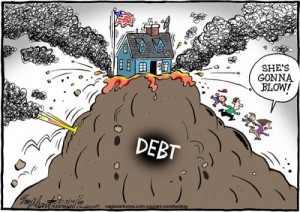

Sovereign Debt is Everybody’s Problem

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The most pressing problem on the planet right now is the European sovereign debt crisis. It is a gigantic highly leveraged mess caused by greedy reckless bankers. It was nurtured with the help of regulators who turned a blind eye and allowed the problem to mushroom into an uncontrollable financial cancer. The European Union is struggling to come up with a plan or bailout fund big enough to truly end the crisis, but there is none in sight. Every time there is a plan, it is shot down or falls apart. There was talk of Germany backing the EU bailout fund with its gold reserves, but that was rejected by the Germans. (Germany is the world’s number two holder of gold with 3,412 tonnes.) Can you blame them? It is ironic this so-called bailout fund is looking for tangible backing and that world leaders would turn to the yellow metal. Didn’t they all have a pact to sell gold not so many years back? This tells me any country with toxic sovereign debt that wants a bailout better be considering putting up its gold reserves.

The first troubled country that comes to mind is Italy. It has the fourth largest gold reserve in the world with 2,451 tonnes. Spain is in just as much debt and trouble as Italy, but only has 281 tonnes of gold. It ranks around 17th on the list. These two countries have ten times the sour debt of Greece. I predict Germany will not be the last country to be asked to put up its gold. I suspect there is not a country on earth that will elect to give up control of its yellow reserves. What else is there? I don’t think Italy would put up the island of Sicily for collateral, no more than the U.S. would post the Hawaiian Islands as security for a loan.

They call this a sovereign debt crisis, but it is the banks that are really at the heart of the problem. This leaves the EU with very limited options. They can allow the banks holding this sovereign debt to default, or print money to bail them out. Laws have been passed in Europe that allow the banks to count toxic sovereign debt as an asset. It is a novel idea–overwhelming debt that doesn’t have a prayer of being fully repaid counted as a store of value. (Oh wait, what was I thinking, this is the same thing the American government allows U.S. banks to do!) That means you can also say the sovereign debt crisis is bank solvency crisis. If you mark all sour debt for what banks can get for it today, many European financial institutions would be insolvent. End of story.

Harvard Professor Niall Ferguson, an expert on the history of money, thinks the EU will be forced to turn on the printing press. He recently said, “The ECB will have to continue buying bonds. They will have to print more aggressively than they have. . . . In the end, it’s going to be the ECB that prints its way out of the crisis…. It’s the only credible end game.” Ferguson’s complete Bloomberg interview from late October is below and is worth watching from top to bottom.

Turning the printing presses on full blast will devalue the currency and cause inflation. I think the ECB will do a combination of bank failures and printing trillions of euros to pick the banks they want to survive. This is a dicey situation because if the power brokers choose wrong, there could be a daisy chain of default. Not just in Europe but in the U.S too. Either way, there is going to be pain for the masses.

Renowned economist Martin Armstrong thinks the situation with sovereign debt is dire for all of Western civilization and time to act is running out. In an article last week, Armstrong said, “We are in the final throws of a Sovereign Debt Crisis upon which the entire future hinges. Pension funds depend upon government bonds. Once one sovereign nation defaults, capital will respond as it historically has – it will look at the financial landscape and ask the only question worth asking – Who is next? We are cascading toward a choice of MONETIZATION or DEFAULT.” (Click here to read the complete Martin Armstrong article.) Don’t kid yourself, it wouldn’t take long for the U.S. to move to the top of the list. Liquid dollar assets could be sold off and interest rates could spike. ($12 trillion in liquid dollar assets are held outside the U.S. according to Shadowstats.com.)

Armstrong thinks that if nothing is done soon, the world could be headed for “Financial Armageddon.” He goes on to warn, “We are on the edge of complete collapse of the Western Financial System that threatens to destabilize everything and obliterate our future. Pension funds depend upon SOVEREIGN DEBT. We are in a position where there MUST be a complete structural reform, or everything goes bust and civil unrest will destroy what is left.”

Armstrong is a consultant to very large hedge funds and governments. He says he just returned from Washington D.C. where he was invited to meet with what he calls “the good guys who know we have a serious problem.” I hope enough legislators on both sides of the aisle listen to him while there is still time to make a difference.

Greg:

Wow my mortgage is an asset, who would have thought….heavy on the sarcasm…

Can not argue with the fact that it is everybody’s fault. If the math is correct and verified then we are all headed for a major change in lifestyle. The only question left is how much of the change can we stand. What preparations have we made to protect ourselves and loved ones. I wonder just how many of those who read these commentaries take precautionary steps to lessen the impact that awaits us. The choice is whether we become slaves or survivors by our own hands and that is the last common denominator. Everything that has happen has been due to our choices. People will do what they want to do, but what angers me is that I will pay for their misguided choices. Another point is that we have used many resources for problems that should not have been created in the first place. We have failed to think things through and now await the consequences.

The only redeeming light on the day of darkness is that there will be a few who correctly understand, “Why” and that may be our saving grace.

Keep up the good work, Greg.

Good stuff Sling and good question “The only question left is how much of the change can we stand?” Thank you.

Greg

Perhaps it’s time to separate debt backed by governments and the federal reserve as the first line of defense, with debts that were created by wall street investment shenanigans.

The shenanigan debt can have no interest rate charges attached. http://swarmthebanks.blogspot.com/2011/11/why-did-pension-fund-managers-invest.html

Greg, Martin Armstrong I’m not, I don’t know anything about much, especially the theories of economics, I only know that somehow, someway, the bankers will protect the elite (of which they themselves are) at the expense of the working people. It may be by inflation, lower wages, austerity measures or whatever, but you can bet it any so-called solution of the Central Bankers and or the governments will be on the backs of its people; count on it.

Art,

That sounds like spot analysis to me!

Greg

Greg:

Excellent article, and well sourced, as usual. Unfortunately I cannot disagree with either Martin or Niall. I believe we are past the point of no return on this problem, and I have virtually no confidence or trust that ANY government has the ability, leadership or political will to make the painful decisions necessary to guide us thru the to the other end of the tunnel without total calamity.

I mean just look at the history and personalities of the major world players. Obama; a narcissistic left wing ideologue, Berlusconi; a womanizing egotistical billionare, Sarkozy; an arrogant blowhard, and the list goes on and on…do any of these people give you confidence in the system?, and they are just the political/governmental side of the equation. I haven’t even brought up the nutcases on the banking/finance side of the equation.

If you follow politics closely, and take a serious, un-baised, non-partisan look at our representatives in Congress, do you walk away with a feeling that these people can solve a problem….any problem, without making it exponentially worse??

Personally, I have come to the conclusion, after many discussions and arguments with friends and neighbors, that I am no longer going to worry about what is going to happen. I am going to focus on myself and my family, and to prepare for the new paradigm that will be upon us within a few years. Elimination of debt, conversion of paper assets into hard assets, personal defense, short term prepping, and quietly strengthening my relationships with like minded friends, relatives and business associates.

Whatever happens, happens. So be it. Unfortunately the outcome of all of this will not be good, and I fear for many people that I know.

Keep bringing us the latest Greg, because reliable reporting and information is invaluable in the age of MSM deception and misinformation.

Thank you Patriot Rider for the comment! It adds to the content of this post.

Greg

Smart man.

This is exactly my approach as well. I’ve also been drawing again which I haven’t been able to do since 2008 because of all the stress.

What I’ve learned is that this train is heading over the cliff and there is nothing I can do about it. I suppose I could start an economic blog like so many others, but there are smarter and more passionate folks doing that already.

I’m laying low, simplifying, preparing, and finding my way among my community to seek out like-minded folks, and encouraging those who are on the fence to educate themselves and take action.

I keep an eye on certain areas of the web, but for the most part I no longer care what is being said and done. Nothing left to do but stand back and prepare to survive the carnage.

Sooner or later someone will get around to addressing the legitimacy of “Sovereign Debt” and whether or not one group of people is liable for debts incurred by others and payable to others. I say no (especially when the group deemed liable sees the funds used to threaten and punish them.)

It’s one big debt circle jerk and we’ve been forced participants in this depravity for far too long. I’m pleased to see it coming to an end.

A lot of people are doing the same, hoping for a solution by the powers who did it to us is insanity, they naturally will only protect themselves in the end as that is all they have done all along. I am preparing for the worst, talking to my neighbors and trying to educate them for the protection of us locally. Two of my neighbors thought the police will protect them and I commented that they might have to go home and protect their own families, their eyes were opened, one is going to stockpile drinking water, the other some foodstuffs. Its getting around and people are slowly taking measures just in case.

Dear Greg,

Nice analysis.

It looks more and more likely that the holders of precious metals, specifically silver, will be the real winners here. Gold is great, but it’s mainly for wealth storage and large items. Silver is for trade. Just as water seeks its own level, so the market and economy will have to seek theirs. Those “preppers” who have bought “junk silver” and Silver Eagles will do fine, those who did not will have to barter. Dr. Ron Paul once observed that if a gas station takes a silver dime for a gallon of gasoline in lieu of the dime’s equivalent in fiat (a dime is 1/10 an ounce of silver, and contains 75% of that metal), then gasoline is a dime a gallon.

So, with the downfall of fiat, prices will go back to their natural levels. So, for that matter, will wages.

Sam,

PM’s are a must have insurance policy for your portfolio. You are spot on man! I hope it doesn’t get as bad as barter but who knows.

Greg

Sorry, but a pre 1965 dime is 1/14 oz of silver. A $1.40 is an oz.

http://en.wikipedia.org/wiki/Junk_silver

Kevin,

I think Sam meant 1964 or earlier. These dimes, quarters and half dollars are 90% silver. $1.50 in change makes an ounce. so a 1964 or earlier dime is 1/15th of an ounce of silver.

Greg

pre 1965 does mean 1964 and earlier, people get this confused all the time. That is why I used “pre” in front of 1965. and according to what I’ve read, it is $1.40. Love your site and all the best. Kevin

Kevin,

I stand corrected. Thank you.

Greg

Oh man, Greg, this is the best article ever.

Every American must know the only way out is to obliterate Federal Income taxes (on US citizens and Business)to as low as Zero percent, pay of Foreign Loans to eliminate interest payments and simply print at 5% government to fund government and prorective programs.

The US needs to act soon before it has to turn on a dime and slips…

Thank you Reader for the comment.

Greg

Holy batsh*#

Greg

With all the years of warning, how anyone can say they “didn’t see it coming” is beyond belief. You, Jim Sinclair, Martin Armstrong, Jim Puplava, Fleckenstein – Zero Hedge was started by a guy who just couldn’t take it any more. The list of truthtellers is enormous!

But, the Sheeple will insist, “They just didn’t know.” And, the propagandists will have much to be proud of:

Nations unprepared, banks empty while banksters seek havens in guarded enclaves, systems so distorted and distrusted that gold, food and energy are the currencies of the realm.

And, all of it could have been avoided by strict adherence to the Constitution and Law – in the United States; and realism on the part of the European nations. Ooops, Japan and China would have to get real, too!

The next generations will reap the rewards of the soon-to-arrive disasters sown by the current (and recently past) ones. Let’s hope we leave the next ones so terrified that they actually remember history this time.

Liah

Thank you Liah and Herman.

Greg

Mentally recreate the Hindenburg disaster with a blimp shaped like Italy or Spain or Greece, covered in a skin of billion dollar Euro notes,oh the humanity! And do you think it’s a possible motive for war with Iran to get some of these gold reserves moving to pay for 200 dollar+ barrels of oil?

Greg, Martin has offer his advice to the USA many times, even while he was locked up in a U.S. jail. Most folks are not aware of the way the U.S. Courts System really works and need to read Martin Armstrong’s bio at his web site http://www.armstrongeconomics.files.wordpress.com/2011/06/armstrongeconomics-about-martin-armstrong-060111.pdf. People need to know the truth about what really goes on behind the closed doors in DC and why these people need to be exposed for what they are, not just crooks, but a danger to any one who gets in their way. No wonder Martin will not rebuild his business in the USA, he knows the people who make up the CLUB and what they are capable of. Just count the the trips he has made to DC to give his advice while in jail & sinse his release from Fort Dix and it proves the CLUB cares nothing about the people of this Nation!

It’s 9.03 am CT where I live & the markets are selling off fast. You know the manipulators are working hard to please their masters.

Martin has said returning to a gold standard in the USA would not stop the crisis the USA faces. Here is a link to another article that agrees with Martin & explains why. It does not say that you should not own physical PM’s. http://www.goldstockbull.com/articles/debt-free-money-resource-based-economy-superior-gold-standard/. If you think about it the way this article explains that the central bankers would only do what they do best, rob us blind like they have done for the past 100 plus years.

The dollar is done, deal with it! This man has a point I am sure it has happen to many families. http://news.silverseek.com/GoldIsMoney/1320691016.php. This article speaks the truth. Believe me I know what this man is talking about & I have seen it close up years ago.

Thank you Greg for the truth we all need to hear, no bull, no spin, just the facts as we face this together.

Greg,

Another great article. The way I see things it’s all pretty simple, Congress sold us down the river in 1913 when they allowed a privately controlled central banking cartel to control our money. Now we have a fiat currency and a fractional banking system that is truly an economic house of cards.

Thank you Bryan, John and Robert.

Greg

Well, as a fond reader of past history, I’m worried the powers that be will pull their usual last card. It will be the same attention diverting ploy that they used after the panic of 1890, and the depression of the 1930’s. I fear that they will find reason for yet another World War to start the factories (and economies) running and enthrall the populace with patriotism.

I really really hope they do something different this time.

Hawaii might not mind being put up as collateral; the new owners probably wouldn’t harass the tourists with the TSA.

My fiancee and I are in a better position than most; We have our home and land paid off. The title is in our hands and it will be a cold day in hell when we would be foolish enough to “cash in” as most people have been doing refis.

That said, we work for mortgage companies doing property inspections and property maintence work. However we don’t get paid that much for working for ourselves but it all about cash flow to keep rolling over our money monthly. There is a lot of work on REO (real estate owned) houses and this is one area people who have worked construction are qualified to do. So, if you need work be careful who you work for because some of the contractors take advantage of their subcontractors.

I have been following Martin Armstrong for a few years. His data is right on the button. Does he still do business with the big boys so soon out of sing-sing?

The only way to bring these shenanigans to a close is for everyone to close their accounts with the big banks, and put it all in a community bank. I did it two years ago….painless….and I can still access my money…..and they give me a bonus every year…..even on my mortgage…..ha ha ha ha ha…Merry Xmas to all!

Oh, out of 201 rural district councils in the UK, 135 are with the Cooperative Bank…I find this interesting.

They can allow the banks holding this sovereign debt to default, or print money to bail them out.

Why can’t they just explain to the people why the banks should be allowed to default? No one is on the side of the banks except the bankers?

This would be populism at it’s core, which politicians like (or so I thought?)

Good question NM, but if that happens they lose power and that is really what this is all about. Who has the power? Right now it is decidedly not with the people but the bankers.

Greg

The link to Armstrongs article is not working

NM,

Works for me. I don’t know what’s wrong but it is a very long article.

Greg

will you bleed, or will you seed?

with so many out of work you would think there would be more farmming going on. sleep on little sheep.

I think for too many Americans and probably people in any of the developed countries the debt crisis is too abstract. Or they fall in line with the likes of Paul Krugman who feel the way to fight debt is with debt. Most people want to put the current economic issues into idealogical boxes like there is too much regulation, or too little, or too many taxes, or too little, etc. At the end of the day the problem is one word, 4 letters, D-E-B-T.

As long as the public employee unions, firemen and police unions, teachers’ unions, and federal employees refuse to reduce their salaries, health care, and pensions which are unheard of in the “real” world, we cannot save America. Those on the government payroll, regardless of whether it is city, county, state, or federal, have become the bourgeoisie, the middle class, which is insane. In fact, they are the upper middle class. A policeman or fireman, in the depressed area of California where I reside, can retire at the age of 55 and receive more than $100K annually. While the retirees in the private sector, who must wait until at least the age of 62 before retiring, are lucky to get $15K annually. Further, very little is being done to bring good jobs back to America and help the “producers” who have been saddled with supporting the public employees. Even the billions of dollars of stimulus monies are mostly allocated to continue propping up government employees, instead of helping restore “real” jobs that will improve the economy. The bourgeoisie (middle class) should be the “producers,” not the government workers who prodouce nothing. We cannot be prosperous as long as the “producers” are mere serfs whose only purpose is to support the government employees and welfare recipients. I believe the solution is to stop the growth of all aspects of government. We must get back to work — doing the things that made America great.

What is really sad is that many Americans don’t realize that it is not the unions fault that the American workers are not paid equal to union workers. While you bash unions, the corporations are laughing at your stupidity because you don’t realize that non-union wages have been supressed by corporations while public employee unions got the raises they deserved tomatch inflation. But hey, it is the unions fault that the company short changed you for 20-30 years … go with it ….

With Italy’s 10-year bond yield passing 7% the US stock market dropped 3%. Tomorrow some insignificant positive news may raise the stock market back but the long-term trend is truly horrifying! Greek and Italian leaders are trying to get austerity passed and then will either resign or lose re-election. How much will US investors/banks lose when the Italian bonds get a haircut? Will some more brokerage firms like MF Global sink? With all that we see, the questions I ask are: what does it mean to me and what should I do about it?

Frank,

I am not trying to be a wise guy but please read what Mr. Armstrong said again in the post. You should be protecting you and your family and take risk off the table.

Greg

Greg,

While we need to make changes, there is nothing short of default or hyper-inflation that will resolve the USA’s debt issues. We owe too much to our own citizens before you even factor in foreign debt to ever pay 100 cents on the dollar…for that matter even 10. it is a relatively simple math exercise. Assets minus liabilities.

There is no way the government can hope to honor promises made to seniors unless they don’t live as long. While you and I would work to modify the system Obama has another plan. That where Rhambo’s brother comes to the rescue by rationing healthcare using cost benefit analysis. If you deny the old medical treatment, you don’t have to pay them Social Security either as dead people don’t draw benefits.

And I love that the Unions voted to allow themselves to bargain…that has been such a big benefit to California and General Motors…or is that Government Motors. So big that they are bankrupt, just like Ohio is going to be

Greg writes, “There was talk of Germany backing the EU bailout fund with its gold reserves, but that was rejected by the Germans. (Germany is the world’s number two holder of gold with 3,412 tonnes.) Can you blame them?”

Hold on, Greg.

Jens Weidmann, chairman of the Bundesbank (Germany’s central bank) only PRETENDED to reject it, because the German masses were outraged by the proposal made at the G-20 summit to use the gold as a basis for the ECB to issue a new salvo of debt bombs. You can take $20 billion in gold and fan it into $200 billion in credit (debt). It’s called 10-to-1 leveraging.

The bankers do not need permission. They have already acted. The gold heist is a done deal. (But you won’t read about this in the corporate media.)

In 2001 the (privately owned) Bundesbank surrendered control of its assets and currency to the (privately owned) ECB. The Bundesbank still exists, but only as the local German branch of the almighty ECB. The average German deludes himself that the Bundesbank is separate from the ECB, and retains control of Germany’s gold and foreign exchange reserves. Nope. Sorry. When you surrender your monetary sovereignty, you surrender EVERYTHING, including your gold.

There’s nothing that German politicians can do about this gold heist, even if they wanted to. (Which they don’t, since politicians collect a cut of every banker heist. If they were not paid by the bankers, they would reclaim monetary sovereignty, and pay themselves.)

Originally, German politicians thought they would control Europe via the ECB. Now the ECB controls German politicians. They intentionally created a banking monster, which has already hollowed out Greece, Italy, Ireland, Spain and Portugal.

Now the monster has turned around. The only way it can keep growing is by eating its German mother, devouring Germany’s capital and savings.

Make no mistake. The ECB bankers have planned from the start to steal ALL the gold from ALL of Europe’s banks. It’s part of “austerity.” (And by the way, what happened to Libya’s 115 tons of gold?)

To pull off their grand heist, the bankers needed 17 nations to give up their monetary sovereignty. Now the ECB bankers will steal a portion of Germany’s gold, and branch out from there.

“Can’t pay the debt we imposed on you? No problem. Just give us your gold. After all, this is a CRISIS.” (Which we bankers deliberately caused.)

This is one reason why Hugo Chavez called for 90 percent of Venezuela’s gold to be returned to Venezuela. The first shipment of Venezuela’s gold will supposedly arrive in Caracas next week.

Do not underestimate the power of the bankers. We have made them into Satanic gods. All Western governments are now owned by private bankers, and thus have no power over their gold. (Anyone who thinks this is an exaggeration is not paying attention.)

And remember, all finance ministers and treasury secretaries come straight from the banks (e.g. Goldman Sachs), and return to them when they leave office. Their allegiance is to the banks, not to their countries. So if the banks want the gold, they are eager to give it to them.

No gold need be physically moved. It’s just a question of who owns it. Tim Geithner is a Goldman Sachs man. Thus, Goldman and the other big banks own the gold.

This gold stuff is important. The “experts” play it down, because they want their paper markets to continue functioning.

In early September gold hit an all-time high of $1,920.30 per troy ounce. Two and a half weeks later it fell to $1,534 per ounce. All the “experts” said China would liquidate (sell) all its gold. I said just the opposite: China would take advantage of the lowered price and buy EVEN MORE gold.

India too.

I was correct, of course, since I am not an “expert.” China’s purchases of gold shot up, and continue to accelerate.

One reason I knew this is that when all the “experts” agree on a prediction, it usually means the opposite will happen.

The question is, who did China buy that gold from? Probably from distressed nations and individuals crushed by debt imposed by private Chinese bankers. Oh yes, private bankers are the same everywhere. They cannot resist the temptation to play God.

After all, the masses insist on it.

Richard,

You are a well informed, smart and gifted writer. Please keep commenting on this site but could you reconsider your pic? If does not represent you fairly. You are NO Hitler.

Greg

Greg,

It is true that “Sovereign Debt is Everybody’s Problem”. But solving the national debt problem should be the responsibilities of the policy makers, not the citizens. Unfortunately the legislators in Washington, D.C. are not working.

Here is the latest news about the Congress’ deficit-cutting super committee: http://www.huffingtonpost.com/2011/11/08/super-committee-republicans-chuck-schumer_n_1082842.html

Apparently the two parties are playing the blame game again. If the Super Committee cannot come up with a real deficit-cutting plan, are we going to have a Ultra-Super Committee to handle the problem? The idea of having a Super Committee is, by itself, a stupid one. Changing from a Regular Committee to a Super Committee doesn’t change anything. May be the Congress expects the Super Committee members to possess super power or super intelligence that can eliminate the deficit? Sadly a Super-Democrat is still a Democrat and a Super Republican is still a Republican. When you put the two in the same room, they just keep barking at each other and nothing will be accomplished.

The Eurozone crisis is still growing every day and the outlook for U.S. is not much better.

We have a DO LITTLE President (Obama) who currently worries more about his job than the unemployed Americans. He had his chance to make changes when Democrats were in control. Now it is too little and too late. The latest plan to help veteran employment is nothing more than winning veteran’s votes for his election. If Obama is doing his job, Attorney General would have prosecuted the Wall Street thiefs; the banks would be regulated; Tim Geithner and Ben Benanke would be gone for good.

We have a DO NOTHING Congress that pretty much DO NOTHING. In order to make sure Obama is a one-term president, GOP want to screw up the whole country. Many congressional members stay away from the OWS and keep quiet about the movement. Don’t they realized that people are angry because their congressional members no longer represent them? If the Congress do their jobs and listen to the people, there wouldn’t be an OWS movement.

The OWS is planning a two weeks march from Manhattan to Washington, D.C. (http://www.cbsnews.com/8301-201_162-57320684/occupy-wall-street-will-march-to-washington-d.c/) It will certainly get the attention from more people. Hopefully it will remind our congressional members whom they represent and what they are supposed to do.

Ambrose

Armstrong said, “We are in the last throes…” O great swift editor. Lord help us…