% gain in commodity prices, but like Mr. Krugman, you ignored that fact because you wanted to make your point look better than it really was. If inflation is measured the way it was in 1980 it would be around 8.9% for 2010, as I said in my piece. If you think we really only have 1.2% inflation, then load up on dollars and treasuries. Thank you for keeping me on my toes.

Greg

It not about “making my point look better,” it’s about the facts. I don’t disagree with you about inflation at all; anyone on a budget sees what’s going on. The point I’m making is that if one blames this inflation solely on QE, then Krugman is correct, one should only compare the value of the dollar now to it’s value pre-QE, not ten years ago.

Juanita,

If it is about the facts (that’s plural) then why not also take into consideration the chart from the CRB that I provided. It shows a 20% increase in a wide basket of commodities since just before QE2. Why will you not acknowledge this overt fact. I used a longer term view of the U.S. dollar because it is clearly loosing value. A three year plateau, is not stability. The effects of inflation can be manipulated and lag but they always catch up to reality in the long term. I don’t think you really understand inflation. It is simply the over production of currency. The U.S. is printing $75 billion a month to buy our own debt. Do you really think this SECOND round of QE will keep inflation low? Another Nobel Prize winner famously said, “Inflation is always and everywhere a monetary phenomenon.” I do not think Milton Friedman has been proven wrong on this point. The notion that inflation is only 1.2% is totally false, and honest accounting exposes this lie. By the way, here is another inflation indicator for you. According M I T, everything in America went up in price by 2% SINCE CHRISTMAS! Don’t take my word for it, follow this story and link to M I T research. http://ilene.typepad.com/ourfavorites/2011/02/monday-market-momentum-prices-go-parabolic.html If Mr. Krugman is trying to convince America that the Fed is not responsible for inflation and that it is really only 1.2%, don’t you think he should be more thorough? After all he is a Nobel Prize winner. Thank you for your spirited comment

Greg

Greg, What will Bernanke say when his current policies fail? No one saw it coming? No one laid out the extent of the problem? Or will he blame it on bloggers? The fact is the “money supply” has grown but not from the FED but from “fractional banking”! So, the money supply is really 10-30 times what the FED issued!

Maybe olde Ben knows that the money the FEd is pumping into the system has already been created by the banks and now we are buying crap as if it were a T-bond. But wait ….soon a T-bond will be worth crap!

Great article Greg, keep on shining the light of truth on the FED insanity!

Thank you Mitch Bupp.

Greg

In the early 80’s, my Mother could get 5 loaves of the cheapest bread for a dollar, yes we were poor, didn’t even have running water for awhile, but I digress. In about the year 2000, I was paying 2 dollars for a good loaf of bread, now, 2010 I’m paying about 4 dollars.

What can I say, once the middle class is decimated, we can revert back to 1929. I don’t really expect any of my money, retirement investments, etc. to be worth anything when it’s time for me to retire in 15-20 years. Now 40 years old, I could never really afford to get married and have kids,(without going into debt), I did not start earning resemblance of a decent salary until I was 25. Now look at youth unemployment!, it’s who you know, not what you know for many employers, especially government.

Hi Greg

I spoke with you this morning on the Brad and Britt show about why the financial experts,ie Clark Howard, are not shouting from the roof tops the same dire warnings you are. I agree with you and the other posters that now is the time to make the drastic changes in our way of life if we are to survive the changes comming. I was cut off before having further conversation with you about this subject, but I wanted to know from your experiences, what is the tell to look for to know when to head for the cellars and batten the hatches. Our government will never let us know and the media is in their pocket so what do we have left. I just found out that the company I work for has not made a contribution of the money it takes out of my paycheck for my 401K in over 6 months. I’m not talking about it’s match, but the money it takes from my pay has not been put into my 401K. I see things like this happening all around and everyone acts like it’s just hard times. A fall is comming and we have to shout it fom the rooftops, everyone reading this, must tell everyone they know. You may look like a fool now, but you’ll be the smartest person they know later. Keep up the great work. Phil

Phil,

I don’t how bad it will get or when think will take a turn for the worst, but this economy has the potential to really spin out of control. I think you are seeing desperate measures being taken right now. My point here is it is best to be a little over prepared right now than under-prepared, and most people are way under-prepared. You also have got to stop your contributions to the 401-k now if the company is taking your money and not putting it into your retirement account. I am sorry you got cut off this morning. You are making a valid point here.

Greg

I stoped the contribution yesterday. Preparing for all possibilities. Most people I know act like what ever happens the’ll just adjust without thinking about the inability to do anything about it after the other shoe has fallen. I do not envy you and the challenges you must face on a daily basis helping people see the light through blinders.

Phil,

You did the right thing. Thank you for your sharing your information here.

Greg

I live in Massachusetts and a friend who got laid off in December has already found another job at a Bio-tech. It took him just two months to find the job and he is in finance/accounting.

I think Massachusetts is doing better than other states because everyone I know is employed and the one’s hat have been laid off have found jobs in a few months.

The bio-techs are still hiring.

NM,

Highly skilled people in the right fields will do better than others in this economy. I am happy for anyone who can land a good job in this economy. Thank you for the information.

Greg

Greg, I read your essays as soon as you post them. You are right on, Brother, every time. I love your strong show of facts delivered with charity, common sense, and just a touch of dry humor. For people who have not abandoned reason, you can only be taken seriously; you are the Paul Revere of our day. Someday I would like to shake your hand. The gathering storm is gonna be tough, something like we have never seen, but we can’t say that you didn’t warn us. Keep your eye on the Middle East. Thanks for all you do. Dan McCartney, Toledo, Ohio.

Dan McCartney,

Someday I would like to shake your hand as well. Thank you so much for your kind words of encouragement!

Greg

I’m beginning to think that the state I live in (Massachusetts) is doing a little better than the rest of the country, largely due to the high concentration of bio-tech companies.

I know two people who were laid off in December (right before christmas, no less) and within two months, they both found jobs at bio-techs.

So, yes, there is inflation, especially when it comes to food, but the pain of the economy hasn’t hit Massachusetts yet.

Great article Greg. I am a little late to the party as you posted this a few days ago. To understand the erosion of our currency look at what one (1) ounce of gold or twenty (20) ounces of silver would by in 1929 or 1932. These amounts of “HARD” currency were equivalent to 20 U$D. I theorize that even while gold and silver are being manipulated, they both are a better indicator of true inflation than the US government measures ergo (for Richard’s benefit I am pointing out that this is Latin, not a abbreviation for ergonomics) real inflation is in the 20-30% range (note to Richard, actual numbers vary depending on starting and stopping points).OR consider an inflation measure base on the entire world. I use food and gasoline everyday; I do not finance houses or buy cars every day. A case can be made the consumer basket the US Government uses for CPI is underweighted toward food and energy.

The only things bad about ‘printing money’ is that everyone, our government, businesses or individuals have to borrow it to get it and pay interest on it to use it. We have too much debt. We have ‘printed’ too much debt NOT too much money. Additionally, we do not ‘print’ money. Printed money, Federal Reserve Notes and coins are not available for direct delivery to the public. They must be purchased with checkbook money.

How can a nation with the Constitutional authority to create money be broke?

How? Because Congress has wrongfully farmed out its authority to create money debt free as a wealth to the people to the banking industry. Now, the private commercial banks create all the money as loans when we sign promissory notes pledging our collateral.

Creating and putting all money into circulation as loans creates economic servitude and only the principal is created never the interest. The interest must be borrowed too. When the principal of the loan is repaid the money is removed from circulation and extinguished. It no longer exists until a new borrower comes along.

Unfortunately, America is mortgaged to the hilt and can no longer afford to borrow. The solution is to SPEND not LEND all new money into circulation.

Money should represent what we OWN, not what we OWE! If men can create money as numbers in computers and LEND them into circulation as a DEBT for their personal profit, men can also create numbers in computers and SPEND them into circulation DEBT-FREE as a public benefit! “Congress shall…provide post-roads, coin-money..” Let’s stop being played for fools, acting foolish and let it be known that debt-money is dead! We’re supposed to be Freedom-loving Americans not Economic slaves!