The Fed’s Inflation Play

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

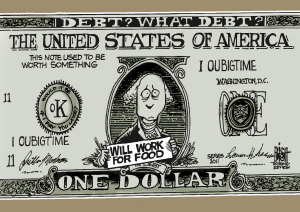

I have been saying repeatedly that the one thing you can count on is inflation. If you take housing out of the picture, that is exactly what we have been getting. The Fed wants inflation and loathes deflation. Ben Bernanke and other Fed officials have consistently said they want to support “asset prices.” In an October statement from the Federal Reserve Bank of New York, it attempted to explain its bloated balance sheet and explain why it was buying government bonds and mortgage-backed securities. The Fed said in part, “Nevertheless, balance sheet policy can still lower longer-term borrowing costs for many households and businesses, and it adds to household wealth by keeping asset prices higher than they otherwise would be.” (Click here to read the entire Fed statement from October 2010.)

According to financial expert James Rickards, the Federal Reserve is playing an inflation game called “financial repression.” The goal is to get the U.S. out from under at least $77 trillion in debt and future liabilities. The Fed would like to cut the deficit in half in 10 years. How do you do that without actually cutting anything? Rickards said in a recent interview on King World News, “The answer is 4% inflation. It doesn’t have to be that high, it just has to be persistent. It’s like holding an ice cube in your hand. It just melts away. Well that’s what the Fed is doing, and that’s what financial repression is all about.” (Click here for the complete King World News interview with Mr. Rickards.) (Click here for James Rickards’ bio.)

In simple terms, in order for this to work, the Fed needs both inflation and growth. This has been implemented in the past, and a great example is the post WWII economy. There was growth because the U.S. was helping to rebuild the world after the carnage in Europe and the South Pacific. There was also some inflation, but not so much that would alarm the public because back then, everyone had a job and wages rose. By the 60’s, the debt overhang from the war was largely in check.

Rickards says the big problem now is we are not getting the growth or the inflation that is necessary to make the Feds financial repression scheme work. I know what some of you are saying right now, “What do you mean there is no inflation? What about food and energy?” I thought the same thing, and I emailed Mr. Rickards to explain what he meant. Here’s Mr. Rickards’ reply: “I understand the price increases in food and energy, however, I used the Fed’s preferred definitions of inflation (core CPI, CPI and the PCE price deflators) all of which are tame. I did this because financial repression is a Fed policy so if you want to understand it through their eyes, you need to use their definitions for analytic purposes. The fact is TIPS spreads to nominal yields are collapsing and inflationary expectations are coming down. So, regardless of what you and I think of QE, the Fed is not seeing anything that would cause it to back off.” In the Fed’s eye, we are not really getting inflation. So, as Rickards says, the Fed is not going to “back off.”

Remember, housing prices are off 4% in the first quarter alone, but that is not the figure used in the consumer price index (CPI). It uses rental equivalents, not actual home prices. Rickards told me if home prices were used instead of rents, the CPI would probably show “deflation.” The Fed is terrified of that and wants home prices to go up, not down. This will keep the trillions of dollars of mortgage-backed securities from becoming worth less than they already are. So, it looks like the Fed will continue suppressing mortgage interest rates and keep holding them artificially down to around 5%. The Fed wants higher housing prices, but what it is getting are higher food and energy prices. This is a huge problem for the Fed’s financial repression plan because the public cannot become alarmed and outraged over inflation.

Rickards gave five reasons why, this time around, financial repression will not work in the long term: 1) There is no growth. 2) There is not enough inflation (according to the Fed.) 3) The debt, this time, is “huge.” After WWII, there was 100% debt to GDP ratio. Rickards says, “Today the Debt to GDP is six to seven hundred percent.” According to a recent Chicago Sun-Times article, the official national debt and liabilities such as Medicare and Medicaid,“. . . now stands at over $77 trillion — and counting!” (Click here to read the complete Sun-Times post.) This figure does not include other government liabilities such as Fannie, Freddie, FHA and FDIC. By the way, last weekend, the FDIC closed the 45th bank of the year. I see no end in sight. 4) Hostile creditors, such as China, are no longer keen on buying U.S. debt. CNSNews.com reported last week, “China has dropped 97 percent of its holdings in U.S. Treasury bills, decreasing its ownership of the short-term U.S. government securities from a peak of $210.4 billion in May 2009 to $5.69 billion in March 2011, the most recent month reported by the U.S. Treasury.” (Click here for the complete CNSNews.com story.) 5) Rickards says, “Financial repression only works if people cannot own gold.” Today, people can and are buying the yellow metal. Rickards sees gold, silver and other tangible assets as a way to preserve wealth as opposed to more traditional assets such as cash and Treasury bonds. Rickards sees a pattern of “higher highs and higher lows” in the gold market for some time to come. He thinks financial repression will work in the short term, but in the longer term, it will fail. He says the Fed can “keep a lid on it” until 2013. After that, he says, “there could be some kind of crack-up” in the economy.

i think this is a very astute analysis. i find the comparison to wwii to be very interesting. i’ve been thinking for months that we’ve been in this mess before – the deficit spending for the second world war and we got out of it with the boom of the fifties – how did we fix the problem then. i’m shocked to here that we are more in the hole now than we were then. and for what? to prevent a severe ecoonomic meltdown in 2008 that would have destroyed wall st. and reset the income distribution in the economy to a more level playing field.

Thank you Josh for weighing in on this one.

Greg

Mr. Rikards is an academic, lawyer, investment banker whose bio contains so many instances of “involved in”, it is funny. According to his bio he was a “participant in the stock market crash of 87”.

Two glaring problems here; He has bought into Bernanke’s “public” evaluation of the problem, citing his belief there is no “core” inflation. That is patently wrong. He should try to buy building supplies, or a set of tires for a car.

Bernanke has know there is inflation and is just holding his breath hoping something will turn up, because he is out of answers.

The Tips spreads are collapsing because of QE, failing auctions, and banks hording cash. It and little to do with real inflation, which yes does and must include food and energy. It is a rigged game among big banks and big investment houses and now the game isn’t working so well anymore.

All of the supposed Fed assumptions might have been proven true in the America of 1970, where we were the undisputed world leader in manufacturing, and banking. In those days the Fed could greatly affect foreign credit policies and purchases. Because we have outsourced virtually everything except the war machine, those days are gone, and the Fed’s old bag of tricks just won’t work.

I agree that this so called “financial repression” is not going to work,(if that is the fed plan) but for different reasons. Inflation is here and will continue. Consumer spending is going to continue to decline in “real terms”, so the American consumer engine is running on watered down gas, and too lean a mixture.

The inflation is originating externally.

Americans need to be prepared for an Eastern Block type of economy.

Hoppe,

Please read Mr. Rickards email response to me in the post. He clearly says it is the Fed that thinks there is little inflation not him. However, I agree with you on this statement “Americans need to be prepared for an Eastern Block type of economy.” And you are correct that we do have inflation in all the areas you mentioned. Thank you for your passion and analysis.

Greg

If you read Rickard’s “five reasons” his number 2 says there is not enough inflation- so apparently he believes it.

Hoppe,

Not enough inflation according to the Fed. There is not inflation in housing, just the opposite. Prices declined more than 4% in the first quarter of 2011. That is precisely where the Fed wants inflation but it going backwards despite artificially low mortgage rates. Remember, if you computed CPI using home prices instead of rent equivalents there would be overall deflation. I do get your point though, and thank you for making it here.

Greg

Most americans without a job or are underemployed know how real this inflation thing is and are allready experiencing an eastern block type economy. A vast amount of Americans don’t need to wait to experience it, they are in the middle of it as we speak; 25 million on unemployment insurance, 43 million on food stamps, vast millions on social security only, etc. The fully employed bureaucrats are one class who are not presently experiencing it but little by little they will as the government (counties, states, & cities) downsize police, firefighters, teachers, etc. due to stagnant tax revenues which have supported their oversized appetite to the trough up to now.

Kicking the can down the road is all they are doing, the Fed and the elite invester class are intelligent people, they know the economy cannot be sustained in the long run with so much debt, but that is the only play they have. Stagflation is what we have now, inflation with low or not growth.

My mother used to complain about inflation in the 60’s which the article touched upon, but my father’s income was rising as well; which is not what we see today. The Fed has no more little tricks left, stimulas didn’t work, employment has tanked, it cannot do anything but another round of “quantative easing” in one form or another, that’s it, period. Quantative easing is just “kicking” the can down the road somewhat like a death roll pardon or stay of execution until another hearing on the matter, its going to happen no matter what, its just a matter of time. The “Government” on the otherhand has one trick the Fed doesn’t have, war capabilities and, lets be honest here, war is where we are heading. When the American people finally admit and realize the “dream” has run its course and the government & main street media cannot bullshit them any longer about recovery around the corner, war will commence only making matters worse, but that’s the only trick our government has and it will use it. Hold on America, its going to get tricky! Thank you Gred for this blog to get the message out to our people.

Thank you Art for your comments and support.

Greg

When I read an article about the Federal Reserve -valuable information, thanks- it often seems to me that the writer thinks the FED is a kind and generous entity intent on doing what is right. I always have to remind myself that the FED acts in harmony with a group of financial organizations one of whose ultimate effects is to destroy nations. The strategy being used against us has two main components: 1) the ways in which economics can be made to work, and, 2) the public’s ignorance of economics. One other thing I have to keep reminding myself of is the fact that the actions of the Federal Reserve System are not inane, stupid, clumsy, uninformed, or incompetent, but that, actually, they are malicious, intentionally destructive, manipulative, and are engaged in a form of warfare against us. Brazen deceit is flagrantly employed, often without anyone recognizing it. Our people’s ignorant gullibility is heavily relied on. As long as writers continue to believe that the FED is a slightly incompetent but well-intended would-be Santa Claus, there is no hope for any of the nations -or for the populations of those nations- which the central banks are intentionally working to render bankrupt.

rr,

Thank you for reminding us of the true nature of the Fed. I think they can be incompetent and malicious at the same time.

How much we need more leaders like Ron Paul!

I cannot agree that the owners and chairman of the FED are incompetent in any way. They are very skilled predators, and they achieve their goals consistently and with considerable effectiveness.

Ron Paul is a nice man and appears knowledgeable. If he runs I may vote for him. But the sort of problem we are up against will not be solved by any one individual, whether leader of a group or acting alone. It is going to take millions of people taking initiative individually, and thus acting together, not because someone is telling them what to do, or is doing for them what needs to be done, but because they themselves, the public, as a whole, recognize thievery when it’s occurring and do what is necessary to make it stop.

The appearance of incompetence, to which you refer, is in fact a deception.

Hooray! There’s somebody other than myself who recognizes them as nothing more than a bunch of rotten, lying, manipulative bastards.

Add one more to your list of people who realize that there is nothing happening now that hasn’t been planned, the elite and or the investor class are smart people, they not a bunch of Mr. Magoos. Their aim to to take power away from the people starting with their money; and, they are doing a great job as we speak.

tom, you left out “murdering”.

Greg,

Great article again.

By manipulating the CPI and inflation/deflation numbers, the Fed avoid making normal increase in benefits (adjustments due to higher cost of living) such as social security. The money saved is often overlooked but significant.

If printing money can solve the debt problem, why don’t they (Fed) print more money for all the bankrupt States? It is sad to see no sign of recovery after QE1 and QE2 (and added $2.325 trillion to the national debt).

There is a better way to spend the money:

For $2.325 trillion, we can hire all the unemployed (9.1% or 13.9 million people) at the national average annual salary of $40711 for more than 4 years. (The average salary, though may be low for some people, is a much better deal than working for McDonald or Wal-Mart.)

$40711 annual salary x 13.9 million people = cost $566 billion per year

The unemployment rate will be zero for 4 years. (Lowest in history.)

Because everyone employed can pay their mortgage, bankruptcy and foreclosure can be prevented.

Unlike big corporations, the newly employed will pay their income tax and hence increase the federal, state and local tax revenues.

Consumers with jobs are more likely to spend their money and help the economy.

Ambrose

(Some people believe there is always light at the end of the tunnel. I hope it is not the light of oncoming train that run me over.)

Ambrose,

Thank you for the analysis and comment.

Greg

Hi Greg,

I don’t understand this premise very well. You indicated the Fed is looking for inflation in core CPI, CPI and the PCE price deflators. The example is non-commercial rents? In other words, the Fed is looking for prices to rise for non-commercial rents, and when seeing this, they will cite inflation is up? If they’re not looking at non-commercial real estate, gas or food prices, what else are they looking at besides rents? Obviously, theirs is a skewed perspective. I don’t see the correlation with this and reducing the debt by $38 trillion.

🙂 Diane

So my question is……….when does the Fed tell Uncle Sam we need a WWIII?

Brian,

They may have already asked. Libya??

Greg

Dear Mr. Hunter:

I always enjoy your article, including this one. However, I’ve been listening to Mr. Rickards interviews on King World News for some time, and can’t help but find him disingenuous. In his most recent interview he talks about 4% inflation halving the debt in 10 years, whereas it clearly would take 7% inflation and a balanced budget to do so. A few months ago he was pushing the theory that the modest debt rollover on the Fed’s books would be enough to fund a version of QE-lite, whereas a high level analysis would clearly indicate that this is not the case. Finally, in the most recent interview he pushes the view that the US does not need China to help but the debt – the banks and the pensions finds will do this. I find it doubtful – the numbers don’t add up. The bottom line: I’m not sure of Mr. Rickards motives, but I treat his views with a big grain of salt.

best regards

Daniel

Thank you Daniel for your comment and analysis.

Greg

Hi Greg!

Yes it would seem as they are kicking a can down the road but it is actually vessels of dishonor moving things into place for the initiation of a global currency this fall that will lead to one neither buying or serlling without a mark 3 1/2 years later. This should come as no surprise but unfortunately it will for most because they refuse to read the only book that really ever matters. Please check out our web site http://www.unleavenedbreadministries.org if you would like to be one of those who know what is coming and how best to prepare spiritually for it!

In CHRIST! Rob

Greece is the Word!

I’d like to think that for those of us who have spent the better part of the last few years trying to prepare ourselves and our families for the ongoing and now accelerating financial disaster, the parade of daily events have now moved beyond being harbingers of troubles to come and have taken on more of an air of farcical comedy. If watching the DJIA tumble yesterday in the closing minutes with each bit of flapping drivel that came out of Fed Chairman Ben Bernanke’s mouth wasn’t entertaining enough, this morning’s CNBC piece titled “Obama Presses Europe, Pledges Help for Greek Crisis” nearly had me exhaling coffee through my nose in fits of laughter. Sometimes laughter is the only way to cope with tragedy.

It’s not that making obvious corollaries has ever been the strong suit of the gods at CNBC but this is ridiculous. After being basically flat most of the day, rumors started spread about the contents of Bernanke’s non-event speech around 2:30 and the numbers started to decline. As soon as he opened his mouth and started spewing his MOPE at 3:45 they went over the edge and fell another 55 points, down 108 points off the day’s high. What was he selling? This inflation is just a “temporary” event caused by a few issues with some commodities. Never you mind those churning noises coming from the basement of the printing presses at the FED working 24/7. Nothing to see here, move along, move along.

Then we get the absurdity of President Obama “pledging” help for any second (or is it third or fourth, I forget) round bailout of Greece. The CNBC article’s statement that Chancellor Merkel is “under political pressure at home to avoid being the financial savior for other struggling European countries” has got to be the understatement of the month. Merkel’s party has been getting its walking papers handed to them in local elections. The German people are simple fed up with financing the foolishness on the Euro periphery and Merkel knows that if she doesn’t get adequate cover from Obama for flushing more money down the Aegean toilet she’ll be looking for another job soon. She may well be done for either way.

I would suspect however that the President’s “pledge” isn’t much more than lip service. Facing his own electoral demise, if he’s not aware that the American populace is no more in the mood for bailing out failed foreign states than the Germans are, then he lacks even what little grasp of reality even I would credit him with. As more and more 99 weekers fall off the back of the unemployment compensation bus and even larger numbers pour into the front any political posturing that “Obama saved Greece” will inspire anger and resentment not admiration.

Just as with our own fiscal condition (anywhere from $60 Trillion to $100 Trillion in unfunded liabilities depending on who you talk to and what you do or do not include in the calculation) there exists no viable or functional methodology that will avert the inevitability of a default of some form. Year over year productivity in the Greek economy has contracted by 11%! Taken alone industrial production is down by an even larger number. Given such a reality just how is even more austerity in government spending (laying off workers and putting them on the dole) and increasing taxes going to facilitate an even larger debt obligation even if some agreement to provide Greece with more money could be reached?

Can meet foot, see you down the road, has reached the end of its usefulness. Posturing, printing and vain management of perception is coming up against hard political realities, and politicians will always, always, always put the preservation of their positions of power over and above any other consideration. They know it won’t work, they know it’s all just a game of extend and pretend, they just don’t want the voters to know it. At least not until we get past the next election cycle, and then they will be telling us one more time to trust them to “fix” the problems they created. I think we’re in for a long hot summer in every possible way. By the time October gets here we may be faced with an entirely different and worse if that’s possible, political and economic landscape than we have today.

One of the biggest factors behind our debt problem is that our manufacturing base has been decimated. When I hear the elitist liars on CNBC chattering about the China “miracle”, I often wish I were there in the studio so I could punch their faces out through the backs of their skulls. Everything they have has literally been given to them by this country, and that which wasn’t given was stolen. Yeah, that’s a real miracle.

The other part of the problem is due to the banks. Thomas Jefferson has proven to be one of the smartest, if not THE smartest individual who ever inhabited this country. His warnings about the banking class have come to pass. I know now why those warnings are completely absent from any public school curriculum. I’ll bet he and the other founding fathers are looking down at what’s going on in this country with total sadness and disgust.

Tom,

Good point!! Very good. We had growth in the post WWII economy because we had manufacturing. The U.S. has lost a lot of that in the past 20 years or so.

Greg

Thanks Greg another excellent article that took the Rickards interview and further explained what he meant and why it won’t work. Great idea in reaching out to him for clarification and explanation.

Thank you David.

Greg

Greg:

I had a discussion on-line back in the fall, 2008, stating that we needed to keep home prices propped up for the banks’ balance sheets to stay solidly solvent.

The idea was the following:

Spend about one trillion dollars for short term stimulus by hiring those folks most affected by the housing collapse to tear down about twenty million homes at $50000, say, a home. Because of cheap warehouse space, they would salvage as much as possible such as windows, doors, plumbing, etc.

The banks would take a hit, per $250000 average mortgaged(estimated) home, of maybe $100000, the homeowner maybe $60000, with the developed lot still retaining a $90000 value (lot plus salvaged items)to the bank.

Also, set a freeze in place on new construction until residential values stabilized and started to grow. Supply and demand principles still apply for home sales; we overbuilt pure and simple.

I didn’t know if this idea was practical or even possible, but it seemed to address the primary problem of bank assets not having any means of valuation if homes are not selling.

Thank you Phil.

greg

Ben Bernanke is causing deflation by creating a HUGE division of wealth as well as trying to FIX the problem before people start working. It will backfire on him because he can want to cause prices for everything but IF PEOPLE AIN’T GOT MONEY, THEY AIN’T GOT MONEY!

Gotta remember that house price inflation was not counted as inflation starting in the 70s so as to not have to pay savers a fair rate on their savings and protect the dollars value, also not to forget the fractional reserve banking system printing 10 to 100 debt dollars that competed equally with every dollar of savings at the house buying bid process for every dollar borrowed, this drove house price inflation and not a complaint was heard for what?..30 years, note also these debt “dollars” have not yet.been destroyed

I always enjoy your info.

So when is the best time to take out a big mortgage on a farmhouse?

this year or next?

NJ,

When interest rates are at or above 10%. You do not buy a loan but an asset. When rates go up prices go down. My best advice is wait. I don’t see a bottom until at least 2014. Please read “The Fed’s Biggest Fear” on this site.

Greg

Wait until interest rates go UP? Why, just to pay MORE MONEY??? RU crazee?

Absurd/ this treating people’s HOMES like a wall street stock alleged “investment” is what caused all this financial mess in the first place, or at least a good portion of it. People should “invest” in a home as first and primary a PLACE TO LIVE, not something to flip later for a profit. **&%! flippers!

What the heck are young folks in the future supposed to do to get into a place to live now? Or don’t you give a crap? Just in my lifetime mortgages went from ten years to thirty to “interest only” perpetual debt bills. Screw that. Ta heck with “investors” polluting a human necessity- a place to live- for their sheer greed and short sightedness.

Buy when prices are low and interest is also low and then LIVE there, stop the insane house flipping “something for nothing” speculator BS. All this “investor” speculation has bankrupted the nation. Investor speculation drives food prices up to that people almost starve all over the world. Investor speculation drives energy prices up, which in turn affects the prices of everything else. For what, so that less than 1% can stay rich as snot and live in ten thou a month manhattan apartments?

Speculator Parasites, got no use for them. Destroying and bankrupting the planet so that people in the future have nothing, never get to own anything, and live in perpetual serfdom to some new aristocracy.

Starve the “investment/speculator” beast, drive the new moneychangers from the land. The planet can’t support any more non producers sucking the lifeblood from everyone else.

Zoggy,

No I am not crazy. What do think home prices would be if rates were not suppressed by the Fed? You would pay a higher interest rate but buy the house at a much cheaper price. I was clearly not talking about flipping, but getting the most bang for the buck.

Greg

I would like to point out that buying a farm is a great idea if you use the banks money at low rates, like now. If you hold cash it’s a good idea to buy now, because the dollar is being eroded, probably intentionally. If you use the banks money, it is a great time to buy, because the dollar being devalued means you are holding someting of value that you will be paying off in more and more worthless dollars.

The bottom line is simply this: The fed can and in my opinion will keep printing ( and therefore inflating) because they can.( Such a deal for them.). Farmland they would have a hard time creating.

Eddie,

I think you are correct but I want to caution people not to use too much leverage. You still got to malke the payments.

Greg

Only just discovered your blog site. Great stuff. Keep it up.

“The government should create, issue, and circulate all the currency and credit needed to satisfy the spending power of the government and the buying power of the consumers. By the adoption of these principles, the tax payers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity”.

Abraham Lincoln.

The Money Masters explains the history behind the current world depression and the bankers’ goal of world economic control by a very small coterie of private bankers, above all governments. A “must watch series” of truly informative videos.

http://www.youtube.com/watch?v=lXb-LrVkuwM

Good stuff Eric. Thank you for the content.

Greg

It doesn’t make sense to include future liabilities in calculations of outstanding debt, and when you do include it for today (six to seven hundred percent), but not historically (100% after WWII), it makes the whole analysis suspect.

The argument that we really owe $77 trillion if we include future Medicare/Medicaid liabilities depends on a lot of assumptions about future Medicare/Medicaid liabilities, assumptions that are going to change as the US Medical system goes into crisis mode and ends up with a single-payer arrangement and a significantly higher quality of care, like many found in other western countries. The other alternative is that Medicare/Medicaid goes the Ryan plan and ends up abolished. At which point, my family and I will expatriate to someplace sane.

Bye bye.

rikards makes a few salient points but, unfortunately, intersperses them among a lot of old paradigm horse dookie. red shield (let’s call a spade a spade here since you let that cat out of the bag when you poste the american dream video a few days back) fears only one thing, they fear an angry mob. they buy low, sell high and manipulate markets up or down to suit the profit move of the moment. this includes gold and silver. i wouldn’t be a bit surprised, and neither should you, to find that vast amounts of gold are being quietly sold off by red shield as we speak, to unsuspecting buyers like you. next month or 6 months from now they will manipulate the prices downward to a few hundred an ounce for gold (similar ratios for silver of course) and buy it all back for a fraction of what they sold it for. and then start the process all over again. if you are going to invest in precious metals, at least wait. don’t buy high. and gtf out before

all in all, a strange dance to be engaged in while you should rightly be stocking up on food, fuel and warm clothing, etc. and maybe even conditioning yourself to survive on earthworm casserole.

the housing market is not running with the present inflationary trends for onc simple reason. the housing market has gone beyond maximum consumer acceptance. in other words, the market will no longer bear (generally) the exorbitant costs.

automobiles, higher education, medicine and legal fees are currently on the brink of max out. (one would not be out of line to argue that some or all of these have already gone past max)

food, clothing and energy are still within a certain realm of affordability, but probably not for long.

to blame medicare and medicaid is an unconscionable mistake since we did not get into this mess by taking care of our retired and our poor. we got into this mess by allowing the ultra rich to take care of themselves.

our manufacturing base has left the building. every corporation that has move it’s manufacturing off shore is either under direct control of red shield via corporate board interlocks or depends on red shield for operating capital.

the idea is, of course, to destroy the greatest bastion of free thinking humanity on the planet. and it is working quite nicely.

G. Johnson,

I am not sure I agree with your premise on gold, but you do make some good points here. I might remind you there are plenty of people who comment on this site that have bought gold in the 200’s, 300’s 400’s 500’s 600’s and are sitting on some nice equity in the metal. I would not suggest to anyone to sell your metal and then try to buy it back later. I think it is much riskier without it than with it. What happened in Belarus recently comes to mind.

Greg

greg,

you are correct. i was a bit unclear. my premis was how the fed (red shield) works to manipulate markkets for it’s own gains.

there are a lot of people who bought real estate 10-20-30-40 or more years ago and are sitting on some nice equity also. problem is, they have no market by which to covert equity to liquidity. the same thing will happen with gold if the price gets to a certain point.

precious metals can still be a useful hedge if you are agile and observant enough to know when to get out of them. when push really comes to shove and people begin to get truly desperate, they are going to be much more interested in your beans, bullets and fish hooks than in your gold.

i am not saying that is where we are headed. but i am saying that there is plenty of indication that it may come to that. being prepared for the worst is the only way to be prepared.

Thank you G. Johnson for the comments and for supporting this site.

Greg

Thanks Greg,

I would like to make the point that the most important dynamic in inflation (and the reason inflation is self-terminating) is that inflation erodes the wage share, which is something that no economists of any school seem to be aware of. I demonstrated this through a simple simulation at http://johanraft.wordpress.com/the-results/

Very likely your spam filter choked on this link and considered it spam.

Regards,

Warren Raftshol

Thank you Warren!! You are corect sir it did, but no more.

Greg

Did you notice in my simulation that the secondary wage share bounce was a direct consequence of the Volcker credit squeeze 1979-83?

I’d be willing to bet a fair sum that no one ever told you that the

‘Clinton surplus’ of the late 90s and the housing bubble starting in 1997 were a direct consequence of Volcker’s interest hikes.

Remember the ‘strong dollar’ 1995-2003?

A correct dynamic model makes these connections obvious. Incorrect models give the type of gibberish that passes for economic analysis these days.

Ben Bernanke should be in Jail, along with Jamie Dimon and most of the criminal banking cartel. The federal reserve should be abolished. Barack Obama should be impeached for treason and illegal wars and so should most of congress for being beholden to the criminal bankers rather than the sovereign people of the United States. THERE ARE CRIMINALS RUNNING THE ENTIRE COUNTRY AND THEY MUST BE STOPPED. The solution is NOT to replace the criminal democrats with criminal republicans. The solution is to get rid of all of them. As a matter of fact I would be all for bringing back public hangings.

The solution to a debt problem is not more debt. The powers that be are either trying to destroy America, or the have the collective IQ of a horse.

The next problem is that the American People are stupid. I know that sounds callous, but they are flat out stupid. Our country is on the precipice of collapse, and come 2012, the stupid Americans will go vote all of the same criminal assholes back into office again while Rome burns.

The main stream media abets the criminals on a daily basis and is part of the reason the people are so stupid. Right now we have blatant criminal manipulation and fraud in the commodities markets, blatant crimnality and fraud in the stock market, blatant criminality and fraud in the banking industry (mortgages and foreclosures), blatant criminality anf fraud in fighting wars that are not approved by congress(add yemen to the list), etc, etc, etc, and all the news can talk about is the Anthony’s, Casey and the Weener.

I am disgusted by my country. WAKE UP PEOPLE, YOU ARE DEBT SLAVES AND YOU DON”T EVEN CARE! WHAT THE HELL IS THE MATTER WITH THE PEOPLE?