Too Big to Fail Means Too Big to Exist

Both the House of Representatives and the Senate have passed their versions of financial reform legislation. Now, the process of reconciliation takes place between both bodies of Congress to iron out a final bill the President can sign into law. There is plenty in the bill such as new consumer protection, increased power given to regulators to prevent systemic risk, and new powers to oversee the $600 trillion derivatives market. These are just a few of the highlights, and there is no telling what will actually end up in the final bill. (The derivatives problem alone can kill the U.S. economy. I wrote about this in a post called “Can The Financial System Really Be Fixed? Some Say No.”)

“Too big to fail”

The most important issues that could cause another financial crisis are not covered in the pending legislation. The biggest problem is the enormous size of the institutions being regulated. “Too big to fail” means they are simply too big, and shrinking them is not on the table. Last month, Senator Sherrod Brown (D-Ohio) explained the size problem this way: “Fifteen years ago, the assets of the six largest banks in this country totaled 17 percent of GDP. The assets of the six largest banks in the United States today total 63 percent of GDP, and that’s too (big)–we’ve got to deal with risk to be sure, but we’ve got to deal with the size of these banks, because if one of these banks is in serious trouble, it will have such a ripple effect on the whole economy.”

After the Senate passed its version of financial reform, Representative Alan Grayson said, “Too big to fail means too big to exist. We have to systematically dismantle the institution that caused the systemic risk to the economy and that, for sure, the Senate bill does not do.” I don’t see any way we are going to see a breakup of the banks. There are some amendments that will force banks to spin off risky trading operations. The banks are against any trading restrictions or spin-offs. So, getting that into a final bill is going to be tough. I don’t think the big banks will get appreciably smaller until after the next meltdown, and one is coming sooner than later.

Big institutions take big risks.

There was a time when banks were not allowed to take on too much leverage. The max was about 10 or 12 times capital. During the Bush Administration, the caps on leverage were unlocked and banks took on insane amounts of risk. During the last financial crisis, it was not uncommon for banks to be leveraged 40 times capital (sometimes even higher!) The pending financial reform legislation doesn’t really address limits on leverage. To be fair, President Bill Clinton signed into law the Gramm-Leach-Bliley Act (GLBA) in 1999. That legislation repealed the Depression era laws of the Glass-Steagall Act and allowed banks to have unlimited growth and take on much more risk. Without GLBA, also know as the Financial Services Modernization Act, the banks would have never grown “too big to fail.”

Fannie and Freddie

Neither the House nor Senate bills address failed mortgage giants Fannie Mae or Freddie Mac. The government took over these two institutions in 2008. They have a combined taxpayer liability of more than $6 trillion! There is not a mention of reform or how we are going to budget for this slow motion train wreck. I guess if Congress just ignores a problem, it doesn’t exist or it will vanish all on its own. Omitting this from financial reform legislation is too stupid to be stupid.

The Fed gets more power!

Finally, the big winner in all of this is the Federal Reserve. The regulator who stood by and watched as the financial system spun out of control is going to be rewarded by getting more power! These are the same people who fought regulation of the derivatives market and pushed for repeal of the Glass-Steagall Act. The Fed will likely get authority to oversee a new consumer protection division for businesses such as mortgages and credit cards. Also, the Fed will supervise the biggest and most complex financial companies. This is like the proverbial fox guarding the hen house. The pending legislation may force an audit of the central bank, but I wouldn’t count on any meaningful look at the secret deals of the Federal Reserve. I hope I am wrong.

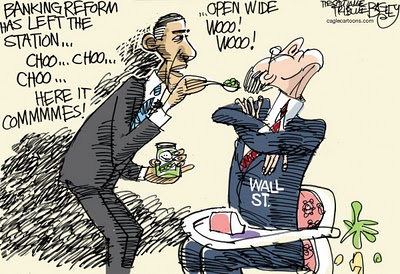

Congressman Grayson recently summed up the importance of financial reform by saying, “We have a basic choice we have to make. Do we want a government of the people, by the people and for the people, or of Wall Street, by Wall Street and for Wall Street? It is disturbing how much this government is by Wall Street and, therefore, you end up with bills that are for Wall Street.”

“The bold effort the present [central] bank had made to control the government are but premonitions of the fate that await the American people should they be deluded into a perpetuation of this institution or the establishment of another like it.”

– Andrew Jackson, the President who “killed” the second central bank and secured our liberties until its third iteration in 1913

In a momentary lapse of reason (for which, no doubt, he received a private lashing) senator Dick Durbin (D-Ill.) said, “And the banks — hard to believe in a time when we’re facing a banking crisis that many of the banks created — are still the most powerful lobby on Capitol Hill. And they frankly own the place.” Though he dare not whisper the name of the puppet master, it is the Federal Reserve that runs the show.

Last month, Goldman Sachs was charged with fraud by the SEC. Politicians have become masterful at channeling the anger of an uniformed populace; the timing of this indictment coincides with the current administrations push to give the cause of our economic woes, the Federal Reserve, complete dictatorial control of our economy. This sleight of hand would make Houdini proud.

Much like the Patriot Act had nothing to do with patriotism, this latest euphemism, “Wall Street Reform,” masks the bills intent – to solidify power in the hands of those responsible for the latest economic mess: the Federal Reserve. In conjunction with their godfather, the Bank for International Settlements, this cabal of bankers has done nothing but suck the life from the population. Since the Fed’s inception in 1913, the dollar ended a century of stability and has plummeted in value by over 90% diluting the labor of those that can least afford it. I’m sure giving them complete dictatorial control over our lives will work out well for the peasants.

Let your mind wander back to October of 2008 when the TARP bill (even more disliked by the public than the recent health care debacle) was rammed through Congress. While the Republicans held the White House, the Congress had been in firm Democratic control since the 2006 mid term elections. No bill could be passed without Democratic support. One month shy of the 2008 Presidential election, congressional Democrats looked to their nominee for direction and he provided it. Bowing to his largest corporate donor (Goldman Sachs), candidate Obama voted for it. This support was crucial because it allowed the Democratic members of Congress to vote for the bill, and it was the Democrats who provided the votes needed for passage. So in a very real sense it was Barack Obama who gave the $750+ billion to Wall Street (most of which ended up at Goldman Sachs, his largest corporate donor).

In short, the entire anti-Wall Street aura of Congress’ antics are for show. It is to convince an ignorant public that they are against the rich. Democrats have done this since the New Deal. Rich Americans are willing to put up with this anti-rich rhetoric as long as the Government keeps stealing money from the average American and giving it to them, and they prove this by donating money to New Deal politicians (Obama’s top four donors where ALL banking institutions). Nothing has changed for 80 years. The only difference is that the original New Dealers were more subtle about it.

The new “consumer protection agency” that this “reform” package is going to create is not placed in the hands of Congress. No, my friends, that would never do. This “reform” places it solely under the auspices of the puppet master: the Federal Reserve. The Federal Reserve is a quasi-government institution. However, it has shareholders that, by law, are paid a 6% dividend. Goldman Sachs, it is reported, holds about a 10-12% stake in the Fed. Additionally, Goldman Sachs is a primary dealer in the U.S. Treasury market and is going to be instrumental in providing the funding to our government for its massive budget shortfalls. If you honestly think that the U.S. government is about to bite the hand that feeds it, you belong in either an insane asylum or on the editorial board of the NY Times. Now that they’ve stolen your car, they’ll be forced to return the hubcaps . . .

“I am one of those who do not believe that a national debt is a national blessing, but rather a curse to a republic; inasmuch as it is calculated to raise around the administration a moneyed aristocracy dangerous to the liberties of the country.” – Andrew Jackson

Nelson,

Bravo! What else is there to say? Thank you.

Greg

Greg

This article makes some good points which must be considered. The citing of Alan Grayson for anything but a commitment order is disconcerting. This is a person who seems to want anyone who disagrees with him confined to a re-education center. Mr. Grayson is the undisguised face of the coming New Order if things don’t change in November.

Regardless there seems to be little real effort at reform and more effort at controlling the general population in this bill. Allowing the banks into the brokerage and collateral businesses was a mistake. Rectify it by reimposing the previous restrictions. The spin-offs and downsizing will follow naturally.

Banks then and now do not hire the best and brightest; anyone with experience dealing with banks understands that. The fact that the CEO of Bank of America apologized while saying that “…we never thought housing values would decline.” makes this very clear.

John Bernard

John,

I don’t think Grayson is all bad. I do not agree with many of his views but on this “reform” he is right. He also must be taking heat from the administration because he is at odds with them on many issues. Thank you for your pointed comment and support.

Greg

Hey Geg,

Thanks for all your great articles! I just wanted to comment and say that of course The Fed was going to lobby to repeal the Glass-Steagall Act! Why wouldn’t it?? The Federal Reserve Bank is just the biggest of the big banks disguised by a name that makes it sound governmental. The Fed is made up of 12 Federal Reserve Banks, they’re organized into corporations whose stock is sold to the COMMERCIAL BANKS within it’s districts. Those commercial banks then elect the board of directors for their regional Fed and its president who then make Fed Policy. If the banks see a law, in this case Glass-Steagall, keeping them from profits and bonus’, then it would be in the Fed’s Best Interest (and by that I mean the Commercial Banks best interest) to lobby to repeal that law!

I don’t know if the Fox guarding the Hen house is the correct analogy, it’s more like Bonnie and Clyde guarding the Bank…

David H.

David,

This statement is pure gold! “it’s more like Bonnie and Clyde guarding the Bank…” I wish I thought of it. Good stuff man!

Greg

The American public is too stupid to actually look into the “why” in the meltdown they certainly will not understand the “how” this is not a fix. The 2 party system and voting “party lines” has streamlined our population into voting for the party and not the people. Can you imagine how lost our population would be if they actually had to research every politician they voted for based on voting record? If they could yank themselves away from “The Bachelor” or “American Idol” long enough to have them look at our leaders based on voting records and how those voting records aligned themselves with the interests of Wall Street they would finally see the truth. Unfortunately, this will not happen.

The last time our economy was in this situation it took World War II to pull us out. My biggest fear is World War III is around the corner. One of my family members has already left the country for South America where he and his fiance’ have bought a 25 acre farm on the foothills of the Andes Mountains as their insurance policy. He is convinced this land will come in handy.

Hope we are wrong but I don’t see how.

Stephen

Thank you Stephen.

Greg

Look at the stock market today. Looks like the slow motion train wreck is fast forwarding!

David,

There will be many more down days. Thank you for weighing in.

Greg

Hey David and Greg,

Are we in the double-dip?

Or, was the run-up just irrational exhuberence?

I work for a national company (I am a BLS U6er–underemployed).

This company is up to something. They may be trying to cut labor for a short-term tactical gain, or they are preparing for the double-dip by “leaning-out operations” at all costs. It seems to be a paradigm shift as the focus on customer service and good presentaion of product is gone–cutting hours is the new focus at this company. I don’t know if this is a local or regional thing. And, I don’t know if this is a company-wide action plan. Dunn-no!

I don’t know why these tactics are being used.

markm

MarkM,

I hate to tell you this but now many experts are saying we are going to have a downturn by fall or sooner. One of the first on that call was economist John Williams of shadowstats.com. He says all of his indicators say we are definetly going to have another downturn this year. Williams has said many times that we are heading for an inflationary depression. I say what is coming will be worse than the Great Depression. Can you imagine a world where money turns worthless? At least in the Great Depression money retained its buying power.

New york and DC will be ghost towns, people who count on money to hold power will not be needed in the future. They have become a drag on the producers. Why should a man produce more then he needs are work overtime for the tax man.

Bob,

I agree,

Greg

Hey Bob,

Don’t forget what is happeining to Kalifornia. Our producers have already left. Retired folks, gubmint workers, and businesses that service Kalifornian’s are what is left.

Yesterday, our legistlators decided against cutting the budget to solve our 20-30 billion deficit. They are going to use a new approach to solving the problem: They are RAISING taxes and fees.

Oh SHOOT! They have been using that tactic on a twice yearly basis for the last 4 years!!!!

“What is it called when a person does the same thing over and over again, but expects a different outcome–this time?”

Thanks,

markm

This afternoon when the stock market continued it’s downward trend, the talking heads on msnbc kept trying to sell us on buying treasury bonds. They kept saying how bad Europe is on how they aren’t see the “recovery” we are. I couldn’t help but laugh out loud in the gym locker room.

The double dip is just starting. Look for housing to continue to look for the floor while the banks hold back inventory. The tax credit is expiring (unless they extend it again) so purchase application will fall as the summer gets underway. Rates will stay low for a while as needed because of the shadow inventory so look for prices to rise on the shelves. The dollar will look good against the euro for the short term but gold will rise regardless. The normal rules just left the building.

Stephen

Stephen,

Thank you for your comment.

Greg

My husband and I fell behind 2 mortgage payments in 2008 with Chase bank. Chase made arraignments with us to pay extra on top of our mortgage payments to get caught up and current, which Chase automatically withdrew from our Chase checking account for three consecutive months, they suggested when we were current, they would set up a loan modification trial with us.

When the three months were up and we were now current, Chase informed us we were now 5 months behind on our mortgage, and they would not accept anything less than the full amount owed, and all the late fees for the the last five months. We explained to Chase, several times, they withdrew the money from our account themselves every month, and that we had our bank statements and the mortgage statements from them that shows all the transactions which we ended up sending copies to Chase, they still said they have no record of any of it!

I also reminded Chase they had lost over $10,000 of our money they took from us, and they better find it! Chase suggested we send in all of the required financial paperwork to start our modification anyway, while they sort out where our money vanished to, but threatened to foreclose on our home if we did not send in all the money to get current and nothing less. It has been 2 years and after losing all our financial information they requested 3 different times and still no word of where our money vanished to, we are still standing our ground! We are not about to let Chase take our home for their sheer negligence and out right robbing our checking account of so much money, and we now have the help of Cabrillo Economic Development Center helping us. The problem is that these banks are getting away with breaking the law because too many people get fed up and walk away just handing their homes back to the banks, and there is no making the banks accountable for breaking the laws that are already in affect! Slowly people are learning and a few class action lawsuits are turning up, but our government can’t keep ignoring what these banks are getting away with because soon THEY will have to answer to why they are not doing their job of enforcing the laws and letting these banks rob the people of this country blind! They are all digging their own graves, and corruption always comes full circle. ALWAYS!

Melanie,

You should consult Marie McDonnell @ [email protected]. Marie is a Mortgage Fraud and Forensic

Analyst and a Certified Fraud Examiner. She has 23 years experience in the field and serve in the capacity as an expert witness in consumer mortgage fraud and foreclosure cases. Marie also has the most comprehensive, well-documented library of case studies in

the country. If you have a problem getting in touch with her please email me and I will call her for you. Do Not Give Up!

Greg