Fannie, Freddie and Gold

By Greg Hunter’s USAWatchdog.com

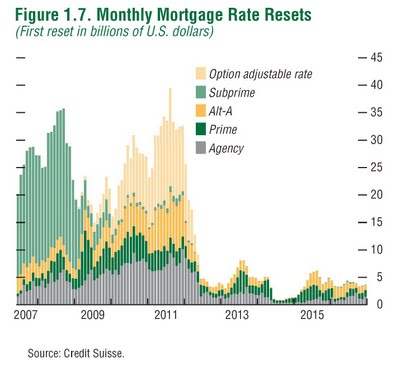

On Christmas Eve of 2009, the Treasury decided to lift the caps on how much bailout money failed mortgage giants Fannie Mae and Freddie Mac would receive to stay in business. The caps represented a maximum taxpayer exposure of $400 billion for both companies. Now, taxpayers will be on the hook for an “unlimited” amount for, at least, the next three years. How much is “unlimited?” Well, for starters, Fannie and Freddie guarantee about $4.67 trillion in mortgage backed securities. Add that to the combined debt of nearly $1.59 trillion for both companies, and you get more than $6.2 trillion of taxpayer liability. (The Fed has bought at least $1.25 trillion of Fannie and Freddie MBS)When I first heard that the caps would be lifted for just three years, I asked myself “Why three years?” The chart below gave me the answer. Take a look at the 2010 mark. You see that wave of mortgage resets for all those different kinds of mortgages? They peak and fall off about mid 2012.

You know the reset mess won’t be over at that precise point. It will take about six months or so for all the defaults to shake out. That’s just about three years, which is the exact same amount of time the caps on Freddie and Fannie will be lifted to bail them out of infinity. I am confident Treasury Secretary Geithner has seen the same chart. He knows those bars represent millions of mortgages. Not everybody will default because their mortgage resets, but many will not be able to afford the higher payments and lose their home.

Also, Fannie and Freddie are going to have to keep providing hundreds of billions of dollars in new mortgage financing because, if they don’t, the real estate market will probably collapse. With all the sour mortgages, securities, and new mortgage exposure, there is no telling how much this will cost the taxpayers. I don’t think it is a stretch to say it will end up being many trillions of dollars. Once again, there was a huge tax bill hung on the country, on Christmas Eve no less, and the mainstream media is nowhere to be found. Where is CBS, NBC, ABC, and CNN? What just happened to the budget deficit is bigger than the $700 billion TARP bailout, the $787 billion stimulus bill, and the $180 billion bailout of AIG, COMBINED. As a matter of fact, lifting the caps on Fannie and Freddie will cost many times more than all those COMBINED! I guess that is just not a story in mainstream media land.

On Christmas Eve 2009, a more than $6 trillion addition to the federal debt was made by a single bureaucrat. This move by the Treasury is a budget buster and will guarantee some very big inflation. Gold will react to higher inflation with higher prices. There was only one other time in the last 10 years that there was such a clear signal precious metals were in for a ride. It was March 2006, and brand new Fed Chief, Ben Bernanke, decided to call an end to the M3 report. (a statistic that shows the broadest measure of all money in the system). The Fed effectively said it was not going to tell the world exactly how much money it was creating. You might as well have walked into the gold trading pits with a starting pistol because, after the M3 died, gold just about doubled in less than four years. Just look at the chart below:

Now, with the elimination of the caps on mortgage giants Fannie and Freddie, you will have gold off to the races again because the government will print money to pay off debt. And if we have another financial meltdown, like 2008, gold will take a moon shot. What makes me say that? It is H.R. 4173, which is the Reform and Consumer Protection Act of 2009. This legislation is supposed to protect the little guy, but it also protects the banks with a provision in the bill to rescue them from financial ruin in the future. The Fed will have pre-authorization to give reckless banks as much as $4 trillion to, once again, bailout the incompetent. The bill has a long way to go before it is signed into law. Still, I’d say the odds are pretty good there will be another crisis; otherwise, Wall Street would not have paid their lobbyists to push a pre-authorized bailout.

My advice to you is to brace yourself for the impact of inflation. The actions of the Treasury and Wall Street have guaranteed it.

Hello Greg,

You wrote:

“It was March 2006, and brand new Fed Chief, Ben Bernanke, decided to call an end to the M3 report. (a statistic that shows the broadest measure of all money in the system).”

And to think Bernanke was appointed by that “ultra right-wing” President Bush! I have read that Bernanke is a product of academia and has no business experience. Those reports must be true.

Will Bernanke use his “trick” to halt inflation by decreasing the money supply when the economy does turn? I don’t think he’ll know when to pull the trigger; and, I don’t think the “trick” will work even if executed correctly.

Greg, you are well read and analytical, what are some scenarios for our future?

1) Will our free market engine overcome these issues?

2) Or, will we founder about and accept our lot as a 2nd world economy(10%+ unemployment for decades)?

3) Or, will we have a true “ballot box” revolution (I mean unbelievably huge upsets in 2010; 100 seats in the House and a tea party/republican sweep of Senate races)?

4) Or lastly, will we have a limited “bullet box” revolution?

thanks,

markm

Mark,

Thanks for the ideas…all are good! Thanks for the comment too!

Greg

Greg – another fine one. Looks like we are way into the sh…er.

Hey, did you here that the dems are close to a deal on the healthcare debacle, and it involves higher taxes on “Cadillac” insurance plans, and that THE UNIONS WILL BE EXEMPT FROM THESE HIGHER TAXES!!!!!!!!

DID YOU HEAR ABOUT THIS?????????????????????????????????????????????????????????????????

Con,

Thank you for the info and the comment!

Greg

Greg,

Thank you for breaking down the implications of our government’s fiscal decisions so that I understand. I am not stupid; I am a licensed Healthcare professional with an advanced degree. Economics is not an area of expertise for me but this is something that concerns me. Your articles on Watchdog are allowing me to educate myself on the economy. You take a complex system and explain it so that I do not need a PhD in Economics.

My husband and I discuss the direction of our country and we do not like what the politicos are doing with our liberties, our money and least of all our country. You are saying a lot of the same things he has been saying for years.

As far as Healthcare, I am an expert. I deal with Medicare and Medicaid every day. If anyone working for a living thinks this is something they want to be on, I suggest they reconsider. Medicare and Medicaid routinely deny payment for covered services and items at an astounding rate. While Congress vilifies the insurance companies [I don’t like them either], their pets, Medicare and Medicaid; decline covered items to citizen and illegal aliens at many times the rate the insurance companies do. Yes, I did mean Illegal Aliens. Every day, I see the entitlement attitude while I work my butt off. Now, I am going to have to pay extra taxes while Obama’s Union buddies get a pass. Is that legal? Can you tax one group while giving a group identical in every way but union membership a tax break?

Now I see why my husband is doing what he is with our retirement accounts. With this Christmas gift for Freddie and Fannie, and as my husband says, Wall St.; all we can do is protect ourselves. My husband talks a lot about history and I know that he can not be the only one that reads history. I would love for you to tackle the subject of why Americans believe that they are immune to the coming storm that other countries have inflicted upon themselves due to irresponsible fiscal policies.

Jill,

Thank you for your thoughtful and intelligent comment!

Greg

None can doubt the veracity of this atrlcie.

I increased my holdings in pm’s when I learned that the Chinese gov’t legalized and encouraged its citizens to buy and hold them. My reasoning being that they, (the gov), would not allow the pm’s to drop in value as doing so would invite unpleasant consequences. While our “gov” plays checkers they play chess. While our gov. thinks tactically they think strategically. While the dollar may go to zero, gold may go to infinity. Good luck to all of you who read this blog. I think you are on the right track.

Elswan,

Good info! Thanks for the comment.

Greg

Now one can understand this quote from Congressman Charles A. Lindbergh Sr., (1913) “From now on, depressions will be scientifically created.”

He was strongly against the creation of the Federal Reserve, and could foresee such things (described in this commentary) happening if it was created. Of course, he was outnumbered then by congressional fools, same as today’s Ron Paul and Dennis Kucinich.

Edward,

Good stuff! Thank you!!

Greg

Greg,

Who gave and / or how did “Turbo Tax” Tim Geithner get the authority and power to make a unilateral decision to guarantee Fannie and Freddie for up to 8 TRILLION? Is this not a violation of the US Constitution and usurps the authority of Congress? 8 TRILLION is twice the Obamachrist’s budget for 2010 totals which totals $3.55 trillion. I wonder if Tim Geithner has lined up a job at Goldman after he resigns.

Bye the way, have you seen the title on the 2010 budget? It made me roll on the floor laughing for about 15 minutes. A New Era of Responsibility: Renewing America’s Promise. What promise what that be? Take every dime from those that work and give to Geithner’s, Pelosi’s, Reid’s and Obama’s buddies in the Unions and on Wall Street?

They must have a comedy writer on the Whitehouse staff that came up with the title. America’s true promise is Life, Liberty and the pursuit of happiness [when the Constitution was written, this meant acquisition of property]. America promises equity of opportunity, not equality of outcome. That appears to be everything Obama abhors and stands against. If I work hard and save, why should I have more than someone that does not?

I ask myself what we could do to get out of this financial mess. This Fannie and Freddie move shows that they see it as a lost cause and they are going to steal from the American people so the politicians’ buddies on WALL STREET can stay wealthy. All I can come up with is to try to position my assets so I do not loss them when Obama’s next wealth redistribution strategy kicks in. I predict in the next two years, Obama will seize ALL 401-Ks, IRAs and Savings Accounts. SOME SUCKER has to BUY the TREASURIES. GUESS WHAT? It’s going to be you.

Disclaimer: Blame me for this mess. I voted for Obama. I voted for change. I could not make myself vote for McCain. I wished for change. What’s that old saying? “Be careful what you wish for, you may get it.” I was sucked in. I thought he meant what he said; a man of his word. OK, I admit it; I had an air bubble pass thru my brain. Why would I believe that he was telling the truth? Come 2010 and 2012, I vow to vote against every Democrat that I is on my ticket and give money to anyone opposing Reid, Pelosi, Obama and company. I KNOW the Repubs are no different but may they can derail healthcare and the looting of the middle class.

George,

Thank you for bringing up the “legal” issue. I did not have time in my post to cover it but the legality of the Treasury’s action is a big question.

Greg

Greg,

Listened to you last night on Coast-To-Coast (George Noori has the single best program on radio for the enlightened 2%ers; i.e., open-minded, clear-thinking, liberty-loving citizens of the world) and was favorably impressed with your oral graphic description (your print description made it even more graphically impressive) re the future dollar market price of gold bullion, as we have both triangulated on a similar number and date; i.e., $5,000 per ounce by year-end 2015.

If you haven’t already done so, you will definitely want to subscribe to/read the Appenzeller Daily Bell and read the Jim Quinn articles on LewRockwell.com via the Daily Crux as all of us seem to understand a similar emerging reality vis-a-vis the ongoing global Social Political Economic Knowledge-based Ethical or SPEKE Revolution.

Semper Fi!

I see that some people think the lot of them are stupid, but they are actually very smart. Why are they smart? They have convinced everyone they are doing what they can for America, when they are actually playing for the other team.

It is simple, they are going to self-destruct the dollar so they can do what was done in the past. Create a new currency, take the gold to back the currency. Then rinse and repeat. Read the history of the Federal Reserve, Great Depression, etc.. it is all there.

James,

I hope you are wrong but fear you are right! Thank you!

Greg

I bought and continue to buy silver and gold coins since W’s second rigged presidential election. Buying this stuff is the easy part, deciding when and how to sell is the problem. But I have never, in 45 years of investing, seen the ‘when and how’ explanation given. Now, here we ae amidst the ruins of the Bushes 41 and 43. I hope that the general public finally wakes up and sees that the USA was an experimant in politics that failed miserably. We are facing a constitutional crisis/convention if we are lucky, a coup if we are not. One thing is for sure, the constitution is irrelevant to us nowadays, justice is relative, and corporate/military elites run the show. Buffoons like Dick Cheney (aka Dr. Strangelove)still think they are ‘in the loop’. Too bad, had he the sense to realize the truth, he wouldn’t have taken himself so seriously and made himself into a leading cooperative factor in the downfall of this country. Party’s over, boys and girls!

Tim

Tim,

You sound like you are right on track but there is plenty of blame to go to BOTH Republicans and Democrats.

Yes you are correct Bush 43 f’d up but Clinton repealed the Glass Steagall act with the signing of the Grahm Bliley Leach act and Obama quadrupled the Bush deficit.

Greg

Greg

First off , thanks for your work, in trying to keep us informed.

I really feel for all the hurt my fellow Americans are enduring.

I feel lucky that as a single person, living out of my R.V.,

on $1800.00 (disability) payments, with full medical coverage,

that I am blessed. I have notice a large number of folks joining

the ranks of the “Mobile Dwellers”. My territory ranges from

Yuma, AZ., to Laughlin NV. to Flagstaff AZ. I wouldn’t trade

this existence with a Beverly Hills dweller. And yes, a per-

son can live like a king on $1800.00 if they live this way.

And let me end on this note, I pray we recover from this fin-

ancial debacle, and steer away from what brought this all about,

GREED!

Daniel,

Please write again and tell me what you are seeing out there. I love your perspective!!!

Greg

So, Greg, do you think this is a deliberate attempt to create such a catastrophe on the dollar that our government will claim that the best option is to bind our currency with another, like the formation of the Euro?

Scott,

Smart people in power know whats going on…something up up and it aint good.

Greg

Hi Greg, I heard you on Coast to Coast and just had to come check out your site….your commentary on what is going on with the Financial state of the nation, is, to say the least, down right scary!! I shall continue to follow you Greg, and I want to thank you for covering what MSM is not….keep up the good work!!

Mr. Hunter, I heard you for the first time with Mr. Noory on C to C AM and looked up your site. I too can connect the dots, but one scenario that gets no play: given our current economic situation, what happens when the New Madrid fault ruptures, or San Francisco revisits 1906? Throw in a hurricane or two and a few tornados in the space of a year or two and what have you got? Answer: another third world country.

Clearly, our Govt.hasn’t been saving for a rainy day. My advice: to Hell with Gold! Buy food, store water and be prepared to protect yourself. I suspect sites like yours are not prepared to speak in those terms. Perhaps it’s too soon, but somebody should. In this past decade, it has become clear that in political and economic terms, absolutely nothing is impossible. Those are supposed to be the things we can control. What about those things we can’t? Keep up the good work.

Greg,

I cannot argue with you because you make some very good points. Thank you.

Greg

Greg,

I just caught the last half hour of coast to coast this morning.And I was wondering in your opinion what silver will do and do you think it would be a good investment? I have in my possession about one hundred ounces of gold and about five thousand ounces of silver.I have converted 90% of my stocks into silver and gold mining stocks. What I would like is your opinion on buying more gold or more silver or both.

Thanks,

BoB X

Bob,

With that mix I think I would buy gold and hold on off on more silver. I also think you should make sure you are in a solid brokerage. I like Scottrade and Edward Jones. They both have little derivative exposure and have high minimum capital ratios. I do not get paid by them at all, I just like them. A good investment in a poor brokerage is not a good investment. Also, ask for you shares to be held as a “book entry” That means the shares are held in your name NOT the firm name. Thanks for the comment.

Greg

BoB X, as smart as Greg is, I believe you are right and he is wrong on your ratio of silver to gold. Just look on the silver and gold eagles to confirm this 50 to 1 ratio. Even the Central Fund of Canada, CEF, stores fifty ounces of silver for each gold ounce. On the other hand, the ratio of silver to gold maple leafs is only 10 to 1. And then the Q’uran specifies 7 dirham to 1 dinar. It sure makes for an interesting puzzle and spirited bargaining when the time comes to actually use your silver coins for daily purchases.

Greg, for what it’s worth, I concur with your advice to hold stocks as a “book entry”.

Thanks for the article, Greg. Heard you on Coast to Coast.

http://www.CrimeZilla.com — Crime News & Views

Quid, Teddy and Crime,

Thanks for taking the time to write a comment and for the kind words of encouragement!

Greg

I don’t even think that FOX would do a story on this. Thanks Greg!

Dear Greg,

How is Tim Geitner allowed to lift the caps like that and plunge us deeper in debt with Fannie & Freddy ? So the Congress doesn’t have to vote on changing the rules like that?

Thanks for helping us understand what is really going on.

Barbars,

Good question. Why isn’t Congress yelling their heads off over thei? Why isn’t the mainstream media on this story! Thank you for your intelligent comment!!!

Greg

Thanx, Greg for the great insight. Thank you also to all who commented. Excellent opinions.

Being a Canadian, it’s tough to criticize any American institution, whether it be the Fed, President, Congress, etc. However, because the U.S. dollar is, at the moment, the world’s reserve currency, any policy changes affect everyone.

I have the utmost respect for Ron Paul. He is a true patriot.

From what I’ve read on the Constitution, only silver and gold coins were to be used as money. If only the country could follow the Constitution, everything would work out O.K. Your forefathers were brilliant – seeing what would happen if a central bank were allowed to operate. This is happening worldwide now. One man’s opinion; TimCanada.

Tim,

Thank you.

Greg

Poor credit mortgage lenders, commonly called sub-prime lenders, are those that offer loans to individuals with less than perfect credit. Because of recent record low rates, a lot of buyers are choosing to buy their 1st home or refinance their current loan in order to get a lower rate.

Thank you Rory. Good luck with your site.

Greg