Denial, Delusion and MSM Disinformation

By Greg Hunter’s USAWatchdog.com

By Greg Hunter’s USAWatchdog.com

What is going on in the world today is both frightening and historic. It is frightening because the amount of debt accumulated is orders of magnitude more than ever before. It is historic because the way this finally shakes out will be considered a major turning point in modern history. I see this, but most people in the world are either in denial, delusional or just a victim of disinformation by the mainstream media (MSM). If you read this site often, you know I heavily source what I write about. I do this because I want people to have solid information and analysis. For example, just last week, a Morgan Stanley analyst named Joachim Fels sent a research note out to clients that talked about the EU sovereign debt crisis. Here is part of what Mr. Fels said, “This past week, by raising the possibility that a country might (be forced to) leave the euro, core European governments may have set in motion a sequence of events which could potentially lead to runs on sovereigns and banks in peripheral countries that make everything we have seen so far in this crisis look benign.” (Click here to read the entire story from Zerohedge.com.)

This Morgan Stanley analyst is taking about bank runs and is painting a calamitous picture of the EU sovereign debt problem. I believe that most people haven’t a clue about what is going on and how their lives are going to change for the worse. If they do, then they just refuse to believe that the government will let anything bad happen. I got a comment from a reader by the name “In4mayshun” on a post I wrote last week titled “Two Financial Nukes Explode.” It was about MF Global and Greece. Both situations are far from over and sorted out. The comment is below:

“Greg,

While I appreciate the time and research you put into the article, I feel it is a little over dramatic. At first you equate the bankruptcy of MF Global to a financial nuclear explosion, and then you reduce it to a canary in a coal mine. Well which one is it? I think this is why so many main stream individuals dismiss alternative media as dooms-dayers, always claiming the sky is falling. To a point this is accurate. Anyone with a brain can see that our financial system is slowly crumbling, but it could take 10-20 years for this thing to play out. Meanwhile, you have everyone with a blog forecasting the next financial apocalypse. Pretty soon, no one takes any forecast seriously.

I’m not trying to criticize, just saying…something to think about.”

I hate to say this, but it is clear to me the world is headed for another economic meltdown. The power players know this and have made many startling and ominous comments, many of which have been quoted on USAWatchdog.com. The only question left is when will the bottom fall out? I do not know how long governments can put this off, but the facts and the numbers speak for themselves. My answer is as follows:

“In4mayshun,

I probably did not explain the math really well, but the bailout fund they have right now in Europe has about $350 billion in it. The combined sour sovereign debt of Spain and Italy is $3.4 trillion. My gut tells me you can multiply that $3.4 trillion with about 40 to 1 leverage. That is a lot of trillions and both of these countries are going to follow Greece’s lead and default too. It’s a better deal for them. How will that affect the rest of the $600 trillion in derivatives the BIS says that’s out there? Some say the true total is more than $1 quadrillion. (FYI, over-the-counter-derivatives have no standards, no guarantees, no regulation and no price discovery mechanism. There is no public market and zero transparency. (Who’s got what and how much is this really worth? I don’t know and neither does anyone else.) This is why they call this stuff “Dark Pools” and why Warren Buffett called OTC derivatives “weapons of mass destruction.” Mortgage-backed securities, credit default swaps, interest rate swaps are a few of the names. Insurance companies, banks, brokerages and retirement funds are a few of the places that are chocked full of this crap. When this goes bust, lots of people are going to be poor just about overnight. I am not being dramatic but warning about a real life changing event coming to the world. I pray I am wrong. Thanks for your email. I am not trying to give you a hard time. I am just giving you some background.”

Greg”

People are in denial or delusional that everything is going to return to normal. I blame this on the MSM and the lack of reporting and disinformation on how bad things really are in the global economy. After one of my stories warning about the coming bad economy (circa early 2008), I was asked off-camera by one of the main CNN anchors if I was ever worried about “causing a panic.” I don’t remember exactly what I said back to him, but it was something like “Telling the truth to the public is always appropriate.” (If you want an example of what I was saying at CNN in March of 2008 before the meltdown, click here.) After the last financial meltdown, people in the MSM sat around and said, “Nobody saw this coming.” I wonder what their excuse will be the next time.

Greg thanks again for the warnings. Noah warned people for years and they laughed until it was too late. So by you sounding the alarm Im sure afew will take heed. As I heard a so called expert state, economic laws have been broken and there will be a heavy cost that there is no stopping. As stated by others, if you can, buy the things you use every day and buy alot of it. It will never be this cheap. What will be really interesting is after the crash and burn happens what will emerge. Thats a scary one.

Thank you William, Brad and Alessandro.

Greg

Greg,

“Too right”, as they say in Australia. “Telling the truth to the public is always appropriate.”

I would liken today’s economic condtion to the 9.0 quake in Japan. First the shaking (2008), then a period of relative calm. Then the real destruction strikes (2012?) as the tsunami washes whole cities off the map while the people are outside inspecting the cracks in the walls of their houses with their backs to the wall of water. (“Nobody saw it coming”)

Keep giving it to us full-strength, Greg, we can handle it and we appreciate it.

I think the solution is not pander to the trillionaires and billionaires. I wrote about that on my swarm the banks blog just a few days ago. http://swarmthebanks.blogspot.com/2011/11/trillionaires-billionaires-higher-taxes.html

Greg… I agree.

This is an unprecedented look at the fall of an empire. Corporations have seized our political system, from the Congress, to the highest court in the land, to the Presidency.

Business has seized our Media through which so it even now controls the paradigm in which we think. Now faced with brink of collapse and youthful and intelligent awakening… they strike our last ability we have left… our right to free-thought. Our fact gathering capabilities have been compromised through ideolog websites and news outlets, as well as direct fire from our congress to our educational systems, teachers, and public unions.

Americans have just begun to get there head out of their iPad and wake up. We’re on the brink of collapse. The corporations know it… the politicians know it… but a few of us are still dancing with the stars or wondering what type of shampoo Kim Kardashian uses.”

This is a collapse caused by the ruling power’s greed, and pursuit of profit and dominance through any means… and allowed by the inability of the mass majority of Americans to critically think. The complacent, brainwashed, and sheer ignorant American population has forfeited their ability to reason by allowing their education system to be turned into a how-to-maximize-profit internship from kindergarten to graduate school. The American citizen b/c of sheer incompetence in basic understanding of how the world works has become a slave in mind.”” Americans are victims of their own complacency. If you choose to bury your head in the sand as a citizen… consider maths and sciences elitism … consider yourself as somehow divinely blessed with exceptionalism … blindly follow a corporate foreign policy wraps in patrotism… etc..etc..etc. The people who truly understand and are aware of what is going on … manipulate those who choose not to enlighten themselves in effort of more power and wealth.

Humans are destined to fail as long as they choose to remain oblivious to reality. In order to know, you’ve got to want to know.

And I conclude…

It is far better to grasp the universe as it really is than to persist in delusion, however satisfying and reassuring. – Carl Sagan

Trevor,

Well done man!!! Thank you.

Greg

Trevor,

Well done man!!! Thank you.

Greg

You’re absolutely right on, Greg. In my small way with my website, I spent four years (2006-2010) trying to warn folks how the subject of economics was twisted around for over 40 years so it didn’t make real. Just like in an old screenplay, “tried for three years, seemed like thirty.” Most responses I got were “Why do you have to be so negative?” If one is describing the coming of an F5 tornado or a Category 5 hurricane, how can one not be so negative? Especially when it’s coming right at us.

Edward Ulysses Cate

I feel your frustration and your analysis is spot on.

Greg

Greg, no excuses next time, their employment within the MSM will become not relevant and they can ask themselves whether or not they saw that coming. Its not that people are delusional, its the MSM failing at its job on a grand scale. The MSM conducts both disinformation and failure of any valid information on this economy. A few of the people are in denial but mostly because they know they are not in any position to do anything about it. What is most scary is our politicians, they must know and are simply avoiding the coming collapse as an impossible consequence, but who knows, maybe they are subject to the false indoctrination of the MSM as well. In any event, the end of fiat is coming and it can’t be stopped and no amount of “just go shopping” is going to stop it. Paper money must represent more than its designation number on its face, it must be backed up by a real standard, try gold on for size as it has a five thousand year history of doing just that. Sounds like were in for a reset which may be long overdue and who would of thought that little old Greece would start the avalanche, it should have started in the country who created the Federal Reserve, the real eight hundred pound gorilla in the room.

Thank you Art and Norcar!

Greg

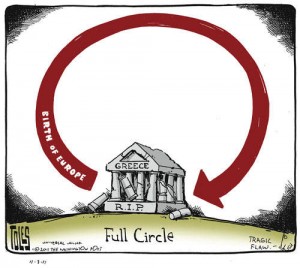

It is actually apt that Greece is the catalyst to the end of western civilization after all it all began in Greece.

Greg

What is happening overseas is just a prelude to what is already started over here. Anyone who thinks none of this is intertwined knows nothing about international finance. Europe are going through a dog and pony show and then the other shoe will fall. I know from personal experience that MOST people only believe what they want to believe. The thing is that MOST people will put nothing in the way of research into their decision making paradigm but will deny the findings of someone who like yourself has spent half a lifetime watching, reading, and discerning the facts and put them in an understandable language that even an idiot can understand. It hits home soon. When our government runs out of parlor tricks it will hit the fan.

Anytime or government does anything that takes away from our liberty, it is done in the name of our good and safety The beauty of Americans is that all we ever wished was to be left lone so we could take care of ourselves and our family. We formed our government to protect our borders from oppressive enemies. Now our borders are not secure and our oppressive enemies are in our government. How did we let this happen? Why do we allow this to continue? We send representatives to speak for us in Washington. This president has said that he will go around the Congress to pass the laws HE feels will help this country. If schools taught the way they used to, we would all recognize that as Tyranny. Our government no longer works the way it was set up to work. This is serious folks. We have one more opportunity at the ballot box to save our country. If we fail next November we will relive another piece of history from one of two perspectives. Revolution or Pilgrimage. Where will you stand then? Phil.

The “1 Quadrillion” dollar figure for derivatives is nothing to worry about. First, as “notational” value, it represents nothing than multiple bets on worthless paper, itself issued by fractional reserves. The actual material value that would be destroyed by the “loss,” “write down,” or “default” on this fictional sum would be zero. The panic that will ensue with the global financial crisis will only be as widespread and anxiety inducing as we let it. Alternatively, we could all summarily default on these debts, every country, and start back at zero. Though a minuscule percentile, well less than 1% of humankind, would experience some financial losses, on the whole, nations would be cleared of debt and the burden of interest payments, freeing untold amounts of potential capital to circulate back into the economy. The key here would be to change the game and not use the same banks, or financial system as exists now. A global banking system in which private banks retain the right to print fractional reserve moneys out of thin air and loan them to governments is a fraud and a system expressly created for the debt enslavement of those who produce the actual value in society. People themselves, through direct shares in their national banks, must own the right to coin money and agree on the proper dispensation of said moneys, preferably debt-free for national/social purposes, and at interest for speculative/business purposes, and the amount of spending vs taxes appropriate as it matters to inflation. Watch “Moneymasters” for more possible monetary systems.

Stephan,

AIG, Lehman, Bear and MF Global were all playing the OTC-derivative market and you see their notional and real values went to zero. I have to disagree with you on this one but as I always say, “good men can disagree.”

Greg

There is really nothing to disagree about. The entire fraud set up through the derivative scam can be traced to the Federal Reserve Bank and the criminals who have played this con out to the point of insanity.

While it useful to understand the scope of the debt crisis, it is better to take that understanding and use it against the sick forces who have imperiled this nation with their unending greed.

GOOGLE: CLASS ACTION LAWSUIT AGAINST THE FEDERAL RESERVE BANK

Or try the link below for the plan to get all the money back with civil and criminal charges under the the R.I.C.O. ACT.

http://www.zerohedge.com/print/365866

Thank you Paul for the comment and the link.

Greg

Greg,

The amount of liquidity sloshing around the world has nowhere to hide. Does the U.S. 10 year rate actually reflect the soundness and stability of the U.S. currency? The U.S. gold reserves (unaudited) of 9,000 tons (largest in the world) reflects a value of slightly more than 500 billion dollars at today’s prices, hardly a spit in the ocean of today’s debt. So as gold absolutely makes sense for the average citizen of the world to acquire it is of no value for a Sovereign safe haven. Hence the rush into to U.S. Treasuries which is like being rescued from the iceberg by the Titanic. The M1 chart of U.S. dollar production is literally going off the chart foretelling a paralyzing inflation train wreck in the near future.

I have written CNBC et.al. many time on their totally disingenuous denigration of gold and silver, as it is manipulated down each and everyday. All currencies and their derivatives including the DOW when priced against gold have fallen over the last ten years. I agree completely with you that hard times are very much ahead for us especially as most Americans are clueless to the currency failure ahead.

Thank you

Thank you Martin for weighing in!

Greg

Greg,

I got interested in the world, only after our funding source Bear Stearns melted down and was packaged, and quite quickly sold to JPM for a whopping $4 a share from $65+ the year before. I started looking at stock charts like Fannie, Freddie,(worse than Bear Stearns) the dollar, gold and the like. I found several websites that directed from one to the next. Uncommon Wisdom, Weiss Group, then the Gold Bugs like Edelson, Sprott. I kept an open mind and kept researching. This thought started in my head, are these people correct? It led me to others, Reggie Middleton, your site, Zero Hedge. What I have found out, is that not only are they right, but the end is nearing at a rapidly hastening pace. I was born in 1960,and have seen my share of civil strife, market meltdowns, and worked for many a large financial organinzations. So, when people try to sell me on the premise, that this too shall pass, and it is not different, I am in your camp. THIS TIME IS DIFFERENT, and is about to unleash MR. MARKET on a ride that will and is bringing down the SYSTEM. We have Europe on the edge starting to crumble. Has anyone seen the 10 year bonds on Italy, Spain lately. They are nearing the point of no return. The EFSF is nearing collapse, the FED started shooting blanks awhile ago, and it is time (BEFORE YEAR END)when this thing starts burning. It is now in full meltdown. I would be very careful where one puts money. The CME is close to a complete mess due to the MF Global catastrophe, and look, Corzine just walks away. No apologies, just saddened?

Craig,

Good stuff man! Thank you for weighing in!!!

Greg

Greg,

Denial, delusion, and MSM disinformation also describe the paradigm regarding the 9-11 attacks and the endless wars of terror. I think the financial fraud, the 9-11 attacks, and the wars of terror are closely related in that they all serve the ruling elite at the expense of the rest of us. Here’s an interesting article from another of my favorite websites that you and your readers might appreciate:

http://www.globalresearch.ca/index.php?context=va&aid=27188

Anyway, other than buying gold and silver, what actions have you taken to prepare yourself for the coming economic tsunami, and what’s your best advice for your readers? What part(s) of the U.S. do you think will do best and worst? If you had to pick a few, what countries do you think would make the best safe havens?

Thanks for sharing the truth,

Henry

Henry,

I tell people all the time to get your life in order and that includes to fix all the things wrong with your home. Make sure you vehicle is in top working order and that includes new tires if you are even close to needing them. I had a friend of mine bought motor oil in the last year or so and that is now about 15% more expensive. There are many things you can do besides buy gold and silver.

Greg

Oil and air filters. A set of spark plugs. Windshield wipers. 2 cycle oil gas additive and bar oil for chainsaw. WD40 and Engine starter. With the motor oil, it keeps you going and warm.

Good stuff Sling!

Greg

For those of us that don’t have money to buy gold… buy freeze dried and dehydrated food that can be stored for up to 25 years. My wife and I decided to take our entire tax return this year and spend it on food provisions. We got a years supply of freeze dried food and hide it in our basement. Found a great deal at this website: http://www.shelfreliancesanantonio.com. Usually we would spend the tax return on furniture or vacation… not this year. Times have changed!

Greg: One of your best posts yet. And yet the worst may not be the coming financial implosion; the propaganda and indoctrination to set us all up for WWIII is quite palpable. Connect the dots with Eqypt, the “humanitarian” war in Lybia, and the sabre rattling on Iran. The only solution (distraction?) that TPTB have left under the marxist/keynesian doctrine. The worst part of what’s coming, IMO, will be some form of internet censorship, in the name of national security.

Thank you Andy.

Greg

Good Morning Greg,

As usual Greg your information based articles seem incredulous to the MSM followers. The pabulum they are fed is habit forming. This is another reason the Internet has opened the eyes of those that want to know the truth. It offers more “freedom of speech.” So when you are challenged about the information you provide know this: many of us who read your site know the difference and appreciate the work you put into gather information.

You are right when you say that know one knows when the bottom will fall out, but the indicators are that it is going to happen soon. How blind do you have to be to see that more people are losing jobs every day, more foreclosures are just around the corner, the crisis of greed is spreading around the world so fast we can hardly keep track of it? Does it take a certified prophet to inform the populace to make it any clearer?

Keep up the good work! We who read your articles appreciate it very much…where else will we get the truth?

Thank you Chuck and Dennis.

Greg

Greg:

Good article. Thanks. One of the reasons many don’t understand the threat to the financial system is their failure to know any depth of the derivative issue. I’ve never understood it totally myself. The best writing I’ve come across on the subject is by Charles Hugh Smith in his recent posting: http://www.oftwominds.com/blognov11/collapse-of-corrupt11-11.html

Perhaps you could add more on the subject because it certainly needs to be understood.

Dennis

Greg,

Is’nt a PANIC is what we SHOULD be in given today’s realities? How long can a system that is morally , economically, and politically bankrupt continue? Come on!

I guess what we all want to know is who pulls the strings that put the words we hear on MSM into the mouths of the readers? Who is leaning on them to do it ? The same people that leaned on the Supreme court’s 5 to 4 decision that there should be no limit to campaign contributions?

Tell us Greg, do you think its the bankers? … or do you know its them?

Dave

Dave,

It’s the bankers and government. I think the government does not prosecute for fear of crashing the system.

Greg

Actually the SEC and CFTC are the felons in charge! They wont prosecute their own selves now, would they?

Mohammmed,

The regulators including the Fed are turning a blind eye to the ongoing mess. I think they are doing this because if they start prosecuting now it would implode the system faster than it is already sinking.

Greg

The timeing of the coming dollar implosion becomes exponentially (more unpredictable) with each new round of illusion supported solutions.

The one thing that the bankers MUST control, is the timing of of the

next US disaster… it must come B4 the system unravels (not after) .

The hords of clueless Americans who believe their fairytale fiat lives

are “God given” , will need a reason to accept the ending that’s coming…a disaster coming after dollar death, with alert them to

the true cause and effect of our criminal government.

I read that Israel and Amerika are trying to draw fire from Iran now,

there are still a LOT of BDMF out there who trace all of their woes

back to “muslims with boxcutters”; The good news is, that the satanists spent just a little to long gang raping lady liberty, and now faces an exponetial einlightenmemnt that’s on an up curve.

The longer they wait to attack Iran , the more people will wake up…

these are very dangerous, and hopefull times. : )

Thank you Matslinger and Brian.

Greg

Theres nothing wrong with yelling “FIRE!!!” in a crowded room if there is a sh!t ton of smoke pouring in from the vents.

We’ll, Greg has been spot on about gold/silver. We never had that huge

correction last couple years the nay sayers talked about. The greatest collapse the world has ever seen thats not an if but when, and looks very likely. No nation in history has ever had recovery going deep into debt. If fact, quite the opposite is true. Most people are living on hope and its going to end badly for those who

are in denial and ignorant of history. There is a small chance we could muttle along for 20 years and work off all this excess debt

but still very unlikely. If you are a person who bets on the higher odds likely outcome and thats my position right now. Yes, I have all

my emergency supplies ready and prepared for worst case I believe is

close at hand. Shortly after they attack Iran thats when power failures will become the norm I believe and be the time to say thats

it…”KATIE BAR THE DOOR” the window of opportunity to prepare is over.

Thank you D. Chapman for sharing your analysis and strategy.

Greg

Nobody saw it coming, except Marc Faber, Gerald Celente, Nomi Prins, Bob Chapman, Peter Schiff, Naomi Klein, Matt Taibbi, Noriel Roubini, Alex Jones, Jeff Rense, Mike Rivero, Mr Hunter of course, Zibignew Brezinski, Elizabeth Warren, other than them we was blindsided!

Thank you Herman for including me in this distinguished group!

Greg

My god! You left out Max Keiser! I’ve collected his RT videos for a couple of years, and his radio shows from 2005. He’s been on top of this story since at least 2005. He’s been warning against the derivatives, the deregulation, the fiat system, the institutional crime, since the beginning. He makes enemies because he speaks his mind, often with a bit of hyperbole, but on these main issues he’s been spot on.

Kenkoy,

We love Max!!!

Greg

Excellent Article. I believe you were respectful and to the point. The best we can do is keep on track and hope people will listen. The skills of the people who lived through the Great Depression and WW2 are needed now more than ever. Keep up the great work!!

Jeremiah,

You are so right on this point. There are going to be so many that will be poor the rest of their lives.

Greg

Dear Greg,

I think you are correct on this one. Everything that the EU has done has been too little, too late. It is unfortunate that the European financial system has to be held hostage to German politics. The spillover into the rest of the world could be tragic.

The time for blame is far in the future when the facts are known and the historians can write their books. What needs doing now is a credible plan to backstop a fractional reserve banking system used by 500 million people mostly in rich countries.

A model that comes to mind is the S&L bailout of the early 1990s. A federal agency was set up to issue 30-year paper, proceeds of which were used to recapitalize the S&L industry. It worked. I invested in those bonds and made quite a bit of money on them.

The government made money on the loans, too.

The ECB and the EU need to move with alacrity on this. Sufficient capital must be raised, despite the howls of the Germans, to prevent a banking collapse should the credit-default covenants on Greek debt be triggered. The result of that, as you suggest, would probably be a run on the banks on the magnitude of 1930-33. Secondly, a financial firewall must be put around the Greek government. That will mean a temporary loss of some sovereignty for Greece, but life is tough, and depression is tougher. Essentially the EU or some other very powerful outside entity will have to run Greek government finances until the crisis passes. The same is true of Europe’s banks. The regulators should be all over them unwinding their overly risky positions in as orderly a fashion as possible. It could take more than a year to do so. But there is no time like the present to start. That should be a condition of aid to the banks.

Cheers,

Ted.

Thank you Ted for your analysis.

Greg

Greg,

Being prepared for worst-case scenario at one point was the American way. You don’t have to be much over 50 to remember the bomb shelters of the past. Having one was pragmatic not being a doomsday cult member. I have a plan to make money, a plan to re-educate myself, and a plan to protect my family and our assets.

While like you I hope I am wrong, I do not see any way around a significant downturn in the entire world economy. India and China are rising as world powers and consumers. They manufacture things, they educate their people. I am on campus with children my daughters age and I find it amusing how ignorant they are and dismayed that a lot feel that the world owes them a living. How many jobs are there for liberal arts majors? We need chemist, engineers, computer programmers, etc. I asked one student why they were majoring in women’s studies [yes, hard to believe that a degree is offered in that] and she responded because it was easy. When I asked about after college she mumbled something about me being too old to understand. Damn right I am too old to understand; Or let’s say I am old enough to understand that she can not do much with a degree in her major.

Keep reporting the truth, it is always appropriate. I don’t mind having my stances questioned as it allows me to defend them and discourse is good. Glad you are of the same mind.

Good stuff George. Thank you for the real world reporting from the college campus.

Greg

Greg,

You are right especially about the hedgefunds, retirement funds and insurance companise where most of the peoples money is stored. I would be very worried about the counter party risk of these accounts. Greece is only the first domino. Papandreou had the right idea about a referendum, the Euro bailout is for the banks, not the people. Greece will be ripe for revolution if this bailout and austerity package is shoved down their throats. I also find it interesting that Germany refuses to use their gold reserves as collateral for Euro funding. It is only a matter of time when everyone is rushing for the exits.

Sandy,

Short but on target comment. Thank you for the analysis!!

Greg

Thanks Greg again, for one of the last UNBIASED true news sites on the web. If you all notice, there is only ONE FOUR letter word that everyone keeps arguing about. GOLD. Enough said. Got yours?

Redwood Tree,

Look out for the IMF and ECB asking for Italy to give up its 2,450 tonnes of gold in return for a bailout. Italy has the 3rd highest gold reserves of any country in the world. Number 2 is Germany and #1 is USA.

Greg

italians AND germans asked. I know one of them will say f off 🙂

Not sure on the other one

And where is their gold held already anyway?

Inquiring minds want to know.

if no-one cared about the non-edibable, traditionally barbaric relic, why all the fuss over it, and over DENYING that it matters. ROFL. Most wars have started over this ONE four letter tradition relic. Interesting…again, got yours?

ahem. one MORE “denial” of gold ROFL…

http://gata.org/node/10648

anyway, you all get it by now, hopefully.

See you all on the other side.

The current financial system – worldwide – is similar to a hopelessly-, terminally-ill individual for whom no one is willing to give a “DNR ( Do Not Resuscitate ) Order” and then have the courage – and the mercy – to insist it be implemented.

All the more reason for each and every one of us – as individuals – to do what we can to not be a party to any current effort at “resuscitation”. Or, in simpler terms …. ( yup, here it comes again ) ……. Stand back and let THIS economy DIE so a NEW, healthier one can be BORN.

The Collapse of Our Corrupt, Predatory, Pathological Financial System

is Necessary and Positive

http://www.oftwominds.com/blognov11/collapse-of-corrupt11-11.html

Greg:

This is in reply to the reader’s concerns, which by the way, are very valid. The quickest example when speaking about “extremistan” events is Enron. Lets not forget that Ken Lay and Jeff Skilling were on major PR campaigns just weeks before the official collapse telling media outlets how strong Enron was and that all rumors of viability with Enron were just that, rumors. One seasoned reporter replied after an interview with Jeff Skilling that he was either telling the truth about the fiscal strength of Enron or that he needed to be in Hollywood because he was the best actor she had seen in her twenty years of reporting. Well, we all know now that he was the latter.

There were those that were shouting the alarm about this company, and they were ignored. Some of these individuals are the same ones who made millions shorting this stock, while others lost everything. Most people, myself included at the time, that only got their information from mainstream media were completely shocked to turn on the t.v. and see people carrying their belongings out of the company as if one day the company was fine, the next it was insolvent. What always has concerned me about the reporting of this event and so many others like it is that if it had been life threatening, I have to make the honest assessment that I would have died.

This is only one event. There is a laundry list scattered throughout history, say for example Black Monday(1987), where individuals brought concerns to the table, and they were quickly hushed as “fear mongers”. I frequently think about Mark Twain’s quote, “It AIN’T so much the things we don’t know that get us into trouble. It’s the things we know for certain that just ain’t so.”

Thank you Brad and John.

Greg

Hey Greg,

You may not get everything right or know exactly how things are going to play out, but in your defense, others are reporting similar stories.

For example, author Chris Hedges wrights in his book, Empire of Illusion, that another few billion dollars in bale out money is not going to stop our decay. Corporations have eaten the United States hollow, their is nothing left.

Max Keiser is another great online source that is actually saying that Greece, all the EU members and the United States should follow Iceland’s lead and default on the debt. Defaulting will put us through 2 or 3 very awful years, but we all keep our sovereignty and we start the process of breaking the strangle hold the FED and IMF Bankers have on our monetary and economic policy. We all then come of the “real” bottom and rebuild and come out much stronger.

Seems that you have missed the point of In4mayshun’s question. The point was not whether but when.

Certainly, the “when” is the really, really difficult part. We all know that horrible things like the sun going nova. However, it’s not something about which I need to worry, at least tonight.

The point is that worries are perishable. And the guy is correct; people do discount thingsthat haven’t happened. – – So, now tell me, “when”?

Bud

Bud,

In4mayshun’s comment also opined that this could take decades to fall apart. The timing is closer than you think, but my best guess is between now and early 2013. The ride from here to there will be anything but smooth.

Greg

but, it is better anyway you look at it that Greg gets his hots off

both ends of the financial freefall, which are perpendicular top to bottom, so that his readers begin to see the flip blops and freefall:

Greg is concerned, correctly,

thus no one should hammer him for getting excited

while both ends of Rome burneth

and olde uncle NeroBernanke plays his diddlefiddle,

he hi ho hum

twas better a pip of rum

while Rome burneth

EuroUnion sinketh and

usa stays asleepeth,

he hi ho hum dee dum dee dum

Greg is usually on point, usually right, so bear with him and

pat him on the back rather than kick his butt for nuances

i gotta tell JsSinclair, the wizard with the magic crystal ball wherein he sees the future, so far so good, next leg up he, Jim, gonna be right on point too, he is a wizard, a magician, one of us

my crystal ball shows that the today riots and econ freefall are

the vote of those who know obumma is wrong for this world

keep this in mind at the 2012 pres.elect. where hopefully obumma

goes away, back to where born in kenya, africa or where he born again

in hawaii, or where he found allah in Indonesia, anywhere just so long as he goes away

and, let us not forget olde uncle Sinclair is living it up

in eastern Connecticut the land of the Puritans and their wikiups

he says he is set for anything, has a milk cow, a pig, chickens for eggs and bar b q, fresh water, good neighbors, a spit away from

New York City yet protected by buffer Connecticuters, his friends

on one of his exhibits he showed us his dandy snow plow doing

the work of ten teams of horses and ten snow plows, and when

he shows us a pic of him and his pets he is content, purrs, knows

he has lived the good life with lots more to come

Greg,

Hang in there. I stated some time back that the collapse of the Euro would start in mid November. Because of the MSM failure to notify the public, I may be a month off. When the truth is revealed, the dominoes will fall. The revelation will come as the U.S. tries to bail the Euro thru the IMF, and connecting rods on our printing presses start to knock. What is happening in Europe obviates the disfunction caused by socialism, and our idiot in chief is trying to change our system to match theirs. The resulting misery is the stuff from which wars are made. ref: Iran/Isreal. I ask everyone to pray that I am wrong……Oldguy

Thanbk you OG.

Greg

Everyone sees this coming…no excuses. Save a nation, burn a bank today!

Chiller,

Don’t burn it down just move your money to a credit union. You can also buy farmland, gold, silver, food and emergency supplies but no violence and no bank burning.

Greg

Greg, would you agree to give them a fair trial after the crash, and if found guilty some hard labor or would just being poor be enough for the elite?

Art,

They should be held to the same standard for punishment as Bernie Madoff. Nothing more but nothing less.

Greg

Hi Greg,

We have an additional excellent reference article for our reader team written by Martin A. Armstrong. It’s long…I’m about 1/4 of the way into it and recommend it:

Title: Financial Armageddon

Link: http://www.martinarmstrong.org/files/Financial%20Armageddon%2011-04-2011.pdf

🙂 Diane

Diane Carol Mark

I love Martin Armstrong!!

Greg

Me, too! Are you going to his conference in Philadelphia on Dec. 4th? Now, that should be fantastic and you could post an article on your experience. Tax write-off as well. Wish I could go, honestly.

🙂 Diane

I believe that many of the people I know suffer from normalcy bias. Most believe admit we are in deep doo doo, but also raise up their arms and say, “well I can’t do anything about it.” It is frustrating and yet really amazing to watch otherwise intelligent people just surrender completely to their situation.

Frank,

Well said. Thank you for saying it here.

Greg

Greg, keep doing what you are doing. People need to be informed of the truth no matter how frightening or distasteful it is. One financial advisor calls it the ‘normalcy bias’ in describing the human condition of not wanting to take heed of forecasts because it’s too disturbing.

Confidentially, you may already know of them, but I glean a lot of truthful financial analysis from experts such as Martin D. Weiss, Porter Stansberry, Shah Gilani, Martin Hutchinson, Keith Fitz Gerald, Jim Rogers, Bill Gross, Peter Schiff, Alex Green, Steve Sjuggerud,etc.

Best Regards,

Joni, teacher and C2C listener

Joni,

Thank you for including me in this distinguished group and for your support!

Greg

It amazes me just how many people have know idea what exactly is the problem here. It’s not debit card fees or even the lousy interest rates that the banks pay. In the short term it all boils down to a single event.

A Republican Congress passed the repeal of Glass-Stegall act and a Democrat President signed it into law. The momment that happened the American consumer got a big target hung on his back and the banks no longer gave a rat’s patooty about risk. Not only did the wall of seperation between commercial and investment banking come down, all risk from investment operations were obliterated by the creation of the “Bank Holding Company.”

Investment banks were no longer partnerships wherein a risky or bad investment would place the welfare of all the partners in jepordy. The parnerships created a natural atmosphere of risk aversion. But under a “BHC” the risk is transferred from the partners to the stock holders. Any losses then gets carried through into reduced dividends for the stock holders rather than reduced income for the partners.

The merging of commercial and investment banking operations also allows the banks to transfer loosing bets from the investment side (derivatives of all kinds) into the commercial side, as BofA just did, so that when if those risky bets fail (like they just did at MF Global) the losses will also wipe out the depositors and the taxpayers will have to pick up the cost of the bad investment through the already bankrupt FDIC. This will be nothing but another bailout for bad behavior. For BofA alone it could cost the taxpayer in excess of $2 Trillion!

But who cares we’re already $15 Trillion in the hole what’s a few more as long as the banks survive right?

Goos stuff Davis!!!

Greg

The crumbling financial system started a long time ago, for me it started in the 70s. Now it’s just speeding up were any old fool can see it. This old man told me in the early 70s don’t save your money for a rain day. He said spend it as fast as you can on land. He told me how he busted his butt and save 600 buck up in the 50s. In the early 70s we could make 600 bucks in a couple weeks with some overtime. Inflation is speeding up faster year after year. The big difference now is the other countries have a say in the world and we are no better then a farm boy in China. I got land a place to sleep and food put up, thanks to that old man. Greg your not a old man but I hear what your reporting and it’s just how it is. INFLATION is the only game in town,best plan for it. Peace

“BUT SOME ANIMALS ARE MORE EQUAL THAN OTHERS” (1945 Animal Farm by George Orwell) comes to mind.

Greg, at present there are 61 comments as I write this post. My advice to you is, keep speaking the truth, that is what the MSM can not do, they would be out of business.

Thank you Steve. Try to answer most folks here.

Greg

Hey Greg,

I am not a major money man, but having had to balance a very tight budget at home due to marital breakdown, I understand basic economic concepts. I also understand when some corporations owned more risky debt that is available in the whole GDP… then we have some serious issues!

I am based in Australia and it was with great dismay that last weeks main news focus was on Kim Kardisians Trip over here and her marriage breakdown… woop dee doo! With everything going on across the globe right now, in war and finances – who really gives a dam about Kim?

I have been saying privately since 2008 that the crash will lead to a double dip recession and even worse because measures were not enacted and NO-ONE has been brought to justice for the complete global financial mess we find ourselves in.

I applaud you for spreading the word. In some ways I don’t have a lot in the way of finances to be concerned about. Only that I can earn an income and pay bills. However my concern is, within a year or two, that will be taken from me.

It’s a sad state of affairs the world system has become, both from MSM, financial institutions, the war state… we have had technology which should have driven the world to peace and prosperity for a lot more of its people. Instead poverty across the globe has expanded, along with war. Where does the real terror threat now emminate from?

Thanks, keep up the good work!

Thank you Karlos for your support and kind words.

Greg

Greg

Sobering!

But even more sobering is the willful ignorance of the general public. Watching the nightly news(hardly)shows us where the world (U.S. and Canada) really has their head at.

The hero of the day is still Steve Jobs. Apple will make or should I say take more dollars from people even as they scatter Jobs’ ashes. The point is, it’s all numbers on the tv screen.

Does the average person have even a clue of what those stock trading numbers stand for in the business report. I think not. Dow Jones – up, down, hmmm, just numbers. A trillion dollars you say, we can just print another batch.

We have a generation of people who have grown up on wellfare who believe this to be an earned income. We also have a generation who have grown up with daddy’s or mommy’s charge card.

So, Apple comes out with a new ipad or iphone or igame – just charge it. After all, that’s what Uncle Sam does.

We’re going down, that’s a fact.

Best get right with God, cuz, it’s nearly over.

Greg,

In response to some questions here,I have a few pointers that I consider MUST HAVES and DO’s.

Every man is responsible for the protection of his family.

Every home should have at BARE minimum 90 days worth of food and water.Preferably 12 months worth.

Plus the means to protect it.

Sounds harsh, but it is what it is.

Like the market saying, “Rather be out a year early,than a day late”.

Advise your grown children to do likewise(most won’t), so YOU will be responsible for care and feeding them also.

NOW,is the time to be ready,if you haven’t started your running out of time.

People in the cities will be the hardest hit.Rural area’s, think they will be safe from the roving bands of thugs, and just hungry people.

Not so.IF your isolated,your an easy target.

Talk to your neighbors about a safety plan, and their is always strength in numbers.

What good is your gold & silver,if you cannot eat, and do not have water to drink(if the SHTF),in a big way.

There are not enough police, and LE ,nor armed forces to protect YOU.

It’s YOUR job to protect YOU and YOURS.

Sound over the top?,well this will make the Depression look like a picnic.

The welfare, and unemployment benefits are now getting shut off.

Be prepared to help others.IF you are financially able,buy more than you need, and IF by God’s grace we do not go into full riot mode, you can always give it to community food banks.

Thank you DosZap. There is another old saying and that is “I’d rather have it and not need it than to need it and not have it.”

Greg

A lot of people see that something big is about to happen.People do not want face that we would not have the trouble we do in the markets if it weren’t for greed.Greed is why people take a chance with so many lives hanging in the balance.Greed is why war has scared the human race.Greed is why slaves were worked in the fields.And greed is why people will take as much as they can take from anyone as long as they get more.It is not gust bankers it all that play the greed market.Man has been battling greed sense the beginning of time.Greed is winning .

Never before has there been a global melt down of the economy.

This is a first.

All others were regional at best.

There really is nothing to peg it to.

All I know is the ensuing war will be something to be remembered for a long time.

The problem as I see it (from a layman’s perspective) is that growth in the developed world was really derived from the increase in credit, who’s corresponding liability is debt. Since manufacturing and production in the developed world peaked sometime in the 70-80’s the declining by-product of production or real wealth was offset in credit/debt and consumer led consumption. It seems that we can play this game for a while, always deluding ourselves that our largesse today can be paid for tomorrow through debt/leverage but eventually the bill comes due.

I suppose that is the day when increasing amounts of credit do nothing for the “profitability” of banks and large corporations or when we reach 100% debt saturation or when the amount of increased debt from government deficit spending has zero return in increased GDP. We are approaching that limit.

The issue of course is debt, is it valuable or not? If it is valuable then it can be paid off with associated interest in the current purchasing power of the currency, or it’s future value has the mathematically predicted value that it was based upon at creation.

However, if it cannot be paid off tomorrow in the assumed future value (current purchasing power) then of course it has no value or limited value – certainly not the value in which it is estimated from fixed mathematical calculations.

Everyone or most everyone is in denial, you are right. Makes one wonder how long mass denial can hold sway?

President Clinton’s time was the last sanguine era. President Bush Jr and the events unfolded portray to me a deliberate plan and a superb execution. By which Obama is totally on board to continue said plan. These events and the new “culture” I call it, was engineered. The fuel spike to almost $5 was the start to a long term recession that persists to today. Oh yes 9/11 was not planned, it just helped the plan go foreward. Us common citizen really do not know where it will end up. A one world currency, controlled information, under fascist Gov? Throw in a moderated population growth from widespread poverty. Two classes the powerful few (gods), controlled independent rich, and the very vast global majority dependent poor rest of us. The USofA is not a place you want to stay. Get the big picture?

Greg,

Do you have a spam filter installed on your WordPress site?

We’ve tried a couple including Akismet (http://akismet.com), and neither works well. Would like your opinion. Akismet kept putting all the comments in the spam, and the other one sends you spam as comments.

Thanks,

🙂 Diane

Diane Carol Mark,

Yes I have a spam filter as I get hundreds of spam emails a week. This one got through and I certainly do not consider your comments spam. You are a welcome guest here anytime.

Greg

Greg,

Would you kindly ask your Webmaster (if you don’t know) the name of your spam filter? We’d really appreciate it.

Thanks!

🙂 Diane

Diane Carol Mark

It is what comes on wordpress. That’s all I know.

Greg

WTF Greg ??????

I can not believe that the MSM and economic pundits can not see the writing on the wall. When two banks moved their $100 Trillion derivative liability so it became a government liability There is no way the US government or FED should be pay any of the derivative claims. We know that BOA and Chase are preparing to file bankruptcy by these moves.

People still foolishly think this is Geek government debt but in actually bank derivative debt……

Thank you Mitchell,

Greg

Since these people (corp. and govt)have no empathy for the common person and plagued with “greed” or high on “power”,and only they are benefiting from this rigged game called “capitalism”. Can the common people of the world say this game is now “AVOID”,we’re playing anymore and we’re taking the ball start a new game without you

rrrobert,

What we have now is not capitalism. If it were a capitalist system (as it once was) the banks would have gone bust and their assets would have been auctioned off in bankruptcy. Yes we can start a new game but not without lots of pain. Thank you for your comment and question. Anyone else want to give an answer?

Greg

while the implosion could play out over 10 to 20 years and the alternative media did use adjectives that are emotionally charged. However, the alternative media makes us aware of some nasty development. In the end, it is our own judgment call whether to accept their forecasts or not, and it is also our own decision on how to use the information. More importantly, some facts don’t change: a corrupted and a non-sustainable ponzi structure is doomed to fail. If the average John and Jane would see the facts for what they are and be prepared, like I do, their portfolios will already be moved to safe places like gold and silver, and they have already made themselves a handsome gain over the past 10 years.

Greg writes, “What we have now is not capitalism. If it were a capitalist system (as it once was) the banks would have gone bust and their assets would have been auctioned off in bankruptcy. Yes we can start a new game but not without lots of pain. Thank you for your comment and question. Anyone else want to give an answer?”

>>Yes, I have an answer.

But first, I agree that we do not have capitalism. Bankers only tolerate democracy and capitalism as long as it poses no threat to their power.

With true capitalism, the bankers and speculators would eat their losses. Insolvent banks would be liquidated. Debts from private bankers would be written down or erased. The masses would not bail out private criminals. Mistakes would be paid for in cash. There would be no such thing as “too big to fail.”

THE ANSWER? Take back out monetary sovereignty from the private bankers, which we surrendered in 1913. Why must we borrow our own currency from private bankers, and pay interest on it? When private bankers control the money, they can create a Depression any time they wish, simply by withdrawing the supply of money and credit. It’s called a “contraction.” The bankers did it in the 1930s, and they’re doing it now.

Let us take back from the private bankers the power to issue money and credit.

Let us restore it to the government and the people per Article I, Section 8 of the US Constitution.

Let us establish a Monetary Authority under the Executive Branch, with the Fed reorganized and put under the US Treasury.

Let us break free from the need to borrow our own currency from the Chinese, the Fed, or anyone else.

Let us end the Depression, and make the national debt irrelevant.

Do this, and America will be utterly transformed. There will be enough money for anything we want to do. We can easily liquidate all “too big to fail” banks with NO shock to the system. America would take off in production, crushing Europe. We could send an expedition to Mars if we wanted. We could fund everything we need.

It all comes down to freedom from debt and private central bankers. This is the only issue that matters.

OKAY, SO HOW DO WE DO THIS?

Congressman Dennis Kucinich has been introducing bills to make this happen for some time. Last year Kucinich introduced H.R. 6550 The National Emergency Employment Defense Act of 2010 (NEED Act) to give us back out MONETARY SOVEREIGNTY.

Kucinich got ZERO co-sponsors, and Congress allowed it to die.

On 21 Sep 2011 Kucinich re-introduced it again, this time as HR 2990 — The National Emergency Employment Defense Act of 2011. (NEED Act.)

This time he got ONE co-sponsor, John Conyers.

The bill is highly detailed and intricately thought out. It has been referred to the House Committee on Financial Services, 80 percent of whose 61 members are fanatically pro-private-banker-control.

So the bill will be allowed to die again.

Occupy Wall Street protesters, do you want a single message that will cure almost everything? How about two words?

SUPPORT

HR 2990

I invite readers to check out the wording of the bill. I promise it’s not dry and boring.

http://www.govtrack.us/congress/billtext.xpd?bill=h112-2990

Richard,

I love your comment but hate the picture you are using. You are so NOT like Hitler. It is not a fair representation of you at all.

Greg

On other thing Greg, further in agreement with you…

As it stands now, bankers and elitists enjoy the goodies of democracy and capitalism, while avoiding the costs and responsibilities.

Well, you can’t have it both ways. (Not for long, anyway.) If you want the stability of democracy, then you must let citizens decide if they want freedom or slavery.

If you want the immense profits of free-market Capitalism, then you must accept the stupendous losses when over-leverage and over-indebtedness render banks insolvent.

But no, the bankers are not held to true capitalisn. Their fraud is rewarded, and their private losses are dumped into the masses. Thus the bankers are free to double, triple, and quadruple their crimes, thereby quadrupling the pain and slavery suffered by the masses.

I say it’s time for referendums in EVERY nation.

I say it’s time for true capitalism in EVERY nation.

Democracy and / or true capitalism would destroy the bankers, as would genuine “free markets.”

I say let the European nations default. The first nation that defaults will do mankind a gigantic favor by seriously cracking the bankers’ network.

I say let’s blow it all up and let the bankers’ ashes fall where they may. Any pain will be directly proportionate to our refusal to work together.

And let’s ignore this garbage about “free markets.”

The neo-liberals want a “free market” as THEY define it, meaning freedom to destroy freedom via monopolies, and freedom to dump speculative losses on the masses. They want less regulation for themselves, and more for you (i.e. a police state). They want more government intervention for themselves (e.g. bailouts) and less for you. They want bigger government and more spending for themselves (e.g. their wars and their security-intelligence complex) and smaller government and less spending for you (i.e. no domestic social programs). They want lower taxes for themselves, and more for you, so you keep paying interest to the bankers (which is the only destination for federal income tax revenue.)

Enough already!

Who’s with me?