Ignoring the Good News?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

I heard Jim Cramer of CNBC say last night people are “ignoring the good news.” I say when it comes to the mainstream media, just the opposite is happening. The folks at the financial news networks are especially good at ignoring the bad news even though they should know better.

For example, we have been told non-stop that we are in a “recovery.” We are clearly not. Want proof that we are not in a “recovery?” Just two days ago, Fed Chief Ben Bernanke said, “We are far from being out of the woods.” According to a Bloomberg story, in a recent speech in Dallas, Texas, the Fed Chief was hardly trumpeting a huge turnaround for the economy. Bernanke said, “. . . the U.S. faces hurdles including the lack of a sustained rebound in housing, a “troubled” commercial real estate market and “very weak” hiring. . .” (Click here for the complete Bloomberg story.) Why is the Fed Chief, all of a sudden, not beating the “recovery” drum? I think someone figured out that if they keep talking up the “recovery” and that does not happen, then the Fed will lose major credibility.

Sure, the economy looks like it stopped falling, but you have to keep in mind we spent trillions of dollars just to get to where we are now. Taxpayers bailed out everything from car companies to insurance companies. ALL the big banks got taxpayer charity, and the best we can do is bottom bounce?

If we really are in a “recovery,” then why is the Fed keeping its key rate at nearly 0%? The Fed has repeatedly said this cheap money “needs” to remain for an “extended period.” If this was a big “recovery,” wouldn’t the Fed raise rates?

Here is another ignored item. The banks are holding trillions of dollars in toxic assets, or bad debt, in the form of all sorts of derivatives. There is no telling what these things are worth because there is no public market. Without a public market, there are no standards for derivatives. There are not any guarantees, and regulation has been non-existent. Most importantly, without a public market, there is no “bid/ask” mechanism that is essential in setting a price (price discovery). I wrote about this in a post, last September, called “Can The Financial System Really Be Fixed? Some Say No.” (Click here for that post)

That’s why Wall Street says derivatives are “hard” to price. You bet they are hard to price! Nobody trusts the fantasy valuation, and there is no way to set a real price without a public market. What do you bet if there was a “price discovery,” we’d find out some of this stuff is worthless? I’ll also bet plenty more derivatives are worth a lot less than the banks claim, and that will spell big losses in the future. Why do you think Wall Street is fighting financial reform so hard?

If you think banks don’t play accounting games with bad debt, then maybe this story, out yesterday, will convince you. According to The Wall Street Journal, “Major banks have masked their risk levels in the past five quarters by temporarily lowering their debt just before reporting it to the public. . .” That makes it appear the banks balance sheets are less risky. I’ll bet it also justified some of those big bonuses too! (Click here for the complete article.) Uncertainty about the true value of assets in the banking system makes a real “recovery” impossible.

Here are another 138,000 reasons we are not in a recovery. That’s how many people filed for bankruptcy last month! An astounding 35% increase over February filings. This increase is almost totally ignored by the mainstream media.

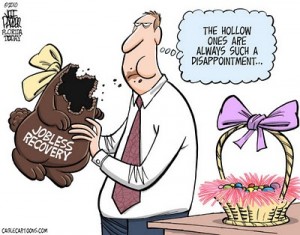

And ignore this–we have lost more than 8.3 million jobs since December of 2007. We were told recently there was a big turnaround on the jobs front by the mainstream media. When you cut out the temporary census workers, we supposedly created 114,000 jobs last month. That job growth was so spectacular it did not even put a dent in the “official” unemployment rate of 9.7%. Although, shadowstats.com says unemployment is really at more than 21%, if you calculated it the way Bureau of Labor Statistics did it prior to 1994. After 1994, if someone is out of work for more than a year, then that person does not count according to the BLS. They keep calling this a “jobless recovery,” but without jobs this is no “real recovery.” Of course, all those unemployed people are probably just ignoring the good news.

(Editors note: This post was late today because thunderstorms on the East Coast knocked out power in my area.)

Outstanding Mr. Hunter – please continue writing what needs to be said, unlike what the media and Washington believes we need to be fed.

Hey Greg,

Great article. You are right-on buddy! I keep looking for real signs of recovery and I can’t find them.

With all of this phony stimulus money and Fed liquidity that has been pumped into this economy, how bad do you think the hangover will be when the effects of the dope has worn off?

Are we in a dead-cat bounce?

markm

Mark,

From Dead cat to money printing and back to dead cat again. Thank you for your continued support.

Greg

We can’t pretend our way out of trouble. History will judge and our children will pay the price.

Gerold,

You are so right sir!! Thank you for the comment.

Greg

Hi Greg-thanks for another great article. For Bernanke to say “we are

far from being out of the woods”is an understatement for the ages, but at least that is more forthcoming about our situation than he’s been in the past. What irritates the crap out of me is the fact that one in MSM wants to even acknowlege that there is a problem either with the impossible hole we are in or the epic corruption going on

within the financial system. We are a nation ( a world? ) of frogs in a slowly heating pot of water, and when it finally boils……

Pokerface,

Thank you. I hope you are taking precautions for the boiling water we are in.

Greg

As a severely compromised “democracy” today, the United States likes to flaunt its purportedly “FREE” press to the rest of the world as if being the global standard. What is FREE about the press today is to report not what is fit or deserved to be reported, but what their particular political or ideological leanings agree with. We Americans are increasingly voting with our channel clickers and dollars against the likes of MSNBC, CNN, The New York Times, and the Washington Post. These slanted venues are seeing the lost revenue from ignoring such relevant and important “news” as the terrifying increase in bankruptcies in this country. WE ARE IN A DEPRESSION FOLKS. You cannot have a failure of the banking system in any economy with $10’s of Trillions of assets evaporating without the economy eventually reaching a 20% to 30% decline in activity. It is happening in slow-motion with all of the printing of Dollars, but it is unfolding. The press in America will be discredited along with most of our so-called “leaders” when the BLS can no longer fudge the inflation rate or nominal GDP. GDP is already negative and has been for some 7 quarters now if you use the real inflation rate of some 7% from ShadowStats. Buy gold and silver while you can. The Dollar will be toast before this is over.

David,

I agree, we are in a depression. Thank you.

Greg

“then the Fed will lose major credibility.”

didn’t they lose it all several times already?

Silver,

You make a very good point. Thank you.

Greg

For sheer entertainment value, I find the denial-of-reality on CNBC to be unexcelled in quantity or quality! From the “green shoots” and “King Dollar” of Larry Kudlow, to the rabidly pro-status quo kneejerk attitude of establishment defender Steve LIESman, to the whining and spittle-filled hyperactive rantings of the stock monkey Jim Cramer, to the banal and witless prattle of the female bubbleheads (all pretty much interchangeable), it is a barrel of laughs all around!

Akak,

You are funny and very smart!!

Greg

Nice article as usual.

You are 100% right. Lets go 6 months without a bailout or a union payback before we go throwing a party

Patriot,

I’ll take 6 weeks! Thank you.

Greg

Thanks Greg for the continued coverage of these issues. There are so many voices out there trying to “talk us back” into a recovery.

I question the whole concept that the economy and the recovery are purely psychological as some of the pundits seem to think.

At some point “real math” kicks in, and even if a person wants to consume, if they don’t have a job, or they are living within their means they will not consume at the rate they did in the credit driven binge days of easy refi’s and easy credit.

Most Americans are either living on cash, paying down debt, or shedding debt through default or bankruptcy… until the debt clears including overpriced real estate there will be no real recovery.

Besides…. do we really want to return to the bubble days?

Dave,

At some point we will bottom and things will get better. I think we still have a ways to fall. Thank you for taking the time to write.

Greg

“Ignoring good news?” Are the leaders is DC along with mainstream media and the Wall Cheat gangsters ate up with economic illiteracy? Or is it a case of them just simply lying to us in an effort to try and cover up the truth? Most likely a combo of each. Crammers comments are exactly the reason I stopped watching CNBC a long time ago. People need to stop drinking the poisoned kool-aid before its too late.

Mark,

Even the agerage person knows there is something really wrong with the economy. In poll after poll on this site more than 80% say things are getting worse. You sir, are certainly way above average. Thank you.

Good post, Greg. You’ve got one of the best blogs on the net.

We’ll know the bottom is in when pixilated leprechaun Cramer kills himself, live, on his show.

Man,

You are too funny!!

Greg

Greg,

I am more and more confused every day with the economy. “Main stream

media” seems more convinced that the recovery is underway and that the risk of a “double dip” is becoming virtually nonexistent. On the

other side of the spectrum, there are a few folks in the media like

yourself that share the belief that the recovery is not yet beginning

and that the worst of the recession may even be yet to come.

Any thoughts?

Barry,

I just read a story that said 4.5 million foreclosures will happen this year (Reality Trac). How is that going to help a recovery. I have written many stories about the so called “recovery” on this site. Some people will recover, such as the bankers who were bailed out, but the general economy will not. Thank you for writing and supporting USAWatchdog.com.

Greg