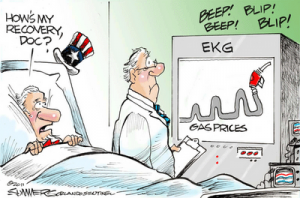

The Roller Coaster Ride of Oil Continues

Gas prices 2011! Oil prices are on the rise. The price per barrel rose again yesterday, and so did gas prices. According to AAA, the national average price of unleaded gasoline added a penny, climbing to $3.879 per gallon. It is already more than $4.00 a gallon on the east and west coast, and don’t expect the price to go down before it goes way up. James Howard Kunstler has researched and written books on fictional depictions of the post-oil American future. Kunstler forecasts very tight oil supplies, with dreadful consequences for our society. In his latest article, Kunstler takes the President to task for blaming the recent price spike on “speculators,” while turning a blind eye to the crooked bankers who brought down the world economy in 2008. Please enjoy this excellent post. –Greg Hunter–

Gas prices 2011! Oil prices are on the rise. The price per barrel rose again yesterday, and so did gas prices. According to AAA, the national average price of unleaded gasoline added a penny, climbing to $3.879 per gallon. It is already more than $4.00 a gallon on the east and west coast, and don’t expect the price to go down before it goes way up. James Howard Kunstler has researched and written books on fictional depictions of the post-oil American future. Kunstler forecasts very tight oil supplies, with dreadful consequences for our society. In his latest article, Kunstler takes the President to task for blaming the recent price spike on “speculators,” while turning a blind eye to the crooked bankers who brought down the world economy in 2008. Please enjoy this excellent post. –Greg Hunter–

——————————————————-

“The Banana Peel of Destiny”

By James Howard Kunstler, Guest Writer for USAWatchdog.com

That was a cute move by President Obama last week, calling out the “oil speculators” with a memo to his Attorney General, Eric Holder. The President proved a few weeks ago, in his energy speech to the nation, that he doesn’t understand how these resources are produced and traded. Consequently, the people he addressed remain clueless, but ticked off nonetheless. And the logic of politics now compels Mr. Obama to call out the dogs on… people who make money trading paper claims on oil?

Funny, he didn’t show any interest the past two-plus years in people who make money swindling taxpayers via booby-trapped Collateralized Debt Obligations and Credit Default Swaps. Maybe those things sound too abstruse to get excited about – but believe me, it was a heckuva lot more money. In fact, a case could be mounted by God’s attorney general – if he has one – that Mr. Obama abetted a gigantic conspiracy in fraudulent financial paper which makes the oil speculators look like shoplifters in a Kentucky Wal-Mart.

For those of you interested in the reality side of things, here’s the scoop: The price of oil is going to go way up, and way down, and way up again, and way down again until everyone is too broke to ask for any, and companies are too ruined to go get it for them, and governments are too broken to interfere in the process.

The oil speculators are normal characters in a stressed market doing what needs to be done on the margins of “price discovery.” The trouble arises when price discovery occurs in turbulent times and places, for instance, when people in a part of the world called the Middle East & North Africa (MENA, for short), start rioting against their governments, which has been the case persistently for a couple of months now – a region that contains about half the world’s oil reserves. So interested observers conclude there’s a fair chance that oil production there might face impediments to normal operations.

And indeed that is already the case in Libya, where some of the world’s lightest, creamiest, sweetest crude oil has stopped flowing into pipelines and tanker ships. With protesters being slaughtered by the score in Syria, and Yemen’s president about to get a one-way ticket to Palookaville, and the Saud family cowering in their solid-gold senior housing facility, and affairs looking sketchy at best in other nations around that neighborhood, speculators at the margins have called for higher oil prices.

You will recall, perhaps, that hoary old concept, the “bumpy plateau” of the peak oil story. This was the idea that the actual tippy-top “peak” of peak oil, studied at close scale, would actually take the form of a raggedy line representing the interplay between supply, demand, and most importantly the frantic psychological response of humans operating in markets. It was clear that economies would stagger under the burden of high oil prices, and economic activity would contract, and people would use less oil and the price would go down. When prices were real low again, people would resume buying more oil (and other stuff) and economic activity would mount and oil prices would go up again. We knew this would happen for a couple-few cycles, and that then things would get… more interesting.

We also knew that this would occur with some “ratcheting side effects” – that with each cycle of up-and-down oil prices, against the background of permanent a decline in easy-to-get oil, there would be less money available to find, drill for, and produce future harder-to-get oil. What we did not know – at least in the morbid clerisies where academic economists spawn – was that the permanent decline in easy-to-get oil would introduce gross disorder into our money systems, nor that we would incessantly lie to ourselves about the health of our money systems, until their operations were so fatally compromised and impaired that their failure was likely to put us out-of-business even before worse imbalances came to pass in real oil supply and demand.

Of course, we also didn’t know that MENA would explode in political unrest in early 2011, or that the earth below the Japan Trench would shudder badly, and no doubt there are other things we can’t predict that will affect the global economic dynamic. But you do what you can with what you’ve got to work with, and here in the USA collective intelligence space, we’re not doing such a great job.

Tensions keep rising around the distortions and perversions now loose in the money system. You can get a headache thinking about inflation and deflation – but either way you stand to end up broke. Either you’ll be rolling in worthless money or you won’t have any money. The banana peel of destiny can send you flying in either direction, or first one and then the other.

We’ve done a poor job of managing contraction, which is the fate of societies that have piled up too much complexity. All of our schemes for grappling with this seem to boil down to one foolish obsession: how can we keep all the cars running? We’re not going to, of course, but we refuse to even think about anything else. President Obama is merely reflecting the foolish obsession of the public.

Whenever I give a talk at a meeting or a college, somebody gets up and censoriously asks we why I can’t present “solutions” to the problems of contraction we face. I do of course. The audience just doesn’t hear them because I don’t believe it is possible to keep all the cars running and I don’t pretend that any of the schemes currently circulating will avail. To go a step further, I’m convinced that we are committing cultural suicide by using all the cars the way we do, so I am not the one to look to for rescue remedies in this department. In fact, I am serenely persuaded that we would vastly improve our chances of remaining civilized if we gave up on mass motoring and deployed ourselves on the landscape differently.

By the way, that will be the eventual outcome anyway, whether we like it or not.

In the meantime, prepare for thrills and chills in the alternate universe of money. The phase of that story we’re approaching looks more and more like the final scenes of the old Todd Browning horror movie about the uprising in a freak show. America can have the role of the pinhead, grinning vacantly while the other freaks burn the joint down.

________________________

Mr. Kunstler is a prolific and talented author. Some of his recent books include: “The Witch of Hebron,” “World made by Hand,” and “The Long Emergency.” To check out Mr. Kunstler’s bio (click here.) To go to his website (click here.)

Sorry, but a farce of a distraction from the true driver of this economic meltdown: Fed “money printing.” I could write a contrary story about expansive coal and oil reserves in this here country. I won’t because for the most part it’s irrelevant to the unmistakably superior issue of central banking. Let’s deal with the banksters first Mr. Kunstler, then we’ll address the possible ramifications of your peak oil theory–and NOT the other way around.

I know, I know…the earth will warm, or the people will overpopulate, or the asteroid will hit…peak oil his here! Yeah, I’m not buying it.

Life, Liberty and the pursuit of Happiness and END THE FED!!!

Thank you Kevin for adding your perspective!

Greg

Kunstler: “…was that the permanent decline in easy-to-get oil would introduce gross disorder into our money systems.”

Please refer to Peter Schiff’s latest video blog for clarity in the discussion of oil pricing: http://www.europac.net/media/video_blog/record_low_gas_prices_imf_china_us

“Peter Schiff was [and is] right.”

“Remember that prosperity can only be for the free, and that freedom is the sure possession of those alone who have the courage to defend it.” – Pericles

Greg, one thing I have noticed over 45 years of watching the price of gas is that it goes up and goes down as Mr. Kunstler described but it never really gets down below the last low – always settling at the pump just a little higher than the last low. This time it is different also. In 2008 when a barrel of oil went to $140 a gallon of U.S. gas cost about $3.90, but we have over that price now when oil just went to $105.00; go figure that one.

The end game then as I understand the article is that we will change our driving habits among others, but in reality that is allready happening. Many people are adjusting to the price at the pump by combining multiple trips around town to one trip, etc. – and, when prices rise futher more changes in our lifestyles will be mandated. Mr. Kunstler has foreseen the future here within the middle class. As prices of everything go up adjusting for those increases mean cutting one place or another, we go out to dinner very seldom now as an example of cost cutting. What Mr. Kunstler knows but didn’t convey very well in my opinion is that when you have cut everywhere

you can and on every level to keep up with inflationary costs of every day living and its still not enough then things will get interesting or another way of saying it is: Then shit will hit the fan.

Art,

Good point “it never really gets down below the last low – always settling at the pump just a little higher than the last low. ” Thank you!

Greg

And isn’t it interesting that current events in MENA coincide with with a US administration that is clueless in foreign affairs and no longer feared as the world’s cop on the beat? Obama is personally presiding over MENA becoming a jihadist region that will eventually stop selling oil to the West, causing the fall of the western economies.

By staying on the sidelines Obama is either complicit with the jihadists (traitor) or a fool……or both.

Jim in GA,

Thank you for your comment.

Greg

Lets just understand one thing please- America has we “knew it” is over! Normally here in Cleveland,Ohio we’d watch those 3rd world countries on our TV’s…..now all one has to do is step outside and see it up close and personal- globalization did its job,didn’t it? After all,when Obama stated “Change is coming” he meant what he said- everything else is a mere side show for your enjoyment- excuse me if your too broke to enjoy it….besides walking is good for you,look how healthy your going to get pushing your car to the pump,growing your own food and ducking them bullets (here in Cleveland)

Norm Ezzie,

Thank you and yes – “Change is coming”!

Greg

Nice comment Norm Ezzie, yea, on the Western Front you got one other thing as well, when you walk out front you need to take your travel language dictionary with you as well so that you can ask for help to push your car to the gas station. Certainly, change we could believe in had allready changed at the last election and all we got was more of the same.

When O’Reilly and Obama are on the same page, you know you’re being had.

So now our would-be “master of all things energy related” has decided it’s time to take on the “corrupt speculators” in the oil market. I’d say this was hilarious but unfortunately he’s serious. But what are we to expect from a neophyte whose depth of understanding of how markets and economies function is about as deep as a mud puddle after a quick spring rain. What’s even more disturbing is seeing populist pundits of the so-called “fair and balanced” kind carrying his water and providing political cover by spouting the same garbage.

This is what happens when ideologically driven politician and pundits listens to a bunch of ideologically driven economists who have no more of a clue than they do. Pundits, Presidents and economists have no more influence on the state of the economy than the weather man on the six o’clock news has influence on what tomorrow’s weather will be.

We’re in this mess because politicians and economists think that all that is needed is just one more government intervention, one more tweak to the system is all that’s needed to fix a particular problem or aspect of the economic landscape. Too bad for these self-important and self-proclaimed experts, economics operates in a vast interconnected world of supply and demand, and reacts in direct correlation to actual and/or perceived value of the currency of exchange.

Both the Obama administration and O’Reilly are engaged in a pernicious little game of either denial of reality or deliberate obfuscation in order to keep the public from casting a critical eye upon actual cause of rising energy and food costs, namely a weak dollar policy, endless spending by Congress and endless printing at the Federal Reserve.

Where O’Reilly’s reasons maybe simply be to further his populist reputation, Obama’s, being a politician, are far more cynical. All the rhetoric about allegedly wanting to defend the consumer aside, his focus is on getting himself re-elected and the “record profits” and speculation make for a convenient scapegoat for his dismal failure on the economy.

In the meantime this false narrative will be played for all its worth by the media and campaigns. None of which will do anything to change the underlying spending and printing problems or slow down the unraveling of the economy by but a fraction. O’Reilly and the like will use their stance to try and apply pressure to the Republican candidates to if not endorse, at least not oppose the continued kicking of the can down the road.

Both sides are making the bet that our fractured economic system can be held together long enough to ensure that the next President whoever it may be will not be someone who will challenge the corruption of the existing incestuous relationship between Wall Street, the Treasury Department and the Federal Reserve.

A lot of things can change of course between now and the nominating conventions and the election, and it would be my bet that they will. During the first two years of this administration the big “inflation is under control” con job has held together. One of the factors helping this has been the American family, those that still have jobs anyway. In the face of what they better recognize than our so-called political leaders as economic uncertainty at best and disaster at worst, they have cut back on spending, added to savings, paid off consumer debt and some have even made extra payments on the principle of their mortgages. All this has had the definitive effect of decreasing the velocity of money through the economy. But now the cumulative effect of decades of growing spending, growing debt and just plain bad monetary policy have triggered a growing political instability in the Middle East and are exacerbating the all too predictable and inexorable beast of inflation.

With these responsible and frugal families seeing the evidence spreading all around them, higher prices at the gas pump, higher prices and smaller packages at the grocery store, lower interest on their savings and higher charges for using their credit cards, we can fully expect a shift in the mindset of these formally frugal families. With a growing sense of futility for all their efforts, and seeing that each new pay check is able to buy less and less, therein lays the danger of a paradigm shift in their attitude towards money itself.

Why postpone on spending on the everyday things they need to survive, when they know full well that by the time the next paycheck arrives things will be even more expensive? Why try to save when it’s buying power shrinks exponentially against any interest payments they may earn and the anticipated price for whatever they are saving for? When this change in attitude sets in look out! When the acceleration rate of money through the economy goes up, the already increasing inflation rate will be placed on steroids. Throw in another economic or political shock event and the breaking point will be reached and all confidence will be lost in the viability of the Dollar. That will be when bad inflation will tip over into hyperinflation. When that happens, all bets on the existing system will be off, violence will rear its ugly head and people will listen to any demagogue that comes along and makes the promises they want to hear. Fear will become the driving motive of politics.

Davis,

Great points. Thanks.

Greg

Davis, your reply is better than Kunstler’s article. Thank you.

It’s a very simple understanding. Oil is reaching it’s peak, we can no longer grasp the concepts of “Cheap Oil”. The roller coaster is going to go spiraling. Many countries – including china – have begun working toward solutions. What are they? Alternative renewable forms of energy for travel, production, and distribution. With cars for example, it is completely wasteful to have everyone own a car. What is the purpose for the car? That’s what’s more important. Take out the use of so many vehicles and create a tram system. We have the technology to make maglev trains run at least 500 mph. Maglevs are much more efficient to get one from point A to point B. With Airplanes, we have the technology to have our planes run off other forms of energy that are much more effective and does not harm the environment. People will have to wake up. We’re in the 21st century, it’s time to evolve once again.

Davonne,

People definitely need to wake up!

Thanks.

Greg

The administration hidden agenda for alternate energy understands that gas has to get to a certain price for other energy sources to be economically viable – therefore, the middle east producers & our oil companies know nothing will be done to reduce the prices here at home or abroad. That is why I believe Mr. Kunstler’s article is foolish in saying oil will go way up and then way down again, etc.

Its going to stay up and go up a little each month until the government is happy and the oil companies can get placed in the “green” alternative energy field(s) and control that price as well as the change is completed.

davonne,

sorry pal, but your thought process has been hijacked and replaced with regurgitated double speak. peak oil is a huge lie, maybe the mother of all lies and you have, through sheer laziness, bought into this lie because it is a lot easier than actually doing the research. let the powers that be supply your opinions for you instead of forming your own.this is the perfect example of the useful idiot.

ahhhh the liberal mindset, every bit as disturbing as religionism or neoconsevatism. all short on facts and long on “idealism”>

you ask, in your liberalistic goofiness, “what is the purpose for the car>” let me give you the simple answer. the purpose for the car is freedom. the ability to go where you want, when you want. and, not coincidentally, that is exactly what is at stake here. freedom, liberty, human dignity. so wake up buddy, we need you sober and alert and thinking on your feet.

back to that peak oil is a lie thing: a couple of facts that may have not come across your personal pervue.

1. there is more oil under the shores of the united states of america that in all the rest of the world combined. by far! dependence on foreign oil producing nations is a diabolical scam that could not have gotten legs without the dedicated assistance of the msm, and the assistence of true believers like yourself.

2. “the powers that be” find such things as free thinking individual humans, well fed humans and independently minded humans to be a threat to their agenda of world dominance. they have wet dreams of a world wide feudal system by which all productive effort is for their benefit. i know this sounds a little out there, but they really do want most of us dead, and the rest of us to serve them.

3. obama is just another of a long line of sock puppets in the white house. take george bush senior out the mix, and go all the back to lyndon johnson and you have nothing but installed shills doing the bidding of the bankster elite.

greg, thanks for this forum, it is good to see so many waking up to the fact that everything they once knew is wrong, but there a so many more dots to connect and so little time left to connect them.

if WE THE PEOPLE do not soon understand that the real power lies with us (don’t believe me? get in a time machine and go ask marie antoinette.) we are truly doomed to hell on earth.

don’t wanna look like a total doomsayer here, i believe in humanity. just getting a little antsy as to where the spark is that is going to ignite us.

Greg: good article. Glad to see someone is keeping the Libyian and other revolutions in front of us. Watching the scarcity of reporting on Libya and Tunisia et al, in the national media, one would think the revolution is over and life has returned to normal in Libya and rest of Africa. Thanks. As Always, “great stuff”. Regards, Ken.

Thank you Ken.

Greg

I would think that this will become a time of innovation. Something bigger than what we see now (wind power, battery powered autos, etc.). However, there is still the apparent coruption within our democratic system. Can anything truly be done about it. Is government still truly for the people ? Are we still a sovern nation ? Are the people in this country still loyal to America ? The future will certainly be interesting to say the least.

With all respect to Mr. Kunstler’s opinion, he missed the mark badly on what this issue is all about…..I am surprised with all his talent posted above that he either does not grasp the depth of this issue as counter point or chooses not to….so am not so surprised with his doomsday ‘go along’ scenario. He seems to present us with the ‘inevitable’, and of course, it will be if the alternative path is left unlit…..Greg – thanx for posting this, ‘it speaks volumes’ as the saying goes…

you think the pension funds aren’t getting in on some of that oil profit. I think it’s a funding system that’s been used instead of raising taxes. Just like inflation boys an girl it’s a proven system of funding. peace lol.

I have to agree with Kevin. As Peter Schiff pointed out, in the 1920’s, a gallon of gasoline was 20 cents. Today’s melt value on a 1920 Mercury Dime is $3.47. So, if we were using real money as defined in the constitution, would gas really be any more than it was 90 years ago? In fact, it’s less. Pretty much every problem we face is rooted in Fed Money printing.

tom,

that 20 cent price held until the early to mid 60’s. comparing the price of a gallon of gasoline to an ounce of silver can be a little misleading. as you and mr. schiff adroitly pointed out, the price of silver and gold have kept pace with the price of gas and now are even more valuable. the fact that these metals have outpaced gas should be a concern to those considering investing in metals. first rule of investing, buy low. metal prices are in a bubble, even if they do go higher, their cost does not reflect true value. when the shit hits the fan, your stockpile of gold may get you a few meals for awhile, until reality kicks in and folks start to figure out that these metals have no real value in the new order of things because, hungry people are not so swayed by bling. and if you have let yourself become deluded into thinking that the great depression of 29 can be any kind of model for the really great one that has already begun, please think again. the one huge difference between 1029 and now is that the dollar did not lose its value during the 29 depression, it actually gained value because it remained rather scarce. that’s not going to happen this time. this one is for real.

fiat monay is not about devaluing the dollar so much as it is about devaluing you.

I have been telling people since Obama hit the campaign trail this guy is a Trojan Horse. His Czars & Executive Orders are the new soldiers coming out to destroy the nation.

Greg,

Kunstler is playing that “Green Game” in my humble opinion. Alternative energy like our overall energy policy is just a mishmash or crappy legislation and regulations that helps no one.

While I agree this is part of the problem. I also have to add that the FTC and the CFTC is also being hammered by the financial and commodities trading industry lobbyists who do not want any regulation governing oil speculation or controlling it as a commodity, which is a huge problem. Currently, out of control speculation counts for some .69 cents per gallon of gas. Add, to this the Middle East situation, POEC, state taxes, crappy policy, speculators and you get $5.00 a gallon. There is really no supply problem here. US Refining problem? Yes, we have not built a refinery since the 70’s. But with the NIMBYS and USEPA we will not either….

But, it’s not just about big oil and OPEC its about taking the caps off a commodity that is not just a economic driver but a national security driver as well , while allowing traders to set the prices without governance and then add firms like Morgan Stanley, Bears Sterns and JP Morgan to be designated as “oil producers” to short change the 2008 Dodd/Frank Legislation. Yes some speculation is a good thing, but to just let the speculators off the hook and run wide is not very bright. We are talking about oil here and for the time being there is plenty of that around (peak oilers begone), not oranges….

We need not to just stop the ever ending luxury or sin taxes, lack of a sound energy policy, but also the out of control speculation of that national security resource and market driver, not to forget, the out of control and misguided government spending.

Tremendous issues here. I am very happy to see your article. Thank you so much and I’m looking ahead to touch you. Will you kindly drop me a e-mail?