Weekly News Wrap-Up 8/5/11

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The big drop in the Dow is the result of a global solvency crisis. The U.S. is spending money by the trillions, and Europe is headed for a crash touched off by Italian debt. The economy is stalling. The Federal Reserve, no doubt, is contemplating another round of money printing to bail everybody out—again! Even gold and silver sold off. Is the Bull market in precious metals over? It’s all covered by Greg Hunter in the “Weekly News Wrap-Up” on USAWatchdog.com.

Comments

“What is money?”, thats about as good as anyone can put it!

Gold, silver, oil, food, water and any other commodity have real value because it takes effort to get it, there is risk involved in looking for it and there is a need, desire and use for it.

But what about paper notes…….hmmmm, the only value they have is what the government says they have. As the government continues to abuse the power it has to declare the value of this paper so too will the need for the government to compel us with force to see things the way it does.

You are right on Greg! Its a simple law of nature, people will naturally go to what has intrinsic value, things with implied value only last as long as those who imply that value can enforce that value….Do the powers that be have the stomach to twist our arm until it snaps or pops out of its socket, thats my question these days.

Good question Brian! Thank you for weighing in on the WNR!!

Greg

Hey Greg,

That was a good report. You are very good when you report on the basics.

A Canadian member of parliment (of the liberal ideology) was interviewed the other day. He was commenting on when Canada lowered the corporate tax rate. He acknowledged that it was back when the government was more liberal. He stated that his party “did the math.” Lowering the corporate tax rate to 15% was better for ALL CANADIANS, so they approved the tax rate decrease.

This really is about eigth grade math.

Utopia does not exist, and neo-Marxists can’t ignore the laws of physics. Economics is physics.

The cost of labor and energy determines the price of bringing a product to market (in basic terms). Government policies and interventions raise the cost of bringing products to market.

It is really simple stuff.

markm

Good analysis MarkM. Thank you.

Greg

Actually they only need electrons to “print” the new money. Trees are not even required.

What is really going on? Do these clowns really believe that you save a man from drowning by providing more water? And if they don’t believe that, what are they up to? I suspect we’ll all be finding out and happy faces will not be involved.

Yes Ron I know that but this site is not for the professional investor. But you are correct the “printing” is currency creation via the computer. Thank you for your comment and your pithy analysis.

Greg

ok greg iv gota know something.

if gold goes up to 12,500 oz seems to me that big brother the tirant will take my gold from me…or make it useless

James,

They will Not make it useless, but they will tax you on the gains. I will gladly pay tax on gains with gold at $12,500 per ounce. There is no doubt, you will be much better off with it than without it.

Greg great youtube clip! Your predictions ae spot on.

Thank you Master Luke.

Greg

Greg, hiring has really gone nuts, if you are out of work & skilled in the opening you are pass on to a worker who flips burgers at Mickey DEES! They will pay them a low wage & after the worker is close to being a full time employee, they get laid off! Now a skilled worker in high tech, IT & security are being offer such low pay they just have to walk away, this is spreading at the speed unseen speed in the USA, you think things are bad now, the power to the fans that blows the crap from DC have been hooked up with Obama’s new debt deal! I have a ton of content I will share later, great week of reporting Greg!

Thank you M Smith.

Greg

Great report as usual Greg. I find it a bit suspicious that the stock market dropped 512 points on Thursday, then late Friday the country’s credit rating was downgraded. I think they knew something. What do you think? Thanks for the information your site provides that the rest of the MSM seems to forget about.

Charles,

Yes, plenty of insiders new and Friday’s rally just gave them a chance to get out. I would not be surprised to see a 300 point drop on the Dow on the Monday open. All is NOT well and this is a monumental event. We are not Japan.

Greg

Greg: I am scared that my 401K will be depleted as I’m nearing retirement. Do you know of any way to get your money from a Fidelity 401k retirement plan to invest in prescious metals? Under the plan I have with my company, they do not allow you to invest in prescious metals.

Any help would be appreciated.

Saani

Saani,

As long as you are working there I think you are trapped. I just do not have any ideas here. Anyone else have any info on this? So sorry I cannot help more.

Greg

I was told by my company’s financial adviser that if I am over 59.5 years old, I can transfer my 403(b) account to an IRA account and then I can put them in PM.

double check that.

Good luck!

Depending on who’s servicing your 401k, you may be able to extract funds in the form of a “loan” against your own account. I did that, took a loan from my own saved funds and bought some shiny stuff with it. Hope this helps.

Greg, I know you are up on the news, well it has a nutted day for sure! Down grade my butt, they are playing with fire, as those in power see their assets drop off a cliff they might get their heads out of their @ss & step back & read the Damn Legislation & Regulations & shut these dumb bone headed fools down, Jim & Armstrong was right! Hope my buddy got his & his wife’s 401K switched over to PM’s & now setting fine. You can watch the primary dealers, we are witnessing the greatest transfer of wealth in history in Slow Motion.

Remember today, the day the dollar almost died while saving the Euro. The race to the bottom will be one heck of a wake call for millions, hope they don’t go off the deep end!

ntu.org is a site

i heard on a MSM biz channels!

Greg, The markets for foreign exchange have truly gone wild, I have been watching this for a while now and believe me last week was off the charts with the US/Aust dollar exchange rates.

Last Saturday July 30, 2011 …. .9095….1.0995

Today Aug 6, 2011… .9577…..1.0442

It must make it interesting for importers and exporters, thats 5.29% in one week. This alone gives new meaning to the term instability.

Bill,

That is a big move for one week, you are correct. I think the rest of the year is going to provide a wild ride in all markets! Thank you for your reporting and analysis

Greg

Hey Greg

Well, It’s official. All that jumping up and down screaming the sky is falling if we don’t raise the debt ceiling is over. The winners smack each other on the backs at how they artfully avoided another melt down and what do we get? Over 600 points down on the Dow and a rating downgrade. Two of the things we were told could be averted if we just did what our captors ( our Government ) told us to do. Wasn’t there a magic number for unemployment ceiling if we just gave the President free reign with the nations pocket book? How long must we suffer the results of this experimental government at the hands of these mad men. How many times must we experience falling skys to learn it is beyond their mental capacity to control. Time to take our lumps and recover from our losses while we have something left to rebuild. Just my two cents worth while they still have value.

Thank you Phil for weighing in.

Greg

greg

your site is the only site that make full sence.

everyday i ck your site first,the detailed articals are more informative then all the news media i find. thanks to you im a ecconomic junky. its become a hobby to see how far down the dollar is going.

oh and i read every one of the coments. i think the smartest folks in the country leave there coments on your site.

greg hunter for congress !

James,

Thank you for the comment and I think you are right. I am continually blown away by the brainy people who comment here.

Greg

I guess Giethner was wrong when he said USA AAA rating would not be downgraded.

http://www.youtube.com/watch?v=q7Z0L-NYFlE

LIES!

Thanks again for getting my thinking cap on. It seems to me that there should be a law that the governing officials that are in power at any time needs to pay off their debt if they spent the money. The law should not let them pass their debt on to future generations. No more raiding the cookie jar at will. Children will help themselves until all the cookies are gone, even if they are sick from eating to many.

Thank you Jerry.

Greg

The recent debt ceiling circus maximus was a sideshow to the real main issue: the imperative for a balanced budget. For years I’ve told my friends we’re … Since the Reagan administration, the parallels between our decline and the Fall of the Roman Empire have been apparent to Common Sense. For example, there was an imbalance in trade between the Western and Eastern halves of the empire and high taxation. Consider: the government lost control of its borders — Goths, Franks, Suevi, Alans — and society experienced moral decay.

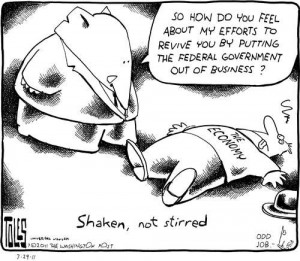

Graphics, like actions, can speak louder than words — here they are:

http://napoleonlive.info/see-the-evidence/debt-deal-graphics/

you ever get the feeling Congress must be getting blackmailed. The smell coming out of Congress is the smell of fear. When a man can’t control his fear, he will make one mistake after another.

I waited until the opening of the Asian markets and the Dow futures market to open. They are both down significantly. The S&P downgrade of the USA was expected by those of us who read USA Watchdog. This is just the beginning of a long controlled process by the banksters as they try to overthrow the USA’s sovereignty

More bad news is that Timmy G is not leaving and the fact that we now have a 12 person super committee that will impose their bills for an up or down vote in the House of Representatives.

I hate to say the sky is falling but it sure looks like it …..

It is going to be a long day and an even longer crash. Thank you Mitch.

Greg