Housing is Dragging the Economy to Hell

A little more than two months ago, banking analyst Meredith Whitney said on CNBC, “Unequivocally, I see a double-dip in housing. There’s no doubt about it . . . prices are going down again.” I’d say unequivocally she was spot on. A few of the hellish headlines dragging the economy down include: Existing home sales dropped 27.2 percent from June. That is a record drop and a 15 year low. One in ten mortgage holders in America face foreclosure, according to a new report by the Mortgage Bankers Association. U.S. home prices fell 1.6 percent in the second quarter from a year earlier as record foreclosures added to the inventory of properties for sale.

Two months ago, in a post called “Double Dips Coming Everywhere,” I wrote, “Whitney warned as foreclosures and short sales go north, bank profits head south.” The news stories, just this week, confirm Whitney was right again.

A tanking housing market is not just a local issue. Recently, one news paper in Myrtle Beach, South Carolina, explains succinctly how sour real estate problems on Main Street are traveling straight to Wall Street. It said, “The role that mortgage-backed securities played in this nation’s economic meltdown is well-documented, both in congressional hearings and on the best-seller list. That meltdown has led to a landmark lawsuit filed last month by an investment group that claims banks knew the securities were worthless but, driven by greed, sold them anyway. But the Myrtle Beach area’s contribution to those toxic investments has largely been hidden in the minutiae of paperwork filed at Horry County‘s register of deeds office. As more of the homes tied to those investments go through foreclosure, however, the path from here to Wall Street is becoming clearer.” (Click here to read the entire article from The Sun News.)

Falling home prices and rising foreclosures are not the outcomes the Fed was looking for after spending more than $1.4 trillion buying mortgage debt. Now, the Fed is at is again, this time, making an announcement to spend at least $10 billion a month buying U.S. Treasuries. According to a recent Bloomberg article, it will be much more than that. The article says, “JPMorgan Chase strategists estimated the Fed will buy about $284 billion in Treasuries during the next year.” (Click here for the complete Bloomberg article.)

The Fed buying debt helps to suppress interest rates by creating demand. It is no small wonder that mortgage rates fell to the lowest level on record this week! 30-year fixed-rate mortgages averaged just 4.36 percent according to government mortgage giant Freddie Mac. Some of those cheap rates are due to low demand from plunging home sales; but some, no doubt, are due to the Fed buying debt. (Plunging home sales mean prices are the next thing that will fall off a cliff.) These kinds of actions by the Fed are not even close to signaling the end of a bad housing market—quite the opposite.

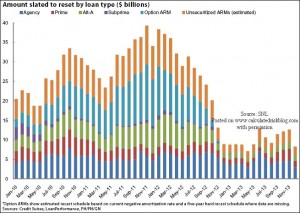

My favorite chart on housing says it all in one picture. Billions of dollars in mortgage interest rate resets will be hitting the market from now until the fall of 2012.

This chart must scare the Fed as much as anything out there. Higher interest rates due to resetting adjustable rate mortgages will mean more defaults as people are unable to make the higher payments. The mortgage market makes up the lion’s share of the more than $600 trillion Over-The-Counter derivatives market. This is what some call dark pools of debt with few rules, guarantees, regulations and zero public market. This dark pool of debt is worthless, or worth a lot less, than the original sales price. (Some experts say the true size of the OTC derivatives market is more than $1,000 trillion.) If these securities start going sour in mass, it will be “deja vu all over again.” Another financial meltdown would occur, and there is no guarantee the Fed could stop it as it did in 2008.

According to John Williams of Shadowstats.com, the recent bad housing news is signaling what he calls an “intensifying depression.” The Fed is looking, once again, like the buyer of last resort by printing money to buy trillions in debt from Treasuries to mortgage backed securities. This is very dangerous and could spiral out of control, according to Williams. He’s been warning about this kind of scenario for a couple of years. In May, he wrote, “. . . eventually domestic and foreign balking at buying U.S. Treasuries should become widespread, with Fed becoming the buyer of last resort, monetizing that federal debt. Coincident with that likely will be heavy dumping of the U.S. dollar and dollar-denominated paper assets. Such should spike U.S. money supply and dollar-based oil prices. The pace of inflation would tend to pick up significantly in response to these circumstances, setting the stage for . . . hyperinflation.”

I think the choice is coming down to defending the dollar, or printing money to buy debt, which will stem defaults and hold interest rates down. With zero interest rates and massive money printing, it sure looks like the dollar is damned. The only question–how much will it fall?

Excellent article which describes the situation we have been enduring since 2007. While I thought GW Bush was a rather lame excuse for a president especially after invading Iraq, I miss the economy prior to 2006. I would go back to the failed ideas that gave us 4.7 percent unemployment and a 400 billion dollar deficit.

Had Bush hotly pursued the reform of Freddie and Fannie it is unlikely that we would be looking into the abyss that faces us now. Cowardice and bullying are not leadership, yet that is what passes these days. I wonder how many remember the asinine comment from the head of Bank of America in reply to a question about the crisis in 2009? He said that he and his colleagues could not imagine housing prices declining. Is it any wonder we are in financial trouble? This is the same attitude promulgated by Dave Ramsey when he says “Don’t buy gold you’ll just look stupid”

Our fellow citizens must be prepared to muddle through a very difficult period similar to that of the lost decade of the 1930’s. I think it will be worse simply because we are now a much more urban society and many of us are dependent on the labor of others for survival. EBT cards won’t save us.

Thanks John for the comment.

Greg

Greg, where is the “summer of recovery” the main stream media and Obama promised? The economy is like any other dynamic system; it seeks equilibrium. We have artificially forced it up and the pressure is building for a dramatic reset or downturn. Just like you have been saying for years both on TV and now on the USAWatchdog, we are in for a correction.

George,

This was not the summer of love for the economy and it will be one hell of a fall. Thanks man!!

Greg

Hey Greg and George,

“We have artificially forced it up and the pressure is building for a dramatic reset or downturn.”

This is not rocket science. Eigth grade math and simple logic are what we need to chart a course to recovery. I keep using the heroin analogy, but George’s explanation is much better.

And Bernanke promises more artificial stimulus “if needed.”

No wonder he won’t publish M3. He does not believe in a free market.

markm

markm

Hello Greg,

I need to rant here.

I keep hearing in the MSM that we may be on the precipous of a double dip. Where was the recovery? Pumping printed money into a faultering economy creates the ski jump graph. It does not create economic growth. It is heroin to a junky with after effects included.

Where was the recovery?

Some more good news from MSM. This morning, at the top of the hour news on Sussman’s show, the reporter said that the economic numbers were better than the “Street” had anticipated. GDP was revised down to 1.6% from 2.4% for the second quarter!! Wahoo, Wahoo, Oohra! Backflips and more backflips! Yeehaw!

Am I supposed to be happy about a 1.6% growth rate? WHAT RECOVERY?

I knew the conditional growth rate of 2.4% was highly fudged by the regime when they announced it.

End of rant.

Oh yeah, the slump in housing sales is a direct result of the heroin that our messiah pumped into the housing market. Printed money will not create economic growth.

An x-candidate for Kalifornia Governor, and now my Congressman, told a small group which included me, “If you live beyond your means today, you must live below your means at some point in the future.”

Yeah, I know, McClintock is just a simpleton from “flyover country.” He does not have a graduate degree from Havard, or Yale. But, his simple qip is reality. Us simpletons know more about economics than the administration does.

markm

MarkM,

Good rant! Thanks.

Greg

From the US Census Bureau two days ago:

“The median sales price of new houses sold in July 2010 was $204,000; the average sales price was $235,300. The seasonally adjusted estimate of new houses for sale at the end of July was 210,000. This represents a supply of 9.1 months at the current sales rate.”

9.1 months?!? Is there really any doubt that QE2 is right around the corner? Just as in 2008, politicians in DC aren’t going to let this fall apart just before an election. The response will be predictable.

I’m loading up on silver before it’s too late. QE2 will be the death of the dollar.

MikeD,

AG is very cheap right now. You are thinking right. Thanks for the comment.

Greg

And the sheeple go about their daily pursuits completely unaware of the coming disaster while the media lie through their teeth that all is well because the Messiah has the situation under control. Unbelievable.

Wallstone,

Yes, I agree, Unbelievable. Thank you.

Greg

While I agree with the drop in prices around the corner I keep waiting for the big drop which I’m not seeing. Where are the 3MM apts in Manhattan going for 250K? I look for Brownstones in Chicago on Craigslist constantly looking for that “deal” and I still can’t find it. People would rather foreclose, and the bank would rather hold then sell at bargin basement prices. A 1MM home is a deal at 850K? Call me when you want 100K.

It’s the slow bleed that’s killing me.

Zippy,

This is a process. Just wait until interest rates return to normal. What do you think will happen to home prices when rates are jut 7 or 8 percent? Hang in there, You will not miss the housing recovery.

Greg

Its time to call,write,get in the face of our reps in DC to follow Ron Paul’s act to audit the fed,treasury,all of the gold/silver that the USA holds. Andrew Jackson did this to the 2nd private for profit banking cartel that led to closing the banksters down,the owners had all their Assets seized here & abroad to pay off our nations debt & returned the control of our monetary system to the congress where gold/silver backed the US dollar,no more FRNs that is no more than a debt based monetary scheme back by nothing but debt! The agents of the Rothschild’s have controlled our politicians since 1913,the time has come for Americans to demand the return of rule of law stated by the Constitution that only Congress has the power to coin money(silver/gold)to back the US Dollar,no more debt based FRNs backed by nothing. Nov will be our test,if we fail to remove those RINOS & PROGRESSIVES with those that follow the rules set by the Constitution,the Republic will no longer exist where freedom,innovation,free markets used to draw people from all over the world to live the American dream. Jim Sinclaire has all you need to know today on his free website, take a look! JSMINESET.COM 27,Aug,2010.

MickeyS,

I have deep repect for Mr. Sinclaire. He is one of the good guys! Thank you for your comment.

Greg

So lots of adjustible mortgages are coming due. Not a big deal if the rates are lower when they adjust – is it?

What makes you think rates will be higher wehn they are set to adjust? The FED has done a reasonable job keeping rates low so far…

Regards,

Preston

Preston,

You got it. Thank you for your comment.

Greg

UKman,

You sound like and insider or at the very least a very knowledgeable person. Ever since I heard the LMBA had 100 to 1 leverage I knew the market was rigged. Until that point, I had my doubts but no longer. We are talking about a BULLION market with 100 to 1 leverage. That is nothing more than a rigged casino game. Gary Gensler (former Goldman guy) has done nothing at the CFTC on naked short selling. I believe the market will fix this criminal mess, and it will not be pretty. Thank you for giving readers here this important perspective. Please comment again.

Greg

More and more folks are learning the basic lesson that the more you try to suppress the market from correcting imbalances, the worse the ultimate and inevitable correction must be.

I predict a continuing economic decline in the official numbers, which will trigger much more QE by the Federal Reserve and perhaps another unpopular rammed-through huge “stimulus” pork barrel bill by Congress.

If the Dimwits lose the House, these Progressive idiot ideologues will probably pass the Mother of All Stimulus Bills in their lame-duck session.

While they’re at it, they might as well do cap and tax.

Oh yeah, I almost forgot. They’ll not act to extend the Bush tax cuts, but they’ll offer some little teaser to mollify the “po’ folk”—another minimun wage increase, jiggering the tax code personal exemption or deduction, etc. Nothing to encourage private sector firms to hire more full-time employees, mind you, or control wild gubmint spending.

Good comment Monnie, You too MarkM.

Thank you both.

Greg

It would seem to me that if the “average” price of homes sold in july was $235,000 then this depression really is doing what they’ve always done….make the rich richer…..my logic?

Well, do YOU have 235 large to spend on a house right now? Can any “average” citizen get a loan for $235,000 right now? The answers (at least in my case) are no, and no, respectively. Those houses were probably paid for in cash and were originally 500,000, but the previous owners just walked out on the payment, givin the upper class only the balance that remained to buy it. Even at a decent pay rate, my rent is only 550 a month but with skyrocketing insurance, and every other bill thrown in, there is NO F’IN way i could afford a 1500 dollar a month house!! hahahhahhha!! not even close!!! hahahhahahahah $235,000????? The average person cannot even SPELL that amount… ( i have to type it…)

Brian,

Good point.

Greg

The media have made me all warm and fuzzy inside. I think I will go back to sleep now……………

where is the comment from UKman?

George,

I don’t know what happened but it vanshed from the site. This has never happened before. Thank goodness I saved it in another format. Here is the comment from UKman:

Twice a day, a few men teleconference in total privacy to set the AM and PM price of a product that turns over $Trillions pa. These men are unaccountable to no-one but their handlers. They are the banking members of the LBMA.

In any rational nation and other markets, this behaviour would result in hefty fines and long jail terms. It is a regulators wet dream.

The companies that those men represent also have representatives operating on COMEX daily, active in the manipulation of precious metals in the same way as is done on LBMA, but at least COMEX is visible.

From the outset there was a concerted effort by the FED and its cohorts to deny any efforts to regulate the OTC derivatives that those same companies that manipulate PMs created on the ’90s, the very companies and derivatives that also created the housing nightmare.

The evolution of derivatives in their many forms has been praised in writing by the BIS. The heads of most nations central banks attend regular meetings at the BIS, always in total secrecy.

The BIS claims for all its members absolute imunity from prosecution, globally.

The BIS is responsible for the engineering of this financial fiasco, and there can by no doubt also of its prior awareness, and very long term planning in this respect. The recent bailout using “BIS Gold” was aimed at rescuing the LBMA, not what we have been told!

Exactly how far does the BIS claim of legal imunity extend to bodies working to its long term agenda? (and would they even admit to such an agenda?)

This agenda has been the maintenance of western financial hegemony, pricipally by levered deceit, which, as in all fiat systems, eventually collapses under the weight of exponentially increasing debt repayments. These structures are now coming under heavy attack.

The centre of gravity of this system is now visibly moving to the East, and those self same operatives are rushing to set up new HQs in the East, having bled western nations to their knees, and debt serfdom.

Surely it is time for the population to be made aware of this blatant criminality, this outrage, in simple terms, and fingers pointed at the guilty parties. Their names are known globally, most make no attempt to hide. Where can justice be sought?

———————————–

I hope this guy becomes a regular on the site. I think he is some sort of insider.

Greg

UKman, Well said! These criminals should be brought to justice.

I hope UKman becomes a regular too. I think many have felt someone was pulling strings to make all the dominos collaspe at the same time. I guess we can count on continuing bubbles, commercial real estate, student loans and credit card debit should keep the Fed printing presses running 24/7.

Jan, Me too. George, I agree!!

Greg

With all of this endless money printing and debt monetization that has and will continue to occur, the dollar is being devalued. It already has been, it just hasn’t occurred to the masses yet. When the people finally realize what has happened and they lose confidence in the currency it will be a waterfall event with the dollar falling off of a cliff.

Gold is going to be the beneficiary of this as people rush out of dollars and into real money and tangible assets. If gold is a good value here, silver certainly is even better. Gold trades for $1240 an ounce. Silver is dirt cheap at $19 per ounce.

Silver Rarer,

Good point. I think everyone should own for gold coins, and I agree silver is a very good value right now. Thank you for the comment.

Greg

I remember the good old days of 18% rates for a house loans. If you were a buyer to bad but the paper holders had a hay day. If you had money to invest times were good in the 1980s. Still we had high inflation with high rates. It was a hard time for young people 10% unemployment. If I had a young family to take care of like I did back then it seems to me I could do better right now, with cheap home prices, cheap rates and a good cheap use trucks Now after a life time of work and a little money save up to invest no safe place to make that money grow are just keep it’s worth but that’s OK. Anything is better then bleeding young people with high home rates.Whatever happens in the future and I don’t believe anyone knows for sure but the one sure plan is don’t buy anything you can’t afford and don’t give loans to people who can’t afford them. This simple plan work good for many years. Life before easy credit was good for everyone.

Thank you Bob.

Greg

Hyperinflation will come, it is just a matter of time. I wonder if we will see hyperinflation across all asset classes? I think those items that require credit like a home, car, etc… will deflate while food and energy will inflate. What are your thoughts?

James,

Home prices are definitely are headed lower, and when the dollar tanks energy will undoubtedly spike. I think you are thinking correctly.

Greg

The stock market has gone up quite a bit during the past week and it is hard to figure out why. I must wonder if this is going to be the next big bubble blowout? I surely would not want to be buying stocks right now!