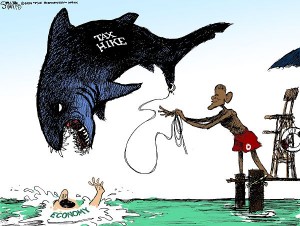

Backdoor Tax Hike

Guest Writer for Greg Hunter’s USAWatchdog.com

I love working in talk radio; the audience is so smart it’s scary.

President Obama’s 2010 budget had just been released, when, at the conclusion of a broadcast, a passionate caller named Madeline told me about the backdoor tax increase contained in our nation’s financial plan.

“I’m a professional economist,” she said. “The Bush tax cuts from 2001 are set to expire at the end of this year. Taxes are going to increase for most Americans, not just the so-called ‘rich.’ Brian, can I email you a breakdown of the numbers? You’ve got contacts—you’ve got to get this stuff out to as many people as possible so we can stop this budget from going forward.”

Madeline is right-on. The Bush administration’s Economic Growth and Tax Relief Reconciliation Act of 2001 lowered individual tax rates, slashed taxes on capital gains and dividends, and steadily scaled back the estate tax to zero this year.

If the provisions are allowed to expire on December 31, the top-tier personal income tax rate will rise to 39.6 percent from 35 percent. However, lower-income families will pay more as well: the 25 percent tax bracket will revert back to 28 percent; the 28 percent bracket will increase to 31 percent; and the 33 percent bracket will increase to 36 percent. The special 10 percent bracket is eliminated.

Investors will pay more on their earnings next year as well, with the tax on dividends jumping to 39.6 percent from 15 percent and the capital-gains tax increasing to 20 percent from 15 percent.

Madeline promptly followed through with the email. Here’s what she wrote:

On Tuesday, January 26, 2010, the Congressional Budget Office (CBO) released their revised budget forecast for the next decade. What was peculiar in their analysis was that beginning in 2011, federal revenue takes a gargantuan leap of $500 billion, or almost 25% of current federal revenue from all sources, individual and corporate. As a result, budget deficits are projected to decline proportionately. When you read the details of the CBO report, however, the spectacular increase in revenue is almost entirely due to the expiring provisions of the Bush tax cuts.

Details of the discussion can be found in the following CBO document starting at page 75: http://www.cbo.gov/ftpdocs/108xx/doc10871/01-26-Outlook.pdf

If the Bush tax cuts expire and there are no changes to the Alternative Minimum Tax (AMT), the CBO projects that revenue for fiscal year 2011 (beginning October 2010) will jump from $2.18 trillion to $2.68 trillion.

The CBO also unrealistically projects that revenues are expected to grow faster than GDP in 2011 and 2012 because strong economic growth usually translates into rapidly rising wages and salaries and rapidly appreciating assets. Also, the recession led to a temporary acceleration of tax payments because taxpayers were slow to adjust withholdings as liabilities fell. Payments in 2011 and 2012 should return to normal. Finally, the unexplained recent weakness in taxes will gradually reverse. All of the above sound good on paper, but are by no means guaranteed.

The CBO projects that federal revenues will rebound sharply relative to GDP in 2011 due to a sharp increase in individual income tax revenues. Individual income tax receipts account for four-fifths of the projected increase in total revenues relative to GDP over the next 10 years. Almost half of the increase in those receipts will come from the expiration of a host of tax provisions. The other half will come from a projected healthy economic recovery.

Individual income tax receipts are expected to surge by 33% in 2011 and an additional 14% in 2012.

Expiration of higher exemption amounts for the AMT in 2010 will raise tax receipts by capturing an additional 27 million Americans who will be subject to increased tax liabilities. To put that number of Americans in perspective, currently only 4 million taxpayers are subject to the AMT. Tax receipts from the AMT are expected to rise from $40 billion in 2010 to $103 billion in 2011.

The expiration of the Bush tax cuts will increase receipts due to tax increases on ordinary income, capital gains, and dividends, as well as a contraction of the tax brackets and standard deductions for joint filers to less than twice those for single taxpayers. In addition, there will be a smaller child tax credit and the end of the Making Work Pay tax credit.

The CBO document makes for interesting reading, not for what it says, but for what lurks in between the lines. If the Republicans seize on the opportunity to thwart the biggest tax increases in recent history NOW, they can possibly save the American public from crushing taxation and stymie economic growth.

In Madeline’s on-the-air remarks she rightly stated that the 2010 election cycle can stop this backdoor tax madness, if true conservatives are elected and take back the House and Senate.

This is critical. In 2011, the next congress can vote to immediately retroactively extend the Bush tax cuts. Then, hopefully, Obama will decide that being a one-termer is not in his legacy’s best interest, and he (and the rest of the slapped-upside-the-head Democrats) will be forced to deal with the ballooning deficit, rather than sweep it under the rug.

By the way, Madeline also noted that if the tax increases are blocked and expenses not curtailed, the deficit will balloon to $1.48 trillion in 2011, not $980 billion as currently estimated.

The last thing the American taxpayer needs is a huge tax increase. The government must cut expenditures for the United States to survive and prosper.

Brian Sussman hosts the top morning radio talk show in the San Francisco Bay Area on KSFO-560AM. His book, “Climategate: A Veteran Meteorologist Exposes The Global Warming Scam,” will be released April 22.

Ah, so the plan is to revert to the tax rates of the Clinton years. You remember those. Eight years of prosperity and relative peace that resulted in balanced budgets and a budget surplus.

We will probably get caught in the AMT, again. I’m certain our tax planner will tell us what we need to do to adjust and we will.

I guess the difference between Mr. Sussman and me is I think America is worth the price. Why doesn’t he?

Brad,

All views are appreciated on USAWatchdog. Thank you for your observations.

Greg

Ahh yes the Clinton years. Clinton road the surf of the computer age. Without every family in America buting a computer, monitor, wireless mouse, inter net service Clinton would of been another liberal. Liberlas believe the World loves us more with Progressives in the White House. Remember all the Europeans cheering Obama or was it free beer they were cheering.

Under Clintons watch derivatives, Fannie & Freddie Mac and bad lending practices visa vi government fines lead to our destruction. There is actually video of Clinton himself saying “he told liberals they needed to back off.”

Under Clintons watch we were attacked multiple times all the while he was under his desk with interns. Not only was this guy asleep at the wheel but reduced our military by 50%.

The only thing Clinton did well was minimize his additions to our national debt. He did not leave the national debt at zero like you sheep believe. He added to the debt regardless of what you are told or want to believe.

p.s Clinton NEVER reduced the NATIONAL DEBT. Would you like to see the facts?

balanced budgets and a budget surplus.????????

Patriot,

There is plenty of blame to go around to both parties.

Greg

Thre is plenty of blame to around but it starts with our government on both sides of the isle

Another platform for a right wing media nut one sided view of how the world works. The right is always right and the left is always wrong. If the right does it its OK if the left does the same thing they are evil.

Thanks for driving me from being a conservative to a centrist. I am an old KSFO listener and caller. I was there when they changed formats to talk and it used to be fun.

I used to call into Rush when he was broadcasting out of Sacramento before he went national. He moved from the center-right to the far far right. Ever wonder why his theme song is from The Pretenders?

He is an actor making money feeding the advanced polarization and decay of our society just like you. He is a lobbyist of the right, just like you are. You guys lobby for your pocketbooks not the good of the nation.

Rational thought is not one-sided thought.

I have to say that your crowd is part of the problem not the solution. You have helped to polarize society with this one side fits all problems approach.

I cant stand to listen to you guys anymore. I am now a “drive by” listener. I listen just for a few moments, That is all I can take.

Did Bush cut spending when he cut taxes? Has any Republican President ever cut spending to go along with cuts in taxes? Tarp was a Bush creation.

Our problems extend way beyond taxes. Can taxes be cut and spending increased? Isn’t that why we don’t see the old gold and silver certificates in circulation anymore? That is allow the government to borrow and spend endlessly without tying currency to things of value.

We tie our currency to bonds we create and pay interest on that cause our bonds to decline in value as we flood the market with them when borrowing increases.

How do we make the bonds more valuable? Increase the interest rate that the taxpayers pay on the bonds to fund the borrowing which in turn leads to more borrowing and lessens the ability to fund Government operations which in turns leads to higher taxes, more borrowing or a combination of both.

Its all about fiat money and securities tied to nothing of value. Its about spending endlessly without enough income. Its about excessive military obligations and a government always scheming and grabbing to extend its reach and influence.

Have you guys on the right ever talked about cutting our military obligations? NO not ever. Its always about cutting entitlements and never the military. As a VET I can tell you that both need to be cut. The DOD three letter police state mentality needs to be reduced just as much if not more than the entitlement mentality.

Jim Bunning was right to take a stand. When are we going to pay for our programs? How did he become the enemy? He should be the hero in that small struggle for sanity.

Do I like paying taxes or do I want to live in a failed state where I have to duck bullets every time I walk out the door?

Its time for someone to stand up and govern from the middle and not the far right or left. Try defining the term “govern”.

By the way, during that period of crushing taxation you mention times were generally pretty good for all of us. Continued borrowing to fund our overextended obligations will be our demise, not the end of the Bush tax cuts.

DTravers,

All points of view are encouraged and welcomed here. Thank you for weighing in.

Greg

Hey DTravers,

Back in the 70’s I identified myself as a conservative and served as an assistant press secretary to former Canadian Prime Minister Brian Mulroney.

Back then, it seemed to me that conservatives were the party of the little guy. It was after all, conservatives who supported Lyndon Johnson and passed the Voting Rights Act. It was conservatives who advocated fiscal integrity and balanced budgets.

My Mom, who’s favorite coffee mug was emblazoned with “Dyed in the wool true blue conservative” and for years recycled a “Go with Goldwater” litter bag in her car. Well she once said, “The worst thing that can happen to any country is wake up one day and find its leader is a reformed drunk who found religion.” Enter George W. Bush.

I didn’t question conservatives much until Reagan passed civil asset forfeiture as part of the war on drugs. That law, upheld by SCOTUS violates our basic belief of hang ’em after a fair trial. About the same time I was being considered for membership in Rotary Club of Bel Air, Ca. Frankly, after meeting the guys I wondered if they wore pointed hats when the sun when down.

In the late 1980’s early 90’s I still listened to Rush, more for his sense of humor than out of agreement. Today he sounds like a mean and very bitter old man compared to back in the day.

My questioning of conservatives continued and in the 1990’s I began identify more with liberals as the party of little guy. I was becoming concerned about economic bias in the system. The rise of corporate power and influence.

Then an amazing thing happened. A slick hick from Arkansas won the Presidency, raised taxes in a recession, reduced the deficit and pulled us out of the Bush economic downturn. At the same time another great fiscal conservative, Jean Chretien in Canada and his Liberal Party balanced the budget and by the near end of term the CDN loonie was nearly at par with the USD.

Then in 1996, I understood what the accounting rule changes in the Republican Contract with America would bring. It was no surprise to me when Enron and Worldcom crap the fan. In 1999 before the dot.com crash I got out of the stock market and have remained out ever since.

When Clinton bent over and deregulated Wall Street, the Republicans saw that Monica Lewinsky was a better issue than China’s political contributions, I supported Ralph Nadar in 2000.

Ronald Reagan once said he didn’t leave the Democrats, they left him. Well my fellow traveler DTravers, I feel exactly the same about Republicans and conservatives.

Hey Brian,

I had the headphones on listening to your show while reading your article. GOOD ARTICLE!

However, your article did not mention the affects of human nature on government revenue. The CBO always uses “static” analysis when calculating the increase in revenue that is caused by increased taxation and fees. History proves that people change their actions to legally avoid or postpone paying taxes.

“If you want an activity to decrease or stop, tax it.” That cliche has a measure of truth to it.

The “backdoor tax increases” will cause more economic stagnation as people adjust their activities to postpone the payment of taxes. Economies don’t react well to regulation and tax changes. Further displacements will occur. If static scoring works this time, and increased revenues result, our economy will still suffer — Keynes was wrong as governemnt spending does not create taxable wealth!

The PIGS and California are examples of what happens when a government uses the revenue models mentioned above and in your article.

markm

You can’t have nine years of war an not pay for it. After the Vietnam war we had big inflation,and jobs were hard to come by. War is just like a gold rush, the store owners get all gold.

Bob,

I have always said if the wars were such a national security issue, we all should have paid for them. The only people who have been suffering and sacrificing are the men and women of the armed forces. The bill is coming due, and we will all do some paying and suffering now. Thank you for your comment.

Greg

Ain’t that the truth Greg. On and shortly after 9/11 friends in both Canada and the USA asked what we should do. I suggested donate blood.

As we all remember, it seemed as though this nation rose with one voice and asked the President what we should do. We were told, “Go shopping.”

That from the man who stood on the rubble of the WTC and proclaimed, “The people who did this will hear from all of us soon.”

And just look were “Go shopping” has brought us.

As you know I’m a dual citizen, US/Canada. Sometimes I get so mad that I intentionally use bad grammar.

Greg,

I just checked my paystub. I am currently paying 10% in federal taxes. It states above that the 10% bracket will be eliminated. Does this mean that my tax bracket will increase to 28%??? That is almost triple. I can’t pay that.

I hope I’m reading this wrong.

Barb

Barb,

Don’t freak out. It does not mean that.

Greg

Barb,

the withholding of taxes on your paystub is not what you actually pay in taxes. go by the line on your tax return that says “Tax”, as on line 44 on the standard form 1040 of 2008. In my mind, your real effective tax rate is that # divided by ALL of your income. Anything that reduces your gross income, ie. deductions, is a way of reducing the percentage of your income you actually pay the government. When you do this it puts a whole different perspective on it. And it is why everybody tries to use as many deductions and credits as they can!!

Sandy

Oh goodie, we’re going back to the Clinton years, when taxes were higher! But, did this mean prosperity for all? Hardly!

I seem to recall during that time when things were terrible. When the Republicans took control of Congress, many of Clinton’s wacky schemes were trampled to the ground. It was because of the Republican Congress that many people had it good.

However, it was also a time when government lying was at its apogee. Unemployment “numbers” were at 5%, real numbers were at 11%. If you were a White male you had a rotten time getting a job with all the liberal reverse discrimination (I should know, I STARVED during the Clinton years). Today, we are told that unemployment is at 9.5%, although this too is a lie, as many unfortunates have been dropped from the rolls, and like the Clinton years, these poor people are “out of sight, out of mind.” Those who are counted as “employed” are working part-time (often temporary), at jobs that they are WAY overqualified for. Like the Clinton years, those working two part-time jobs are counted as TWO people employed, not one. Conversely, those who’ve had it with economic ups and downs and who have started their own businesses are not counted as “employed,” in fact, they are not counted at all! No wonder this “president” is anti-small business, he does not even know all the small businesses that are out there, as not all have been counted as such!

Added to the higher Federal taxes are new and more destructive state taxes. Governors, their eye on the next elections, try to please all by trying to keep the “benefits” gravy train running, even though this train has as passengers unionized government “workers,” and minorities who receive these “benefits.” The average taxpayer is forced to subsidize these drones. State governors and state legislators do not have the internal fortitude to not only cancel the “benefits” gravy train, but to also tear up the track!

As usual politicians and bureaucrats, playing the class warfare game, are only too happy to tax the heck out of the “rich” small businesses – forgetting that the small business can pack up and head for sunnier climes, leaving a wake of unemployed people behind. Although often enough a small business cannot move operations to a foreign country like a larger business can, a small business can head for another state – one where state government is only too happy to lavish TLC on another taxpayer and employer.

When does all this “tax and spend” end? When parents take a more active part in their childrens education – when these children are educated enough that they need to vote for politicians who stand for the Constitution – and not for some liar who practices class warfare, and who is more than happy to open the public treasury to their cronies.

Awesome article, kudos!