The Only Thing You Can Count On

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

Last week, in testimony on Capitol Hill, Fed Chief Ben Bernanke said, “The pace of the economic recovery will pick up.” As far as the weak economy is concerned, Mr. Bernanke also said there would be, “a notably better performance than we have seen so far this year.” I could not believe what I was hearing. It was totally opposite to other economic news that came out in the very same week. For example, unemployment claims stayed above 400,000 for the 14th straight week! I do not see how that trend is going to reverse itself anytime soon with the anemic job growth in the economy.

Another big economic downer came from RealtyTrac. Even though the happy headline splattered all over the mainstream media was similar to what CNN posted, “Foreclosures plunge in first half of 2011,” the real story was buried. CNN went on to say, “RealtyTrac’s CEO, James Saccacio, sounded a sour note, however, contending that the drop-off in filings can be traced not to economic improvement or a pick-up in the housing market, but to processing delays . . . ‘[That’s what is] pushing foreclosures further and further out — we estimate that as many as 1 million foreclosure actions that should have taken place in 2011 will now happen in 2012, or perhaps even later,’ Saccacio said.” (Click here for the complete CNN story.) How do you put out a headline that misses the point of your own story by that much? I guess CNN has the same problem Mr. Bernanke has–grasping reality. The expert quoted in the CNN story said the housing market may not recover until “2016”! (And you thought I was bearish.)

Can we count on Mr. Bernanke when he says the “recovery will pick up”? Treasury Secretary Tim Geithner recently stated just the opposite. He said, “I think for a lot of people it’s going to be – it’s going to feel very hard, harder than anything they’ve experienced in their lifetime now, for some time to come.” Based on many wrong market calls and current economic facts, I say we cannot count on a recovery for most Americans, at least not anytime soon.

Can we count on Mr. Bernanke being correct when he says gold is not money? Not according to Peter Schiff, CEO of Euro Pacific Capital. In a recent article, Schiff said, “By claiming that gold is not money, the Chairman demonstrates his ignorance of much of monetary history. . . . And gold is money because central bankers like Mr. Bernanke cannot be trusted with a paper substitute. Bernanke further disputes the facts by claiming that the only reason people are buying gold is to hedge against uncertainty, or “tail risks” as he calls them. . . . I can assure him that my gold buying has nothing to do with “uncertainty.” In fact, it’s just the opposite. I am buying gold because of what is certain, not what is uncertain. I am certain that Mr. Bernanke’s incompetence will destroy the value of the dollar and unleash runaway inflation.” (Click here to get the complete and most excellent post from Mr. Schiff.)

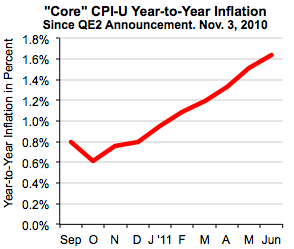

So, what can you count on? Look at the chart on “core” inflation from economist John Williams of Shadowstats.com put out last Friday. Forget about the ridiculous idea from the government of tracking inflation by excluding food and energy, and just look at the direction. The flight path is up since QE2 was started by the Fed in November 2010.

Williams explains the chart by saying, “. . . The broad economy is experiencing pass-through upside inflationary pressures from higher oil costs. Significant here is that higher inflation does not reflect a strengthening economy, but rather it is tied to the dollar-debasement efforts of the Fed, the resulting weakness in the U.S. dollar and the related strength in oil prices.”

Even though inflation is heating up, business activity is cooling off—in a hurry. According to Williams, the economy has “slowed sharply,” and the U.S. is already in an “inflationary double-dip recession.” Williams goes on to say, “The implications are horrendous in terms of the federal budget deficit, Treasury funding needs and banking-system solvency . . . This circumstance also likely is why Fed Chairman Bernanke suddenly started hemming and hawing about having another round of “stimulus,” some form of a QE3. Yes, the economy is that weak.”

Consider this is going on against a backdrop of historic budget problems on both sides of the Atlantic. In Europe, the sovereign debt crisis looms. Any one of several countries can cause a daisy chain of debt default. In the U.S., the debt ceiling impasse, where America could default on its obligations globally. I am getting an increasing dark feeling about both of these problems getting resolved before one or both of them blows up. Even if both problems are brought under control, gobs of money will surely be printed to avert the crisis. This brings me to the only thing you can count on–inflation and lots of it. According to Shadowstats.com, the true inflation rate of 2011 (if computed the BLS did it before 1994) is now 11.1%.

Thank you Greg, I could not have said it better … I would have probably been harsher on helicopter Bens economic theories…..

When it comes to gold Bernanke is just protecting his fiat current because no one has effectively communicated what inflation has done… here is my take on it!

Gold coins like silver dollars and gold pieces are so much better than paper it is not even funny… I would explain inflation to the layman like this. Once upon a time many years ago gold and silver coins were acceptable money and valued at face value of the coin…

For example a $50 gold piece was once worth that $50 just like a $50 bill. Then along the way their paths separated as paper money became more convenient.

The $50 bill will always be worth just that like old paper $50 bills

Yet when you have a $50 gold piece the value is not lost through inflation but increased that is why now a $50 gold piece (an ounce of gold) is worth about $1500 and not $50 cash!

while the $50 bill can never be worth more than $50 except to collectors of antiques while the $50 gold piece will gain in value as more dollars are required to buy the same “dollars” worth = inflation

Secondly, our economy has been on life support since the FED under Greenspan dropped interest rates to near zero in what 2001-2002? I often get lambasted by others especially between 2004-2007 when I complained about how bad our economy really was even during the housing boom which was another bubble created with cheap money.

The housing bubble is unlike any other bubble the banksters created because most bubbles blow up and collapse while the housing bubble is backstopped by Fannie Mae and Freddie Mac through insurance products which in turn have set a high artificial bottom to the housing bubble. This has created an environment where the bubble just doesn’t blow up and pop like a stock market bubble in a few years … this bubble has a long lasting impact on the economy since many homeowners mortgages last 15-30 years bought in the bubble do not have recovery since they are lock in their mortgage contract……

This why I have said in the past that the QE money pumping is nothing more than trying to blow air back into the bubble keeping it inflated while the rest of the economy tries to catch up which will never happen…….

how is this … a better example for inflation in my own words…

Once upon a time a silver dollar was worth just that one dollar bill. Then somewhere along the line people figured out paper money was easier to use since the price of silver went up and down … so the dollar bill was pegged to a dollars worth of silver or gold

… then in 1971 Nixon took the US off the gold standard and everything changed …

the dollar bill would never be worth anything more than one dollar (face value not actual value) while gold and silver became more valuable because it took more paper dollars to buy the same amount of “gold” valued in paper dollars …..

So, inflation has not increased the price of gold VS paper money but the reverse…

Paper money has become less valuable VS gold…..

As the FED increases the money supply through quantitative easing Bernanke is purposely causing inflation. They do not believe that they are diluting the value of money because they don’t believe or understand the concept of a dollar based in a physical asset. The FED and Bernanke believe that if you have more money in your pocket that you will spend more money expanding the economy. The result is the value of the dollars that you do have are devalued in buying power so the number go up while your buying power with the goes down

….. Sad but true like on old CIA psyop ……

Interesting. A monetary novice (me) thinks of value or buying power in US dollar perspective. Like a person riding on a dollar train, we see everything else of value from the train window. We don’t notice that the train is slowly losing speed and will eventually not be worth more than walking.

We see gold as some “other” thing, the value of which increases or decreases in some vaguely understood economic dance. But as you have pointed out, it isn’t that gold is more valuable, it’s that the buying power of the dollar – though the number of them in my hand remains the same – is dropping inversely compared to gold.

Most of us average joe’s don’t realize this and will be holding the same cash as the train/buying power just slowly dwindles away.

Mitch,

Thank you for adding to the content of this post. Love it!

Greg

Not to rain on your parade, but an ounce of gold – a double eagle, is $20, not $50…

Inflation is global and it is making a lot of people angry and frightened.

Evasive Action, Mr. Sulu.

Thank you Reader and Art for the comedy and content.

Greg

are the Ferangi incharge of the economy?

Greg, yes, inflation is at 11 percent, a very unsustaining number even in a robust economy. Wage decrease with inflation increase is where we are at, I’ll call it the crossroads or cross-hairs it you like. We certainly are in the cross-hairs of our government’s economic policies. Printing more money will not kick start this stagflation present economy, especially if they just giving it to the banks to keep them solvent. Even if another round of stimulas is done the resulting inflation will outweigh the wage growth three to one leaving everybody worst off in the long term. The only solution here is to just leave the economy alone and let it shake out the fat, do we really need CEO’s and ball players or wall street pee-wees making 20 million a year? What about the military, its a crime that both parties are talking about social security & medicare cuts but military curtailment is not even mentioned or on the table; how is that possible?

Ben B. wants inflation to pay off the debt with cheap dollars but he has no real clue as to what it does to a basic working family. Inflation is destroying America as we speak. Out here on the Western Front our communities are dying, people are leaving, homes are boarded up, businesses are closed or closing, the area is in free fall. If you don’t believe it American come an see, it’s soon to hit your towns and cities as well if it has not yet done so. This thing out here is ugly & is getting more critical by the week. I have not heard of one new job created around here by small business in the last year. Sure gas and groceries still abound, but there is practically no real disposal income around, a true sign of a robust economy or one on the mend. Having a tooth pulled instead of a crown put on is a economic transaction and the dentist does have a job with a benefit to the patient but you couldn’t call that type of downsizing really good for either. Just another poor example of what is going on out here, most people are downsizing, less cars, vacations, evenings out to dinner, etc., a sure sign of a less than a turned around economy. Thanks for the article Greg, more Americans waking up is a good thing.

“What about the military, its a crime that both parties are talking about social security & medicare cuts but military curtailment is not even mentioned or on the table; how is that possible?”

This is the mindset that got us into the mess we’re in. Our government deviated from the constitution, which describes one of the our government’s primary jobs as providing “for the common defense”. I don’t read anywhere in the constitution about social security or medicare. Our country survived and thrived without social security and medicare for over 150 years. Social security was the beginning of our entitlement mentality in this country. A majority of all the handouts stemmed from FDR’s big government approach (I won’t go into other FDR shortcomings…there are so many). If we’re going to overtax Americans (and we do), I would prefer that it go to the military so that we can deter or confront China, Russia and the other anti-freedom countries around the world. The SS and medicare taxes are just an illusion that the government uses to spend more money than it has.

Personally, I have paid in tens of thousands into SS and medicare over my career and expect to get nothing from it when I retire. What I do expect is a Dickensian approach to obamacare; i.e., the new obamacare death panel will pronounce judgment on us the first cold we get to “reduce the surplus population.”

Joe is right: three wars and counting just don’t cut it. We need to “deter or confront China, Russia and the other anti-freedom countries around the world.” More wars! More bombs! More death! USA! USA! USA!

Bernanke’s comment “The pace of the economic recovery will pick up.” is precisely correct, since the direction is down. Acting as interpreter of Fedspeak, Ben is saying the economy is continuing downward while hoping his comment will be read as upward….more Fed doublespeak happy talk.

Jim,

You got that right!

Greg

1) Any public utterings of a Fed Chairman serve the purpose of manipulating the public perceptions and should not be confused with the truth or with what the said Chairman actually thinks. I mean, think about it. Only a complete idiot would honestly believe the veracity of the things that the Bernank has predicted since the crisis began – and he clearly is no idiot; idiots don’t have Ph.D.s and aren’t appointed Fed Chairmen.

2) When claiming that gold is not money, he has a point. For, what is money? Money is (a) a medium of exchange, (b) a unit of account, (c) a store of value and (d) a standard of deferred payment. Since gold is not used directly as a medium of exchange in any country, (a) is clearly out. Since no country measures its debt, GDP and so on in gold, (b) is clearly out, too. Finally, since countries no longer pay each other in gold, so is (d). What remains is is (c) – gold is a store of value, and that is why people (and banks!) are buying it. It’s not a perfect store of value (it has storage and insurance costs and about 1.5% annual inflation due to mining production increasing the supply) – but it stores value a hell of a lot better than fiat currency. The question, however, is – can you maintain that something is money if it has only 1 of the required 4 properties for money?

Vess,

Very good man. I agree completely.

Greg

Spot on comment Vess.

What about Utah and all the other states that are lining up to declare both AU/AG legal tender. I realize a few states makes not a country but I believe your assessment will not stand the test of time. I would amend your comment by removing the ‘clearly’ because clearly you have not thought this out to its conclusion.

Last time I looked, gold wasn’t a medium of exchange in Utah, either. What they are “lining up to” is irrelevant – I’m looking at the present reality only. Some Muslim countries have been talking about introducing the “gold dinar” for ages and so far this has been just that, talk. The Swiss are currently debating whether to allow a “gold frank” as a parallel currency. But, as I said, I’m talking only about what the present reality is – not about what might be in the near or more distant future.

I also don’t see how “legal tender” has anything to do with it. Aren’t Gold Eagles legal tender in the USA, too? So, in theory, you could pay with them there (using their face value of $20). But, of course, nobody is stupid enough to do so, since their market value is 80 times higher. Ergo, they don’t serve as a medium of exchange and aren’t really money. Just store of value, like the other bullion gold coins.

All this raises some interesting questions about the definition of money, though. Fiat money is not a good store of value (i.e., doesn’t meet criterium “c”). So, maybe it isn’t money, either? (Just currency.) Does that mean that money doesn’t exist, because nothing we currently have meets all the 4 criteria? Or maybe fiat money, while poorly preserving value over the long run, can still store it for a short while? How short this while can be, in order to be acceptable? (By the rate the Fed prints money, that’s how long – a picosecond?) Or maybe something can be called “money” if it meets at least some but not necessarily all of the 4 criteria?

There are some ATM’s in the middle east that dispense gold coins.

Libya, while not officially on the gold standard, does have a lot of gold bullion in it’s non-privately owned central bank. That will soon be gone when the US backed coup is complete and the new ( already formed) private central bank takes over.

And with that backdrop, we (the US) are talking about borrowing even more (raising the debt ceiling). What am I missing??? For example, Moody’s is threatening to lower the credit rating of the US unless Congress and the President agree to RAISE the debt ceiling!! Is that a typo or are they simply that incompetent? Let’s see, the #1 credit rating agency in the world threatens to lower the credit rating of an “essentially bankrupt entity (the US)” unless that same entity – the one that cannot make its payments without taking out a larger credit card limit – agrees to borrow more. Wow: we really do live in Alice’s Wonderland.

“Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes … known instruments for bringing the many under the domination of the few.… No nation could preserve its freedom in the midst of continual warfare.”–James Madison

Thank you Tom, Brian and Dave!!

Greg

The question that keeps surfacing is are they that stupid that they dont understand the consequences of what they are doing, or is the destruction of individual wealth, the work ethic, the family and the community exactly what they are seeking to accomplish?

For those of us who feel “the boot on our throat” the point becomes moot and our options are reduced to just one…………

Few of your readers are shocked that QE3 is about to happen Greg, the fed/Washington have no choice.

I wouldn’t be surprised to see gas at $5.00 & gold at $1700. within 4 weeks of the renewal of the QE program.

This is getting interesting.

Beware,

The Banksters and Wall Street are at it again. Moody’s is suggesting the repeal of the debt ceiling law. This will give the Feds a limitless credit card. Like I said before: the major fall into the second dip will start in mid November…this year. The new tax is called INFLATION.

OG,

This is outrageous and your warning is on target!

G

Actually, this is a good thing. The sooner this ponzi scheme comes to an end the better. Our founding fathers seemed to think a ‘revolution’ was needed every now and then to keep things in check. We are waaaaay over due. If everyone quit paying their taxes, we could starve the beast in short order. Violent revolution will probably be the only thing our reps will listen to although if we don’t have the courage to ‘silently protest’ (via taxes), I sincerely doubt if those same people will have the courage to pull the trigger when push comes to shove.

we need NEW definitions: (such as)

Money is a store of value (it is not a unit of EXCHANGE)

Currency, is unit of exchange (it is not Money)

Wealth, is not money (money is only a portion of WEALTH)

You do not work for money.

You do not spend money at the store.

Currency can be plastic coins or paper bills or shells or zinc, etc.

The currency is merely guarentee of (valid) governments.

Exchangable by decree into money.

Money has the properties of GOLG, (fungible, transportable, world-recognized, fairly fixed amount, can’t be fraudulent).

You can build on these basic concepts !

Greg –

Nice that you gave Schiff a nod. Many have known and prognosticated precisely what is going on right now – that of rising prices, rising unemployment and falling (phony) asset values, namely residential real estate.

Where Schiff added ‘value’ to the already known and understood, was that he was one of – if not the first, to appear on mainstream media outlets, espousing the concepts of Hayak and Hazlitt and dovetailing their concepts into our current economic situation – namely, the Worst of Both worlds, i.e., Rising unemployment AND rising prices for necessities.

This was thought to be unthinkable in the face of a ‘deflationary’ collapse in asset values – again, namely residential real estate. And here we are now, witnessing it in real time –

Reg Q,

If I were President (fat chance) I would make Mr. Schiff Treasury Secretary in a heartbeat. The bankers would hate him but the people would revere him. We are in for a wild ride as we just topped the tallest point on the roller coaster. Thank you for weighing in. By the way what does Regulation Q pertain to?

These people who are in charge of national debt and money printing are really in a box of trying to keep things going a bit longer. I can’t blame them for debasing the USA currency because it appears that’s the only way they can delay the day of reckoning.

Don’t know what’s going to happen nor when, but buying votes during the last several decades is adding up to a bill that’s far beyond the ability to pay. Far beyond!!

“P. metals pay no interest, cost funds for storeage etc.”

.

2k ys ago, one ouce bought nice…clothes shoes, but also ‘slaves.’

.

news “p i i g s broke, now what?”

ya know, it gets very frustrating to see people begin to wake up and then revert back to the same old paradigm of thinking that got us into this mess to try to explain to try to first explain and then to solve the problem.

benny boy is not fool. he is not incompetent, he knows exactly what he is doing and he is very good at it.

bernanke is an agent of the fed. the fed is an institution of the crown. the crowns objective, visa vie the united states of america, is to destroy once and for all the last vestige of the concept of free humanity from the minds of man. the whole paradigm of fractional reserve currency was doomed to fail from it’s inception. and it’s inception was no accident.

greg, a few weeks ago you asked the very astute question: “what is money?” the question did not get answered.

money is simply a means of tallying the exchange of goods and services, or more to the point, the means of keeping track of the exchange of different types of productive energies.

commerce is not really about money. real commerce is all about the exchange.

it does not matter in the least if money is backed by commodities or not. what matters is how the money supply is controlled.

in rome, circa 300 bc one of the most successful economies the world has ever known flourished because cheap money struck from copper and bronze was created by the senatorial government of rome and spent into existence backed only by the people’s faith in the productivity of the economy. spent into the economy, not borrowed into the economy. huge difference.

when julius caeser came into power he outlawed this cheap money and began to mint gold coins declaring these coins to be the only legal tender of the empire. (he then declared himself emporer for life and disbanded the senate) it didn’t take long before the all the money was concentrated among an elite few and rome fell into widespread abject poverty. not much longer and the great society or rome was no more.

like the proverbial broken clock that is right twice a day, bernanke is correct in saying that gold and silver are not money. they are just commodities and can be bought and sold like any other. what gives value to gold and silver is not their relativity against the dollar (or whatever form of currency you want to compare them to) but in their perceived scarcity. and it is this very scarcity which makes them a poor substitute for money because there is simply not enough to go around.

for money to work properly, it has to be accessable. no monetary instrument lends itself to concentration better than gold and silver. except (just maybe) fractional reserve currency born from debt.

watch the film. i will keep posting this link because it is really really hard to get people to take the time to look at something which could very well make a significant difference in how they think. (shudder!). i sure that many of you (should you watch it) will have critical comments. bring em.

http://www.youtube.com/watch?v=7qIhDdST27g

Reg Q,

I agree, Ben Bernanke is not stupid and knows exactly what’s going on. He has an end game and it looks like it is the destruction of the dollar but time will tell. Thank you for re-posting this link. It is a good one that all folks should take the time to watch! By the way, what does Reg Q pertain to?

why are you asking me this? in short, what little i know about reg q is that it was a law to restrict banks from paying interest on demand originally enacted in 1933 and later pumped up as part of the happy glass-steagle horse dookey and repealed and reserved this year although it had been largely rendered moot by a lot of creative bank workarounds since the 80’s or so.

excuse my typo. shoulda said “interest on demand accounts”

G. Johnson,

I was answering a comment from a person who used the name “Regulation Q.” Sorry for the confusion.

My reply to this is during the Roman times without doing any research I’m going to assume (as a %) speaking there was much less Silver & Gold per person as there is now. Technology has allowed us to get more access to this resource, therefore the same does not speak now. Making gold/silver currenty is a whole different issue then pegging a currency to gold/silver.

Also, back in historical rome it would be much easier for a few rich families to gather their hands on all the gold/silver then now. I’m sure you could have your own mercenary legion if you where highly afluent historically speaking.

I can see the comparisions of bronze/copper to fractional banking. Both involve relatively easily accessible curreny. I think the bigger problem that may lead to hyper-inflation is going to be scarcity of resources. If your starving and you have 1 gold bar and you need 1 sack of wheat to fead your family for a week what are you going to do? Sure the 1500 dollars of American currency may not get you that sack of wheat in the future but the 1oz of gold will. The question is, is it really important to buy silver/gold with an apparent system failure? I guess the real question is, do you believe in the American economy going into the future? If you do then gold is not a bad buy, if you don’t then you should purchase land/guns/livestock… end of story.

Why do we even care what Bernanke says.

We should already know:

“The last duty of a central banker is to tell the public the truth.”

-Federal Reserve Board Vice Chairman Alan Blinder,

Nightly Business Report, 1994

Edward Ulysses Cate,

Good to know! Thank you.

Greg

Let’s look for the root cause of it all and find the real mentor Bernanke owes his ignorance to:

It seems every eighty years or so a wannabe genius is born, who wants to show the world how to get something for nothing, aka a free lunch.

John Law convinced Louis the Sixteenth of France that his Assignats paper money could perform that trick for him. Of course, it didn’t work and the mob chopped his head off.

Karl Marx also had an idea and found a laboratory for testing his theory, Russia. It took 74 years, and immense suffering to prove that is wasn’t workable.

Then came John Maynard Keynes. He managed to get his real live laboratory by getting his witchcraft taught at universities in the whole western world, and we are now reaping the disastrous result.

William in Canada

Spot on William in Canada!

Greg

Just remember folks…after that drop-dead-date of August2nd,Congress goes on vacation! Only in America,heh?

Bernake is backed in a corner just as he was when he looked to the experts in banking for answers when he was addressing the public. Goldman’s was no good for help because AIG had fell of the cliff, so Bernake had to spin the world into thinking, we faced head winds but it’s no problem. You see the bureaucracy runs the government. Congress passes a bill but it is the unelected judiciary who tells what is law & the executive uses his discretion to enforce any or part of the laws passed by congress. That make congress irrelevant to do the people’s work because unelected judges say what is law & what is not as the executive decides to act or not! You only have to look to the up grading of our nations air traffic control system, the law has long passed into law but it funds were pulled by who knows, the same may be said by the boarder security.

Bernake said inflation was a non issue, tell that to us filling up our tank or mowing your lawn. Gas keeps jumping up right along with food. Jobs are harder to find, bullions sales has jumped even as the spot prices keep jumping but far from keeping up with inflation, moon shots up & them corrections to higher moon shots will be the norm for the near term, but later on it will get nuts.

What ticks me off is the rating agencies are as crooked as the bankers, court system, corporations & politicians. Raising the debt ceiling because the Keynesian rating agencies say so is just as bad as Bernake giving a speech on gold is not a form of money. I bet Bernake has a lot of physical gold just like the bankers and the lifers in congress who have been in congress longer than Qaddafi has run Libya! Great stuff Greg, keep the ‘good’ bad news coming, you may not get a pat on the back from the progressives or Obama, but your readers can’t get enough, thanks again!

Don’t completely blame the FED…..if Eric deCarbonnel is correct the Exchange stabilization Fund may be the real culprit, he proves that the ESF has been running roughshod with our money since 1934.

Really interesting video series, Greg you should watch it and give your analysis.

http://www.marketskeptics.com/2011/06/the-esf-and-its-history.html

Judd this is good stuff and I am glad you posted it here,

Greg

My theory is in good economic times – Fiat or paper money does the job just fine. This is because the nation is employed with jobs the citizens want and people don’t ever rationalize fiat money. They are under illusion.

The E-leet dug themselves a double edged sword. They wanted more profit so they shipped away a lot of good paying jobs and now the unemployment has revealed the truth about money. So the truth is out. Those jobs we shipped out aren’t coming back. So a lot of people say “retrain the workforce”. What are we going to retrain the workforce to be? It would be one thing if we started to mass colonize space. There would be some more good paying jobs. The problem is our idea of retrain the workforce is low paying service jobs.

So now you have tons of people collecting unemployment, rising debt issues, and no real vision in this country. Recently, I saw the CEO of duke energy speak and all he talked about was renewable energy. My university is an appropriate technology campus. He was speaking to the crowd. Was he telling the truth? What if he was speaking in WVU? Do you think the coal energy business wants to see a huge jump in renewable energy? I doubt it. The same goes with politicians. Do you think politicians want to see a total collapse of our system? . What about the big corporate news business? Is it in their best interest to constantly display depressing economic news in your tube? No they would rather have you live in a dreamworld while you sink quickly into the gutter. Its called profit and someone is going to get their slice of the pie taken from them. If you want to make the world a econmic playing field with dwindling resources then not only is America going to suffer we are going to get crushed.

I saw a really cool shirt several months ago. It was a bunch of little fish paired together making one giant fish eating a big fish. I think a lot of this crap can be beaten.

There needs to be massive reform in this country though. Every child should not go to college. I’m tired of seeing no good pieces of crap in college. College is a privledge not a requirement. The testing should be designed to keep unintelligent people out not everyone in. We shouldn’t be blowing up the earth left and right for every last resource, we need to tax the hell out of oil and seriously persure other energy, we need to colognize space, and first we need to get rid 99% of congress.

Thank you Master Luke.

Greg

We are in the 98th year of the 100 year plan to destroy the American economy by looting it of all worthwhile assets. The “planners” and their minions have been enabled by the most corrupt politicians that money can buy. All other analysis of our current problem is just deflective delusion.

Subject: Mule Team Gee Haw.

When the mule skinner yells out “Gee” or “Haw”, his intent is to

control the mule team. There is no issue here about the truthfulness of his message. It is verbal control in its most basic form.

When economic data is released to the public media with the advertised purpose to “inform”, part of that message has been crafted to control the behavior of business and finance. The numeric alterations are not designed to be lies. They are designed to nudge economic activity in new or more desirable directions. 13% Gee, 4.8% Haw, and some “Getup.”

When you read new economic data, realize that you are part mule and part driver and the information presented may not all be fiction (although this is a point under much debate at present).

If a Federal Reserve spokesman makes statements which are clearly untrue, there is nothing sinister here. You may conclude that the information is 100% Gee Haw and the mule skinner is in panic mode.

The jury is out – both communism and democracy do not work. In a democracy, either cutting back in government spending or raising taxes (or both) are a NO, NO because that amounts to political suicide for the politicians. So helicopter Ben has to do the dirty works for the politicians citing cut back in government spending will push back the economic recovery or even causing recession and raising taxes will also push back the economic recovery or even causing recession. Therefore, the only option is printing more money (quantitative easing)to grease the economic machine of the US. But that merely debased the US dollar as what happened from QE1 & QE2.

We all know that when you print more money, the value of the dollar drops against gold, silver, oil or other commodities and other currencies. So helicopter Ben by introducing QEs resulted in inflation of 11% and the American citizens jointly pay or suffer through reduced purchasing power (the terms of trade is against the US’s favour with a weaker currency) instead of paying higher taxes or scrafice employment through cutting government spending.

Let’s see how things play out in the debt ceiling issue and solution.

Agreed.

The only thing that makes any sense at this point is a reenactment of the Glass Steagall Act of 1933,now in congress as HR1489. It’s support is growing by the day as more congressmen are realizing that Ben’s way is a dead end. This would not have to be done if that idiot Clinton had been on the ball and thought more about the results of repealing the act in the first place. Glass Steagall will make it possible to recapitalize the banks and get the economy going again and write off all the worthless paper that nobody wants. This is what the people of the last Great Depression learned and our government has been ignoring it!

Greg, I would like to add a web site many might find interesting about the feds basket of tools yet to be used but may do at any time with out the publics knowledge. There is no way of telling how it will effect the public but most likely it will be painful to say the least, so far this acting as if he is dumb is a decoy & congress falls for it every time. As most in congress are not very good in economics nor common sense, the oldest members still live in the stone age & will never realize they have been the problem all along.

Also they are having a free live web conference on 21,July at 12. noon ET about he Fed, gold and more, how to protect your assets in these troubled times, all free! All the info is at the bottom of the article. http://www.uncommonwisdomdaily.com/bernanke-out-of-bullets-heck-no-12482?FIELD9=2. GATA sent it to me & I thought I would pass it on! Any chance to learn more about the powers of the fed the better you may defend yourself.

Thanks for this article Mr. Hunter. I swear if it was not for the Internet, I would still be buying all the bullcrap lies being told. We are in a depression, not a recession, the debt ceiling will be raised, all these idiot overpaid pundits cannot think past their teleprompter, its not the ceiling thatg is the issue, IT IS THE DEBT ITSELF! The ratings agency (and Moodys I don’t count, its a load of crock), but even they along with the S&P, have stated raising the debt ceiling will not do anything to the tracgetory, the rating is still going down, so instead of confronting this now, we are going to pile on more debt and still get the same result.

as for Bernanke….

Looks like Dr. Bernanke is trying his “green shoots” line again…

July 22, 2010,

http://www.youtube.com/watch?v=0Hi_lSI8f9k&playnext=1&list=PL837AF0AA77D82666

and then I see a See-BS poll of 71% against the repub, well I’m not a repub, I am very much a limited govt fiscal conservative, well guess what I saw when I saw the make up of that See-BS poll? 15%+ skewed towards dems in the sample.

These people lie and lie and lie, and think Americans are too stupid to get it, when the Dollar is replaced by some basket of currencies in the SDR by the IMF, these fools will be scratching their heads still.

Honestly, I do not see this country recovering within a decade or 15 years, by then China will exceed the US in economic strength.

Independent Voter,

I hope you are wrong about China but you are probably correct.

Thank you.

Greg