Real Deficit Numbers and Real Consequences

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

We just finished 2009 with a record federal deficit of $1.4 trillion. Let’s think about that for a minute. The U.S. government says it is $1,400 billion in the red at the end of 2009. But is that the “real” deficit number? The reason why I ask is the government uses accounting gimmicks to make just about every number it puts out look better than what it really is. For example, the most recent Consumer Price Index for inflation was officially 2.7%; but if you compute inflation the way Bureau of Labor Statistics did it in 1980, the inflation rate would be 9.7%. The same goes for unemployment. Officially, it stands at 10%; but if computed the way BLS did it prior to 1994, it would come out to 21.9%. (source: shadowstats.com)

I asked economist John Williams of shadowstats.com to weigh in on last year’s record $1.4 trillion of red ink for the “real” deficit number. Williams told me, “It was closer to $2 trillion because they knocked off $500 billion with accounting gimmicks.” Just because the government knocked off a half trillion bucks using an accounting gimmick, doesn’t mean we owe any less. The reduced number just doesn’t look quite as ominous. Another way to state the $2 trillion of red ink from last year is $2,000 billion! It is a very big number, even for the U.S.

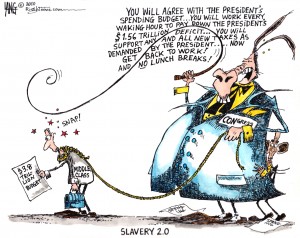

In its latest budget, the White House is projecting $1.56 trillion in red ink, and that is another new record! What will the “real” deficit be when the year is over? Williams says, “With a weaker than expected economy, the 2010 deficit likely will top $2 trillion…” So, according to Williams, the government probably understated the “real” red ink this year by another half trillion bucks. If this analysis turns out to be correct, then the government will have understated the red ink by at least $1 trillion in the last 2 years alone!

No matter how the government does its accounting, the actual deficit will have to be financed. America will have 3 choices: (1) raise taxes to the moon in a very bad economy, (2) get foreigners to buy more debt, and (3) monetize the debt. (print money to pay the bills) Williams chooses what’s behind door #3. In his latest report he says, “…worse-than-projected borrowing needs for the U.S. Treasury likely will trigger increasing flight from the U.S. dollar. At such time as that moves to a panicked level, and U.S. Treasuries increasingly are dumped or otherwise shunned, the Fed will have little choice but to monetize the Treasury debt, becoming the buyer of last resort for Treasuries. Those circumstances should lead to mounting inflation woes and flight-to-safety outside the U.S. dollar, particularly to hard assets such as gold and silver…”

There is another possible consequence to record deficits–higher interest rates! Countries around the globe with high deficits are starting to see interest rates rise. For example, Greece is facing a huge debt load and interest rates there are skyrocketing. In a recent article from “Money and Markets,” analyst Mike Larson put it this way, “Imagine what would happen if Uncle Sam’s borrowing costs shot up like they have in Greece — by 60 percent! Imagine what that would mean for the cost of car loans, mortgages, and other products whose rates track Treasury yields! And imagine the impact on an economy still struggling to recover from the Great Recession! This is the next big story that few people are talking about.”

The founder of “Money and Markets,” Dr. Martin D. Weiss, went on to say, “…unless the Obama administration and Congress can somehow ax the budget or find a new gusher of revenues — both extremely unlikely anytime soon — collapsing U.S. bond prices and sharply higher long-term interest rates are unavoidable.”

The most recent record breaking budget does not take into account what we will spend in the continued bailout of failed mortgage giants Fannie and Freddie. The two were nationalized last year and, on Christmas Eve, the Treasury decided to give them both unlimited bailout funds for the next three years! There is a total of more than $6 trillion in liability. (The Fed bought at least $1.25 trillion of MBS from Fannie nad Freddie.) I guess the folks at the White House Budget Office are going to pretend that commitment doesn’t exist. Why is the mainstream media not asking how we are going to pay for the Fannie and Freddie budget buster?

So, it looks like higher inflation or higher interest rates or both are coming. This will be the consequence of a ballooning deficit and out of control federal spending. Plan your financial defenses accordingly.

If you believe Williams and I do, higher inflation is already here.

What hasn’t happened, though oft predicted by the Austrian schooled economists and their followers on the right is the collapse of the USD.

The USD hasn’t collapsed as recently predicted in part because it already did from 2002-2005 when it lost approximately 40% of it’s value compared to other G7 currencies.

The primary reason we haven’t seen another collapse in the USD is because while the currency is expanding exponentially, the new money isn’t making it’s way through the economy.

As I pointed out a week or so ago on this site, banks are using the new money to shore up reserves and meet new higher capital requirements proposed in new regulations.

For three years running economists on the right have been predicting the collapse of the USD. For three consecutive years they’ve been wrong. For the reasons stated above and three more very compelling reasons.

First, paper money hasn’t gone out of style. Second, the USD is still perceived as the safe haven currency by the vast majority of investors.

Third, the collapse hit us first. In terms of this Great Recession, we are ahead of the curve compared to other nations. And if you think our numbers are fudged wait until you see what happens in China when they realize a thing produced is not GDP until it is sold. Even worse for the Chinese, they are still expanding their export production capacity at very time trade is contracting.

Yes the world is going to hell in a hand basket. All things considered, I’ll continue to make my bed in the USA.

As far as the three options to finance the deficit, what about a fourth option of forcing American investment? There seems to be a rumor going around about the government requiring a portion of all 401Ks to be converted to treasury bonds. It sounds like a crazy, desperate move – surely that couldn’t happen ?

Christy,

Good point! Thank you for the comment.

Greg

Hey Christy,

Yes and it’s on the table. Not sure but I think it’s part of the financial regulation bill. As I posted here awhile back, pensions today are the gold of 1933.

As to your question, oh yes, it surely can and probably will happen. Is it a crazy and desperate move though? Certainly it is a response to a desperate situation but that doesn’t mean it’s a desperate move.

Only one fund that I’m aware of has survived this crisis unscathed. Imagine where many would be today had privatizing Social Security passed? Thankfully cooler heads prevailed and we didn’t entrust Social Security to the paper money boys.

Hey Brad,

Your contradictions are confusing me.

You wrote: “If you believe Williams and I do, higher inflation is already here.” “What hasn’t happened, though oft predicted by the Austrian schooled economists and their followers on the right is the collapse of the USD.” “For three years running economists on the right have been predicting the collapse of the USD.”

Isn’t inflation a sign of a collapsing currency? The only thing that is keeping our “official” inflation rate low is the deflation of so much of our economy.

Who are these Austrian schooled economists?

The comments I read and hear on TV and radio from conservative economists have not projected a TOTAL collapse of the dollar. They have warned about an expanding money supply and resulting inflation issues when “printed” money attains velocity. These economist are worried about huge deficits and insolvancy for our federal government.

Conservative economists I am familiar with have proved to be better at predicting economic growth, or lack thereof, than our Bolshevic president and his progressive operatives.

Who are these right wing economists?

Are you a progressive liberal?

FULL DISCLOSURE: Fiscally, I am an ultra-right winger. Culturally and socially, I am a moderate.

markm

Our Dollar is in the process of collapse. The Austrians had a front row seat to the Weimar Republic. They know its coming. America had a better financial footing at the start of the crisis than the Weimar Republic. And our Government is running an Orwellian style disinformation campaign.

Hey Mark,

You posted, “Isn’t inflation a sign of a collapsing currency?”

I don’t think so. A collapsing currency is one of the symptoms of inflation.

Mark: The only thing that is keeping our “official” inflation rate low is the deflation of so much of our economy.

me: Certainly devaluation of assets in certain sectors of the real economy is a curb on inflation. Compared to all the convoluted notions used to determine the “official” inflation rate, I would suggest deflation is secondary to the lies we’re being told.

Mark: Who are these Austrian schooled economists? Who are these right wing economists? Are you a progressive liberal?

me: Really? Okay, I’ll take the bait. Ludwig von Mises and Friedrich Hayek are probably the most famous of the Austrian School. Carl Menger is generally it’s catalyst and his Principles in Economics (1871) is considered a classic. Contemporaries of the Austrian School,include Chicago School of Economics grads and profs, Milton Friedman, Alan Greenspan, Bernard Bernanke and what may seem odd, Rep. Ron Paul, who has written 6 books on the subject.

Essentially, anyone advocating the classical liberalism of laissez-faire is of the Austrian School.

Not sure what you mean by “progressive liberal.” I’m now 57 Boomer Generation. Identified myself as a conservative until the mid-1980’s when I began to fear that the Reagan Revolution had nothing to do with traditional conservative values of balanced budgets and was the anti-thesis of the party of Lincoln.

I identify myself as a liberal today and have since the mid-90’s because it’s liberals who now advocate fiscal integrity and produce balanced budgets and deficit financing during recessions exactly as Keynes suggested. In the larger context I think the most serious threat to our Republic is the corporate-religious right coalition that promotes fascism as freedom.

Okay Mark, your turn.

Freeze all government spending by cutting every budget by at least 10% for years to come. Fire Geither and Bernake. No new taxes and keep the capital gains and dividends at 09 rates.

Susan,

You are correct …we need to some drastic budget cuts but I fear we will get the opposite.

Greg

Hey Susan & Greg,

Is the reason we have big government due to the people’s demand for government services?

How do you cut back on the demands upon government to solve problems?

All the Best,

Thrash

So what if they paid off every mortgage, school loan and credit card in USA? The banks would have gotten the money anyway so you would have gotten 2 birds with one stone. Consumers would be free to spend again and generate more tax revenue to pay the deficit. They were too big to fail and you were too small to matter.

So what have we learned from EU financial mess? Nothing