Inflation Up Globally

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The meeting yesterday in Europe to come up with a plan to stem the sovereign debt crisis turned sour. Zero was accomplished, except to put even more fear into the world over an impending financial meltdown that will likely be worse than the 2008 mushroom cloud. The Telegraph UK is reporting, “During two hours of bitter exchanges during a meeting of all 27 EU leaders before a crisis summit of the Eurozone’s 17 members on Wednesday, President Sarkozy fought hard to get the Prime Minister barred from talks that would finalise a 100 billion euros cash injection into banks. ”We’re sick of you criticising us and telling us what to do. You say you hate the euro, you didn’t want to join and now you want to interfere in our meetings,” the French leader told Mr. Cameron, according to diplomats.” (Click here to read the complete Telegraph UK article.) It appears members of the EU are having a hard time coming up with a plan which will, no doubt, be some sort of combination of bank failure, steep haircuts in sour sovereign debt, and money printing to pick winners.

So, what does Europe have to do with global inflation? I figure if there is no plan soon, things may get out of control. In this scenario, the ECB may be forced to print euros like crazy. Meanwhile, the Fed would rev up its printing press at the same time to help fight off another out-of-control systemic failure. This latest possible money dump falls against a backdrop of accelerating global inflation caused by multiple rounds of currency creation since 2008.

How bad is inflation around the world right now? In Asia, Bloomberg recently reported, “Singapore’s decision to slow its currency’s advance rather than halt gains shows the dilemma facing Asian nations trying to tame inflation while protecting exporters from faltering economies in Europe and the U.S. . . . Singapore’s inflation will average about 5 percent this year and 2.5 percent to 3.5 percent in 2012, the central bank said yesterday. Consumer prices rose 5.7 percent in August from a year earlier.” (Click here to read the complete Bloomberg report.)

In the Middle East, Business Intelligence reported last week, “Saudi Arabian inflation accelerated to 5.3% last month, its fastest pace since January . . . the Saudi Press Agency reported today, compared with 4.8% in the previous month. The cost of living index increased 0.9% in September from August, the report said. Annual inflation in January was also 5.3%.” (Click here to real the complete BI-ME.com report.)

In the UK, FXStreet.com reported last week, “What we are seeing though is the signs of inflation creeping up around the globe, most visibly in the UK who reported CPI of 5.2% inflation vs. the expectation of 4.9%. I thought that expectation figure yesterday had to be wrong, but boy was I mistaken. To be clear, the BOE has an inflation target of 2%, which means it is running more than twice their mandate. I’m sure the UK citizens love this as the economy slows down. Stagflation anyone?” (Click here to read the complete FXStreet.com report.) I don’t think the recent 75 billion Pound Sterling injection into the UK economy will slow down inflation there.

In the U.S., inflation is following the upward global path. Shadowstats.com reported last week, “The September producer price index jumped by 0.8% for the month and 6.9% for the year, versus August’s unchanged monthly reading and 6.5% annual inflation. Annual inflation in the September consumer price index again hit the highest level for the CPI-U series since September 2008. The CPI-U gained 0.3% for the month and 3.9% for the year. . .” If inflation was calculated the way Bureau of Labor Statistics did it in 1980, the true inflation rate (according to Shadowstats.com) would now be “11.5%.”

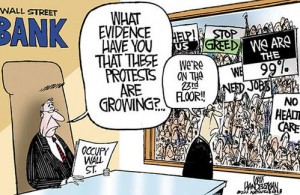

Even if the EU comes up with a plan to avoid a repeat of the last train wreck, money will be created by the electronic truck load. At the very least, global inflation will increase. At the very worst, there could be hyper-inflation (especially in the U.S. dollar) and a systemic crisis. I am sure higher inflation will be like throwing gasoline on a fire with the Occupy Wall Street protesters!

Greg,

It looks like the EU is headed toward a crackup. read the article today about Blair [UK], backed by Sweden and Poland, saying that they [UK,Sweden, Poland] were not going to let the Franco-German block set terms of a bailout that gave their banks a leg up on the rest.

Keep the news coming brother!

Thank you George and Art!!

Greg

Greg, good article as that is the way it will go, just more and more printing and inflation until all credibility is lost that 5 to 10 percent inflation will not be enough to pay off the world’s debt at that level. When inflation continues without wage growth, which is what we are experiencing now, more discontent from the working people, more protest, and so on and so on, until the economy cannot function as we know it. At that point who knows what will happen, a new currency or whatever, one thing is for sure is that the middle class will be vastly destroyed. Without a strong middle class what you have is third world which is probably where we are going in the long run in any event.

All this protesting and has anyone seen a change? The Credit Unions

are doing more business since Wells Fargo Banks, did their card fee. I hear grumblings about the checking and inactive account fees. Guess we all accept the high price of gas. Cars racing down the interstates at speeds well above the speed limit. Must be the gas additives used to counteract the bad effects of ethenol? But really, is there any conversations about the Euro and the European banks by the sheeple of our country, other than here and a few other sites?

I see that the major department stores are bringing back Lay Away, for the Christmas shoppers. Want to bet how clogged the isles are, with the selective inventory this year? Halloween and Thanksgiving will be side stepped and the drive for Christmas sales will be paramount.

Yes, people are still buying food with maxed out cards. Resulting with items placed back on the shelves or put back into the coolers. Imagine if grocery stores charged a restocking fee.

All that aside,brings us back to the protests in the major cities of our country. How long will they last? I say wait till the temperature drops and a few inches of snow appears. Time is on the side of the bankers. No Valley Forge here.

The protestors and the bankers, kick the can down the road together.

“Bankers roasting on a open fire” I just love Christmas Carols.

This debasement race has been going on since 1971, the difference now is, that .001 changes in inflationary money creation have been replaced with .01 changes, soon .1, then 1.0 and eventually 10.0

100, 1000, and welcome to Zimbawe.

40 years in the bible represent a probationary period of time, 40 years is the historical established length of time that governments who adopt a fiat money standard last before hyperinflation kicks in. 1971 nixon removed our gold backing 1971+40=2011. we may last a little longer than the average, but I wouldnt count on it. the bible also says it will take a days wages to buy a loaf of bread, and we will be putting our money in a purse with holes in it. if history is our guide and it should be its just about over with. buy gold tried in the fire is my financial advisors recommendation, his name jesus christ.

Good stuff George Skrmetta!!!

Greg

Greg,

nice array of facts you have given your readers, thanks

as The Wizard of Oz sayeth ::

“Humpty Dumpty sat on a wall

Humpty Dumpty had a great fall

All the King’s men and

all the King’s horses

could not

put Humpty Dumpty

back together again”

translated into mumbo jumbo means gotta bite the bullet and

payoff the debts dollar for dollar, 100%, today or else

europe, west, is going to be one big banana republic

if paid off today then the wise guys can devise an original

european, west, charter, unique, that has a chance

to succeed :: altho given the lack of brains, trans europe,

the big shots will fail again

let me give them a clue for you to chortle over::

west europe leaders are still playing

make believe one world government

whereas the world nations are stuck playing musical chairs

in accord to the music “each nation versus each other nation

dog eat dog,

evolution will determine

“mirrow mirrow on the wall

who is the fairest of all?”

“i am sayeth humpty dumpty”

and so all the merry govt leaders

and big shot bankers

and other assortment of thieves

cried and cried and

ate their bananas

as good little clones

always do…. “

hi Greg,

i gotta add this jingle to

the musical score called

government politics

(or bleat bleat bleat as the goats say)

1) your uk members are doing their best

to make the meeting members focus on

all but the uk because they are the

dumbest of all, with the worse economic

situation, worse than Africa, worse than

mid-east, and of course much worse than w.europe

thus the mighty mice of uk want king Sarcozy

and

Marie A. Merkel to solve the problem of w.europe

and

get it going again, from the dead,

so that the

uk members can clone themselves off w.europe

and thus

no one the wiser that uk was the cause

of all the economic grief worldwide

hiya Greg,

no rest for the weary

so i thot i ought give you another heads up

the so called defunct group called G20

do not have a clue how to handle, bury, their

scam called world chaos and economic death

but if they were to ask me nicely,

i would tell them,

in fact i would show them,

in fact i would do it for them

their first clue is to be responsive to

ussr when they cut across their bow

and do not let prc slip away

these two have the euro solution in-hand

and will not share these solutions with you

because they want to feed you bananas

out of their hand,

so you fall in line and make their life easy

and successful, all for them none for you

Emperor Sarcootzy wrote this game with

emperess M.A.Merkel, the Rulers of Hazard,

and lost

now they have to let ussr-prc run with the ball

and tag along, letting the exploitation begin

so w.europe can survive on the fallen bananas

no, europeans can not be in on the top leadership

mostly because they never have been in that domain

Greg, i give you this the third of today, i will

be surprised if even one is published by you,

but at least you will have read my spew and

that is good enough for me

similarly, i read yours, daily or whenever,

because you take the best of all publications

and put it out on your forum, with your notations,

so i dont even have to think, i merely read yours

and have the essentials in-hand, thanks for saving

me the time of reading the gibberish of the

public publications written by high school drop outs…

our olde uncle J.Sinclair publishes you now and then

but if not living in prehistoric Connecticut

would know to publish you daily

on his otherwise excellant on point lengthy extract

and predictions

Greg, inflation is showing up all over the world. The USA will see a difference at the end of this month.

There is a report or study that has come ouZürichch that is a direct threat to our freedom in the USA & The world Western Nations. Armstrong has written one of the most revealing articles I have ever read about who & what “The Group Of Manipulators’ are up to & their past & the reason he turned them down when he was asked to JOIN the Club. We know what the results were to as far as Martin rejection to become a club member and he paid dearly for it. I hope your readers will read this revealing detailed report of the world behind the Curtain at http://www.armstrongeconomics.com/wrtings/10/22/2011/ Is The Zürich Alleged Super Global-Super Entity Real? Martin puts it in a real as you can get article & he puts names to those who are the main Protectors of the Group Of Manipulators. This may be the most important piece about what is really going on with those who use the curtain to carry out their crimes and why they always seem to never face justice in the U.S. Court system. This is a must read for the millions of Americans who will be on the receiving end of what this group does. Just as Boomberb will attack any one saying the free markets are not manipulated we will see the rest of the MSM do the same by running lies to protect the group of manipulators to the very end.

Greg, I have to give you many thanks for reporting the truth & if Amstrong is willing to put up such damning data on what he has seen and suffered because he would join the club I have to give him credit for defending freedom & the U.S. Constituion. He shows that life is not worth living if you are not truely free & you may have to fight for the freedoms the government will take away in the name of security.

M Smith,

You are correct. Look at oil price!! Back up over $90 a barrel!

Greg

Good post Greg. The deflationists always seem to want to ignore the money printing of the BOJ, BOE, the seemingly only solution ahead for the EMU, and of course, China. All these extra trillions that will be sloshing around the world’s economy certainly certainly indicate more inflation ahead.

Yes Andy,

About the only thing deflation are Greek bonds and real estate!!!

Greg

Greg, We all knew this was coming, so, bend over & spead your cheeks, or if you prefer, buy gold, silver, or good mining stocks of them, & prepare for the ride of your life. Some of us made this choice a few yeas ago, but for those who haven’t, it really is time NOW! Chuck

As I have said before the policy makers at the FED do not believe that mony printing causes inflation because the money is not backed by gold or silver. Bernanke indicated this in his paper to the Kanas FED. However, he is wrong because this excesse money is used by the big banks to hedge against inflation which in turn drives up commidity prices.

As I read this article, the thought of Peak Oil came to mind. World oil production has plateaued beginning 2007. Lending depends on growth, growth depends on energy, energy prices are much higher and more inelastic than thought. Higher prices have not brought larger energy supplies on-line. Higher prices have allowed higher priced energy sources into the market such as deep water crude and oil sands.

I agree that that the economic doctors are using a prescription of antibiotics (creation of money from no where) to help the patient linger along until the contagion is gone and money creation through debt resumes.

What if the contention that cheap energy equals growth and growth as we knew it is not possible without cheap oil? Are the wrong symtoms being treated?

Peak Oil advocates have expressed this link before, but has a formal study been published to study the link between peak oil aand growth to determine the validity of this conjecture?

went to a barter fair, many folks are still just living on a little cash. The money made by the fair goes to the local needs. It helps with food and clothing and many other thing. This years I saw many home can goods, I think more people are canning. A gallon of high country honey , went for a wool cap and 10 bucks. More trading this year then money. My friend did take a gold coin in trade for his produce. The local fairs will only get bigger and more local. In Washington state produce is not tax and a fair trade is fair. 0 inflation, it’s the only game in town and you best plan on it. PEACE

I stopped by Whole Foods last week on my way home to get a bag of herbed popcorn (I like to get it every now and again). I don’t shop at Whole Foods very often because I think they are very expensive (there are way cheaper alternatives in Tucson).

Anyhow…I used to pay .99 a bag for the popcorn; the other day, it was $1.29 – a .30 increase. So, if I’ve done my retail math correctly, that means the dang bag of popcorn rose nearly 8%. No inflation?

On another note: My college students met with an organization in Tucson yesterday that helps homeless women and children. Currently, there are approximately 1200 homeless people (men/women/children) in the city with more arriving as winter sets in elsewhere. The organization is getting at least five-six calls a week from women who have children who are out on or about to be out on the street. Food pantries are low on stock and people are becoming desperate. One young mother – a widow with three children – has taken to pulling garbage out of dumpsters to feed her children; she also has a child who is quite ill. She lost everything after her husband died. “Tent cities” are popping up all around. I asked “What are the city officials doing to help your organization?” The answer: NOTHING; the City of Tucson does not want to deal with any of it!

My husband is reading Howard Zinn’s book “A People’s History of the United States” and his comment thus far is that history truly IS repeating itself; chilling.

I come from old seafaring stock, so “batten down the hatches; we’re in for a blow.”

Thank you Samantha for the reporting on inflation and homelessness.

Greg