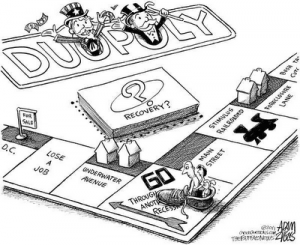

Mainstream Media Spins Real Estate Recovery

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Just about everywhere you turned yesterday, the mainstream media (MSM) was talking up the good news in the latest Case-Shiller Home Price Index report. For example, the online version of USA Today had a headline that read “Spring buying boosts home prices, market still sluggish.” The first line of the story said, “Prices rose 0.9% in July over June, marking the fourth-consecutive month of increases for the Standard & Poor’s Case-Shiller index released Tuesday.” But, buried in the same story was this little piece of information, “When adjusted for seasonal factors, home prices were essentially flat in July over June, S&P’s data show. “The housing market is still bottoming and has not turned around,” says David Blitzer, chairman of the index committee at S&P. July home prices were down 4.1% year over year, according to S&P’s index of 20 leading cities. Minneapolis and Phoenix led the declines, with prices in those areas down about 9% year-over-year.” (Click here for the complete USA Today article.)

What a spin job! “Prices were essentially flat,” and “July home prices were down 4.1% year over year.” Shouldn’t the headline have read something like “Home Prices Decline year over year– Flat for July”? Why does the MSM try to spin good news out of a rotten situation? Why do they think it is their duty to make a story look better than reality? I was in the MSM for most of my career, and I know what its duty should be. Give it to the viewer or reader straight. There is not a single inaccuracy in the USA Today story, but the spin and omissions are stupefying. Would you like an example of what I am talking about? Sure you would.

USA Today and many other news outlets such as CNBC and Fox were touting a little talking point from the report that said, “. . . 17 of 20 cities in the Case-Shiller index showed unadjusted increases in July over June. . .” This would make you think Wow! We must have a turnaround in real estate going on. Look at the actual chart from the Case-Shiller report, and focus on the last row of numbers on the right under the heading 1-Year Change (%):

July 2011 July/June June/May

Metropolitan Area Level Change (%) Change (%) 1-Year Change (%)

Atlanta 104.55 0.2% 1.5% -5.0%

Boston 155.76 0.8% 2.4% -1.9%

Charlotte 112.47 0.1% 1.9% -3.9%

Chicago 117.78 1.9% 3.2% -6.6%

Cleveland 101.5 3 0.8% 1.5% -5.4%

Dallas 116.96 0.9% 1.4% -3.2%

Denver 125.9 7 0.0% 1.6% -2.1%

Detroit 72.04 3.8% 5.8% 1.2%

Las Vegas 95.48 -0.2% 0.1% -5.4%

Los Angeles 170.05 0.2% 0.3% -3.5%

Miami 141.15 1.2% 0.6% -4.6%

Minneapolis 115.25 2.6% 3.5% -9.1%

New York 168.51 1.1% 0.9% -3.7%

Phoenix 100.54 -0.1% 0.3% -8.8%

Portland 135.80 1.0% 0.0% -8.4%

San Diego 155.22 0.1% 0.2% -5.9%

San Francisco 135.28 0.3% 0.4% -5.6%

Seattle 137.57 0.1% 0.7% -6.4%

Tampa 129.61 0.8% 1.2% -6.2%

Washington 187.79 2.4% 2.2% 0.3%

Composite-10 156.23 0.9% 1.1% -3.7%

Composite -20 142.77 0.9% 1.2% -4.1%

Source: S&P Indices and Fiserv (Data through July 2011) (Click here for the complete Case-Shiller Report.)

The talking point should have been, year over year, 18 out of 20 cities had price declines! The two cities that had price increases, Detroit and Washington, were only up 1.2% and .3%!!! Who cares about monthly numbers? It is the year over year numbers that matter most!!!!! This report was spun to make a very bad market look like it was improving. It is not improving! It is an unfolding disaster, and that is a statistical fact straight from the report!!

Real estate attorney Adam Leitman Bailey dropped a real stink bomb on CNBC yesterday when he was talking about the enormous backlog of foreclosures. He said, “That’s going to take prices down to a really low level . . . I see this as a huge problem lasting at least 5 years.” Mr. Baily went on to say, “I think we’re going to have to understand that we may not have appreciation on equity in their homes for the next 30 years. And it’s really a big statement, and I know that, but so many people are underwater that they may not be able to recover unless they have cash.” One of the cheerleading talking heads on CNBC closed the interview by saying, “Depressingly, thank you very much.” Why is it “depressing” to know the truth?

Mr. Leitman said the foreclosure crisis will be around for “at least 5 years.” To me, that puts the bottom at around 2016. That is the same real estate bottom date an expert predicted in a story I did in July. The post was titled “The Only Thing You Can Count On.” (Click here to read it.)

Besides foreclosures, I think there will be another big drag on real estate– interest rates. Right now, the Fed is suppressing interest rates. The latest Fed move (the so-called “twist”) has forced interest rates on mortgages even lower. Right now, a home buyer can get a 30-year mortgage for around 4% and maybe less. When the suppression game ends, real estate prices will take another cliff dive. What do you think will happen to home prices if mortgage rates go to 8% for a 30 year loan? Prices will tumble or, at the very least, stagnate for years. The real estate market is not coming out of the tank anytime soon– no matter how the MSM spins it.

Thanks Greg,

you save alot of us hours and hours of research. We hear our friends and neighbours parrot this stuff coming from MSM and we know something is not right about it.

Thank you Roderick!

Greg

Thanks again for adding 1 plus 1 equals 2, not 2.99?

There is currently alot of individuals holding cash and the Fed is doing their damnest to get it out of Treasuries and into the stock market. The Media is doing everything it can to conjure up some alchemy as well. The public and business’ are no longer fooled, 12 plus Trillion in Cash on sidelines in personal wealth, $2 Trillion on balance sheets on the business side. No job creation, gridlock, and a continuing lying government. Euroland is leading the race to our next 9000 Dow when the Germans reject bailout heaven produced by none other than TAX CHEAT Geitner. As an American, I still have high hopes for this country, just not right away. We are going to have to pay a price first. I just hope we dont wait too long or else the price tag increases exponentially. Hope and Change was an illusion that has and will increase the price tag for every American and (Imported Illegal but soon to be annnexed Americans). Crony Capitalism is costing and redistributing. We need to take our medicine now. If and when Societe Generale and BNP go bust, so goes our big banks. We need to stop bailing and adding to this mess. I think we will see the 9000 as soon as this

Bravo Craig!

Greg

Round and round goes the spin cycle into Fantasyland! Cooking the numbers for the best looking outlook is standard operating procedure (SOP) for the MSM and government. I find few reporters like Greg Hunter that actually “report” the news. This is why Greg doesn’t work for the MSM anymore. Greg Hunter is a real investigative reporter who questions and evaluates the information given to him. The MSM and corporate government like the British Empire once did fear an open and independent press that exposes their propaganda for the lies and twisted truth that it is. The corporate owned MSM or the government will not give you the truth about economy. They believe that who ever controls the printing press; controls reality. Well I have news for them that they are losing the info war for our minds.

The housing market is not recovering. The shadow inventory of REO (bank owned) houses is growing and now the banks are now requesting information about occupants of some homes in foreclosure and they are trying to rent the foreclosed homes back to the person who lost the house.

Don’t expect the prices of foreclosures to drop at auctions because the bank can not get their government backed loan insurance paid if they take less than what is owed on a property.

Thank you Greg for lighting the path into the dark world of the MSM ……

Thank you Mitch for the kind word and for supporting this site.

Greg

Greg, good article and example of MSM’s continued recovery spin. Your article does not, however, answer the question or even speculate as to why the MSM keeps spinning recovery and or economic news. If there is no reason except MSM sees its role as an advocate for the system now instead of its original role as a guardian of truth then we must nickname at least the three largest (ABC, NBC, & CBS) as the three stooges.

Art,

My guess is that bad news is bad for advertisers. Look at all the companies that support the housing market that advertise on the MSM. You ever wonder why there is not more negative news questioning the crime and rip-offs the banks perpetrate? Look at all the big banks that advertise on the MSM. That is just my guess.

Greg

They need to project a “recovery strawman” so that when the FED’s paper money shell games folds, (just AFTER the next timed 911

style false flag event)they can proclaim that the recovery was

derailed by the event! if the event should happen ( AFTER the dollar collapse),

then they’ll have a real problem presenting their “cause and effect formula”. Most of the sheeple , and civil servant woodticks will buy into the lie if it’s presented on cue…

Matslinger

Thank you Matslinger.

Greg

== Foreclose THIS! ==

Someone I know works in the land records section of the circuit court for a major city in Virginia. The other day, she was reflecting on the daily average rate of home-mortgate foreclosures.

“In this city, it’s purring on at about two per day,” she said. What’s more: she mentioned that just recently she’s received a number of filings of “substitute trust” notices — a precursor to the filing of foreclosure actions.

Mediameisters may spin the foreclosure story all they wish, but we can’t ignore the hard, cold facts staring us in the face at the courthouse foyer. — Larry W. Bryant (28 Sep 11)

Thank you Larry for the reporting from Virginia.

Greg

Greg, this article spells out why the MSM will not tell the truth to the public. http://news.golseek.com/InternationalForcaster/1317233593.php. This is about to hit fan of millions who still hold any savings in a 401K’s & any other saving the bankers and politicans can lay their hands on.

Hi Greg, I always enjoy your news. I am Canadian and I have been invested in USA real estate for many year. The truth is, my American real estate investments have rarely made any money.

Everyone needs to relaize the enemy is the government, the finacial industry and the media.

It is ironic that America has been fighting Communism for 100 years and now America depends on the Communist Chinese to bail them out because America is a failed state. It is really sad how America has declined so fast and it looks like it will take another depression to fix it.

Bruce,

Thank you for the comment and sharing your personal investing info.

Greg

Greg: great post; now go after the phony CPI and unemployment numbers; the lies about repayment of bailouts; the GM channel stuffing (a sale is counted when the auto carrier leaves the plant, not when the dealer actually sells); and every other government lie.

Unfortunately, you could never live long enough to expose it all; just from this one Administration.

We need naked women reporting the news, these leg shots just don’t work anymore. I hate the so called reporter more than ,DC or Wall Street.

Greg,

I never trust the stats released by the MSM or Uncle Sam. First, the stats are always better than the real numbers. After the stats are released, then there comes the adjustment to the numbers (for whatever reasons.) Sometimes there are even adjustments to adjustments a few weeks later. And then the MSM or Uncle Sam always sound like used car salesman. “This (used) car is running great but…” “The economy is recovering but…” There is always a catch after what they said.

I don’t think the banks will let the enormous backlog of foreclosed property to bring down the home prices. Since 2009 the banks have demolished hundreds of foreclosed property to get rid of unwanted homes. http://www.vvdailypress.com/news/demolished-12162-homes-new.html

In July, Bloomberg reported “BofA Donates Then Demolishes Houses to Cut Glut of Foreclosures”. http://www.bloomberg.com/news/2011-07-27/bank-of-america-donates-then-demolishes-houses-to-get-rid-of-foreclosures.html The banks could demolish more foreclosed property in order to stabilize home prices.

Can you imagine how sad the former homeowners felt when they watched their once loving homes got demolished? Many of them were probably angry when they found out their banks used robo-signed falsified documents to foreclose their homes. Robo-signing foreclosure paperwork is a federal crime, but no one goes to jail. Again the American public watch the rosy picture painted by the MSM.

Ambrose

Ambrose,

You will get no argument from me on this one. Spot on man!!! Thank you for the content and links.

Greg

I live in my friend/former bosses house in Melrose Ma. He recently re-married and is in the process of moving to New York about an hour north of the city. He is trying to sell the house in Ma for $399K. It was easily priced well over a half million a few years ago(large house, great neighborhood, ten minutes from downtown Boston). It has been on the market for over a year and the best offer he has recieved has been around $350K. He owns the house outright but does not want to sell so low, so he is going to let me rent out the master suite upstairs, that he used to live in. I have been paying him $600/month for a 16×18 bedroom on the first floor with an attached bathroom for about four years. If I can find someone to rent the upstairs and give them the office and second bedroom on the first floor for $1500/month, which is actually below normal for this area for all that space, my rent will actually go down. There are silver linings in housing crashes! P.S. my sister lives in Alexandria VA and there does not seem to be a housing crash in the District of Criminals lol.

Thanks Greg.

Thank you James M for sharing your story.

Greg

Greg,

How can anyone believe the housing industry is going to recover anytime soon. Most people need a job to qualify for a mortgage even if the interest rate is 1%.

Job losses are continuing, despite what the government and the MSM tries to promote. In the California county I live in the unemployment here is over 20% and increasing. In my small town we have over 550 homes forclosed and vacant. These homes were all built in the last ten years and sold for ridiculous prices.

Those who bought one of these homes and are still living in them are now $150,000 – $300,000 in the hole. Many of them will simply waqlk away in the next year or two. Why? Loss of job, significant reduction in pay, and inflation.

I don’t see the housing industry recovering in the next decade. My town is hanging on by desparation and strained hope.

Thank you Charles and Brad for the comments and analysis.

Greg

Hi Greg,

It is satisfying to read your articles because they have the feel of truth to them. It is sad to see the sorry state we are in but it is even worse than you are saying. It is easy to compartmentalize events and miss their connection to each other. We may be swept along by the normalcy bias, assuming somewhere in our minds that the dollar is stable. Accessing the data from John Williams at shadowstats.com inflation year on year is at least 11.4%. The stated value of the home sold in reality is 11.4% less than what the chart shows because it could be purchased with inflated dollars.

Demolition of homes reminds me of the 1930’s government efforts to boost the prices to the farmers of hogs, milk and oranges by destroying them to reduce supply while people were going hungry. How can we get these meddling government numb skulls to just leave the market alone?!

Greg,

you are 100% correct on all points. Thank you.

As to MSM, up until about 8 months ago, I ALWAYS scanned Bloomberg on the Internet and regarded Bloomberg as an important source of financial news. Today, I hardly every look at Bloomberg. Yes, the “facts” are buried somewhere in the story. But, writers place major emphasis on twisting the events to harmonize the overview with the big messages the editor wishes to convey and reemphasize.

The Press used to be regarded as the “Fourth Estate”, serving as another “check” or “balance” on government. That was back in an era when the publisher could write what he pleased and did not have to cater to advertisers. There was a monopoly on the printed word and captive readers a publisher “possessed”. And, if you did not read the WSJ, NYT and other major newspapers 5 days per week, you were not fully informed.

Today, MSM must be a business first and foremost. Look at the NYT, which was once an unshakable institution and now seemingly a candidate for bankruptcy. If a publisher does not pander to advertisers, the later just moves to another news vendor. Why would the purchasing agent for a large real estate brokerage company go out of his way to place ads with a publication that reports, with clarity, that real estate sales and prices are going deeper into the toilet.

The reader is no longer a captive and can go anywhere on the Internet to obtain news. That is the major problem for publishers. The publisher now must walk on a thinner tightrope of pleasing both advertisers and readers/viewers. No audience, no revenue from advertising. Big audience drawn to content, no revenue from ads that will never get placed by those businesses that object to the content.

I personally rely on you and others, like Zero Hedge, to print the facts first and then comment on them second.

Keep up the good work.

Regards,

peter

Thank you Peter for your kind words, analysis and support!!!

Greg

Tks Greg. As a sidenote, I got through to one guy in San Diego who was sitting on $250,000 of cash after selling his home in 2007. He listened, did his own research, and opted to rent. But he listened to his wife, and bought a new place about a year ago. I couldn’t really chastise this wonderful friend, but I did tell him I’m sorry that he bought prematurely.

Again, thanks for the outstanding perspective, especially regarding the MSM, which is most of us here rely on the internet.

Greg,

I am a big fan, have left a few posts, and have not had any published. I am a big fan of yours, with NO agenda whatsoever. Just curious if my comments don’t make the grade, if you think I have an agenda, or if they are just way off base. I do not have an agenda, so it must be the first or the last. Please advise and I will quit wasting my time. Thanks!

You have done a great Job Greg! Your reporting tactics really helpful.