Is The Recession Over? Don’t Bet On It!

By Greg Hunter’s USAWatchdog.com

The headline on Reuters this week read, “U.S. recession over, unemployment seen at 10 percent.” This great news is according to a new survey by the National Association for Business Economics. Forty-four professional forecasters took part in the assay. After four straight quarters of declines, 80 percent of them believe the economy was growing again . I would like to know who the recession is over for because it is not over for main street America. I would also like to know how the 44 professional forecasters were chosen. Did the NABE stack the deck? Are these “professional forecasters” some of the same people who completely missed the financial crisis two years ago and told us everything was just great?

For one thing, the real unemployment rate stands at 21.4 percent not 10 percent. That is according to John Williams of shadowstats.com who computes the UE rate the way it was done by the Bureau of Labor Statistics pre-1994. That’s more than one in five working people who are unemployed or underemployed! Bankruptcies shot past a million in the first nine months of 2009 according to the American Bankruptcy Institute. What end of recession?

Just last month Bloomberg reported, “Sept. 23 (Bloomberg) — The crash in U.S. home prices will probably resume because about 7 million properties that are likely to be seized by lenders have yet to hit the market, Amherst Securities Group LP analysts said. The “huge shadow inventory,” reflecting mortgages already being foreclosed upon or now delinquent and likely to be…”

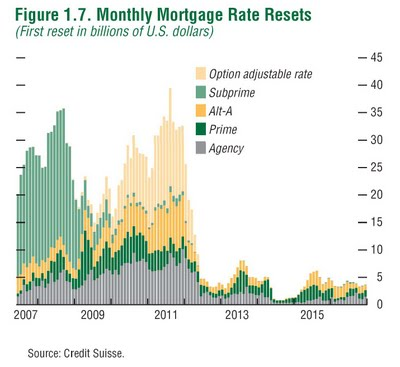

What is the NABE looking at to make such a rosy forecast? It is not this chart from Credit Suisse that shows the mortgage resets for millions of adjustable rate mortgages. This chart shows a tsunami of debt that will wash ashore in waves here in America until mid 2012. There is no doubt mortgage payments resetting higher will cause many more foreclosures than the one million we have had so far this year.

This is my favorite “a picture is worth a thousand words” picture. I have used this before in a prior post because it says so much about where the real estate market is going. Look! The resets don’t stop until 2012. How can the recession be over?

The FDIC is bracing for another round of bank failures according to Chairman Sheila Bair. Banks are coming under increasing financial pressure due to an imploding commercial real estate market. In early September Bair said, “Commercial real estate will be more of a driver of bank failures.” What! You mean more than the imploding residential real estate market? (Click here for more from the original post) This is what the end of a recession looks like?

Speaking of commercial real estate…“The other shoe to drop,” according to Daniel Tishman, Chairman and CEO of the Tishman Construction Corporation, is commercial real estate. Tishman says 3.7 trillion dollars in commercial property will need financing in the next several years. Financing will be difficult because commercial property values are in a steep, ongoing decline. (Click here for a great chart about declining Commercial Real Estate) Where is the end of the recession? I do not see it and neither does a close friend in North Carolina who makes his living as a business broker. He tells me business in his area is definitely “slowing down” not getting better.

Finally, according to John Williams at shadowstats.com, there is still absolutely “no substance to the economic recovery.” Williams works for very big companies and hedge funds as a consultant. He also has a subscription based newsletter. I am not getting paid to plug him. I just admire his very accurate work. He has been spot on with his numbers and predictions. He sees unemployment topping out at 34 percent, computed the way BLS did it pre-1994.

In his most recent alert, he sees the U.S. is “headed for still weaker growth.” When I asked Williams about the new survey that says the recession is over, he said, “A recession does not end until the ecomony begins to recover. At best it has flattened out in some areas, but those are about to turn lower again, as the clunkers and first-time home buyers programs expire. Employment still is plunging, and that is a coincident, not a lagging, indicator.” My bet is Williams will be right again and we have a long way to go.

So as far as I can tell, the recession may be over for some greedy, reckless Wall Street types. Also, the stock market has seen a more that 50 percent rise since March. That is positive news, but that is probably a bear market rally. The recession is not over for the overwhelming majority of Americans. My advice: Take some money off the table if you have enjoyed a big run up in your portfolio. Pay down debt and stay conservative in your investments and purchases. This is not what the end of a recesion looks like. I think all indications show it is appearing more like a deepening depression!

Two quotes come to mind.

Paraphrasing Joseph Goebbels, If you tell a big enough lie and repeat it often enough, people will eventually come to believe it.

On an old Tonight Show, George Gobel said, Do you ever feel like the world is a tuxedo and you’re a pair of brown shoes?

I do.

Mike,

Nice comment thanks for contributing.

Greg

I am not “betting’ on a recovery being meaningful. I have been looking for work for 4 months (I am a nurse) and have not found any offers that are reasonable and commensurate with my level of experience. If I wanted to sell my job skills for a 40% cut in pay, then I would be working. I saw that there were huge gains posted for the Big Four Banks, but I don’t know anyone who has seen these gains reflected in their 401Ks, the value of real estate or personal finances. So perhaps corporate entities can crow about recovery, but in my experience, individual entities are not so well off.

Thanks, Greg, for the great site!

Melissa

Melissa,

I know as a nurse you are worth so much more but the important thing is to get working again and not burn your savings. You can always take the 40% less paying job and keep looking for something better. That way you will not burn your savings. You will get medical benifits that right now I am sure you are paying dearly for every month. You will also reset your Unemployment and COBRA so if you really need it in the future it will be there. This down turn will end up being a marathon…a very long one. Thank you for commenting on the site!!!

Greg

hello i really like your blog. this is great knowledge.

Tesha,

I really like your comment and support!

Greg