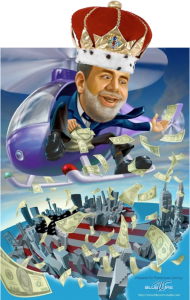

Never Ending Money Printing

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The Federal Reserve held its first press conference in its 97 year history last week. In my mind, it did this because it recognizes the deep financial trouble the U.S. is in. It wants to put a positive spin on the mess it largely created and/or allowed to happen. After all, it was Tim Geithner who was the head of the New York Fed during the go-go years of the mid 2000’s. He was supposed to regulate the big Wall Street banks. You see how well that worked out—the entire system melted down and Geithner got a promotion to Treasury Secretary.

I’ll give my interpretation of a few of the important points the Fed was trying to get out to the public. Overall, the Fed wants people to keep their confidence in a system where money is loaned into existence. Yes, that’s right. Every time you swipe your credit card, you are not borrowing money but creating it. The banks love this because there is virtually no cost to them, and you have to pay back the money with interest just for the privilege of going into debt. Can you see why the Fed wants to keep this confidence game going?

My interpretation of a few specific points brought up in the Press conference hosted by Fed chief Ben Bernanke are: high oil prices are not the fault of the Fed; neither is the weak dollar, that is the Treasury Department’s problem even though U.S. dollars say “Federal Reserve Note” across the top of every single one of them; and finally (and this is my favorite), the second round of Quantitative Easing (QE2) will end by June 30th. (Click here for more on the Fed press conference from Reuters.)

The overt fed money printing of $75 billion a month is going to end, but the covert money printing will not. It can’t because who will step in and buy all that debt at discount rates? Jim Rickards, Senior Managing Director for Market Intelligence at Omnis, Inc., thinks the Fed will still be printing “$750 billion” a year. Rickards wrote a piece about 5 weeks ago spelling out why he thinks QE will be “perpetual.” Rickards is a big thinker, and he is the insider’s insider. He says, “The Fed is now like a 400-pound man who can eat 5,000 calories per day without gaining weight because his morbidly obese metabolism requires it to function. The discussion of QE, QE2 and QE3 has become irrelevant. What we have is permanent QE until such time as the Fed decides to tighten financial conditions. This is unlikely to happen until mid-2012 at the earliest, perhaps later in view of the housing double-dip and increasing oil prices. In any case, QE will be with us for an “extended period” no matter what the Fed announces.” (Click here to read the complete post from King World News.)

The continuing fed money printing to prop up an insolvent system is flashing a long-term green light to gold and silver. Jim Willie at Goldenjackass.com says, the green light is stuck on and will not turn red until there is resolution and reform. Mr. Willie wrote in his latest post, “Have they liquidated any big US banks?? Has any reform come for encouraging the return of US industry?? Has any regulatory reform been pursued for expanding business?? Have they stopped printing money to cover debt?? Has any reduction in USGovt deficits been realized?? The answer is a loud NO on all counts of the basic test, which signals a continued bull market in precious metals.” (Click here for the complete post from Jim Willie.)

Economist John Williams, founder of Shadowstats.com, says the inflation in food and energy is coming from a weakening U.S. dollar. Inflation will increase as the value of the dollar decreases. In his latest report, Williams says, “U.S. inflation is on the rise, due primarily to the Fed’s successful efforts at starting to debase the U.S. dollar. It is the dollar’s weakness that primarily has driven oil prices higher, more so than political tensions in the Middle East and North Africa, or Mr. Bernanke’s suggestions of surging global oil demand. As a result of Fed activity, the U.S. dollar has lost its safe-haven status and is hitting all-time lows against a number of major currencies. . . . even the Fed’s Vice-Chairman has acknowledged current Fed policy is weakening the U.S. dollar.”

Williams says the U.S. is sliding towards “systemic solvency crises,” and the dollar continues to fall “unabated.” He is predicting hyperinflation within a few years, at the latest. So, no matter what the Fed says it’s doing, the evidence shows a trail of never ending money printing. This will only enrich the few, while robbing the masses of their money’s buying power.

Hi Greg. Great article and as usual, spot on. The FED will continue to create money. Our dollars will continue to shrink right before our eyes.

Thank you George, Mountianaires and Adnan.

Greg

Another informative blog post, Greg, thanks for such a great site!

Charles Hughes Smith echoes the sentiments:

http://www.oftwominds.com/blogmay11/managed-perception5-11.html

Everyone is focused on Osama’s death today, and celebrating the news. So am I. So, we should take a moment to reflect on 9/11 and the victims, and those military men and women who have given their lives in pursuit of Bin Laden and Al-Qaeda/Taliban for the past 10 years, as well as those who successfully planned and executed the raid in Osama’s hideout and killed him. Americans are justifiably happy to hear that justice has finally been served.

But it changes nothing about our economic crisis. There will be no “justice” served there.

It is hard for me to see the cause of a today’s economic problems as originating in one single American Institution. In fact, it is highly unlikely that such would be the case.

(Read MartingArmstrong.org for real and historically-proven ideas on debt, money, History and the American way…)

Greg, one can read information daily from many different sources that indicate problems with the Fed (which should be independant of political pressures which now is questionable), debt, deficits and the inability of our 545 leaders (1 President, 435 House members, 100 Senators and 9 SCOTUS judges)to make decisions that provide for a secure future. We read about how the American people are so fed up with the way the country is being run and want real change.

But then, when real change is proposed, all kinds of pushback occurs from those who asked for change when the change impacts them personally. I question if Americans really want change due to this reason and the fact that so many young people today have no idea what is happening until some disaster occurs and they become part of those that have been hurt. Would Americans really want a Fed that controlled the money supply and built long term security at the expense of short term gains?

Ron,

Like it or not, change is coming. Thank you for your comment.

Greg

Good article as usual, always enjoy reading them.

Its sad really, all this madness we see in government today does not exist in a vacuum. It is merely the tip of the rotten iceberg, it is just one of many symptoms that our culture, our very society is beginning to get that funny smell and has not moved in some time. I guess thats just a nice way of saying that we the people, virtually ever last one of us, have come to take too much for granted for too long–that or we are all way to specilized to the point that we no longer have the common sense afforded by the “bigger”.

Unfortunatley those all important attitude adjustments and work ethic resets called depressions have been papered over for at least 2 decades or so now. There are too many “jobs americans wont do”, too many roofers and diners and widget stamping mills who cant find legal citizens to do the work.

Like the forest that never has a fire, if things persist fire won’t help anymore, the forest floor will be too steeped in rot and decay and so the forest will become a swamp……..

Thank you Brian and T Bonham.

Greg

So then, “will the real Rumplestilskin please stand up, Ben Bernake or Tiny Tim Geitner?”

Back when dinosaurs roamed the halls of wall street, Jim Sinclair predicted all this – even spotted an obscene gold price of $1650 way, way back when, and most everyone frowned with a ‘huh? – what’s that noise over there?’ A few others were with him out there standing in the snowy cold jumping up and down pointing fingers and shouting, ‘look people, look’ – and now $1650 is just a yawn and a matter of time. Lots of prognosticators out there – the trick is to stay away from the noise on MSM so you can hear the correct ones, those that are aware of the underlying fundamentals that most only see in the rear view mirror if ever…..Greg-keep on hitting the ‘heavy bag’ as they say in boxing, you are in good company…..

Big Tom,

I agree with you completely about Mr. Sinclair. He has made one of the best calls in the history of gold investing!!! He made his now famous $1650 price call in December of 2002. He only missed by a few hundred dollars and a few months. Fantastic call ($1650 on or before Jan. 2011) considering he made that call 8 years earlier!!! Spot price plus commission is already at around $1650, so as far as I am concerned Sinclair is totally on target!!! Thank you for the comment.

Greg

Best site ever!!

Thank you Pablo and Steve!!

Greg

Thank you Pablo.

Greg

Greg;

Spot on as usual. I listened to the Fed’s press conference as well. What I gathered from it is that they’ll be taking the printing into stealth mode, through the “reinvestment” of sales of Mortgage Backed Securities and other such schemes.

They have to keep pumping money into the system. Otherwise, the crash and burn will be spectacular (and brutal). So the people get sacrificed on the Wall Street altar.

Most people don’t know the squeeze that Main Street is undergoing. As a small manufacturer, I’m seeing price increases on a weekly basis. The costs are going up, but the retail price cannot. That squeeze is going to drive a lot of small businesses out of existence.

Sad and scary times.

As Darryl Schoon often says, “Buy gold, buy silver, have faith”.

Steve,

Good advise.

Greg

Another great article but I am somewhat confused about how the Fed will convertly keep printing and what those specifics may look like after the end of QE2. Maybe you can give me (us) an idea as to how this trick will be played out?

Greg, another T-shirt: FUZZY MATH: QE2 = FUALL – Sorry for the sick humor but just couldn’t resist an opportunity to make fun of the Fed.

If you want to censor the last paragraph no problem, just look for the shirt in your local underground swap meet, the new retail stores of America. From the Western Front, A.B.

Art,

Got to the link in the post where I introduce Jim Rickards. He explains the complicated process very well. It is basically reinvestment of money from mortgage backed securities, but read this link and you will get the whole explanation. Thank you for all your support and comments!

Greg

Good article, it really reinforces a point that it seems a lot of people are struggling with, focusing on the long-term fundamentals. As long as the Fed continues to ease us into oblivion, and the politicians and insiders are only looking out for themselves, the outcome is all but assured, its only the timeline that is in question. So we all have to ignore the momentary distractions and stay focused on our individual goals for mitigating the coming economic crises. When it all goes down, we won’t remember when the market jumped on fabricated economic data, or that gold traded down a few dollars in May. We’ll be surrounded by the masses saying things like “No one could have possibly seen this coming!” and “The fundamentals of the economy are most likely still sound” even though the facts had been there all along.

Thank you Serapis and Kenny. Kenny, it will be very hard to pull out of it this time!

Greg

“History’s great inflations have almost alway’s been followed by a dictator who promised among other things to restore the currency’s value. Napoleon, Hitler, and mao Tse-tung all rode to power on the back of hyperinflation.”Time, March 10,1980………..We pulled out of it over 30 yrs. ago do you think he’s gonna show this time around Greg.

Greg: GR8 posting, and it’ll be interesting to see how long the ‘game’ can continue. Deficit-spending $1.6T/year is the norm for the 3rd year in a row and the Fed’s stuck. They can’t borrow the money from the market-buyers cuz the rates would have to skyrocket to 4,5,6,7%, which isn’t as good a deal as ZIRP by printing money. But that’s a fool’s game, that Obamao/Bernanke hope lasts at least til Nov ’12.

It’ll be very interesting to see if the game continues to unravel with higher energy/food prices, because if this keeps happening for 18 more months, Americans will hopefully flip their 2008 53%D/47%R — will 4% or more ‘see the light’?

Thanks Steve.

I think your prediction will come true.

Greg

The “private” Federal Reserve held it first “PR BS” conference. And what? Are we suppose to be confident in their actions? Are we supposed to believe that “dilution is the solution” to Americas debt crisis?

there is only one credible answer ….. intentional deflation of the dollar … theft throuh inflation is still theft!

Mitch Bupp,

I cannot disagree. Thank you for your crisp short analysis!

Greg

My Silver Dreams of Cheap Gas and Bread and Circuses

So now we have a new distraction to keep our attention focused away from the pickpockets of Wall Street. Our military and intelligence teams that made it possible to bring Osama Bin Laden to his just reward deserve all the congratulations and praise for a job well done, that are coming their way. But in the long term it will not change the ongoing deterioration of either our economy or the overall foolishness of thinking that fiat currency has any real value just because Uncle Ben Bernanke and Tiny Tim Geitner say so.

Look at it this way.

In 1964 gasoline was $0.25 a gallon, today its $4.00 a gallon.

In 1964 LBJ removed all silver from American coinage and recalled all Silver Certificate currency bills.

Today a 1964 90% silver quarter ($0.25) has a melt value of $8.00.

In 1964 a 16 gallon tank could be filled for $4.00.

Today a 16 gallon tank costs $64.00.

BUT if we were still using silver coinage and Silver Certificates that $0.25 face value quarter would buy you 2 gallons of gasoline and you could fill your 16 gallon tank for only $2.00!

So before you go complaining about the oil companies and speculators “ripping you off,” ask yourself a couple of questions:

1. Was it the oil companies or the politicians and the bankers who put us this road to fiat currency ruin by taking us off the silver standard?

2. Was it oil companies or the politicians and bankers who sold off ALL of our nations silver reserves?

3. How is it that as the politicians keep getting those fat campaign contributions and the bankers on Wall Street keep getting those fat yearend bonuses checks, you get up every morning and worry about how much gas and food have gone up and will you have a job next week.

But hey we do have your bread and circuses! Osama Bin Laden is dead, the dollar may take a dead cat bounce off of the .73 level for a few days, so all is well, right? After all its NBA and NHL playoff season, Baseball is just getting started, so we can get lost in that for awhile. At least until the cable company comes along and pulls the plug because your unemployment ran out.

Thank you Davis!

Greg

First it was Japan, then Tunisia, Egypt, Syria, Libya, throw in some tornado’s and now Bin Ladan. People are as numb a gum. Their eyes glaze over when you start talking Federal Reserve, inflation, deflation, silver or gold.

The hits just keep coming. The majority of people will be wiped out by what is coming and they don’t even see it.

US President John F. Kennedy planned to exterminate the privately owned Federal Reserve System. In 1963 he signed Executive Orders EO-11 and EO-110, returning to the government the responsibility to print money, taking that privilege away from the privately owned Federal Reserve System.

Shortly thereafter, President John F. Kennedy was assassinated. The professional, triangulated fire that executed the President of the United States is not the most shocking issue. The high- level coordination that organized the widespread coverup is manifest evidence of the incredible power of a “hidden government” behind the scenes.

Another myth that all Americans live with is the charade known as the “Federal Reserve.” It comes as a shock to many to discover that it is not an agency of the United States Government.

The name “Federal Reserve Bank” was designed to deceive, and it still does. It is not federal, nor is it owned by the government. It is privately owned. Its employees are not in civil service. Its physical property is held under private deeds, and is subject to local taxation.

It is an engine that has created private wealth that is unimaginable, even to the most financially sophisticated. It has enabled an imperial elite to manipulate US economy for its own agenda and enlisted the US government itself as its enforcer. It controls the times, dictates business, affects Americans’ homes and practically everything in which Americans are interested.

It takes powerful force to maintain an empire, and this one is no different. The concerns of the leadership of the “Federal Reserve” and its secretive international benefactors appear to go well beyond currency and interest rates.

the u.s. is up for sale cheap

Germany was hopelessly broke when Adolf Hitler came to power in 1933 . The Treaty of Versailles (le Traité de Versailles) had imposed crushing reparations on the German people, demanding that Germans repay every nation’s costs of the war. These costs totaled three times the value of all the property in Germany.

Private currency speculators caused the German currency to plummet, precipitating one of the worst runaway inflations in modern times. A wheelbarrow full of 100 billion-mark banknotes could not buy a loaf of bread. The national treasury was empty. Countless homes and farms were lost to speculators and to private Zionist controlled banks. Germans lived in hovels. They were starving.

Nothing like this had ever happened before – the total destruction of the national currency – German mark, plus the wiping out of German’s savings and businesses. On top of this came a global depression. Germany had no choice but to succumb to debt slavery under international Zionist bankers until 1933, when the National Socialists came to power. At that point the German government thwarted the Zionist international banking cartels by issuing its own money. Zionist bankers responded by declaring a global boycott against Germany.

Adolf Hitler began a national credit program by devising a plan of public works that included flood control, repair of public buildings and private residences, and construction of new roads, bridges, canals, and port facilities. All these were paid for with money that no longer came from the private international Zionist bankers.

The projected cost of these various programs was fixed at one billion units of the national currency. To pay for this, the German government (not the international Zionist bankers) issued bills of exchange, called Labor Treasury Certificates. In this way the National Socialists put millions of people to work, and paid them with Treasury Certificates.

Under the National Socialists, Germany’s money wasn’t backed by gold which was owned by the international Zionist bankers. It was essentially a receipt for labor and materials delivered to the government. Adolf Hitler said, “For every mark issued, we required the equivalent of a mark’s worth of work done, or goods produced.” The government paid workers in Certificates. Workers spent those Certificates on other goods and services, thus creating more jobs for more people. In this way the German people climbed out of the crushing debt imposed on them by the international Zionist bankers.

Within two years, the unemployment problem in Germany had been solved, and Germany was back on its feet. It had a solid, stable currency, with no debt, and no inflation, at a time when millions of people in the United States and other Western countries controlled by international Zionist bankers were still out of work. Within five years, Germany went from the poorest nation in Europe to the richest.

Germany even managed to restore foreign trade, despite the international Zionist bankers’ denial of foreign credit to Germany, and despite the global boycott by Zionist-owned industries. Germany succeeded in this by exchanging equipment and commodities directly with other countries, using a barter system that cut the private Zionist bankers out of the picture. Germany flourished, since barter eliminates national debt and trade deficits. Today Venezuela does the same thing today when it trades oil for commodities, plus medical help, and so on. Hence the Zionist bankers are trying to squeeze Venezuela.

Hjalmar Schacht, a Rothschild agent who was temporarily head of the German central bank, summed it up thus… An American banker had commented, “Dr. Schacht, you should come to America. We’ve lots of money and that’s real banking.” Schacht replied, “You should come to Berlin. We don’t have money. That’s real banking.”

Schacht, the Rothschild agent, actually supported the private international Zionist bankers against Germany, and was rewarded by having all charges against him dropped at the Nuremberg trials.

This economic freedom made Adolf Hitler extremely popular with the German people. Germany was rescued from English economic theory, which says that all currency must be borrowed against the gold owned by a private and secretive Zionist banking cartel — such as the Federal Reserve, or the Central Bank of Europe — rather than issued by the government for the benefit of the people.

Canadian researcher Dr. Henry Makow who is Jewish himself says the main reason why the Zionist bankers arranged for a world war against Germany was that Hitler sidestepped the Zionist bankers by creating his own money, thereby freeing the German people. Worse, this freedom and prosperity threatened to spread to other nations. Adolf Hitler had to be stopped!

Makow quotes from the 1938 interrogation of Christian Rakovsky, one of the founders of Soviet Bolsevism and a Lev Davidovich Bronshtein (Trotsky) intimate. Christian Rakovsky was tried in show trials in the USSR under Joseph Vissarionovich Stalin. According to Christian Rakovsky, Adolf Hitler was at first funded by the international Zionist bankers, through the bankers’ agent Hjalmar Schacht. The bankers financed Adolf Hitler in order to control Joseph Stalin, who had usurped power from their agent Lev Davidovich Bronshtein (Trotsky). Then Adolf Hitler became an even bigger threat than Joseph Stalin when Hitler started printing his own money.

Joseph Stalin came to power in 1922, which was eleven years before Adolf Hitler came to power.

Christian Rakovsky said:

“Adolf Hitler took over the privilege of manufacturing money, and not only physical moneys, but also financial ones. He took over the machinery of falsification and put it to work for the benefit of the people. Can you possibly imagine what would have come if this had infected a number of other states?” (Henry Makow, “Hitler Did Not Want War”).

Economist Henry C K Liu writes of Germany’s remarkable transformation:

“The Nazis came to power in 1933 when the German economy was in total collapse, with ruinous war-reparation obligations and zero prospects for foreign investment or credit. Through an independent monetary policy of sovereign credit and a full-employment public-works program, the Third Reich was able to turn a bankrupt Germany, stripped of overseas colonies, into the strongest economy in Europe within four years, even before armament spending began.”

(Henry C. K. Liu, “Nazism and the German Economic Miracle”).

In Billions for the Bankers, Debts for the People (1984), Sheldon Emry commented:

“Germany issued debt-free and interest-free money from 1935 on, which accounts for Germany’s startling rise from the depression to a world power in five years. The German government financed its entire operations from 1935 to 1945 without gold, and without debt. It took the entire Capitalist and Communist world to destroy the German revolution, and bring Europe back under the heel of the Bankers.”

These facts do not appear in any textbooks today, since Zionist own most publishing companies. What does appear is the disastrous runaway inflation suffered in 1923 by the Weimar Republic, which governed Germany from 1919 to 1933. Today’s textbooks use this inflation to twist truth into its opposite. They cite the radical devaluation of the German mark as an example of what goes wrong when governments print their own money, rather than borrow it from private Zionist cartels.

In reality, the Weimar financial crisis began with the impossible reparations payments imposed at the Treaty of Versailles. Hjalmar Schacht – the Rothschild agent who was currency commissioner for the Republic — opposed letting the German government print its own money… “The Treaty of Versailles is a model of ingenious measures for the economic destruction of Germany. Germany could not find any way of holding its head above the water, other than by the inflationary expedient of printing bank notes.”

Schacht echoes the textbook lie that Weimar inflation was caused when the German government printed its own money. However, in his 1967 book The Magic of Money, Schacht let the cat out of the bag by revealing that it was the PRIVATELY-OWNED Reichsbank, not the German government, that was pumping new currency into the economy. Thus, the PRIVATE BANK caused the Weimar hyper-inflation.

Like the U.S. Federal Reserve, the Reichsbank was overseen by appointed government officials, but was operated for private gain. What drove the wartime inflation into hyperinflation was speculation by foreign investors, who sold the mark short, betting on its decreasing value. In the manipulative device known as the short sale, speculators borrow something they don’t own, sell it, and then “cover” by buying it back at the lower price.

Speculation in the German mark was made possible because the PRIVATELY OWNED Reichsbank (not yet under Nazi control) made massive amounts of currency available for borrowing. This currency, like U.S. currency today, was created with accounting entries on the bank’s books. Then the funny-money was lent at compound interest. When the Reichsbank could not keep up with the voracious demand for marks, other private banks were allowed to create marks out of nothing, and to lend them at interest. The result was runaway debt and inflation.

Thus, according to Schacht himself, the German government did not cause the Weimar hyperinflation. On the contrary, the government (under the National Socialists) got hyperinflation under control. The National Socialists put the Reichsbank under strict government regulation, and took prompt corrective measures to eliminate foreign speculation. One of those measures was to eliminate easy access to funny-money loans from private banks. Then Adolf Hitler got Germany back on its feet by having the public government issue Treasury Certificates.

Schacht , the Rothschild agent, disapproved of this government fiat money, and wound up getting fired as head of the Reichsbank when he refused to issue it. Nonetheless, he acknowledged in his later memoirs that allowing the government to issue the money it needed did not produce the price inflation predicted by classical economic theory, which says that currency must be borrowed from private cartels.

What causes hyper-inflation is uncontrolled speculation. When speculation is coupled with debt (owed to private Zionist banking cartels) the result is disaster. On the other hand, when a government issues currency in carefully measured ways, it causes supply and demand to increase together, leaving prices unaffected. Hence there is no inflation, no debt, no unemployment, and no need for income taxes.

Naturally this terrifies the Zionist bankers, since it eliminates their powers. It also terrifies Zionists, since their control of banking allows them to buy the media, the government, and everything else.

Nalliah,

You forgot one very big reason Germany went into a financial tailspin, It LOST WWI!!!!! Did the Zionists cause that too. NO!!! I think it is a little simplistic and frankly historcally wrong to blame everything bad in the world on the Zionist bankers. I will accept no more comments on this subject.

Greg