Tap Dancing on A Land Mine

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

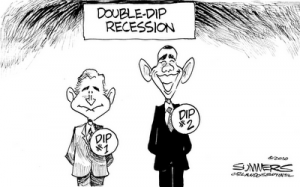

The economic “recovery” talk picked up some speed yesterday as retail sales for August were announced. The government said sales were up a whopping .4%. It seemed everybody on financial TV was talking like the worst is now behind us, and there was no chance of a dreaded “double-dip” in the economy. Even Warren Buffett ruled out a falling economy. Yesterday, Bloomberg quoted the “Oracle of Omaha” in a report where he said, “I am a huge bull on this country,” Buffett, Berkshire’s chief executive officer, said today in remarks to the Montana Economic Development Summit. “We will not have a double-dip recession at all. I see our businesses coming back almost across the board.” (Click here for the complete Bloomberg report.)

I guess I’d be bullish on America, too, if companies I invested in (Wells Fargo, American Express, GE and Goldman Sachs, to name a few) all got taxpayer bailouts to help them survive the economic meltdown in 2008. Mr. Buffett might not look so smart or be so optimistic if those bailouts had not happened.

Last week, FDIC Chairman Shelia Bair said pretty much the same thing as Mr. Buffett. Bair said on CNBC, “We are not predicting–I would use the “we” for the FDIC. I rely on a lot of very smart economists at the FDIC in helping us make those judgments, but right now, no, our economic staff do not predict a double dip.” (Click here to see Bair’s entire CNBC interview.) This optimism is despite the recent addition of 54 more banks to the “Troubled Bank” list for a new grand total of 829. The majority of those banks, according to recent comments by renowned economist Nouriel Roubini, will go bust.

Didn’t we just get news that car sales are down sharply? Yes. (Click here.) Didn’t we just get news that home sales are down sharply? Yes. (Click here.) Don’t we still have 15 million Americans unemployed? Yes. (Click here.) Forget the fantasy 9.6% number the government claims. The real figure is 22%, if unemployment was figured the same way the Bureau of Labor Statistics did it before 1994.

Yale economics professor Robert Shiller must be reading the same things I am because he recently told the Wall Street Journal a double-dip “may be imminent.” He says the U.S. economy is “teetering on the brink of deflation.” (Click here for the complete WSJ article.) I don’t think a measly .4% rise in retail sales is going to change Shiller’s mind. You might remember, he correctly predicted the giant real estate meltdown we are still suffering through. In another WSJ article, most of the economists it surveyed think the economy is so bad the Federal Reserve will be forced to act soon. The article said, “Three in five economists surveyed by The Wall Street Journal expect the U.S. Federal Reserve to resume large-scale purchases of securities in the face of a deteriorating economic outlook.” (Click here for the complete WSJ story.)

Yesterday, Rick Santelli said on CNBC his big banking sources are predicting as much as “$1 trillion” in a second round of Quantitative Easing or “QE 2.” That’s Fed speak for more money printing. That will surely put a big dent in the deflation situation.

According to economist John Williams at shadowstats.com, all the money pumping by the Fed is creating a big downside problem. In a special report released Monday, the headline read “Systemic Stability: Tap-Dancing on a Land Mine.” The report goes on to say, “Pardon the use of the Aerosmith lyrics in the opening headers, but the image of tap-dancing on a land mine pretty much describes what the Federal Reserve and the U.S. Government have been doing in order to prevent a systemic collapse in the last couple of years. Now, as business activity sinks anew, much expanded supportive measures will be needed to maintain short-term systemic stability. Such official actions . . . likely will trigger massive flight from the U.S. dollar and force the Federal Reserve into heavy monetization of otherwise unwanted U.S. Treasury debt. When that land mine explodes — probably within the next six-to-nine months, the onset of a U.S. hyperinflation will be in place, with severe economic, social and political consequences that will follow.”

So, as the government and the Fed continue their “tap dance,” you should be heading for cover from an explosion of inflation. Fear of inflation might be the reason gold hit new all-time highs this week. Oh, and remember that .4%increase in retail sales? More than three quarters of that, according to shadowstats.com, came from increases in food and energy. Yeah, that’s right—Inflation. Maybe the Fed will print so much new money we will have a so called “recovery” and avoid a “double-dip,” but we will pay for it with much higher prices for everything!

Greg,

Excellent reporting of the facts which the mainstream media cannot report since they are part of Management of Perspective Economics (MOPE). They are part of the problem and not the solution but facts need to be reported to the Main Street which actually lives each day with the real numbers and faces each day earning an honest living while Wall Street and powers-in-charge do not. Just look what happended to gold and silver spot price on Sept. 14. Once again, keep up the good work that you continually do.

Pat

Snap!When Obama’s boys and girls start telling things are going up, I sell the market short. thanks Greg

George,

The Bush gang did it too. They all do it the only difference is the worse the economy gets the more desparate the false messages. Thanks man!!

Greg

Hello Greg,

Thanks for an article based on sanity. I listened to pundits sex-up the economic figures last night and almost puked. What BS.

I don’t understand what the game is. Why are usually sane economic pundits starting to chearlead a bad economic situation? I don’t get it.

markm

MarkM,

I think the worse things get, the bigger the lies will get. This is the wrong thing to do for the mainstream media to allow unchallenged lies on the air and in print. They are lulling the masses into thinking things are much better than reality. When it blows up, those same people will be more panicked than ever. The situation will be worse than if everybody new what to expect. Already only 25% (Gallup Poll) strongly believe in what the MSM reports. People have needed to prepare for what is coming instead most are in the dark. Sad. Thank for the comment and your support.

Greg

They have to ‘lie’. There is no other alternative at this point.

Then again, from the ones who are lying, to the ones who are buying it (election results, circa 2008…?) is it really ‘lying’, or simply feeding a Stupid, Dumbed-Down Electorate what they want to eat…?

Absent lying, what is the alternative…?

That’s right: Social Unrest.

Which we will get anyway, but why not forestall it while you can? No sense in bringing on the destruction of the political class prematurely, now is there…?

C. C.

I think if the electorate is lied to it will make things even worse when it blows up. We should meet problems head, and on not put them off for as long as we can. I ask you this: How many problems in your life got better or at least stayed the same after putting them off? I see your point, but as a journalist I hate the lies and distortions. As always I say, “Good men can disagree.” Thank you for making your thoughts known here. You are always welcome.

Greg –

I was being overly cynical and sarcastic with my comments… The level of corruption, entrenchment and league with which this government is involved, is so deep and systemic that typical solutions (election cycles of revolving-door 2-party candidates), is not likely to bring about any kind of meaningful change.

It has taken ~30 years of Debt-based economics and Deficit-Spending to reach the point at which we now stand. If even we were to approach the problem with drastic measures as offered by David Galland today from Casey Research, it would take a few years to clean up – and that is if we did near Everything right – immediately…

Most Americans have absolutely no inclination at all of what lies around the corner for their standard of living – and I would even suggest, domestic safety.

Funny, we seem to be all about ‘Reality’ television, but when it comes to real Reality (1930’s style), we are in a LSD-fueled parallel universe.

C.C.

No problem, be what you want to be here!! Peace man!!

Greg

Regarding “Reality TV” – It is telling that there is a show called the Real Housewives of Franklin Lakes, NJ or something like that, which shows these women spending money and living extravagantly. The show didn’t mention that one of these women is going through bankruptcy. All lies.

Deborah,

Entertainment and lies all in one program. Look how efficient the media is getting. Thank you for your comment.

Greg

The MSM-specially the financial networks-are so off base when it comes to reporting the gravity of the situation that I have no doubt that if the US were attacked with two suitcase nukes that they would promptly proclaim “Hey, it’s not like it was 3 nukes, let’s get out there and buy stocks!!”.

You’re right Greg, the worse this gets the bigger the lies will be.

Dave,

The I predict the MSM will be shunned by the public after all is said and done. Thank you for your observations and comment.

Greg

A highly reliable sage source from the gold banking world and international consulting is loaded with deep insight, vast experience, solid connections, ongoing relationships, privileged insider information, and diverse industries tied to banking. He tipped the Jackass off in early August 2008 as to the weekend of September 15th being one to mark in history as three great failures would occur. He gave one month advanced notice of a locus of failure in three places, with great urgency. My guesses of Lehman Brothers and Fannie Mae were correct, but a blank came on the third which turned out to be AIG. He has frequently shared a viewpoint on the inevitable USTreasury default in the coming years. He first enlightened me as to the USFed resignation pathway to default, after it was loaded to the gills in toxic irredeemable impaired assets that no banks wanted. As buyers of last resort, the USFed would choke to death. Rather than a citation of path to default, he shared a great risk of a major event. He said, “The USGovt will devaluate the US$ by 50% overnight in the not too distant future. They need 11 days to do this. If they push it, they can do it in 6 days. So look for a long holiday weekend as an opportunity. The best time to do this is the Christmas / New Year time window. They tried to do it in 2005/2006, but the Chinese put a gun to their heads in Washington and they backed down. You can slice and dice it as you like, but the USDollar is dead and so is the Euro. The systemic change will be a cataclysmic and traumatic event for the West, since all it stands for will go into the toilet in a blink of an eye. The period immediately following the collapse will be filled with violence and total breakdown of law & order. Keep an eye on Greece. It is the guinea pig and incubator for what is coming to Western societies.” He went on to mention some positive regenerative power left in the US people to reclaim their country and to restore its legal framework. Soberly, he warned it will be ugly, but loaded with great opportunity. So he sees a sudden massive USDollar devaluation with grand shock waves from vengeful reaction.

B.I.S. GOLD SWAP & L.B.M.A. DRAIN

◄$$$ L.B.M.A. IS DEAD, DRAINED, AND DEFUNCT. LIKE THE BIG BANKS, IT IS A ZOMBIE SHELL OF A MARKET ENTITY. A MAJOR RUN ON THE BULLION BANKS HAS BEGUN IN EARNEST. ITS PHONY STRUCTURE IS BEING REVEALED. SETUP STORIES ARE COMING TO HIDE ITS EMPTY INVENTORY. THE DATA DARK EVEN IN LATE JULY WAS PROBABLY DUE TO A SUCCESSFUL LEGAL RAID. $$$

It has come to my attention that coordinated raids of the London Metals Exchange have taken place, all very legal, but done in a manner that its officials do not realize the scope of the organization. Several buyers acted in organized coordinated fashion. The raids took place in July and continue. The buyers went into the market with a massive volume compared to what can be considered normal. The buyers were ringed around the globe, in direct communication. In at least two instances agents within the inner sanctum of the London gold market worked in collusion with the buyers, the agents volunteering valuable information where certain quantities existed. This data enabled optimal positioning for the trades, where demand was made where supply laid. The buyer then cleaned all the physical out in one sweep, with pressure given by attorneys when necessary. The sellers obviously had misjudged the buyers financial resources and inside knowledge. A degree of military precision was demonstrated, along with seemingly unlimited financial resources. Hints of hidden unconditional political backing was mentioned, for applied pressure, although in vague terms. No trace of their activity was evident, as would be expected with numerous high volume demands for delivery. No insurance register spikes were permitted, as the buyers flew under the normal radar screens when lifting the gold bullion without protection. The raid, or legal surgical removal, might have been the largest ever. They took advantage of deep insider knowledge, even deeper pockets, and precise execution team to pull off the event. In doing so, the LBMA members inventories were nearly drained. The London officials scrambled to replenish their raided gold supply. Members of the exchange are in the process of having cut off their entire raw precious metal supply at the source. On the following week, the LBMA shut down all trade data.

THE LONDON METALS EXCHANGE SUFFERED A MAJOR HEART ATTACK FROM A GLOBAL GOLD RAID, VERY LEGAL. LONDON SUFFERED MAJOR DEPLETION OF ITS GOLD INVENTORY DURING THE COORDINATED RAID. THEY SHUT DOWN ALL DATA REPORTING UNTIL THEY COULD REJIGGER AND DOCTOR THEIR PHONY INVENTORY DATA. The financial press reported data darkness, but omitted the story about global coordinated legal raids on gigantic gold supply at numerous supply sources. They undoubtedly did not know about the raid, or were ordered not to report it. That would have been damaging for the gold cartel.

In the aftermath, a note came from a well established trusted gold banker source. He hinted at knowing at least one or two participants in the coordinated raid. He said “The Boyz at the LBMA probably had digestion problems, and are putting their inventory books back in order after some of their member inventory was raided the other day. From what I hear, they did not see that one coming. A second wave should hit them not before long. They are absolutely defenseless. It is called feeding one’s adversaries their own medicine while turning the tables on them.” Incredibly, the group has managed to solicit the cooperation of two agents from inside the LBMA, exploiting a division inside. People within the LBMA are working to destroy the LBMA. My guess is that 15 to 20 parties worked closely together, with military precision and without telltale insurance contracts that would serve as warning flags internally.

Some direct questions were delivered to this source, who has 25 years of experience in the gold trading business. My question was: “Did the London dark data problem have anything to do with the Bank For Intl Settlement Gold Swap?” His answer was LIKELY YES. My question was: “Did the BIS have to bail out London in supplying them urgent gold inventory?” His answer was SURELY YES. My question finally: “Was the story permitted to be incorrect regarding the Portugal Central Bank as distraction?” His answer was COULD BE YES. Very intruiging!!

Two analogies make sense. One is of a big car whose engine lubrication is slowly drained. The temperature of the moving parts is rising, as the engine grinds, and a seizure comes. Another is a man with a bad case of chronic diarrhea, who cannot stop emitting the nether substance. He continues to lose his inner juices as effluent until he passes out. Eventually he dies from dehydration and electrolytic starvation. The gold market is living on borrowed time. The window will soon close for private citizens to purchase gold bullion in any form. Time is running out. Seizures and magnificent deceptive cover stories are to come. Let’s see how much credibility the mainstream stories contain. The flimsy stories, in my view, will be shot full of holes, shot to hell. The Gold price will skyrocket when it becomes clear that the gold inventory is non-existent in the gold metal exchanges. The Powerz might evade legal responsibility by means of assorted lies and stories, but the end result will be absent gold supply in inventory. No supply, huge demand, and price rises without resistance.

◄$$$ A DRAIN ON THE L.B.M.A. INVENTORY IS WELL ALONG. EVER SINCE THE DEATH EVENT OF WALL STREET, THE MOVEMENT BEGAN TO TARGET LONDON. THE L.B.M.A. TEMPORARILY SHUT DOWN THEIR DATA REPORTING. THEN IN FOUR DAYS, IT WAS RE-OPENED. A SHOCK WAVE PROBABLY STRUCK THEIR INTERNAL STRUCTURE, FORCING A QUICK RECOVERY.

Willie

Lucdog,

I think this is commentary by Mr. Jim Willie publisher of “The Hat Trick Letter”. Willie is one of my favorite writers on the web. Thank you for the content!! I hope everybody reads this.

Greg

GREG- can you have Willie give us a SILVER Summary? Not sure if he is gonna see my reply. You may give him my personnel e-mail. My house is going without so we can fetch SILVER not as investment but because they are SHORT. Can Willie tell me if it is looking as ugly or close with SILVER

Patriot,

So sorry, I do not know Mr. Willie but Silver is still very cheap. Thank you for the coment.

Greg

Damn! We are so screwed. I wonder how much of this is IMF [mostly US Gold] or just plain US Gold? We are bailing out everything else

George,

You are sooooooo right!

Greg

Willie where does SILVER fit into this picture. Can we expect the same? Are these same PEOPLE banks included SHORT on SILVER?

Scare the people with the truth and they would do less spending and that would mean more QE. The plan is keep the money moving or the government will. It just seems to me inflation no matter who idea’s we use is going to happen anyway. Like I said before the Goodwill stores prices have double. The states revenue is going to scare the people sooner then anything. My governor out here in Washington state is going to do a cross aboard cut 5% are more. It depends on how much bailout money the state gets from DC. This state is in better shape then others but we have a big welfare program. If are governor was smart she would kill the welfare programs and drive the poor people to other states before things get really bad. The big fight will end up over funding state pensions are welfare programs, anyway that’s what I think. TAKE CARE

Thank you Bob.

Greg

Great article!

However, I don’t think the double dip will be coming as soon as everyone thinks. We live in a command economy with Enron accounting. The powers that be, the same that flukely stopped the S&P on 666 during the bailout B.S. game will not let it be. I believe they will keep the market in the 10,000 – 12,000 range between the November elections and the next presidential election.

Inflation will increase and the dollars purchasing power will decrease but they will hide the stats like they always do i.e. Enron style. The Corporate Feudalists will get richer, we will get poorer and the people will not be able to vote them out.

The reason is the Banksters hide behind a bureaucracy shield where 25 voices out of 600 ain’t much representation for us. The bureaucracy shield which I call “The B.S.” is designed to keep the status quo for those who profit the most from the current state of things.

Hopefully I am wrong about this, I will be glad if I am. If you want to read why I think so here is the rest. Scitzo-Flation part II

http://www.scribd.com/full/35556095?access_key=key-1nywb8vbygqnkfdk429s

Keep up the great work. I am really enjoying this site.

P.S. Did you ever work with Lou Dobbs while at CNN? He always seemed like he was on the common people’s side also.

Mike,

I hope you are right. Thank you form the comment.

Greg

Stock up on food and other supplies and get ready for very hard times. Get out of debt as fast as you can and prepare for our standard of living to fall through the floor. Farming and the basics of existance are about to make a very big come back. A Great Panic is coming our way along with all the dread and loathing that you can or cannot stomach. Americans are not prepared for what is heading our way.

The idiots on the boob tube and in the government LIE, it’s all a big smoke screen and along the way big brother is gathering as much power as possible. The unprepared and blind will gladly hand over their freedom and liberty for government cheese, and we all know that government cheese comes at a very VERY steep price.

The foundation of our Republic is rotten, the termites of government have undermined the the Constitution and Bill of Rights, while the public got fat and lazy with more “Stuff” (i.e. McMansions, fast cars, massive debt and drugs)

November will be small bump in the road, and will not make much of a difference, the damage is done and the piper demands payment except WE ARE BROKE. A massive “Reset” is coming, the wheat will be seperate from the chaff.

My 0.02 cents.

Ray,

Good advice thank you.

Greg

Smart people disagree on the deflation/inflation debate but price increases are coming fast and furious now that manufacturers can no longer delay passing on their own higher costs of doing business. Raw materials are up and other costs of business are rising; think Obamacare costs, the new 1099 reporting requirement costs, fuel/freight costs, etc..

I’m in the furniture business and in placing orders now for 2011 furniture I’m seeing 4-8% price increases from manufacturers. Plus freight bills now include fuel surcharges that track oil prices higher.

I don’t care what “they” call it, price increases are NOT deflation.

Thanks for reporting the facts.

Mike,

Thank you for reporting news from the front lines of business in the real world. Good luck to you my friend!!!

Greg

Love your site, Greg.

What I see around me is people not spending money at all, except for food, cars or medical. my shop owner friends are closing their stores because they say people are not buying clothes. the new super Walmart near us seems put on hold. The Lexus dealer is offering free carwashes and oil changes. People know the country is screwed up….they know goverment is inept. but they do have faith in their ability to change. And many are constantly making changes to survive.

The “sheeple” talk says people don’t “get” the changes coming; but many do. And as one neighbor said, vote the bastards out. I think the goverment underestimates the people.

Good.

Mariah,

Thank you for your voice on this site. Please come back and comment anytime!!

Greg

Hi Greg

Whether it is spin, or the economy spinning out of control, the rate of both is increasing. As is the BS.

I encounter two sets of people regularly… those who want to believe things are improving and those that do not want to prepare for the consequences of what is playing out. The outcome for both people will be similar.

The good news, there is the odd person and family that are trying to prepare, trying to keep focused on what is before us. I cannot see what a double dip recession coupled with hyperinflation looks like, but I do know it won’t be business as usual.

Today is likely a good time to turn off the TV and get the family together around the kitchen table and begin talking about how to get through this… whatever this may be. It is not a time to be distracted. It is a time for families to act like families and for communities to come together.

All the best.

Ciga Glen

Thank you CIGA Glen,

(For those of you who do not know, C I G A stands for Commrades In Golden Arms.)

Greg

Great story Greg, as always. You are the voice that keeps me working hard every day, because I truly believe that I will make it through this mess with a job because Ive been told the truth, and ever since my first episode of Coast 2 Coast (where you where a guest) i haven’t listened to a single word of the mainstream. Its just unbearable to be lied to, like they think we arent smart enough to see that EVERYONE IS BROKE.

BLT

Brian,

You make a good point in that we will get through this, some (as yourself) better than others. Thank you for the comment.

Greg

Since 1976, yes that long, you have always been a source of sane, reasoned thinking to this friend. I am so glad to have a place to daily find what you have to share.

Tom,

Thanks man. It was good talking to you the other day!!!!! Peace Bro!!!!!!!!!

Your Friend,

Greg

We’re heading into a double-dip in housing now, with all the Option Arms resets coming up, and foreclosures up 4% over the past month. People have a little more money to spend when they’ve made the decision to default on their mortgage, because they’re in negative equity, or filing bankruptcy.

Most of those millions of jobs we’ve lost aren’t coming back. Our economy is based on consumer spending. What will people use to “spend” when they don’t have any money, or jobs? It’s patently ridiculous to think our economy is going anywhere but down the tubes.

Mountainaires,

I missed your comments and I an happy to see you back!!!!!

Greg

“Homelessness is a lagging indicator”

Desperate calls in Connecticut for help, just more anecdotal evidence in small, disparate stories that no one knows about because it’s not “national” news. This is happening all across the country; and in some states, it’s brutally worse than in others, due to the housing bubble, which burst with a vengeance. The disconnect between the “pretend and extend” policies of our government, and the lives of real people is a vast chasm, unbridgeable, and growing every day. To believe that this economy is anywhere near coming back is breathtaking denial.

http://fairfieldweekly.com/news/featured-news/nearly-21-000-connecticut-residents-lose-their-unemployment

Wow. This is crazy. The Feds are snapping up homes in foreclosure in Colorado. Do they plan to snap up every single foreclosure in the nation?

http://www.9news.com/news/article.aspx?storyid=152976&catid=339%22

Double-dip in Housing right now:

http://www.businessinsider.com/home-prices-just-dropped-in-most-states-and-8-million-foreclosures-are-about-to-hit-the-market-2010-9#ixzz0zfRTXHuE

Hello All,

May I sum-up what I have read on this thread? OK, I will!

A reset is coming; be prepared.

More of my opinions:

Some believe that coporations and banks are the problem.

I believe it is Neo-marxist academics and opportunistic Wall Street players who will gladly except the cash being handed-out like candy from the Neo-marxist academics who control our gubmint.

Opportunistic bankers are included above.

thanks,

markm

MarkM,

Happy you chose USAWatchdog for the “sum-up.” I think you did nicely!

Greg

If Greg keeps this up he’s going to get a nasty visit from govt agents and end up in Costa Rica like a golden jackass. Don’t worry though, after the “reset” Costa Rica will have an NHL hockey team. A few years ago the jackass gave a brief account of the nasty visit from USgovt agents that took place in Germany (I think it was in Munich). Would it be possible for the readers of this site to get a recount of this fascinating event?

Gary B,

To put me in the same sentence as Mr. Willie is a great honor. I like hockey!!

Greg

“Go down gambling. Say it when you’re getting low”

“Go down gambling. You may never have to go” No, No”.

Blood, Sweat and Tears.

Yepper, That is Congresses favorite song.

Another very good article.

With respect to these quotes from your article, namely:

1. “Yesterday, Bloomberg quoted the “Oracle of Omaha” in a report where he said, “I am a huge bull on this country,” Buffett, Berkshire’s chief executive officer, said today in remarks to the Montana Economic Development Summit. “We will not have a double-dip recession at all. I see our businesses coming back almost across the board.” (Click here for the complete Bloomberg report.)”

2. “Last week, FDIC Chairman Shelia Bair said pretty much the same thing as Mr. Buffett. Bair said on CNBC, “We are not predicting–I would use the “we” for the FDIC. I rely on a lot of very smart economists at the FDIC in helping us make those judgments, but right now, no, our economic staff do not predict a double dip.”

Why would you take notice of either of these claims? These people (and nearly every one of their peers) did not predict the disaster that broke in 2008 either. They did not see it coming despite serious warnings at least 12 months earlier by a few notable people who were largely ignored (but not by me). They did not see it because they did not look for it despite all the warning signs.

But now they still claim to be experts on predicting the economy. Well I think we have all seen by now just how expert they actually are.

Those in Government are going to talk up every statistic they can find which is positive despite how marginal it maybe. This will be the case even more now because there are imminent national elections.

One month of reasonable retail sales does not make for a sound economy or a turnaround in the overall trend. Retail sales will will continue to be inflated by cost increases. Much of retail sales are just imports and, by the way, if Government and others think the US economy will be saved by consumers buying more imports then you really have a problem. Consuming imports right now = NEGATIVE national wealth. But the point is that the falling US dollar will continue to make imports more expensive and these price increases are all incorporated in retail sales figures. Margins are already under pressure and cost increases to importers due to currency movements have to be largely passed on by higher retail prices. Likewise, manufacturer/exporters/suppliers to the US must increase their US dollar wholesale price levels to retain the same level of returns in their local currencies.

Berkshire has a motivation for every public comment made. Primarily they will do what is necessary to “talk up” the value of their investments right now. If you were in their shoes you would too. Talk of another dip in the markets will only encourage you not to buy which will only depress the value of their holdings. They want you to buy and obviously they certainly don’t want you selling up your portfolio.

Finally, given the many thousands of millions of dollars that have been injected into the economy by the Government, if you did not see an odd month with a slightly positive RS figure, taking account of the inflation factor factor also, then it would indeed be surprising. The Government does not have the funds to repeat the exercise to that level again. It’s just not sustainable and all evidence so far suggests that it did not really work in any sustained fashion. The proof? In part, much more chatter about the “pressing need” for yet another stimulus package (that is most unlikely to work this time either, but is seen as politically expedient).

Sean,

Thank you for the info and comment!

Greg

SYSTEMIC BREAKDOWN AT HAND

◄$$$ SYSTEMIC BREAKDOWN EVENTS ONLY DAYS OR WEEKS AWAY. A TRIGGER IS COMING THAT WILL OVERLOOKED FOR ITS POTENTIAL TO PRODUCE A POWERFUL IMPACT. EVENTS WILL OCCUR IN A CHAIN REACTION THAT GATHERS TREMENDOUS MOMENTUM, AND THEN GLOBAL IMPACT. THE SEQUENCE WILL USHER IN THE THIRD WORLD STATUS FOR THE UNITED STATES. $$$

Out of the blue, a very important insider contact within the banking world sent an email last week. Its significance stems from its unsolicited nature. He was privy to some critical but sensitive information, and shared the news of its imminence. He was not at liberty to divulge the exact nature of the event in progress, but shared that we are at the doorstep of major events. It could have been as simple as gigantic gold demand to strike. He has significant obscure foreign security agency contacts, including from Britain and Russia. He wrote on September 8th, “It appears to be prudent to fasten your seat belts and batten down the hatches. Watch out for a trigger event incident, like the assassination of Archduke Franz Ferdinand in Sarajevo which led to WWI. It will appear to be insignificant but will trigger an avalanche that will make the entire system collapse onto itself. I have strong indications that this is only a week away from happening, in any case before this year draws to an end. Do not ask me for specifics, since I cannot share them with you. Regarding your list of potential events, any combination thereof is likely.” The last line pertained to my immediate query.

The Jackass shot back a message with a list of potential events, all of which appear possible. Here is my laundry list, which given its length and not outrageous likelihood should be alarming unto itself. For example, something like A) a debt default by an EU member nation, or B) a big bank failure within an EU member nation, or C) a big bank failure event by a big US bank, or D) a phony story like a big inventory theft at London Metals Exchange to cover up absent metal, or E) a revealed major fraud from inside the USGovt (like with Fannie Mae), or F) a decision to permit certain markets to find proper equilibrium level (which sets off a giant mudslide), or G) a lawsuit against the SPDR Gold Exchange Traded Fund (GLD) for fraudulent leasing, or H) a credit derivative breakdown centered upon the Interest Rate Swap that manages to hold in place the near 0% official rate, or I) arrests made of some respected US bankers for bond fraud. That is long list of potential deep crisis events to trigger chaos, each highly likely.

◄$$$ MAJOR TIDBITS ON DEADLY BANKING DEVELOPMENTS MUST BE SHARED. THEY ADDRESS THE ABOVE WARNING OF SHOCK WAVE EVENTS. DEVELOPMENTS BEHIND THE CURTAINS AND MARBLED OFFICES ARE IN PROGRESS, SOME IN PREPARATION. EXPECT A BANK OF AMERICA FAILURE SOON, MUCH LIKE LEHMAN BROTHERS. $$$

Bank of America had a bank failure on July 24th. It was fixed right away by a massive infusion of USFed money, as they pulled BOA out of the fire at great cost. The banking community heard about the event, but the public did not. A bank run at BOA was averted. Such a failure will most assuredly happen again, since the big bank is both dead and having great difficulty with liquidity demands. Later, either JPMorgan or Goldman Sachs will acquire the entire bank, their entire depository accounts, their wrecked derivative books (like Gold futures and Interest Rate Swaps), including their teetering accounts held by gumbands and baling wire to the USDollar, USTreasurys, Gold, and Silver. Signs of desperation creeping in have come from reports of BOA attempting to sell $billions in assets, the source being analysts and fund managers who recently attended meetings with BOA executives. Deep concerns over its bloated damaged $2.3 trillion balance sheet have come to the fore. BOA middle and upper management expects a collapse, just a matter of time. A failure and merger of Bank of America would light the crisis fires again, and even focus attention on the Gold price, which is well understood to be suppressed by BOA as part of the corrupt Big Four Banks.

*** The gold & silver prices have broken out to new highs, extended further on Thursday. Tremendous heights will be achieved. We will see $2000 gold, then later $3000 gold. We will see $40 silver, then later $70 silver. It is pre-ordained and written. Nothing is fixed nor will be fixed. Much money has been wasted, and more will be wasted. Each round of economic stimulus pushes the gold & silver price higher. Each round of big bank bond redemption pushes the gold & silver price higher. Each round of sanctioned official debt monetization pushes the gold & silver price higher. Each round of inaction from political delay or stalemate pushes the gold & silver price higher. The only lack of satisfaction from the leaps higher in precious metal prices comes from knowing that the world as we know it will change, as the landscape shows evidence of economic scars. Supply chain disruption, price inflation, lost financial security, social unrest, and growing chaos will make life difficult. But the alternative is so much worse than not holding precious metals (true money) in investment. Gold & silver are a vote of no confidence in the paper system. Gold & silver are life boats during a tsunami. Gold & silver are a stake in the future.

Willie

Lucdog,

More good stuff from Jim Willie at the Hat Trick Letter. Thank you for sharing it.

Greg

All should be aware that the retail sales “increase” is quoted on year over year on EXISTING STORES. It ignores the thousands of stores closed in the last two years and doesn’t account for any transfer of sales from those closed stores. A YOY increase of 0.4% is really a big decrease and the phoney numbers are just more public relations for the “recovery”. There is no recovery, and the reported numbers are make believe.

One more thing…..sales reports should be based on gross sales tax receipts, a true indicator of total retail activity. I doubt you can find a state comptroller in the US that will tell you their sales tax receipts are up over last year.

Very Good info JiminGA. You sound like economist John Williams ast shadowstats.com. He is very respected and always spot on. Thank you for your comments.

Greg