Will The Real Estate Crisis Continue?

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

There has been some encouraging news about the real estate market recently. In San Francisco, real estate prices shot back up 16% according to the Case-Shiller Index. On the other coast, friends of mine in the New York City real estate business say price declines seem to be leveling off. There has been plenty of talk that “now is the time to buy a house.” After all, the government will give up to an $8,000 tax credit if you purchase a home. But what is the real story on the housing crisis? Are we at or near a bottom?

I rang up one of the best experts in the business, Yale Economics Professor Robert Shiller, to get an appraisal on where home prices are heading. I first interviewed Shiller in fall of 2007 while I was at CNN. I asked Professor Shiller, “If the housing crisis was a baseball game, what inning would it be?” Shiller immediately said, “First.” Looking back, I’d say that was an accurate assessment of the crisis. A little more than a week ago I started off, once again, by asking, “What inning are we in now?” Shiller responded by saying, “Why don’t we say fourth.” Fourth inning, meaning we have not yet even hit the halfway point. I have to admit; even I thought we were further along than that.

So why is this crisis taking so long to unfold? According to Shiller, the real estate boom that kicked off the new millennium is the biggest in history! It was the first time real estate speculation was a global phenomenon, and it was very easy for the common man to play the market. Shiller says, “It used to be that speculation in real estate was primarily land speculation, and it was kind of a special breed of person who would go out and buy 1,000 acres somewhere, you know. But now, it’s like everyone can play because it’s your own house. And so, it’s created a national and international pastime of real estate speculation that’s very easy to do.”

Shiller told me that he worries that prices may still fall further, even though prices have rebounded in some markets. He says the banks are holding plenty of real estate off the market in an effort to keep prices stable. But, many more houses will go into foreclosure, and that will be a big problem for the banks. According to RealtyTrac.com a record 2.8 million homes in America were fooreclosed on in 2009. Shiller says, “… they’re going to find it hard to just sit on that. And so, there will be more property on the market, and that may tend to bring home prices down again.”

There is another less tangible problem the banks are facing in this crisis. The negative stigma associated with a default is fading away because of the bailout of the bankers. (The bankers caused the ongoing financial crisis in the first place.) Shiller says, “…what might make this worse is our moral compunctions against defaulting are eroding somewhat.”

Greg: In other words, are people finding it less of a stigma to just throw the keys on the table and say, “that’s it, I’m out”?

Shiller: Right, because they’re thinking all these bankers are making a killing. They got bailed out, you know, and now they’re making huge salaries. So, why should I worry about them?

And, according to Shiller, even if interest rates stay right where they are now, real estate prices could still take another hit.

Shiller: Even if they don’t go up, I think there’s a risk. We’ve had a 0% virtual federal funds rate for some time now when home prices were falling at that time.

Greg: Even if rates don’t go up, you’re saying that prices could still go down?

Shiller: Right.

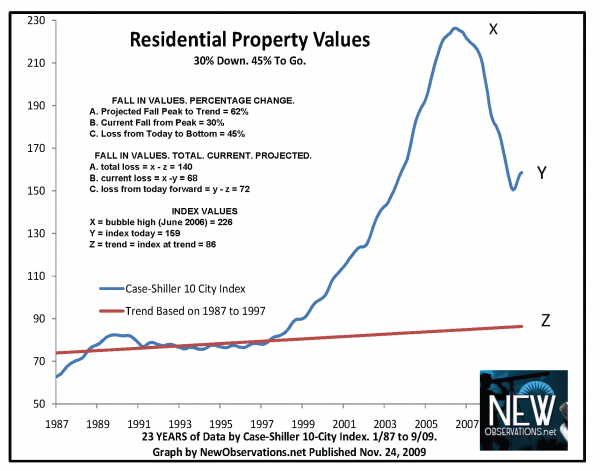

Take a look at the chart below which was put together at the end of November by real estate expert Michael David White. He used data from the Case-Shiller Index. If White’s calculations are correct, the market has at least 20% percent more to go on the downside. I predict the market does not bottom until 2013. Why 2013? Check out my favoorite real estate chart below for the answer:

He used data from the Case-Shiller Index. If White’s calculations are correct, the market has at least 20% percent more to go on the downside. I predict the market does not bottom until 2013. Why 2013? Check out my favoorite real estate chart below for the answer:

Thanks Greg,

As usual, you are providing me with information from a range of different sources that I would not normally read.

I have occasionally read and heard Shiller before. He seems to know his business.

If the reports and information discussed on this site prove to be pessimistic, we are still in for a long slow recovery.

However, I believe the optomism/pessimism index on this site is balanced.

Thanks again for true investigative reporting; something we rarely get from MSM pack journalists.

markm

I heard a radio clip last week that said Citigroup was going to skip the whole foreclosure routine and is telling people to just give them the deed and they will give them six months to find a new place to live. I guess that’s Citigroups version of “living happily everafter”.

And then I wonder what ever happened to “deficiency judgments” and if all these foreclosed upon people are getting “releases” or if they are going to have the lenders haunt them forever, attaching wages, and generally looking to make up the loss difference. I’ve heard no one speak of it, but perhaps the lenders are just to busy foreclosing at the moment to give it much thought. If I were being foreclosed on, I would be hoping for a statute of limitations on that part of the action, or make sure I got released.

Susan,

This plan may be in part because 40% of the time the Foreclosing bank cannot “Produce the Note.” Check out the Bio section of my site and see the story I did at CNN. Without the note the bank has a very hard time foreclosing. Thank you for you comment.

Greg

Hey Greg & AnybodycityUSA,

Just wanted to ad that many banks are pursuing deficiency judgments. Laws vary from state to state so it’s always good to check with someone local.

Thankfully the IRS is no longer treating deficiency amounts from deed in lieu of trust as taxable income and the IRS is no longer voiding the mortgage interest deduction taken in tax years prior to the foreclosure.

I guess we should be thankful for small favors.

All the Best,

Thrash

Brad,

Good info.. thank you!

Greg

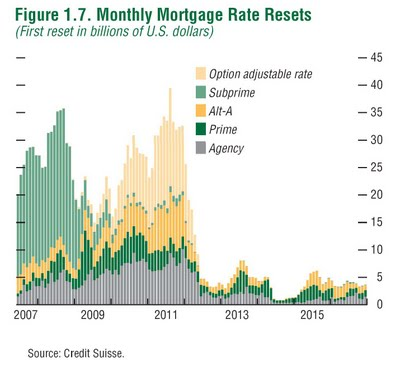

Long term I remain an optimist. Dr. Shiller’s “4th inning estimate” seems a tad optimistic though. This year residential foreclosures are expected to increase beyond the records set in 2009. ARM’s begin to reset and stubbornly depression like unemployment rates take their toll on ALT-A mortgages.

With free money flowing from the Fed, banks have absolutely no incentive to lend when they can make 3-5% returns from government debt.

FDR’s policies stemmed the bleeding during the Great Depression. World War ll took everyone’s mind off the problem. Real measurable relief wasn’t felt by the little guy until the late 1940’s – early 1950’s, a full 20 years after the Great Depression began.

In Japan they are now speaking of two lost decades. 4th inning? I think not. Two outs in the top of the 1st maybe.

Those two outs being subprime mortgages and the too small to save banks. We still have the ALT-A’s and ARM resets, commercial real estate paper to wash, unfunded pension liabilities, a stubborn trade deficit, huge public and private debt.

With all due respect to Dr. Shiller and to Greg, this is far more than a five year long Great Recession.

Brad,

I did not use this in the post but the first thing out of Shiller’s mouth when I asked him the baseball question was “3rd” then he change his answer to “…4th inning”. I do not think Shiller sees the innings as years. I am sure the professor sees big trouble ahead. I agree with you… this will go on a lot longer than 5 years. Good comment as usual!!

Greg

With so many houses out there and to many people who”s credit is ruined will the banks have special programs to own as you go.

Carlos,

Anything can happen in this economy. Thank you for your question.

Greg

to me the solution is obvious. and that is a long term solution.

which gives the whole realestate industry stability. but more

importantly main street americans can relax and feel they have

some control over their lives again. in france if you buy realestate

a condo a house etc.. the term is 20 years no not amortization

i mean for 20 years the interest rate remains the same. presently

the rate is 4 percent or close to it. imagine how you would plan

your future if you knew your interest rate wasnt going to change

for 20 years.

Elwood,

This makes too much sense so I sure it will not happen. Thank you for your comment.

Greg

Hello Greg, I just heard you a few hours ago on coast to coast AM. I had a question regarding this whole housing mess. I have a loan with Chase and have been waiting for months now to get word on the re mod. My loan was not an ARM loan, it was a fixed loan at 5.37% for 30 years. I applied for the re mod after my wife lost her job due to the financial hard ship that caused. I contact them weekly to find out the status. The response is always the same, it is under consideration or it is at the underwriters. I am over 90 days since the time the process began on their parts and still do not have a yes or no answer. In the mean time i have been asked for more proofs of bank statements and various other documents. I feel like I am being strung along, as my credit score continues to drop into the abyss.

My question is, should i continue and hope for the best, letting the late fees pile up and still am only one month down as suggested by the company, or should i bite the bullet and use the only amount of savings i have, a small amount received from my tax return to catch this up and forget it. My home value, was 196,000 two years ago, the last tax assessment put it around 123,000. I have been wanting to see what happens, but part of me is starting to think differently… I feel either way I’m for the lack of a better term… screwed!

Do you have any advice for me?

I would appreciate your help

thank you

David

can’t find the “Produce the Note” , can you email me how to find thanks I may need this. I’m praying for all.

Donna,

You will find a link in the my “Bio” section of the site. The “Bio” tab is on a black bar near the top of the Home page just under the USAWatchdog banner. Open the “Bio” section and look fot the “Produce the Note” link in light blue. Let me know if you have trouble. Thank you for supporting USAWatchdog.

Greg

Thank you for using an honest Case-Shiller chart. I’m referring to the one that shows the bubble actually started in 1997 with the beginning of the dot-com bubble (which was replaced by the toxic loan bubble)

From what I have seen lately, the CS charts now start with 2000 as the base year. It makes me question if

Shiller hasn’t sold out to the NAR.

Perhaps Dr. Shiller would like to proffer his opinion on the value of his own residence. It’s “zillowable” in case you were wondering.

Furthermore, I will assume that the “impromtu” answer of “3rd” inning is probably more true to what Dr. Shiller TRULY feels as it was the “uncensored” version. But hey…he’s a media darling and who pays the bills for the media? Used House Salespeople and Debt Peddlers perhaps?

This party’s just getting started. I wouldn’t listen to an Economics professor. Heck…the heads of my Econ department were instrumental in bringing Greece into the EU. Look how that turned out.

EconE,

Dr. Shiller is not a sellout. Thank you for your comment.

Greg

I think Shiller is entirely correct. My personal forecast is that bubble-markets will slowly adjust another 20% downward in real terms over the next three years and then rise more or less with inflation and natural growth.

It will take about that long for the market to absorb a steady-stream of distressed properties that the banks and government are trying desperately to keep from flooding the market all at once. There’s just no doubt about it – financial institutions, encouraged by policy-makers, are conducting a best-in-a-bad-situation dynamic inventory management strategy (almost similar to the way OPEC and other cartels deal with the marketing of their resources).

It is impossible for home prices to rise until all these distressed properties are finally cleared off the market and normal conditions return at last.

The key number to keep in mind to determine when we’ve finally reached re-equilibrium is the household-income to monthly-payment ratio. Compare the after-tax disposable income of the kind of families who tend to live in a certain neighborhood or “tier” of housing in a local area with the Principle-Interest-Taxes-and-Insurance (PITI) that a potential buyer would face at current market prices. If it’s below 3:1 you’re probably not at the bottom yet.

Indy,

Today Shiller said this is the worst housing market he has ever seen. and that it is “Totally supported by the government.” We have a long want down to go indeed.

Greg

Solving the Real Estate Crisis

The Facts: Many real estate loans that were granted to those who bought houses in the United States since 2002 are being wiped off the books, as many of these homes are being foreclosed upon, or the mortgage company is allowing the home owner to enter into a short sale, which also wipes the loan off the books. Every time a house is sold in a distressed circumstance, we are not only punishing the owner of the house, but we are also punishing the economy of the United States.

The Problem:

Homes are being sold after foreclosure or short sale far below actual market value. These homes are flooding the market, which has been driving down market value of surrounding properties for the past five years.

The Solution:

“Sell” the house to the current owner at current market value instead of placing the property into foreclosure, or selling the home as a “short sale”.

Erase the original mortgage and start a new mortgage at the current market value ONLY IF the current owner agrees not to sell the property within five years. The new loan would be contingent on current owner agreeing to pay the original mortgage in full to the company if the owner sells the house prior to the five year period ending.

Current owners must meet the following criteria to be eligible:

Must be their primary residence

Must have purchased the property after 2002

Must not have refinanced for a higher amount of their original mortgage

Must have had a hardship such as loss of income, illness, spouse deceased, etc.

Must be able to qualify under current mortgage company guidelines

Mortgage companies would be receiving the same amount in monthly payments from the current owner as they would from a new buyer – what’s the difference who makes the payments? The property is going to be sold for a reduced price anyway, so why not “sell” it to the current owner if they can afford the new payments based on current value. Furthermore, the original loan granted to the home owner is going to be taken off the mortgage company’s books anyway, so why not let the original home owner keep their house thorough this type of “home loan modification”?

Everybody Wins:

Mortgage companies would save money by not having to pay for the foreclosure process, not having to pay property taxes during the foreclosure process, not having to pay the staff that is needed to manage the huge amount of distressed properties the mortgage company has, not having to pay real estate commissions when the property is sold after foreclosure, and not having to sell a home that, on many occasions, has been damaged by the former owners. Also, it would not be months before the VACANT property is actually sold, and instead, the mortgage company would be receiving regular monthly payments towards a new loan, instead of nothing on the original loan.

The property would continue to be maintained, instead of deteriorating, which brings down the value of neighborhood homes. Mortgage companies will receive the exact same mortgage payments that they would receive if they sold the home to another person. Owners of real estate would keep their homes for a minimum of five more years.

This would greatly decrease the real estate inventory of short sales and foreclosures, helping to start the return of a normal real estate market. The economy would begin to recover because the strength of our economy is directly related to the real estate market.

Russ Eppen, Realtor

Broker/Salesperson

I know that in the Phoenix RE market, there are lots of Canadians picking up houses as they can’t believe how cheap the houses are, and they’re probably supporting the RE market there. My question is, why not let more foreign nationals in to buy to help turn the market around?