B of A Settlement, Another Taxpayer Rip-off

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

In case you have not heard, Fannie and Freddie (also known as Government-Sponsored Enterprises or GSE’s) settled a big lawsuit with Bank of America Monday. The case was settled for cents on the dollar, even though the GSE’s had had a strong case to force B of A to buy back billions in sour mortgage-backed securities (MBS.) I wrote about some of this in a December 1 post called “Foreclosure Bombshell.” The post was about some of the legal trouble Bank of America was having with the mortgage debacle and the possibility of the banks being forced to buy back billions in sour MBS. Here’s part of what I wrote back then, “Mortgage-backed securities have to meet what is called “contractual representation and warranties.” That basically means the MBS are required to be free of fraud and be exactly what the seller says they are. Do you think mortgage-backed securities are free of fraud? Do you think these securities are the triple-A rated risk free investment the big Wall Street banks claim?—NO WAY! The banks are going to be forced to buy back all the toxic mortgage junk they sold. (Click here to read the entire post.)

On Monday, after news of the Fannie and Freddie settlement, I got a gloating comment from a reader named “Rick.” Rick tells me he’s retired from the “finance industry.” Here’s some of what he wrote, “I told this would be nowhere as bad as most made out. Hope you read about the settlement with the GSE’s With BofA, 1.3b, this makes BofA total exposure probably around 3b going forward, not the 50B+, everyone thought. Additionally, B of A audit by Moody’s and others has been complete and found that Loan doc’s were delivered. PIMCO will settle for very little in the coming weeks and AG’s to follow. NO Conspiracy and Fraud as you have promoted on your blogs, just very bad process. As stated in our last exchange, I hope you man up and write a new blog retracted and admitting you got a little carried away with you statements. This is what happens when you repeat from others and do not do your own homework. Just remember the fraud was committed buy the rating agencies not the Banks.” (You can read the entire exchange at the end of the Foreclosure Bombshell post.)

I’ll “man up”alright. Yes, Rick you were right, the American taxpayer got ripped-off once again. It was not that bad for B of A because it is another back door bailout for the banks that caused the mortgage mess in the first place. The headline over at Fortune/ CNNMoney.com says it all “Is Fannie bailing out the banks?” Of course, the answer is YES! The report goes on to say, “Monday’s arrangement, according to this view, will keep the banks standing — but leave taxpayers on the hook for an even bigger tab should a weak economic recovery falter. Sound familiar? ‘The administration is trying to weave a path between two bad alternatives,’ said Edward Pinto, a resident scholar at the American Enterprise Institute. “They want to bail out the big banks without doing apparent damage’ to the sagging U.S. budget position.” (Click here to read the entire Fortune/CNN report.)

This is an outrage, especially when you consider what kind of a sweet deal B of A got. Investing expert and owner of a blog called The Big Picture, Barry Ritholtz framed the B of A settlement this way, “Bank of America settled numerous claims with Fannie Mae for an astonishingly cheap rate, according to a Bloomberg report. A premium of $1.28 billion was paid to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008. That amounts to 1 cent on the dollar to Freddie Mac. Imagine if you had a $500,000 mortgage, and you got to settle it for $5,000 — that is the deal B of A appears to have gotten from Freddie Mac.” Click here for the complete Ritholtz post.)

Maxine Waters, a senior Democrat on the House Financial Services Committee, also thinks taxpayers got a bad deal. The Congresswoman’s statement was included in a story from the Businessinsider.com. Representative Waters said, “. . . I’m fearful that this settlement may have been both premature and a giveaway. The fact that Bank of America’s stock surged after this deal was announced only serves to fuel my suspicion that this settlement was merely a slap on the wrist that sets a bad example for other negotiations in the future. I understand that the questions raised by fraudulent servicing practices were not addressed in these settlements, and I hope that Fannie Mae and Freddie Mac, along with their conservator, are more aggressive in pursuing banks for the fraud I documented in my Subcommittee during the last Congress.” (Click here for the complete Business Insider post.) The sad thing here is I don’t think this administration or any Republican administration will pursue the “fraud” Congresswoman Waters has documented. I envision every other major Wall Street bank that dumped its toxic mortgage-backed securities onto the GSE’s to also get a sweet deal at the taxpayers’ expense. Many more billions will be poured into the banks to prop them up when some are clearly engaged in malfeasance. Former bank regulator and professor of economics William Black has called for banks such as B of A to be dismantled in receivership. He co-wrote a piece last October called “Foreclose on the Foreclosure Fraudsters,” but what is happening here is just the opposite. Once again, incompetence and alleged crime is being rewarded. (Click here to read the William Black article.)

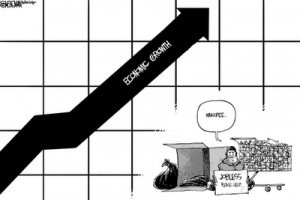

My only question is how long can the bailouts and spending go on? The banks will no doubt get another round of bailouts via the GSE’s, costing hundreds of billions of new dollars. In his most recent post, Jim Willie of Goldenjackass.com sums up the end result of the massive and ongoing bank bailouts in one chilling sentence. Willie writes, “The extraordinary efforts and attempts to save the big US banks will be the precise policy that leads to systemic failure and the US Treasury Bond default, all in time.” (Click here for the complete Willie post.)

Meanwhile, the Fed continues QE2 at a rate of $75 billion a month of pure money printing to finance the country. When QE2 is finished in June of 2011, how difficult will it be to get foreigners to buy our debt? QE3 anyone? I have a novel idea–the U.S will once again raise its debt ceiling. (Currently it stands at $14.3 trillion.) That will be painless for the politicians, and besides, nobody goes bust or gets punished in America anymore. We do not have leadership in this country; we have political hacks taking turns protecting their donors and cashing in—at the expense of the American people.

If anybody wants to understand how devastating the HAMP program has been for close to a million HAMP applicants trying to avoid foreclosure, please check out my article. http://mythirdparty.blogspot.com/2011/01/us-government-may-be-using-hamp-to.html

Greg is right, for the government to let Bank of America off the hook so easily is cause for alarm.

I would also like to add that last year U.S. Banks collected around 38 billion in fees from its customers. I have spent close to an hour googling for a bank breakdown of collected fees.

I have not found it yet but we can assume Bank of America is probably between 8-10 billion in the amount of fees they collect every year from their customers. Amazing that Bank of America was only fined a small percentage of the amount they fine their own customers every year.

Greg, read this article recently that may shed more light. Keep up the great work. http://www.howestreet.com/articles/index.php?article_id=15549

The cold hard fact is that the American People are stupid. I am beginning to believe that we deserve this mess for allowing all of this fraud to continue without a fight. We continue to elect the politicians that created the problems in the first place. We continue to put our fake money in fraudulent banks. We are sitting back and allowing this to happen to us.

“Rick” is like a petulant child with his “I told you so, na na na na na rant. His indefensible defense of outright fraud makes him an obvious part of the problem. The fact that he is retired from the finance industry probably means he has benefitted from the fraud and is living a cushy life while Main St. Americans are being tossed on the street and living on food stamps. A typical response from a typical fraudster. He and Bernanke should go bowling together and let someone else pay for it.

In the meantime, the congress is going to read the constitution out loud today. For many, I am sure it will be the first time they ever heard it. Tomorrow, it will all be forgotten, and the peopl’s representatives will continue their push against the people and toward a police state. Check out this video clearly showing the kind of command of the constitution our representatives have. They swear an oath to uphold it, and don’t even know what the hell it says:

http://www.youtube.com/watch?v=wdIYgV77xMc&feature=player_embedded

“First they came for the Communists, but I was not a Communist so I did not speak out. Then they came for the Socialists and the Trade Unionists, but I was neither, so I did not speak out. Then they came for the Jews, but I was not a Jew so I did not speak out. And when they came for me, there was no one left to speak out for me.”

– Martin Niemoeller

Tom H,

Thank you!

Greg

I, too, told you that this problem wasn’t as bad as it looked on the surface. I didn’t have to be “retired from the financial industry”, on order to see that. All I had to do was to take a look at the banking index. If, as you and several others claimed, banks were facing trillions of losses and lawsuits due to this problem, the market would have anticipated that and the banking index would have been falling like a stone. Yet, it wasn’t. Therefore, Big Money, the people who know much more than me and you, the people who have plenty of inside information, knew that this was either a non-issue or was going to be resolved – and had voted with their wallets.

Yes, it’s a taxpayer rip-off. Yes, the whole US economy is built on fraud. Anybody with a brain can see that. But from this it doesn’t follow that its collapse is imminent. Inevitable – perhaps. But not imminent. The Powers That Be still have plenty of ways to fight and delay the collapse – at the expense of the common man, of course.

Vess,

Not a huge problem for who? The deal forgave $127 billion in future put-back claims. This is still a huge problem. this settlement is just for one bank and is only Fannie and Freddie. What about all the other investors such as pension funds, insurance companies, sovereign wealth funds and other investors? Vess, I did not say that a “collapse is imminent.” I asked “how long could this go on?” Its not the banks collapsing that I am worried about anyway, it’s the Treasury market. By the way I wouldn’t bet the farm on the banking index. It did not predict the last meltdown coming. Thanks for the comment.

Greg

1) Not a problem for the banks. (The common man doesn’t matter anyway.) Yes, it’s just one particular case for one particular bank. Wanna bet that other banks will resolve their similar cases in similar ways?

2) How can you say that the banking index did not predict the collapse?! Have you ever looked at it? (And not just it – I could tell that something bad was going on in early 2008 just by looking at the charts of the general indices, like the S&P500!) From February to June 2008, the $BKX *was* falling like a stone – much before Lehman collapsed. And its 50-day moving average crossed below its 200-day moving average much before that.

Good points Vess. Thank you.

Greg

Hopefully impending consumer class action lawsuits will level the playing field.

Greg, good article. Just more of the same, American middle class will

be the losers again, all the while Congress does nothing. It is nice to hear about a person in Congress who is “fearfull” it maybe a bad deal, but what the American people need is Congress to do something about it! My father use to say talk is cheap, that’s all you ever hear Congress do is talk, unless it is something that is not in the best interest of middle America. Debt ceiling raise, you can bet that Congress will do more than talk about that. Thanks for your blog, a lighthouse on a foggy shore.

Dear Greg,

Nice to see you back. About your article, spot on! Thank you for posting!

Hello Greg,

Nice.

Rick is just another religous zealot. As we have written before, a simple math equation, a quick timeline, and a mental spreadsheet will paint the picture. Our gubmint’s actions are not sustainable. Only a religous zealot would believe otherwise.

In business, we commonly use TVM (Time Value of Money) calculations when piecing together our proformas. It is a bit difficult now. If the economy recovers, inflation will hit. If not, QE2 and QE3 will further devalue the dollar at some point in the future. Throw in the drastic increases in regulation (especially in Kalifornia), and we have unchartable waters ahead.

How does a business create legitimate plans for the future in this environment?

Rick obviously believes that professors who manipulate the economy can create utopia. This is nothing more than religous zealotry.

markm

I read your response and the guy’s main contention seems to be that you over estimated the toxic assets that banks have:

“this makes BofA total exposure probably around 3b going forward, not the 50B+, everyone thought”.

So, is your counter argument that the exposure is STILL $50B (or more) even with this settlement?

NM,

I’ll tell you what I told Vess. “This is still a huge problem. this settlement is just for one bank and is only Fannie and Freddie. What about all the other investors such as pension funds, insurance companies, sovereign wealth funds and other investors?” Who knows what the actual monetary value of the exposure is. We are talking about the OTC Derivative market. Happy New Year NM!

Greg

Greg,

Here, finally, you have summed up perfectly the sad state that this country now finds itself in… “nobody goes bust or gets punished in America anymore. We do not have leadership in this country; we have political hacks taking turns protecting their donors and cashing in—at the expense of the American people.” Exactly! And that’s why, I’m afraid to say, we’re just barking at the moon.

Thank you Doug.

Greg

In 1999 I became convinced that the Democrat and Republican parties were crime enabling organizations. I stopped voting for either of those parties candidates. Mostly I “write in” candidates on my ballots. Today, the fraud and criminal activity is, “in your face”, obvious. And yet, 99% of people continue to vote for candidates of the two parties that condone/encourage this illegal activity. The populous switches back and forth, but never seems to realize that nothing is changing.

I would think that the criminals themselves are surprised that their crimes can be publicly documented, and yet there is very little response from the people of this country. It is this apathy towards financial fraud that has me convinced that a financial collapse is certain.

Thank you Pete and Andrew.

Greg

Exactly!!!

An interesting little nugget concerns Bank of America and the Julian Assange affair. Rumors that Wikileaks were set to blow the whistle on “a big American Bank” (reportedly Bank of America) immediately preceded the hounding of Assange over those ludicrous ‘sexual scandal’ allegations. A coincidence? Yeah, pull the other one!

Andrew Gardner

Lawless nation, nothing good can come of it. Some people need to man up but it’s not you Mr. Hunter. I blame the last 50 years on congress for the whole mess. The White house is just the place the sheep watch. Once the state pension are broke and health care fails we will be living in a third world nation. Then we all will need to man up. peace

Thanks Bob.

Greg

Just another example of “privatize the profits and socialize the losses”. The B of A “repurchase” of toxic MBS’s is all done with money printed by the Fed and the future losses will be borne by the taxpayers. I’m surprised the Fed didn’t just buy them directly and bypass the middleman. I guess they’re too busy with buying stocks and treasurys.

Jim,

You are clever and funny!

Greg

BOA is the 36th largest company in the world according to the # of employees. BOA is the 30th fastest growing company according to incremental revenue gained.

(http://money.cnn.com/magazines/fortune/global500/2010/performers/companies/biggest/).

I believe the government would rather lower unemployment in the short run then worry about the deficit which is more of a long term situation. This bailout will likely lead to more jobs for BOA (they have more leverage to spend) and a fraction increase in the government debt. I believe the true value of this story is the continued destruction of the American Taxpayer and the continued domination of the United Corporations of America.

Luke,

Those jobs will cost taxpayers dearly. Debt is written down in receivership. That is not happening in this giveaway. Incompetence and alleged fraud is being rewarded. Peace bro.

Greg

Thanks Greg for again shedding light on the financial crimes that these banks are getting away with…and being rewarded for. And yet B of A still denies continuously people in the HAMP program…what an abomination and insult to all of us working hard to pay our mortgages yet needing help in this failing economy!!

Thank you Paul Dooley.

Greg

“A premium of $1.28 billion was paid to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008. That amounts to 1 cent on the dollar to Freddie Mac. Imagine if you had a $500,000 mortgage, and you got to settle it for $5,000 —”

I have many questions. First what exactly is the “claim”? Is it physical real estate or fractionalized notes the bank created? And how could Feddie and Fannie settle for that amount?

one word .. RICO, THIS WHAT IT IS MADE FOR!

can shareholders stop this deal?

What I am beginning to realize is we have situations occurring in our fiscal mess that no one knows exactly what the answer to the problem is. Never have we gone through the mess we are in today and it appears that the ones in power are illiterate to the solution, as they were to the cause. One can only question if there will be a benign outcome to this mess or that this cancer will continue to grow until foreign countries force our government to take harse actions if we want our debt covered.

The government allowed banks to grow and cross state lines through deregulation. Until sometime during the 80’s or early 90’s, banks were unable for the most part to cross state lines, which kept them at a size that was small enough to fail. They were also small enough that they knew what they were doing and those analyzing their operations knew what they were doing. Then deregulation occurred and they grew to be “too big to fail”. They also grew too big for those analyzing their fiscal position and portfolios to understand completely what was going on. They failed and then the only option the government had was to bail them out.

Now we have a situation where we need to look at the size and determine if “smaller is better’. If so, is there anyone in a government position smart enough to put together a regulatory package that requires banks to move back to regional in size?

I for one doubt it. I believe nothing substantial will happen with the incoming congress and believe the answer will only come when the country enters into a fiscal crisis due to our debt becoming close to junk status. Wonder what the conversation between the Chinese Premier and Obama will end up being when they discuss matters in DC sometime in late Jan, early Feb?

Just what part of “Too big to fail” do you all fail to understand?

All the assets held by banksters came from somewhere. Among the biggest somewheres are pension and insurance funds. There aren’t enough unencumbered assets available to cover the losses.

The banksters are fortunate in as much as the commoners/consumers have no memory, no financial skills and far too much trust for any and every voice of authority. “Respect your elders/experts.” “Submit to authority.” “We just have to trust those appointed over us.”

Banks were profitable in the 50’s when I opened my first account. What changed? If you don’t know the answer, please re-read the previous paragraph.

The politicians know that the only game in town is rigged against them. If you play by their rules, they will slap a fresh coat of paint on you and channel election campaign funding your way. Pools of money are power. Nobody willingly gives up power. In the case of BofA, we might just call the bail-out what it is; leverage.

Play for us or we will beat you up, steal your lunch money, pants you and run them up the flagpole and never, ever let you play on our team again. You will only get to play with the fat kids, geeks and dorks.

Life is a training exercise. The general public has been trained well. Recall the statement about why we had to retain the very people that got us in this mess? Remember that they are the only ones that understand it and can unwind it? Why would we bite the hand that feeds us another credit card offer?

As goes the families’ finances, so goes the nation’s finances.

And in the words of Dr. Phil, “and how’s that working out for you?”

BOHICA

Bend Over Here It Comes Again. I am going to say this is a non-issue. Simply because it does not matter anymore. They will do what they want, when they want. So what does 50 billion mean in a trillion dollar world. It is nice to be informed but what can you do. One thing is this skat about all of us are in debt to the tune of $45,000.

Next year maybe $60,000. Nice to know that my $45,000 goes to a government grant to explore why the ringtail rat spins on his head, during a solar eclispe. Yet what if the government turned and wanted its money NOW! It’s their money. Call J.D. Wen….. ;0)

I mean they are coming to get it and you better have it. Be an Issue?

Turn in your guns? Take the welfare, unemployment and food stamps away?

Nah, they know better than to do that.

Does that make us The Last Of The Bohicans ? ( sorry, couldn’t resist )

Greg,

So, B of A settlement these claims for cents on the dollar, gave the money to Fannie Mae and now Fannie Mae is stuck with these toxic mortgages?

Assuming the economy doesn’t improve and that more and more people keep going into foreclosure, what exactly is Fannie Mae going to do (now that they have even more toxic mortgages on their books?)

It looks like the problem was simply transferred over from a private company to a public (read: taxpayer funded entity). Is this correct?

Nm,

You are correct.

Greg

Sorry that should read:

So, B of A settled these claims for cents on the dollar, gave the money to Fannie Mae and now Fannie Mae is stuck with these toxic mortgages?

Assuming the economy doesn’t improve and that more and more people keep going into foreclosure, what exactly is Fannie Mae going to do (now that they have even more toxic mortgages on their books?)

It looks like the problem was simply transferred over from a private company to a public (read: taxpayer funded entity). Is this correct?

How does B of A’s settlement resolve the underlying problem?

Greg: keep up the clarity and persistence. Yet, people just don’t seem to get it. It’s like hammering a thin finishing nail into hardwood: no matter how hard you hit the nail on the head, it will bend and slip and do everything in its power to not go in. Please keep pounding away. Even if you manage to sink the nail halfway, it’s better than nothin at all. Thanks. Best of luck, Ken.

Thank you Ken,

Greg

Greg,

It’s obvious that Rick has benefited considerably from the fractional reserve lie of which he was/is a willing contributor… No doubt his face is still in the “financial industries” trough in some way shape or form “earning” his retirement through the bailouts you and I are providing him and those like him… Check his shoes and hair… Both are, without a doubt, big and red, for he is a clown.

I dont know what to make of Vess… He must not have kids or grandkids… I’m more concerned for my 13 year old son than myself and my wife. As a result, inevitable is synonymous with imminent as far as I’m concerned. I guess Vess figures he’ll be gone before inevitable strikes…

And please, Greg, for all that is sacred, never ever quote Maxine Waters as some sort of pillar of light in Washington… I cant believe you mentioned her as an authority on anything other than divisive, partisan self-promotion… Really??? Pointing to her as a “reasonable, studied voice” in the same article with Black and Willie is like mentioning Barry Bonds or Mark McGwire in the same breath as DiMaggio, Williams and Gehrig… It is wrong and should never be done…

Thanks for all you do,

DukeDaddee

Thanks for the comment Duke.

Greg

Obviously Rick knew the fix was in already. Didn’t we all know really. Just because a GSE accepted pennies for fake dollars, it obviously doesn’t mean non government establishments will settle like that at all. It doesn’t really matter anyway, a house of cards is still a house of cards. What it comes down to, I think, is eventually, as stated above, there will come a point in time when no one is going to keep buying these junk treasury bonds. The Fed can only print money and support the government for so long before faith is lost in the dollar, inflation becomes incredibly bad or all these derivitves come home to roost. This is not going to go away, it can only get worse for almost all Americans, less the insiders and the very wealthy and the politicians. Also, the people that are considered the fringe and that question this mess, that are ridiculed as doomsayers, that have prepared themselves and their families, may have a shot a making it through the shift. Just look at oil shoot through the roof as we sit here. Oil set off the last catastrophe. I have a 30 gallon gas tank in my truck, at one point I was inserting my debit card at the pump three times, $50,$50 and to finish off another $20 just to fill up from empty. When that happens again it is game over this time. You can play with the paper work and the numbers all you want but if there is no real wealth then it doesn’t matter. Paper money and debt are not wealth nor can they be converted into wealth. With out real capital the show can not go on. Collapse is inevitable at this point. The question is when?????

James M,

Good question.

Thank you for weighing in.

Greg

Greg our debt is really over $20 Trillion already

Obama’s $6.3 Trillion Scam Is America’s Shame”

snippet..

Look through President Barack Obama’s proposed 2011 budget, and you’ll see a line calling for a $235 million increase in the Justice Department’s funding to fight financial fraud. Lucky for them, the people who wrote the budget can’t be prosecuted for cooking the government’s books.

Whether on Wall Street or in Washington, the biggest frauds often are the perfectly legal ones hidden in broad daylight. And in terms of dollars, it would be hard to top the accounting scam that Obama’s budget wonks are trying to pull off now.

The ploy here is simple. They are keeping Fannie Mae and Freddie Mac off the government’s balance sheet and out of the federal budget, along with their $1.6 trillion of corporate debt and $4.7 trillion of mortgage obligations.

http://www.bloomberg.com/news/2010-02-03/obama-s-6-3-trillion-scam-is-america-s-shame-jonathan-weil.html

CountryHick,

You sound like one smart “Hick.” Thank you.

Greg

‘SETTLEMENT’?????

With no prosecutions, nor arrests for a crime, call it what it is…. THE STATE’S ‘CUT’!!!!!

—-

Hot on the wire, Greg, just minutes ago. The Massachusetts Supreme Court has ruled AGAINST WellsFargo and U.S. Bancorp in the “prove you own the wet note” case.

Pandora’s Box is now blown to smithereens.

ManAboutDallas,

Thank you. The mortgage mess is a giant problem. Few people know the true enormity of this calamity!!

Greg

Manaboutdallas & Greg:

Hasn’t this happened before? A state court rules against the banks and they just lawyer up and keep fighting for years.

Nothing seems to be happening to the banks. They keep getting bailed out by the government, the courts eventually rule in their favor and the cycle continues.

NM,

This was the highest court in Massachusetts. They could fight it higher (Federal) but chances go way down on winning.

Greg