Banks Should Face Bankruptcy, Just Like GM

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

General Motors started trading publicly last week in what is being called one of Wall Street’s most successful Initial Public Offerings (IPO) in years. The automaker took in $20 billion selling newly minted shares of this iconic American company. That is only part of the $50 billion price tag in the bailout, but letting GM go under would have been far worse. Many were against the bailout. I have been a proponent of saving GM from the beginning. The reason is simple. Unlike the big banks, GM (and Chrysler) makes something in this country. Saving GM was not pretty or easy because the bailout, also, came with a bankruptcy. High ranking company executives and workers alike were fired. Bondholders, shareholders and creditors took massive hits. Even the unions gave large concessions, although they should have been forced to take a bigger hit. Unions (unsecured creditors) got more than the bondholders (secured creditors), and that was one of the truly ugly parts of the deal. However, in the end, GM was saved from the scrap heap of history and so were a couple hundred thousand jobs. This does not mean GM has clear sailing from here on out, but it does have a better than average chance to weather any future storm.

What happened to GM is exactly what should happen to the big banks. America’s largest financial institutions have not been fixed. They are still floating in a sea of red ink, phony government sanctioned accounting, and free, seemingly endless, bailout money. Barry Ritholtz, Chief Market Strategist for an institutional research firm called Fusion IQ, says the GM bankruptcy/bailout was “the single best decision of the bailout era.” On his “The Big Picture” website last week, Ritholtz said, “It seemed to be the only decision that was not made in a panic. It adhered to the rules of capitalism — when your company is insolvent, it goes into reorganization or dissolution. The brutal, Darwinian rules of the market and of bankruptcy applied — not the influence of lobbyists, or special favors from Senators. The Treasury Secretary’s former gig was not running an auto company, he ran a Wall Street bank — so there could be no special favors expected to come from that quarter either.” In short, the plan worked!

When it comes to the big banks, Ritholtz says, “Instead of letting insolvent banks fail, we turned over the keys to the castle. We could have fired the incompetent management that caused the problems — but most of these execs are still in the same highly placed positions in their firms. In terms of senior personnel, the industry is literally unchanged. Bad debt? Still on the books. Sufficient capital? Many years away. Business model? The same highly leveraged reckless strategy that got them into trouble in the first place . . .” (Click here to read the complete Ritholtz post.)

Unlike GM, most of the big banks didn’t just make bad business decisions or produce an inferior product, they engaged in all sorts of financial fraud according to former bank regulator and economics professor William Black. In an Op-Ed article he wrote for the Huffington Post, he said, “The banks that are foreclosing on fraudulently originated mortgages frequently cannot produce legitimate documents and have committed “fraud in the inducement.” Now, only fraud will let them take the homes. Many of the required documents do not exist, and those that do exist would provide proof of the fraud that was involved in loan origination, securitization, and marketing. This in turn would allow investors to force the banks to buy-back the fraudulent securities. . . . Foreclosure fraud is the only thing standing between the banks and Armageddon.”

Black thinks we should, also, put many of the big banks into bankruptcy starting with the weakest–Bank of America. In his October article, he said, “. . .it is time to place the financial institutions that committed widespread fraud in receivership. We should remove the senior leadership of the banks and replace them with experienced bankers with a reputation for integrity and competence, i.e., the honest officers that quit or were fired because they refused to engage in fraud. We should prioritize the receiverships to deal with the worst known “control frauds” among the “systemically dangerous institutions.” (Click here to read the complete HP article Black co-wrote.) By the way, during the aftermath of the savings and loan crisis in the early 90’s, more than a thousand financial elites were successfully prosecuted, according to Black. In the aftermath of the 2008 financial meltdown, not a single financial elite has been indicted or convicted.

Trillions of dollars have been wasted already bailing out the banking system, and nothing has been fixed. The banks are as insolvent as ever while Wall Street pay is hitting new all-time records. This is happening against a backdrop of a plunging economy. It appears the greedy, incompetent and crooked bankers are taking as much out of America as possible before their day of reckoning. The banks cannot escape their fate. It is controlled bankruptcy now or uncontrolled bankruptcy later, but bankruptcy it will be. Let’s pray it will not turn into a financial “Armageddon.”

I disagree with your conclusion, that is, the banks in the end will go bankrupt. I don’t believe it. I think the same thing will just

keep happening, more money thrown at them, law changes to allow them to foreclose at will, etc. Anything and everything the washington-wallstreet boys will do to stay status-quo they will do. The elite will prevail as Rome burns. “Let them eat cake” is and will be their

motto to the end. By end I mean a third world status for the US. Remember that in third world countries such as Brazil the elite are very wealthy and have even more power over the many. The bankers, wallstreet shoe boys and the washington establishment including main street media don’t have any worries, just more power and more wealth as the country downslides to look forward to; that is why I say I disagree with your conclusion because they have a vested interest in not fixing anything. Those powers know if they just keep enough food on the table for the people as in Brazil the people will not revolt, march or complain. Not trying to present a depressive view of the situation just the reality of the mindset of the elite and apathy of the american masses. Simply stated, there just isn’t enough of the learned to make a difference however hard we try to pass the truth on.

Art,

Market forces could force bankruptcy. The giant pool of OTC derivatives could swamp the system but you are right the elite in both the public and private sector “have a vested interest in not fixing anything.” At some point the money printing for the elite bailouts will be worthless. Thank you for your comment and views.

Greg

Greg

I do not agree that the GM bailout was the best decision. OK it saved a few thousand union jobs, but most likely it was the IPO payoff to the unions that was intended. GM was a publicly traded company before it ran in to financial problems. What makes an investor think it won’t happen again particularly in today’s world?

If GM had truly been allowed to go bankrupt the bond holders would have been paid, the worker’s contracts renegotiated, and business continued. There can be no good will attributed to corporate value in this IPO so what is gained? The unions have 102 million shares with an IPO value of $33.00 per share;sounds like a big number. Once the trading value declines, as it will, where is the benefit to the pension plans? They will shrink again. GM has been given a 49 billion dollar tax exemption to boost the share price; they don’t have to make a profit.

Should the banks go bankrupt there should be no bailout. Let them go some plan will emerge to takeover the assets of those who fail. Others will re-emerge leaner and a bit more ready to conduct their business properly. Re-impose Glass-Stegall and get the banks back into banking. Eliminate fractional reserve banking.

There is no stomach in government or ignorant citizens for any of these actions so the disaster lumbers closer to the surprise of many.

Thank you John. I agree we should bring back Glass-Steagall.

Greg

so, John, a mega-tax break for the ultra wealthy is not a bailout for them? or just more tax welfare for those who can afford to buy congress?

Fully disagreed that the GM bailout was morally or financially the right decision. First… what nobody is repeating in the news is the current $50 billion tax break they are now getting on top of all of our money. Basically, what happened financially and immorally is the fact that the money was redistributed from the bondholders to the union workers. The rule of law was broken and we are still on the hook for the union pensions and health care and the taxpayers will continue to pay. The Lie is that a bankruptcy would have cost all of the jobs…, not true, what would have happen is that the company would have been restructured and the union workers along with the bondholders would have both been accountable for their action.s

Thank you Glenn.

Greg

Free trade is not free if there isn’t balanced trade between the parties involved. Nobody wants our exports because they are to expensive. They are to expensive because of manufacturing costs. A lot of the costs are from compliance with the EPA and OSHA. America should require that ANYONE WE HAVE FREE TRADE WITH, should be made to produce a current “pedigree” so to say for their product they are importing. The pedigree would verify that the products were made at a factory complying with U.S. EPA and OSHA standards. EPA and OSHA inspectors would issue the pedigrees. (well looky there, just created some new jobs) After all, America is suppose to be the big environmental and human rights watch dog. Yet we allow goods that we know are made at sub-standard wages and in factories that do not comply with any kind of regulations to enter our country under the guise of free trade. Basically duty free. We need to level the playing field by making it just as costly to manufacture abroad and import to the U.S. than it would be to manufacture right here. After all we are the largest consumers in the world. As long as there is profit to be made, manufacturers will return. Anytime the free trade issue is held to scrutiny in the public venue, there is always a fat cat politician who starts screaming protectionism. Well, at this point in time I wouldn’t call it protectionism rather preservism. Thanks, Mike

Thank you Mike.

Greg

As I said before about the GM union,they should lose just as much as the bond holders. I don’t know how much, if any union money was tied up in GM bonds,but a good chance the union did hold GM bonds. The trouble I see coming, who can afford a 40,000 dollar electric car. China, are some other country will ship a good cheap electric car in and game over. Did you see in Florida the condo auction that went so bad, they stop the auction,it’s not a good sign. Mark to market is like 2+2=4, the truth hurts. peace

Bob,

I thought the unions should have lost more than the bondholders. Let’s hope the electric car gets a lot cheaper. Thanks for the comment.

Greg

Today @ http://www.jsmineset.com, Jim Sinclair has a very good comment on the banksters that all should read.

I agree that the if GM went thur real bankruptcy, the Unions would have lost the power they now use to steal from tax payers at will. The TBTF banks are broke, but are allowed to use OCD to crash other nations at will also, we need to demand they be shut down ASAP, but the Fed is running the gov & until that is change,things will get worse!

M Smith,

All valid points. Thank you.

Greg

Sorry Greg, but the concept of “too big to fail” is false. Nothing is too big to fail and the US will soon discover that fact. Not only did GM fail but so did their financing arm and few are willing to talk about that now. There are those who point to the last “bailout” of Chrysler but that was a loan, not debtor in possession financing. GM failed because they became too big to succeed, buying Hummer, SAAB, launching Saturn on one business model and discovering it wasn’t sustainable. Not to mention lousy products and competing with itself in every tier of the market. And Chrysler? I think they found out just how many mini-vans can be sold when people just don’t want them any more. But they’re going to bring out lots of new and improved models someday. Reminds me of Audi after they destroyed their image in the past selling defective junk. Now Audi’s wildly successful selling something like 10,000 cars per year in the US. WooHoo!

Sure, GM sold some IPO stock, but only Alzheimer’s victims would buy any of their bonds (no disrespect to Alzheimer’s victims – I lost both my mother and brother to it). Both GM and Chrysler are insolvent and toxic and will fail again. But Fiat will be a winner when they can walk away scott free from their freebie. Does anyone remember how successful FIAT wasn’t the last time they were here?

The auto bailouts have caused and will cause again, more pain than orderly bankruptcies. But the unions are happy, and will be even happier with taxpayer funding of their insolvent pension funds.

Jim and James,

Jim, you did see where I said the banks should go into bankruptcy. There would have to be some government protection of depositors, but that is it. James, I did say ,” Even the unions gave large concessions, although they should have been forced to take a bigger hit. Unions (unsecured creditors) got more than the bondholders (secured creditors), and that was one of the truly ugly parts of the deal.” Guys, the banks have gotten trillions of dollars in a bailout and NOTHING is fixed. GM got $50 billion and was forced through bankruptcy. All I am saying is the banks should be forced to do the same thing but also face criminal charges for fraud.

This is not a story about GM but a comparison on why the banks should be forced into bankruptcy too. I guess I did a bad job with this one. Thank you both for your comments and insight, I really appreciate the feedback and your points of view. Both are valid.

Greg

I agree that the GM bailout was small potatoes compared to the banking fraud fix. You did however say that the GM bailout saved thousands of job. These are not jobs of productivity, they are jobs of special interest. They unable to survive in the free market without subsidization from my tax money. I earn 2/3rds of what they get with less than half the benefits. It is the exact same as federal employees. It is non-productive and inefficient. That is part of the reason for the failure of GM in the first place. The federal govt is the largest employer in the country and they are quickly running out of productive people to pick up their tab of waste. I do agree that the banks should have been put into a similar recievership as GM. At the very least we could have routed the management. Absolutely nothing has been done except to give the Federal Reserve power to take over banks that pose inherent risk to the economy. When only eight banks control most of the money/economy then they are an inherent risk simply by existing. Too big to fail banks unfortunately are too powerful to fail because they have total control of our government. Starting with Regan through every president and congress of both partys, Wall St bought and paid to remove laws(Glass/Stegall) and virtually all regulation. Nothing has been fixed at all, it is worse now than before. Until Washington is owned by the people and not the banks this will be standard operating procedure. Fiat currency with fractional reserve banking is working just as well as it did 1000 years ago. It is a failure pure and simple. Someone creating money from nothing and charging interest and then forclosing on an actual asset is criminal, plain and simple.

Even if we had routed the management of the banks, none of them would have been prosecuted. They would have gotten government jobs for cooperating or became lobbyists. Their ilk will not be purged until the system itself is purged.

Thank you James for both comments.

Greg

I do not think the union should have gotten priority over the bond holders. I used to work in the Carpenters union in Boston. They pay is great and the benefits are great but it is a political mess that rewards laziness and punishes producers. I worked in the real world for 10 years doing carpentry work and got into the union by sheer luck in the early 2000’s. Usually you need to know someone in power to get in. They unionized the company I was working for and it was great for a year or so until one of the big contractors destroyed the company I worked for that had existed in the non-union world for 20 years buy not paying for signed change orders in excess of $100,000. My friends and I tried working for other companies but when we tried to get work done we were told to slow down because this was a state job and we could stay there for years if we went slow enough. I found it to be incredibly unethical and very sad. Incompetence is rewarded and it is all about who you know. Nothing at all was based on productivity at all ever. It was exactly the opposite, if you got a lot of work done they took you off of jobs. It was a nightmare. I am sure that the UAW guys were exactly the same, and they had as much to do with the failure of GM as the terrible managment. No joking at all, I could accomplish in one day what would take some guys over a week to do. I truly believe that unions are totally corrupt and about as inefficient at getting things done a government agency. There may be good ones but from my experiences it was a mini-government that overcharged taxpayers for every state job I was ever on. The UAW should have been thrown out of the whole deal if you ask me. It is a racket.

Great article. Your site makes me question our country. Why does the Obamachrist get to choose what businesses get a bail out and those that don’t? Why did the bond holders of the former GM get the short end of the stick on the GM bankruptcy and the union got ownership against all of the precedent in bankruptcy law? And why did Wesley Snipes get jail time and all Charlie Rangel got was a scolding?

George,

All good points. Thank you for your comments.

Greg

To big to fail? Some would argue that the US of A is to great a nation to fail; too rich to become a third world country. At least the ones that don’t understand basic math, deficit spending and the corrupt cesspool we call government. Like Nancy Pelosi says, “You have to pass the bill to see what’s in it”. A bill is not like a piñata. How stupid do you have to be to send some like Nancy back to represent you? Note to those with an IQ of less than 70; Nancy is not representing you, she is representing her own interests. After all, do you think her husband’s company getting that sweetheart deal from government was based on merit? Suckers…

We are in the process of failing as a nation. JP Morgan said recently that we had one of the world’s weakest currencies. How many generations did it take to go from the best to the worst?

Sir:

Do you have a link to your last week’s program on Coast-2-Coast, so that I can place it on my blog? alternatively, do you have it recorded in MP3?

Thanks

Kareem Salessi

Kareem,

You have to go to the Coast to Coast site and pay a small fee for a down load. I even have to pay to listen to myself. Thank you for your support and comments.

Greg

If I disclose to you, in plain language, why banks have been legislated never to file bankruptcy you may blow up your neighborhood banks tomorrow.

Greg,

I’ve been reading your blog for a while have always fund sound reason and judgement within, until today. No company should ever get a bailout, period. Not only do taxpayers get the bill, but comsumers have inferior products to buy. Bailing out GM blocks potential superior products from reaching the market. We could have cars that got unbelieveable gass mileage, cars that fly, or whatever the human mind could think of, if we would have had the courage to rely on the individual.

Bailouts reward incompotance while blocking future advancement.

Brent,

You are correct, “no company should ever be bailed out” and that includes the banks. Might I remind you that GM was not merely bailed out, it was taken into a bankruptcy. Let me say this again as I said in the post, “Unions (unsecured creditors) got more than the bondholders (secured creditors), and that was one of the truly ugly parts of the deal.” I totally agree that “bailouts reward incompetence.” Thank you for your comment and “Good men can disagree.”

Greg

HI Greg,

The problem with banks claiming bankruptcy is they will not pay their bills to the small businesses they owe money to and will bank holiday on deposits. . . which will hit good citizens. Instead, why not restructure the bailout phony funds to force them to pay the bills uprightly and forego anything they owe the Fed or govt in taxes of various forms and other measures to secure citizens and leave the cabal with the debt? While they are at it the govt needs to start printing its own money and leave the private ownership of the FED to pay off all the debt (includes the phony derivatives/bonds etc.) as it will equal close to all the money they have made since the 1700’s in their worldwide take over with the elite banking system! Time to give what they have taken back – in full – karmic balance!

As for vehicles, we should build a really good model that uses more advanced technology that we have but has been purchased/stolen/burned and held from the public . . . and our transportation worries would be over and we won’t need GM or Ford . . . just a great three or four model type that appeals to all in price and performance – clean, green, design, safety, style and mileage plus high speed trains. Even FREE ENERGY is being withheld – inventors are being killed so the tech never reaches the public . . . manipulation continues to benefit the few. Even tech that reuses nuke used fuel has been blocked by the unions who want their truck drivers to drive the spent fuel all over the nation to the dump sites.

Non wisdom forces hold back what can be a utopia . . . imo. Take care. The Seer – female Futurist

PS Another subject, when will there be an Allodial Title movement in the USA? Yes, even with your mortgage paid off you still do not have full ownership and clear title to your property. Just another matter to get changed in the good ol USA . . .

Thank you Seer.Greg

I must respectfully disagree in regard to GM. This wasn’t GM’s first time at the bailout trough as I’m sure you know. I am quite sure that the GM employees still being employees is a good thing, but it seems to me that there is certainly a moral hazard here. How many more bailouts will be required to keep GM afloat? I am however in complete agreement regarding the big banks. Thank you for the information and views you present here-they are much appreciated.

Randy,

This was not a simple bailout, it was a bankruptcy. What the government spent on GM was just about 1/3 of the Wall Street’s bonuses this year alone. Lots of people lost money in the GM bankruptcy but bankers gained and that is the point I was trying to make by writing this story. Thank you for your comment

Hello Greg,

You are condoning the illegal theft of GM stock from shareholders and now the goverenment is selling shares without making whole the people who were aced-out when Obama illegally took control of GM.

The unions got a sweetheart deal. The GM deal proves pay-n-play is alive and well. Nancy’s “Pay-go” is also alive and well. The unions pay with “walking-around” money on election day and then the administration uses “pay-n-play” to pay them back.

Welfare for unions is what the GM takeover was.

No civil rights loving, and moral person would be for the stealing of GM shares from stockholders and bond holders to support unions who took advantage.

A person who believes this was a good deal does not believe in the rule of law.

Law by bureaucratic edict is OK for you?

markm

Mark M,

I am not condoning any such thing. GM went through bankruptcy and that is what happens in bankruptcy. Yes the unions got a sweet deal and that is wrong and ugly. May I remind you I said this in the post: ” Saving GM was not pretty or easy because the bailout, also, came with a bankruptcy. High ranking company executives and workers alike were fired. Bondholders, shareholders and creditors took massive hits. Even the unions gave large concessions, although they should have been forced to take a bigger hit. Unions (unsecured creditors) got more than the bondholders (secured creditors), and that was one of the truly ugly parts of the deal.” You do realize what GM got is about 1/3 of the bonus money that Wall Street banks are paying themselves this year alone. You do realize not a single bank has been taken to bankruptcy. That is the point of the post. I did NOT say thought this was a “good deal” It appears the only words you read in the post were “bailout” and “GM.” I do not know how a fair-minded person can read this entire article and infer that I am immoral or against civil rights. Your criticism is unfounded on the facts and therefore incorrect and very unfair.

Greg

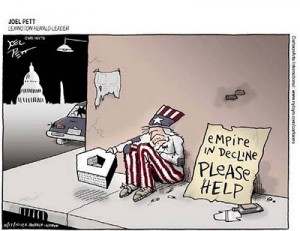

Agree with article but not carton, missed that we had an empire. maybe we should get one before its too late

The unions big mistake was trusting that triple A was a safe bet. When I got in the Ironworkers union in 1973 we just started a pension plan. The old boys were dead sit against it, the old dogs wanted all there money on the check and take care of there own health care and there own retirement. Most the old guys new you couldn’t trust the bankers are any man who push paper for a living. Also after 35 year of watching the big contractor and there buddies in government that’s were the big money gets rob. A union guy is like the guy who robs a 7 eleven an gets 20 years for the crime. Rob the bank, from the inside you get a bail out. If the unions are to blame for GM down fall, they must of been taking care of the book keeping to. Blaming the unions is just smoke. Paper pushers produce very little for what they take. The down fall came with the battle over wages and investors. To many investors and only a few producers it had to fail. peace

Thank you for your comment Bob.

Greg

I agree with you on GM and in time I think this will prove to have been the correct move. That is not to say that the “bail out” of GM was necessarily carried out optimally.

GM is a multinational – not just a US car manufacturer. The collapse of GM would have had serious consequences for economies beyond the US.

As far as the solvency or otherwise of the BIG banks is concerned, I think the QUOTE OF THE WEEK must go to Deborah Solomon of the Wall Street Journal when she was interviewed earlier this week by PBS’s Judy Woodruff on the Newshour program.

The lovely Deborah does not think the big banks were or are insolvent. As she explained to Judy:

“I mean, one of the problems we saw in the financial crisis was that banks, basically, they weren’t insolvent, but they didn’t have the money to deal with all of the losses that were on their books, which is why they had to take government money, you know, taxpayer bailouts. So they’re starting to build up their capital reserves as a part of global capital regulations that have been agreed upon.”

(Deb Solomon -PBS Newshour interview – Nov 23 2010)

Maybe that is the broad WSJ staff view of the Big Banks – “basically they weren’t insolvent”. (Apparently not being able to cover your liabilities/losses does not mean you are insolvent. You really are in good shape after all).

I read it here again just to make sure I heard it correctly————–

http://www.pbs.org/newshour/bb/business/july-dec10/financial_11-23.html

I am looking forward to Debs next TV appearance.

Don’t you just love America?

Thank you.

Sean S,

Thank you for adding to this post. This is great info and insight into the mainstream media. The MSM is basically running a propaganda scam to cover the insolvent big banks. Good stuff man.

Greg

Greg,

Sorry for the length of this – but there are a couple of questions in here for you.

In 2008 Sept – immediately after the AIG bailout and the subsequent strong arming of the banks to take on Federal Loans (At least in my mind that’s what I am calling the monies the banks were “forced” to take from Paulson)- I had one recurring thought going through my head. “Capitalism – if it ever existed just died”

For a sense of perspective – I am 43 years old today – graduated from College in 1991 and up until Jan of 2008 knew nothing other than the stock market going up – rather I should say my 401K knew nothing other than that. I was in college in 1987 when the dow went from 1200 to 700 or something like that, and I have for a long time been aware that there is something like a 2 to 1 ratio of people alive that are 15 years older than me than 15 years younger – I mention those 2 things because for a long time I have been aware that for lack of a better word – Shit can happen – and that as one of the first members of Generation X – I needed to keep an eye on what would happen with the markets when the Baby Boomers stopped putting in an started taking out. Against all “Sane Wisdom” at the time, I bailed my 401K into Money Markets in Jan of 2008 largely due to what was going on with oil prices and a shift in what I saw going on in my own industry – consumer products. I am still in MM.

OK that was a lot longer than I intended,

Back to my questions.

What would have happened – truly happened if AIG and GM and everyone else were not bailed out – and went through a normal BK?

Moreover, is not whatever the answer is to that going to happen anyway?

Is capitalism, as we know it over – or was it never there?

Buckley once said – the only problem with capitalism is capitalists. The ones I suppose who will try to game the system. Nevertheless, if these people are gaming the system – part of that is if they lose – which they did – they truly lose they go into BK. Governments’ steeping in as it did, in my mind, is an admission of failure (for capitalism) on a colossal level.

It truly pisses me off to no end how that went down. I am of the opinion that I would have rather seen the Dow at 2000 than the Govt get involved. 99 times out of 100 Govt sucks – yeah our missiles work great but we bought them from the private sector. Govt getting involved only makes it worse.

If these people are too big to fail then the rest of us are 2 small to succeed.

Dan,

I think you kinda answered your own questions and I think you came to the correct conclusion. Thank you for posting this on the site.

Greg