Debt Downgrade, Not Default, is the Problem

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

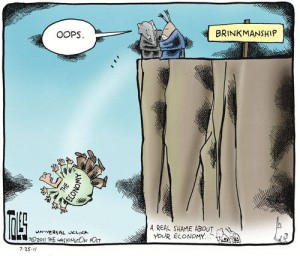

Watching the debt negotiations is like watching two stubborn people headed over a waterfall. Both are too blockheaded to steer the boat towards land on the left or the right. So, both go over the edge and will see how long the other can hold his breath. Both, of course, drown in this story, right along with the rest of the country. Yesterday, Speaker Boehner said he wanted to call the President’s bluff and not give him a “blank check.” The President, on the other hand, has said (many times) he’s going to veto any plan that doesn’t raise the debt ceiling past the 2012 presidential election. I know many think there is going to be a last minute deal before the August 2nd deadline, but I just don’t see it. If the Republican bill from the House makes it past the Democrat-controlled Senate and there is only an increase in the debt ceiling to make it for 6 months or so—veto here we come. Or maybe, there is no bill that can get through Congress, and nothing even makes it to the President’s desk by the August 2nd deadline.

I eventually see a debt deal getting done, but not until after the August 2nd. That’s when the Treasury says it will exhaust its borrowing limit. In this scenario, both parties hope the other side will take it on the chin and be hurt worse in the eyes of voters. I don’t know who will come out on top if this happens, but big time damage to the U.S. economy will be done. Forget about default on the U.S. Treasury debt. That is simply not going to happen, at least not anytime soon. America has the money to pay the interest on its Treasuries. It is the credit rating of the United States that will take a beating. In the latest report from Shadowstats.com, economist John Williams said, “If I were to script a scenario as to how the United States quickly could debase the U.S. dollar with maximum impact, impairing the dollar’s reserve status and dwindling global credibility, and accelerating the movement towards a U.S. hyperinflation, it would be extremely difficult to come up with a more destructive course of action than what already is taking place in Washington, D.C. The chances of a U.S. debt default remain nil, but risk of a U.S. sovereign credit rating downgrade—though small—is increasing. . .”

If the debt of the United States is downgraded, other debt will also be downgraded. As credit ratings go down, interest rates do the opposite. U.S. consumers would start paying more for things like credit cards, mortgages and car loans. Hundreds of municipalities would also pay higher borrowing costs for their debt. These are just a few of the interest rate wild cards. This would put a huge drag on an economy that is already on the skids. The dollar would also take a pounding because nervous investors would start to dump dollars and Treasuries. The Shadowstats.com report goes on to say, “The administration claims the U.S. will default if the debt ceiling is not raised by August 2nd. There are those who suggest there is more time beyond that, if only the government selectively pays its bills, giving priority to interest and debt payments. With other government obligations not paid as due, though, that circumstance likely would trigger the rating downgrades and intensify dollar dumping and abandonment.”

Paul Craig Roberts, former Assistant Treasury Secretary in the Reagan Administration, agrees with the Shadowstat.com analysis. In a recent essay, Roberts said, “The US dollar could plummet in exchange value and lose its role as world reserve currency. The US would no longer be able to pay its oil bill in its own currency, and as its balance of payments is heavily in the red, the US has no foreign currencies with which to pay its oil import bill. Or its manufactured goods import bill, or any other bill. We are talking about a crisis beyond anything the world has ever seen. Does anyone think that President Obama is going to just sit there while the power of the US collapses? He doesn’t have to do so. There are presidential directives and executive orders in place, put there by George W. Bush himself, that President Obama can invoke to declare a national emergency, suspend the debt ceiling limit, and continue to issue Treasury debt. This is exactly what would happen. The consequences would be that the power of the purse would transfer from Congress to the President.” (Click here for the complete Paul Craig Roberts post.)

I think, by now, both parties are calculating how bad the fallout will be and which party gets the blame if a debt ceiling deal is not done by the August 2nd deadline. Could the Republicans really not want the economy to get much better until after the 2012 election? On the other hand, maybe the Democrats know the economy stinks and figure it won’t get much better anyway come election time. Might the President veto a bill he hates and blame a plunging economy and government shutdown on the Republicans? Bill Clinton did a similar thing in the mid-90’s, remember? Although, the stakes this time around are exponentially higher.

It wouldn’t be hard to sell a “national emergency” to the public if the stock market sold off a couple of thousand points and gasoline prices went to 8 bucks a gallon—would it? Whether or not you like Barack Obama, never underestimate the power of the President. Wouldn’t it be strange if a debt deal finally got done on August 15, 201l? That’ll be exactly 40 years to the day President Richard Nixon took America off the gold standard.

When O was elected, I told my Lib. brother that O had one aim, and that was to bring this country to its knees. The easiest way is fiscally, and everything seems to be going as planned. An ornery & angry old 72 yr. old is what I am. “Fiddlin’ Ferch

Well? If you truly believe this obamas fault then where does GWB and his band fit in? They were handed a surplus, started two unwinable wars and “brought the country to it’s knees” way before ‘O’ was even near the office. Blame? Go ahead, but be sure you place it where it belongs. Give my best regards to your liberal brother.

Are you as addled as you sound? This country was hanging by a threat before “O” was even nominated, let alone elected. It is now possible to quantify the cumulative damage of more than ten years of catastrophic mismanagement. Repeal of Glass-Steagel gave banks the ability to grow huge by manufacturing toxic mortgage backed securities and other OTC derivatives with no effective government oversight and no clearing mechanism. Outsized reductions in capital gains taxes allowed CEO’s and hedge fund managers huge paydays. Two illegal off the books wars commenced and financed on our maxed out national credit card at the same time a costly prescription drug benefit is enacted the major beneficiaries being insurance companies and big pharma. Add to that the creation of a huge Homeland Security/TSA/NSA/CIA boondogle

and you have the makings of what will soon be the financial downfall of our once proud nation. We are presently staring down the barrel of a financial canon aimed at the heart of our once proud dollar. We are looking at losing the undeniable advantage of having the world’s reserve currency. These tea party idiots think that blowing up the government will heal US. Just wait ’til they feel the wrath of hyperinflation and $8 gas. We will come to a grinding halt and it won’t be the president’s fault . It will the the cumulative fault of a foolish, poorly informed and short sighted greedy nation.

Dear Greg,

I was not replying to your article but to the respondent named Willard Ferch. I thought his simplistic comment seemed “addled” I agree with you. Both Democrats and Republicans are to blame for this mess, but if you want my honest opinion it has been thirty years in the making. There is enough blame to go around on both sides of the isle. Our electoral system has failed US. Politics was never mean to be a lifetime career, but a period of public service , time out of an otherwise productive career elsewhere. Right now the public is ill served by men and women who need to raise obscene amounts of money just to keep a job. Lobbyist write out laws and rewrite them to suit their special interest.

Anne

Anne Winn,

Oh my goodness! I will take down my response. Please excuse my mistake. I am so sorry. Thank you for being kind.

Greg

You too sound as foolish as the words you spew. Where is the buck stops here attitude? Where is the famous quote about a lack of leadership that Barack gave in 2006 railing against the debt ceiling being raised? The fact is this fool was too stupid to understand that when taxes are raised and the full impact of Clintons signing the NAFTA and GATT treaty come into play…… those with money move to where their money is safe. I swear you two who responded to Willard sound like a couple of Lemmings ready to jump off cliff for good ol’ Barry!

Greg – thanks for your valuable articles – I visit regularly and always enjoy your insight.

I too thought that there would be a deal on the table soon (actually last week), but we’re coming down to the wire. My investments are most substantially now in Canadian $ assets and Gold and Silver bullion. I have further pared back all my other holdings over the past few days and gone to C$ cash or Sprott Physical Silver Trust. I am very concerned about how the markets may react and the spiralling effect that may take place. (I learned from 2008 – and my investments really never recovered from that melt-down). I fear this market adjustment may be far, far worse and the US$ is in it’s last dying gasps as the Reserve currency.

I have now come to believe that the Fed is an evil criminal enterprise and that the TBTF banks are in the same league. I would call myself a Capitalist and a Free Market advocate – so, It’s a big shift in thinking from where I was a few short years ago.

Central Banks + Government + TBTF Banks = theft from us all (our labors are being stolen).

Thank-you for spreading the reality.

I think you have a pretty good defensive position Jeff. Thank you for sharing your strategy here.

Greg

You say “If the debt of the United States is downgraded, other debt will also be downgraded.”

Can you please elaborate a little more on why other debt will be downgraded? What is the mechanism between a rise in treasuries and a rise in other debt?

Brian,

Other debt would suffer downgrades if U.S. sovereign debt was downgraded. Here is a quote from a CNNMoney.com story from yesterday: “After a downgrade: A downgrade could wreack havoc in the United States and roil global financial markets, which rely on U.S. debt as an essentially risk-free investment. Government-backed agencies like Fannie Mae and Freddie Mac would be downgraded. Municipal debt, banks and insurers would face possible action.” Here is the link to read the complete post: http://money.cnn.com/2011/07/26/news/economy/debt_ceiling_downgrade/ I hope this explains my line in the story further.

Greg

“Other debt would suffer downgrades if U.S. sovereign debt was downgraded.” When one considers the fact that the whole house of cards is based on debt that was issued in the United States in order to prop up the debt and fiat currencies of the rest of the world which the U.S. calls creditors, this is a very easy concept to grasp. Back in the 1980’s it was said that when the U.S. sneezes, the rest of the world catches pneumonia. Now the tune has changed a little. When the U.S. dollar dies, the rest of the world realizes that they have committed financial suicide.

Ever wonder where your hard earned tax dollars go, seeing that your social security payments will never be returned for most people under 50? They go to the world bank and the IMF,(read bank of England) which buys up the infrastructure, ie…(water, sewer, highways, power grid, etc.) of nations the world over. It then trashes these naions and puts those nations in debt to the IMF to rebuild and put them into private hands while paying off the government officials who allowed it to happen.

Can the FDIC bail out your bank and save your hard earned money. Of course it can, if your bank and 5 or 10 others are the only ones that fail. But the FDIC was never designed to bail out the entire financial system all at one time like what is coming. Keep cash under your mattress? Yes, it might help you for a week or so until everyone realizes that the dollar is worthless. Gold? There’s going to be some mighty hungry people sitting on piles of gold.

Thank you Jay for the analysis and comment!

Greg

Jay, your analysis strikes the root” of the issue.

We are witnessing the final battles between nationalists and globalists. When the US Inc. defaults (whenever) it stiffs the international banksters,(ala Iceland),goes it’s own way with a new money system then a very wrenching rebirth of our nation state will happen, replete with nationalization of resources.

IF instead when US Inc. defaults it defers to the international banksters, forced austerity and privatization will follow and Americans will be condemned to perpetual servitude as (at best) a second world nation. Re-nationalization offers hope, the alternative offers a bleak twilight existence.

Greg,

Great post as usual! Does the financial crisis give birth to a constitutional crisis? In the name of saving the economy and country does the presidency become a dictatorship? Would people care or would they cheer him on?

We’ve heard the former White House Chief of Staff espouse not letting a good crisis go to waste. I shudder to think what power grabs, money grabs and the like will be sought if a major crisis like a default or credit downgrade becomes reality. One of our national strengths has always been the consistency of the contitution and the rule of law. What if that consistency goes away because “drastic measures” are needed? This is scary stuff.

Robert,

You bring up a valid point. The country is in trouble both financially and politically! Most folks are not really seeing this …YET. You are one of the few who gets it!! Thank you for the comment.

Greg

Greg:

So, besides buying gold and silver (& I bought silver) what more can we do? How can one make money with this coming economic downfall? shorting US treasuries? buying stock in certain foreign companies? I’m looking for practical ideas that I can execute at this point.

NM,

I do not give market calls of trading ideas. This site if all about soild information and taking out protection for you and your family. If you want to make money making trades I wish you lots of good fortune and luck.

Greg

Relax Greg,

There is at least an extra week, due to higher tax revenue income in the last quarter.

Besides that, a higher interest rate is one thing this country does need. The artificially low interest rate the banks now enjoy is far too low. Thanks to the Fed, we are in the Japan 10year recession scenario.

If rates do go up, Treasury auctions will have lots of buyers. What else would they buy- Euros or new Drachmas maybe?

But tell me why I should care if the US dollar is no longer the world reserve currency? Not that it is going to change this year.

Hoppe,

You will care when you pull up to the gas pump and everything else you buy that is imported. Thank you for weighing in.

Greg

So you are inferring that if/when the dollar looses it’s position as the world reserve currency, that it will collapse? Why has the Euro ( not the reserve currency) increased against the dollar by 50% since 2004? Why has the Loonie, Swiss Franc, etc not collapsed against commodities? ( They have increased) It is because their Central Bank has not artificially reduced interest rates- IMO

What do you think?

Oh, also, will I miss buying cheap Chinese made crap, that winds up in next years garage sale? No. But if the dollar fails, the Chinese will not have a buyer and we would have to start manufacturing the stuff ourselves again. Imagine that, Americans smelting steel, turning lathes…..

Do you really think they will let that happen? This is all a circus side show- for the next few years anyway.

Hoppe,

Not a matter of “let” a dollar plunge is a statistical certainty.

Greg

Whats worse passing an eventual collapse and civil war to our grandchildren or taking our medicine now?

Thank you schweizer40 and Sling.

Greg

Have to breakout the “White Album” and play Helter Skelter, cause it’s coming down fast.

A National Emergency will signal that Congress has lost control. That last desparated act would signify that the people have no voice.

That we have finally come to the point of a dysfunctional government. A pinnacle in the discription of a polarised nation which is about to get a crash course in Economics.

Greg, the stock market is at least $3,000 over valued, how in the world it’s above $7,500 is beyond me except for the free money “easing” of the last three years, all to the detriment of the middle class’s dollar holdings. Right at the last minute the market will react suddenly deeply downward forcing our esteemed great leaders of impectable reputations for morality and honesty (ha ha) on both sides to compromise and a deal with be reached. Everybody knows this is play acting, just politics as usual, especially wall street understands that, that is why the market hasn’t reacted but a few points downward lately, they have the inside information.

Ratings that go down can go up, your discussion about possible repercussions are a little far fetched in light of how our government and its leaders never tell the truth about anything to the American people. How can we believe them now that the world is coming to an end? Wow, the market would get corrected back to where it belongs, interest rates would go where they belong in the first place, remember the banks are the only ones out here that are getting zero interest, the rest of us are allready paying through the nose – that won’t make a difference for the middle class as a whole. We are allready in a hyperinflationary cycle of great porportions, just go to the store and buy some milk! Greg, I just don’t get your article and its premise of the sky is falling, its allready fell, and a downgrade will place the economy where you have been preaching its already been for a year now. Greg, all that being said, just watch these clowns on August 1st scramble and get a midnight behinds closed door deal. This is America Greg, our bunch of esteemed elitist criminals have it all handled they just need to play the last act.

Greg:

I believe that a downgrade is a done deal.

Someone dropped a bomb on the bond market last Thursday – a $1 billion Armageddon trade betting that the United States will lose its AAA credit rating. The trade wasn’t placed in bonds themselves; it was placed in the futures market.

The value of the trade was about $850 million dollars. That means with a single push of a button someone was willing to commit more than $1 billion of real capital to this trade with expectations of a 10-to-1 return ratio.

You only do this if you have inside information on a done deal.

This means someone is confident that the United States is either going to default or is going to lose its AAA rating. That someone is willing to bet the proverbial farm that U.S. interest rates will be going up.

Some people that come to mind are hedge fund manager John Paulson, Bill Gross’s PIMCO, Soros, et, al.

People who were long 30-year Treasuries panicked as they saw the huge short put on the futures market, and started to unwind their long exposure.

The enitre system is a scam and a Ponzi scheme, the insiders know it and constantly take advantage without consequence, while the rest of us are continually screwed.

I believe that our Triple A rating will be downgraded in the next 3 weeks, and someone will make 9 billion dollars as a result.

Let’s see what happens.

PatriotRider,

I saw that trade. Yes further proof a downgrade is coming. Thank you bringing this up and posting it here.

Greg

Hello Greg,

You have been drinking too much cool-aid!

On August 2nd the country will not default. The federal goverment will have to furlough some people and halt some activities. Debt service will be covered. Revenues are up and the actuall date is more like August 14th without any changes to federal spending.

As for a downgrade, well the rating agencies have hinted that there will be a downgrade unless Washington quits borrowing money and printing money.

You have fallen for group-think. Our economy will be spared only if Washington spending decreases and money printing ends. Oh yea, there will be short-term pain for federal gubmint workers; it is about time they feel my pain!

Raising taxes, any taxes, in a depression is most harmful bromide for our economy.

The world does not evolve around Wall Street!

markm

Markm,

I said in the post “Forget about default on the U.S. Treasury debt. That is simply not going to happen, at least not anytime soon. America has the money to pay the interest on its Treasuries. ” I think there will be more pain than you think but we are going to find out. Thank you for your comment and support.

Greg

markm,

laying off a few thousand federal employees (i am not against that in concept) will turn around an eleven figure debt?

who’s drinking the kool-aid?

oops, scuse me. that should have read 14 figure debt.

neither debt downgrade nor default are the problems. they are just two miserable examples of how lunatics try to sweep reality under the carpet when push finally comes to shove and a big lie blooms into fruition.

the problem is an independent entity of multinational banksters that has been given control over the printing and distribution of money in the western world. the problem is money born from debt and created with no choice but to inflate. governments do not control this entity. the entity controls governments. the entity creates chaos and confusion, strife and contention all for profit and control.

humanity is at war with this entity and barely knows it. humanity is not fighting back, humanity does not even realize it is at war.

it has been said that the definition of insanity is: doing the same thing over and over and expecting different results. the same applies to electing the same ineffectual wankers over and over and expecting them to fix what they keep breaking.

give up on your party. both major parties are hard at work against your interests. just walk away and ignore them.

when you are in a fight for your very life, it is a really good idea to realize that you are in a fight for your life. the alternative is…..well pretty much a done deal.

Greg,

Again, thanks for your article and opinion. We are an ignorant society when we can’t elect politicians who can balance a check book. Of all the educated souls in congress, many do not know how to add and subtract. Fiscal discipline is difficult for some to attain, and if not acquired, spending can turn into a drug addiction. It’s so frustrating to watch, but being able to respond to your articles in this forum, although having very little impact on the overall problem, is therapy.

Thank you John for venting out your feelings here. I appreciate your point of view and comment!

Greg

Greg,

Notice how the political zeitgeist has everyone angry at the politicians instead of the bankers? I believe they are way off point, for it is the central bankers who are at the very root of the debt problem – they created a system of debt money that benefits them, the only reason to be mad at politicians is for giving them the power in the first place, and for not taking it away in the second place

Baja,

You got that right!! It is the Bankers who cause the mess we are in and they continue to be bailed out.

In his dark and mysterious heart there is a dictator awaiting the cue to emerge.

A Reichstag fire,economic chaos,anger in the street are the perfect background Obama is counting on to bring about his destructive revolution where he rules with total control.

Who says it can’t happen here ,it happening again before our eyes and he’s got the media and his National Democratic Socialist Party in lockstep opening every door and slowly shutting down the only minimal opposition,the demonized ‘tea party extremists’.

They will be the ones blamed for the coming collapse.

Obama Following in Hitlers Footsteps

Marcel,

I really do not agree with your premise here, but in the spirit of free thinking I am putting this up for people to read. Democrats made similar “Hitler” references about President Bush. I did not agree with them either. You must go a very long way to find someone as evil and diabolical as Hitler. He murdered millions in multiple countries. Russia alone, lost 20 million people in WWII, and of course let’s not forget about the holocaust. Bush and Obama are not even remotely close in my mind. That does not mean I support either of them in terms of their policies. Both parties are responsible for creating the mess we are in. Both parties support and bailout the bankers. The bankers are the real villains here because they are the people who caused the mess. I think they are reckless and evil but still not in Hitler’s league.

Greg

On September 11, 2001, terrorists attacked the twin towers, which (in their minds) represented the financial might of the USA. Almost 10 years to the day, our own politicians are doing the same thing with the exception that they are not attacking a physical building, but the US Dollar itself. The repubs do not want to cave because many signed pledges not to raise taxes. The dems know that they can defeat the repubs in the upcoming elections (aka, George Herbert Walker Bush) if the repubs do raise taxes. The dems only have one plan – to either get repubs to raise taxes OR to crash the system and blame it on the repubs (even though only the repubs have put forth plans). While all this is going on, Obama is attempting (but not succeeding) to stand above it all. I can hear it already, “I tried to help the two sides negotiate, but those evil repubs wouldn’t cave;” not withstanding the fact that Obama kept pushing for more repub caving so that he could bolster his chances in 2012.

For many years, Obama sat under the tutelage of the Rev. Wright, who made it clear that he disdained this country. Obama’s wife, Michelle, said (only after her husband was a shoe-in for the democrat nomination for the president) that it was the first time she was proud of her country (obviously she is a self-serving human being). Obama has questionable ties to George Soros, a man who dabbles internationally in currency manipulation and speculation. Obama is a narcissist and his poll ratings are plunging daily. So my only question is: Does anyone really think that Obama doesn’t want the system crash?????

Personally, I am all for slashing the government payrolls and cutting spending back to the pre-2000 levels. I’ll even take the house republicans plan of “Cut, Cap, and Balance.” Alas, it’ll never happen though. With the congress and president being who/what they are, this is the perfect storm that our founding fathers’ feared would one day come to pass.

Thank you Joe and Mitch!!

Greg

great post Greg, I find it hard to see where the US would not be hurt if the dollar lost status as the world’s reserve currency. Everything the dollar touches or traded in a dollar value would become very expensive knocking out the crumbling foundation under the American economy. There are no goods I can think of that would not be impacted by a doubling in price with a week.

It really is as if all this is out of some movie. Just a few years ago I thought the dollar was unshakable, never dreamed it could ever be something that had no value, heck I thought gold coins were for those old fuddy duddies with bad body odor and ham radios.

A few short years later and I find myself looking at the dollar and my government in a completely different light……..and it really is scary.

Brian,

I hope you have turned into one of those old “fuddy duddies.” Thank you for the comment.

Greg

All this bickering is just two stubborn headed parties having a pissing contest to see whoose stream is bigger. I think both parties need to grow up and realize that everyone is going to have to make sacrafices to put this country back on the right path rich and poor alike. What we need to do is get rid of the politicans and let the american public set budgets, laws ect. Good lord it’s like kindergarten all over again.

Well-written article, Greg! I live on my sailboat (completely paid for) in Honduras. My monthly bills are minimal. I have zero debt. My income is considered average back in the USA, but, I live like a king here. I plan to buy shares in a Swiss Franc Trust next week, on Monday, before the August 2nd “deadline” on the debt talks. I also plan to look at buying shares of SLW (Silver Wheaton). I would love for you to pass on any advice or recommendations to me, Greg! Also, like you, I believe the debt ceiling is going to be raised, and, hopefully, the powers that be will use this borrowed time to make tough decisions that significantly lower government spending, and, yes, even get rid of corporate tax loopholes, at least modestly. I believe, because of the empowering effect of the internet, we will weather this storm, without a complete meltdown, because, people will behave rationally.

Kirk,

I love your life. I hope you have your shares at your brokerage listed as a “Book Entry.” This means they are help in YOUR NAME and not firm name. In a brokerage bankruptcy you will want that. Also please do not overlook the power of physical gold and silver coins. There is deep counter-party risk in the brokerage world, make no mistake! Thank you for you comment and sharing your cool life with us here on land.

Greg

Wow Greg, Our once law of the land, Constitution and Bill of Rights, have all been ignored, stomped on, laughed at, and called antiquated by the politicians, FED bank, Military, and Corporate criminal cartel. I appreciate patriots like you, Ron Paul, Judge Napalitano etc. that try to get the “WE THE PEOPLE” to understand at this late hour of their plans to ruin the nation. It’s heart breaking and amazing when one studies the history of the USA in the years since “The Federal Reserve Act” and you can only wonder how to get these people out of power before it’s to late. Their planned destruction of America, is fast escalating. Why did they choose to be treasonous, tyrannical, and unpatriotic to this country is the question. I have asked myself this over and over again, and the answer always is, they are not patriots, they are the true enemy. No one could do these things by mistake.

Greg, I’m not expecting specific equity picks, but in what general ways should people protect their portfolio’s, especially those who, like myself, have limited options through existing IRA’s on where we can allocate our funds. Thanks in advance.

Mark,

The best way to truly protect yourself is with physical gold and silver coins. Many who read this site tell me they cashed out a significant part of their IRA, paid the tax and penalty, and bought physical gold and silver coins. If your brokerage goes under you will be hard pressed to get all your money back. The lions share of your funds should not be tied up into a brokerage because of the extreme counter-party risk that most have. The last time I checked SIPIC had a little mere that $1 billion in its coffers. Madoff was $60 billion? This kind of extreme leveraged market and world wide sour debt has never happened before in all of human history. We have a world wide debt implosion going on right now! I don’t know what will happen and so you should have as few people between you and your wealth as possible for at least a good part of your portfolio. I know this is not what you want to hear, and your broker will tell you I’m nuts. I’d like to remind you if you simply bought physical gold when it was $300 and ounce you would be up more than 5 fold. Ask yourself, why didn’t my broker tell me to do that? Why didn’t he tell you to do that at $500 per ounce? You would be up more than 3 fold. The big point here is not how much you would have made but how utterly protected and insulated you would be now. Precious metals are going much higher (in the next few years) in dollar terms because the currency is being inflated away right along with the debts. I hope this helps you.

It’s the great devaluation not the great recession. What is a mans debt worth, what is a mans labor worth. The great fear is devaluation and nobody can stop it. What we got here is a bunch of white people who my be picking apples for a living, welcome to the human race,YOU have been devalued just like a billion people around the world. It’s nobody fault it’s just a system that is in change and people trying to come to grips with it. Because of human nature fear is running wild in the Great Devaluation. Some people run to gold some to God others to holes in the ground. Sooner are later we all will be working for food and a place to sleep. Anyway that’s my 200 dollars worth. PEACE

Bob,

I think all people should run to God and take a little gold with them! Is that 2 bucks in pre-1965 quarters? Thank you for weighing in and for supporting this site!!!

Greg

Greg,

Whether the debt is default or downgraded, it will have minimal effects on our fellow citizens already at the bottom of our society.

Higher credit card interests: Don’t care! They don’t carry credit cards. They lost their credit rating when they filed bankruptcy.

Higher mortgage interests: Don’t care! They don’t have a mortgage. They lost their homes when their banks foreclosed them.

Higher gas prices: Don’t care! They don’t have a car. For those who own a car, they lost their jobs and don’t need to commute to work everyday – gas consumption will be very low.

The debt negotiation is just another example of our failing government. How could we elect those incompetent people into Congress? They put their ego and personal agenda over the American people. Can we say,”YOU ARE FIRED?” I wish there is a total recall for all the morons in the Congress.

Ambrose

Ambrose,

Great pithy comment!!! Love it, keep em coming!

Greg

The R’s keep drafting plans and the D’s following the orders of the President keep voting them down. I think the President is giving the R’s enough rope to hang themselve with and the damned fools are taking it. They should step back and hand the economy over to the President so he truly owns it and can no longer blame Bush.

The debt ceiling will be raised sooner or later. If later the R’s are the bad guys, so matter how reasonable their Cut, Cap & Balance budget.

I just hope the Balance Budget Amendment passes. We are American’s we will sacrafice if we can see the light at the end of the tunnel. Out sacrafice will be for our children and grandchildren.

I don’t know why people keep saying that the USA will “default on its debts” if the debt ceiling is not raised. No such thing will happen. The tax revenues by far exceed the amount of money, necessary to SERVICE the existing debt – so, at least in the short term, the debt will continue to be serviced. There will be no default.

The other dangers are real, though. If the US debt is downgraded, this will have a domino effect around the globe. If the debt ceiling is not raised by the time maturing debt has to be rolled over, THEN there could be a default – but that’s at least a couple of years in the future. The raising of the debt ceiling will, of course, mean more money printed and higher inflation. And so on.

The situation is somewhat funny, if one has a wicked sense of humor. The Democrats can’t back off, because this will hurt them in the eyes of their voters. The Republicans can’t back off, because this will hurt them in the eyes of their voters. But the Republicans HAVE to back off eventually, otherwise they will be blamed for the economic catastrophe. And the Democrats know this, so they won’t even try to back off or reach a compromise.

The thing that really bugs me is that there is simply NO WAY OUT. I don’t mean the debt ceiling, I mean the economy. Not even the US economy – the global economy. No matter what is done, we’re screwed.

Debt ceiling not raised? This will lead to a financial catastrophe.

Debt ceiling raised? More money printed, eventually leading to a financial catastrophe.

Start contracting the debt now? This will lead to a financial catastrophe.

Switch to a gold standard? This will lead to a financial catastrophe.

There is no way out. The catastrophe is inevitable (although not necessarily imminent). All that can be done is wait until the collapse happens, until the current system completely destroys itself (because nobody would dare to destroy it on purpose earlier), and see what happens. Maybe then we could try to build everything from scratch, based on sounder principles. If we’re still alive…

No paper currency has ever sustained it’s value because of greed an ancient scripture say’s it all “The love of money is the root of “ALL” evil”.

This not about 2 stubborn people fighting while going over the falls…thats a deliberately misleading analogy.

There IS a right side and there is a wrong side. The wrong side is trying to perpetuate the deception of fiscal responsibility while maintaining the status quo. The right side is trying to strip the deception off and take the medicine now and not defer the pain to when it will be much worse.

The wrong side knows if they backload the process they have plenty of time to negate and undermine anything they might have agreed to. Ten years is a long time.

Thank you Major for weighing in.

Greg

This whole debt debate is simply delaying the inevitable. When an agreement is reached the real problems start. With the Fed no longer buying debt, who will purchase it? No investor is going to purchase this debt at rates that are below inflation. If the Fed does step in, higher inflation and debt downgrade are assured. Make no mistake, the budget ‘cuts’ in all these plans are laughably small and are actually above baseline. The only hope of salvaging our country is to immediately end all foriegn military excursions and not only cutting federal agencies budgets, but eliminating departments altogether. Harder times are coming….

Greg,

I enjoyed reading the article, and, for the most part it was well written. I do not agree with the premise that compromise is the best path to solve the problem. We got here specifically BECAUSE of compromises in the past. Economics is a finite mathematical regimen. There is a right way to do it, and a wrong way, as Major pointed out so well. Ms. Winn sort of has the right idea, but she hasn’t looked deep enough, or far enough back in time to actually understand why the financial meltdown occurred. I researched and wrote an article on this very subject. I invite anyone interested in finding out what I did, find my article and read it. It is titled, “Who REALLY caused the ECONOMIC MELTDOWN”. I posted a copy on the facebook site: Citizens Defense Coalition, and Tea Party Forum. Yes, there is plenty of blame to go around, but the banks are not even close to the top of the list. What you have to understand now is that economist John Williams said it right, ” “If I were to script a scenario as to how the United States quickly could debase the U.S. dollar with maximum impact, impairing the dollar’s reserve status and dwindling global credibility, and accelerating the movement towards a U.S. hyperinflation, it would be extremely difficult to come up with a more destructive course of action than what already is taking place in Washington, D.C”. The past no longer really matters, it is what to do now. The problem lies with two diametrically opposed economic theories, Keynes’ and what is popularly titled, “Supply side”. We have tried the Keynes theory many times, dating clear back to FDR. More recently it was LBJ and Carter, along with democrat socialist party majorities in both houses, just like to first two years of this man’s term. When you control all three branches, you don’t have to compromise, do you? Every single time, the result was total disaster and a horrible litany of unintended consequences that led to extreme economic stress for the common American citizen. On the other hand, we have the example of Ronald Reagan, who was verbally pummeled for employing the other theory. He cut the tax rates on everybody, mostly the lower classes, but significantly the upper rates also. Fact: the treasury took in $40 Billion more the first year at the lower rates than it did under the extremely high rates imposed by the democrat Carter. A little history here, John F. Kennedy proposed the exact same thing in September of 1963, and, I believe, it is what got him assassinated by Johnson. Reagan and I were both democrats at that time. I personally have a copy of the newspaper, look it up: Sept. 23, 1963. In the succeeding years, our economy grew at a 7-9 percent clip, until Bill Clinton was elected. He passed the largest tax increase in the history of our country, which effectively killed the economic growth that was still going up. The only reason he didn’t succeed at totally decimating the economy was that he cut the capital gains tax rates significantly (compromise with Newt) which helped the business owners and companies, but killed the common citizens finances. But, at least, the whole thing didn’t collapse. I hear that the budget was “balanced” under Clinton, which a total falsehood. It was an illusion propagated by all for political purposes, when the truth was the result of using VERY FUZZY MATH, or, in other words, accounting tricks. These same accounting methods have been in use since, and, the real estate bubble and associated mess, was what happens when one of the cards is pulled out of a “house of cards”, it crashes. Since Barney Frank, Dodd, and a litany of others, of both parties, were mixed up in the deception in the first place, they all banded together to “con” us taxpayers and home owners into the “necessity” of bailing out all these mortgage banks and brokerage houses, except Lehman of course. Now, every time something in the card house starts wobbling, we all hear the “chicken little” speech. Well, I for one, am not buying the ruse any longer. I am demanding that the debt ceiling NOT BE RAISED PERIOD. NO MORE MONEY BORROWED. The fact is, I don’t think it matters anymore. I think we are all in a barrel which has already went over the waterfall, and we just haven’t reached the water at the bottom yet. When we do, all hell is going to break loose, and I predict this to occur around the next election in November of 2012.

Robert,

Thank you for adding your perspective to this post!

Greg

Thank you a bunch for sharing this with all of us you actually recognize what you’re speaking approximately! Bookmarked. Kindly additionally consult with my site =). We could have a hyperlink alternate agreement among us