Stealth Austerity Already Hitting the U.S.

Last week, at the G20 meeting in Toronto, there was much discussion about money printing for bailouts and cutbacks for austerity. These were the two main options talked about to deal with the economic malaise facing the globe. The U.S. is firmly in the money printing camp. Europe, on the other hand, is officially taking the cutback and austerity path. Who knows how either will turn out? Phil Davis of Phil’s Stock World sums up the official G20 statement on the meeting this way, “There’s 26 pages of this nonsense but the gist of it is: We promise to keep bailing out the economies but as soon as that’s done then we are right on top of this deficit thing.” (Click here for Phil’s complete article.)

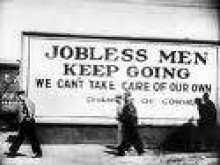

Money printing and austerity are not simply about choosing one or the other. I think both will happen, more or less, at the same time. Like it or not, what I call stealth austerity is already hitting America. Just look at individual state budgets that are covered in red ink. Last Friday, a Bloomberg headline read: “States of Crisis for 46 Governments Facing Greek-Style Deficits.” California alone has a budget shortfall of more than $19 billion, and that does not include the state’s under funded pension liabilities. The Bloomberg story said, “Forty-six states face budget shortfalls that add up to $112 billion for the fiscal year ending next June, according to the Center on Budget and Policy Priorities, a Washington research institution . . . . “States are going to have to cut back spending and raise taxes the same way Greece and Spain are,” says Dean Baker, co- director of the Center for Economic and Policy Research in Washington. “That runs counter to stimulating the economy and will put a big damper on the recovery in the latter half of this year.” (Click here for the complete Bloomberg story.)

Banking analyst Meredith Whitney thinks state deficits are much higher. Recently, on CNBC, she said, “As far as the United States are concerned, Obama has proposed a $50 billion bailout package for the states but the states are underwater $200 billion, so it’s really a drop in the bucket.” All this red ink will lead to layoffs, pay cuts, pension cuts, and cuts to all kinds of programs that help poor people. States cannot print money, and there surely will not be enough federal money to bailout every state.

Census jobs have been a temporary bright spot, largely credited with holding unemployment below the 10% mark. When you take a closer look at this type of employment, a dark picture emerges. For one, census workers do not get benefits. Also, these jobs are being done by people who could not find work anywhere else, and most are being paid less, on average, than their old jobs. The census is in the process of winding down work, and more than 240,000 were fired in June alone. Another 300,000 census workers will be let go in the next few months and will, once again, be without jobs.

There are 1.3 million Americans that are losing their unemployment benefits. A bill to extend emergency pay to the long term unemployed was killed in the Senate last week because fears of the deficit growing too large. (Do you think Senators worry about the little guy as much as the bankers? I think not.) This is money that is almost immediately recycled back into the economy. That money has now been cut off with no additional legislation or real jobs in sight. Millions more will run out of unemployment benefits in the future.

As the ranks of the unemployed swell, so will foreclosures and defaults on all sorts of debt. Here is a story from a Southern California newspaper that came out just a few days ago. The headline read: “Unemployed dumping car leases.” The story said, “The unemployed are walking away from their car leases in droves as more laid-off workers see their jobless benefits cut off, reports Lease Trader.com.” The company said it, “noted the surge in listings coincides with the failure by Congress to approve HB 4213, a bill that would allow extended unemployment benefits through November.” (Click here for the complete story.)

This is what stealth austerity looks like. Pretty soon, it will be uncloaked and brought out into the light of day. When that happens, it will be like the economy taking a nose dive into the deep end of a swimming pool with no water to cushion the plunge.

Leave it to the gov’t to cut spending in all the wrong places.

Thank you Jean.

Greg

Hey Greg,

You wrote:

“This is what stealth austerity looks like. Pretty soon, it will be uncloaked and brought out into the light of day. When that happens, it will be like the economy taking a nose dive into the deep end of a swimming pool with no water to cushion the plunge.”

Are you thinking that austerity will be a bad thing?

Do you think we should keep printing money as gubmint spending will create taxable wealth?

Good article, but I sensed that you don’t want our economy to suffer withdrawals when it is weaned-off the drug called deficit spending.

I KNOW YOU WANT OUR GUBMINT TO LIVE WITHIN ITS MEANS, but your article SEEMED to pine for more druggy-spending.

I am a U6 unemployed person who is working part time as a “rack-diver” (underemployed and can only find part time work). However, I know that millions of gubmint workers and others who receive benefits need to be kicked-off the dole–this will make it harder in the short-term for me to find meaningful work. Higher unemeployment must occur before my chances for meaningful work increase.

Gubmint workers and other welfare recipients must feel my pain for things to get better–it is 8th grade math and simple human nature.

markm

MarkM,

I think we should have let the banks go under. They all should have been taken to receivership. Only depositors should have been protected. My plan would have been a lot cheaper; we would have washed out the debt and not transferred it to the public. I wrote a post months ago called “Default Option.” That route would have been tough, but we’d be on the way to real recovery right now. The point of my article is we are headed for a crash no matter how much the “boyz” chant we are in a “recovery.” I also think it is ironic Congress is cutting UE benefits and still supporting the banks through the Fed and FDIC with multibillion dollar bond back-up programs. (TLGP you can Google the term it is a $300 billion sweet deal for the big banks.) If we are going to cut then let’s give everybody some real pain. I guess my point is we already have austerity no matter how much Obama wants to print money. And by the way, we are still printing lots of money. My beef is the little guy gets none of it. Just the rich are bailed out and are still being bailed out. Overall, I agree with you, we need to stop spending. Thank you for your comment. You are a bright guy who is always welcome here!

Greg

Thanks Greg,

And, I concur with your last post–the ivy-league FOBs get bailed-out for risks that THEY agreed to. I did not sign-on to those risks, yet I have to pay to keep highly-educated rich-people solvent.

markm

Greg,

The current process of monetizing the debt will create hyper inflation. In the history of the world, few governments have tried to “print” money like the USA is now. Think Weimar Republic and 13,333% inflation in about two years (1921 thru end of 1922) and a wheel barrow to buy a loaf of bread or Zimbabwe, who in the early 2000’s kicked out the white farmers and advised the IMF Bankers that they were not going to repay their debt; inflation was estimated in Dec 2008 at 6.5 quindecillion novemdecillion percent (6.5 x 10108%, or 65 followed by 107 zeros). I would have written the number out but it would be several lines of zeros and though I’d spare your readers. Zimbabwe quit printing money as they could not put enough zeros on it. It would take a truck load to buy a loaf of bread.

I hate that all the money was sucked out the economy to bail out Bush and Obama’s banker buddies. I hate that a lot of people are unemployed. However, when you understand that these lost jobs will not be coming back how long should unemployment benefits be extended? There are a few hundred thousand people that will never be employed at the level that they were. But to be honest, we can’t afford to pay for these people until they find work; some will never find work as they are too proud to ask “Do you want fries with that”? While others like myself are older and less attractive to employers. How many years of indentured servitude in the form of über high taxes are we willing to impose upon our children, grandchildren and great grandchildren for a little comfort now? My guess is that most of us are willing to even sell their souls to the devil as long as we can get that extra cup of Starbucks now. The voting Sheeple of America care not. They want more benefits now and are willing to allow someone else to pay for it. What are these selfish parasites on future generations going if the system crashes in our life time? Well…I’d advise some firearms, ammo and shooting classes with your gold and silver purchases. People that feel “Entitled” will easily justify taking your stuffing.

I think that we are economically past the point of no return but we can control the speed at which we slam into the ground. Unless we cut spending our impact will be earth shaking but beware; cuts in government spending slow down the economy. At this point, we’re damned if we do and damned if we don’t. Personally, I’d rather damn myself than future generations. After all, we kept these bozos in power and ALLOWED them to get us in this mess.

Peace

George,

I think what you are really saying to buy physical AU and AG. Thank you for taking the time to write this well thought out comment.

Greg

and food, water and guns and ammo…oh and a good security door, maybe a vault, and a generator 😉 and don’t forget the training. Nothing is worse than having a hand tool that you don’t know how to use. ;-(

Maybe some think that’s silly. I think the only way to hold Gold or Silver is in bullion coins and not in some storage facility. My concern is that when things get bad and I have to start using Gold or silver coins, what is crime going to look like? If things go really wrong, the police, firefighters and ambulances are going to be unreliable. If not them, then all the people that were getting some form of government payments are not going to be happy that they can’t buy a loaf of bread with their welfare check. Granted that is a worst case scenario but if we go back to commodity money [gold and silver], I think we are talking anarchy. Just my opinion and I hope I’m wrong.

George,

I hope you are wrong too but I am afraid you are not. Thank you.

Greg

Hey George,

Way to go BUDDY!

You are so right about the possible upcoming nastiness that we have wrought. Our relatives, friends, neighbors, and co-workers voted for this crap. They don’t understand eigth grade math.

I was in the woods plinking again with my wife. Slowly, she is getting tuned-up on gun handling. I am hoping she will be ready for the unrest that MAY result.

Thanks for the good read.

Have you read Krugman lately?

http://www.theglobeandmail.com/globe-investor/markets/markets-blog/krugman-a-depression-is-coming/article1621377/

markm

Hey George,

Would you mind if I come over to your place when it hits the fan?

Don’t worry George, I’m going to do fine on myself. All the writing is on the wall for I read countless articles on this financial mess each day. For years I have been warning others only to fall on deaf ears. My parents lived in the Great Depression so I have first hand stories of what it would be like, and it’s not good. My Dad always said there is money to be made if you choose and to never turn your back on hard work. Our New Generation should heed these words.

I feel that America has lost its way. Being a nation that has always took pride in helping others,we now support them and even encourage them to seek assistance. We can not pull ourselves up by our bootstraps for we have sold our boots for security. The same way Rome, who placated the Huns, only to have them ransack the city in the end.

So as our Congress plays the role of the Roman Senate which pays the Pleatorian Guard (bankers) for protection, will soon find the Hun (depression) at our walls.

Those that hide in their ivory towers, in fortified citadels, expounding the philosophy to “let them eat cake” will find themselves besieged by a sea of rage.

We can all find Hope if we prepare for what lies ahead. Get out of debt. Stay out of Debt. Put something away for a rainy day. Vote in November. Not just along party lines but for the one who will do it.

If you have to have me spell it out, then all is truly lost if your reading this.

Hang in there, George.

Slingshot———————@

Greg,

I love your insight & analysis on all of the topics you present but please use the correct wording for your blogs.

“There are 1.3 million Americans that are losing “there” unemployment benefits.”

The correct spelling would be “their” not “there”.

Sorry to nitpick.

Keep up the great work.

God Bless.

Thanks James.

Greg

You’ve got to be cruel to be kind, in the right measure.

Frankie, Thanks.

Greg

No such thing as too big to fail!!!! “let the bodies hit the floor!!!”

Thanks Dino,

Greg

List of Obama campaign contributors in order:

1. University of California $1,591,395

2. Goldman Sachs $994,795

3. Harvard University $854,747

4. Microsoft Corp $833,617

5. Google Inc $803,436

6. Citigroup Inc $701,290

7. JPMorgan Chase & Co $695,132

8. Time Warner $590,084

9. Sidley Austin LLP $588,598

10. Stanford University $586,557

11. National Amusements Inc $551,683

12. UBS AG $543,219

13. Wilmerhale Llp $542,618

14. Skadden, Arps et al $530,839

15. IBM Corp $528,822

16. Columbia University $528,302

17. Morgan Stanley $514,881

An awful lot of commercial and investment banks on there. I don’t see “Joe Unemployed” on this list so I am guessing he will continue to reward his “investors” with bailouts and useless reform while shouldering the taxpayer with the liabilities of their risky investments. This certainly sounds like our own “Road to Serfdom”.

Stephen

Stephen,

Thia is good stuff man!!

Greg

Please allow me to jump back on the soapbox.

George touched upon the subject of urber taxes and I am about flamed out about it. My property tax is going up. A 10% increase for my electic in October. Our Transportation Authority is adding 5 cents more gas tax on top of an existing 6 cents. Driver’s license and vehicle registration has doubled in cost. Have to buy a fishing lic. where it was free to fish from shore. Hunting lic. is another $5.00.

We used to park at the beach for free, Nope! That’s another $5.00. On the news they were talking about all the fat in food. How about a FAT TAX for meals that exceed so many grams of fat in the future. We managed to get rid of the toll booths to clean the air. They might be coming back. And a $75 garbage tax to boot. If you are into precious metals, the premiums are getting higher. Congress is still considering a Value Added Tax and then tax you again when you sell. Just what are you going to have left if you are on a fixed income and inflation eats away at your purchasing power. How much interest do you get on your savings and checking account after being bittened by banking fees. What the IRS don’t take, State and Local Government will.

To add insult to injury. How many of you friends are unemployed or face downsizing in their industry. How many store fronts are vacant in your Town Centers and the existing ones that have floundered in the first year due to high rental fees and marginal income. Our rescue missions and food banks are stressed out trying to feed and shelter the homeless. Families are living in the woods and tent cities in ever increasing numbers. The new soup lines are the unemployed and welfare recipients with EBT cards. Out of sight,out of mind.

What is happening in your neck of the woods?

Slingshot—————–@

Thank you Skingshot.

Greg

Being two years away from S.S. I would give it up but they would just give it to someone who never broke a sweat, maybe a broke banker. I could still get by without S.S. because I live within my means for 40 years. Because I didn’t buy boats, motorcycles and fancy pants I can sit on my land and grow potatoes. I also don’t mine paying my health ins. but because others don’t pay for their own, mine cost more then it should. This country has change from sweaty workers to something I don’t understand. HAY KID PUT THE PHONE DOWN LETS GET SOME WORK DONE. also there’s so many rules an laws you can’t make a move without breaking a rule. It’s time to grow up like the folks in the 30’s . BRING THE TROOPS HOME

Bob, You are a good man! Thank you.

Greg

Without restraint, Money has one pure goal, more. Assuming that, the consolidation of wealth is accelerating and the human collateral damage will be collosal.

Those who read George’s survival tips and shook off the inference fail to connect the dots. That type of failure is another reason why we face this mess…. people don’t see the umbrella footprint of their actions until in hits them personally. And in this country, they never look in the mirror when pointing fingers.

I think that as wealth consolidation moves up the financial food chain ladder, upper middle class who always voted for Money are finding themselves not immune to Money’s eternal hunger.

One thing I would add George to your list…. water.