Make No Mistake–Europe is in Big Trouble

Greg Hunter’s USAWatchdog.com

Greg Hunter’s USAWatchdog.com

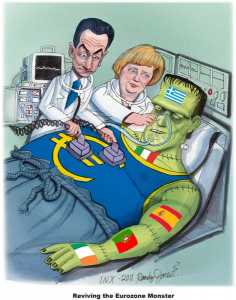

Treasury Secretary Tim Geithner said yesterday that European states “are going to have to do more” to solve their enormous debt troubles. To that I ask, “more” of what? That can only be “more” money printing. Mark my words, more debt and fiat currency will be the ultimate answer to the European debt problem. It is either that or let the banks and some countries in Europe go under. If Greece was the only country to default and leave the EU, then that would not be all that bad. The real problem is all the other heavily indebted countries that are levels of magnitude more of a problem than little Greece. France24.com reported yesterday, “The Eurozone crisis could wreck the European Union, top EU officials warned on Wednesday as the leaders of Germany and France held talks with Greece to avoid a default and widespread chaos. The pressure rose on all fronts with United States again expressing great concern, with Treasury Secretary Timothy Geithner saying European states “now recognize they are going to have to do more” to resolve to the crisis. Highlighting the threat to the global economy, Geithner is to exceptionally attend talks between European Union finance ministers and central bankers in Poland on Friday.

French President Nicolas Sarkozy, German Chancellor Angela Merkel and Greek Prime Minister George Papandreou were to hold a teleconference late Wednesday as markets price in a default by the government in Athens, and credit rating giant Moody’s downgraded two major French banks given their exposure to Greek debt. “Europe is in danger,” Polish Finance Minister Jacek Rostowski, whose country currently chairs EU meetings, told the European Parliament in Strasbourg. “If the eurozone breaks up, the European Union will not be able to survive,” he added. At his most dramatic, Rostowski even warned that “war” could return to Europe if the crisis fatally weakens the EU, founded amid the rubble of World War II.

His underlying message was backed up by European Commission president Jose Manuel Barroso, who described the crisis as “the most serious challenge of a generation.” Barroso stressed: “This is a fight… for the economic and political future of Europe.” EU economic affairs commissioner Olli Rehn warned that “a default or exit of Greece from the eurozone would carry dramatic social, economic and political costs. “Not only for Greece, but also for euro area member states, other EU states, as well as global partners.” He said what Europe needed was a moment of clarity leading towards a federal future, “and that moment must start today.” Barroso announced he will “soon” present proposals for Eurozone states to issue joint bonds, a way to even out interest rates among the single currency area’s 17 nations. Such “Eurobonds” are currently opposed by Germany and could require a new round of painful EU treaty negotiations.

Meanwhile Italy’s lower house of parliament endorsed its government’s 54.2 billion euro ($74 billion) austerity package — although a final vote of passage will not come until the evening. Italy’s debt stands at 120 percent of gross domestic product, and many analysts are convinced it is next in line to draw sustained bond-market fire. Stocks in Europe and the United States rose in the run-up of the Sarkzozy-Merkel-Papandreou talks. Sarkozy will “do everything to save Greece,” government spokeswoman Valerie Pecresse said, with the Greek government struggling to squeeze more savings out of its recession-ravaged budget. (Click here for the France24.com story.)

If Europe implodes from its debt mess, then the crater from that blast will surely suck the U.S. down right along with it. Remember, nearly half of the 20 “Primary Dealers” of Treasuries are European banks. You want more proof the EU (and for that matter, the entire western world of fiat money system) is in trouble? Here is another story for you, and the headline says it all: “20 Quotes From European Leaders That Prove That They Know That The Financial System In Europe Is Doomed.” (Click here for that story from Beforeitsnews.com.)

Greg, Wall Street knows the crisis in Europe is a big deal too. CNN (money section) today said …”Stocks ended sharply higher Wednesday following a choppy start, after German Chancellor Angela Merkel and French President Nicolas Sarkozy calmed jittery investors by insisting that Greece would remain a eurozone member and would achieve its fiscal targets”. Wall street has had rallies on goes negative for the last 6 months on every little detail of the Euro crisis. Clearly, it could lead the charge to a global financial meltdown type depression. But, as you indicated, fiat money printing is the only game in town that they will actually use. Which is just can kicking again as over here. The socalled “job” bill of the administration is more money printing in the long run, another future raise of the debt ceiling no matter what our esteemed politicians say the “committee” and the rules of that giant can kicker deal of late August was. Greg, thank you for you good work. Its seems clear that the fiat money system and the central banks have outlived their use for modern economies and especially for the middle class as it has turned negative and backward for our class making it in my mind not relevant any longer for the modern worker with a family. Of course, here in lies the problem, the fiat money system is alive and well for the upper crust elite who the cental bank will protect at all cost. Nothing will change, they will print till they run out of ink and the worker is impoverished and begging for food.

Just proving once again that total control of the world via political, economic, or military forces is simply impossible. That pursuit is one of madness. Please end the madness!

No doubt the Euro dollar and the union are in trouble, BUT…

“”If Europe implodes from its debt mess, then the crater from that blast will surely suck the U.S. down right along with it.””

They are still a ways off from total failure.

Greece could wind up doing what Iceland has done, except to go back on the Drachma, thumbing their noses at the Northerners. It would be ugly for Greeks, for a while, but maybe necessary to make them the sacrificial lamb.

That would not solve the Euro problem, but would give them some breathing room, which is what all these bandaids are designed to do anyway.

Good analysis Hoppe.

Greg

When Bernake made that Europe needs to help itself more speech, I knew then it would be with our reserves…It’s not what they say, it’s what they do.

Hasn’t Iceland rewritten their constitution, refused to pay the bank debts, and broken with the IMF. Greg, would you confirm if this is true.

It would seem that they have found a solution, albeit a temporary one.

And yes, I have still been reading since my first post. Let’s hope this one is interpreteded the way I intend it to be. The last one didn’t work out quite like I’d hoped.

Update as I type. Clusterstock had posted a message saying that the central banks were going to inject American liquidity, probably in the trillions upon trillions, into the Eurozone. The posting has been removed since I started to type this.

The posting was not removed, but rather moved within the Clusterstock website. Here it is:

http://www.businessinsider.com/breaking-ecb-and-fed-announce-new-liquidity-measures-markets-surging-2011-9

Yes damit! Why can’t we do more to pay down the banksters gambling debt? Can’t we just let the banksters fail …… for everyones benefit …..

Let’s hope the experiment in regional centralization fails. The money printers are working overtime to keep the global fiat afloat. Default and liquidate. Yes it will be painful, but a trillion times better than multi-generational debt bondage. Despite the claims to the contrary–“There’ll be tanks on the street…!”–the too-big-to-fail mantra benefits no other than the bankster/corporativist crowd and we the people become burdened with additional chains of debt. Likely instead…there’ll be printing, and taxing, and austerity measures, islands and various other asset taking, gnashing of teeth, and cracking of whips…. And Geithner and cabal will incriminate the infernal politicians for lack of compromise and resolve…but no mention of the wizard behind the curtain. And the lackey politicians will play the scapegoat, but publicly feign offense, to continue their paymaster’s bidding. The Greeks and people of Europe should look to Iceland for the solution. I just wonder what Americans will do when this crisis inevitably makes its way to our shores….

Raising Taxes One Page At A Time.

On the one hand the President is fond of saying that he won’t raise taxes on the middle class, on the other hand the Republicans would have you believe that they are adamant about not raising income taxes under the current economic situation. With both the President’s and Congress’s approval ratings abysmally low it would be fair to say that the public has caught on to the game and they’re not buying the story from either side.

While looking trough a list of taxes that have been raised a few days ago I came across one at the bottom of the list that made my blood boil. It was a $26 Billion tax on what is know as “Black Liquor.”

So what is Black Liquor and how does putting a $26 Billion tax on it affect the economy, the country and you? No it’s not a tax on Thunderbird or Ripple. The simplistic definition given is that it is a tax on particular type of bio-fuel. Well, yes and no. If the administration is so gung ho on so-called “Green Jobs” why are they leveling a huge tax on a bio-fuel?

Having worked for years for various companies that manufactured and supplied boiler cleaning equipment to the paper industry, black liquor is something I know a little bit about. I can say this in that I have patents for innovations in the design of this equipment.

Anyone who has driven by a large paper mill knows it’s a large, complex if somewhat malodorous operation. Turning wood pulp and rag stock into paper requires chemicals, lots of chemicals, and produces a considerably sized waste stream containing some very nasty and highly toxic by-products. Not the kind of stuff you can bury in a landfill or hold in a waste pond. If they were to leak into the water table the results would be disastrous.

With disposal not an option, the paper companies process these chemicals into a substance called red liquor and then further process it into the black liquor “bio-fuel” that is now subject to being taxed. This is then burned in specially designed units called Recovery boilers, so name because the burning allows the paper makers to “recover” the energy the chemicals contain and use it to generate electricity that is then used in the paper making process or sold into the electrical grid.

I won’t go into the details of the complexities and dangers involved in burning black liquor or red liquor, which is even more complicated, here. But as usual as with any ill-conceived tax policy, the problem is in the unintended consequences.

As a result of this foolishness every kilowatt of electricity sold into the grid by the paper makers just got more expensive. Every piece of paper you use just got more expensive. And every consumer product you buy, from cereal to light bulbs to laundry detergent, if it is packaged in paper or cardboard, it just go more expensive. Your children’s school supplies just got more expensive. Every administrative function in government and in business that requires a piece of paper just – got – more – expensive.

So when you go to the store and buy those things you need and you get angry because it cost more this week than it did last week or last month, now you know why. As you look at that receipt and your blood pressure rises, remember it cost more too and it’s reflected in the total at the bottom. So you might want to take a piece of that now more expensive paper and write a note to the President and your Congressman and let them know how this little known, unadvertised and ill-conceived tax just made your life more difficult and expensive. Let them know that its just this kind foolishness is how we get saddled with ever increasing inflation, and that that is the most pernicious, destructive tax of all.

Greg,

I’m going to add a bit to Davis’ input regarding red and black liquors. Remember when our fabulous MESSiah said he would bankrupt the coal-fired generating plants? Well we may now add the natural gas plants too. It was not until the late ’60’s that we found out what smog was and why it only occurred during daylight. The all wise EPA is setting new standards on ozone emissions by generating plants. They have been using ozone as an indicator of smog concentration saying it is the cause of air pollution. Ozone is actually an intermediate resulting from the photochemical breakdown (by sunlight) of nitrous oxide. This very active ozone then unites with active hydrocarbons such as carbon monoxide and volatile petroleums to form many toxins such as aldehydes…one of which is formaldehyde; hence, the yellow color of smog. The carbon monoxide is completed to form CO2.

Nitrous oxide is generated by high temperature and/or pressure. Before using catalytics, the automakers lowered combustion temps by retarding ignition and lowering compression ratios. This of course drastically dropped engine efficiencies to create the gas guzzlers of the 60’s. 10mpg was very common then.

Nitrous oxide, the real culprit, is commonly produced by fuels burned with a high temp blue flame such as in our gas stoves, furnaces and dryers. In electric generation, coal is powdered and injected into the boiler firebox, and if tuned right (air/fuel), it also burns with a high temperature blue flame. When natural gas is used instead of coal, the result is again a blue flame. To prevent this, the temp must be dropped causing a loss of efficiency and a higher cost per KW hour. Here’s the kicker: The greatest generator of NO is the jet engine. Each airliner produces more NO than a thousand cars and an electric power plant. But the EPA either doesn’t know this, or is afraid to say anything for fear of ruining our airline industry. It’s ok for the consumer to pay the higher prices, but this would be disaster for the airlines. Alcohol does burn at a lower temp because it only has 70% of the energy of gasoline meaning you burn more. Burning more does not ring as a clean fuel to me, but it does mean more tax paid. Again, the EPA is working hard to save our butts. Who was it that said: “A little knowledge can be dangerous.”. Bless you all,

Oldguy

Thank you OG on the EPA info.

Greg