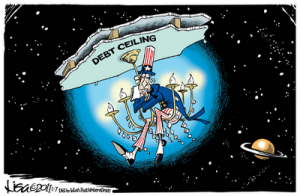

Will Raising the Debt Ceiling Bail Out the Banks, Again?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Just after the first of the year, the Chairman of the U.S. Council of Economic Advisers, Austan Goolsbee, emphatically pushed for Congress to raise the debt ceiling. Goolsbee said on the ABC Sunday talk show, “This Week,” if it was not raised, the “impact on the economy would be catastrophic . . . “If we get to the point where we damage the full faith and credit of the United States, that would be the first default in history caused purely by insanity.”The debt ceiling currently stands at $14.3 trillion and has been raised nearly every year since the beginning of the new millennium.

I received an email from one of my regular readers concerned and confused over the alarming statements by Goolsbee. The reader who goes by the initials “NM” asked, “So, is he saying that if we can’t go deeper into debt we will default? i.e. the minute America can’t borrow more money, it will default on its debt obligations???? It doesn’t make sense. How many times are they going to keep raising the debt ceiling?” NM seems to have asked all the right questions. Yes, Goolsbee is saying the U.S. will default if we do not go deeper into debt. And, no, it really doesn’t make sense to regular people like you and me. As far as the question, “How many times are they going to keep raising the debt ceiling?” for that answer, I turn to Bill Gross, the founder of PIMCO, one of the world’s largest bond funds. On CNBC last week, he said, “We have a deficit in the $1 trillion plus arena, which means we must borrow at least a trillion dollars additional a year in order to fund the deficit. And, so, the debt ceiling currently at $14.3 trillion, which is 95% of GDP, has to go up by another trillion or so every 12 months.” (Click here to watch the entire interview.)

“Another trillion or so every 12 months!” Apparently, the debt ceiling needs to be raised every year for at least the foreseeable future. To put it another way, the debt ceiling, according to Mr. Gross, needs to be raised by more than $1,000 billion each and every year! Seems to me, not many people in the mainstream media are alarmed by this amount of debt accumulation or by the fact that if it is not raised, the U.S will default. That is the precise warning Treasury Secretary Tim Geithner gave when he wrote a letter to Congress last week saying if the U.S. did not go deeper into debt, “The Treasury would be forced to default on legal obligations of the United States, causing catastrophic damage to the economy, potentially much more harmful than the effects of the financial crisis of 2008 and 2009.” Mr. Geithner also explained, “It is important to emphasize that changing the debt limit does not alter or increase the obligations we have as a nation; it simply permits the Treasury to fund those obligations Congress has already established.” (Click here to read the complete Geithner letter to Congress.)

“It simply permits the Treasury to fund those obligations Congress has already established.” Two of those already established “obligations” are failed mortgage giants Fannie Mae and Freddie Mac. They represent more than $5 trillion in liability to U.S. taxpayers. You might remember on Christmas Eve of 2009, Secretary Geithner lifted the caps on the amount of money the mortgage giants could lose. Just last week, you may remember that Bank of America settled a big lawsuit with Fannie and Freddie that let B of A off the hook for buying back $127 billion in toxic mortgage debt it sold to the mortgage giants. I wrote about it in a post called “B of A Settlement, Another Taxpayer Rip-off.” It has been reported that Mr. Geithner was one of the key players in the settlement. Other big Wall Street banks also packed Fannie and Freddie with sour debt and are also probably on the hook to buy back billions of dollars of bad debt. Do you think they will want the same deal B of A got? You bet! Do you think some of this new debt ceiling money will go to the banks via Fannie and Freddie to fund buy back forgiveness? How could it not.

There are many other reasons for raising the debt ceiling such as military spending on two wars, Social Security and extending tax cuts. How many times can the U.S. raise its debt ceiling? Who knows, but the world is not going to sit and watch America print money like candy wrappers and toilet paper forever.

I will close with a quote from 87 year old Harry Schultz. He is widely respected for his economic and market calls published in his newsletter. Schultz recently retired, but in his final post, he gave this warning: “Roughly speaking, the mess we are in is the worst since 17th century financial collapse. Comparisons with the 1930’s are ludicrous. We’ve gone far beyond that. And, alas, the courage & political will to recognize the mess & act wisely to reverse gears, is absent in U.S. leadership, where the problems were hatched & where the rot is by far the deepest.” (Click here to read more about Mr. Schultz from the EconomicPolicyJournal.com.)

It is difficult to compare different eras because our present day society has more infrastructure built up. People could coast on very little, especially if interest rate charges on existing debt were drastically reduced and incentives were put in place to lower every consumers debt.

But the government and the banksters want consumers to take on more debt, and that is where the problem lies. I wrote a 4 point economic program that would stabilize the economy without requiring any bailout or stimulus package.

http://wallstreetchange.blogspot.com/2010/11/2010-after-election-4-point-economic.html

Thank you Alessandro and Slingshot for your input and comments.

Greg

Mr. Machi — you’re absolutely right. The gov’t and banks want all of us to increase our debt. It’s the only way that they can keep this Ponzi scheme going. It’s all the result of dishonest money with no PM’s backing it. Nothing good can come from this dishonesty (the cur-rency is a lie). I remember reading years ago (I can’t remember from where) – that the one good thing about a gold standard was actually a negative – in that it forces government and politicos to be honest. All of this “potential” honesty is long gone now and we expect the world to improve regardless. Our father Gov’t has gone rogue and this is the glowing example we’re provided with, a deadbeat dad. Gov’t should be a night watchman versus the Santa Claus that we’ve come to expect…and as long as we expect Santa to provide for us – the results will always be lacking and subpar. Bob D

Damage the full faith and credit of the United States.

The Chinese are laughing at, Timmy.

Where has this guy been? On Mars? Just another poke in the american peoples eye. Can’t see? Let me poke the other. There, that’s better. My point being that most will not see it coming and it’s going to hurt like hell.

If they cut all discretionary spending it would give an extra two weeks before a collaspe. Very reassuring. What can you do about it?

I feel like I am riding down the road at a hundred miles per hour with a drunk behind the wheel. What to do? Then ask myself why I got into the car in the first place.

Good article, Greg. Keep it up.

Hey Slingshot,

I feel your pain.

You said: “If they cut all discretionary spending it would give an extra two weeks before a collaspe.”

Good point and the solution is simple: Cut non-discretionary spending. Massive bureaucrat lay-offs need to occur. Entitlement spending needs to be curbed and quick. Yeah, I know that granny will be kicked to the curb and she will have to survive on donated cat food; sorry, the free ride is over.

Cash, Grass, or Ass; Nobody Rides For Free! The laws of nature ensure that this humorous axiom will always be pertinent.

Your point about the drunk behind the wheel is a good one. The drunk needs a serious intervention. I hope that we the people are in control when the intervention occurs and not a coup de tat or foriegn entity.

I can see a day when my civil liberties will be cut-off in short-order to allow for an intervenor to “fix” the mess.

markm

Greg,

Good post. Although I’m not sure the debt ceiling going up or being capped really makes much diffence. With all the ecomonic regulation with any teeth in it having been done away with over the last 30 years its all just a house of cards ready to fall again.

Also, the issue of free speech in your last post prompts me to lay a few quotes from Salman Rushdie on your readers:”Free speech is the whole thing, the whole ball game. Free speech is life itself.” and “What is freedom of expresion? Without the freedom to offend, it ceases to exist.”

Have a good day!

Howard,

I love the quotes. Thank you.

Greg

Greg, apparently the repeal of Glass – Steagall in 1999 allowed wall street to run wild. On top of that, the internet helped create a path for short term profits on long term deals (mortgage securitization).

Financial planners realized they could take almost anything, securitize it, and then slice it up and sell it over and over again. They were not creating anything new, just taking a loaf and slicing it up and claiming it was five loaves.

It seems to me that there is a huge group of individuals in the country that are not paying any attention to what is happening in the fiscal mess. They walk around with the smart devices, keeping up with all their friends, celebrities, jokes and new games to download, but they do not listen to the nightly news, read a newspaper or access anything that is not directly impacting them at that same instance.They vote, but do not really know what they are voting for other than a liberal or conservative label. Not until they lose their job or credit line are they ready to pay attention and get educated as to what is happening around them. I fear that many of our politicians are falling into this same class. Are they not paying attention to what is really happening with the national debt? Will it take another major collapse for them to act? What happens when foreign countries begin to pull back and demand higher interest rates on our debt to cover the increasing risk associated with that debt?

There are many who are paying attention as supported by those posting comments on this site, but does it seem that the ones able to make positive changes to the current situation are not paying attention or are those that talk about the debt and its ramifications the one running around like Chicken Little? I am beginning to question my own concerns as those that “are in the know” and understand government are not acting, so why should I worry?

Ron, very astute observations.

Mr. Harris is right on. All the money worries don’t add up to a hill of beans,when we are living in a lawless land. The DC folks have lost the respected of the voters and they are starting to fear what’s ahead. We will see strange hand holding in DC,just like them putting health care on the back burners.The new comers to DC are being told right now, how the game plan is going down. They will be told to toe the line are be anthrax. There is still 2 trillion dollars missing in the pentagon,but a trillion dollars is chump change now days. We are living in one big system of lies and the out come can’t be good. peace

Dear Greg,

Thank you for posting.

Now, if we can only do what has been suggested by Congressman Ron Paul, that is, go back to the Constitution.

Start by closing down all the overseas bases, reduce the military to a 100,000 force. Our military was meant to only defend our borders, NEVER to be “the world’s policeman.” As for “backup,” denationalize the National Guard, have them revert back to the states’ control. Do as the Founders intended, let any gaps be filled by the “unordered militia,” the private firearms owners (for those of you who scoff at the latter, Arizona has the unordered militia patrolling the border; the only thing Arizona supplies is the training).

Get rid of every bureau and department not specifically mentioned by the Constitution. Fire all the “workers.” Since government “workers” love to mention how “superior” they are, that they are a “cut above,” they should not have any problems starting their own businesses, or getting a job. Lower the pay of the survivors on a par with the private sector. Currently the “snivel service” does not attract the “best and brightest,” they hire on quotas, including many who can’t speak English. Also, get rid of public employee unions.

Turn the airports over to the private sector.

Boot out the Federal Reserve, declare their script null and void. The only “good” money is that coined by the Mint. Back it up, and make it exchangeable with, gold and silver. Our Constitution forbade paper script once, it should be done again. Please note: currency was exchangeable with the former until 1933, and with the latter until 1963.

Get rid of most taxes, go back to duties and tariffs. Let the “big box stores” pay for importing Asian junk.

Get rid of all onerous laws that punish businesses. Bring manufacturing back to this country. Make union membership optional.

Bring God back to public life, as we have no one of any honor or scruples in most political offices. The First Amendment to the Constitution bans a NATIONAL religion, but states could keep state religions. Let’s have that back.

Sam,

I hope Mr. Paul can make a real difference.

Greg

However radical your propositions are, America is now in a such a precarious position on so many fronts, certain radical ideas should be implemented. They certainly will not happen under this president who cannot and does not want to stop spending.

If the United States could run its own economy based on everything that resides on our own soil, then yes, it’s a no brainer to reduce our military.

However, the money people are in it to use up the world’s oil supplies, and there in lies the problem.

Are you suggesting that we recall our legions and stop extracting tribute from the world by letting them use some other currency? That’s blasphemy! (unless of course you’re one of the heads of the NWO)

The good news is we don’t have to cut down trees or grow cotton to make dollars anymore, we just create them with a keystroke. Isn’t technology wonderful?

Glenn and NCdirtdigger,

Thanks for the pointed comments. Short and sweet!

Greg

Another great read Greg. The ‘United Three Ring Circus of America” has become equated to a run-away 18 wheeler down the north face of Mt. Everest.

Look folks, the citizenry has exactly the tax and over-spend government the want. Those of us that haunt sites like this understand reality, but the average joe and joan american think reality tv is reality.

There is no cure. Our only chance at setting things right is triage. We just have to understand that it isn’t government, it is the citizens. We can’t do anything for them until they are completely broke, battered and sick of the status quo. Only then will they realize we have to save what we can and let the rest die. We can’t afford to keep every sacred cow program that makes the public feel warm and fuzzy.

I agree that we need to eliminate income tax in all forms. Just keep in mind, duties and tariffs aren’t paid by the importer, but rather buy the end purchaser in the form of higher retail prices. No problem though. We have a choice to NOT buy. Not buying provides an opportunity to save.

Save. Even the average citizenry believes that a 20% off sale is saving. The people haven’t a clue. You don’t save anything by spending.

The debt ceiling will be raised. Money will continue to be injected into the zombie banks to keep them alive. The people want to believe in the ability for Congress to solve every problem. Congress will do whatever they can to feed the belief. Any failure will expose the Congress as fallible. Belief will vanish and never underestimate the effects of large masses of unhappy and mad people. The people will never admit thier culpability in this mess.

Keep em coming Greg. Unfortunately, we’re all in this together.

Thank you OTE for the comment.

Greg

Didn’t Newt Gingrich shut down the gubmint over the debt ceiling? We’ve been there, done that. And there was no USA default on obligations. Ah, but in those days the banksters were not perceived as the enemy. They weren’t as powerful or extorionistic. (Did I just coin a word?)

Now that middle class prosperity is in the dumper, it’s unlikely that politicians will stop raising the debt ceiling.

It’s the only option… until the elected class starts squelching spending.. That wont happen until an enlightened god emerges to show the evil ones the errors of their ways.

Sadly, if raising the debt ceiling bails out banks, it also bails out a lot of other entities. And the denial of reality advences.

Then again, Chicago and Illinois are about to go bankrupt. Do either have a debt ceiling?

….ikb

The Government operating debt is daunting, and I know you know this but the real story is the unfunded liabilities which I recently heard estimated at 100 Trillion. Not to mention the current account deficit which has to be funded every day too, as long as we shop at china-mart. The 18 wheeler down Everest is a good word picture, but I wonder if a full 100 car train may be more accurate, and the engine is just reaching ground.

Thank you Mike for your perspective and comment.

Greg

So help me to understand: If I keep paying my mortgage with those checks my credit card company sends me, I’m good, right?

Tom H,

Very funny man!!!! LOL

Greg

It is amazing that the banksters are able to get away with it and that almost nobody says anything. B o A just unloaded over a hundred billion of toxic mortgage debt to the tax payers and nobody goes out on the street to protest. I am glad you brought that up on this page. All this financial mess is the biggest fraud in the history of mankind and yet no one has gone to jail…

Eric

Right on Eric!

Greg

Greg,

My dilemma has been my 401k. I have been in cash for over a year now out of concern that rising interest rates was inevitable. I realize that precious metals are the hedge that everyone is touting but these funds do not have that option. My thoughts were that stocks and bonds would not perform well and would likely fall in value. I am in my mid 50’s and I did not want to risk principal. Now I fear that if inflation enters the picture that equities might enjoy price appreciation even if that appreciation falls short of the inflation of commodities and the cost of living. However, if we were to incur a significant drop in equities I would have made the correct call. The answer that I seek is which will prevail. Will stocks appreciate in value due to a liquidity push by the Fed or do they drop in value because no matter how much QE activity occurs those equities still must have a positive earnings forecast. Thanks for any thoughts on this.

BenFlorida,

Stocks will likely face a sell-off sometime this year as the market is up around 80% since March of 2009. After that, stocks in general will go up. I am not sure of the timing. The real question is will your brokerage still be in business after a systemic collapse. Who knows? That is why gold is more of an insurance policy than a money making venture. Yes, people will and have made great gains with gold (and silver) but the primary reason to hold gold is protection and these days we all need financial protection. Gold and silver ETF’s are NOT protection. Only the physical metal offers the kind of hedge I am talking about. You should be asking yourself: “How much protection do I need?” Making gains in the market is always secondary to preservation of capital. I hope I helped you. Thank you for supporting the site.

Greg

Thanks for writing this article, Greg.

At this point, purported economic management (by the Fed, Obama & whoever else) has simply become comical. It’s no longer making sense and the system will eventually implode.

See this article link below on yet another bailout to banks that the press isn’t talking about. FASB changed the accounting rules and is allowing the banks to collect interest on mortgages, which are not being paid and which are about to be foreclosed.

It’s a joke.

http://blogs.forbes.com/robertlenzner/2011/01/12/us-banks-reporting-phantom-income-on-1-4-trillion-delinquent-mortgages/?boxes=Homepagechannels

NM,

Thank you for this link and your comment!!

Greg

Remember this quote over the next two years…

Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants and debt is reserved for slaves…

Good post Greg…no matter what they do, we have gone past the point of no return. All we can do now is individually avoid being a slave.

Thank you PatriotRider. Good quote!

Greg

There’s only two words that we must appreciate when it comes our monetary-financial-henchmen at work! and those 2 words are: “fiat and fantasy” – need I say more? Until my next visit- Best* N~

Norm Ezzie,

I like it comments like this, short and direct. Thank you and come back soon.

Greg

Greg have you every considered that the U.S. establishment is driving us toward gold/silver as debt-free currency ? They cannot take a top-down approach, however, so they “carry the stick” to drive the free market. A top-down approach would crash the legacy system in the process of the migration.

The development of the fiat dollar and its floating characteristics are not exclusively about the dollar’s value being completely allocated to that of a currency. It has a dual role. It’s a currency within the fiat currency paradigm, but within the real-time gold weight payment paradigm, the dollar’s “value” as a real-time measure is unavoidable. It’s the bridge between fiat pricing of economic widgets and payment in weighted bullion.

No free floating dollar development by fiat would have meant no real-time measure for bullion payments. A fixed dollar-bullion peg does not work. The economy is a real-time event.

Some evils are necessary. We’re all following the same “script”.

I can now buy a single toothpick from a merchant in Timbuktu, priced in almost any currency, pay for it in exact gold weight and have the transaction closed in an instant with no lingering debt. Debt-free store of value has married with instant global liquidity. We don’t have a design problem. We have a marketing challneg is all.

Never forget the gifts of the Magi.

Therooster,

Thank you for your perspective and analysis. Very interesting!

Greg

“Will Raising the Debt Ceiling Bail Out the Banks, Again?”

Allow me to answer this with ANOTHER question; Does digging yourself a DEEPER GRAVE ‘bail you out’ from being DEAD?

Mike,

I love the comment and logic!!!

Another good one, and great posters. I tell everyone, who will listen, about your site. Keep it up Greg. There is a lot to learn.

I am not looking forward to $100 BigMacs, but I am afraid they are not far off….just saying.

LostinMissouri,

That would mean $500 silver? Yes a lot to learn, let’s hope we can stay ahead of the curve. Thank you for the comment.

Greg

Raise the debt celing ????? Hell they can’t even balance the budget let alone start to pay down the debt ……

A Parable for your consideration.

Way back in ancient times, before the internet, when there was a “fairness doctrine”, before cable news systems there existed gods and lesser gods. The New York Times was the Zeus of the news world and resided on the new Mount Olympus known as the island of Manhattan. The lesser gods of ABC, CBS and NBC all paid fealty to the supreme lord by taking the stories published in the NYT and regurgitating them on their nightly news broadcasts. Obsequiousness to the great “Grey Lady” was the normal order of things, simply because that was how it had always been.

But the world of the gods began to change with the advent of cable television and it’s giving birth to a new lesser god, CNN. The order of things on Mount Olympus changed little at first as CNN remained loyal to father NYT, but the mortals below soon became restless with the oppression of the gods, and being what they are, some of them rebelled. Soon they gave birth to a lesser god of their own, FOX, and this new lesser god refused to pay homage to father NYT or any of the other lesser gods for that matter.

At first this new lesser god struggled under the weight of the older gods but still refused to bend its knee to them. The word began to spread amongst the mortals that perhaps they too need not cast their fealty to the gods of Manhattan. Soon the mortals became empowered to become their own gods! The internet was born and gave birth to its own child the “blogosphere!”

All this of course angered the gods of Manhattan. “How dare these mere mortal pray to other gods!” they bellowed in their private conclaves. They would never state so publicly but they knew that just as with the gods of ancient Greece they would be rendered powerless without the fealty and prayers of the mortals.

Soon not only was it their power that became diminished but also that of their demigods, the politicians, over whom they claimed the power to create or destroy at their whim. Not only had these impertinent mortals created their own rivals to the gods of Manhattan but they were beginning to not just challenge, but replace the demigods that had been chosen for them!

With each new lessening of their power the gods of Manhattan would hurl new bolts of thunder and lightning down upon the mortals from on high. “This FOX you attend is a false god, a usurper of the wisdom of Manhattan! Your new politicians are powerless; we will destroy them just as we have those that came before them that refused to bow before us!” But the mortals continued to ignore the gods of old and their newly created lesser gods of MSNBC and CNBC as well. Fewer and fewer mortals went to their temples of circulation and Neilson numbers, so each new lightning bolt was weaker and farther off the mark that the last! The edifice of their temples, the great taxing and redistributing, all powerful government wherein their demigods had resided, we being redecorated by the mortals in their own image.

The gods of Manhattan have not passed into mythology yet, the rumblings of Mount Manhattan will continue for some time but they grow weaker with each new cycle of the rebellion of the mortals, but like the Titans that preceded the Greek gods of Olympus they will soon fade into the mists of time, starved of the offerings of circulation and Neilson numbers.

Davis,

I like your Parable and I feel the Manhattan “Gods”will die by a thousand cuts. I for one am buying razor blades. Thank you for the content.

Greg

Greg,

Keep it up. You’ve got me energized.

Using the US Census estimate of about 113 million households in the USA, that $14.3 trillion in debt works out to around $125,000 per household and about $52,000 for every US citizen under 65. Ouch! Oh, I nearly forgot. That $1 trillion they add each year, that adds another ~$3,700 per year, per person.

It’s never getting paid back, is it?

Joe

Joe Salamon,

Not in real money. Why do you think rich people are buying gold and silver? That is real money!! Thank you for the excellent analysis.

Greg

Will Raising the Debt Ceiling Bail Out the Banks, Again? | Greg Hunter鈥檚 USAWatchdog is a good post, thanks for providing this enlightening information. It is always good when you not only be informed, i will visit your blog often for the most recent articles.

GOLD is money everything else is Credit.

Bruce,

Short, sweet and 100% correct!! Thank you.

Greg

Raising the Debt ceiling and raising taxes on the American people is the road to hell. The constructive way forward is to 1. Use QE3 and QE4 to PAY OFF THE NATIONAL DEBT i.e. burn the foreign credit card

2. REPEAL THE FEDERAL INCOME TAX PERMANENTLY. Get this money back into the peoples hands (and business) and watch the economy boom. No more credit crunch, a phenomenal return of OPTIMISM to America and a automatically right-sized and handsome social security Fund.

3. Organize a national healthcare plan including Family Doctors and Private Hospitals. Focus on the elderly and children. Ban the crazy malpractice business. Last but not least, Americans must consider a return to the Rule of Law such as the bill of rights and the constitution. The world is watching and if America, or the Tea Party, gets it right, all will breath a sigh of relief. Good luck and God bless.