The Fed Bought Fraud

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

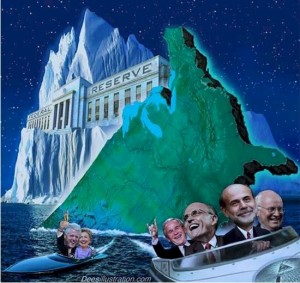

In the wake of the financial meltdown of 2008, the Federal Reserve announced it would buy mortgage-backed securities, or MBS. The January announcement by the Fed said it would buy MBS from failed mortgage giants Fannie Mae and Freddie Mac in the amount of $1.25 trillion. At the time, the Fed said in a press release, “The goal of the program was to provide support to mortgage and housing markets and to foster improved conditions in financial markets more generally.” (Click here for the full Fed statement.) It did provide “support” to the mortgage market, but did it also buy fraud and cover the banks that sold it? The evidence shows, at the very least, it bought massive amounts of fraud.

We now know the Fed definitely bought valueless MBS because it has joined other ripped-off investors to demand Bank of America buy back billions in sour home debt. A Bloomberg story from just last week, featuring Philadelphia Fed President Charles Plosser, reports, “The New York Fed, which acquired mortgage debt in the 2008 rescues of Bear Stearns Cos. and American International Group Inc., has joined a bondholder group that aims to force Bank of America Corp.to buy back some bad home loans packaged into $47 billion of securities. On the one hand, the Fed has “a duty to the taxpayer to try to collect on behalf of the taxpayer on these mortgages,” Plosser said today at an event in Philadelphia.”

Mr. Plosser lamented the “difficult spot” the central bank is in because it is both bank regulator and plaintiff. He said, “Should we be in the business of suing the financial institutions that we are in fact responsible for supervising?” (Click here to read the complete Bloomberg story.) To that question, I ask shouldn’t the Fed have done a much better job of supervising the big banks in the first place? The whole financial and mortgage crisis from sour securities to foreclosure fraud is in the process of blowing sky high. The entire mess is clearly the biggest financial fraud in history! It looks to me like the regulators were just supervising their pay checks being deposited into the bank.

And remember, the $1.25 trillion of mortgage-backed securities the Fed bought from Fannie and Freddie? How much of that is fraud? William Black, the outspoken Professor of Economics from the University of Missouri KC, says all the big banks were committing “major frauds”in the mortgage-backed security market. Black says, at Citicorp, for example, “. . . 80% of the mortgage loans it sold to Fannie and Freddie were sold under false representations and warranties.” (Click here for the complete Black interview.) Black claims the frauds increased at some banks, and it is sill going on today! (I admit I used this same video in a recent post. I use it again, because it is the single most important and damning indictment of the big banks out there. Professor Black defines the size of the entire fraudulent mortgage mess.)

If he’s right, and I think he is, that means the Fed just spent the last 20 months (the program ended in August 2010) buying a trillion dollars in mortgage fraud! That is a staggering amount even for the most powerful central bank in the world. Could the Federal Reserve have bought that amount of fraudulent MBS and not have known it? Could the Fed have been buying that amount of rotten worthless debt to cover the banksters in the syndicate? Who knows if we will ever find that out because the Federal Reserve cannot be independently audited. And who knows what else it bought in sour debt to bail out their banking syndicate buddies because the Federal Reserve cannot be independently audited! It has never been audited in its 97 year history. I know one thing, if the Fed is going to keep its banking cartel alive, it is going to be forced to print massive amounts of money out of thin air to buy a heck of a lot more fraudulent mortgage-backed securities. That’s what worries and scares me the most.

Excellent expose’. There are many dimensions to this problem but the most basic one is that there is no longer a trustworthy government in the USA. Perhaps this has always been true to a certain extent, but now it is too obvious. Essentially what this article says is that the taxpayers of the US now own most of the housing and commercial buildings . Of course this ownership must be administered by government employees who take a whole different view of their fellow citizens.

The separation between the governors and the governed is so great that the return of feudalism seem imminent. This particular tipping point is so egregious that national anger should well up and make itself known. Where is it? As a nation of sheeple we have abdicated our claim to active citizenry.

The only group with passion apparently is the minority of Marxist, Socialist, Communist, (financed by billionaires like Gates and Soros) whose aim is to reduce the United States to an experimental asylum for life denying liberals.

We are now a hulking shell of what once was and it won’t take much of a push to knock us over. Why with the bankers not in prison, the congress free on its on recognizance are we tolerating this?

John,

Good comment and very good question!

Greg

Thank you for a great article. I posted this reply earlier to another poster and I want to make sure you get to read it because I liked what you both had to say.

Hi,

That was really excellent to read. I too am just recently becoming aware that the White House is a terroist threat to this country and they can no longer be trusted. Unfortunately, I don’t think Ronmey is any better of a candidate because I feel he is one of the Manchurian candidate kids as well. The whole fiasco in my opinion is a set up from the bankers both local and international. This also has a lot to do with political power and positions amongst the players. Russia and China want the dollar off of the oil standard and with the collasp of the dollar they will be in perfect position to place the next currency in the top spot.

Why our guys in the Fed are willing to put this country into a substandard position is amazing to me. I actually get why Nobama would be angry and hate America but what ax does the Treasury Secretary have to grind with us?

This is crazy and I don’t know what it will take for people to wake up. I found this information that speaks on a slant about the Fed. It is biased but the information is thought provoking. Here is the link. It seems really out there and I was not really with it until I realized that this whole life of ours is now playing out like a Twilight Zone episode. This is crazy and we are living in the craziest time of all.

http://www.scionofzion.com/federalreserve.htm

I would be interested to have both my reply to you and the link information forwarded to the Iowa attny featured in the article above. If he understands this concept, I think he can find a case in which to build and ensure Americans are returned to their homes. He will have them by the balls if he can follow the thread. They need to be stopped, or at least slow them down as this country becomes wise to their motives. It will take them another so many years to regroup like a virus and re-infect a medicated future America. But not on my watch if I can help it.

I lost my home, pets, papers, furniture, appliances, everything in 2008. Bush wrecked this economy and took this country to an unnecessary war to keep the dollar connected to the oil market and by doing so sent thousands of soldiers to their slaughter like sheep. It is disgusting and it sickens me that we have to be afraid of our own citizens.

As a Christian, I am confident I will be fine in any circumstance and I am so thankful for that assurance. The country though is about to fall. Electing leaders that have no allegiance to God and this country in my opinion, tells the Lord that we have turned our back on Him and all of the grace He has shown this nation through peace and prosperity. His protection of this land can only stand if this country stands for Him. May the Lord have blessings upon you.

L. Wilson

There is no anger because people are either not at all savvy about this stuff (it is complicated) or are still blaming Republicans or Democrats and getting lost in that stupid debate. Someone I spoke with recently thought Bernanke was part of Congress, and many are still grousing about the TARP. We’re WAY past TARP! Our little citizens’ group (which focuses on the economy, climate change and how those two affect availability of cheap fuel)is dissolving because of lack of interest. I seem to be the only one furious (well, me and a couple friends who are trying to keep up) and everyone else thinks we’re nuts.

Deborah,

The facts say you are not “nuts.” Thank you for you perspective!

Greg

lol I have that same problem. It’s hard but The Lord wants His to obey and go save His sheep. Good reply!

tolerating , is the only game in town. Who is going to stand up and say your money is fake. There are no pension funds. That the American work needs to live on 30 cents a hour to compete. When the crazies march on DC an take the country back how will they the new leaders print money, pay the military, defend human rights. The first new leader would be roped up in a week. It’s just crazy to think DC ,wallstreet,banks have any why to change the fake system we find are self’s in. Who is the Man with the plan who can rebuild a country of millions who can’t even feed themselves day to day. What is going on in DC is a failing system build on power over other countries resources at a cheap price for the high living we had. Simple put a freeman is a man who can feed himself and a man who counts on the kings money system lives his life as a servant to a system. It won’t matter who is in DC the ship is sinking, out with the old and in with the new system, whatever that might be. The only solution I see is rebuilding the city are town you call home into a more low energy, base on human labor growing food but that won’t happen without great pain to many. No free lunch. When I was young working on a ranch you did your morning chores before you got feed. No work no eat. PEACE

Good work once again Greg. Yes, you should be scared, because if you have a dollar in your pocket this morning, after the Fed gets done with their “Q easing” (printing money out of thin air) that their

policy statements in recent weeks said they would, your dollar should be worth about 50 cents; and, its not worth that much now! That, of course, sets in motion another round of inflation. Simply stated, you can’t have one without the other or inflation follows the printing, no other way. Wait till the American people find that their grocery bill shot up another 40 percent all in a mere few weeks and the price of fuel, utilities, etc. did the same. When they do I wondering if they will set back and take it or commence acting like

people with a backbone and march. The evidence is in, the witnesses have testified, but the jury is out. We shall watch and see. As for me, I’m a product of the 60’s, I’ve had enough of being screwed, I’m taking it to the street, not for me but for my children and grandchildren’s sake as they will get the bill and have to live in a

third world country.

Art,

Thank you for the comment. You may be valuing the $ a littlle high at 50 cents my friend. Peace bro.

Greg

I think the pensions get the bill and the new workers cares not what a dollar should be worth. Old money needs to be inflated to make way for the new workers. You wipe out people savings before printing money you can print without as much inflation. The law of nature is in with the new out with the old. We old people can’t sit on tons of S.S. pension, investments, healthcare cost and say the bankers rob are grand children. Old money is always in the way be it gold are paper money. The human nature is to hoard wealth. The people who get mad because 2+2=4 never add human nature in to the equation, it helps to explain why sh-t happens. PEACE

Thank you Bob.

Greg

Greg, what I dont understand is why isn’t this kind of news what’s motivating the Tea Party to be full of angst… when you listen to them and their leaders what theyre angry about is immigration, the federal deficit because it now includes the 2 wars that Bush ran off the books so they didn’t show up *they dont realize that nor will they listen to anybody who says anything their string pullers hasnt approved), gay marriage and all the red meat tactics the rightwing pundits use to keep the far right agitated…

Why aren’t they saying they want justice because of what the banks did to the economy… If you read the blogs they buy into the BS that it was the people who bought homes that the government allowed them to buy… thats total rubbish… all these sub-prime loans were a Wall St creation because they couldnt get enough people to buy the amount of homes necessary to create the derivative products so they opened up the loan process to sub-prime candidates… The banks responsibility is to ensure that people being given loans have the capacity to pay them back under the full terms of the loans… That wasnt being done in the loans made from 2002 -2008…and there is no legislation that says people who cant pay back their loans must be given loans anyway.. NONE…

The rightwing punditry is trying to say that 30 year old legislsation caused this mess… No, what caused this mess was an adminstration that said government oversight is bad, we dont need no rules, we do what we want, we make our own reality…. all the loans that caused this mess that were subsequently packaged into derivative products that are basically valueless were made in the 2002-2008 years… not 30 years ago… not 20 years ago, not 10 years ago… but from 2002-2008…the period when the free market anything goes tribe got whatever they wanted and the oversight agencies were just a dirty little 9 letter word…

So back to my question, why aren’t the Tea Party members upset about this situation that caused the economy to be where it is today… Answer, because the people behind the curtain giving them theyre talking points are republican party officials who get their funding from the very companies that benefitted from this no govt is the best govt attitude that the republican party runs on… and now we see where that mindset has brought us and we have a whole slough of new Tea Party candidates that are taking the government is bad concept to even bigger levels…. what a mess and many of them will win their elections…

Robert,

That is a good question. My question then is the Tea Party a sham? I don’t know, but I hope it is not.

Greg

I too loose brain cells trying to figure this out!! I find it incredible how not just the Tea Party, but conservatives in general, have this glaring blind spot (not that the left side doesn’t have their blind spots too…). Even Thomas Sowell, an economist on the right (who I respect immensely as one of the most insightful conservatives) has this same blind spot. I think you’re right though; so-called “conservative” leadership (aka Republicans) are complicit in the scam of hiding the truth, ironically because of the very 800 gazillion ton gorilla yanking their chains that conservatives refuse to see.

Here are a few other observations that further elaborate on what Robert says…

1) when it comes to our overall business sector and our economy, conservatives and Tea Party folks do not seem to make a distinction between Main Street (which truly is the productive good part of our country) and Wall Street (namely the non-productive vampiric TBTF banks and their minions, all of which are rotten and corrupted to their core). Conservatives insist on viewing all of our economy, including Wall Street, as if it is all Main Street which is being attacked and dismantled by a left-leaning government. At first glance this is true, but it’s not as simple as that and all the political spin out there serves to hide and obfuscate the large truth so as to maintain the political divisions.

2) the preponderance of people out there that see the root of our problem and are vocal about it (i.e., a corrupted Wall Street oligarchy occupying a level of power and control over our government and the Presidency) are left-leaning. E.g., Yves Smith, Bill Black, HuffPo, Matt Taibbi, Simon Johnson, Elizabeth Warren (to name a few)… Conservatives have a long history of automatically discounting anything from the left (and vice versa). Anybody ever see reference to any of these individuals above at a right-leaning non-financial news or blog site??

3) lastly, many conservatives are unable to wrap their minds around the extent to which such a core part of our society (our banking system and associated entities) can so thoroughly and wholeheartedly abandon the Rule of Law, ethics, and morals for not just greed, but for socially destructive and predatory life-sucking greed. They are in complete denial. Perhaps this massive, festering, oozing pile of refuse that is our fraud-riddled mortgage market (and all the corresponding MBS-related investments) will be exposed enough for reality to finally impose itself on them.

Truth be told, one has to go to financially-focused blogs and news websites (like Greg’s here) in order to get a relatively more a-political perspective on the full extent of what is going on .

I think the worst nightmare for the banksters would be a united populace who sees them for the thugs they are. The powers-that-be will do everything within their capabilities to see that this doesn’t happen. As for the Tea Party movement, they have to know who the real enemies are in order to have any success at waging an effective battle. The politically divisive stuff flying all over between both sides is a hugely successful distraction.

Geofizz,

Thank you for your kind words and thoughtful comment.

Greg

Robert

Your view is also one dimensional in that it ignores the collusion between government policy (The Community Redevelopment Act Meets the Repeal of Glass-Stegal) and political greed for power and money. That is the point of the article. No one blames the people who got mortgages they couldn’t really afford; well some might. These people were exploited by the Democrats by hoping for home ownership (that would keep them on the voting Plantation) and destroyed by Banksters who were aided by Republican and Democrats who ignored the Savings and Loan debacle.

Your view represents the idea that their are competing ideological values which might be blamed. Nothing so complex is at work here. Simply our country is the victim of an outrageous criminal act and quasi conspiracy.

Neither capitalism nor socialism will survive. Most likely we will an imposition of some form of fascism which means private ownership of corporation with business policy set by the ruling government.

Sort of like what we have, and have had for some time.

This just gets better and better! Not even the elderly’s 401K’s and IRA’s will solve this one. Lets face it, we will have to sell the USA to the highest bidder to pay off our indulgences.

Thank you Schweizer40 and Tim Mercier.

Greg

The Fed and the Banking whores…..or is it the The Banksters and the whoring Fed?

http://www.zerohedge.com/article/paralyzed-fed-defers-decision-monetary-policy-primary-dealers

Greg, I thought I had read some of the most disturbing articles there is,but this tops them all. Have a seat,it will take your breath away! http://www.goldseek.com/GoldSeek/1288358131.php.The Goldsmiths, Part CLXV. Just how more is there out there that we do not know about? Thanks again for your hard work!

M Smith,

Thank you for your comment and content.

Greg

I say quit pumping money into them and let them suffer the fate that they so deserve. At least the dollar might still be worth something!

Amen Brother.

Greg

Forget the right wing vs left argument. They exist only as a diversion tactic.

Both the Dem’s and the Rep’s are corrupt to the core, what you are witnessing is the pilaging of a countries treasury before it implodes.

Our free market disappeared when the Federal reserve took control of our money. You are witnessing the death of Socialism, and it ain’t gonna be pretty.

Dean, You are correct sir!

Greg

Good morning Greg,

Another great piece. Too bad the Sheeple’s attention, on queue, have been misdirected by Al-CIAeda placing “suspicious” packages onboard planes just in time for the elections, again.

Below are excerpts from a court case proving the Federal Reserve

system’s status. As you will see, the court ruled that the Federal Reserve Banks are “independent, privately owned and locally controlled corporations”, and there is not sufficient “federal government control over ‘detailed physical performance’ and ‘day to day operation'” of the Federal Reserve Bank for it to be considered a federal agency:

LEWIS v. UNITED STATES, 680 F.2d 1239 (1982)

John L. Lewis, Plaintiff/Appellant,

v.

United States of America, Defendant/Appellee.

No. 80-5905

United States Court of Appeals, Ninth Circuit.

Submitted March 2, 1982.

Decided April 19, 1982.

As Amended June 24, 1982.

Plaintiff, who was injured by vehicle owned and operated by a federal reserve bank, brought action alleging jurisdiction under the Federal Tort Claims Act.

The United States District Court for the Central District of California, David W. Williams, J., dismissed holding that federal reserve bank was not a federal agency within meaning of Act and that the court therefore lacked subject-matter jurisdiction.

Appeal was taken. The Court of Appeals, Poole, Circuit Judge, held that federal reserve banks are not federal instrumentalities for purposes of the Act, but are independent, privately owned and locally controlled corporations.

Thanks again.

Good info Dan! Thanks.

Greg

Don’t use THEIR courts for tort claims. Tort claims go to risk management. If you use the CAFV process the tort should slide right through since THEY cannot answer the questions in the proof of claim documents.

I’m sorry Greg, I forgot to insert the link to the John L. Lewis v.

United States of America Original Case:

http://vlex.com/vid/john-l-lewis-united-states-america-36993065?ix_resultado=9&query%5Bbuscador_id%5D=119680&query%5Bcoleccion_id%5D=14&query%5Bct_resultados%5D=10178&query%5Bfrase%5D=john+lewis+v.+united+states&query%5Bfuente%5D=1102&query%5Blc_query%5D=%28texto%3A%28john+AND+lewis+AND+v.+AND+united+AND+states%29+OR+titulo%3A%28john+AND+lewis+AND+v.+AND+united+AND+states%29%29+AND+%28fuente%3A%281102%29%29&query%5Bmodo%5D=all&sort=score

Thanks.

I’m a newbie at this kind of stuff so bear with me.

I have never understood why anyone (the fed, businesses, banks, countries, etc…why they would want to buy someone else’s debts).

My assumption has only been that the more debt an individual or organization has, the more financial trouble they are in. So, why would I want to assume their debts? If they had the money, they wouldn’t have fallen into so much debt?

Therefore, why did the government purchase these mortgage securities? What assumptions were they using? i.e. people don’t just decide that they won’t pay their mortgages. If you see that happening then it should tell you that there is something very wrong with the economy and it is that people simply don’t have the money and obtaining that money back takes years and sometimes it never happens.

Why don’t people like Bernanke and Geitner understand that average middle class Americans really don’t have that much cash on hand?

NM,

The very short answer is the government wants to prop up a faltering economy, while bailing out their banker buddies.

Greg

Great post, just twittered it to all my followers.

One of the things that I can’t help but wonder is if they were really attempting a cover up with the hope that time would help get things sorted out before the mess it the fan. We’ll probably never know at this point.

Hal,

I think we have passed the fork in the road a very long time ago. Thanks man!

Greg

Yeah, you’re right, Greg. And now, the forks in our future on this down hill road are not forks at all. They are fissures, and they are growing.

How difficult is it to post a URL correctly?

http://news.goldseek.com/GoldSeek/1288358131.php

The Goldsmiths, Part CLXV

The Tea Party could not be run off by the repulicans, so they are infiltrating and adopting for their own. The Tea party was started by “The Patriot Movement”, Ron Paul is the main political figure and has been working for years to get the Fed Audited. His bill for Audit received 280 supporting members four years ago (approx) and has been losing steam ever since. Virtually no Democrat support.

As far as the home loan financial mess, is a result of the removal of government regulation known as Glass-Stiegal. Implemented after the first bankster robbery known as the depression. Glass-Stiegal was removed at the end of the Clinton administration. Simply put it made banks either be a lender, such as home mortgages, or an investment bank, such as mutual funds. There is a direct conflict of interest in allowing the banks to lend, and create investment products from their own lending. This is where the derivative problem is. I would be surprised if there was actually $ 1 of real mortgage backing $ 100 worth of the derivative product. And there is the fraud. With a willing bailout cash vault know as the Fed, and wake up america, that is our money being stolen, and our debt to repay via taxes. Great deal, they charge us to rob us.

If you would like to get the real info on “The Patriot Movement / Tea Party” go to http://www.infowars.com. And hold on to your hats because you will find the only group to go directly after the “king rats” who are destroying this country by design. No democrat or republican blame game at infowars.com. In fact this story is featured there and is how I found this site!

Thank you Adam.

Greg

Good article Greg but is there really anything new here?

Were we all not very well aware that the MBSs were packaged up and sold off at values that exceeded true market because they contained many high risk sub prime loans and many other loan types that would be of questionable value if the RE market slowed, went flat or declined? All this was carried out in conjunction with the “fraudulent” ratings agencies who operated in cooperation with the banks by providing “false” investment ratings on MBS products.

Indeed there were concerns being raised about MBSs well before the RE market fully turned.

Once the RE market went into decline no one really knew the true diminished value of MBSs. They certainly were not worth their original sale value and the fear was that if they were forced to be re-valued in some manner, at market, their value would be a fraction of the original sale price. In fact I recall it was feared that there was no real market for these products once the “fraud” behind them was revealed very early in the peace.

When the Fed commenced it’s purchase of these products (and paid well over their true value of course) it was surely very well(and widely) known that the creation of MBSs was itself fraud. The product was overvalued, the security and backing of the product was questionable and the investment ratings given by the ratings agencies were incorrect in order to make the product appear to be something that it was not.

Banks that were stupidly still holding billions of dollars of these toxic assets when the balloon deflated knew only too well they had a dud investment – and why – (as did everyone else) and they were facing massive losses as a result.

The FED knew very well what they were buying. So did Treasury, the White House, Congress etc etc. who, in the end, were all only too happy for the Federal Reserve to go ahead.

Please correct me if I am wrong.

The killer here is the final 3 lines of your article:

” I know one thing, if the Fed is going to keep its banking cartel alive, it is going to be forced to print massive amounts of money out of thin air to buy a heck of a lot more fraudulent mortgage-backed securities. That’s what worries and scares me the most.”

How true. We all share your concerns.

Sean S.

Most informed sources guessed the MBS were fraud, you are absolutely correct about that point– but how much? Bloomberg is still fighting a court of appeals battle over a FOIA request with the Fed over what it did in the meltdown in 2008. Now we actually have some concrete numbers of what the Fed actually did. It bought 80% fraud (at least.) Your point is well taken. This post was not a revelation for most of us but it does give us some solid numbers for the fraud. I thought that was interesting. Thank you for your kind words and support for the site.

Greg

I don’t see how the banks can buy back bad mortgages. They used up the bailout money to line their pockets with bonuses. The amount of money invested in a mortgage sold four or five times, or more, can’t be redeemed as far as I can see. The collateral only covers the first note. Soooo… how many mortgage notes are out there with no collateral? When they get caught the court proceedings are secret and we are told that is to protect trading secrets. Trading secrets have nothing to do with it. What they did is downright fraud. Unless, of course, fraud is their trading secret. Get ready for a rough ride. I think that when the states go bankrupt/default Corp US will put them under receivership. Since Corp US is already in receivership to The Crown(US bankruptcy-1933) the future of our states will be under The Crown. Think about that next 4th of July. Independence my ass.

Thank you Bildo.

Greg

The Banksters should go to jail, for sure!

But along with them, the Heads of the SEC, CFTC, FHA, FDIC, FBI, AG, FED, TREASURY, and whoever else, I left out of the bunch, whose job, it is, to make sure crimes like this, do not happen, should be in jail, also!

I fact, those guys should be hung first! just saying.

Lost, Sam and Concerned,

Thank you all for your input.

Greg

The only way to stop central banks (primarily the Federal Reserve) from exploiting people is to stand united. Please research for yourself and make a stance for the sake of our future generations. The Fed and many high government officials want and need your apathy.

Excellent news article. You hit the nail on the head. Please keep up the good work. Educating people is the most important thing you can do to stop corruption.

None of this would really matter if the taxpayers weren’t on the hook for bailing out these banks and paying interest on Fed created money.

One intervention leads to another and another and another and pretty soon we end up in the absurd situation where one one government (taxpayer) backed entity is suing another, and in the end, we taxpayers are the only ones that get the bill.

Ken

Ken,

You are right we are fon the hook one way or another.

Greg

I just got back from watching the documentary “Inside Job”. I encourage everyone here to watch it right before you vote. Obama is no better than Bush. There has been no change and I say this as someone who voted for Obama and is a registered democract.

The game is rigged against middle class America and their only chance at fighting back will be to start electing third party candidates like Ron Paul. The two large parties are all but the same.

The documentary just proved what I’d already suspected about Obama. That he fundamentally does not understand economics. I’m a registered democract, but I hope the dem’s lose and lose big on Tuesday. Obama needs to be shaken out of his arrogance and he needs to understand that keeping Geitner and Bernanke in place will lead to him becoming a one term president.

NM,

PM’s are precious metals. It is a common way to refer to gold and silver. Thank you for your review of the documentary “Inside Job.”

Greg

I thought this was a great piece and I love the included link of what Professor Black had to say. Very eye-opening once you piece it all together. Will definitely be suggesting this article to some friends of mine. Nice work.

Thank you Chris.

Greg,

This is the main reason I don’t vote. Enjoy the beer and chips while you can. There is no freedom and you proved it Greg.

Thank you Carl, I am sorry you do not vote but thank you for the comment.

Greg