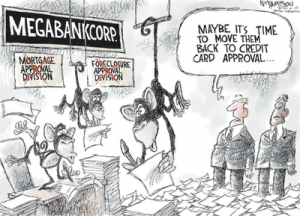

Bank Shot

What a week for real estate! The mortgage document fraud investigation kicked into high gear with all 50 state attorneys general opening investigations. There are calls for criminal investigations, and trial attorneys smell blood over allegations of fraud many say will be easy to prove. On top of that, many investors and pension funds are getting ready to sue the big banks over big losses. Allegations include everything from sloppy record keeping to fraudulent mortgage backed securities. The problem is sure to cost trillions for the big banks who might be forced to buy back the crooked securities they sold. What a mess! Think you won’t be affected?–think again. Before it is over, the whole country will be changed, and for many, life will be much harder to live. Published author, James Howard Kunstler, gives his overview on how we got into this monster of a mess and how most in government did not even notice the huge problems until recently. His view of the future is bleak, but it is said “to be forewarned is to be forearmed.” Enjoy the post below written this week by Mr. Kunstler. –Greg Hunter–

What a week for real estate! The mortgage document fraud investigation kicked into high gear with all 50 state attorneys general opening investigations. There are calls for criminal investigations, and trial attorneys smell blood over allegations of fraud many say will be easy to prove. On top of that, many investors and pension funds are getting ready to sue the big banks over big losses. Allegations include everything from sloppy record keeping to fraudulent mortgage backed securities. The problem is sure to cost trillions for the big banks who might be forced to buy back the crooked securities they sold. What a mess! Think you won’t be affected?–think again. Before it is over, the whole country will be changed, and for many, life will be much harder to live. Published author, James Howard Kunstler, gives his overview on how we got into this monster of a mess and how most in government did not even notice the huge problems until recently. His view of the future is bleak, but it is said “to be forewarned is to be forearmed.” Enjoy the post below written this week by Mr. Kunstler. –Greg Hunter–

——————————————————————–

By James Howard Kunstler

Guest writer for Greg Hunter’s USAWatchdog.com

The banking authorities were shocked – shocked – to discover last week that an awful lot of mortgage paper in this country is not quite in order… appears to contain, er, irregularities… seems less than kosher… frankly, exudes an odor like unto dead carp or, shall we say, a heap of dead carp the size of the building at 3900 Wisconsin Avenue, N.W., Washington, D.C. Any day now we will hear that… mistakes… were… made.

Is it indelicate to say that the USA as an enterprise has its head so deeply and firmly up its ass that the all the proctologists alive on planet Earth could not extract the collective cranium from the collective cloacal chamber even with the aid of a Bucyrus-Erie 1060-WX bucket-wheel excavator? Like, where were we the past ten years? Surely not everybody in the nation was doing bong hits while playing Grand Theft Auto, or watching The Real Housewives of New Jersey, or downing tequila shots and Percocets in the parking lot of the Talladega Superspeedway, or cooking meth in the family room, or whacking it to Internet porn, or searching for “excitement” in one of America’s 450 commercial gambling casinos.

Did nobody, for instance at Fannie Mae or Freddie Mac, review any of the paperwork fluttering in from places like Countrywide or Ditech and scores of other boiler rooms where mortgages were hatched like Peking ducklings? There was an awful lot of it, I’m sure, but aren’t there a lot of seat-warmers at Fannie and Freddie who collect their salaries for the express purpose of reading mortgage documents? Was nobody the least bit suspicious about the mysterious flurry of “restaurant employees” and “lawn-care technicians” buying million-dollar condominiums with no money down at terms that would make a three-card monte dealer weep with laughter? After all, they had to sort and bundle all these contracts for the likes of Goldman Sachs and JP Morgan and Citibank – the list isn’t that long, but you get the picture….

And speaking of these august institutions, didn’t anybody in the divisions charged with assembling complex securities composed of mortgages, or composed of bets against bundles of mortgages, or composed of some notion of something dimly related to a rumor of mortgage lending – didn’t any of these expensively-educated chaps or lasses pause a moment in their aardvark-like labors of bonus-seeking to withdraw their snouts from the moist ground where swindles pupate and at least goggle in self-admiration at the fantastic legal novelty of their endeavors.

And what of the numberless agencies, federal on down, starting with, say, the Office of Thrift Supervision, or the Comptroller of the Currency, or the Federal Deposit Insurance Corporation, or the Board of Governors of the Federal Reserve, or the chairpersons of a dozen senate and house subcommittees on matters related to finance, or the various inspectors general from sea to shining sea or the attorneys general of all fifty states plus the US Department of Justice, or the countless fiduciary officers of the pension funds who tripped over each other buying all the tainted paper churned out like so much Purina Rat Chow – or, for Godsake, a lonely loan officer here or there with something resembling a conscience?

Nobody in the USA noticed anything the least bit fishy. And now all that epic rot has eaten through the last hanging tendrils of the banking system. And the whole shootin’ match is fixing to seize up and blow like a Chevy Big Block Super Stroker 632 engine that some clown has poured karo syrup into.

But, sadly, I can only return to the trope of cranial rectosis. And when your head is in such a dark place, it’s hard to see the truth, let alone tell something you can’t even see. And sadly too, the truth is that this ghastly mortgage fiasco was a fraud that the whole nation perpetrated on itself in a tragic rush to get something for nothing. Since the failure of authority is complete, it’s now up to nature to act as the arresting officer. She’s a harsh mistress. She’s going to kick our ass.

I’m sorry, but I don’t see anyway out of this. With fraud absolutely everywhere in our banking system, like some advanced metastatic cancer, financial metabolism comes to a sickening stop. Nobody can buy or sell property. Nobody can trust any American financial institution. Money can’t circulate. Nobody will be able to get any money. It won’t be long before that translates into nobody getting any food. We may be a nation of clowns, but as Lon Chaney famously observed a while ago – when explaining his technique of horror movie-making – “…there’s nothing funny about a clown in the moonlight….”

——————————————————-

This article was reprinted with permission of Mr. Kunstler. To read Mr. Kunstler’s bio click here. Click here to go to Mr. Kunstler’s web site.

The sequel to Mr. Kunstler’s 2008 novel of post-oil America, World Made By Hand,is available now. His next book “The Witch of Hebron” is coming out soon. Order via AMAZON.

I was expecting something using a more direct assessment of the grim situation. All that Mr. James Howard Kunstler IMHO did in this article was attempt to bash the system and govt. with sometimes low class metaphors to the point where I will not be re-posting his article with any of my social groups. I’ll save you a headache and a little confusion from all of the elaborate premise blurring hyperbole. Next time please come with a little more research and sources please.

Pertinent Information:

The banking authorities were shocked – shocked – to discover last week that an awful lot of mortgage paper in this country is not quite in order… appears to contain, er, irregularities…Is it indelicate to say that the USA as an enterprise Like, where were we the past ten years Did nobody, for instance at Fannie Mae or Freddie Mac, review any of the paperwork fluttering in from places like Countrywide or Ditech There was an awful lot of it, I’m sure, but aren’t there a lot of seat-warmers at Fannie and Freddie who collect their salaries for the express purpose of reading mortgage documents? Was nobody the least bit suspicious about the mysterious flurry of “restaurant employees” and “lawn-care technicians” buying million-dollar condominiums with no money down at terms that would make a three-card monte dealer weep with laughter? After all, they had to sort and bundle all these contracts for the likes of Goldman Sachs and JP Morgan and Citibank – the list isn’t that long, but you get the picture….And speaking of these august institutions, didn’t anybody in the divisions charged with assembling complex securities composed of mortgages, or composed of bets against bundles of mortgages, or composed of some notion of something dimly related to a rumor of mortgage lending – didn’t any of these expensively-educated chaps or lasses pause a moment in their aardvark-like labors of bonus-seeking to withdraw their snouts from the moist ground where swindles pupate and at least goggle in self-admiration at the fantastic legal novelty of their endeavors.And what of the numberless agencies, federal on down, starting with, say, the Office of Thrift Supervision, or the Comptroller of the Currency, or the Federal Deposit Insurance Corporation, or the Board of Governors of the Federal Reserve, or the chairpersons of a dozen senate and house subcommittees on matters related to finance, or the various inspectors general from sea to shining sea or the attorneys general of all fifty states plus the US Department of Justice, or the countless fiduciary officers of the pension funds who tripped over each other buying all the tainted paper Nobody in the USA noticed anything the least bit fishy of the banking system. is fixing to seize up and blow the truth is that this ghastly mortgage fiasco was a fraud that the whole nation perpetrated on itself in a tragic rush to get something for nothing. Since the failure of authority is complete, it’s now up to nature to act as the arresting officer. She’s a harsh mistress. I’m sorry, but I don’t see anyway out of this. With fraud absolutely everywhere in our banking system,Nobody can buy or sell property. Nobody can trust any American financial institution. Money can’t circulate.

I am not a disinformation advocate. I want the truth without opinion which you usually do a good job of relating through your website. thanks for your time.

Super Tard,

I am sorry you did not like Mr. Kunstler’s post, but I put it up as an “overview” because I thought it was good. Please keep in mind this is a free site when you tell me, “Next time come up with a little more research and sources please.” I am a little taken back by your disrespect and rudeness. The sentence you wrote, “I am not a disinformation advocate” implies I am putting out lies. I have more two hundred original posts on this site that say otherwise. I don’t expect everyone to agree with me or my guest writers but your comment was out of line and offensive.

Greg

Greg,

I am sorry if you found the comments that I typed disrespectful or rude. They were not directly aimed at you, they were aimed at IMHO the choice you made with posting this article based in worse case scenario metaphors and assumptions. As I said in the comment I respect your site and the job that you are doing with trying to bring the less known news to light. I apologize for the misunderstanding. I was not implying that your guest writer did not have sources. I am asserting that he did not put them to good use nor speak from facts, instead he chose to speak from his opinion and stated it with discrediting hyperbole. My comment about not being a disinformation advocate was to assert that my opine is from an objective point of view. Please do not brush off my criticisms of the article. The constant metaphors are to the point of confusion! Also I think the tone of my previous comments are ‘dress right dress’ with the tone of the article. BTW I check your site daily, I’m a fan.

Super Tard,

Yes, you are correct the guest writer did not have sources. I wanted to put Kunstler up to give folks a view of a possible future scenario. There is no way to know how this will all shake out. I just want to give people as many views as possible. I am sorry if I came off harsh to you. Your criticism is valid. Thank you for this comment and your support.

Greg

Greg,

You mention that Kunstler observed as “how most in government did not even notice the huge problems”. True enough, but Elliot Spitzer had 50 governors on board years ago, filing suit to stop these liar loans and other dubious lending practices, when the Bush justice department shut it down with an archaic civil war era law.

Of course afterward, when Spitzer exposed Bush and his staff in a Washingon post editorial. Spitzer was soon arrested for using DC prostitutes- about as common as jay walking for big wigs in DC.

Eight months later, after being derailed and destroyed politically, the Feds dropped the charges.

The fraud in banking extends to the highest level of our government- past and present.

Hoppe,

The Bush Administration didn’t make Mr. Spitzer (who I like) repeatedly sleep with a prostitute. Both parties have been bought and paid for by the banks for at least 2 decades of Republican and Democratic administrations. Yes the Bush Administration let the banks run wild and so did the Democrats. Remember, Bill Clinton repealed the Glass-Steagall act when he signed into law The Gramm–Leach–Bliley Act (GLB), also known as the Financial Services Modernization Act of 1999. This is what allowed banks to grow uncontrolled and to allow everyone to securtize mortagags. Both parties are to blame here. Both parties have sold out America. Thank you for your comment.

Greg

The word fraud will be translated into mistakes were made.

Bob,

Yes Bob you are right on target!!

Greg

I just read “Bank Shot” and I completely agree with what you and Mr. Kunstler wrote. But I have a small problem; I have some money stuck in 401(k) and I don’t have many choices of where to put it. What would be the safest way to invest it, assuming all of this does happen?

I do not hold you responsible for any suggestions. I just want your opinion.

Thanks!

Andy

Andy,

I told one reader to try to borrow the money and simply not pay it back. You will have to pay tax and 10% penalty but you will then have your money to buy some gold and silver coins. (silver is the better deal right now) Maybe you can pay off your car. That’s all I got for you. Thanks for the comment and question.

Greg

If you want to keep your money in your 401k, maybe invest in companies that produce gold/silver?

Andy, PMs IRAs may be a way,I really dont know,but will check with others that have the know how! Try http://www.seekingalpha.com & search for Jeff Neilson’s post & advise. I will post later today after 5pm CT!

M Smith and Luke,

Thank you for the info.

Greg

I think the GLB bill had over a 2 third vote an could not be veto. Not saying Clinton would of veto it, but that both parties have sold this country out.Sen. Bob Kerry said it’s a 30 year plan the whole mess. You think about the 30 year average home loan. What if people had not done all these second loans and refinance, the bankers would of been out of a job. Those old 30 year home loans were hated by the bankers, they wanted them of the books one way are the other. The sky is blue out here in Washington state today. PEACE bring the troops home

Bob,

It has been reported that Clinton has lamented that he signed GLB. I think he probably new it was wrong then but he surely knows it now. Both parties are to blame for the mess we find ourselves in now. You make a good point about the Refi market and the bankers. Thank you and Peace to you and our troops. We should bring them home soon.

Greg

Greg-

Where will this all end? It is anybody’s guess. The greed and corruption depths are nuclear and global. Everyone is now guilty until proven innocent. What a shame. The Madoff sham as bad as it was looks pale in comparison to the overall landscape of corruption.

I have very little hope that we can turn this country around for the better. Yes, come Nov 3 some will have been voted out but that will not make a difference. The cancer is too enormous. So what if the Republicans take the House back. They won’t cut taxes and they won’t strip entitlement programs and they won’t stop QE. At the end of the day the two political parties are nothing more than Coke and Pepsi designed to confuse the “You Can’t Fix Stupid” voter.

Most can’t come to grips with voting for the Libertarian so the dog continues to eats its own vomit election after election. Next week when the early voting polls open in Texas I will not vote for a single incumbent period. Get over it people and stop voting for your party because you have been brainwashed into believing that a vote for the 3rd party is a vote for the opponent. I have been hearing this static noise since I was a young man when I voted for Ross Perot. And because I voted for Perot I helped Clinton get elected? Well those of you voting party lines have really helped make a big improvement. Think before you vote!

Thank you Mark.

Lots of people saying to buy gold and silver… I bought silver in the 80s. When I went to sell it, the dealer said it was tarnished therefore the wgt of the ingot had changed and made it of lessor value.. He offered me some real low price.. I ended up trading it for services with my dentist…

As far as the rest of this thread, nobody of any name or stature will be sent to prison. These guys all know each other.. theyre buds…

As one person noted, fraud will just be termed as a mistake… the laws are just for us little people… some low level paper shufflers will take the brute force of the US Govt in this situation just as a show trial, like Martha Stewart was used…

With the growing obvious wrongdoing committed in some very high places, how long before people in the rank and file are going to lose all respect for the law..Then what kind of a world are we going to live in? Did you see a recent article where law enforcement agencies are going to employ citizen volunteers to collect crime scene evidence as it will be cheaper for some municipalities. Are we going to become a nation of snitches too? Isn’t that how East Germany and the old USSR were like?

PS – you can bet that files are being created on every State level DA preparing a lawsuit against the big banks. How do you think they found out about Spitzer? We all have files now.. All that has to happen is for someone to be considered a threat to the system and a few investigators are put in place to build a case should one be needed… That’s the America we now live in… this should be nothing new, Hoover was famous for his personal files….

Robert,

I don’t know what kind of silver you bought but “Junk” silver and “Silver Eagles” will hold their value. I agree, the deeper people dig the uglier things will get.

Greg

Greg, your readers would get great info from todays 10,15,2010 articles by Deepcaster & R.D.Bradshaw at http://www.goldseek.com, all of them great! Also Jeff Nielson has a great post at http://www.seekingalpha.com/Reserching Gold/Silver Mineing Stocks, he also has a blog,but the host server was down at 1.48 PM today, he hopes to have it back up soon,also he has a blog that you can link to from seekingalpha.com Free also!

I would try looking into getting my money out of 401Ks & get advice from a trusting sourse. No ETFs PERIOD! I wish i could talk with the likes of Jim Sinclair,he would steer all of us right,heck that’s where I found your site Greg, he likes what you are doing & I do to!

Greg, one more great sourse of info comes from Ed Steer Gold & Silver Daily at http://www.caseyresearch.com, lots of articles from readers world wide! Have a great week end Greg & thanks again! We are like a band of brothers/sisters on your site.

Greg,

I once heard you on a radio program (WZTK) claim that that our current political parties have “two heads, one body”.

You are dead on.

God help us!

Peace

James

James,

Sad but true. Protect yourself because neither party will. Thank you.

Greg

When the Roman empire fell the people with gold tried to get out of England an head back to Roma. Some of that gold is still being found today in the farm lands in England. I would buy gold if I had more money to spend because there are few places to trust your money with right now. I just want people to understand in a lawless world a world without the rule of law, gold maybe worthless unless your are one of the insiders who control the outlaw armies. If I was a hungry man I would kill a man for his horse so it could be eaten but leave the useless gold for it will only bring you death in a lawless land. Gold was used as a currency in the past but no currency is usable without the rule of law. We see right now the people are forming all kinds of gangs are different groups of people trying to get a share of the pie. The political parties,unions,bankers,Wallstreet and all the street gangs you name it the people are ganging up because nobody is living by the rule of law. I would like to think people are better then this but look what this country has done in the name of freedom, how many did we kill in Iraq how many in Vietnam it gets to a point that the people in are government will turn on there own people but then again the people in government may very will be globalist not people who believe Americans is a nation of laws. No law no nation no owner ship of gold. PEACE

Dylan Ratigan had an eye opening news story on just how big this problem with fraudulent loans is to our economy… the problem wasnt with people applying for loans that should have never been approved.. there were regulations in place that would have prented that had they been enforced.. the problem was the banks needed more and more new loans to satisfy the ponzi scheme that had been in place for years and with the removal of the Glass/Steagall act by Clinton, that avenue was opened up.. all it took was an administration that said, ok boys and girls, all that matters is greed.. we dont need no regulations now and that was the role the Bush administration played in furthering this mess.. Both parties are to blame..

Besides that they knew that Fannie and Freddie would buy the bad paper…there were regs in place to prevent this but they were deliberately overlooked because the greed and big paychecks overrode good and sound business practices…Until we have a govt that will prosecute the high level perps behind this fraud, nothing will change… and the American tax payer will be handed the bill…

Considering that we no longer build much of anything in this country that allowed for higher tax revenues, wheres the tax revs supposed to come from to pay back trillions in losses that the banks need to have to cover these bad investments especially at a time when a huge portion of our society, the baby boomers are going to start applying for social security and medicare (of which I paid for and I better get)..

If the banks fail, so do the people who have money deposited because the point of the bailouts is to keep them solvent so we can write checks againsts our checking accounts.. This cavalier attitude of let them fail means innocent people that have deposits in these banks will also fail so letting them fail isnt an option… do people realize that?

http://www.ritholtz.com/blog/2010/10/fraudclosure/

http://www.ritholtz.com/blog/2010/10/fraudclosure/

PS – You want to see the misplaced priorities in the Obama administration, look at his DOJ (Eric Holder).. by god, theyre going to be right out there enforcing federal POT laws if California passes any legislation that legalizes it… but you don’t see Obama’s DOJ out there saying were going to get the people who destroyed the economy of America and the world… uh uh, no way….. http://www.huffingtonpost.com/2010/10/15/eric-holder-to-prosecute-_n_764153.html

Like Mike Papatonio of Ring Of Fire Radio says, Eric Holder is beholden to the corporate interests of America..Thats the kind of law firm he came from, one that protected corporate interests.. not the peoples interests… Now why did Obama pick such a person if that’s not who Obama is in place to error in favor of…

I voted for Obama and I want him to start doing what I and 10s of millions of people who voted for him to do… stand up to the out of control corporations like FDR did… you want our votes earn them! Im tired of platitudes and lies…

Good Lord!! “Shocked” Well, 100,000+ forclosures in September. I’m just saying there will come a breaking point for Americans when they ‘are mad as hell’. No cost of living for our grandparents/parents, illegal aliens crossing the land, continual foreign wars, high unemployment.

With that said, I strongly recommend you just read a book out where Americans Finally take a stand. It’s powerful & could be our hometown one day. Could be our destiny in history. I recommend it.

http://www.booksbyoliver.com

Luke Said:

“If you want to keep your money in your 401k, maybe invest in companies that produce gold/silver?”

This is why I’m getting confused. People like Jim Sinclair are now saying that you should purchase physical gold or silver, not the stocks in companies because those are not safe. So, which is the better alternative?

And if like a reader above said, he tried to redeem his silver coins and was told they are no good, what’s the point?

Where can one actually purchase silver or gold coins today?

nm,

Don’t be confused. You should invest directly into gold and silver coins. I answered the question about the coins being “worthless” on a previous comment–no way at all real U.S. gold or silver coins will be worthless–NO WAY. I don’t know where you live, but there are some excellent places around the country. Find out your local sales tax laws. In New York State for example any purchase of coins over $1,000 THERE IS NO TAX. In Missouri I think it is any sale in coins more than $10,000. Check around and see if you can walk in with a check or cash and walk out with your stuff. You may email me for some places that will ship your stuff to you after a wire transfer. I hope this helps you.

Greg

Greg, for the heck of it, maybe some people who own gold and silver coins (or whatver form they hold they hold the metal in) should take some in and try to sell it and see how it goes.. then maybe they can post on here how the experience went and if it went smooth or if the quality or legitimacy of the pieces was challenged…besides that, how do dealers verify what is being presented to them is real and not counterfiet?

It would seem the possiblity to counterfiet such coins would be just as possible as it is with US Dollars. Do buyers get some kind of confirmation what they are buying from these shops is real and certified?

Robert,

It is much harder to counterfeit bullion coins and then there is also the weight issue. I suggest U.S. gold or silver Eagles not bars or rounds. I also like other well know coins such as Krugerrands and Maple Leafs. I suggest you use a well know coin dealer with good mint connections. I would not worry about selling right now buy securing a supply for protection. Time is short. Thank you for your question and suggestion.

Hey Greg:

I live in Massachusetts. Do you know of any reputable dealers who sell gold and silver coins?

And once you buy them what? keep them in your closet for a rainy day when they can redeemed?

nm,

I do not know of a coin dealer in Mass. or the sales tax laws. I know for a fact that in New York State there is no sales tax if more than $1,000 in PM’s are bought. Contact Arthur Blumenthal at Heritage Auction Galleries. His direct line is 212-486-3511. I know him to be honest and one of the very best coin dealers in the country. Tell him I told you to contact him through USAWatchdog.com. Because you live in Massachusetts, you might want to consider taking a road trip and picking up your product directly. Although, if you wish, Mr. Blumenthal can ship it to you. If he does that, then you might still be responsible for state sales tax in MA. Good luck.