Little Growth Means Big Trouble

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

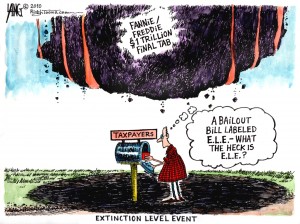

Second quarter GDP growth numbers were revised down last week to a paltry 1.6% from 2.4%. Wall Street celebrated because some were expecting “growth” to be revised even lower. The stock market shot up on this news, but should everyone feel relieved because the U.S. got at least some growth? Consider this–we paid dearly for that 1.6% growth. If you add up what was spent on TARP, the stimulus bill, nearly $2 trillion spent by the Fed buying mortgage backed securities and Treasuries and all commitments to Fannie, Freddie, FHA and the FDIC, you come up with a total of about $3.7 trillion. This is what it cost to support the U.S. financial system according to Neil Barofsky, the Special Inspector General for the Troubled Asset Relief Program. (Click here for more on this story.)

To me, spending or committing $3.7 trillion to the American economy and getting just 1.6% growth is frightening. Expert trader Dan Norcini had a very sarcastic take on this subject in a recent post at JSMineset.com. He said, “The fact that it has taken gazillions of conjured-into-existence-out-of-no-where dollars (some call that stimulus) to produce this pitiful growth rate number for the quarter, seems to have escaped the attention of the equity perma bulls who have yet to come to grips with the consequences of all of this. My own view is that it should be a relatively easy matter to get that growth rate up to double the figure given us. All we would need to do to get to 3.2% growth rate is to print twice the number of Dollars and double the rate of government indebtedness.” (Click here to read Norcini’s entire article.)

To John Williams of shadowstats.com, anemic growth was not a surprise. In an interview yesterday, Williams told me, “The money that was spent just went to support the banking system to help prevent a systemic collapse. They have prevented a collapse, that’s a big plus. . . . It was not designed to stimulate the economy. It was designed to prevent a systemic collapse.” We did get some stimulus from the home buyers tax credit and cash for clunkers. That’s now gone, and it probably robbed sales of cars and houses from the future.

So where does that leave us? We just had dismal numbers reported on jobs, housing and GDP. Does that mean we are at a bottom? Not a chance. If we really were in this so called recovery, wouldn’t we have much stronger growth? Sure we would, and the Fed also knows there is something very wrong. It recently announced it would spend at least $10 billion a month buying Treasuries. The Fed also suggested it would act to keep the economy from sliding further. That doesn’t sound like a recovery to me. It sounds like further money printing is in the cards as the economy continues to falter.

Williams predicts the banks are going to need another “bailout.” He also told me, next year holds a “particularly high risk for a major systemic disorder, a heavy sell off of the U.S. dollar and early stages of hyperinflation.” He also thinks the stock market is “irrational, unstable and terribly dangerous.”

In my interview, I asked Williams where people should invest money for safety. He would not give specific asset categories, but he did say, “You want to be in hard assets that will retain their value against inflation.”

That sounds to me like a warning to lighten up on the stock market and buy things such as silver and gold coins. If nothing else, be conservative and protect yourself from the downside risk. It appears the economy is set for another slide.

Another honest article. Bravo. I’m worried and concerned. After tonights prime time from The Red House I can read into everything he said based on track record. SPEND SPEND SPEND

In the next couple weeks the above ground silver reserve will drop below 9,000,000,000 ounces. It is a sad day in my home that we will celebrate that day and watch it happen at usdebt.org. When it drops below I will kiss my wife and give her a hug. Than we will turn and I will probably come back here so i do not get caught like most Americans will as they hurry about their lives

p.s. J.P. M keep shorting I’m playing the game. I’d rather be working hard and dreaming but you will not allow that. So we are going without so you do not take what is ours. We are going without so we can play the game. Just remember one thing. When you need us we will play the fool till we see 300+ and than we still will not be home. KEEP SHORTING there will BE NO bailout. Time to deal with the people and the people aint happy boss man.

God Bless Dog

Thank you Patriot!

Greg

I see the economic picture a little differently than many in the CNBC world. The “Economy” is different than than the “Real Economy”. The “Economy” is wall street and the mega-financial elites and the “Real economy” is street-level you and I. The economy (wall street and the financials) are in an inflationary mode. They are flush with cash. The real economy is in a deflationary mode. We are bleeding to death economically speaking. The bailout money went to the “Economy” while the “Real Economy” was saddled with that debt burden. Wealth, in the form of debt, was transferred to the elites. The elites are clamouring for more but there is the problem with the parasites killing the host. Killing the host taxpayer is the worst thing the parasite elite can do.

Jimbo,

I like the way you think! Thank you for the comment.

Greg

Hey Jimbo,

+10 on that post!

You and I think alike on this issue.

markm

This is a GREAT comment. Said very well in my opinion. It appears as if there is a money grab. The question as to why remains to be answered. I have several opinions but they will stray HARD away from this blog. The money GRAB is so obvious that if the media would report THE NEWS I believe it would be a different day in America.

You know I have thought this but never said it aloud. “If the media would report the NEWS instead reporting their self interest it would be A NEW DAY in AMERICA.

The selfishness my country represents is devistating. Built on CHRISTIANS morals and we can’t even do the right thing. I guess all this getting religion out of the public square still needs some time like the Obama destruction term.

Greg,

It clearly shows that for the mainstream media, “truth” must be denied and only the “lie” and “myth” exists and thus propogated. The media must already know the facts but they just cannot report. Economic, fiscal and financial fundamentals cannot be altered or changed but can be twisted via spinning and Management of Perspective Economics (MOPE). People like you, Jim Sinclair, Monty Guild etc. speak the “truth”. Keep up the good work.

Pat

Pat,

Thank you for the comment and support!!!

Greg

Pat awesome comment. Just replied to someone above you before reading your comment. Thanks for Jim and Monty, If they are even half way close to the Dog I appreciate it. It is super tough to get good inforamtion and dig out the Patriots.

Both political parties are misrepresenting the soon-to-run-its-course stimulus enacted in early 2009. Republicans are in hunker down denial mode claiming it hasn’t done anything. Democrats are frothing at the mouth about how much good it has done. Both sides ignore the basics. Government, especially one that has outsourced monetary policy, cannot end a recession by fiscal policy alone. A stimulus program cannot lift a damaged economy out of its doldrums. It can prime the pump, and in that regard the 2009 stimulus package has done a pretty good job. What we need now is for the private sector to grab the pump handle and get busy. Since that is not happening, the obvious question is why – why hasn’t the private sector capitalized on the momentum created by the stimulus? Their answer has been FUD – fear, uncertainty, and doubt. I see another possible answer – politics of the dirtiest and ugliest form.

First is the politics of the banksters holding out for the kind of bailout they wanted in the first place, a government buyout of the toxic assets that continue to haunt their balance sheets. Second is the politics of groups like the USCOC, BRT, et al who have apparently struck deals at meetings with Republican leaders earlier this year for rapid implementation of their legislative agenda should the GOP take over the legislative branch in exchange for slow-walking any recovery.

The effects of any stimulus program don’t last very long, as we are already seeing. My advice to the private sector comes in 2 parts: Stop firing your own customers (and wondering why nobody is spending). Listen to the old Kingston Trio song, Desert Pete, and start pumping.

Ken,

Thank you for posting this comment. It is a good one!!!

Greg

People I have the solution….I don’t see why the gubmint wont just rob social security and medicare, put a 40% tax on EVERYONES paycheck, and then tax every single thing you buy with what’s left of that paycheck, tax everything like cigarretes and gas heavily and even tax inheritences and bonuses!!! Oh wait…

BLT,

I see your humor. Thank you.

Greg

Keep up the good work Greg. Perhaps, given the nature of the system we are in, major elements of the bailout were necessary to avoid systemic collapse, as John Williams says. However, it is plain that neither party is prepared to deal with the Too Big to Fail situation. FinReg only takes us further down that road.

While I agree with some of the elements of previous repliers above, it must be recognized that no amount of Pump Priming is going to work in the long run if we do not deal with the debt situation.

Any debt contracted by individuals, corporations or governments is effectively current consumption at the expense of future consumption overlain by the debt service costs. If the expenditure was not for an investment with the capability of “self-liquidating”, ie generating sufficient revenue to pay back the borrowing, with interest, then it is generally a bad thing. Cash for Clunkers, house purchase incentives, etc., simply steal economic activity from the future, reducing the activity in the future (as you noted) and imposing the debt service costs. Needless to say, war-making is about the worst case spending activity, and this expenditure (on plus off budget) amounts to about half of total government revenues at this time.

I am afraid we are not going to turn this thing around in time, so it will be necessary to do as Williams advises and prepare for inflation.

Cheers,

GS

Thank you GS.

Greg

WOW Greg you challenge me and I like. Have to comb back and forth and to and froe to put it together because of the massive information. it is comments like this that makes me smarter.

You could of wrote a book on what you just siad. Example: Cars for clunkers! My travels and circles bring me around the auto collission and custom car business. Cash for clunckers created all kinds of craziness just within the two industries stated above. example: return policies on parts especially within the auto makers changed drastically.

Great article-Thanks!

I have a minor suggestion, though. Is there some way You could add an option for increasing the size of the type for easier reading?

Chris,

So sorry but I am stuck with the format I have. If there is an upgrade I will consider.

Greg

id rather see e-mails reminders of replys. Lots of smart people here Id like to pick

I refuse to blame the government for all the problem. Even the citizenry refuse to conform to the concept of “Pay-as-you-go.” We, collectively, fund purchasing of goods and services on speculation of brighter tomorrows.

Nothing will change until we start funding on “the bird in the hand” basis.

I won’t hold my breathe.

OTE,

I agree.

Greg

Great article Greg! Here is what I never hear anyone talk about. It’s how housing made up 20% of GDP leading up to the crash and roughly 80% of that is now GONE. The numbers were 1.2 Million to 1.4 Million new homes sold per year and now we only produce a little over 250,000 per year. So if my math is correct that reflects a 15% drop (or more) in GDP. FIFTEEN PERCENT! Somehow the government has been able to magically keep that drop out of the GDP numbers up to this point. I’m certain they count refinancing of homes as GDP now as if it were a new home, which helps fluff the numbers. But, funny how that doesn’t create any jobs or tax revenue. I guess that helps along with all the gazillions of conjured-into-existence-out-of-no-where stimulus dollars and make up the new GDP. I would be willing to bet they count the treasury selling bonds to banks as GDP, even though we all know the banks are borrowing (wink wink) money from the Fed at zero percent interest to buy them. I wonder what the real GDP is once you strip out all the BS?

Thanks again and keep up the good work.

David H,

Economist John Williams just told me the government’s GDP numbers are “worthless.” Now I can see why. Good stuff man!!

Greg

I guess so much for Recovery Summer. Who’da thunk that trying to borrow and spend your way out of a debt-induced depression would provide such dismal results? How could those White House wiz-kids like Geithner, Summers, and Krugman have foreseen this, they don’t have crystal balls? And who could argue with the sheer genius that the reason none of it has worked is because it simply wasn’t big enough?

Until these freakin’ bozo’s in Washington realize that you cannot fix deep-rooted economic problems with smoke, mirrors, and Monopoly money, we’re going to be in this mess. Even if they do figure it out, its probably too late anyway. Be prepared!

Greg, another good article, keep up the good work! At least no one can say you didn’t warn them.

Thank you William.

Greg

How can growth occur in the vacuum we have created by exporting our industries and refuse to use the vast wealth of this countries natural resources? We are no longer create wealth for the nation, but transfer wealth via service sector jobs that create nothing of lasting value.

We see warning signs all around, yet like some of the citizens of New Orleans before hurricane Katrina we don’t want to see them. They saw the size of the storm on their TV’s but could not imagine how bad it would be, the storm surge and the levees crumbling.

Too many expected the government to come to the rescue. They were sadly disappoited. I get the feeling the government is totally going to fail the American people again.

Good point Jan.

Greg

Excellent article! Hard assets NOT tied to credit is the ticket for survival. So glad I’ve been loading up on Scottsdale silver stacker bars this summer. Silver is a nice hedge and a great thing to have in the event hyper-inflation hits. Err—- when it hits. Best to all that are paying attention….thanks again Greg!

Thom R,

I think that was what Economist John Williams was talking about. Thank you for the comment.

Greg

Greg, readers of your site need to read this article by Deepcaster at http://www.goldseek.com posted on Sept 1,2010,titled “Velocity-Armageddon Antidotes,& Just Say “No” to 401K & IRA Confiscation”. What the gov is up to is pure theif! Hope this helps to keep Americans informed what the fed run gov is up to!

Thank you Mickey S.

Greg