Recovery Hype and Fed Audit

It seems everyday I watch mainstream media there is a discussion about the ongoing so- called “recovery.” Yesterday was no exception. I was watching an anchor on MSNBC ask a guest why the “recovery” is so uneven and why it was hard to maintain upward momentum? I yelled out to my TV, “Because there is no recovery!” The “recovery” story is talked about as fact, no matter what the facts really are.” For example, a story on housing just last week from the Wall Street Journal said, “Bank repossessions hit a record monthly high for the second month in a row, totaling 93,777–up 1% from April and 44% from last year.” (Click here for the complete story from WSJ.) Bank repos up 44% in a year! Why are “record” home repossessions not included in the “recovery”discussion? Maybe because it wouldn’t sound like a “recovery” after all?

Here is another “recovery” buster from yesterday’s Washington Post. It says the President, “. . .urged reluctant lawmakers Saturday to quickly approve nearly $50 billion in emergency aid to state and local governments, saying the money is needed to avoid “massive layoffs of teachers, police and firefighters” and to support the still-fragile economic recovery.” (Click here for the complete Post article.) “Emergency aid” sounds like a crisis and definitely not a “recovery” to me.

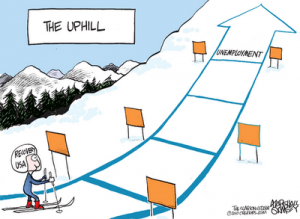

In the most recent report from Shadowstats.com (out last Friday), John Williams is, once again, forecasting a big dive coming in the economy. Williams says, “I would describe the shape of this recession/depression as one tracing out the path of an inept skier trying out a ski jump: sharp decline, then some leveling out with a brief up-blip, followed by a renewed plunge with the potential for an unexpectedly disastrous landing.”

I think many politicians know the economy is really not very good. They might say the economy is recovering publicly, but privately they know it’s in the tank and headed deeper. I think some are hoping the Federal Reserve will wave a magic wand and painlessly make everything better. Those are the politicians who will fight a bona fide audit of the Fed. Many think an audit would spark public outrage that would put it out of business.

I also think there are growing numbers in Congress who are afraid if the Fed maintains its secret powers, it will bailout its buddies in the financial industry around the globe and leave America bankrupt. The final financial reform bill, officially know as the “Wall Street Reform and Consumer Protection Act of 2009,” has passed two similar versions in the House and the Senate.

Now, both chambers have to get together and agree on the final language for just one bill that will be sent to the President to sign into law. The language to audit the Fed has been watered down in the Senate version. Republican Congressman Ron Paul and others are fighting to restore language that would make possible a full audit of the Federal Reserve. And get this, powerful Democratic Representative Barney Frank is supporting Paul! If Rep. Frank is for real on this and not just trying to look good to his constituents to get votes in November, then hats off to him and any member of Congress who supports a full Fed audit. I can’t believe the mainstream media is completely ignoring this monumental story. There is nothing more important, financially speaking, that Congress can pass right now. Check out the video below that came out from the floor of Congress just last week:

Greg, you spent time in the broadcasting business so I’d like to get your take on a thought. In the past, the news outlets seemed to sort of set the mindset of the public such that if they said “there is a recovery” or whatever, then that was sort of accepted by the public as fact and they bought stocks, looked for higher paying jobs, etc. Now that folks like me look to sites like this and others for news, it seems as if the same old game is being attempted, but it isn’t really working. In other words, a large percentage of folks aren’t responding to the old propagandistic tactics which worked so effectively in the past. Do you have any feel as to how effective ABC/NBC/et all modernly are in terms of information dissemination? Are or they rapidly becomming an irrelevancy or do they still have an influence?

Steve,

The mainstream media is in the middle of some big changes. You have given me a an idea for my next post on Wednesday. Meanwhile, let me just say MSM is in the process of going through the sausage grinding machine. It will not dissapear but it is going to be hardly recognizable when it comes out the other side. More Wednesday unless sommething blows up. Thank you for the question.

Greg

“…$50 billion in emergency aid to state and local governments, saying the money is needed to avoid “massive layoffs of teachers, police and firefighters”

This sounds more like the President trying to buy more union votes through Congress at the expense of the US taxpayer.

And Greg, you already know the reason this story is not being covered in the major media outlets. The mass media companies have to answer to their shareholders (the banks) and an audit of the Fed would be counterproductive of their goal to privatize profits and socialize loss.

Now we have a recovery that is jobless and also homeless. You can wrap a turd in a box with a nice bow and call it a present but it’ still a turd.

Stephen

Stephen Clifton,

You are probably right. Thank you for weighing in.

Greg

Hey Greg,

Are we both crazy or normal? You wrote: ‘ I yelled out to my TV, “Because there is no recovery!”’ I do the same thing!

Yea, audit the fed.

My father told me when I was a kid that it is easy for people to be critical of the decisions that leaders take, but when you become the leader, it is very difficult to craft solutions that are a “win-win” for everybody. Difficult decisions have some down-side negatives and all they have risks. Utopia only exists in an academic’s mind.

Government spending does not create wealth–the creation of taxable wealth is what grows an economy.

Our President and gubmint–local, state, and federal, need to bite the bullet and cut spending. True stimulus will come when these politicians role back all tax increases that have been passed since Obama was immaculated, and vote to keep the Bush tax cuts that are set to die at the end of this year.

Our government needs to focus on what it does well, police, fire, courts, prisons, and the military.

We need to keep paying for our occupation of Europe and other parts of the world. Our occupations have kept Europeans from another bloodbath–which is a “sea-change” from history.

In order to fix our economy, gubmint workers need to be laid off. Higher unemployment needs to happen.

Bite the bullet Mr. President. Give your friend, Andy Stearn, the bad news.

markm

MarkM,

I think we are both right. Thank you man!

greg

Thanks for the video.

And yes MarkM you are right.

Government workers need to be laid off. Starting with our soldiers off in foreign lands fighting boogey men.

Ha! And now that they “found” all those minerals….we will NEVER be leaving Afghanistan! Why? SO as to privatize the gains

(Corporations get rich)

and socialize the losses…

(We ALL pay for the military that REALLY benefits a FEW)

Remember they had all those base closings a few years back? Well, why? So they could wage war on multiple continents??…instead of providing TRUE NATIONAL SECURITY?

Wars are ONLY possible on today’s scale BECAUSE OF THE FED.

END THE FED !!!

Johnny Dangereaux,

Thank you for the comment.

Greg

Just a note to let you know maybe why not very many banks are listed as failing every Friday by the FDIC.

I was always wondering about the solvency of the bank I use, Mercantile, owned by The South Financial Group, TSFG. On May 17, TSFG was bought by TD, part of Toronto Dominion. TSFG received $347 million in TARP funds last year. TD paid only $192 million. After paying shareholders $61 million that left 131 million to buy the gov owned shares from the TARP bailout. Us Taxpayers just ate another $216 million on that deal. And in the usual media twist thestreet.com headlines it as a win for taxpayers! Incredible!

http://www.thestreet.com/story/10759659/td-bank-buys-south-financial-us-taxpayers-win.html

I reckon it’s a win for the FDIC because the missing $216 million will come out of a different taxpayer pocket instead of the FDIC already empty pocket. And it is now much lower, almost out of sight, on the bad news totem pole

Thank you DonF for the comment and info.

Greg

Yes, the fed should be audited. And goodness gracious, what will be found if it ever is?

David,

Amen to that.

Greg

All this has to make you say…”Thank god (or whoever) for the internet!! You know it just kills the politicians to know that the real truth (or at tleast parts of it) is becoming easier to find with the freedom of the internet…ill bet the military is saying “dang we should have just kept it for ourselves!!”

BLT,

Yes sir. The truth is always in style.

Greg

Greg,

It’s a shame, it really is to think the “brass” on the hill, can’t monitor in a way that would assist in a transistion towards the recovery of the US. I’m not to big into realizing what really needs to happen for every screw up by the hill, however things are not going to swiftly. To me control is not the answer, however thrifty thinking and a brief “start from scratch” thought process may help. It’s sad to say, however me may indeed “double dip”.

stu

Stuuuuu,

Thank you for the coments.

Greg