How Do I Protect My Assets?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

The FDIC just shut down another 6 banks last Friday. There is no end in sight for the bank failures coming. To make matters worse, the FDIC is way more than $8 billion in the hole as far as insurance funds to close insolvent banks. That is pretty scary if you ask me. Many people have been asking how they should protect themselves? One of these people is Susan. Please check out Susan’s email to me and my answer on how you can get yourself ready for the economic storm that is blowing our way.

(email from Susan)

Thank you for your article, Greg. In your opinion, is it safer to deposit

my money with a reputable credit union and

stay away from the big banking cartels?

If the FDIC is broke and borrowing money

from banks, will they also dip into credit union funds which are regulated at a federal level? Thanks for your reply.

Susan

Susan,

I think what you want to know is how to protect yourself. I wrote a post in August called “Get Out Of Debt, Stay Out of Debt!” It is really a

“how to” on hedging yourself. You cannot truly hedge your investments if you have lots of debt. In this post I give links on how to check your bank.

Listen up… I do not bank where there is a brokerage. That is because the Fed allows brokerages to “borrow” depositor’s money in time of economic calamity. The FDIC is effectively broke, and I do not want the bank lending my money to the brokerage. So, a small top rated bank or credit union are equal as long as there is no brokerage. You can check your credit union or bank at Bankrate.com and I provide links in the post highlighted above.

Also, if you have a brokerage and you are holding securities outside of an IRA or 401K, make sure your assets are held in what is called “book entry.” That means to hold your securities in your name instead of in the name of the firm or brokerage. In a bankruptcy, you want your assets held in your name. If the brokerage gives you any grief about it, move your money, it is not safe. Assets in IRA’s and 401K’s should be titled “For Benefit Of” or FBO by the fiduciary. The brokerages I mention in the post “Get Out of Debt and Stay Out of Debt” will hold securities in a book entry and title them correctly if they are IRA’s. (This was not in my original email response to Susan.)

That said, until you are out of debt and you hold physical gold (that means gold coins in a bank safety deposit box and not an exchange traded fund like GLD) you are not protected no matter how solvent your bank or credit union is. The reason is the dollar (the currency you are saving your money

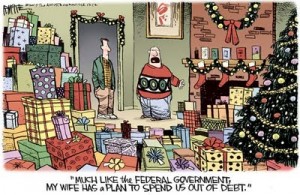

in) is collapsing in value. I do not know how else to say this, but the United States (or any other country) has never done this kind of monetary policy before. That is to print, print and print our way out of each and every tough spot to avoid collapse. The situation in America is dire and unraveling quickly. Forget the grandkids or the kids, this is here and now and it will not end well for the U.S. People invested in dollars (that includes most of the American stock market) will end up poor. Here is another post you can read with some links to some relevant stories …It is called: “Currency Crisis Coming.” Please read it

and the links with it. “Something Wicked This Way Comes” is also instructive.

Some have compared this “financial meltdown” to the Great Depression. To that I say Ha, Ha, and Ha. We could only be so lucky. During the Depression, the value of the dollar and the U.S. credit rating were never called into question. By the time this crisis ends, both the dollar and U.S. credit will be fried. Please protect yourself as soon as possible. Thank you for supporting USAWatchdog.

Greg Hunter

How Do I Protect My Assets?

Now look at the title, and ask yourself from whom?

You cant ask the question from what, because all whats are derived from whoms.

So, answer the question, from whom?

And if whom want to take your asset, are you going to roll over?

Soul search. Have a good day.