Freeze Spending, Raise Debt Ceiling?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

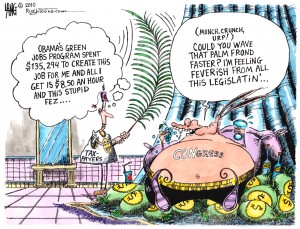

The Obama Administration is planning to seek a spending freeze for 3 years on domestic discretionary non-security spending. Officials say the freeze could save $250 billion over the next 10 years. That may seem like a lot of money until you compare it to the most recent national debt-limit raise of $290 billion last month. It sure looks to me like we have already spent the future savings and then some.

This new agenda is being put forward while the Senate is debating raising the national debt level again by a whopping $1.9 trillion! Add the $290 billion from last month and this is nearly a $2.2 trillion increase in the debt limit in less than 2 months! It would give the Treasury a $14.3 trillion ceiling for borrowing to run the country. And get this–the Congressional Budget Office is projecting a $1.35 trillion deficit for 2010! Last year’s red ink was a record $1.4 trillion. The $2.2 trillion in new debt will just get the country through the November election.

There has already been 9 national debt limit raises in the last 9 years, and number 10 is coming soon. I do not see how you can save money on one hand while you spend it on the other.

It is hard to argue that what the country really needs is big spending cuts and not debt-limit increases. The party in power will rarely cut spending, especially during an election year. Look at the spending of the Bush Administration. Congress raised the nation’s debt-limit 8 times in 8 years. The Bush tax cuts were supposed to produce more money for the government. What happened?

President Obama is keeping with the tradition of spending and forcing up the debt ceiling every year; but this time, he will also be asking for tax increases to offset the deficit. There won’t be many in the House and Senate that will want to vote for either tax increases or painful budget cuts. So, Congress takes the easy way out and increases the deficit. That’s what’s wrong with Washington. Neither party wants to take tough actions, and both want to blame the other side for the mess we find ourselves in now.

A new debt ceiling will surely pass; otherwise, the U.S. will risk defaulting on its obligations, and that is not in the cards. But what is in the cards, according to economist John Williams of Shadow Government Statistics, is a problem selling that much new debt. Williams told me, “The Treasury will not be able to sell the debt easily, and the Fed will have to take the position of buyer of last resort and will monetize the debt (print money) and create more inflation pressures.”

How do you think the holders of Treasury Bills, corporate bonds, and dollar reserves will react to the news of yet another giant increase in U.S. debt? The new debt ceiling of $14.3 trillion will roughly equal the Gross Domestic Product of America! Could foreigners get queasy about the buck and sell everything dollar denominated?

Williams says, “A massive dollar sell off in 2010, I think, is a fair bet.” My prediction is the 2010 federal budget will set another record for red ink because there will be much more economic “stimulus” before the November election.

It’s kinda funny really. At $25 billion per year, Obama is promising to cut less than .000025 out of the budget.

Put another way, Obama is talking about slashing 25 cents from every 100,000 dollars in proposed spending. Big whoop.

The part I don’t get is why he’s in front of tv cameras bragging about it.

Brad,

I agree.

Greg

Greg,

This is the standard slight of hand accounting that Congress has used for years. If the US Government was a business, we would be forced into bankruptcy by our creditors. While a lot of people think that the US government has an unlimited source of income for social programs, defense and pork barrel projects; the money comes from you and me. It comes from the people WORKING and Congress is giving it to the NON-productive people. According to Bloomberg’s Insider [David Rubenstein] at 7:25AM ET, the 2010 U$D is worth $0.15 1960 U$D and $0.45 compared to 1980 U$D. Does this disturb anyone besides me and you? If you invested $1,000 in 1960, you’d have to $6,666 just to be even in terms of buying power. That’s to BREAK EVEN.

A news article you posted in the side bar a week or so ago, a little technical, but it basically exposed the cover-up on US Treasury sales. Anyone really believe that US households are buying treasuries at a rate to replace all the foreign governmental sales? If so, there may be some truth to the urban ledged and conspiracy theories about why fluoride is being added to our drinking what. The FED is buying all a tremendous amount of the Treasuries and monetizing it. Where did the FED get all this money? They make it the old fashion way, the PRINT it.

Now on Bloomberg, Charles Calomiris of Columbia Business School is saying the government will not lose any money on the bank bailouts including AIG. I did not have time to play it back but I think he included GM. And he said it with a straight face. W H A T ! Damn, while I may not be a Harvard grad or a Columbia PHD, I KNOW that is some much unadulterated bull feces.

WHAT I do see is an orchestrated effort by the US Government and its friends to lull the sheep to sleep. The Obamamites are getting us to argue of how many jobs they created….they did not create any except $100K government jobs…but instead of us discussing how many jobs they LOST the country, we are arguing how many they created which means they actually did some thing positive. Oh, yes…we ARE really that stupid.

Ayn Rand and George Orwell would be warning us. The US has a cancer, it is dying. We need financial Chemotherapy and radiation which is going to be painful. What are we getting? Breads and Circuses. Can anyone else hear Nero’s Obama’s lyre fiddle in the background? Wake up people and smell the smoke. Let’s start to put this out in 2010.

Oh.. Anyone know how many people are going to be 65 this year? About 1.2 to 1.5 million; the FIRST wave of the baby boomer this year and more to follow every year. Do you understand the implications?

George,

Thank you for joining the discussion.

Greg

Hey George & Greg,

With the caveat that I am an unapologetic liberal and decidedly Keynesian, the root problem is that once established, the primary purpose of each and every government department is to perpetuate itself and expand its turf.

Solving the problem for which any government agency or department was established, is at best, secondary.

Fixing that requires a better mind than mine.

All the Best,

Thrash

Brad,

People should hear all perspectives. You are welcome here.

Greg

Hello Greg,

Thanks for your insight and the info.

I heard that many of the programs that will be “frozen” in 2011 have seen budget increases that total 24% during FY 2009 and 2010. I would accept a similar freeze if my pay had been increased by 24% over the last two years.

Here we go again with “Washington Speak.” In DC a budget cut is actually a budget increase because the size of the yearly budget increase is trimmed, not the year to year budget figure. I think this is called 0 base budgeting.

A savings of 25 billion a year is chump change.

markm

Mark,

Thank you for taking the time to comment.

Greg

How can the people in the Country be so dumb.

We have become the Country of fools.

The bankers think Obama can sell you a pot of crap. If he told you it was gold, you would believe him.

You know the old saying take it to the bank

Hell there is nothing left to take to the bank.

They already have it all. And you got that pot of crap.

That Obama sold you. Retire on that.

See how far you can get with it.

fools

You mean this takes follow through? Damn it!

Armida,

I like the phrase “we are doomed.”

Greg

Discovered some interesting informations here, thanks. By the way, when it comes to sleeping issues, sleep debt and so, I found some fairly intriguing specifics on web site sleepdebt.info