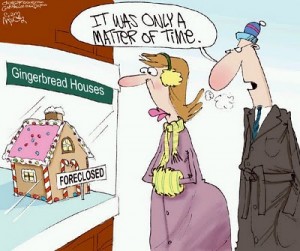

Bad Real Estate News Ignored to Spin Bright Future

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I was shocked to see this headline from an Associated Press story yesterday, “Economists project home sales, construction to rise sharply in 2011 from extreme lows of 2010.” I was dumbfounded by the title of the article and even more taken back when I read the story which said, “The forecast delivered at the International Builders’ Show in Orlando sees U.S. economic growth sharply lifting home sales and residential construction over the next two years, but from near-historic lows posted last year. “ The chief economist for the National Association of Home Builders, David Crowe, said, “Single-family home construction, a bellwether for the housing market and the economy, will rise 21 percent to 575,000 this year and climb to 860,000 in 2012.” (Click here to read the full AP story.)

That is still about 75% less new construction from the peak of the housing boom a few years ago. This forecast was made just prior to yesterday’s release of the “Year-End 2010 U.S. Foreclosure Market Report” from RealtyTrac.com. Its headline read “Record 2.9 Million U.S. Properties Receive Foreclosure Filings in 2010 Despite 30-Month Low in December.” The report went on to say, “Total properties receiving foreclosure filings would have easily exceeded 3 million in 2010 had it not been for the fourth quarter drop in foreclosure activity — triggered primarily by the continuing controversy surrounding foreclosure documentation and procedures that prompted many major lenders to temporarily halt some foreclosure proceedings,” said James J. Saccacio, chief executive officer of RealtyTrac. “Even so, 2010 foreclosure activity still hit a record high for our report, and many of the foreclosure proceedings that were stopped in late 2010 — which we estimate may be as high as a quarter million — will likely be re-started and add to the numbers in early 2011.” (Click here to read the entire RealtyTrac report.)

So, a back log of foreclosures will increase by about 20% in 2011, which RealtyTrac is predicting to be another record year. There have been 3 million repossessed homes since 2006, and RealtyTrac says there could be “3 million” more by 2013. 2010 was also a record year for repossessions with well over one million homes taken back by the banks. Meanwhile, the National Association of Home Builders is expecting a 21% increase in new homes?

So, with all these foreclosures in the pipeline, there is only one way prices can go and that is down–right? Not according to Crowe who is “forecasting prices for new and previously occupied homes to be flat this year and inch up 1.4 percent next year.” That is in stark contrast to people such as Yale economics professor Robert Shiller whose Case-Shiller index reported a rapid drop in home prices at the end of 2010. The Business Insider reports, “Housing guru Robert Shiller says the decline in October’s Case-Shiller house-price index was much worse than expected (over 10% annualized). He also says that if house prices keep falling this fast, the economy will face “serious reasons to worry” (which, for Professor Shiller, is an apocalyptic statement.) . . . If prices continue to fall at this rate, Shiller expects the panicked Congress will issue another home-buyer tax credit . . .” (Click here for the complete BI report.)

Respected economist Gary Shilling thinks housing prices will fall (on average) another 20%. Shilling has put together a 27 page slide show to back up his prediction. If you want to see it and find out more about Mr. Shilling, you can go to the Business Insider by (clicking here.)

I feel for anyone in real estate or home-building, but fantasy projections will surely disappoint when they do not pan out. Spin is not what is needed in journalism. Now, more than ever, people need to hear the truth to correctly navigate this unraveling economy. Optimism is a wonderful thing, but it is not a plan of action.

In just the past day and a half I have read so many great articles that dovetail into your article, Greg.

Articles about Banks walking away from foreclosures, Banks foreclosing and giving the homes to non-profits, Why do banks continue to sell their mortgages rather than hold on to them? A wonderful article about real value versus perceived value. Is it deceitful to call investors, investors, when they are really REinvestors not to be confused with those who invest in the construction of a home. Bad Real Estate News Ignored to Spin Bright Future. (ahem)

I created an article and put all links in one place for those interested.

http://swarmthebanks.blogspot.com/2011/01/so-many-important-foreclosure-related.html

Thank you Jan, Alessandro and Armand.

Greg

I think it is wishful thinking by the International Home Builder’s Association. We see the same rosy reports in our local paper.

Who is going to buy these new homes? The unemployed or underemployed? Maybe those newly minted college graduates with a hundred grand in student loan debt? Not bloody likely!

The powers that be are doing everything they can to fend off further devaluation in the home market. For instance FHA is going to start lending to people with credit scores in the 500-600 range if they have a down payment. That down payment can be as low as 5%. One problem with this is the fact that people with credit scores between 500-600 don’t have 5% to put down. If they did they would have paid their bills and their credit score would be at least above 620.

With the new legislation coming that will require lenders to hold 5% of the mortgage on their books if the borrower is not putting down 30% or more you will see more loans going FHA to avoid this requirement. Conventional financing with a down payment of less than 30% will carry a premium in rate passed down to the borrower from the lender to help with the 5% holdback.

In summary, when they take one step to open up credit they are taking another that tightens things up. I firmly believe we have not made any headway towards recovery in the housing market. In some places, things appear to have found a bottom but that is the best I am hoping for right now. The new legislation (Frank-Dodd) combined with higher interest rates or premium pricing will cause another down turn in the housing market.

The only way to fix this horrible mess is to ban the securitization of all mortgage loans. Require the customer to put down 20% with the only exception being VA. The banks need to hold the loan on their books until it is paid in full. This would make underwriting more stringent and stop the shenanigans with promissory notes and deeds. MERS would be irrelevant. Yes, housing prices would fall to a point but they would be much more stable than they are today.

Stephen

Industry Insider

Stephen,

Thank you very much for your insider analysis. This is adds to this post! Thank you for taking the time to take us to school.

Greg

Stephen,

Whoa doctor! Your conclusions are right-on! I enjoyed reading that.

markm

Will the banks make the loans?

Wonder what the credit score of the buyer will have to be? Then how much down payment will the bank require? How secure is the buyers employment? What is the total of the buyers debt?

What is the price range of these new homes?

Let’s put the people in the houses, then figure out their payments.

We have to pass the bill so we can read what’s in it.

Art ans Slingshot,

Thanks for your perspectives and comments.

Greg

Greg, spin is all we get today on almost every topic. When did media and government become such good buddies? I can remember a time when our government use to bitch like crazy about the media and their reporting, which was’nt as much sugar coated as today. Besides when, which had to be in the last 30 years or so, the real question is WHY? You being in the “Business” might have some comments and answers as to why, what may have prompted this outrage.

Every time I read such nonsense it just makes me more likely to suspect the next article will be full of bull. Maybe the Fed believes it can print money till there is a chicken in every pot and the media’s role is a new age positive thinking wealth creation, self

fullfilling type metaphysical philosphy. Meanwhile, down here on the ground (in reality) in central California, more layoffs, foreclosures, business failures, and bankruptcies.

big article

Hey Greg,

Your conclusion is profound!

“I feel for anyone in real estate or home-building, but fantasy projections will surely disappoint when they do not pan out. Spin is not what is needed in journalism. Now, more than ever, people need to hear the truth to correctly navigate this unraveling economy. Optimism is a wonderful thing, but it is not a plan of action.”

That was worth pasting and re-reading.

When will the people in power realize that their “spin” only works for people who allready believe in the religion called progressivism. 40% of our population has sipped the cool-aid. Their isn’t anybody else who is willing to “convert” to their religion.

My message to the spin-miesters: Stop spinning to your base, they don’t need the propaganda. And, stop spinning to me because I will never convert to your religion!

markm

Right on Markm. Thank you for your kind words and comment!!

Greg

Markm,

There is nothing ‘progressive’ about the Main Stream Media lying to us, progressives have been railing about this for years now, but we get called ‘conspiracy theorists’ and other things by people who don’t know the difference between ‘their’ and ‘there’ (third grade level education). The reason we keep getting lied to is because people believe the lies, instead of thinking for themselves. Turn off your teevee and start getting your information from more complicated sources than the nightly news, that thinks ‘in-depth reporting’ is a 90 second film clip. The corporations own the news and the government and if you’re having trouble thinking straight, it’s because you keep listening to lies.

We’re being divided by these corporate thieves into left and right, progressive and, well, whatever unprogressive is… Meanwhile, we aren’t supposed to notice them robbing us blind.

signalfire:

Progressivism is a belief system. Just as christians, islamists, and jews have a belief system.

The laws of physics and psychology are immutable. The three laws of thermodynamics preclude a “perpetual motion machine.” Human nature precludes a top-down communal sytem from ever working because it requires the societal equivelant of a perpetual motion machine.

Life is dynamic and not static. Static analysis is required for progressivism to work on paper. The law of unintended consequences rules-out static analysis for most everything.

Progressivism (neo-Marxism) is not a viable replacement for christian or judeo values (many of the other great religions have a good value system; I did not include them because we are a Judeo-Christian nation).

Progressivism has helped our society. It has filed-down some of the judgemental aspects that religous zealots of other stripes have placed on our society. In some ways we are a more tolerant nation because of neo-Marxists; and that is a good thing.

However, people who have suffered the wrath of progressive’s for not sipping the kool-aid know that the tyranny of the left is no better than what we had before. Life is dynamic.

In closing, I respect your unalienable and creator granted right to sip the kool-aid and pray to your God, the diety called progressivism.

markm

Signal, Please define what being a progressive means. To me, its “take from me and give to others” regardless to whether we are talking money or freedom. from reading your post, that doesn’t sound like you

Markm,

They continue to spin and spin because spinning their propaganda helps keep the herd in line. Earlier I heard Rush Limbaugh complain that they continue on with the shootings Tuscon, whist pushing aside real news stories such as the price of oil to $100 a barrel, the push for gun control, a lousy housing market, and the worsening economic climate in the world. A restive herd begins to question, and doesn’t buy shoddy products or watch sports. A restive herd throws out the bums as in 2010, and if these are new bums they get VERY restive.

As to the “40% who have sipped the Kool-Aid…” Don’t you know? Most of the Kool-Aid sippers “work” for government, snobs who consider themselves “superior” and “a cut above.” Where I live there are crowds of them, they’ve pushed the real middle class out of their homes and live a lifestyle that mocks them. Yet, these government “workers” have had gallons of Kool-Aid, and been blinded by it, because they cannot see that they are living in an overly-expanded bubble that is ready to POP! There is a story on Drudge Report about how the Feds want to force cities and states to live up to UNION contracts – an impossibility.

All I can say is: pass that jug of cool, clear, spring water around, as many will need their internal systems flushed clean if they want to wake up to what is really going on.

I don’t know where they’ll build next, as much ARABLE LAND has been paved over already; land that COULD BE used in food production and thereby help lower food costs now has a crop of

of empty/abandoned homes. Why can’t people buy one of these empty homes at reduced prices, instead of parking their keysters in yet another exclusive and expensive yuppie community?

Hey Sam,

Our crazy zoning laws have prohibited the use of low quality land for home and industrial production. West Tuoulumne County Kalifornia is a good example. The land is horrible. It barely supports sheep. However, its beautiful rolling hills are perfect for housing and industrial develepment.

Instead, the progressives want arable land below, with expensive irrigation systems in-place, paved over because farming and ranching are “bad for the environment.” “Evil corporations” plunder the arable land and make money off of food. SHAME!!!!

To the progressives, a farm, a house, a wind-farm, is the same thing!

markm

Newspapers everywhere must twist and misrepresent the facts with regards to home construction activities and real estate sales for the simple reason that newspapers everywhere must rely heavily upon that industry’s advertisements to keep themselves in business.

Has anyone met a real estate broker or saleperson who ever admitted business was slow, or bad ? I have’nt. I’m 72. All I have ever heard throughout my life, in good times or bad, is that property values forever into eternity will rise and will make everyone millionaires, or multi-millionaires.

Good point Mike. Thank you.

Greg

Greg–thanks for another great post–seems the gov’t/media has done their best to destroy religion so one can believe in ‘them’ instead…it’s a sad world and unfortunately I hear many ‘a sheeple’ repeating the nonsense spewed out by the ‘new religion’ being offered up. They believe this kind of stuff with conviction and are taught to look upon others as a conspirators when one doesn’t buy the party line!! keep up the good work and I always look forward to your columns…..

Thank you Big Tom for your support.

Greg

The real estate lobby has their hands in both sides of the isle in Washington and in the press also. Spin is the word and truth does not apply to these people and their shills.

I look at homes in my stable Northeast community that sit with for sale signs 12 months on average with numerous price deductions with no takers. The housing market on stuff over 200K does not move! Florida properties are in a depression state with 10% marketdowns every 2 months on average. Most Florida properties are selling 30% less than replacement value.

What recovery?

Jeff,

What recovery is right. I am asking that question every week! Thank you.

Greg

Concur, +1

markm

These fools actually believe the nonsense they push out to the public through the MSM. They view reality with a good dose of psychotropics to aide them in making the statements that they do.

The reality of the situation is, housing in 2011 and 2012 will continue to tank. No jobs, no housing sales. Increasing interest rates, no housing sales. More foreclosures, no housing sales. An increasing shadow inventory by banks of worthless real estate assets, no housing sales. More stragegic defaults by homeowners, no housing sales.

There are 19 million empty homes in the US that are either foreclosed, being rented or for sale; with many more to be added to the list every week. Lawerence Yun of the NAR and the rest of the BS’ers listed above can spout all of the statist feel good rhetoric they want, it won’t change the facts.

PatriotRider,

You are correct sir, it won’t change the facts.

Greg

Hi Greg,

I am a commercial real estate broker and business broker in northwest North Carolina. And let me say this: Business is bad! Banks will only lend money to those with outstanding credit, good, secure job(s), and those who have their own resources (cash) for a (substantial)down payment. There is a large university in my town with tons of students that in other times needed housing. Also, this is a resort area and many of the homes in this area are second/vacation homes ….. and many of the owners of these homes are hurting financially. Hence, many of these nice, second homes are now on the rental market. This of course has had the effect of stopping apartment construction ….. developers can no longer fill them. My point here is that more bad news simply makes for more bad news … one sector hurting (student housing) greviously affects another sector (construction). And sadly, the students don’t treat these rental houses with kid gloves; one day when they do go back on the market many will need significant repairs.

We have not seen the bottom, my friend.

David Conrad

Dave,

I am afraid you are correct. Thank you for your professional analysis!!

Greg

One also needs to compare where these homes are being built and why they are being built. NAHB data for 2009 show that to be the weakest year in housing starts since the early 90’s, with modest increases in much of the US in 2010. But when looking at this data, there are indications that there is something else behind the scene driving some of the construction. For instance, Michigan increased 33%, Florida gained 13% with the Miami MSA increasing 65%, California increased

Continued: hit submit button at wrong time

California increased 21%, all of these states with high foreclosure rates. Is there some federal program that is making new construction starts profitable while allowing existing homes to hit the market as foreclosures?

Thanks Ron P for your comments.

Greg

I’m with you Greg, people need to hear the truth. Unfortunately, most people have been lied to, and don’t have a clue how bad things are, and how bad they’re going to get. Anyway, I found your site, because I saw you on Max’s show.

One person I follow is Nicole Foss. Some may call her a doomer, but she is very smart, and tells it the way she sees it based on facts and hard data. Here’s some info regarding housing from her site: http://theautomaticearth.blogspot.com/2011/01/january-1-2011-us-housing-story-of-2011.html

I also follow http://www.kunstler.com – he made an interesting comment the other day on his site which was: The housing market is dead, they just don’t know it yet. He was referring to the home builders, realtors, etc.

Rick,

Thank you for the comments and for adding content to this post!

Greg

Greg,

I want to know what “Economists” were on that Associated Press story. I don’t believe they live in this Country. Let’s come back to the real world folks. First of all, it’s not as easy to even get a mortgage anymore like it was – so that is the first hurdle.. having enough people to afford the down payment to even acquire a home. Secondly, the sheer fact that there aren’t enough jobs and that nobody is getting raises at the jobs they are at ..oh, unless you’re a banker , wall street “player” or are working at the Ford Plant. The company I work for in Buffalo, NY is quite large but we will probably get the standard 3% raise that we got last year. That’s just enough to cover the cost of the the gas price increase but not enough to cover the increase in Insurance we just had or the food inflation that has been creeping up on us and will continue to creep up. My husband and I are looking for a house as we speak but that’s because we have 20k to put down . How many people have that? If anything we are hearing that people are moving in with parents and doubling up families. These “Economist” have it dead wrong. I predict that the prices will continue to drop on homes because the inventories will continue to be high. And btw..most of the houses we see out there are still too over –valued. They still are not back to 2000 prices which is where they should be given this whole mess started at least that far back. I’m not the only one who thinks that either because these over-valued houses are still sitting out there since last year when I was first looking.

Liz,

I think this is a sign there are some really desperate people in business right now. Thank you for the good comment!

Greg

Liz,

Going forward if I were you, rent don’t buy a home. Home prices are going to fall big time, we haven’t seen the end of this. Anyone who says different is lying to you. 20K sounds great, but you don’t want any debt going forward.

If you haven’t read this, you need to:

http://theautomaticearth.blogspot.com/2011/01/january-1-2011-us-housing-story-of-2011.html

PS – homes are not investments.

Rick,

My stepson was 6 months into a one year lease when the sheriff deputy delivered foreclosure papers [Dec 2010]. He was paying on time. You have to wonder what the landlord did with the money. Here is my 25 cents of opinion.

Yes, property values are going to go down but if you have assets and can buy, you are in a much better place than a renter.

Here’s why:

1) Credit will NOT be available in the future

2) Inflation will skyrocket meaning the dollars you make or worth less but so are the dollars you owe someone. They can not change a fixed rate mortgage to offset the effects of inflations.

3) If you start renting now and in five years credit is not available, the USA housing market will be like some third world countries. When you buy a house, you pay in cash. They don’t do mortgages there

Excellent article Greg.

American government and big business have decided to go the course of Argentina & Zimbabwe by making false claims based on wildly doctored stats and numbers that were massaged until they come out all shiney & pretty at the other end. They prematurely congratulate themselves for “having avoided the worst”. They hire shills and alleged “experts” to spin reality into news items that are the ideological equivalent of a Chicken McNugget: it may look good, but nobody knows what kind of crap is REALLY in it.

The SADDEST part is that our government & business ‘leaders’ themselves ultimately wind-up believing their OWN LIES, while everyone else & their grandma just giggle and think “THESE PEOPLE ARE CRAZY!”

The situation of the U.S. reminds me of a Sufi saying, “How long can you hold a flame against your chest and not get burned?” I guess we’ll all discover the answer to THAT question in just a few more short months.

Thank you for adding to this post Mike.

Greg

The only thing that will rise for the housing market in 2011, is the cost of building.

All materials, lumber, steel, copper, oil, are going up in response to the inflationary dollar/euro printing going on. Add to those increased costs, increased taxes, depressed lending and the recipe creates further housing depression.

News media management knows people do not buy papers and magazines to deliver more bad news in the middle of a depression. Their advertisers, don’t want people being reminded to watch their pennies instead of spending on new cars, homes, and appliances.

It is market forces at work. The fourth estate has no more scruples than Wall street bankers. Difference now is, we are just beginning to believe that. The curtain is being pulled back.

Hoppe,

The curtain is being pulled back. I like the way you summed it all up!

Greg

Hey Hoppe,

I see inflation everyday. Are some sectors so bad-off that the numbers are being skewed? A Sh**! That was stupid question.

markm

Perhaps the most frustrating point is that the cities & counties are still riding the bubble – i.e., they have risen their property tax values as the prices of the houses rose higher and higher, but now that the bubble is deflating, these same governments refuse to drop their property tax values. Indeed, many locations have adjusted their tax base upwards again in the past two years, because without jobs fewer people are paying the tax, and the government answer is to have fewer people pay more tax to keep the status quo of revenue. The worst case scenario is Detroit, which began last year to bulldoze empty standing homes so a builder could build new, non-depreciated homes in the same location. That is the epitome of the “broken window” theory. The only people making money are the builders and the government tax rolls.

It is also insane to expect a newlywed couple making $60,000/year to purchase a four-bedroom house at $240,000. Why is making a two-bedroom house that can be added onto in the future such an evil right now? Instead of four to six times annual income, what about a house worth two times annual income? When I graduated from college in 1996, I noticed that all my friends wanted what their parents already had, but they wanted it right now, not after 20 years of upward mobility. Thus credit cards and impossible-to-pay mortgages, with the government following right behind with increasing property tax and capital gains tax.

Jeremy,

You sir have a bright future. You are thinking right!

Greg

I was wondering if perhaps that forecast was written by Winston Smith?

Very Good NCdirtdigger. You Probably have a PhD in literature. FYI for the rest of us from Wikipedia: “Winston Smith is a fictional character and the protagonist of George Orwell’s 1949 novel Nineteen Eighty-Four. The character was employed by Orwell as an everyman in the setting of the novel, a “central eye … [the reader] can readily identify with”.[1] Winston Smith works as a clerk in the Records Department of the Ministry of Truth, where his job is to rewrite historical documents so they match the constantly changing current party line. This involves revising newspaper articles and doctoring photographs—mostly to remove “unpersons,” people who have fallen foul of the party. Because of his proximity to the mechanics of rewriting history, Winston Smith nurses doubts about the Party and its monopoly on truth.” Thanks NC.

Greg

I’m freezing my butt off up here in Toronto. I guess I had better buy up some foreclosed vacation property in sunny Florida fast since the Cdn. dollar is above parity now and before house prices return to peak levels again which sounds like that’s right around the corner.

Glenn,

Good idea! Just make sure you get the clear title at closing. I think I would stay long my Canadian dollars. Thanks for the comment.

Greg

Greg, you don’t need to a Dr. in literature to have read (and understood) that great piece of work (1984); but many thanks for discussing it for some who haven’t. I remember discussing it in college and there were a few, yours truly as one of them, who were preaching then that it would come to pass and for the country to take notice of what our government was doing at that time to take away freedom; we were laughed at. Now, 40 years later we have all but arrived. The MSM and the Government are now close buddies with the same agenda, to keep themselves in power and wealth while the rest of us middle class go to Brazil status. We are the frogs in the cold water pan who don’t jump out as the water is warmed because it is warmed a little a time and we can’t tell the difference. Well, it won’t work any longer, too many frogs are jumping out. You can tell by the responses here that, as once was said by a young follower of

Woody Guthrie “the times they are changing” – and, yes they are. I am confident the American people will get it sooner rather than latter, and throw the bums out, wall street, and all of them, and take this country back for the middle class who built it upon their broken backs and sweat and who are the rightful owners of it.

Art

Art,

I am with you. Thank you for the comment. It was especially poignant today.

Greg

If you got more house then vegetable garden ,your in over your head. There, their? nothing wrong with a third grad education if you live within your means. Even my son who has a good education and knows how to push paper in his banking job, has his as- hanging out and doesn’t hear are smell the storm coming. TV news boils down to lipstick and lie’s and all this happy talk about getting along in DC is about the two parties keeping the new players in town under control. All those congress people from New york want more gun law’s, they must have a bad feeling that NY will be were the revolt will start. PEACE lol

Thank you Bob for the “Lipstick and Lies” comment! Love it!!!

Greg

Greg,i can’t say thanks enough times to express my gratitude for the truth being told by your web site.

Thank you Kenny.

Greg

At times, I am beyond confused. Being in Real Estate (both an investor and broker), I see what is happening in housing. The flood of REO homes into our brokerage firm is telling. Gas goes up, commodities are up, unemployment shows know signs of improving…how can we say that there is any kind of economic recovery? I can only think that the MSM just does not want to let the American people know exactly how bad it is. What I feel like I know with certainty is almost in direct contrast to what is being broadcast to the public…and I feel like some kind of conspiracy-theorist nut-job or interminable pessimist. Because, believe me, I want things to get better. But I can also read and connect the dots, and the information out there just does not line up with what most news outlets are broadcasting. If I hear, “moving in the right direction” one more time, I think I will scream!!! It’s not moving in the right direction if we have to keep raising the debt ceiling, housing prices continue to slip, and unemployment doesn’t improve! Is there something I am just not seeing????

Nicole,

Thank you for your professional analysis. You are Missing nothing.

Greg

Greg,

I don’t think the average American is buying the spin about the real estate market anymore. What surprised me last week was how much focus there was on Obama’s “speech”. I voted for him, but I’m sick of his endless speech (talk about blind optimism).

Anyway, the other big spin that people aren’t getting is the spin that the stock market is doing well. They are not connecting higher stock prices to inflation or to the continued debasement of the currency. They are incorrectly assuming that their raising stock prices means that they are getting richer. They are not and this will be the next shock to many Americans who are hoping to retire in the next 5 years. Me thinks they’re going to get wiped out.

I have 2 friends who sold their old houses and bought new (bigger) one’s last week. I was surprised that they were even able to sell and I can’t figure out how they were able to save for their down payments. Yes, they have jobs, but it’s still hard to save nowadays with inflation and all. Why can’t people live in smaller houses?

It amazes me that none of them realize that if just one of them loses their job, their mortgages will be in trouble and this is where the REAL danger is with mortgages. Everyone I know is in a two income household and BOTH incomes are needed to help with the bills. Very few younger couples today would be able to afford their mortgages on just one income.

Thank you NM.

Greg

We are doing a seminar in SLC, UT about bad credit. It’s a serious problem in part because people who need jobs in order to purchase homes often cannot get hired (or promoted) because of bad credit.

So, if they can’t get jobs, they can’t pay rent or buy! There is also a possibility that people who have no equity will walk away from their mortgage and go rent before their credit is shot.

Rental place that are too strict on credit will end up vacant. Bankruptcies are way up. Lawyers are busy lining people up with Ch 13 to avoid foreclosures. But, if people can’t make the payments on a CH 13, foreclosures will happen anyway. Loan officers aren’t renewing their licenses by the same numbers and neither are real estate agents.

Short-sales is the name of the game in residential sales.

One in every 45 homes is foreclosing. That number is likely to increase in 2011. Imagine all the bad credit that all these people now have or are going to have! What did the big banks do with all of that taxpayer bail out money they received? Additionally, state laws have passed against upfront fees from loan modification companies that were scamming people! That’s probably the only good news I see in all of this mess.

AND THAT IS A METHOD TO FORCE PEOPLE TO RUN OUT AND BUY………

Maybe worthwhile background

http://theburningplatform.com/blog/2010/08/01/john-paulson-will-be-wrong-this-time-featured-article/comment-page-1/#comment-11695

Americans who are financially intellectualy challenged got suckered with teaser rates and 5 year ARMs. Banks trying to cut their losses, seem to be holding these millions of forclosures off the market. If they dumped 6 million or so foreclosure properties on the market all at once like they are supposed to do, housing would actually be really affordable for first time buyers like myself. All of us late twenty, early thirty single people could benefit from the deal of the century and actually help improve the market. Unfortunately, the banks are too greedy, even after getting bailed out. Honestly, this real-estate collapse/bubble was the biggest financial heist of the millenium. (Except for the Federal Reserve Act in the 1913) It has almost single-handedly wiped out the middle class.

I was watching CNN this morning and a commercial came on addressing seniors to get a govt. backed reverse mortgage on their homes. An equity swap if you will. Unbelievable. They are running the same scams they used just 5 years ago again!

Dude1,

CNN, “The most trusted name in news.” Yeah right! Thank you for the comment and info.

Greg

YEAH BUT WALKERS WHO PAID IRRATIONAL PRICES WANT THE DEALS OF THE CENTURYS ALSO….

One of the best ways to reinvigorate the real estate market would be to honor our unalienable right to own property.

The current system of property taxation violates this right. Property taxes never end. Thus, one can never really own his property. How often do we hear a family loosing its farm or business because they can’t pay their property taxes (which have been arbitrarily escalated over the years)? And what about the elderly being faced with difficulty in purchasing food or medicine. Why should they also be burdened with an unending property tax?

The solution is to replace the property tax with a fixed sales tax. This tax could be applied to the sales price of the property and paid up front or amortized with fixed interest over a time certain. Once the mortgage and sales taxes were paid, the property owner would own his property.

No need to worry about government revenues dropping. The money that property owners would no longer need for property taxes could be spent on whatever they wished – which would probably include other taxable stuff. Governments are notoriously good at finding stuff to tax.

THIS MAY BE IRRATIONAL BUT IF ONE IS THINKING OF THE EFFECTS OF UNRESTRAINED FRACTIONAL RESERVE BANKING ON SAVED DOLLARS AND THE DESTRUCTIONS OF DOLLAR VALUES IN RELATION TO HOUSING OVER 20 PLUS YEARS WITH ONE DOLLAR OF DEPOSITED SAVINGS COMPETING WITH 10, OR 100 OR AT TIMES 1000 DEBT DOLLARS COMPETING EQUALLY AT THE BUYING PROCESS AGAINST THE DOLLAR DEPOSITED THAT HAD ALLOWED IT, COMMUNIST HOUSINGS WOULD BE MORE EXPENSIVE ON RETURN TO THE MEAN……

Mikl,

Thank you for all your comments.

Greg

So all of you still believe that government is your buddy, your friend?

What will it take to wake up?

Foreclosures continue to be an issue, especially in our area of Dayton, Ohio. It seems whatever buzz your hear in the media the exact opposite is what’s really happending. Everyday I’m working with “someone” that over their head on the mortgage and is heading to foreclosure. I just seen another stat in the paper that said 50% of all buyers are now paying cash. My personal experience is about 5% of buyers are paying cash.

Thank you for the real estate update from you part of the country!

Greg

Bad Real Estate News Ignored to Spin Bright Future.thanks for share it with us..

I feel for anyone in real estate or home-building, but fantasy projections will surely disappoint when they do not pan out. Spin is not what is needed in journalism.

Real Estate News Ignored to Spin Bright Future.thanks for share it with us..

Bad Real Estate News Ignored to Spin Bright Future.thanks for share it with us..