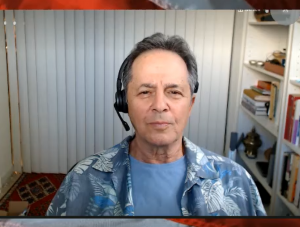

No Upper Limit to Bitcoin – Rick Ackerman

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

Analyst, professional trader and financial writer Rick Ackerman says buckle up because Bitcoin is going to go much higher in price. Elon Musk is the latest in a line of billionaire investors that have bought the crypto currency that is now in the mid $40,000 range per unit. Ackerman says, “Bitcoin is pure speculation, and we are in a phase right now where the big players absolutely know they can’t lose. Just buy it now and announce in four weeks, six week or two months that they bought it, and it just keeps going up. . . . I don’t think there is an upper limit there really because it’s a pure speculation in a vehicle that is not constrained by earnings, multiples, real products or real service. Bitcoin is a complete abstraction. It’s just a speculation. . . . You might say there is a bit of a mismatch to this big dynamic vertical move in Bitcoin that is happening and whatever time remains to distribute it all to the rubes. In order to allocate all the Bitcoin they are acquiring right now to the rubes, they are going to have to have a way to allocate it fractionally. . . . When Bitcoin gets to a million dollars per coin, who are the buyers going to be?”

The rate on the 10-year Treasury spent most of 2020 stuck around .6%. The 10-year Treasury has now doubled, which is a huge percentage gain for a relatively short amount of time. Ackerman sees the trend for interest rates rising, but he warns it’s not going to take much more of a rise in rates for the Fed to lose control. Ackerman predicts, “Everybody knows the Fed is run by a bunch of charlatans, and they are making it up as they go along. They are in control of nothing really except asset inflation, and that’s going out of control too. Where do interest rates have to be before you can say the Fed is losing control? I can give you an exact number for that. The number on a 10-year note is 1.267%. . . . When the 10-year rate goes above that number, we are going to have what I call an ‘impulsive move’ on a daily chart. What that implies is any move down is going to be corrective, pursuant to another move up. . . . Once that happens . . . the Fed is going to be out of control above that number. . . . The dollar is going to strengthen, and the thing that nobody on planet earth wants is a strong dollar. . . . The last thing that anyone who owes dollars needs is a strong dollar.”

There is $2 quadrillion in the derivative market alone, not to mention tanking commercial real estate and underwater pension plans. In short, Ackerman contends there is an enormous amount of debt that simply cannot and will not ever be repaid. This is also why Ackerman says he’s counting on massive deflation long term, and that means debt destruction and asset destruction.

Ackerman says, “All the speculative energy that would have pushed gold up to $2,500 to $3,000 range by now is all getting pushed instead into Bitcoin. Gold is basically saying, okay have your little fling. . . . I see gold and silver are biding their time, and they are fine. . . . Gold and silver are in arrested bull markets. . . . I think, in time, they will confidently reassert themselves in a hierarchy of assets. . . . They will always hold their purchasing power relative to any other class of assets you can imagine.”

What should the little guy invest in? Ackerman likes cash, physical gold & silver and owning your assets, including your home and your vehicle. These are the things that will survive the coming asset destroying event of massive deflation according to Ackerman.

Join Greg Hunter of USAWatchdog.com as he goes One-on-One with analyst and trader Rick Ackerman.

(To Donate to USAWatchdog.com Click Here)

After the Interview:

There is free information and original analysis on RickAckerman.com.

To get much more, you can become a subscriber. There is a two-week trial on the front page of RickAckerman.com that will cost you $1.

This segment is sponsored by Discount Gold and Silver Trading. Ask for Melody Cedarstrom, the owner, at 1-800-375-4188.

As Ackerman says … both gold and silver will survive the coming US dollar denominated asset destroying event … as Bribe’n and his buddies at the Fed are on track to create a massive devaluation of the US dollar!!

While you are busy touting BitCoin,

You failed to mention FedCoin that will destroy Bitcoin,

I am no bitcoin shill, Retired 42, and you need only listen to the entire interview to understand why. Bitcoin ranks right up there with rare tulip bulbs in the annals of speculative manias. That said, the mania has gripped institutional players, and there is little new supply. That’s why I am not discounting a blowoff to some absurd price, even $1 million. The players have little skin in the game, since most of the institutional speculation is with Other People’s Money.

Sorry, but Bitcoin is anything but a pump and dump, Rick has missed the boat on this completely. As someone who is a libertarian and hard money advocate and has been involved in Btc since 2014, I can say that their is a liked minded community of hard money advocates who have decided Btc is viable alternative. Is not money something that we collectively value as a means of exchange? Well there are some very smart people who are liked minded around Btc. By a couple of Satoshi’s if you are a little guy and just sit on it. You can also stake your Bitcoin and get 6-8 % interest vs. the pittance the bankster will give you.

I didn’t make this point in my interview with Greg, but the game will be over for bitcoin when the bear market that may already have begun gets rolling. Bob Farrell’s Rule #4 applies here: Parabolic rallies do not correct sideways.

Stone

So what happens when the internet is down? A coup just occurred in Myanmar and last I heard their internet as well as all cell phone service was not operational. I think it’s better to have one’s wealth in close proximity.

Agreed. I bought silver when I started to get my head round the money creation fiasco. And when Bitcoin came a long it made sense as well. Money is ultimately about trust. Trust in gold, trust in silver for their qualities. And trust in “some” cryptos such as bitcoin due to maths, cryptology, game theory, decentralised, just study. It’s function? A Trustless p2p medium for exchanging value.

“A Trustless p2p medium for exchanging value.”

It’s not really p2p when you need the exchange to confirm/verify the trade.

Great comment. Amazing how many do not get it. Calling it a Tulip mania is so old..and signifies the Noriel’s of space….I thought Rick had a little more under his belt of understanding money…with future technologies.

You need to revisit the chapter on Tulip-o-mania in ‘Extraordinary Popular Delusions’, Davis. Where the fatal mixture of greed and stupidity are concerned, nothing has changed.

Rick,

Can you comment on this?

Stacy Herbert: Bitcoin Fastest Horse in the Race, Gold Headed for the Glue Factory

She says she still has gold and silver for entertainment value.

https://m.youtube.com/watch?v=c9mr3FZtKXA

Could the authorities be letting Bitcoin run in order to divert capital flows away from the precious metals. they know that if they take down the system by staging a false cyber attack from Russia that nobody will be able to access/use bitcoin anyway. physical metal would be accessible even in the event of the financial system going off line.

Good point Manley … the Banksters are likely telling their corporate buddies to buy Bitcoin and drive up its price as an excellent way to keep people from buying gold and silver (because as they short sell gold and silver they are making the precious metals irresistibly cheap … and people with any money “will buy them” (unless their money is tied up and locked in Bitcoin “at the top” and they would have to take a huge loss to get out of Bitcoin to buy gold or silver “when the banksters pull the plug and do a reset while declaring Bitcoin illegal” (as they bring out their own digital currency) …as for their corporate buddies now buying Bitcoin the banksters will simply print up some extra fiat for them (making up their losses the way they are now bailing out the Hedge Funds)!!

look up “Cyber Polygon” world economic forum. they are planning for (or planning?) a cyber attack that could take down the entire financial system or large parts of it. probably the only way they can reset the debt. often wondered if they are targeting the elderly with the vaccine first as pension funds maybe the biggest holders of debt. What happens to the assets held by a pension fund when the pensioner claiming dies?

Sir Manley,

I guess you haven’t read the many comments that “Jerry” has posted about this for months.

With the amount of Covid related deaths in the nursing homes, I wouldn’t be surprised S.S. is now solvent.

Right. The current vaccine is given to the elderly and homeless. And then something big may happen to wipe out most of us. Finally when the system comes back on, Microneedling biosensor patch will be the”mark of the Beast” for the survivors who are willing to comply with the government. Bitcoin may reach one million but you will not be able to sell your Bitcoin without the patch.

https://www.weforum.org/projects/cyber-polygon

“Could the authorities be letting Bitcoin run in order to divert capital flows away from the precious metals.’

A big YES, it also diverts (a backdoor) capital flows from the Chinese yuan to American dollar.

If they turn off the internet they cannot spy on us. Bitcoin is here to stay and is useful.

Goodmorning I have a ” Question” for you. I have often wonder if the use of Bit-coin is trial run for a cash less society? Thank you and have a good day. SP.

buy sumcoin not bitcoin the worlds only index coin

https://sumcoinprice.com/

Can’t get your video on your website to play- takes hours to load or never…no where to send you an email to let you know? You Tube plays immediately and clearly- I fear you will be gone if we can’t watch your info…I’ll pay to watch on twitch tv as I know it will play or maybe gab? You need to find a new spot to post. God bless you Greg and thanks for all you do.

and after I post I get this as an answer “Duplicate comment detected; it looks as though you’ve already said that!” P.S. that was my first time saying this- I never post

Elizabeth,

So sorry you are having trouble. It plays instantly for me. Try another browser??

Greg

the video is hosted by Rumble you can go to rumble and sign up and subscribe to to USA watchdog on Rumble along with many other Youtube conservatives that have channels over there

Take down ur videos on YT until ur strikes fall off to save ur channel. They can give u a strike from someone’s comments on ur videos.

Bitcoin – most miners are in China – if CCP decides to confiscate all Bitcoins from them then CCP would control Bitcoin and could pump and dump it. Also, didn’t Russia buy millions of bitcoin when it was like $50 a coin? What if they sold all to China? I’m not a fan of digital anything – we are too primitive to rely on digital anything. Blackouts from weather, EMP satellites overhead.

the video is hosted by Rumble you can go to rumble and sign up and subscribe to to USA watchdog on Rumble along with many other Youtube conservatives that have channels over there

By the way!

While you are at it,

Get all your dollars out of the banks before they Bail-In.

The Dollar is losing it’s value but still needs to be better than giving it all to a bank.

Best advice. Starve the banks.

Get money out of the 401K if possible.

Along with getting your dollars out, clean out the safety deposit box.

So you only use cash? No cheques, no credit cards, no debit cards. Just paper? Just saying…

China tried to ban bitcoin. The price went up. India is now trying to ban bitcoin. The price goes up. Iran is mining bitcoin to the point of power black outs. The dirty little secret is the United States treasury has a ton of bitcoin and has been mining it for years.

Keep a tank of nitrogen and mask handy. Why suffer?

At 6:25 Rick:

The only problem is how are they going to unload all this stuff that they are acquiring on the…

I didn’t understand the last word of the sentence.

… on the what?

On the common people!!

Paul…

Is that a polite way of saying suckers?

Why do we say There’s a sucker born every minute? – BookBrowse

Meaning: There is no shortage of naive people ready to become victims of frauds and cheats.

https://www.bookbrowse.com/expressions/detail/index.cfm/expression_number/212/theres-a-sucker-born-every-minute

Yes the “Rubes”, meaning the Deplorables and Suckers trying to stay afloat. Watch congress five minutes and you know who he is talking about. A very good article was on Zero Hedge yesterday about how to deal with these tyrant socilaists now in charge of our country. The strategy of Sun Tsu, Gandi and Anne Rand(John Galt). Basically stop working for them, same as we have done to NFL, NBA, Hollyweird Pedos and other Hollywood Trash. So many of them are broke because we quit paying the bills for them. They will not admit it but I heard there were cardboard cutouts in the Superbowl stands. That means they are going broke. As Rick says you will have to stop supporting them anyway to survive and start working for yourself and your neighbor. Ukraine of the Bolsheviks, here we come.

Ruse -(trick, con, scam)

JC. – I re-listened to the whole video because Rick and Greg said quite a lot today. It is “rubes” meaning “country bumkins”

Rachel, thank you.

Now that sentence makes perfect sense to me.

“Rubes”. The common people, the little guys.

Unload on the RUBES, JC.

Got it Rick, thanks.

With a turkey oven bag. Long live Betty and Max Dog!

Mr. Hunter,

What a run of great guests!

Prussian military commander Helmuth van Moltke said something like: “No plan survives first contact with the enemy.” Mike Tyson put it this way: “Everybody has a plan until they get punched in the face.”

I feel like I’ve been punched in the face and that I’m in a fight for my life.

We’ve known for a long time that a catastrophe was coming. We’ve all planned for it. But, it’s still a full-time job trying to absorb and deal with its actual dynamics as it unfolds. Thanks for keeping us informed.

As Gunny Highway said in Heartbreak Ridge: “Improvise, adapt and overcome.”

Thanks William!!

Greg

Greetings William, tis I your dear friend. Keep up the good fight. Silver will have it’s day.

Dear Friend:

It’s good to hear from you!

And thanks for responding about silver, too.

His whole blurb was deflation for sure. Then right at the end he described a likely scenario if pensions are bailed out is hyperinflation. … The thing is pensions will have to be bailed out. He gave the case of the retired ny transit worker, under a plan which will have not even enough revenues to pay pension administrators. There will be deflation of the white elephants like massive unused buildings but hyperinflation, via shortage, for needed items like food, clothing, energy, housing. Health will be under attack. Vax delivery cheaper than bullet delivery. Get into dollar and stay out of bitcoin … that summarizes his total advice. Yes, even though he states bitcoin has unlimited highs ahead, to get into dollar and stay out of volatile bitcoin. Wow.

Tech,

You are probably smart enough to get out of Bitcoin at the right time. Most people are not and cannot gage the risk. He’s just telling people to make the safe play.

Greg

The pension funds cannot be ‘bailed out’, since sending out checks for just a couple of months to Illinois government retirees would trigger hyperinflation when New York, California, Connecticut, and 23 other states nearly as bankrupt as Illinois line up for their fair share. When you talk about a Government bailout of anything, it is useful to substitute the word ‘taxpayer’ for government, just so you know what the limitations are.

Bitcoin since day one has been divisible to 1:10,000,000th. And I’ve been teaching people how to buy and use Bitcoin for a decade now.

I am now adding into my BTC position. The signs are there as in the beginning of Amazon and other super successful entities. Energy consumption by BTC is overcome just like invention of rail, Steamboat, air travel. All those inventions benefitted people even though they consumed energy. Think of your future holdings in cash, especially Biden Admin sending out $2 trillion. The government will print trillions more making your retirement worthless. Buy BTC even at $45k. Like you always said buy a little bit of silver at a time. You can do that with BTC, $100, $200, $500..!

Mark, the millennials don’t want stocks or bonds and maybe PM’s(100%) because they see the corruption in mass printing of fiat, manipulation of shorts and price suppression. They will take mom and dads fiat inheritance and buy BTC’s. They can’t print more BTC other than the new mined BTC(minus the 4 million estimated lost). They will jump into BTC as Apple, Tesla and others drive up the price. I believe the insurance companies are looking to dump billions soon to back up their Life and annuity contracts. It’s coming.

Thanks for all you have don Greg. Without stumbling upon your website over ten years ago I probably would be broke and unhappy in my retirement.

Remember every year, Amazon had a new high price and everyone said I missed it and it is too expensive. That is what is going to happen to BTC!

BDS,

Sounds good in theory, but beware of the powers that be…

European Central Bank President Christine Lagarde took aim at Bitcoin’s role in facilitating criminal activity, saying the cryptocurrency has been enabling “funny business.”

“For those who had assumed that it might turn into a currency — terribly sorry, but this is an asset and it’s a highly speculative asset which has conducted some funny business and some interesting and totally reprehensible money-laundering activity,” Lagarde said in an online event organized by Reuters.

The remarks, made in a conversation largely focused on the euro-area’s economic outlook, show top policymakers are taking notice as a speculative fever sweeps cryptocurrency markets. Bitcoin prices have more than doubled since November and topped a record $41,000 earlier this month.

https://www.bloomberg.com/news/articles/2021-01-13/lagarde-blasts-bitcoin-s-role-in-facilitating-money-laundering

JC,

You can’t take any of those bankster’s to heart. They money launder fiat currencies all the time through their banks via Shell companies and transfer monies between companies with no ties to individuals. They know the loopholes are legally designed to launder and pay no taxes. These companies then pay out to a company that eventually is owned by the outlaw say as a consulting fee or other service. Perfect example was the Clinton foundation(501C3). They would get a $50 million deposit in the morning and by the afternoon the money was transferred to on offshore account/s. The huge deposit from overseas to an account in the USA triggers a report . That report ended up at the FBI directors desk. At the time, it was Comey! Comey and Clintons have a long relationship that goes back years! This is typical of the international wealthy. They transfer billions all the time and their friends are the ones in charge of countries and or very powerful individuals that have the connections. Mark Carney made a speech August 2019 or 2020 and it is listed on the Bankofengland.com site. Read it and see they want a crypto currency and may use XRP for international payments. Also, fiat is loosing favor with the fraudulent stock market, Federal Reserve printing to oblivion, precious metals (naked Short Selling and market manipulation) all for the benefit for Christine L, super wealthy and the Wall Street, City of London , BIS and Central Banks. Everyone is laundering money through manipulation and short selling. Politicians get a book deal for $100’s of thousands as an in your face pay back. They get someone to write the book based on minimal input! Majority of this is in the public eye, you just have to understand they are that dishonest and are used to it and never think they will get caught. Most people believe everyone in power is nice, I wish it was true!

BDS – One bad electrical storm from the sun that fries the electrical grid , including electronics like hard drives (that store you bit coin) and the rest will be history!

Freebrezer,

You need to look into blockchain and how an EMP or a solar flare will not eliminate your leger. It is on the blockchain and stored all over the world where blockchain is recorded.

As long as you have you info for your ledger you can retrieve your ledger holdings after an event as you describe.

Freebrezer,

I agree and would see a period of time after a severe Mass Corona ejection or EMP the grid would go down. I would think within three days people will turn on each other for food and water. Stores would be looted and no water being pumped through the water system from your local utility company. At that point , Not sure having money does anything for you. I would think the precious metal lead would be very valuable until you run out.

One of the characteristics of Bit coin no one has mentioned and that is you can trade it person to person. No way can the government outlaws private trading. You don’t need a bank or an exchange to privately trade. You can bet with all these people buying and selling there is a lot of private trading going on out-of-sight of everyone. The other characteristic is there is an end to Bitcoin. Only so many of them can be created. Yes it can be broken down into bits, but eventually even those bit are limited. That is why it is so viable as a currency. I know people think the Feds will step in but I don’t see how. They may try but the very nature of Bitcoin makes it impossible they will try but us rube’s still have “yard sales”.

It is easy to barter tangible things, less so encrypted “money.” Just be sure when you are trading bitcoin person-to-person that the guy has no ties to Kazakhs

tan, Nigeria or a thousand other centers of lower learning.

Amazon is a real company with revenues and significant positive cashflow from multiple business segments and many physical locations (warehouses) shipping real products to end users every day.

Bitcoin?

Great interview! Rick Ackerman has both feet firmly planted in reality. Thanks!

Great show as usual!

He doesn’t get it. Michael Saylor explains it’s not an asset you sell. You hold it and borrow against an appreciating asset. A whole industry is being created to service this called De-Fi or decentralized finance. The rubes are the ones left holding depreciating fiat currencies.

Robert, you are correct. Rick Ackerman is a smart guy but he needs to study the technology behind bitcoin and the emerging de-fi industry. In every other area, our society is becoming digitized. Why not also in finance? Everything I read about bitcoin’s technology and fundamentals, and more importantly, the power of the emerging de-fi industry tells me that in time, these technologies will overtake the existing financial system. While there are a number of reasons for this, two stand out to me. First, de-fi is highly efficient in that it cuts out the middleman by using mathematics to perform the middleman function. In a competitive market, the most efficient processes always replace the existing, less efficient processes. Cutting out the middleman (bankers, financiers, etc.) greatly reduces the overall cost of financial services. That is why some of the crypto lending services can pay out 3%-10% on crypto deposits when money deposited in a bank these days is lucky to pay 1%. As someone who chooses to save rather than borrow, that sounds like a much better alternative to me. Second, mathematics is far more honest than a middleman. De-fi is set up so all can see the code, therefore any shenanigans in the code are easily discerned. From what I read, financial regulators like crypto currencies because the blockchain allows them to trace all transactions – which is likely the hardest part of their job when investigating financial crimes.

One thing I have noticed over the past few years is that when financial analysts having a strong macroeconomic background take a hard look at bitcoin, its technology, and what it is capable of, nearly all of them switch from nay-Sayers to proponents. If you listen to them, they are not doing this because bitcoin is a bubble.

H – The energy consumption to produce a bitcoin is huge!!! I don’t think Greta would approve. here is the chart per cost per country per bitcoin. Energy consumption is one of the Achilles hill to bitcoin … https://powercompare.co.uk/bitcoin-electricity-cost/ … This is a classic exponential function and all exponential money$$$ ventures collapse… Dot.com bubble/2000, subprime mortgage crisis/2008 and even the major currencies around the world that are debt based. the only question is when. Right now it takes $10,000 to $15,000 to mine one coin in the USA! The block chain relies on an ever expanding base of computers to support the ever expanding use … again it is an exponential algorithm. Good luck and may there be plenty coal power plants in your future!

Any “money” that needs technical expertise to understand is not the kind of money I want to accumulate.

Just remember how that worked out with housing…

Did you not hear Ackerman say, “Don’t leverage!”?

I would not claim that Saylor doesn’t get it. He surely does — just not in the way you seem to think.

None of it will matter when you/we run out of food.

Food shortages are intentional and will get much worse.

I’m having trouble posting.

And we haven’t seen anything yet on food shortages as we enter into the Eddy Minimum. This Spring, people need to start growing a portion of your own food. If you fail, it won’t be critical but if you wait till food becomes critical and you fail, your family might go hungry. Buy seeds now, there is a growing seed shortage already.

It will be much, much worse. Deagel was right. CYA.

Large gardens, inside and outside

Wood stoves, you can cook on, and a lot of wood.

Maybe AOC’s new rebuilding of our cities into “green” is already underway. If existing real estate is written off in mass, the gov. will step in. The crystal ball is cloudy, I see smoldering ruin, piles of ash and dust. The only green is “Soylent and green”.

Ackerman thinks bitcoin could hit $1 million and advises “the little guy” to stay out of it? That’s a disgrace. Kids are buying $10.00 worth of bitcoin right now. If you look at bitcoin trades on any of the exchanges, they are mostly ALL fractional, small transactions and have been that way for years. The Big Players are buying up bitcoin because of its scarcity. Why would they dump it on “rubes” when it might slightly decrease in value because of a short term strengthening of a failing fiat currency? Bo Polny made the right call. Anyone who listens to nonsense like Ackerman is peddling deserves to stay poor.

“The Big Players are buying up bitcoin because of its scarcity.”

How could there be scarcity in bitcoin when it can be divided again and again? If it’s divisible by units of 100 millionth of a bitcoin called a satoshi, why can’t one satoshi be divided again by another 100 millionth of a satoshi and call it mini-satoshi?

In another word, bitcoin is no different from any fiat currency. As the matter of fact, it’s worse than an ordinary fiat currency since it’s not even back up by taxes or by force like the dollar.

T – good point, plus look at the cost (this is from 2018) https://powercompare.co.uk/bitcoin-electricity-cost/ If energy prices go up, which it will, and the Greta gets involved … this will become a house of cards! they (TPTB) just need enough rubes/plebes to buy in over a period for them to rake in billions$$$$ … Same story just a different theme.

Another great point, most folks don’t know the blocks in the chain are the miners who are willing to pay the cost of energy to maintain the integrity of the BitCoin. When the energy cost becomes too prohibitive to produce/mine a new BitCoin, the blocks will shut down – unless it’s paid for by the pump and dumpers until they are ready to pull the rug. That is going to happen (most of the miners are in China, who knows if they are truly miners or pump & dumpers) which is something to think about. On top of that, an eventual happening of government crackdown on the exchanges will occur when the government introduce their Central Bank Digital Dollar.

I concur BitCoin is the same story, as GameStop, just a different theme.

How will people access bitcoin when they take the system off line for “the great reset”?

HMR:

Let’s think this through: The Big Players own the politicians. Then, by proxy, they also own the government, including the courts, the regulatory agencies, and the military. Now “The Big Players” are buying Bitcoin. I’m thinking that gives us a clue about where “The Reset” might be heading.

Good point…unless it’s a pump and dump.

Elon Musk is not a “Big Player”. Rothschild IS. Haven’t heard he is buying.

H,

Re: What you haven’t heard about what the Rothschilds are buying

They don’t converse too much with me either. Let me know when you hear something.

Wonder what a modern-day Carrington Event would do to Crypto supporting infrastructure and wallets…

If everything gets fried, how do you recover it?

Steve:

Re: “If everything gets fried, how do you recover it?”

Bit by bit? (just kidding)

Both my wallet and my phone are (sometimes) protected from EMPs of all sorts, especially those resulting from coronal mass ejections. I assume at least some other people take similar precautions. That’s the easy part.

(unfortunately, I’m often careless about such things)

Ha. Good one.

I guess my biggest question is whether the primary infrastructure is shielded. If the transformers supporting our grid are at risk, maybe I shouldn’t be focused on everything downstream…

Steve,

Unless things have recently changed drastically (unbeknownst to me), the US electrical grid is poorly protected against a strong solar coronal mass ejection . . . even though such protection could be achieved at “relatively” modest cost. Some other countries, particularly Russia and, I believe, the Nordic Countries are in much better shape. I’m not sure about Canada, but my guess is that it, also, is well protected.

Concerning other risks to the grid, including an EMP attack: The US grid is very vulnerable. Of course, that risk extends to everything, not just Bitcoin.

(As an aside: the very quick (E1) EMP pulses from detonation of nuclear weapons at high altitudes can directly damage microcircuitry. The E1 pulses do not do their damage via strong induced currents on long wires, such as transmission lines. There are, however, measures that utilities and their customers can take to greatly reduce EMP-attack risk as well as the risk from coronal mass ejections).

That bitcoin supply cannot increase and fractions can be purchased is inflationary? If gold goes to $10,000 and you buy a tenth of an ounce for 1,000 is that inflationary?

William,

I purchased shares of Arcane Crypto which just last Monday achieved listing on the NASDAQ Nordic exchange. The shares are priced in Swedish Krona, the price in USD at last Friday’s close was .42 krona or 5 cents USD. It’s a penny stock which appreciated 42% last week. Here is the symbol: ARCANE:SE

You can buy 50,000 shares for $2,500 or however many depending on your budget. It will likely triple very soon from these levels. All the best.

Well, at least you haven’t insulted my mother. Regarding The Big Players, they are going to have to unload it on somebody, MPG, and you sound like just the guy they’ll be looking for.

What you don’t get Rick is the Big Players thus far have demonstrated zero interest to unload bitcoin on anyone. They are accumulating and locking it up in cold storage. The Big Players are just getting in, perhaps in the end hoping to dump a portion their holdings off on we “rubes”. The Big Players are in it for the long run. You are right, though, I may indeed be the guy they are looking for when it hits your possible price of $1 million.

Sorry, forgot to tell you the symbol:

ARCANE:SE

That was such an idiotic statement about who will buy bitcoin at a million dollars a coin. It’s divisible by units of 100 millionth of a bitcoin called a satoshi. So each satoshi will be 1 cent at that point. So people could buy 1000 satoshis for $10.

Even now most people buy fractions of a bitcoin or tens of thousands of satoshis.

Instead of stashing “infinitely divisible” Bitcoins … why not stash “very rare” silver (that is going to be the first element to go extinct)!!

…and trade them for Pokemon cards of lesser rarity.

Greg, please get Max Keiser and Stacey Herbert on your show.

I caught a cold with BTC but have just bought 100 euros in otherwords I am only betting what I can afford to lose. I am heavily invested in gold and silver.. thanks Greg.

When dealing with a “pure speculation” it’s best to only bet with what you can afford to lose. I got in BTC at $8k, $10k and $13k and recently pulled out my original investment. Still sitting on a small pile of cash in BTC but now I’m playing with the house’s money.

Playing with the “houses money” until it goes to zero and leaves you with no profit? … why not “take out twice what you invested” so at least you will book a profit!!

The only way to go, Matt. Congratulations on your very good common sense.

Jane,

Why don’t you take those 100 Euros and buy Arcane Crypto which just last week listed on NASDAQ Nordic, stock symbol ARCANE:SE

It’s currently .05 USD or about .04 Euro. It could return you 10% per month for this year.

It is not an easy thing to list on any NASDAQ affiliate. That alone demands a level of regulation and accounting procedures which increases value.

I own shares. I have owned three broker/dealers in the United States and am well aware of regulatory hurdles. I don’t make this recommendations lightly. Greg, it may be worth a flier for you, too. You can buy 100,000 shares for a little over $5,000.

Thanks Mr Hunter and Mr Ackerman very sobering.

Economies have been in trouble before and recovered. Why can’t the present economy revive without going through this drastic change just ahead?

A Major Difference

The world’s economic problems are not the same as those of a generation ago. A major difference is the interdependence of nations and their economies. Economic policy or action in one industrialized nation affects the others. Even the poorest of developing nations is interwoven in the global economy, affecting rich nations. Prosperity of the rich countries depends on the well-being of the poor countries, who not only sell vital raw materials to the rich but also import billions of dollars’ worth of goods, creating much-needed jobs in the industrialized nations.

Developing nations want a new international economic order that would give them a better share in the world economy. It is a call the rich nations cannot ignore. As Canadian Prime Minister JustIn Time Trudeau noted, it is “an element of global security.”

To what extent if any the economy will revive and nations will move toward negotiating a new economic order very soon now, time will tell. But as as we know here as USAWatchdogger digger’s, there is beyond belief convincing proof, that what’s really wrong with the economy is beyond cure.

What’s Really Wrong?

A number of things are wrong. First, there is greed—who can control it? Regardless of actual need, people want more and more material things and a “better way of life,” even at the expense of others. Greed has fueled excessive expectations and demands for higher wages that are met by more increased prices. It leads to nations’ placing restrictive controls on the economy to protect their own wealth at the expense of others. Like a disease, greed infects the world economy with exploitation and manipulation.

Another driving force in the world economy is the threat of war. Nations want to strengthen their economies so they can afford armaments to assert or defend their sovereignties. In a massive hidden arms race with the Russki’s, the United States has introduced a plan to raise its defense budget to develop hyper supersonic weapons in the billions of dollars. Such spiraling costs of seeking military advantage could further cripple the economies of all major countries. Can one expect justice and equity from an economic system that, in two weeks, spends for military purposes amounts that it is said could provide drinking water and basic health care to all the world’s population?

The basic problem, however, is government. As the coming reset Summit acknowledged, “economic issues reflect and affect the broader political purposes.” The challenge facing Western nations is to demonstrate that their economic and political institutions are superior to those of the Chi-com’s!.

Leading up to the reset Summit, Prime Minister Trudeau told the Canadian House of Commons: “Eight hundred million people live on the margin of human existence. They live in overwhelming deprivation, with despair and in a state of perpetual crisis. The management of this crisis is a test both of the humanity and the credibility of governments.”

The fact is that 6,000 years have failed to produce a credible form of government from among mankind. Despite some gains, the crisis overall gets worse, not better. Is such a credible government possible, one that can remove the present inequitable economic order, driven by greed and its obsession for warfare?

Yes! The needed government is God’s heavenly kingdom. It will bring to this earth solutions far superior to anything dreamed of in economics textbooks and theories. That government’s principal textbook, the Holy Bible, long ago pinpointed the severe economic problems to be experienced in our day. (Rev. 6:6) But it goes beyond showing what’s wrong; it can lead you to experience the blessings of the only satisfying solution.

It will help you to appreciate why only God’s kingdom can guarantee full employment, no inflation, fair distribution of wealth and economic security. Even now it is changing personalities to eliminate greed and is turning productive efforts away from building armaments to peaceful pursuits and eventual economic security. (Mic. 4:1-4) Instead of simply creating a new economic order, soon it will remove the entire world system—including unjust economics—and replace it with a righteous new order. Only a superhuman government can accomplish such a superhuman feat!—Dan. 2:44.

Why not look into the Bible and find out for yourself what you need to do in order to benefit from that coming world change? Greg Hunter may not fully know it, but USAWatchdog.com is ready to help you in your efforts to do so.

[

I’m not sure that I understand this.

ZeroHedge:

Indeed, if one want a truly diversified and safe asset one would just buy gold. But that’s not why anyone is buying bitcoin, least of all corporate CFOs and Treasurers, who have made their case for the crypto very clearly: in a world in which just under 1% of US GDP enters the market in the form of newly created central bank liquidity, bitcoin is becoming an asset that while not safe from high beta correlation to other risk assets, is certainly a hedge to not just infinite monetary dilution but to outright fiat and monetary collapse.

https://www.zerohedge.com/markets/jpmorgan-again-tries-slam-bitcoin-fails-spectacularly

I think the bottom line here is the large companies that are including bitcoin in their asset holdings think they can delay or avoid a sharp share price drop as the value of the dollar drops during accelerating money printing. They are expecting the money printing to be a threat to their company share prices. Shares are basically a dollar denominated asset and they will decline in a dollar crash.

They are probably also thinking that the if younger generation of investors believe in bitcoin then that “faith” will also hold their share price up.

If the stock market tanks and your company’s shares are the last to fall, then you can afford to buy up some of the other companies who’s share prices have collapsed.

They may also think if bitcoin goes up excessively their share price will also go up excessively and they can make a last minute fortune on their personal stock holdings in their company and sell out before it crashes. In either case Greg is right that this behavior is a sign that a last minute crack up boom is about to unfold.

Thank you for all the work you do and for being a true Patriot!

Gentlemen, the infrastructure for a digital economy has and is being built. Yes, gold and silver will increase in price at some point and makes sense to invest, especially if SHTF and we have a Mad Max scenario. If the power goes out and the internet goes down, we all go down and the masses will not survive will not survive for long.

Rick is severely misinformed on Bitcoin. All of these financial advisors that have told their clients to avoid Bitcoin, and other crypto, are going to have some explaining to do when it becomes obvious that avoiding investing in Bitcoin was a mistake. That time is coming soon.

Greg, try to interview Michael Saylor from MicroStrategy. I’d put him up against Rick and anyone else who is negative on Bitcoin, especially Martin Armstrong. Martin is gonna have some “splainin to do”!!

Thanks Greg and God bless!

We shall see, Lawrence. I have no fear of facing your day of judgment.

remember, the government can just make Bitcoin illegal, no matter what we believe ….

Which government? There isn’t just one. The mighty USA tried making booze illegal and where did that get them? Couldn’t even get that to stick in their own country. What chance banning bitcoin worldwide. What nay sayers don’t realise is that crypto is a new technology and the cat is out of the bag now. Debt money will become a relic. Think of businesses seeing their retained profits melting ways due to money printing. Why would they not put their stored value in something that not only retains value but increases due to constrained supply – constrained by mathematics. As Simon Dixon commented “I don’t keep my wealth in fiat as too risky”

I sold 2/3 of my Bitcoin to buy gold while I still could. I’m holding the rest for now. I expect governments to outlaw it so it doesn’t complete with their cryptos.

The move to cryptocurrency is now on. This is not a one time event, it’s the destination humanity is being moved to by the Elites. Gold and silver (I love silver) will do well but fade as the entire global financial system is moved to the blockchain via Decentralized Finance (DeFi). Gold will eventually be produced in the lab at economic rates just as diamonds are and limit gold’s worth. China is at the early stages of this as per Clif High’s research. As for the “rubes” comment, government’s will buy it for global trade settlements.

Greg,

Here we go again, thinking we have a choice. Gold, silver, paper, cryptocurrency? As Hillary once said “ what difference does it make “? It will be worth whatever our overlords tell us it’s worth. Here’s a prime example.

https://www.whitehouse.gov/briefing-room/presidential-actions/2021/01/21/executive-order-promoting-covid-19-safety-in-domestic-and-international-travel/

Certificate of vaccination ID”s are coming. If you don’t have the stamp of Lucifer, you may not be able to travel or even have access to your money anyway. Employers will soon be rolling out mandates that require vaccinations for their employees. The globalist have us right where they want us. They have already stated that once the pandemic is over, they will do the reset.

FYI – that could mean anything? When the vaccinations reach herd immunity. Or when the next planned crisis hits. I’m betting on cyber polygon and the takedown of the grid in operation dark winter. The groundhog didn’t see his shadow a few days ago so we’re basically screwed. I doubt seriously you will care what the price of gold is when you’re facing death. Get your spiritual house in order. If you have issues that need to be resolved, get them taken care of now, because you may not have opportunity to resolve them later. You need to do whatever you have to, to make sure you have the companionship of the Holy Ghost with you at all times, because when this veil of fraud finally burst, it will happen so fast that it will literally take the breath away from the unprepared.

Hint,

Cyber polygon exercise in July. WEF major meeting in August.

https://www.channelnewsasia.com/news/singapore/wef-klaus-schwab-singapore-prepare-special-annual-meeting-14145692

Follow the plan.

Here’s a refresher.

https://patentscope.wipo.int/search/en/detail.jsf?docId=WO2020060606

Isaiah 2:19-22 KJV

19 And they shall go into the holes of the rocks, and into the caves of the earth, for fear of the Lord, and for the glory of his majesty, when he ariseth to shake terribly the earth.

20 In that day a man shall cast his idols of silver, and his idols of gold, which they made each one for himself to worship, to the moles and to the bats;

21 To go into the clefts of the rocks, and into the tops of the ragged rocks, for fear of the Lord, and for the glory of his majesty, when he ariseth to shake terribly the earth.

22 Cease ye from man, whose breath is in his nostrils: for wherein is he to be accounted of ?

Rev 6:15-17 KJV

15 And the kings of the earth, and the great men, and the rich men, and the chief captains, and the mighty men, and every bondman, and every free man, hid themselves in the dens and in the rocks of the mountains;

16 And said to the mountains and rocks, Fall on us, and hide us from the face of him that sitteth on the throne, and from the wrath of the Lamb:

17 For the great day of his wrath is come; and who shall be able to stand?

Sounds like the near future will be disturbing. No gold, silver, bitcoin…leadership hiding in fall out bunkers. Cheyenne Mountain comes to mind and the Congressional bunkers in and around DC.

The terrible day of the Lord…not for believers. We will rejoice in the presence of the Lord.

This could be part of the mRNA within the vaccine.

They can use this to integrate into the human DNA by inserting reverse transcriptase coding into the vaccine. Fauci is an expert in retrovirus and no doubt capable of using this HERV-W as a bioweapon adjunct.

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5537654/

Don’t take the vaccine.

What is amazing is the number of “physicians” taking it and advocating for it.

Eddie,

Thank you for your comment. You might find this interesting. My son who had COVID-19 was having trouble with his kidneys. He thought he was having kidney stones. But when the surgeon put a stint in and filmed the inside of his kidneys he found scar tissue that had massed. After further testing and consultation with other urologist it was determined that the scar tissue was caused by the COVID-19 virus.

The globalist we’re going for maximum impact when they ginned up this virus. Maximum damage. Maximum death. I just hope I get a chance to meet up with them someday and return the favor. Maybe that’s why they have a razor fence around the capitol?

Jerry, eddiemd,

Check this out.

31 Reasons Why I Won’t Take The Vaccine

https://gatesofvienna.net/2021/02/31-reasons-why-i-wont-take-the-vaccine/

One of the (many) mysteries of biblical prophecy is the seeming absence of the USA in the conglomeration of nations present in the end latter days wars. Some think a relatively obscure reference in Ezekiel to the “Merchants of Tarshish, and the young lions thereof” refers to the USA standing idly by as Israel is invaded in the “Gog” war.

Could it be that the vaccine itself is what brings the USA to its knees?

The processes driving viral blow-back in the form of ADE and/0r VADE are not fully understood even today…and without long term human trials, there is no way to know what risks we face going forward.

We have embarked on an exceedingly dangerous roll of the dice with the lives of untold millions in the cross-hairs, and have bet the farm on a potentially reckless assumption of safety.

We may very will find out together if the biblical plagues of Revelation have arisen from our own hubris. Time will indeed tell…

P.S. Research seems to suggest enhanced disease processes are inextricably linked to characteristics of the surface proteins of the virus, with different structures inducing different responses.

Therein lies the rub. Now, I’m not a microbiologist, but the Pfizer and Moderna vaccines are designed to instruct your cells to produce the spike protein on the surface of the Sars-Cov2 virus.

How did researchers select this particular protein for the vaccine? Since we do not understand the mechanisms fully that lead to viral enhancement, and we spurned the need for long-term human trials, how can they possibly know the spike protein is a “benign’ choice?

They don’t…

Sorry Gold and Silver Bugs (I once was one)

Sadly, it’s not an arrested market for you, it’s the end of the road 🙁

Let’s face it, the millenials don’t want your precious metals, they want Bitcoin.

Web 3 is coming to take over the world as we know it and I suggest that you start learning all about it or be left holding your (very heavy) bags .

well, how will bitcoin survive using all that electricity without silver to conduct the electricity?

I can play your videos fine. Thanks for continuing with them.

My concern lately is how much longer will/can the ruling elites play games and change rules to extend the game? I can’t believe what has happened on so many levels the last 12 months. Still, gold and silver not at all time highs? Bitcoin =trade, and gold/silver=investment. Maybe the play pays off for my kids.

Rick Ackerman seems to see the financial numbers but doesn’t know the technology that is very close to be rolled out on Bitcoin. Bitcoin will soon have the lightning “2nd layer” network applied which will make Bitcoin very fast for even very small purchases. Bitcoin is the only crypto that is secure enough to be trusted. That being said silver and gold should also be good assets to purchase.

Bitcoin is only a small party of my interview. I have no stake in bitcoin, nor any desire to wade into the fever-swamp that supports it. Might I humbly suggest listening to the entire interview, which mostly concerns the coming, ruinous deflation?

You don’t now, and never have had to buy a whole Bitcoin. Each Bitcoin is comprised of 100,000,000, that’s 100 Million units of what’s called a ‘satoshi’. Comparable to a penny, which is 1/100 of a Dollar. You can buy $5 worth of Bitcoin on Gemini right now and could have done so for years. That’s why the following statement Mr. Ackerman made about Bitcoin is ‘strange’. The ability to distribute Bitcoin to the masses is built in, by virtue of the ability to divide a bitcoin into 100 Million pieces (satoshi). And anybody with a phone or computer can hold Bitcoin.

“In order to allocate all the Bitcoin they are acquiring right now to the rubes, they are going to have to have a way to allocate it fractionally. . . . When Bitcoin gets to a million dollars per coin, who are the buyers going to be?”

Lazio … The Fed is working to divide the dollar into one hundred million pieces also … so what makes Bitcoin any different from infinitely printed Fed fiat IOU notes??

Paul,

It’s not the same thing. The dollar is being “printed” into infinity. That cannot happen to bitcoin. Its supply is limited to 21 million “coins”. Think of it this way: If gold goes up to $10,000 an ounce in response to dollar money supply expansion, and afterwards you buy a tenth of an ounce of gold for $1,000, does that contribute to inflation? No. The debasing of the dollar is what’s inflationary.

Bitcoin is a brand of cryptocurrency backed by no physical asset.

1. WHY should anyone think Bitcoin is more important than other cryptos?

2. Why should Bitcoin be “as good as gold” or silver?

3. Isn’t Bitcoin used by the Cabal to move their funds around without being tracked by government?

4. Are there any significant differences between Bitcoin and tulip bulbs?

5. Why isn’t Bitcoin a Ponzi scheme?

Greg, unless you can answer these questions AUTHORITATIVELY you should not be talking about Bitcoin, there is too much else to talk about. And given that we don’t KNOW ANYTHING about Bitcoin’s algorithm and “banking” methods, we now know more about Dominion’s algorithm, it is IMPOSSIBLE to state what all this IS with any authority.

The bitcoin software is open source, you can download and analyze it all you want…

https://www.mycryptopedia.com/bitcoin-algorithm-explained/

Thanks Greg, this was a great summary of how to lose money in a crazy market.

Bitcoin = Tulip Mania (see https://en.m.wikipedia.org/wiki/Tulip_mania ) The nice thing about Bitcoin is you don’t have to get your hands dirty. Those were my thoughts years ago and now I’m kicking myself for not buying BC when it was in three digits — yeah, no — BC is a Ponzi. Rick Ackerman is exactly right when he labels it pure speculation. Don’t be a bagholder when the market collapses.

Tulips are flowers that grow and are real – you can pick one and smell it. E=MC2 is not real because you cannot touch it or smell it. So lets abolish all mathematics, logic, abstract thought and ban their use as not real. And lets ban “money” as well for as Robert Kiyosaki wrote, “Money is just an idea”.

Ask the folks in Hiroshima and Nagasaki if E=MC2 wasn’t “real” and if they didn’t “feel” it

Yes, why, way back in that time did people buy into the tulip hype at a time when gold and silver were anti-inflationary and the actual current currency? Why would they spend on a speculative bubble like tulips? Because most people are sheeple. IMHO, BTC will continue into a hyper parabolic phase because of so many people grasping toward anything they see as “out of the system”. It is speculative in its base with some false hype into how it could become “real money.” But make no mistakes in believing it won’t come crashing down. So, Why not just play it as the speculative animal it is? I play btc just like that. Buying some and selling every 25% up tick to make a fiat profit, wait for a drop and buy more with only my profits… the house money……

Another guy who gets it. Nicely summarized, Rich.

Don’t forget the beanie baby phenomenon. One of the keys to the craze was that Warner (the creator) restricted supply of select models as a tactical feature. Formulaic supply restrictions work for awhile, but ultimately cannot infuse a product with sustainable value.

The market for beanie babies eventually crashed anyway when people realized that cute, small stuffed toys had no lasting value.

Beanie babies did have the advantage of being tangible, and ultimately retained a residual value in the arms of a child.

Bitcoin will be the currency of the realm for the naked Emperor…until a child sees his nakedness, and cries out for a beanie baby instead.

Congratulations to all who have made a fortune in the rise of Bitcoin. I looked at it at $300, but didn’t pull the trigger. Oops…

Rick always provide valuable info….

Greg, this guy is a hard core deflation theorist… and is so hidebound in his opinion that he refuses to acknowledge his own inflationary opinions. Bitcoin is the inflationary canary in the coalmine and other assets like gold and silver will follow as history has shown us over and over… Germany Weimer Republic, Hungary, Argentina, Yugoslavia, etc, etc. This is because governments can not afford the unrest caused by all the pensions and banks going insolvent , so they paper it over. And the big money will keep bidding up assets seeking refuge till they’re gone. History will repeat itself here. I bought 1/2 a Bitcoin in 2017 after it came off its 20K high around 1,700. I think it would be prudent for the “little guy” to hold some crypto as even the Fed has plans to issue their own.

Heff, you should take the time to listen to my entire interview if you want to understand why the endgame is far more likely to feature deflation then hyperinflation. You mention Weimar, but I doubt you have any knowledge about what actually occurred in 1921-24; for if you did, you’d understand why hyperinflation is not in the cards. I suggest Adam Fergusson’s ‘When Money Died’ as the best source of information on this.

Hello Greg, Rick is one of my favorite People. I know there are some very smart people on your site so I would like to ask for some help. My brother has $5,000 of XRP, his broker is Kraken. Since the SEC did their thing with XRP, he can not sell to get his money. I was wondering if anyone here could offer any advice on how he could sell? He is an American citizen not sure if that matters. Thank you

He can swap his XRP for almost any other crypto on Simpleswap. Then he can sell that BTC or almost any other coin on Coinbase or Gemini or many other exchanges.

Stop being apart of the system that is destroying you shake it off. As much as you can of course. I deleted my youtube channel ( not that I had any content) and I do not sign in. Im off ALL social media facebook twitter etc. I canceled my Amazon Prime and only use Amazon and a product search engine to find what I want then I visit the seller and buy from them… I will pay more I don’t care. I don’t buy through Amazon anymore. NetFlix will be next to be canceled. Matthew 10:14 — And whoever will not receive you nor hear your words, when you depart from that house or city, shake off the dust from your feet.

Rick doesn’t understand bitcoin. It is not a stock. It is extremely easy for the everyday person to buy a small amount of btc. If someone wants to buy $20 of btc, they can do that. It’s not about ‘fractional’ btc, that alone tells me, he doesn’t understand it, or believe in it. Btc has a 4 year cycle. So yes, it will top out later this year, early next, then correct, and then it will go up again. It won’t reach $1mill this cycle. He reminds me of Peter Schiff, just an old schooler who just doesn’t get it. Even so, it was entertaining to listen to his point of view … lol

Helen … The old school teaches: 2+2 = 4 … in Bitcoin school: 1 / infinity = 1 million … unlike the “new math” … the “old math” says it is impossible to divide by infinity!!

Helen, one cannot argue with stupid, as the saying goes. Even so, I should point out that nearly 100% of the buying in BTC these days is for speculative purposes.

Greg,

Nick Barisheff keeps about 100% in au-ag. Same message as Egon. With your savings not your budget money.

David

For so long they have claimed that there was not enough gold to back the dollar. Bitcoin proves this false.

The Best Is Yet To Come! Donald J. Trump

My Grandfather told me that he stayed out of the market until 1929 and then got sucked in by the free money. He lost his life savings of $20,000. We now know that the big boys pumped up the prices and then dumped them and then shorted them. We are in 1929.

John … Your Grandfather’s dollars back in 1929 were worth 100 cents each while the current dollar is worth only one 1 cent … if your Grandfather simply bought silver with his money back then (when silver was selling for 25 cents per ounce) instead of getting caught up in the greed … he could have bought 80,000 ounces of silver … today 80,000 ounces of silver at $27 dollars is worth $2.16 million dollars … but since today’s dollars are only worth a penny each … the $2.16 million dollars today is only worth about the same as your Grandfather’s original $20,000 back in 1929 … “proving” silver to be an excellent “store of value” if you are looking to preserve your purchasing power (which is of course what investing should be all about)!!

People with 2 million dollars today … looking to preserve their wealth from the ravages of “deflation of their purchasing power” by the currently massively printed US dollar … should seriously think about buying 80,000 ounces of silver (instead of investing in the current bubble stock market and bubble Bitcoin)!!

Hard to believe so many would be so crazed at to buy an esoteric, electronically manufactured digital bit of nothingness to preserve their wealth.

I don’t fault speculators, only their idiot idea that they will all exit at the top. They are out-idioted only by those who are convinced there is no top.

Hi Greg, appreciate your work as always. Regarding Bitcoin, Ackman simply doesn’t understand what he’s talking about YET. Just as those who didn’t understand the internet when it first came out.

PLEASE, most of your guests are old school, and nothing wrong with that… (I own plenty of gold and silver too), but your viewers will be better served by contrasting their opinions with a guest or two who actually understands what’s happening with crypto (a whole new system is being created right in front of our eyes, and only those who use it understand how it works, how much better it is, and how it will change the world in favor of humanity). Decentralization always wins over centralization…

I would recommend asking Micheal Saylor on as he is best at verbalizing what is happening. There are others like Trace Mayer who also are great at verbalizing.

Thank you again for your great work and passion!!

Nate,

What caught my attention is very big people with trillions of dollars undermanagement buying it. Too big to be simple greed in my mind but what do I know.

Greg

Mr. Hunter:

Re: “people with trillions of dollars under management buying [Bitcoin]”

Hmmm: Owning politicians AND Bitcoins. THAT sounds profitable!

I’ve spent a part of my Saturday morning responding mostly to those who think I don’t get it. I’d suggest you read my comments, since your own misunderstanding could prove financially fatal.

The unborn babies used for vaccine development were alive at tissue extraction

https://rumble.com/vcq539-the-unborn-babies-used-for-vaccine-development-were-alive-at-tissue-extract.html

There is a reason the Fed and JPM invented Bitcoin. I’ll let y’all know why in due course.

Stan,

Really? Why don’t you let us all know now and don’t be a weasel.

Greg

To stan, You are to stupid to have any inside info, ALL of your past postings are proof, you don`t no squat. If you really want the truth listen to stan and do the opposite .

Jim,

Not so fast. Stan has said the dollar is king, and so far it has been. I can’t tell you how many times the feds have smashed metals down with paper contracts. The markets are rigged. Period. Under normal circumstances I would agree with you. Gold should be $ 10,000. an ounce but if it was allowed to go that high, the dollar wouldn’t be worth toilet paper. The rigging will continue until a new system is put in place.

Jim: You insulted me. Therefore I put you on ignore

Stan … Wasn’t the reason the same as them producing the ETF’s (GLD and SLV) to siphon money away from the precious metal markets??

Paul: No, that is not the reason.

video too choppy to watch. sits and spools

Great interview. Maybe Mr Ackerman is right about Bitcoin i.e. it’s going much higher but who will you sell to, which is when the price drops like a stone. But here is another perspective: BTC may become electronic gold. The market cap of BTC needs a tenfold increase to match gold. Does anyone ask: why buy gold? Who will you sell to? Further, I suggest gold has been heavily manipulated, which probably means when the fiat dollar situation/catastrophy evolves, prices will be much higher for BTC than the current $400-500k to match gold.

“Electronic gold”! This is so oxymoronic that even BTC religionists in this thread will see it for what it is: nutty.

French nun, world’s 2nd-oldest person, fends off COVID ahead of her 117th birthday

FEBRUARY 10, 2021 / 6:52 AM / AP

https://www.cbsnews.com/news/sister-adnre-france-2nd-oldest-person-beats-covid-before-117th-birthday/

This young woman, at heart. Has been through two world wars, might she see the third?

Gone from donkey, to jet plane travel! Driving a horse to muscle car! Electricity. Atom-Hydrogen thermo-Nuclear bombs. Acceptance of dope smokers! Free sex, ad nauseum!

Since the turn of the last century we have already lived through two world wars and many other major conflicts, along with famines, earthquakes, pestilences and the like. (Luke 21:10, 11) Yet Jesus said: “This generation will by no means pass away until all these things occur.” (Matthew 24:34) Therefore, you might ask: What other major events remain to be seen by the generation of the whole of the 1900’s? And can these actually take place in the time period that remains for that generation?

Jesus’ prophecy: “This good news of the kingdom will be preached in all the inhabited earth for a witness to all the nations; and then the end will come.” (Matthew 24:14) Yes, this is the work that has to be completed to God’s satisfaction before the end comes.

What other events must take place in the period left for the generation of 1914? The Bible clearly points to certain major developments that will lead into and form a part of the “great tribulation” that culminates in Armageddon, “the war of the great day of God the Almighty.” (Matthew 24:21; Revelation 16:14, 16) It is urgent that you know what these developments are and that you take necessary protective action before it is too late.—Zephaniah 2:3.

One of these developments was prophesied by the apostle Paul when he stated: “You yourselves know quite well that God’s day is coming exactly as a thief in the night. Whenever it is that they are saying: ‘Peace and security!’ then sudden destruction is to be instantly upon them.” This prophecy makes it clear that, just prior to the end of this system, “peace and security” will be declared in some exceptional way, whether by the United Nations or independently by political and religious leaders. What will follow that declaration? Paul said: “Then sudden destruction is to be instantly upon them.”—1 Thessalonians 5:2, 3.

At 120, that generation is running on fumes, so ? That means, so are we. Figure it out, INCOMING!!!!!

Gold and silver markets are 100% manipulated. No matter how much money is put into those markets, the price can be pushed down with derivatives. The money being put into Bitcoin is a drop in the bucket compared to what it will take to buy up all the physical gold and silver and crush the COMEX. So why put all your money in gold and silver ? What these old school economists don’t get is that the blockchain technology of Bitcoin is what gives it its value. It has all the properties of monetary gold. Its easier to make transactions. And, unlike gold, all the transactions are on the blockchain, making it impossible to steal without a permanent trail. Bitcoin and other cryptos are the future of money. Yes, Gold and silver for the upcoming crash, but cryptos are the new financial system 7+ years from now when people figure out a gold standard isn’t all that great because the government can still manipulate the supply. Plus try using gold and silver to pay for your online transactions…it ain’t gonna happen. Bitcoin supply is fixed to a predetermined slightly growing supply. I tell people to buy it now as part of a portfolio, not something to put all your eggs into. Realize its true value won’t be reached for several years and it will go up and down a lot so hold on tight for quite a while. But most importantly, do not trust in gold, silver, cash, bitcoin or anything else. Trust in God the Father and his Son Jesus Christ. If you do, you will be lead to the financial path that is right for you.

Dozens Develop Rare Blood Disorder After Taking Coronavirus Vaccines – Report

by RT February 10th 2021, 11:24 am

One dead and doctors can’t rule out blaming vaccine

https://new.infowars.com/posts/dozens-develop-rare-blood-disorder-after-taking-coronavirus-vaccines-report/

There is another big bomb to go off besides commercial real estate. Those billion dollar cruise ships that have been in hot storage for a year! Unlike a building these ships sit in a very corrosive environment. They need constant paint and maintenance. Now some ships have to go into drydock which is incredibly expensive. Yet no money is coming in nor will it for at least a year!

Empty NYC skyscrapers will need maintenance too. When the $4.5 billion Revel Hotel/Casino in Atlantic City closed for a long time, the heating and air conditioning ran at reduced load. The resulting seasonal underheating/undercooling created structural leaks that allowed pigeons to take roost inside the building.

All cyptos are worth what they started at which is ZERO !! It is only worth what you can get someone pay you for it. All fiat currencies are a ponzi at this point and have been since the US came off the gold standard. If playing in this CASINO is in your blood and you have cash to gamble then play the game.

Why do some people believe everything the authorities tell them?

Remember when doctors said smoking was good for you.

Teflon coated cookware was safe. (It causes cancer.)

Thalidimide.

Vioxx heart medicine. It killed 40,000.

Many virologists and doctors are warning about RNA vaccines. 99% of deaths are to old people. So who did they test it on. Young healthy people and they experience death and serious side effects. What if they tested it on old people?

https://articles.mercola.com/sites/articles/archive/2021/01/31/covid-19-vaccine-gene-therapy.aspx

Greg,

If using the past investing experience, as if that is the path forward, you are woefully being deceived!

Look at who these men are, what they represent and their concerted efforts to entice a large unsuspecting audience into casting their lots with them

Be careful; Times are changing rapidly and not in their direction. Best wishes.

TJZ,

I am not being deceived. I am reporting on a huge trend and trying to make sense of it. Did you not listen to the interview where Ackerman told people to pay off their house and don’t take on risk? No, because you did not listen to it.

Greg

It seems like a lot of big investors realize – or feel the FED and the big banks are throwing them under the bus and they are taking precautions. Does that sound like a fair assessment of what his happening? All the shorting to control the prices and markets does not appear to be working as intended – any longer?

I listen to all your interviews by downloading and converting to mp3 audio I can play in the car. I can download and convert you tube videos but not rumble, can you also post an .mp3 file in the guest page?. Thanks

THERE IS ALWAYS A LIMIT TO EVERYTHING. TREES DO NOT GROW TO THE SKY. HOWEVER, FOR THE TIME BEING, ALL ASSET CLASSES AND ALTERNATIVES ARE GOING-UP TOGETHER WITH MUCH EXUBERANCE. THAT WILL CONTINUE UNTIL IT STOPS AND EVENTUALLY, IN A MATTER OF MONTHS, NOT YEARS. IT ALWAYS DOES AT THESE EXTRAORDINARY VALUATIONS. VERY SPECULATIVE MARKETS AT THIS TIME. DON’T FORGET VOLATILITY, ESPECIALLY IN REGARDS TO BITCOIN. IN FACT, BITCOIN IS A HIGH RISK ASSET CLASS.

Bitcoin is, in-fact, a High Risk Asset (Speculation). Trees don’t grow to the sky so there are always limits to what someone will pay for any asset or alternative.

This interview with Mr. Ackerman covers a handful of topics. My 2 cents on them:

– Bitcoin: Rick is right, there is no easy mechanism to “offload on the rubes”. Not enough transaction per second bandwidth, even though BTC is infinitely fungible. So he’s answering his own question there, regarding what may happen to storage of value with Bitcoin. Once that money goes into it, it doesn’t liquidate fast. So it will be a storage of value for large sums (digital gold for banks/nations). The rubes will transact daily on another blockchain, and the value of Bitcoin will be determined by other factors.

– Interest rates: If they go up, what will that do to our debt servicing ability? Won’t it contribute to runaway inflation? The fed/US has painted itself into a corner.

-Gold and silver bullion as a safe haven from systemic collapse/long term investment:

I used to be a precious metals bug, but some factors have come up that tampered my enthusiasm. 1) We’ll be mining space soon enough. What’s that going to do to the rarity of gold/silver in 10-15 years? 2) As a safe haven, look at the countries that had currency collapses in the last 4 years? Argentina, Chile, Zimbabwe, Venezuela. People there all had one common approach to preserve purchasing power from hyperinflation, and transact: crytpocurrencies. Not gold. Bitcoin, doing what the IMF should be doing. Financial stability for the people, by the people. And because I held some of my money in bitcoin, I helped stabilize it for others in need. It’s got a proven track record for remedial value storage in the modern age. If people in Zimbabwe were able to make it work, why not in a first world country? Who’s going to care that Janet Yellen made bitcoin illegal, if it’s the only way to put bread on the table? They will have lost control at that point, and that’s why they’re pushing hard for universal income/helicopter money. Because they don’t want people to get off their asses and look for alternatives to THEIR money system.

I enjoyed the argument that bitcoin has no intrinsic value and it is an abstraction. Fair enough. So is the USD, and yet we decide to put our faith in it. Also, gold represented stored labor value at a time when labor and the mineral used to extract it were rare. This paradigm is changing inevitably, with robotization (and space mining). We are entering an age where more and more of our labor is done by machines. How do we assess the value of a chunk of metal, then? Doesn’t it become an abstraction itself?

Thanks for your thoughtful comments, Raphael. Concerning rising rates, they will increase the real burden of death. That is deflation’s most destructive symptom. I often say that an increase in the real burden of debt IS deflation. The monetarists definition no longer works because there are too many fungible forms of money to measure. To your other points: I am unconcerend that gold from Mars will impact earth gold’s value any time soon. As for bitcoin putting bread on the table, that may be true, but only for this nanosecond moment of speculative zeal.

Bitcoin is an illusion – backed by Nothing and going Higher

Makes No Sense – Billionaire Buyers – They Know We Guess They Win We Lose

Just think one Billionaire Buys Silver it Would Skyrocket to $500.00

I’m amazed that every thing is totally Corrupt – Government, Military, Media and so on In my Opinion the Nation has lost its Soul.

Greg Hunter is our Ultimate Patriot – Thanks for all you do for America

Hey everyone,

I don’t understand what people don’t get!

First there is a difference between money and currency.

Gold and silver have value because of a few of their attributes, their chemical/physical properties, there is a finite amount of both and both are recognized as something of value. It’s also costs something to get the gold and silver out of the ground. It has intrinsic value.

Currency on the other hand is a method of exchange. People don’t cart around all their silver and gold for lots of reasons. It’s heavy, it’s not easily divisible, it’s not convenient, a little piece is worth a lot and can be easily stolen or lost. This is where currency plays a part. Several thousand dollars can be carried about in a small stack of $100 dollar bills, it doesn’t weigh much and doesn’t take up a lot of room. And if you want to buy something that’s a few hundred dollars it’s easy to pay rather than chipping off a piece of gold or silver from the hunk of rock in your purse lol.

In the Roman Empire thousands of years ago they used salt as money! How is that possible? Well for starters it has value “worth” because it’s useful, it’s in limited supply and all the people using it as “money” agreed on its value.

We hopefully can all agree that the only thing holding the economy together, although dwindling, is confidence. Fiat currency is a scam. It’s not backed by anything, well actually it is, it’s backed by debt. If we were still on the gold standard we wouldn’t be in such a huge mess, still a mess but not quite as big lol.

Now bitcoin meets the requirements for being money. It’s is in limited supply. Work has to be done to get it. Mining bitcoin cost energy and money. “They” can’t print or make more bitcoin when they want too. And the people using crypto’s see it as having value. There are all kind of places that accept it as method of payment. You can buy groceries, pay for fuel and a haircut with bitcoin in several countries. Sounds to me like it’s meeting the requirements of “money”.

Crypto’s will do awesome in the next 12 months. Don’t miss the ride. Don’t bet the farm just a little bit will get you a lot.

Bitcoin’s wild price fluctuations alone disqualify it as money.

When Ackerman said Silver is a little Pricey – ?????

The only real money is Gold & Silver

I was speaking from a trader’s frame of reference.