Gold’s Flashing Warning Sign

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

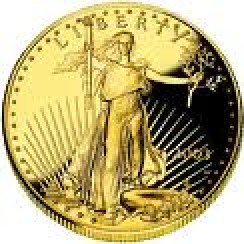

Gold hit another all-time high yesterday! According to gold website Kitco.com, “. . . investors continue to seek out the precious yellow metal as a safe-haven asset amid heightened financial, economic and geopolitical uncertainty. One market watcher in a wire service report summed up nicely gold’s recent price action, saying “it’s a warm blanket on a cold day.” August Comex gold closed up $4.80 an ounce at $1,245.60 after hitting a new high of $1,254.50 in early trading.” For gold investors, it was a gratifying event. For everybody else, it should be considered a warning sign that all is not well in the financial world. A wicked storm is blowing our way. What is triggering gold’s record rise? I’ll sum it up in just one little four letter word—DEBT, and lots of it. It seems you can find it everywhere these days. Debt has soured the banking system, but it is kept hidden with government sanctioned accounting fraud. The consumer is loaded with debt and is tapped out. Entire governments are on the brink of insolvency; just take a look at Europe. The biggest ball of debt is possessed by our very own Uncle Sam. Yesterday, Reuters reported, “The U.S. debt will top $13.6 trillion this year and climb to an estimated $19.6 trillion by 2015, according to a Treasury Department report to Congress.” (Click here for the complete Reuters story.)

Let’s just let that sink in for a moment. The debt clock just tripped a cool $13 trillion, and we are going to tack on another $600 billion by the end of the year. Wow! I can’t believe I am still hearing that gold is in a bubble from the wonks on financial TV. We are in deep trouble folks, and gold is trying to slap us in the face to wake us up! Gold is not a commodity; it is money. Just ask the folks in Greece, who will probably be leaving the European Monetary System, if they would like to hold gold instead of the Greek Drachma?

Debt is the problem. There are only 2 things that can happen to debt. You can either pay it off or default. That’s it. The U.S. will not default outright. It will continue to print money; however, that is the same as a default. It just masks the action with inflation and spreads it out to everyone. The U.S. is going to be taking on a lot more debt when the economy takes another plunge. In his latest report, John Williams of shadowstats.com says, “. . . the economy is headed into an intensifying downturn or double-dip recession, which should blow apart forecasts of the federal budget deficit and related Treasury funding needs, as well as trigger massive selling of the U.S. Dollar. . . . Ahead lie likely increased federal bailouts of banks, the unemployed, insolvent states, etc., which will balloon the deficit and Treasury funding well beyond current market expectations.” More bailouts will require more money printing and that, in turn, will cause big inflation at the very least. (“Real” inflation, according to Williams, is running at 9.5 %.) Williams is projecting hyperinflation within the next 5 years.

In a recent Bloomberg story, Bill Gross, who runs the world’s biggest mutual fund, calls what we are facing “the debt super cycle trend.” Gross suggests, “. . . U.S. economic growth won’t be enough to support the borrowings “if real interest rates were ever to go up instead of down.” (Click here for the complete Bloomberg story.)

I think Mr. Gross is also suggesting the U.S. government will be printing lots more money to make up for the shortfall. He is not alone. Egon von Greyerz, founder of goldswitzerland.com, was on CNBC Europe Monday to talk about the yellow metal. Greyerz says the1980 $850 peak would equal more than $7,000 per ounce today if the price was calculated using “real” inflation numbers. John Williams says the exact same thing, and this suggests the gold price will go much higher.

The video below treats you to a lively and informative discussion about the future of gold:

Politicians are like rivers: they follow the path of least resistance (which is why both are often crooked). All debts are eventually settled; the only questions how. Politically, the path of least resistance is to camouflage a slow motion default by devaluing the currency. You can bet this is the agenda.

While this is my humble opinion, the greatest wealth transfer in history is taking place today. Having been smashed by an iceberg of debt, a golden lifeboat is all that may protect you from the chilly waters.

“With the exception only of the period of the gold standard, practically all governments of history have used their exclusive power to issue money to defraud and plunder the people.” – Friedrich August von Hayek

Nelson,

Yes, “slow motion default.” I think the speed will pick up a bit sometime soon. Thank you for your great comments!

Greg

Hey Nelson,

F.A. Hayek had it all figured out. Monetization of the debt will devalue the wealth that the middle class has gianed while the ruling class will reap the rewards.

BO, et allia, will have nice lives while inflation runs wild.

markm

MarkM,

Thank you for your thoughtful comments.

Gerg

Interesting…F.A. Hayek’s The Road to Serfdom is currently the #1 selling book on Amazon. Exciting. The American re-awakening…

“Remember that prosperity can only be for the free, and that freedom is the sure possession of those alone who have the courage to defend it.” – Pericles

Thank you Kevin.

Greg

Greg,

Great reporting, as always.

How do these money pundits not get it? Have they sold their souls? Don’t they realize there is more audience, hence money, to be made by telling the truth?

Will

Will,

I believe they do get it, at least some of them, but that, yes, they have sold their souls. Their “expert analysis” is bought/paid for by the uber rich inlfuences that control these networks and other media.

In the same way, guys in Congress (most of them, I’d say) know the deal; they know what’s happening in America and across the water. But, they are in place for a reason… to play ball. And they’re not playing on our side; whether Republican or Democrat, it’s all the same. In this way, the interests of the rich and well connected continue to be protected. There has to be a real uprising in America so this can truly be a land of free enterprise and the pursuit. To start with, let’s begin the process of continuing to educate the masses… spread the word and adopt an “each one, teach one” mentality. A real movement of the people, by the people must emerge with no agenda except to even out the balance of power & really put it in the people’s hands. I liked the TP movement, initially, because I saw it as an organized means to that end but it has taken on another direction and been marginalized (predictably) by the establishment. We need real, unabashed patriots who don’t belive in political labels or doctrine but in the principles or fair and balanced trade/power, honesty, and freedom. Please share your thoughts with me at http://www.opulentogre.blogspot.com

Kudos to you, Greg, for the work you’re doing. With some more like minded people who really saw through the BS, we could really start to change the world.

It was disturbing to watch the panel mock their guest. Obviously they either don’t believe the current situation is serious or they are completely dishonest. I have turned to silver as gold is getting beyond my reach, but I wonder if it would be better to spend the paper currency now while it still has value and gold is still a relatively cheap purchase.

For me gold is not an investment it is what I intend to use to survive the coming economic flood.

The US debt is undeniable as are the solutions to the problem. Why keep closing one’s eyes?

John,

I agree. I thought the panel did not take him seriously but he held his own! Thank you for the comment.

Greg

Greg, The only reason Gold is priced so low is the blatant manipulation by the Government’s proxies who are forcing the prices down at the government’s request. This is just like the US Government propping up the Euro by selling large amounts of US $ and buying Euro.

You are correct George! Thank you.

Greg

Hey George,

I am going to restate your opinion here:

We are living beyond are means now (via the gubmints version of a credit card), but will have to live below our means later to make the economic correction.

We are living through an economic illusion. All of our problems “seem” survivable right now.

“What has made the state a hell on earth has been precisely that man has tried to make it his heaven.” Holderlin from Road to Serfdom.

markm

Will,

You are assuming the politicians hold all of the power. They are beholden to their campaign contributors (investors) just like a corporation is beholden to their shareholders. The banking lobby is incredibly strong and have a vested interest in keeping the American public in debt. Some politicians are popular enough to get re-elected in their districts/states like Ron Paul but most need the financial backing of their campaign contributors to keep suckling at the teat of power. The banks are also very large shareholders in mass media giants. Keeping people on the air who speak favorably of the banking system and their chosen candidates while canning people who have critical opinions. Our freedom is only perceived as we are all slaves to our debt.

Could you imagine a society without fractional reserve banking and paper money being back by gold? There would be no inflation at all.

Stephen

Stephen,

“Keeping people on the air who speak favorably of the banking system. . .” I experienced this first hand in my network TV days. This is why so many people are in the dark about the true state if the econmy. Thank you for the thoughtful comment.

Greg

No end in sight. I hope that a double dip recession is the worst that we see. I fear a full blown depression.

David,

I am going with Greatest Depression. Thanbk you for your comment.

Greg

Hey Greg,

I have been caught-up in group think before. I have also been caught-up in a variation of group think, which is pop culture.

Many of the people who are in power or on TV have been taught at prestigious schools. The dogma that is taught leads to group think. I recently attended school again. I was surprised at how many people accepted pop-culture theories as gospel. I was not surprised when I used eigth grade math to disprove these theories and recieved vitriolic replies from the zealots.

I got the same impression from the panelists on this clip. The smug smirks did not hide the vitriol.

“Few discoveries are more irritating than those which expose the pedigree of ideas.” Lord Acton from The Road to Serfdom.

What is the pedigree of Keynesian ideology?

markm

Greg,

Here’s a little perspective on the amount one trillion. If you were given $1,000,000,000,000 to spend and every second you spent $100, it would take you roughly 317 years to spend it all. Absolutely mind boggling.

Very interesting Tom.

Greg

All you have to do is look at the national debt clock or watch I.O.U.S.A to understand where we are headed. A documentary made before Sub prime and Obamanomics and we were in trouble back then.

Thank you Darren for reminding us of that fact. Very good point.

Greg

What about silver??????

Dino,

I think silver is a deal. Here’s why. It’s all time high (1980) was about $50 per ounce. Today it is trading at about $18 an ounce. Gold on the other hand is about $400 above its former all time high (also in 1980) of $850 an ounce. Silver has a long way to go to catch up to AU. Also, experts say for the first time in history there is less above ground silver than gold. And the normal gold to silver ratio has been around 30. Meaning 30 ounces of silver should equal 1 ounce of gold in value. Today that ratio is around 67. So gold is way too high or silver is way too low. One warning silver can be very volitile in both up and down swings. So if you buy, buckel up and hang on. I hope this helps.

Greg

Von Gruyerz missed a terrific opportunity to explain why gold (and other precious metals) prices are seemingly unaffected by the financial Armageddon unfolding all around us. The reason, he must know, is ongoing, systematic and even institutional manipulation of the metals markets by the largest players. GATA recently announced a London trader and whistle blower asserting exactly that. Government response, however, was negligible. Given gold’s traditional role as canary in the coal mine, they directly benefit from price suppression. Banks and Wall Street will do whatever is required to keep that little bird on life support so the average Joe won’t see hyperinflation coming until it has devoured his earnings, investments and retirement fund. That, abetted by a media that equates physical gold ownership as quaint, eccentric, or borderline terrorism makes for a lethal propaganda war against the yellow metal.

Mark,

Good point.

Greg

Richard Russell has been writing the Dow Theory Letter since 1958. You must read everything that he wrote in May 2010! He is now “insisting, demanding, begging all of his subscribers to get out of stocks except gold” “I see a major crash as the outcome. Pul-eeze, get out of stocks now…” In one of his newsletters , Richard forecasts the DOW going down to 1000. “The gigantic fiat house of cards is slowly coming undone. This primary bear market will be of historic proportions and earth-shaking proportions!” (go to http://www.321gold.com and read about gold and what Richard Russell has to say0