The Elephant in the Room

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

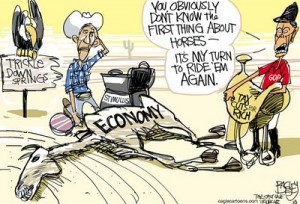

There has been a flurry of proposals this week on how to get the economy growing again. The President has been giving speeches across the country offering up plans for more infrastructure spending, business tax cuts and credits. The Republican plan includes keeping all the Bush tax cuts in place and rolling back spending to 2008 levels. Basically, the Democrats want more stimulus spending and some tax cuts, and the Republicans want more tax cuts and some spending reduction.

I do not hold out much hope for either plan to lift the deeply troubled economy. The reason? We are dancing around the problem child—the banks. (The financial reform bill passed in July did absolutely nothing to fix the banks or the economy.) On the bottom of the spectrum, about 120 banks have failed so far this year. Underwater commercial and residential real estate loans are swamping the banks. The trend here is for more failures than last year. Last week, economist Nouriel Roubini of Roubini Global Economics said more than half of the 829 U.S. banks on the FDIC’s “Problem List” are likely to fail. (Click here for more on this story.)

In July, I wrote about the cash problems the FDIC will face next year in a post called “Banking Disaster Largely Ignored By Mainstream Media.”At the current bank failure rate, the FDIC will surely be out of cash and relying on a Treasury credit line well before this time next year. FDIC Chairman Sheila Bair appeared on CNBC with Larry Kudlow this week. Did he ask her about the extreme stress with the banking system because of the surge in failures? Not a chance. The mainstream media continues to ignore this gigantic problem.

On the top end of the spectrum, there are the “Too Big to Fail” banks. Under Congressional pressure last year, the Financial Accounting Standards Board (FASB) changed the accounting rules for toxic assets such as mortgage backed securities. According to a Bloomberg report, “Changes to fair-value, or mark-to-market accounting, approved by FASB today allow companies to use “significant” judgment in gauging prices of some investments on their books, including mortgage-backed securities. Analysts say the measure may reduce banks’ write-downs and boost net income.” (Click here for the complete Bloomberg story.) To simply make up a value on questionable assets is nothing more than government sanctioned accounting fraud. To abandon a major principle of accounting is a financial abomination! Up until this rule change securities were valued in what is called “Mark-to-Market.” It simply means valuing a security at what you can get for it today. Also, a sharp reader of the site, ( Harold Goodman) points out this new change does not simply apply to securities but also real estate. Harold wrote me and said the new FASB rule, “. . . applies not just to toxic derivatives on the balance sheets of the banks, but to the more than 1 million foreclosed properties banks are sitting on which have not been listed for sale.”

Renowned precious metals expert Jim Sinclair of JSMineset.com has written a new book called “A Pocketbook of Gold.” Sinclair cites what he calls a “Mark-to-Myth” accounting scheme, allowed by FASB, as a major reason to own gold. Remember, until last year, securities used to be valued as “Mark-to-Market,” (or its current value.) Sinclair wrote, “Of course, if these toxic assets, for which there is little or no market, were ever properly taken onto the banks books, it would sink them completely. . . . The FASB changes are quite simply, a (now) legal way to lie about the financial health, and more specifically about the worthlessness of trillions of dollars of toxic assets on the Banks books. ‘Mark-to-Market’ has become ‘Mark-to-Myth.’ In truth, the situation is dire, and banks and lawmakers are trying to push back the day of reckoning. . .”

The dramatically impaired U.S. banking system is the reason why the economy is not getting better. According to financial writer Jim Willie, who holds a PhD in Statistics, there is only one solution to break the grip of this financial crisis. Last week, Mr. Willie wrote, “The secret to a legitimate solution is easy. The big banks must write down their credit portfolios, and accept deep losses. If that results in liquidation, so be it!! Accounting fraud is not a substitute for restructure. Nor is dispatching badly impaired assets to the USFed, whose by all accounts is a Bad Bank Repository.” (Click here for the complete story by Willie.)

The economy cannot truly be fixed with tax breaks, stimulus, more debt or small spending cuts. We have a deep financial insolvency dilemma. A real recovery will only be achieved by honest reporting by the mainstream media, and honest accounting by the banks. If we don’t demand this, then we will continue to dance around “The Elephant in the Room.”

Greg,

You really nailed this. In fact, the entire system is full of fraud. When the government is lawless, the entire system follows. The U.S. is bankrupt. Many states are bankrupt. Towns and cities are BK. People are broke. As Catherine Austin Fitts puts it, we live in a tapeworm economy. The tapeworm is eating away at all of us as a society, but most are unaware that the tapeworm exists.

This country is no longer free nor has it been for a long time. People are subjectively prosecuted based on who they are or who the know. The system is rigged. More people everyday are starting to figure this out. You already have.

Thanks.

Silver Gold Ratio, Jimbo, Pat, John,

Thank you all for your comments and support!!!

Greg

Greg,

You are very right about us spectator/thinkers watching the end game unfold before us.

I, as well as many others, have come to realize that the “Government” political class has become so very corrupt(the scale dwarfs a bannana republics wildest dreams). It is getting increasingly difficult for the corrupt political and corporate business class to conceal the Machiavellian schemes. The corporate media is enjoying a prolonged crisis of legitimacy, which if left unchecked, will lead to a collapse of that business model. These symbiotic elitist classes are headed towards a potentially lethal trainwreck of which none may recover for a very long time.

There must be a catharsis to purge the corruption cancer eating away at real Americas vitality.The political, corporate, media connections must be severed.

Greg,

You have hit the nail-on-the-head and must be lauded for your reporting as the mainstream media just is nothing more that “managed news” for Management of Perspective Economics (MOPE) of persons-in-charge. You, Jim Sinclair, Monty Guild, et al are focussed on key issues plauging the U.S. and also Europe. The fact of FASB capitulating to OTC derivatives and Credit Default Swaps (words of Warren Buffet; “weapons of mass financial destruction”) is that Wall Street and Main Street are really are stuck with these toxic assets up the kazoo and persons-in-charge have really done noting in the last 24 months but danced around and full of self-interest. It is very interesting to also note that the manufacturers of the OTC derivatives and CDS are continually supported by the powers-in-charge and the “Fin-Reg” which was passed just does not address the core problem and not end in sight. Thus, persons such as yourself are the only beacons of light to Main Streem which need to be awakened as these are good people who are not told the truth. Keep up the good work!!!

Pat

Greg

This article is sad but true. Disinformation is now the norm, abetted by the MSM. Yesterday the stock market took off on unemployment figures that were “estimates” with nine states not reporting. Why should government sanctioned accounting fraud be a surprise? There is not time for the coalescence of a conservative constitutional party before the imminent collapse of the United States and others. Such a part will emerge from the ashes, at least in the nation that develops during and after the crash; this might not be the same as the one that will fail.

Neither Democrat nor Republicans are capable of getting past their greed and desire for power, that is why we are sunk. As an example of political idiocy take a look at a small green project: compact fluorescent bulbs. 2014 is the mandated date for the banning of sales of incandescent light sources. The last manufacturing plant, in West Virginia, is closing this month with the loss of 200 more jobs. The green jobs created by this mandate, bipartisan, are in China.

The banking system in the US is going bye-bye with all the power concentrated in the TBTF club members. Our financial systems is now a criminal enterprise of Madoff style on a massive scale. \

I hope that gold drops in price shortly so I can buy more.

Would it not be more accurate to use the singular ‘bank.’ The problem is THE Bank. The Federal Reserve Bank, which controls directly/indirectly all the others. Thanks Greg- U da man!

Darren,

Good point. Thank you for making it.

Greg

To simply make up a value on questionable assets is nothing more than government sanctioned accounting fraud.

You couldn’t have stated it any better.

Wonder what Bernie Ebbers thinks of this as he rots in prison? Part of the WorldCom scam was to capitalize expenses that should not have been, resulting in a higher bottom line. Is what Bernie Ebbers did really that much different from what banks are now legally able to do?

What did we really learn from Enron, WorldCom and the like? Investor confidence was shaken after all of these scandals. One of the goals Sarbanes-Oxley was supposed to accomplish was to reassure potential investors that they could trust the numbers in the financial statements. How can those same potential investors now look at the financial statements of any bank & not wonder if the numbers possess an ounce of integrity?

Apparently we didn’t learn anything. Integrity of the numbers is at the heart of investment, and now FASB has granted permission to fudge them — and less than a decade after the WorldCom scandal was uncovered. Bernie Ebbers must be scratching his head.

Thank you Mike D!

Greg

Hey All,

WASS!

(We Are So Screwed!)

markm

MarkM,

I like to use doomed but “WASS” also works quite well.

Greg

History shows that those making the decisions will do what is politically easiest, that means that there will be more QE, bailouts,stimuli and a general ramping up of the presses.

I can only see one way for this to end, massive inflation,or a total collapse of our currency ending in some global unit that may end up being worth 10% on the dollar when exchanged for what you have in savings.

How does $30. per gallon gas sound?

At 48, I’m getting a little bored with my mundane life, this may just change all of that!

Dave,

We all are in for a less mundane lives. Thank you for the comment.

Greg

Thank you Greg for mentioning Jim Willie. His postings have exposed the criminal nature of the finance industry for years now. Consensus around these parts is that we should protect ourselves with precious metals, which I have done. But how much confidence can we have when buying non-mint metals from places like Monex and Kitco when fraud is on the rise. Also, after the collapse of the American empire what do you suppose will be the condition of Monex and Kitco. I should suppose with thier supplies of PM’s that they should prosper dispite the collapse. If that is the case, thier products should be good as gold.

Gary B,

Mr. Willie is one of my favorite guys to read. Consensus where you live is on target.

Greg

Hi Greg –

Thanks for the blog! My thoughts on a definitive approach … . 🙂

The lack of Jobs problem is that [after we exported our industry] our domestic small companies don’t see markets here in the USA where they won’t be undercut by pegging in the currency markets.

Tax policy only works if there are profits in an industry to be taxed.

And, consumer and business consumption of goods from US producers keeps the $US here to be recycled, not exported.

Policy: Build it here to sell it here – America First. It’s OK for foreign companies to build plants here to sell here and take the profits home, but the jobs stay here.

Only method that occurs to me to make this happen is that we return to “a flat tariff” on all imports based only on the inappropriate pegging by foreign governments in the currency markets. For example, China devalued its currency by 40% when they pegged 8 Yuan = 1$US [Clinton says thank you for the $$ contribution]. So, we look at the current appropriate undervaluation and, for example, add a 40% tariff to all goods manufactured in China. USGov keeps the tariff revenue.

Protectionism of course, but we base it only on aggressive foreign currency pegging, not by industry, on currency.

Result: Small US companies see will markets for all types of essential products that they can manufacture and profit if the currency costs are leveled. They will expand to fill the market and in doing so, hire new workers and buy new “American High Tech Tooling”.

At some point it’s America First. Tariffs can be used or abused. Use to level the economic-cost playing field is a fair use of tariff tool, gives the Feds a revenue stream, and American industry a market into which they can expand.

ps. I went to Home Depot to get some copper pipe fittings: guess where they were made – China. Egads!

John Treichler,

We must start making more things here. Thank you for your assessment.

Greg

Question is…… how long can they kick the can?

Kenny G,

I think that can is getting really dented by now. Thanks man!

Greg

what about the trillions in derivatives?

Guil,

The OTC Derivatives are the mortgage backed securities. They are there on the books, and will make the bank insolvent when the music stops. Thank you for the comment.

Greg

Greg,

Mortgage backed Securities are a big chunk but aren’t there other flavors?

George,

You are correct, but MBS’s are the biggest. Thanks for the question and all your comments today friend!

Greg

This is what I do not get. we bailed out everyone of POWER. Yet the American people get their unemployment benefits unfunded. Obama is telling me that because of Republicans there is no UE funding. Are you kidding me? How does this work and what changed since you passed OBAMACARE

I absolutely have NO other opinion than OBAMA hates this country and his PRIMARY goal is to cause her to fail.

Where am I wrong

Patriot,

You are not wrong to feel things are bad and getting worse, because they are. I really do not think “O” is trying to fail. He’s a politician he does not want to be a one termer. I think the man is waaaaaay over his head, and on top of that, he is getting classic bad advice, especially from his economic team and the FED. I do not want “O” to fail because if he truly lands on his ass we all go down. I am afraid we all need to be fitted with hockey pants.

Greg

Patriot,

You are right that the Obamachrist bailed out his banker buddies and left the rest of us high and dry. It would have been better to let the big banks go bankrupt and pay employment benefits longer but that’s not what the Democrats did. They gave their buddies stimulus money to pocket for jobs but they did not create any jobs. While I do empathize with the unemployed, exactly how long should my grandchildren pay someone’s unemployment benefits? America is broke and unemployment is not a God given right. I am barely getting by and I can not afford to pay more taxes so some people can collect a check and sit on their a$$ while I work my a$$ off. I realize that not everybody fits the above but it is amazing the number of people that find jobs when their unemployment runs out. Unemployment costs should be borne by the unemployment taxes you paid in while working; not by my federal taxes. When the funds run dry; sorry, I can not carry you.

I am tired of getting a billion dollar tax bill from the UN which the UN uses to find way to steal American power and freedom. I tired of Congress exempting themselves from laws they pass [Social Security, Insider Trading and the New Healthcare bill]. If it’s good enough for the rest of us how come Congress feels they deserve something different?

The morons in Congress, both Republican and Democrats, are drunk with power and greed; the tax payer is just someone they can steal from to line their own pockets. And they bribe people that are nonproductive, that are a burden on society with goodies to vote. If you can not take care of yourself, how is it not a conflict of interest to vote for a politician that promises to give you extra? Call me crazy but I do not believe dead people or illegal aliens should vote either.

I do not want the government to “give” me something. I want to KEEP what I earn. I do not mind paying my fair share. I want Congress to stop their malfeasance and be a prudent steward of our money instead of pretending like the tax payer fairly can provide them an endless supply of money. We went to war against the British for less than what our government is doing to us now.

And Obama is working hard at destroying the country.

Love your comment dude…just want to add that we went to war against the british because our “politicians” of the day did not like being taxed without representation. (As if nancy pelosi really represents me or you!! hahahhahahahaha!!!) anywhoo, Dont forget, the very first thing the new govt did back in the day was start taxing the crap out of whiskey….hence, the whiskey rebellion. The whiskey rebellion was the last stand the american people made (until the civil rights movement)for what they considered right. That is, until George W….(Washington that is)marched his army all the way up to western pa to make sure everyone knew that the war was over, and that no rebellion would be tolerated. Now we are in the same boat as the country was back then. However, they have came up with a new word to describe someone who will FIGHT for what they believe in….its called a terrorist. Could you imagine if we brought George Washington back to life and told him that the president of the usa personally asked some pastor in florida to not burn the koran,…..A FREEDOM THAT IS GRANTED TO US IN THE FIRST FEW WORDS OF THE BILL OF RIGHTS!!!! IF I WANT TO BURN A BIBLE, KORAN, AND THE KARMA SUTRA ALL AT ONCE I SHOULD BE ABLE TO DO SO. Nowadays you can expect a call from the president himself asking you not to, when those cowards in the middle east have DAILY FLAG AND BOOK BURNINGS…..so tell me who is really free?

Actually, it was Bush that initiated TARP for HIS banker buddies.

You are right – unemployment is not a God-given right. Either is a job, for that matter.

How long should your grandchildren have to pay? Ask the politicians who CREATED this mess.

If you care enough to check it out, three successive republican administrations led us into the Great Depression. Then the American voter handed it off to FDR. He created a huge national debt that became the legacy ot several generations of Americans including, my father’s and mine and a couple in between. Know what, while I was busy paying off THAT national debt, America was enjoying it’s greatest period of prosperity – EVER.

Each successive administration after FDR did a good job of trying to pay off the national debt – up to but no including Reagan Bush. With the exception of the Clinton administration, each administration has added to the national debt until it had reached $6 trillion.

When Obama was campaigning and when he was elected, he said that it was going to take a long time to turn this situation around. Everyone seemed to understand that – then. He inherited this mess and, you know what? YOU elected the people who created it. So, if you don’t like the job he’s doing trying to clean up YOUR mess, bring the republicans back.

Obama was a community organizer that did what? Nothing other than organize his community so that it gets the MAXIMUM AMOUNT OF MONEY FROM THE GOVERNMENT. WHO PICKS UP THAT TAB? HOW DO YOU EXPLAIN OBAMACARE OR THE PITIFUL FINACIAL REGULATION BS? NOW I CANT EVEN AFFORD THE SAME INSURANCE I USED TO HAVE. Your statements are hilariously biased and in case you havent noticed this about politicians, THEY ARE ALL CRIMINALS. Your not a hero for paying your taxes just like the rest of us. We’ve all been duped by a system so corrupt that our little minds cant get around it. I hope yours will come around soon.

Geaorge I am with you 100%. My problem brother is that I have worked a 30 hour week since I was 10 years old. PAID for my high school. paid for my college. Bought a home. Been paying tax for a long time sitting here at 44 years old. Worked for a company that supported a federal Program called SCAAP. After 9/11 that job went bye-bye. Had a brief stint with health issues and NEVER collected because my belief is the same as yours. TODAY s different my friend. OUR government drove us into the ground with FANNIE & FREDDIE MAC. Republicans are power grabbers NO different but I have congressional video of PROGRESSIVE DEMOCRATIC LIBERALS blocking attempts from conservatives as EARLY as 1995 to instill REGULATIONS for the LIBERAL Corporations of FANNIE & FREEDIE. The PEOPLE did not do this. IVE been paying my WHOLE life since I was 10 years old. NEVER ASKED or taken a dime. I am back on my feet but I can see were AMERICANS arent having any luck. Jobs are disappearing quicker than we know and it will get worse.

So YES my fellow Patriot we need to draw the line somewhere when it comes to unemployment. They are at 99 weeks but that is unfunded if I am NOT mistaken. PEOPLE will fall on harder times in next two to weeks to 6 months. This country has not seen what is about to happen. We just funded UCLA 800,000 for study on washing balls in Africa to reduce AIDS. How about drawing back some federal aid to foriegn countries. How about bring some troops home from the dozens of bases. How about collecting all the ILLEGAL CRIMINNAL ALIENS sucking us dry. How about letting the states pave their own roads. Shut down the board of education. I could go on and on and I have NOT researched the waste my government burns. See my point. We are willing and you seem willing to pull the plug on the AMERICAN people while we can reduce our spending in MANY areas till this improves. The longer this goes the longer the people will have frustration build up. If my government aloud me to take back what I put in we would NOT have to worry about it. However MY MONEY and MY FAMILIES money has been spent on people that you refer to in your comment and have sucked us dry.

Do not take my comment wrong. i stand next to you friend. NO need to look over because I am there yesterday, today and tomorrow.

SOMEONE please SAVE my country.

Greg,

Loved your give & take with Brad Krantz on FM 101.1 WZTK today. (To all others on this blog, check out http://www.fmtalk1011.com to find Greg co-hosting with Brad Krantz, Monday 09/13/10 from 6 to 10 AM EST if you live in most of NC, otherwise stream it from their website. You won’t be disappointed.)

Greg Hunter is one of the best,honest,last true journalists that we may have in these trying times.

Keep your powder, gold, & silver dry.

Peace

James

James,

Thank you for the words of encouragement and comment!

Greg

At the current bank failure rate, the FDIC will surely be out of cash and relying on a Treasury credit line well before this time next year.

Question here: of the 120 banks that have failed this year, how were those failures handled by the FDIC? Last year, seemed it was typical for the FDIC to “ask” another bank to acquire customers’ deposits so that they could continue “business as usual,” if you will. Otherwise, I’ve heard that getting your money back from the FDIC in the event of a bank failure is a lengthy process. And with so many living paycheck to paycheck these days, that lengthy process could drag anyone into bankruptcy while waiting for a refund of their guaranteed deposits.

So is the FDIC continuing to “ask” (probably “pressure” is more like it) other banks to acquire customers’ deposits from these failed banks?

MikeD,

I have not heard getting insured deposits back from a failed bank is a problem. When a bank fails it does not mean that is the end of government involvement. The FDIC does not pressure a bank in to taking on a failed bank. They make it a sweet can’t miss deal with something called a “loss-share agreement.” That’s where the FDIC guarantees 80% of the losses for the acquiring bank. So far the FDIC has entered into nearly $180 billion in these agreements. Read about it in detail on a post USAWatchdog post called “Banking Disaster Largely Ignored By Mainstream Media” Here is the link: https://usawatchdog.com/banking-disaster-largely-ignored-by-mainstream-media/ . Thank you for the question and comment.

Greg

Greg

Interesting article.

1. Is it not correct though that much of the bad “assets” held by banks have been purchased by the FED – most likely at grossly inflated real market value? Only the Banks and the Fed really know the level of overvalued assets now likely to still be held by the private banks. Of course how transferring privately held bad assets to the FED really addresses the long term problem is still a mystery to all.

2. Your solution would almost certainly create another financial panic which would reverberate around the world. Now solvent banks may well now become insolvent with one off massive losses. This is what Government is desperate to avoid and this is what their Wall St masters also want to avoid. Wall St always gets what it wants in the end. It has the promulgation of fear, most effective lobbying strength and political access as well as massive contributions to political parties and individuals as some of its ultimate weapons.

3. Unfortunately Governments do not make economically based decisions anymore. They just “spin a line” to the electorates that their decisions are only based on what is good economic policy. They are, in practice, more heavily influenced by the politics. Politicians spend more time considering the political considerations/consequences of their actions and decisions than anything else. While they continue to do this the right economic decisions will rarely be made because good economic and financial policy will only rarely coincide with good politics. Good politics will always overwhelm and that is what is still very much driving the current administration’s decisions and proposals.

Sean C,

I don’t think I said much of the assets have been bought by the Fed. This is why this is still a big problem. The banks still have them but because of FASB accounting rule changes they can hold them on their books at fantasy values. This problem is not fixed by doing this and we have only postponed the crash that should have happened in 2008. You do make many very good points in this comment that I cannot dispute. Thank you for weighing in on this.

Greg

Everyone here sees the train wreck coming, but what can we do to stop it? We can take whatever necessary steps to protect our families and try to preserve some of our wealth. Okay, that is good for us personally, but what about the country?

We were an economic powerhouse using our human and natural resources to make and sell goods that had value to us and to other countries. Paper shuffling, retail sales and the service industry cannot match the loss of our industries.

How do we short-circuit the elitist plans to fleece us and turn our kids and grand kids into docile slave labor?

Jan,

At this point,protecting yourself is really all you can do. Remember,you are not alone. So happy you comment regularly on the site.

Greg

New to your blog. Like your professional approach of responding to those that comment on your blog. Shows you actually read your comments. Atypical web-wide. ~Best.

John T.

You are very kind, and always welcome here. Thank you.

Greg

You are a step ahead of other sites and very well appreciated for your personal attention…..thanks Greg.

Kenny G,

Thank you for the complement.

Greg

I thought about my own question all day today. I did a Google searh for products made in the US. There is an extensive list of products made here. I do not know if these products are on my local store, but I am okay with shopping online. We make our money and we (for now) have the freedom to spend them as we choose. We can choose to support our manufacturer’s and if it means paying a bit more for a product so be it, we are supporting jobs in the US and keeping our hard earned dollars at home.

Jan,

Good idea. I drive a Chevy.

Greg

mark to market, they been talking about this for years. Even a old news paper reader like me could see the danger where this was taking us. Simple math, my house is worth 100,000. if a bank owns a house just like mine, his is worth twice that. So many people better educate then myself, can’t are refuse to use simple math. When you hear the words exotic instrument is another 2+2 = YOUR GOING Get 20% interest on your investment year after year. Replace the word exotic with toxic AND TOXIC = 2+2= 4 . peace

Bob,

You have a voice of experience and I’ll listen to that any day. Thank you for the comment.

Greg

I’m new to your site so you may have answered this question many times. Have you written or read a crredable account of what will happen when the can stops? What can a family with three small children do to prepare? Gold? Guns?pay down dept then buy farm? Move to Canada? Where would you suggest i look for answers? How do I protect my family

Dave,

I do not know a lot about your particular situation, so it is hard to pinpoint exactly what you should do. It is also getting late in the game but you can still protect you and your family. I wrote about this in a post called “Get Out of Debt and Stay out of Debt” in September of last year. Here is the link: https://usawatchdog.com/get-out-of-debt-stay-out-of-debt/

The level of protection depends on what you can afford. It may be better for you to pay off your car than to buy gold or silver. That said EVERYBODY should have some gold and silver coins. DO NOT BUY AN ETF!!!! Not the same as physical gold or silver. If you are on a budget, start small but start. Buy silver and gold coins (NOT BARS) if you can afford it. Buy a little extra food every time you go to the supermarket to store. All my sources say, think loss of buying power of your money. Yes, I mean inflation and it could get ugly, really hyperinflation ugly, but at the very least inflation. One friend of mine is stocking up on motor oil and filters because that could go up dramatically. This is not a drill and not a maybe. The U.S. is in for a very rough ride and a crash landing. Some will not walk away. Please look through the site you will find many articles. Here is a new piece of information out today by my favorite economist John Williams. He is out with a warning today that says the U.S. economy it “tap dancing on a land mine.” I will elaborate in a later post. If you do nothing else, I think silver coins are a screaming deal but to be fully diversified you should have both AU and AG. I hope this helps you. Write back if you need more info. I’ll be happy to help you more.

Greg

Greg,

I would first like to thank you for all of your efforts and the service that this site delivers.

My family, (me, wife and four young children) have one car payment, a mortgage and no credit card debt. We are considering selling our home and either buying a smaller home or renting in an effort to lower our monthly housing expense.

We are a two income household and our combined income is much higher than the national average. However, our mortgage payment is also much higher than the national average.

With this being said, would you recommend paying off the remaining car loan first or would you start buying gold and silver now? We each have 401k’s, (they are beginning to scare me) but we have 0 in gold, silver or any other commodities assets.

Even though we are lucky and blessed to be “OK” now, I am getting very concerned about our country’s economic situation and would like to start planning accordingly.

Any advice that you can offer would be appreciated.

Mike,

I always say a car runs so much better when you own the title. Pay off your car before you do anything. I can’t advise on selling your home but I will say the less debt you have the better you can manage your life and money. Everybody needs exposure to physical gold and silver. For the common man coins in both are the way to go. If you buy bars they may need to be assayed in the future if you want to sell them. Coins are already in easy to sell increments. I am not saying to sell everything and bet the farm. I am saying you need some insurance and gold and silver once bought never expires. The stock market has been a terrible place to invest money for the buy and hold investor. The S&P 500 is where it was in 1999. Enough said about that. I would cut you 401K contributions down to whatever the company match is and no more. Use the rest to save and get ready for the bad economy that will get a lot worse before it gets better. Check put this link for more info: https://usawatchdog.com/get-out-of-debt-stay-out-of-debt/ It is called “Get Out of Debt and Stay Out of Debt” Here is another post I have written called “Where Should I invest My Money?” Link: https://usawatchdog.com/where-should-i-invest-my-money/ Read all the links with this one for more info and education. Let me know if you have questions. Thank you for reading USAWatchdog.com.

Greg

About help for Dave’s family future. Make your kids get jobs of any kind after school for a hour are two. A kid with a collage education and no work experience has a lot of growing up to do. Sports at school has nothing to do with the really world it’s a control kid place safe and the kids are still treat like children. Nothing like a first job and being treat like a person to build self worth.

Bob kids need to learn to work even for a few hours a week. Paying jobs for kids are few and far between. Our kids did volunteer work for local non profits. It beat the age old problem of being unable to get a job because they have no experience and they have not experience because they can’t get a job.

Our daughter did several different clerical volunteer jobs through high school. She asked the nice ladies she worked with for references and landed a high paying part-time hospital job at the University of New Mexico. Her college friends were doing minimum wage food service & retail jobs.

I recommend volunteering for anyone, kid, unemployed, returning to the work force. The experience and the networking are wonderful and the small non profits run on shoe string budgets.